Jensen > Jay: NVIDIA Takes the Spotlight from the Fed and Mag 7 Earnings

Key Takeaways

- NVIDIA shares tagged a record $5 trillion market cap after its stunning GTC showcase.

- The S&P 500 has climbed to fresh multi-decade highs as chip stocks lead.

- Momentum, fundamentals, and AI tailwinds keep NVDA squarely in the driver’s seat.

Jensen matters more than Jay. That might be this week’s market modus operandi.

Ahead of the Fed meeting and following a jaw-dropping GTC event, NVIDIA (NVDA) reached the $5 trillion market cap milestone mid-week. Along with the nearly 5% advance on Tuesday came all the usual accolades and stats, such as:

- NVDA remains larger than all non-U.S. countries in the All-Country World Index; it’s bigger than the majority of S&P 500 sectors.

- It’s now the best-performing Dow component year-to-date.

- The chipmaker’s shares are up 55% in 2025 (as of Wednesday morning).

- More broadly, the S&P 500 Index printed fresh multi-decade highs relative to the S&P 500 Equal-Weight Index.

The gaudy list could go on. NVIDIA’s GTC Washington, D.C. AI Conference wraps up today, and it has been a stunner. CEO Jensen Huang name-dropped a slew of S&P 500 companies across sectors, highlighting just how deeply embedded the world’s most valuable firm is in corporate America. NVIDIA grabbed the spotlight from the Fed, and earnings from Microsoft (MSFT), Alphabet (GOOGL), and Meta Platforms (META), all of which report after the bell.

Geopolitics Enters the Chat

The focus shifts back to NVIDIA on Thursday when U.S. President Trump and Chinese leader Xi Jinping meet in South Korea. The POTUS said he may speak to Xi about the “super-duper” Blackwell chip in pursuit of a trade deal. Keep in mind that NVIDIA seeks access to China’s market for the first time since 2022.

Perhaps NVDA’s stock price is the ultimate barometer of trade-deal progress. Oh, by the way, Jensen may be the final geopolitical high-roller to sit down with Trump before the Trump–Xi handshake.

