Foreign Fireworks: Global Politics Ignite Moves in Gold, Bitcoin, and the Dollar

Key Takeaways

- Japan’s raging bull run continues with a new pro-market prime minister expected to take office.

- Additional political turmoil in France sent that nation’s stock and bond markets lower to begin the first full week of October.

- Amid macro upheavals (and record high global stock prices), the dollar, gold, and Bitcoin are on the move.

October is notorious for “volatility” events. Well, we now have a pair of them, just not domestically.

Over the weekend, Japan’s Nikkei 225 Index soared 4.75%, notching another all-time high. The USDJPY currency pair rose 2% to near its highest level since March, breaking through 150, following the news that pro-stimulus lawmaker Sanae Takaichi could become the next prime minister of Japan.

Then, in France, Prime Minister Sébastien Lecornu unexpectedly resigned after just two weeks on the job. The euro fell 0.7% against the dollar on Monday, hitting its weakest mark since mid-September. The CAC 40 Index shed 1.5%, while ETFs tracking Europe fell as U.S. equities made more highs. European banks were hit particularly hard.

Abenomics 2.0 in Japan and persisting Paris political turmoil lifted global interest rates. Japan’s 10-year yield rose to 1.68%, a rate not seen since 2008. The French 10-year OAT spiked almost eight basis points to 3.59%, threatening the highest mark going back to 2011.

Macro volatility overseas comes as the U.S. federal government remains shut down. Prediction markets peg the duration of the closure at about three weeks from the October 1 start date. Stocks haven’t minded the impasse, as the S&P 500 ($SPX) tallied fresh record highs as the data-light week began. Earnings season doesn’t kick off until the middle of next week, either.

With global shake-ups rattling some markets, let’s assess price action in the dollar, gold, and Bitcoin. Each caught a bid in early-week trading, potentially setting the stage for how price action may play out in Q4.

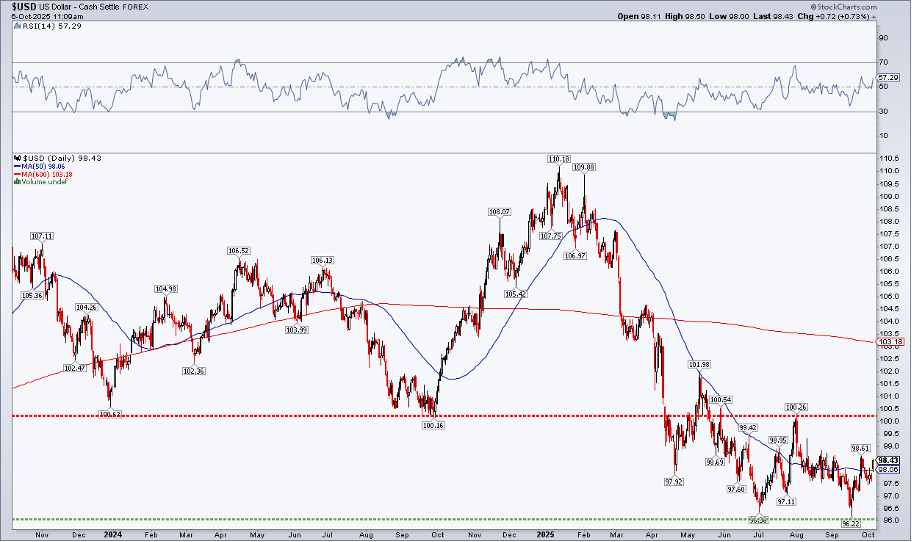

Dollar Watch: Range-Bound but Resilient

More fiscal easing may be on tap in Japan, and France’s budget is in turmoil. The U.K. has made strides to improve its sovereign balance sheet, but it’s clear that a 6.5% U.S. annual fiscal deficit doesn’t look all that unattractive in comparison. The dollar has indeed steadied itself since late in the second quarter. Now back above its flat 50-day moving average and holding key support just above 96, the buck has some room with which to work.

Resistance lingers between 100–101 on the USD Index, while the long-term 200-day moving average continues to decline. A rally through last month’s high of 98.61 could result in a boost toward the early-August peak of 100.26 (which came immediately after the disappointing July jobs report).

