Capital Rotates Into Defense Stocks as the “Golden Dome” Theme Gains Traction

A notable shift is taking place beneath the surface of the equity markets, as investors increasingly rotate toward defense stocks amid rising geopolitical uncertainty and renewed focus on national security. While much of the past two years has been dominated by AI, semiconductors, and mega-cap technology leadership, defense-related equities have emerged as a relative area of strength, supported by macro trends and long-term government spending priorities.

At the center of this renewed interest is what many are referring to as the “Golden Dome” theme: an expansion of missile defense systems, space-based surveillance, and next-generation protection infrastructure designed to counter evolving global threats. As geopolitical tensions remain elevated and conflicts become more technologically complex, the strategic importance of advanced defense capabilities has moved front and center for policymakers and, increasingly, for investors.

Why Defense Is Back in Focus

Unlike more cyclical sectors, defense spending tends to be remarkably durable. Governments, particularly the United States and its allies, are committing to multi-year defense budgets that prioritize modernization, missile defense, cybersecurity, and space-based systems. These commitments are less sensitive to short-term economic slowdowns and often accelerate during periods of global instability.

The Golden Dome concept underscores this shift. Rather than relying solely on traditional ground-based defense, governments are investing in layered systems that integrate satellites, radar, AI-enabled threat detection, and rapid-response interceptors. This represents a growth opportunity for companies positioned across aerospace, missile defense, space systems, and advanced electronics.

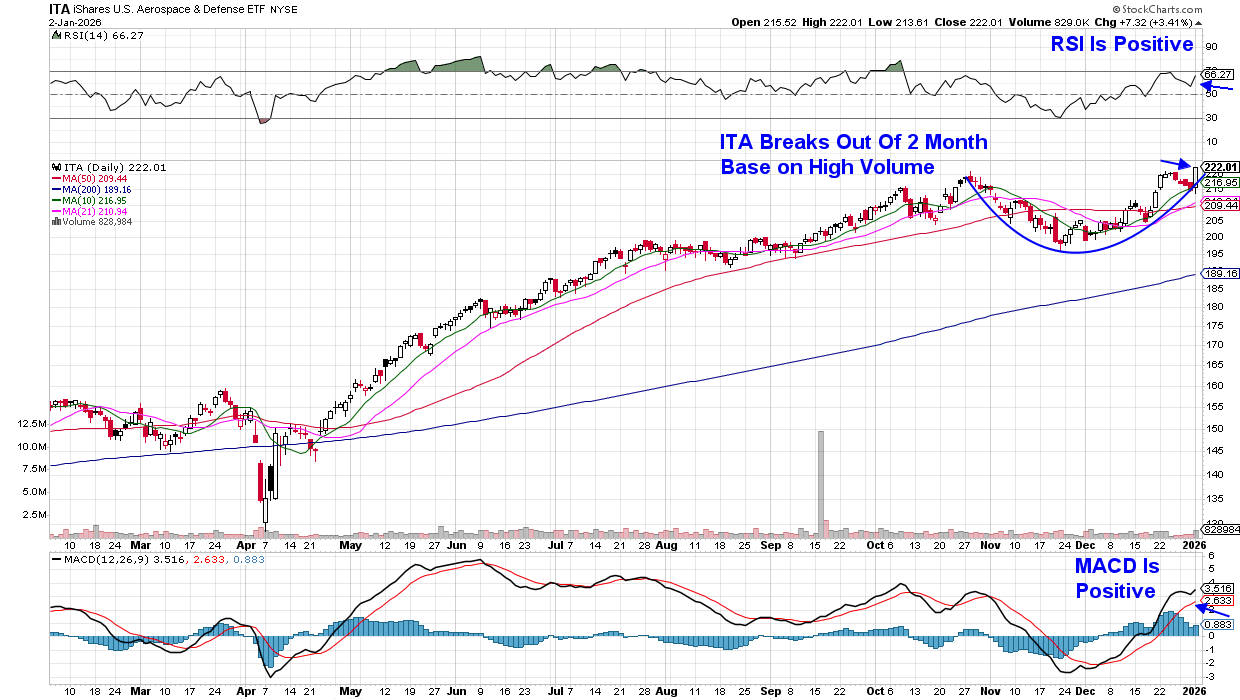

Market Rotation and Relative Performance

From a market perspective, defense stocks are benefiting from two powerful forces. First, they offer earnings visibility at a time when investors are becoming more selective. As higher interest rates persist and valuations in some high-growth areas come under pressure, companies with predictable cash flows and long-term contracts are becoming more attractive.

Second, defense stocks are increasingly viewed as a hedge against geopolitical risk. Historically, periods of heightened global tension tend to coincide with relative outperformance in defense-related equities. This doesn’t necessarily require an escalation of conflict; rather, it reflects sustained investment in deterrence and preparedness.

My twice weekly MEM Edge report has been highlighting the most important aspects of the Golden Dome theme — its emphasis on space. Modern defense strategies increasingly rely on satellite networks for early warning, communications, navigation, and real-time intelligence. This has blurred the line between traditional defense contractors and space-focused companies, creating new opportunities across both sectors.

As market leadership broadens and investors look beyond traditional growth sectors, defense stocks have been quietly moving to the forefront. Selectivity remains key however, and if you’d like immediate access to my top picks in defense related stocks, use this link here to trial my twice weekly MEM Edge Report at no cost.

You’ll also be kept up to date on broader market conditions as well as opportunities in other expanding areas of the market.

Warmly,

Mary Ellen McGonagle

MEM Investment Research