How to Insure Against an Equity Market Reset

For months, this market has felt invincible. But if you look under the hood, the rally is starting to show cracks.

We are seeing a divergence that should make investors nervous. Even as the S&P 500 ($SPX) grinds higher, the high-beta "risk-on" assets are signaling a potential liquidity crunch. Crypto has crashed, gold and silver are selling off, and perhaps most concerning, we are seeing a major divergence with the Tech sector, where the biggest names in AI, driving the markets, are starting to falter.

The Outlook: I am not calling for a recession or a 20% bear market. But, given the exhaustion signals, a standard 5% consolidation over the next 45 days would be well within the realm of possibility for a correction.

In a normal market, a 5% drop is a "healthy pullback." But if you are 100% long, a 5% drop takes the SPY back to $660, potentially wiping out your gains from the last quarter. The question, then, is this: How do you protect your portfolio without selling your long-term winners?

The "Insurance" Trade

With the VIX hovering around 17%, buying straight put options for protection is expensive. The premiums are high and, if the market stays flat, you’ll lose money.

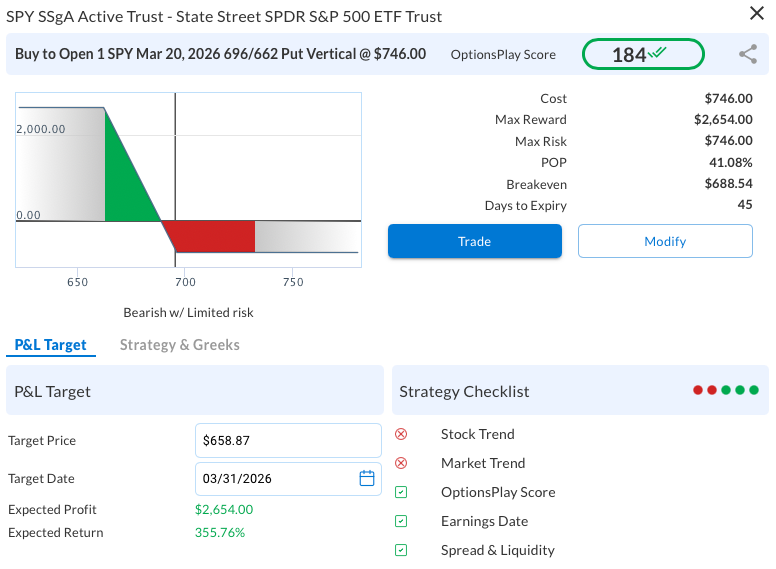

What I've done instead is use OptionsPlay integration to engineer a Bear Put Spread. This strategy allows us to finance the purchase of our protective Put by selling a lower-strike Put against it. The result? A protection trade that pays out 3.6x your money if we get a modest pullback.