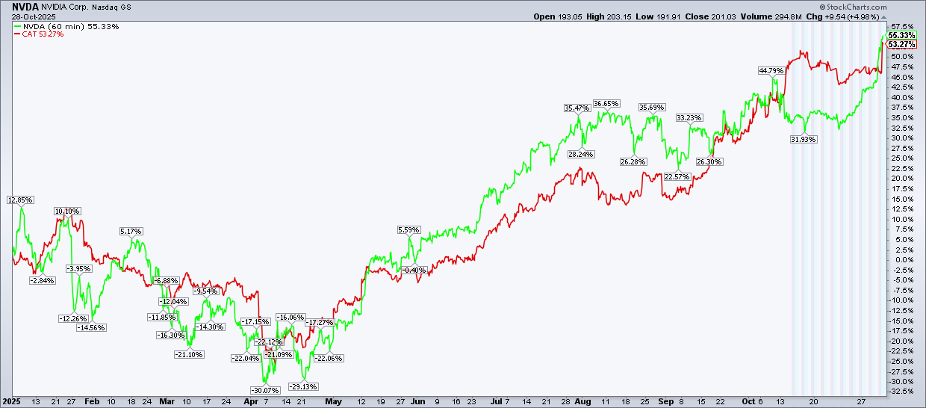

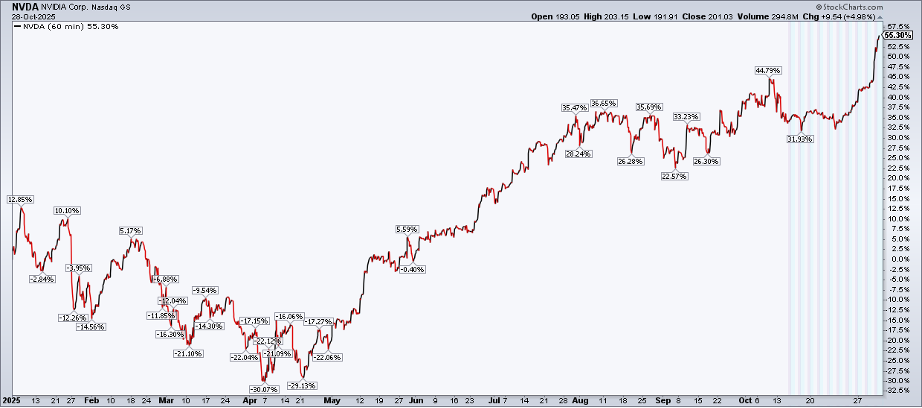

A Chart Worthy of Admiration

For NVDA investors, it’s a beautiful chart. Up 54% on the year, with another notable advance on Wednesday, there are clear skies above. Recall that on October 10, shares sold off hard from open to close, nearly printing a dreaded bearish marubozu candlestick. More selling followed, with a low of $176.76 notched last week, but on light volume.

The likely five-day rally negates what was an ominous potential bearish false breakout earlier in the month. Almost $1 trillion of market cap has now been added from its October nadir, with the most recent jump occurring on significant volume.

Notice on the chart below that NVDA has straddled its rising 50-day moving average, while the long-term 200-day moving average has been upward-sloping since early May. Also, take a look at the RSI momentum oscillator at the top of the graph. Even before the midweek run-up above $205, a higher high in the RSI helps confirm this breakout to a new record.

Valuation and Fundamentals

Long-term investors and swing traders alike may find the chart compelling, but there’s always more to NVIDIA’s story. On the fundamentals, the stock’s trailing 12-month price-to-earnings ratio is now in the mid-50s, though that’s below its five-year average of 62x. What’s more, the PEG ratio (deflating the P/E by the expected EPS growth rate) is a mere 0.77x, about a point below the S&P 500’s average.

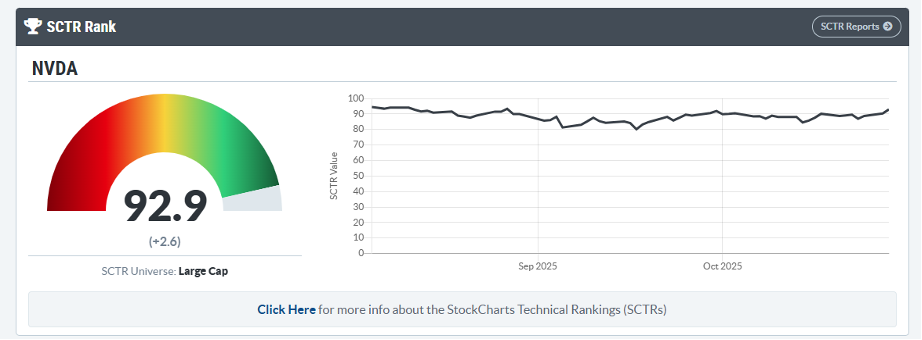

On the Symbol Summary page, we can observe that the SCTR Rank has been high for several months. At 92.9, it has been among the strongest U.S. large caps in terms of overall price action. We’ll see if the bulls keep control through the November 19 third-quarter earnings report. Jensen and co will also be active on the conference circuit, with engagements at KubeCon North America 2025, Supercomputing 2025 (SC25), Microsoft Ignite 2025, and SLUSH 2025, all before the Q3 numbers drop.

Earnings and Risk Management

StockCharts’ new Earnings View helps traders manage risk around reporting events. While NVIDIA has beaten top- and bottom-line estimates in each of the past four quarters, shares have traded lower post-earnings twice.

As it stands, the options market prices in a 6–7% expected swing after November 19. Over in the OptionsPlay Strategy Center, traders can create their own trade ideas with defined risk levels.

