Late-October Volatility Playbook: What the VIX, KRE, MAGS, and Gold Are Telling Us

Key Takeaways

- The VIX rose toward 30 last week, suggesting traders are on edge as earnings season ramps up

- Investors’ focus likely shifts from regional bank “cockroaches” to Mag 7 earnings in the sessions ahead

- The government shutdown persists, the Fed is poised to cut next week, and gold aims for its longest weekly winning streak since 1980

The Cboe Volatility Index ($VIX) spiked to near 29 last Friday morning. The fear boost came right on cue, as October is notorious for punching above its weight in market shocks and bouts of selling pressure. It’s always something, and last week’s bearish catalyst was a possible infestation.

Jamie Dimon’s comments about “cockroaches” crawling through the financial system, namely the burgeoning private credit space, were taken more seriously following temporary turmoil in shares of Zions Bancorp (ZION) and Western Alliance (WAL).

Those small regional bank stocks have since bounced. Right now, it looks like it was a “shoot first, ask questions later” situation. That makes sense, since the 2023 regional banking crisis, sparked by the demise of Silicon Valley Bank, is still fresh in traders’ collective memory. This time may be different, however.

For one thing, financial system stress back then stemmed from the steep rise in Treasury yields—it was a duration story, not a credit event. Second, the Fed had no choice but to continue raising rates in 2023. Today, Chair Powell appears to be ceding to the doves, and further rate cuts are on the way.

What to Watch Ahead of the Fed and CPI

We’ll know more after Friday, when the (now-dated) September CPI report hits the tape, but it might not matter much. Fed funds futures point to a 99% market-implied chance of another quarter-point rate cut when the FOMC meets on October 28–29. The probability of a third ease in 2025 is likewise nearly a lock.

Such apparent certainty is almost hard to fathom against the backdrop of the ongoing government shutdown. Prediction markets now peg the length of the closure at 45 days, which would make it the longest in history. For market-watchers, that means a dearth of official data. Traders probably won’t mind — Q3 earnings reports roll in fast and furious beginning Tuesday. Sales and profit updates broaden beyond Financials this week, and commentary from CEOs takes on added importance amid the shutdown.

Where do markets stand with Halloween drawing near? The spookiness has abated. The VIX is back near 20, while implied volatility on the S&P 500 Equal Weight ETF (RSP) is somewhat tame, near 16.

Four Critical Charts to Watch

1. The VIX: Fear Gauge Cools Off

Be mindful of the VIX. A drift back down into the teens would be bullish after the steep rise to just below 30 last week. Typically, those sorts of spikes mark tradeable lows in stocks. A dose of October fear may be just what the bulls needed to lay the foundation for a year-end rally.

2. Regional Banks: KRE and Financials Sector Support

Next, the SPDR S&P Regional Bank ETF (KRE) had its biggest volume session since May 2023 last Thursday. The low of the day was $57.55 — that’s the line in the sand. Above it, the Financials sector at large may rally.

Keep in mind that the big banks posted a clean sweep of bottom-line beats for the first time in a few years. Cockroach comments from Jamie Dimon aside, loan loss provisions were in check among the large money-center banks.

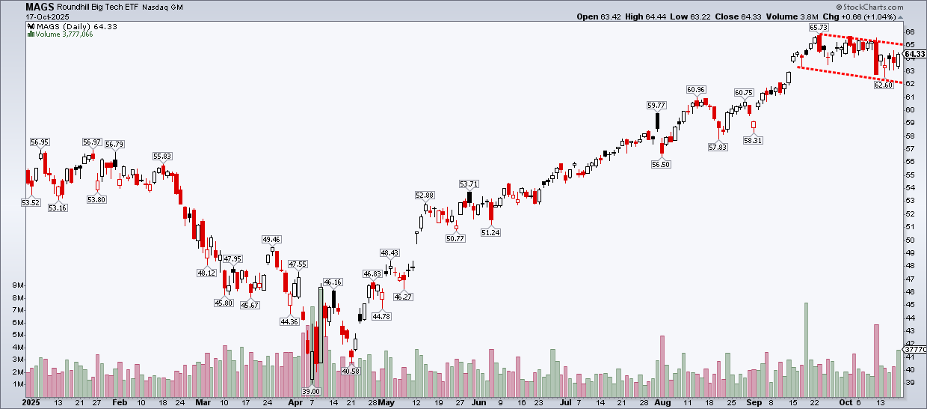

3. Big Tech: The MAGS ETF and the Mag 7 Earnings on Tap

Flying under the radar is the Roundhill Big Tech Fund (MAGS), colloquially known as the Mag 7 ETF. The market’s most important stocks have been conspicuously quiet for almost a month now. Shares soared 69% from their April low to the opening print on September 23 but have since drifted down.

Technicians may dub it a bull flag, but the longer the flag extends, the more questionable the consolidation becomes. It’s an “innocent until proven guilty” pattern, and it comes right ahead of Mag 7 earnings. Tesla (TSLA) is first up on Wednesday afternoon.

4. Gold: Momentum or Mania?

We can’t leave out gold. The precious metal is going for its 10th straight up week—that would be the longest since 1980. While KRE was in the bears’ crosshairs last Thursday, gold and silver were slammed in the following session.

We know that weekly closing prices matter most, and gold’s $4,250 Friday finish was a record high. Is there too much froth? We’re hearing calls for $5,000 and $10,000 for the yellow metal. At the very least, position sizing must be revisited, given that the SPDR Gold Shares ETF (GLD)’s implied volatility is holding at a 52-week high of 30%.

The Bottom Line

It’s late October. Everyone is entitled to one good scare, right? The VIX’s sneaky spike to almost 30 last week was a reminder that markets are on edge, with new risks coming out of the walls. The upcoming stretch leading into November should put the focus back on AI and the strength of corporate profitability. The VIX and gold may offer macro tells, while KRE and MAGS are bellwether industry ETFs to keep on your radar.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.