The Best Five Sectors, #31

Key Takeaways

- Technology maintains leadership, but industrials show signs of weakening.

- Utilities are gaining momentum, and more is needed to move out of lagging quadrant.

- Communication services and consumer discretionary at risk of dropping from top 5.

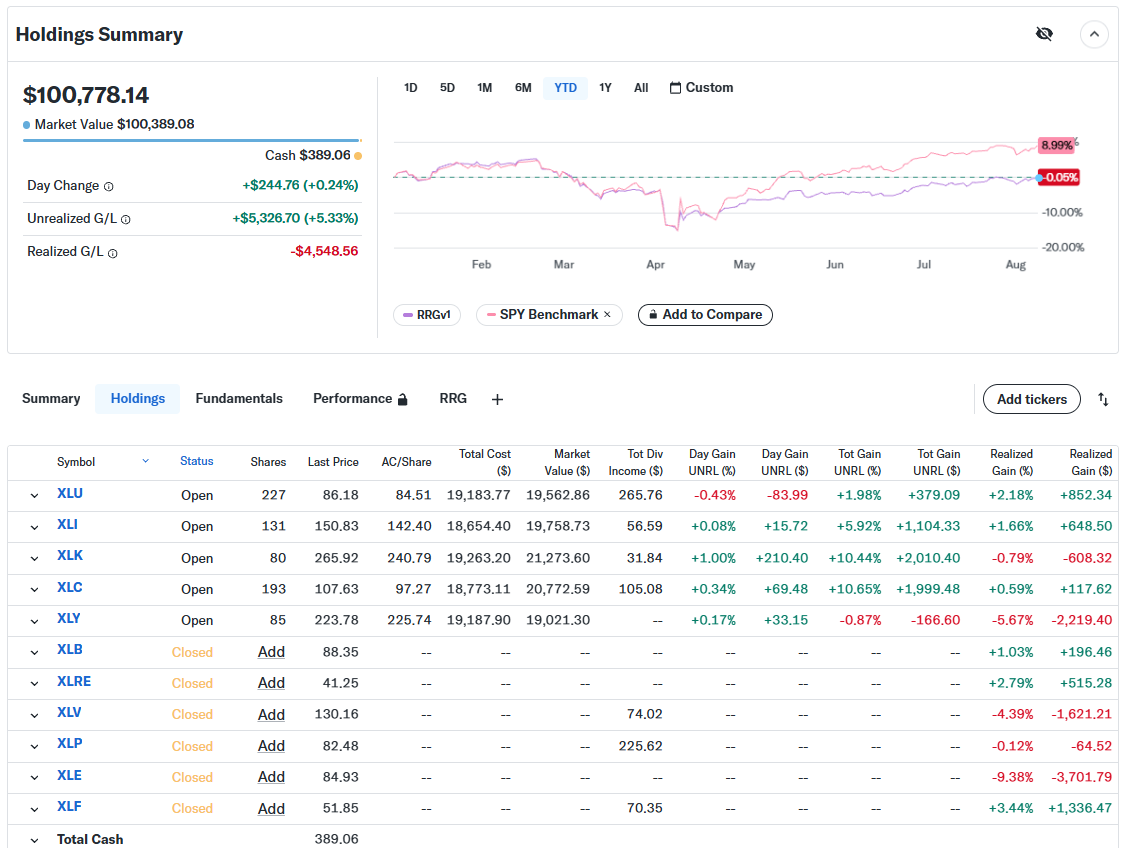

- Portfolio performance remains ~9% below S&P 500.

Despite a 3% gain for the S&P 500 last week, the sector rankings remain unchanged, presenting a mix of stability and potential shifts. Portfolio performance remains ~9% below S&P 500. The weekly Relative Rotation Graph (RRG) continues to show technology as the lone leader, while other top sectors display varying degrees of strength and vulnerability.