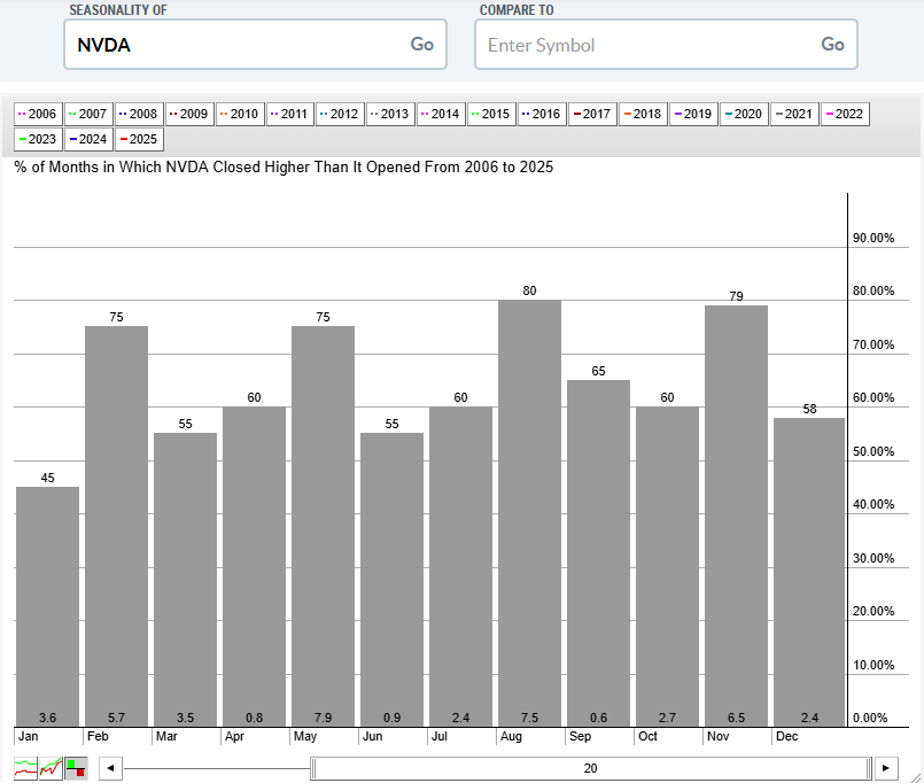

Seasonality Favors the Bulls

Seasonally, November has been among the semiconductor stock’s best months. Since 2006, shares have averaged a 6.5% advance in the year’s penultimate month, with a 79% positivity rate. December, while positive on net, has a lower 2.4% mean return, up 58% of the time. So it would make sense for momentum to continue into year-end.

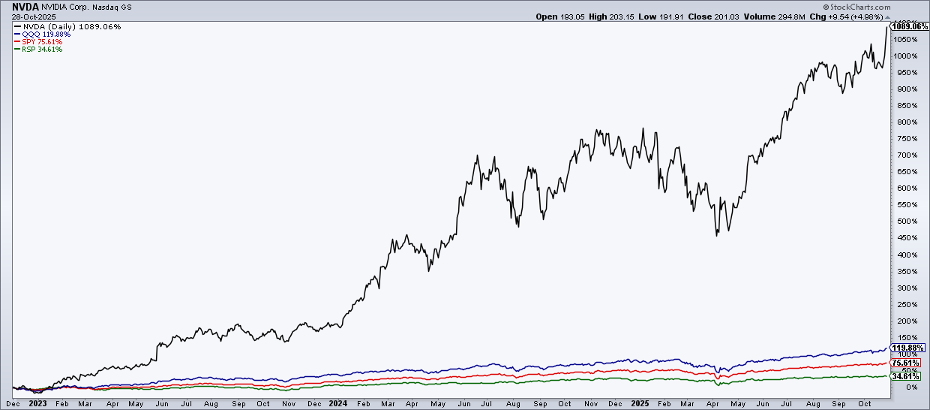

Another date to mark on your calendar? November 30. That marks the third anniversary of ChatGPT’s launch. Arguably, the AI breakthrough, now used by 800 million people worldwide, will keep NVIDIA in the media limelight. NVDA is up about 1,100% since ChatGPT debuted.

Since then, the company has weathered speed bumps and landmines, including China’s DeepSeek AI announcement in January, stiff competition from custom chipmakers, and macro turmoil amid the tariff selloff earlier this year. Battle-tested, the stock has taken yet another leg higher in what has been an incredible rally.

The Bottom Line

Remember when NVIDIA crossed $1 trillion in market cap? It wasn’t that long ago, just 29 months ago, in May 2023. This week’s breakout bodes well ahead of what’s historically been a bullish month for the stock, particularly after a small October shakeout.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.