How Turbulent Markets in 2026 Can Be Offset By Select Yield Stocks

As 2026 unfolds, financial markets continue to experience above-average volatility. Investors are grappling with government policy shifts, geopolitical tensions, and sector rotations that have pressured select growth stocks.

Against this backdrop, dividend-paying equities, especially those with strong balance sheets and reliable cash flows, are regaining attention as potential anchors for portfolios seeking income and risk mitigation. Below is an overview of why dividend-oriented stocks such as Kinder Morgan (KMI), Coca-Cola (KO), and Realty Income (O) can be ideal as stabilizing anchors in an otherwise choppy 2026 market.

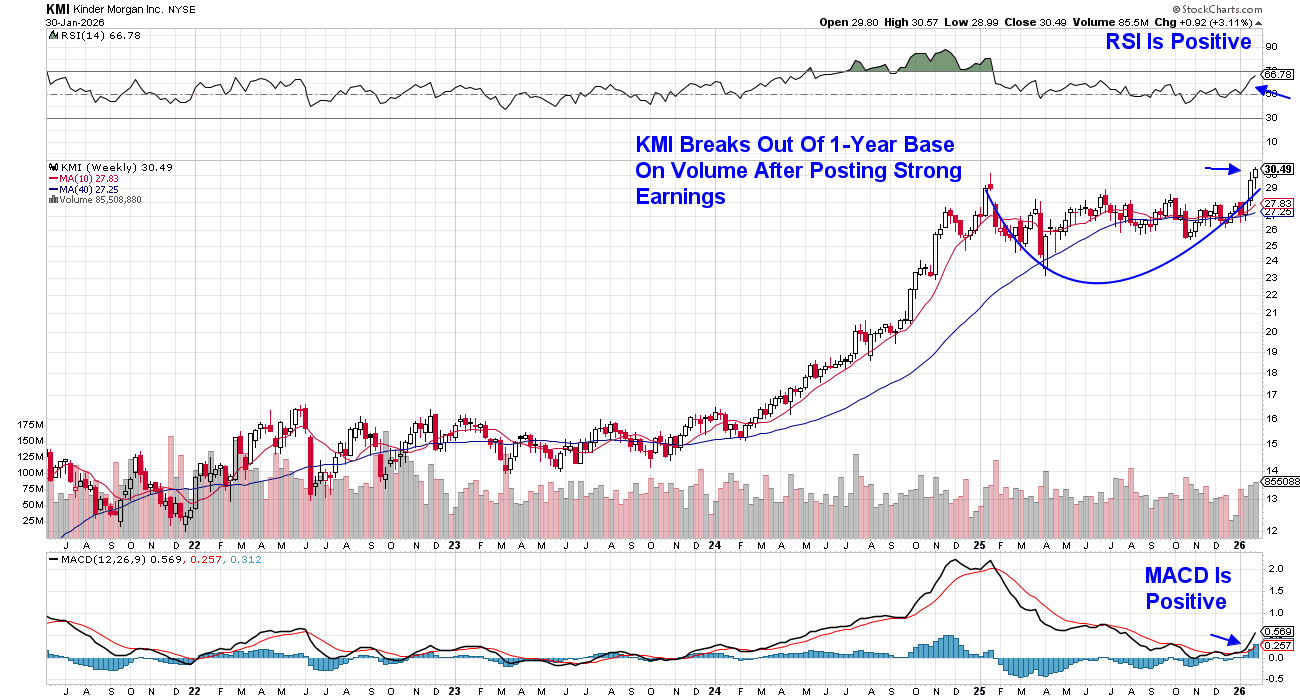

Kinder Morgan (KMI): A Midstream Dividend and Cash Flow Engine

Kinder Morgan operates one of North America’s largest energy infrastructure networks, including natural gas pipelines and storage facilities. These assets generate fee-based revenues, which tend to be less sensitive to commodity price swings when compared with pure upstream oil & gas producers.

For 2026, Kinder Morgan has projected earnings growth amid steady operational performance. While we’ve seen extreme price spikes in Natural Gas prices, midstream companies like KMI typically are less sensitive to those swings. A blend of reliable cash flow and balanced leverage supports Kinder Morgan’s 3.8% dividend even when markets whip investors around.