Top 5 Sectors Holding Steady

- (1) Technology - (XLK)

- (2) Industrials - (XLI)

- (4) Utilities - (XLU)

- (3) Communication Services - (XLC)

- (5) Consumer Discretionary - (XLY)

- (6) Financials - (XLF)

- (7) Materials - (XLB)

- (8) Real-Estate - (XLRE)

- (9) Consumer Staples - (XLP)

- (10) Energy - (XLE)

- (11) Healthcare - (XLV)

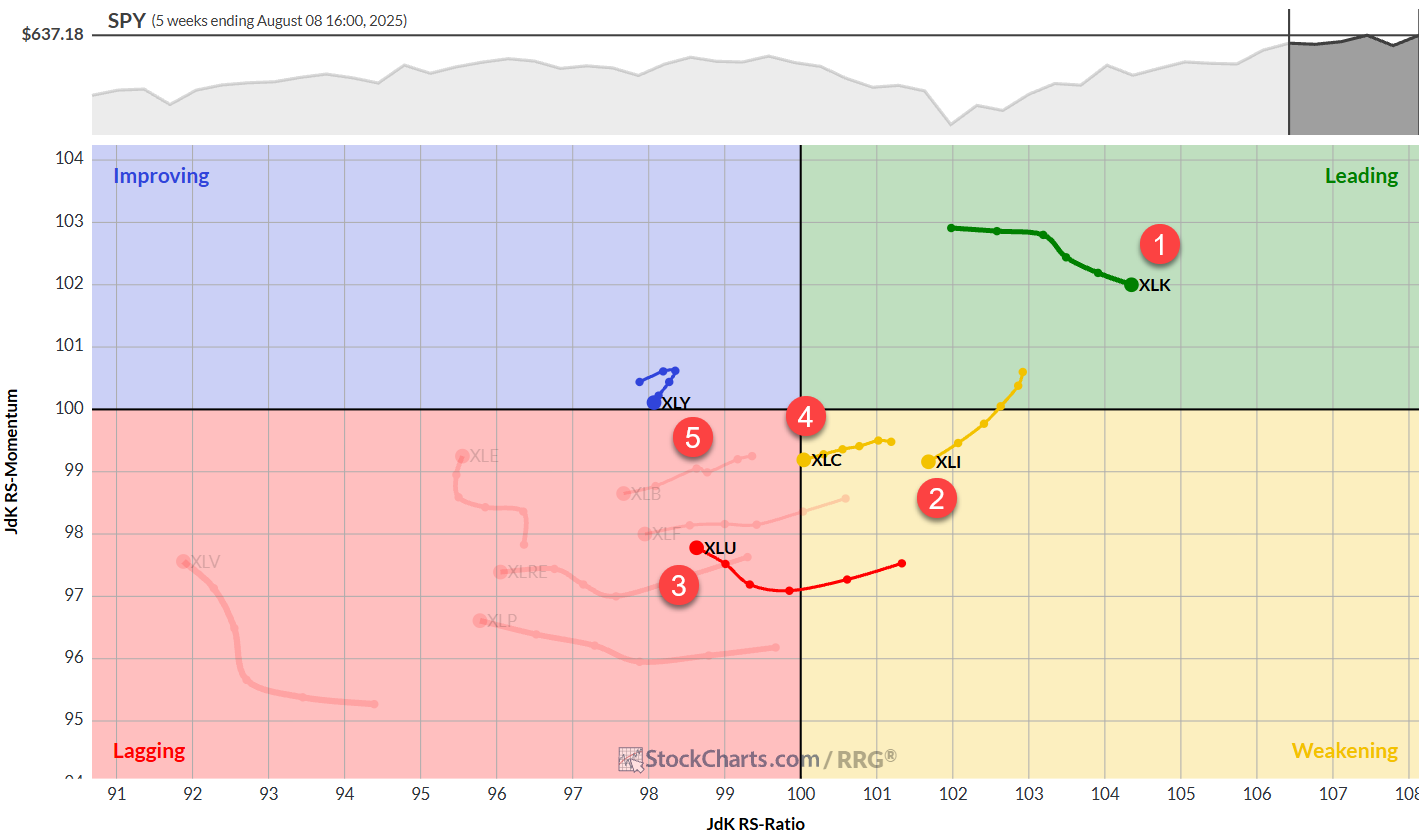

Weekly RRG

Technology remains the only tail inside the leading quadrant, continuing its upward trajectory on the RS-ratio scale, a bullish sign despite a slight loss in relative momentum. Industrials, however, are showing signs of weakness, moving from leading to weakening but still maintaining the second-highest RS ratio.

Utilities, currently in the lagging quadrant, are picking up relative momentum, a positive sign that could signal a potential move out of lagging territory. Communication services, on the other hand, is on the verge of pushing into the lagging quadrant from weakening, traveling at a negative heading.

