Nifty at a Crossroads; Awaits Clarity from Global Triggers

The markets saw a decisive breakdown from the 500-point trading range (26200-25700) after a period of consolidation, ending the week on a negative note.

Throughout the week, Nifty traded with a clear downward bias, oscillating within a range of 750 points between 26,373 and 25,623. It was the only major global equity index to end in the red, weighed down by rising uncertainty around US trade tariffs and a deferred Supreme Court decision, now expected on January 14. India VIX spiked 16.51% for the week to 10.93, reflecting heightened caution. As a result, Nifty ended the week with a loss of 645.25 points or -2.45%.

The current technical structure signals a potential pause in the prevailing uptrend as the index has closed below the lower edge of the 500-point trading range. The close below the 20-week moving average (25,579) would end up in some incremental weakness.

Markets remain vulnerable to further pressure, especially amid a combination of domestic consolidation and global risk events. A breach below the current support region could deepen the corrective move, while a bounce back above 25,850–25,900 would be essential to regain strength.

The coming week may open on a tentative note, likely influenced by further developments from the US. Initial resistance is expected at 25,900 and then 26,100, while immediate support lies at 25,500 followed by a more crucial zone near 25,300. A failure to defend 25,300 could attract incremental weakness.

The weekly RSI stands at 53.16 and has marked a fresh 14-period low; it remains neutral without any divergence against price. However, its flattening near the midline, suggesting waning momentum. The MACD has shown a bearish crossover with the MACD line now below its signal line, accompanied by a widening negative histogram, reinforcing signs of a developing downside. No strong candlestick reversal pattern was observed on the weekly timeframe, but the long black candle indicates negative sentiment.

From a pattern analysis perspective, the Nifty is still above the falling trendline that it penetrated. The support on this trendline would translate into the Nifty testing the 25500-25300 zone. The index also failed to hold above the upper Bollinger Band in recent weeks and is now testing the median line, further suggesting that upward momentum has faded. Despite the broader trend still being intact, the index will come under short-term pressure if it slips below its 20-week average.

Given the current setup, traders would do well to adopt a measured and stock-specific approach. Aggressive index positioning should be avoided until clarity emerges either through reclaiming resistance zones or external event resolution. For now, it is prudent to protect gains, trail stop losses where applicable, and remain selective in fresh buying. The week ahead should be navigated with heightened caution and an adaptive, reactive strategy rather than a predictive one.

Sector Analysis for the Coming Week

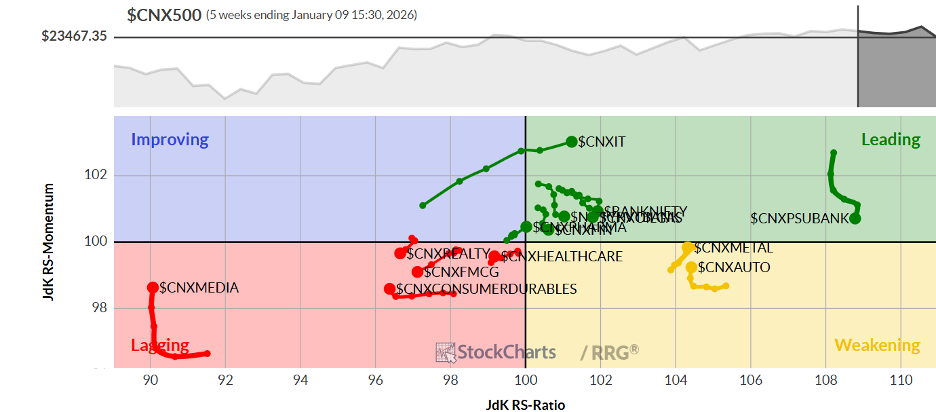

In our look at Relative Rotation Graphs®, we compared various sectors against the CNX500 (NIFTY 500 Index), representing over 95% of the free-float market cap of all the listed stocks.

Relative Rotation Graphs (RRG) show that the Nifty Services Sector and Pharma Indices have rolled inside the leading quadrant. These groups, along with Infrastructure, Banknifty, PSU Bank, IT, Midcap 100, and Financial Services groups, which are also in the leading quadrant, will relatively outperform the broader Nifty 500 Index.

The Nifty Metal and Auto Indices are inside the weakening quadrant. However, they are seen as sharply improving on their relative momentum against the broader markets.

Nifty FMCG, Energy, and Realty Indices are inside the lagging quadrant. These groups may relatively underperform the broader markets. The PSE and the Media Indices are also inside the lagging quadrant. However, they are showing a strong improvement in their relative momentum.

There are no sectors presently inside the improving quadrant.

Important Note: RRG™ charts show the relative strength and momentum of a group of stocks. In the above chart, they show relative performance against NIFTY500 Index (Broader Markets) and should not be used directly as buy or sell signals.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae