Retail Lags, Restaurants Sink: A Technical Check on the U.S. Consumer Story

Key Takeaways

- Restaurant stocks’ price action points to a Main Street growth slowdown

- Equal-weight Discretionary now tests decade-plus lows relative to the AI-powered S&P 500

- Year-end trends are often bullish, but bears control the puck among consumer stocks

It’s Jobs Week on Wall Street. At least, it would be if not for what’s very likely to be the longest federal government shutdown in history. Over the weekend, analysts at Goldman Sachs noted that 2025’s shutdown will have “by far” the greatest economic impact on record. Prediction markets suggest the impasse could last all the way to Black Friday, the unofficial beginning of the most important spending period of the year.

Shutdown Fallout and Consumer Strain

What’s more, SNAP benefits expired for millions of Americans, while folks buying health insurance on the ACA marketplace faced sticker shock on November 1 when open enrollment began. All of these events make the employment data we will get this week all the more crucial. Let’s start with a wide view, then zoom in on some consumer areas of the stock market to gauge where risk and opportunity may lie.

Key Data Points On Tap

This week, we’ll get labor market reads via the full slate of Employment PMI sub-indexes. S&P Global’s October final update and the ISM’s Manufacturing and Services surveys are “soft data,” which generally take a backseat to actual hiring and firing numbers. You may have heard about ADP’s new weekly preliminary jobs estimate, but that won’t post again until Tuesday, November 11, since ADP issues its on-schedule monthly private payrolls report at 8:15 a.m. ET on Wednesday.

November 6 (a year after the 2024 election) brings jobless claims, which many sell-side firms can tabulate from state-level data. Challenger Job Cuts is released before the bell on Thursday. UMich hits on Friday, with plenty of Fed speak throughout the first week of November. Volatility could be in play midweek at the Supreme Court, when the International Emergency Economic Powers Act (IEEPA) tariff case is heard.

Market Uncertainty and the Data Backlog

A macro review and reset are needed for traders, given the fogginess around what reports will be issued and which are delayed. It’s also possible that once our dear friends on Capitol Hill reach a deal, a data deluge could come fast — there could even be a pair of jobs reports within two weeks.

Focus Shifts to the Consumer

With all but NVIDIA (NVDA) among the Mag 7 having reported Q3 results, I assert that this month will focus heavily on the consumer. The likes of Walmart (WMT), Home Depot (HD), Target (TGT), and TJX Companies (TJX) issue third-quarter numbers mid-month. McDonald’s (MCD) sheds light on restaurant spending trends this week, and while its July–September revenue and earnings may be fine, Micky D’s outlook will be in focus.

Restaurants as a Canary in the Coal Mine

Restaurant stocks have indeed suffered so far in the second half, with losses accelerating in just the last few weeks. Maybe this is one of the economy’s corners in recession, as Treasury Secretary Scott Bessent noted over the weekend.

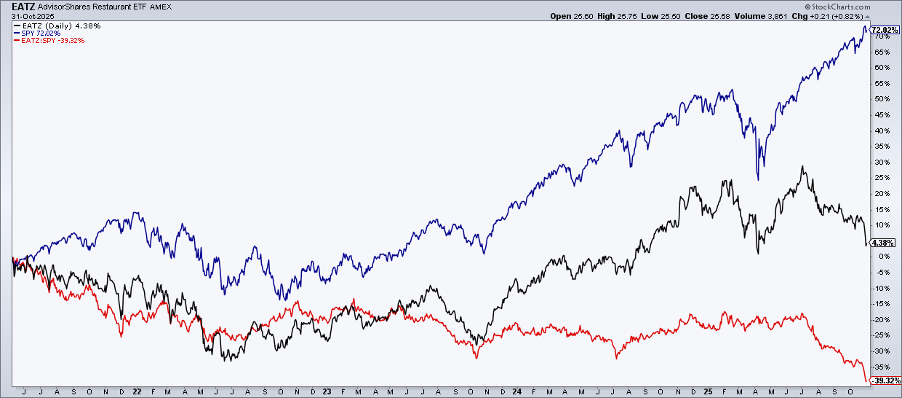

The AdvisorShares Restaurant ETF (EATZ) is a small fund tracking the niche. It’s now at fresh all-time lows versus the SPDR S&P 500 ETF (SPY) and very near a 52-week low on its own. If you’re looking for parts of the economy that point to a growth slowdown, restaurants may be among the first places to eye.