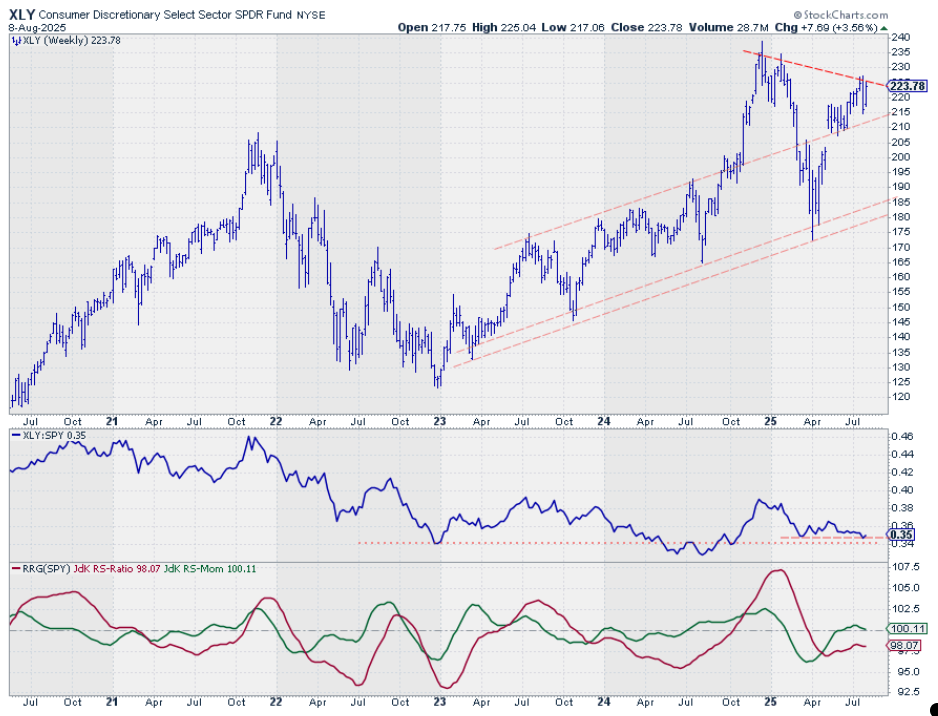

Consumer Discretionary, imho, appears to be the most vulnerable in the top 5. It's rotating downward inside the improving quadrant, nearly moving back into lagging, indicating a likely continuation of its relative downtrend.