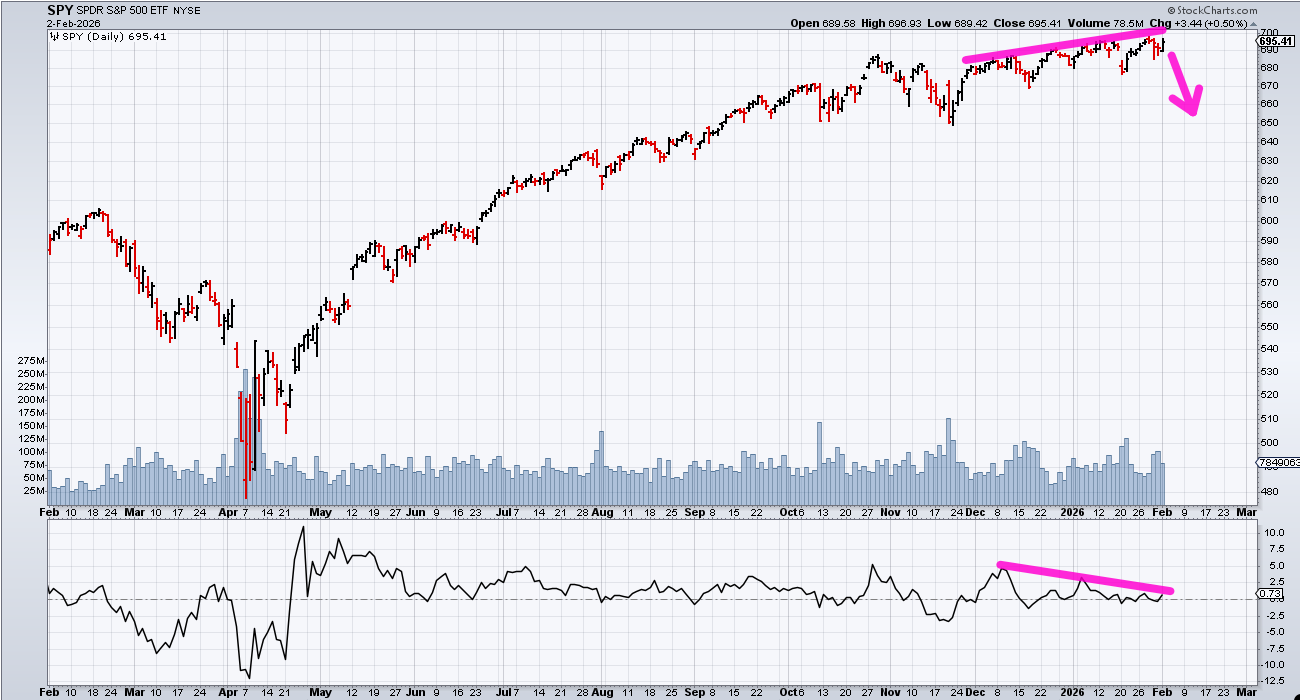

The Technical Signal

We are seeing a classic "Double Top" formation with bearish divergence on the Relative Strength Index (RSI). The price is straining to make new highs, but momentum is falling off a cliff. The path of least resistance has flipped to the downside, with a modest target near the $660 support level.

The Trade Execution

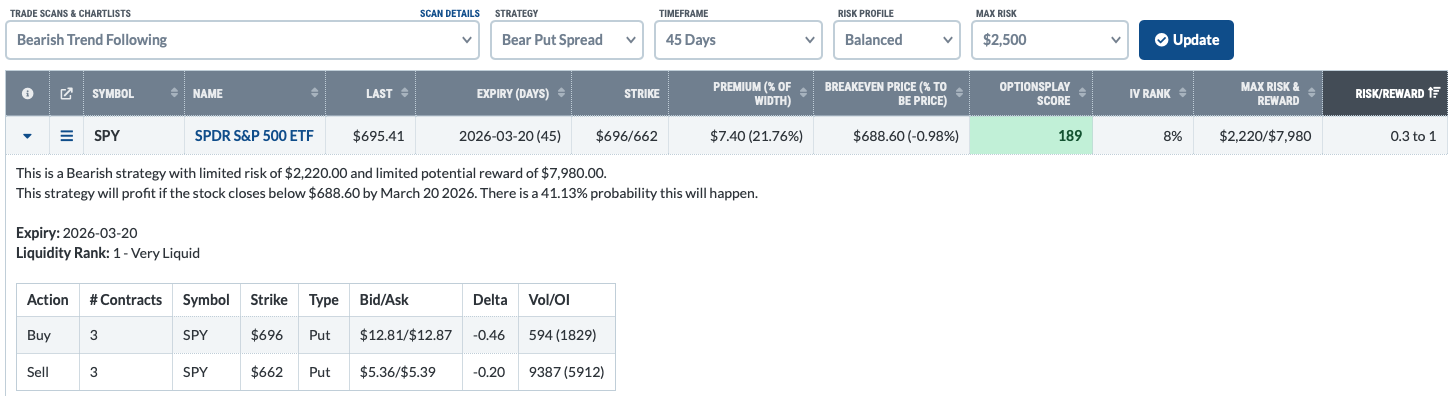

I ran the "Bearish Trend Following" scan in OptionsPlay to find the most efficient way to hedge the SPDR S&P 500 (SPY).

The Trade

- Strategy: Bear Put Spread

- Expiry: March 20, 2026 (45 Days)

- Legs: Buy $696 Put / Sell $662 Put

- Net Cost: ~$7.40

- Max Payout: ~$26.60

Why this trade is a no-brainer: This trade risks $740 to potentially make $2,660 per contract.

That is a 3.6-to-1 Risk/Reward ratio. You don't need a market crash to profit here. You just need the SPY to pull back ~5% to the $662 level — which is a perfectly normal consolidation move — for this trade to hit max profit.

What if the market shrugs off the bad news and keeps rallying? In that case, you only lose the cost of the spread which is about 1.05% of SPY’s value (your "insurance premium"), leaving your long-term portfolio intact to capture further upside.

How I Found This Trade

Usually, constructing a hedge like this takes a lot of guesswork. Which expiration? Which strikes? Is it too expensive?

I found this SPY trade in 5 seconds.

I simply opened the OptionsPlay Add-On for StockCharts, selected the "Bearish Trend Following" scan, and SPY was ranked near the top with a score of 189. The tool instantly identified that the $696/$662 vertical spread offered the best "bang for your buck" protection in the current volatility environment.

Don't wait for the selloff to start before you buy insurance. Let the math help you sleep well at night.

If you'd like to explore this strategy further, you can analyze bear put spreads directly in StockCharts using the OptionsPlay Add-On.