This week, KMI broke out of a one-year base on heavy volume.

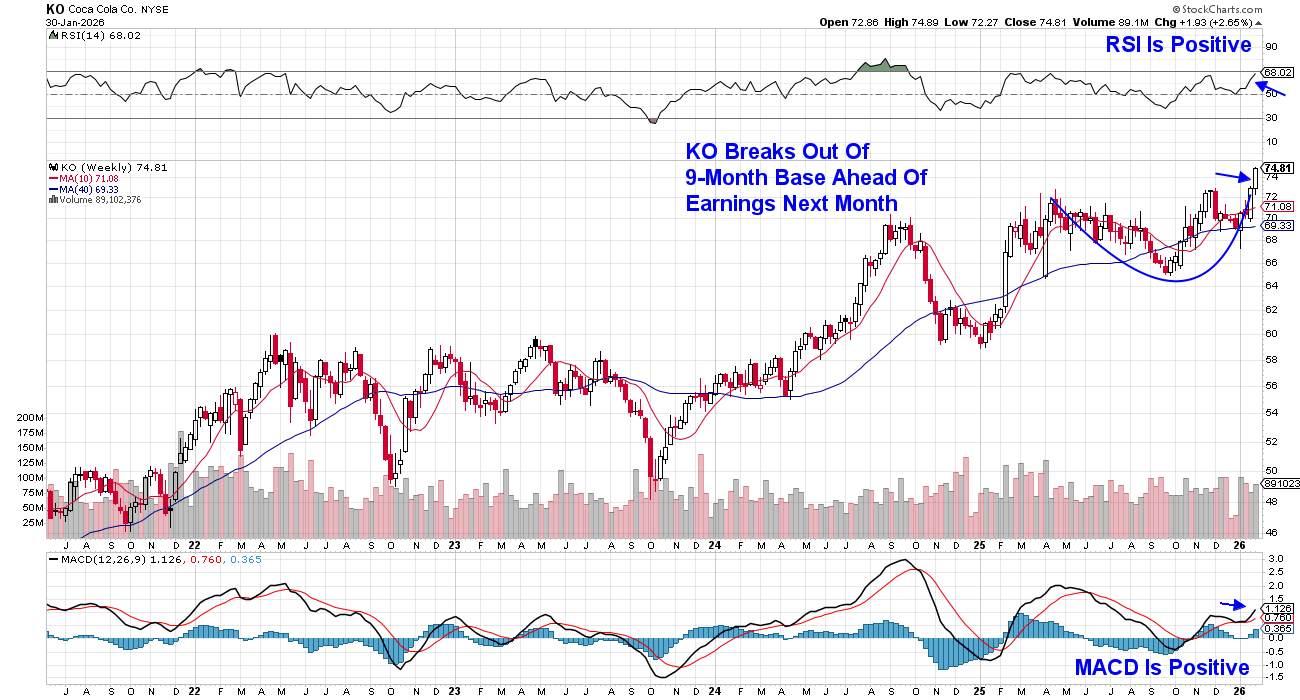

Coca-Cola (KO): Classic Defensive Yield with Brand Moat

Consumer staples stocks have historically acted as volatility dampeners during turbulent markets, and Coca-Cola has this trait. The company offers credible growth fundamentals paired with dependable dividend income, which is why it’s attractive during market volatility.

KO has had a steady, rather than explosive, pace of growth as the company expands its total beverage portfolio. New products like Sprite + Tea and an increased presence in coffee (Costa Coffee) have broadened its market beyond traditional soda. KO’s non-cyclical demand profile — people drink its brands regardless of economic conditions — creates earnings and dividend predictability. That steadiness can act as ballast when the broader market’s growth-oriented names swing sharply.