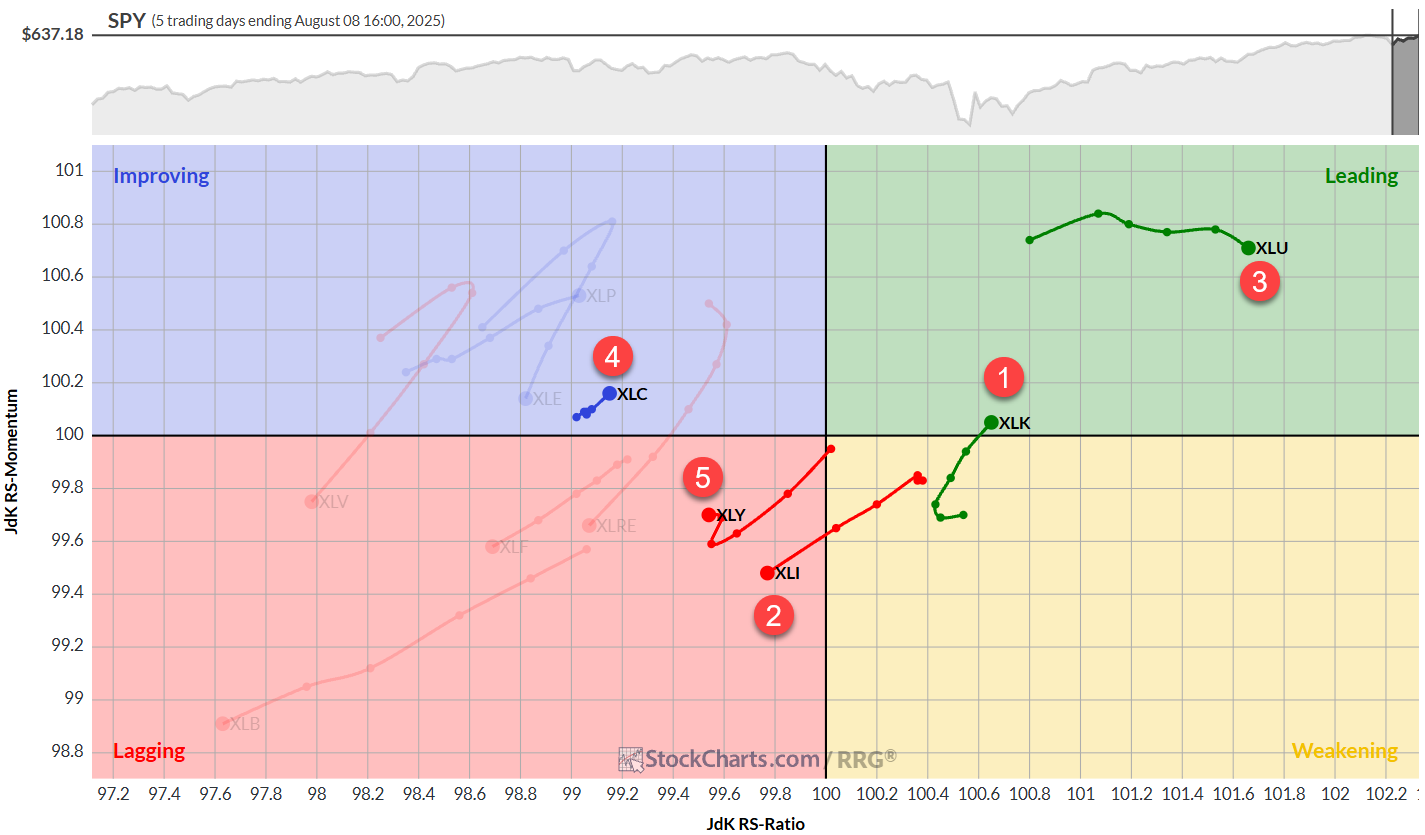

Daily RRG

When we compare the weekly rotations with the daily RRG, we see some interesting confirmations and potential reversals:

- Technology is rotating back into the leading quadrant from weakening, a strong confirmation of its sector leadership.

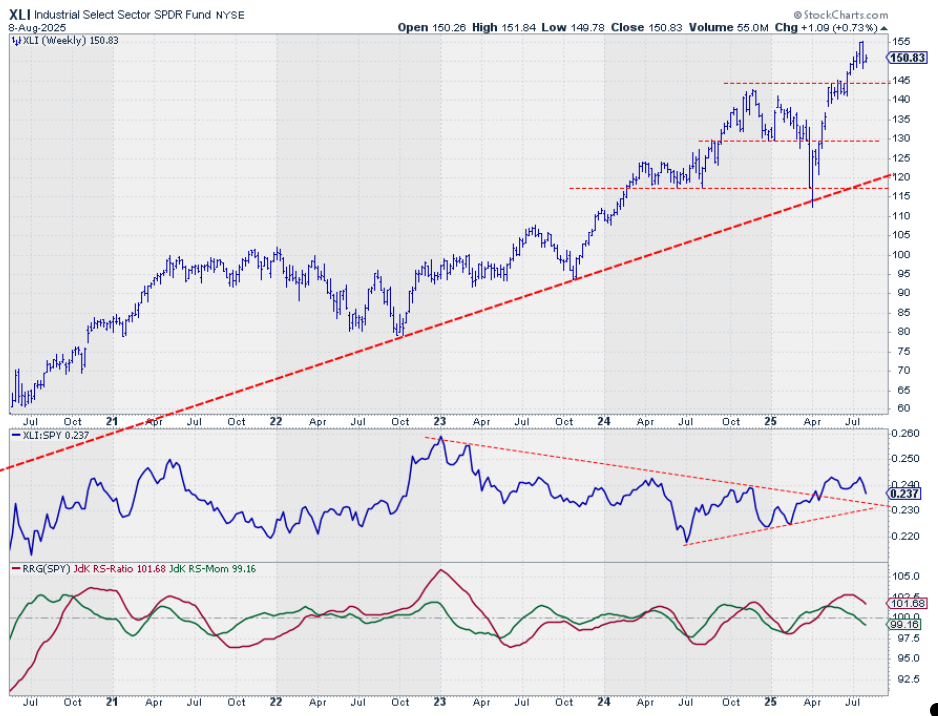

- Industrials are pushing into the lagging quadrant on the daily chart, confirming the negative heading on the weekly RRG. This sector needs to improve soon to remain in the top 5.