So we have clear spots to watch on the greenback’s chart.

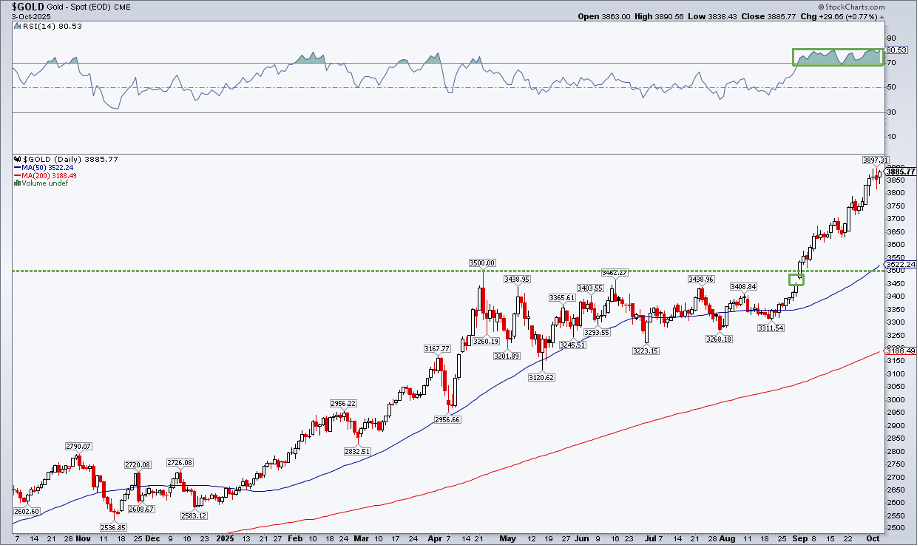

Gold Glitters as Safe-Haven Demand Soars

The debasement-trade feels full-steam ahead, and gold has shot through my $3,800 technical price target outlined in early September. The precious metal traded to a new high, above $3,940, in the wake of leadership shake-ups in Japan and France. “When in doubt, buy gold” seems to be the mantra. Now up by more than 50% on the year, it’s poised for its best yearly return since 1979.

Gold bugs now tilt their heads up to see the $4,000 round number. Historically, gold has had issues with such psychological chart levels. Up seven weeks running, gold has gained nearly 20% just since the low on August 20. As a result, a troy ounce is now 24% above its rising 200-day moving average. The daily RSI has been above 70 all but one day since September began. In short, it’s frothy.

A pause at the $4,000 round number would make sense. BofA put out a note over the weekend suggesting that gold's seven-week winning streaks have often led to pullbacks over the following four to five weeks. $3,500 remains strong support.

A Bitcoin Breakout?

Briefly, bitcoin was rallying as gold took a breather. Both alternatives are working now (ironically, as stock and bond volatility stay muted). The world’s most valuable cryptocurrency tagged a new all-time high on Sunday morning, above $125,000, and largely held those gains today.

What I like about Bitcoin’s jump since September 25 is that it has come alongside a sturdy RSI momentum move. That’s bullish confirmation between price and momentum. Moreover, this is actually the third attempt at hurdling the mid-$120,000 range. Triple tops are said to be rare, so the presumption is that sustained new records are in play.

Based on the $107,000 to $124,000 range breakout, an upside measured move price target to $141,000 is in play. Also, keep in mind that October through December is historically a bullish seasonal period. You can view all of these charts in real-time using StocksChartsACP.

The Bottom Line

The S&P 500, Nasdaq, Dow, and even the Russell 2000 are at record highs. The Cboe Volatility Index ($VIX) is calm and collected, under 17. The ICE MOVE Index ($MOVE) of interest rate volatility rests at its softest level since December 2021.

Indeed, we must do some globetrotting to find stressed markets. Political developments in Japan (new leadership) and France (a lack of leadership) rattled currency and interest rate arenas in early-week trading, all while the U.S. government remains shuttered.

It’s at times like this when gauging upside and downside scenarios with the dollar, gold, and Bitcoin helps set the macro foundation. Next week, we can turn back to corporate earnings and single-stock plays, and maybe we’ll get lucky with official data coming back into the picture thereafter.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.