Consumer Weakness Broadens

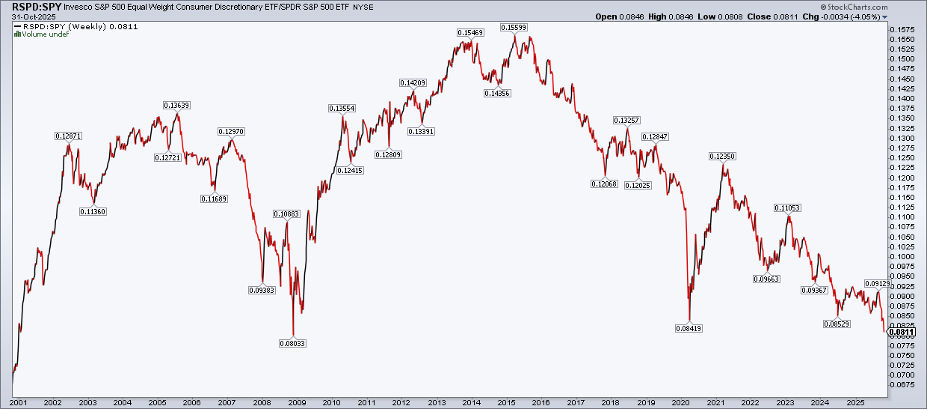

We can get less granular, too. The Invesco S&P 500 Equal Weight Consumer Discretionary ETF (RSPD) is now at its worst level compared to SPY since 2008. Another bad week could result in a new relative low going back to 2001.

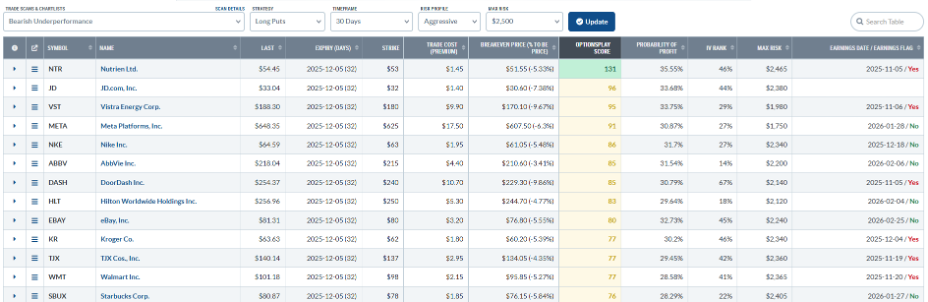

Digging deeper, on StockCharts’ OptionsPlay Strategy Center, I noticed that a handful of consumer stocks appear on the “Bearish Underperformance” scan, applying the “Long Puts” strategy going out 30 days with an “Aggressive” risk profile. We’re talking DoorDash (DASH), Hilton Worldwide (HLT), Kroger (KR), Starbucks (SBUX), and the aforementioned TJX and WMT.

The K-Shaped Economy Persists

Bigger picture, the so-called “real” economy appears to be sputtering, with further pressure on the lower-end wealth cohort impacting non-luxury consumer categories. Sure, Delta’s (DAL) business class seats are selling, but the “Chipotle (CMG) economy” seems to be the weakest in years.

Job-cut announcements from Amazon and Target highlight such retail worries, all while the Johnson Redbook continues to print above 5% year-over-year retail sales growth as the wealthiest 10% fare fine.

Watching the Fed

But is there a Fed backstop? Powell underscored that a December rate cut was not a foregone conclusion, “far from it.” If the jobs data we receive this week are soft, and spending trends turn lower heading into early December, a third quarter-point ease might become reality. Cutting rates has a few possible effects in today’s K-shaped economy.

First, it may lead to reduced spending among the wealthiest 10%, as they will receive less interest income on their cash. At the same time, the bottom 50% would benefit from a small break on their collective debt-servicing costs. Perhaps small-business growth also catches a tailwind.

A Glimmer of Optimism

It’s not all doom and gloom, though. Larger-than-average tax refunds should bolster household coffers in Q1 and early Q2 2026. Moreover, most economists forecast improving employment trends next year.

Until then, traders must focus on price action. Will the underperformance of consumer stocks bleed into the S&P 500? It’s something I’m watching as year-end approaches.

The Bottom Line

This week’s jobs data and upcoming Q3 earnings reports from consumer companies will help determine the Fed’s next move. Restaurant stocks and equal-weight Discretionary have struggled mightily lately. Does the overall economy catch down, or will retail bellwethers play catch-up? Watch the charts.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.