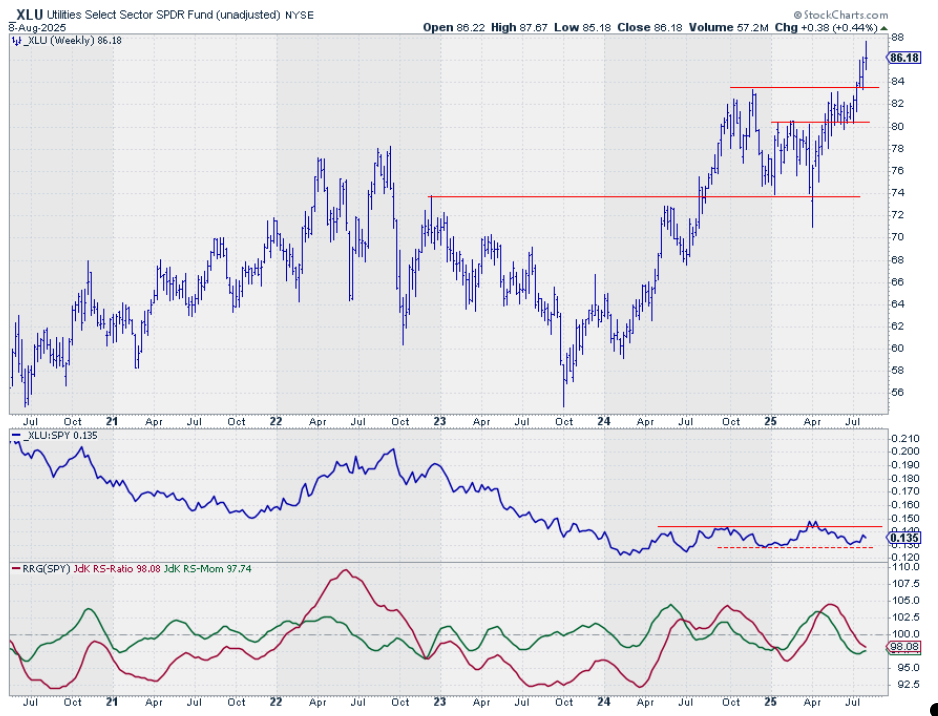

- Utilities show the highest RS-ratio and RS-momentum readings on the daily chart, supporting the pickup seen on the weekly RRG.