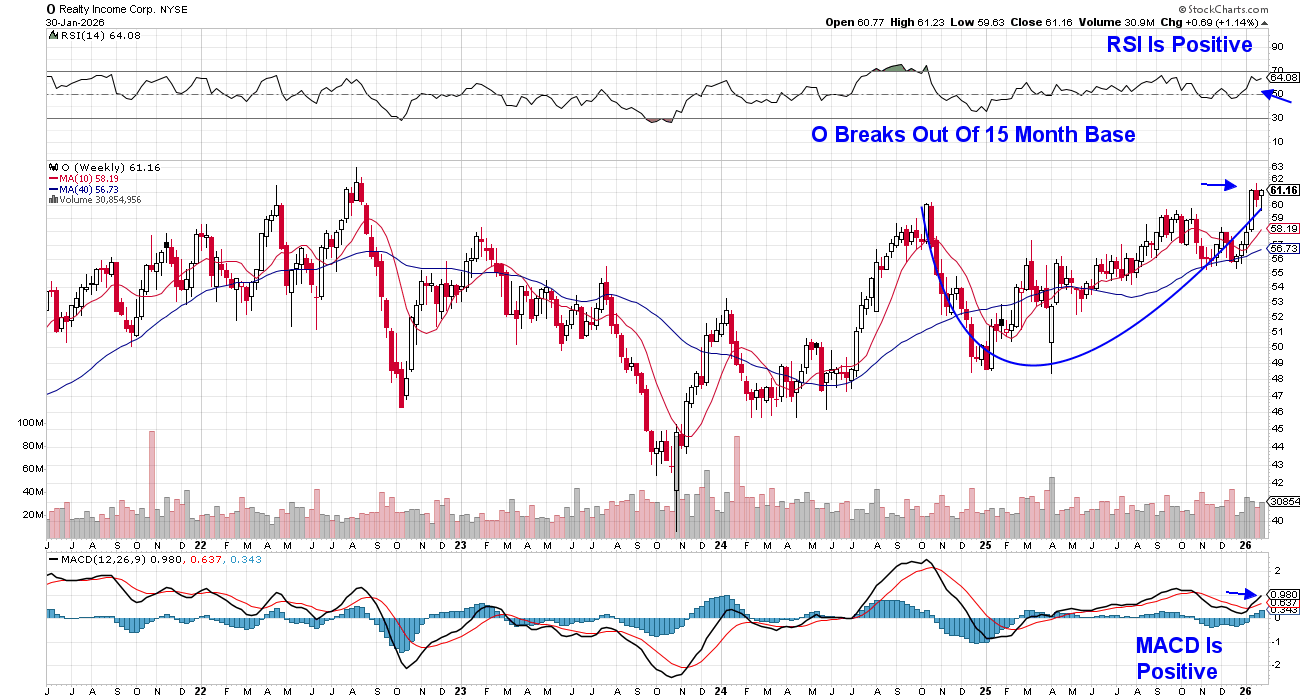

Realty Income (O): Monthly Dividend & Real Estate Stability

Realty Income (O) has a unique niche among yield stocks: it’s a REIT that pays dividends monthly, not quarterly, and they’ve declared hundreds of consecutive monthly dividends over decades. At this time, the annual yield is 5.3%.

Realty Income has a diversified property base with exposure across retail, industrial, and service-oriented tenants in the U.S. and abroad. By converting rental cash flows into regular monthly income, the company gives investors a near fixed income-like return stream that isn’t tied directly to share price gyrations.

While yield stocks can offer an income buffer from volatile environments, I urge you to not give up on growth stocks but rather, augment them. A quick review of this year's biggest winners reveals that these faster-growing companies are continuing to see the largest inflows of new money.

Within the S&P 500, both Seagate Technologies (STX) and Micron (MU) are up over 45% this month, with these AI-related stocks poised for further upside. Both names have been on the Suggested Holdings List of my twice-weekly MEM Edge Report since last fall.

Other top Growth names from my MEM Edge Report List are also on the move higher, and if you’d like to have immediate access at no cost, use this link here.

While no investment is completely risk-free, yield stocks with solid financial footing, such as WMB, KO, and O, can help investors weather market uncertainty. However, longer-term growth that can make a big difference to your returns, you’ll want to have exposure to growth stocks as well.

Warmly,

Mary Ellen McGonagle

MEM Investment Research