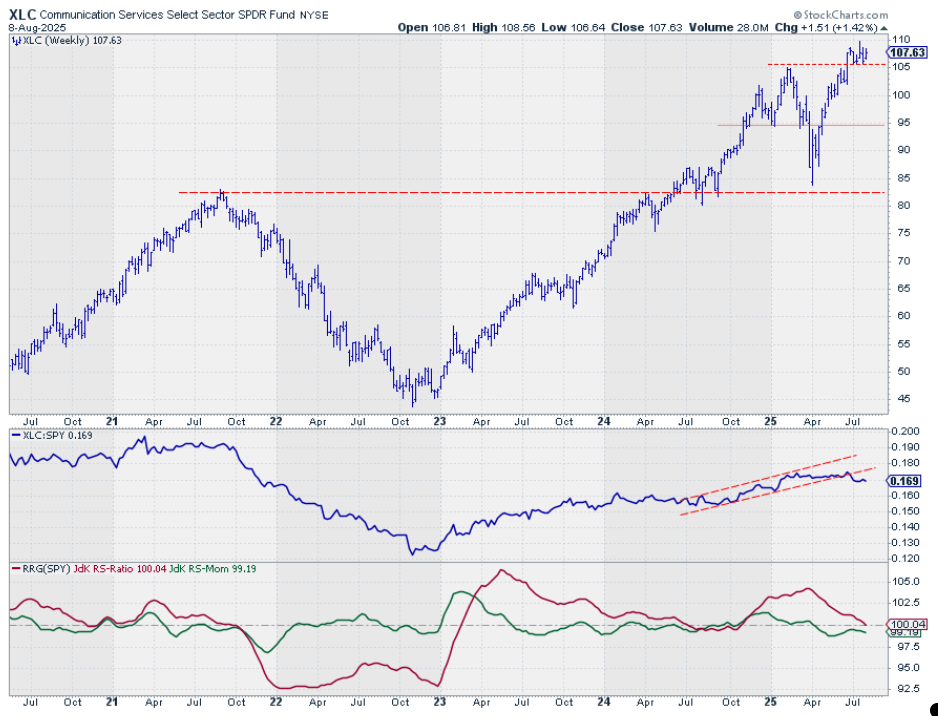

- Communication Services is rotating into the lagging quadrant on the weekly but starting to push higher on the daily RRG, a mixed signal that needs attention.

- Consumer Discretionary remains weak on both timeframes, reinforcing its vulnerable position in the top 5.

The Top 5 Charts

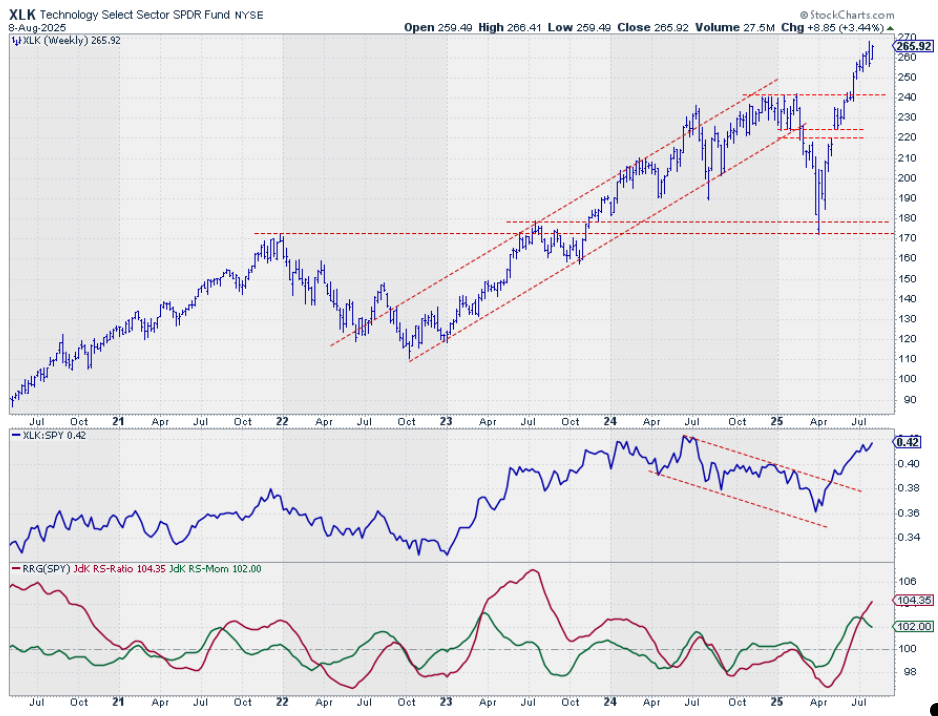

Technology

Technology continues to hold up well on both price and relative strength. The slight loss in relative momentum seems temporary, at least for now.

Industrials

The Industrial sector is maintaining its position above the breakout level, but the RS line has peaked and started moving sideways. This is pulling the RRG lines lower, positioning industrials in the weakening quadrant.

Utilities

Utilities had a strong week, pushing to a new high. The RS line has bottomed out and appears to be on the way back up, reflected in the rising RS momentum line. This could be the start of a more significant move.

Communication Services

While still holding above the former breakout level (~105), Communication Services is flirting with danger. The potential double-top formation is still very much in play, and a break below 105 would damage the price structure. The RS line has already broken its rising channel, and the sector is close to crossing into the lagging quadrant.

Consumer Discretionary

Consumer Discretionary is up against a shallow declining resistance line, keeping both the price and RS line under pressure. To maintain its top 5 position, we'd need to see a break above this resistance; otherwise, the sector is at serious risk of dropping out of the top 5.

Portfolio Performance

The portfolio composition remains unchanged, as does its performance relative to the S&P 500, still hovering around 9% below the benchmark. We're waiting for relative trends to pick up and become more sustainable, but, for now, this is where we stand.

#StayAlert and have a great week, -Julius