The Best Five Sectors This Week #53

Key Takeaways

- Real estate made a remarkable jump, moving from last position (11th) up to seventh.

- Utilities advanced, rising from tenth to eighth.

- Technology and consumer discretionary both dropped, now sitting at ninth and tenth, respectively.

- Financials fell two spots, landing at the bottom in eleventh place.

Energy Leads, Heavyweights Lag

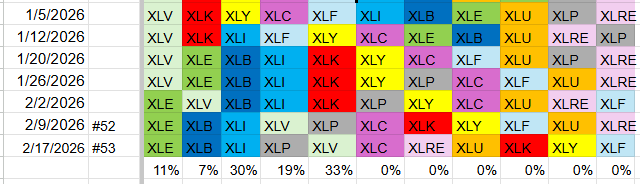

At the end of last week, the overall composition of the top five and bottom six sectors in the portfolio remained unchanged, but there were notable shifts in their rankings.

Energy continues to dominate the number one spot, followed by materials and industrials in second and third place respectively. Consumer staples climbed to fourth place, pushing healthcare down to fifth. Communication services held steady at sixth.

The screenshot above shows the portfolio’s composition over the past few weeks, along with a new row showing current sector weightings based on a market cap-weighted approach; these highlight the major drivers of performance. Industrials and healthcare now account for 30% and 33% of the portfolio, respectively.

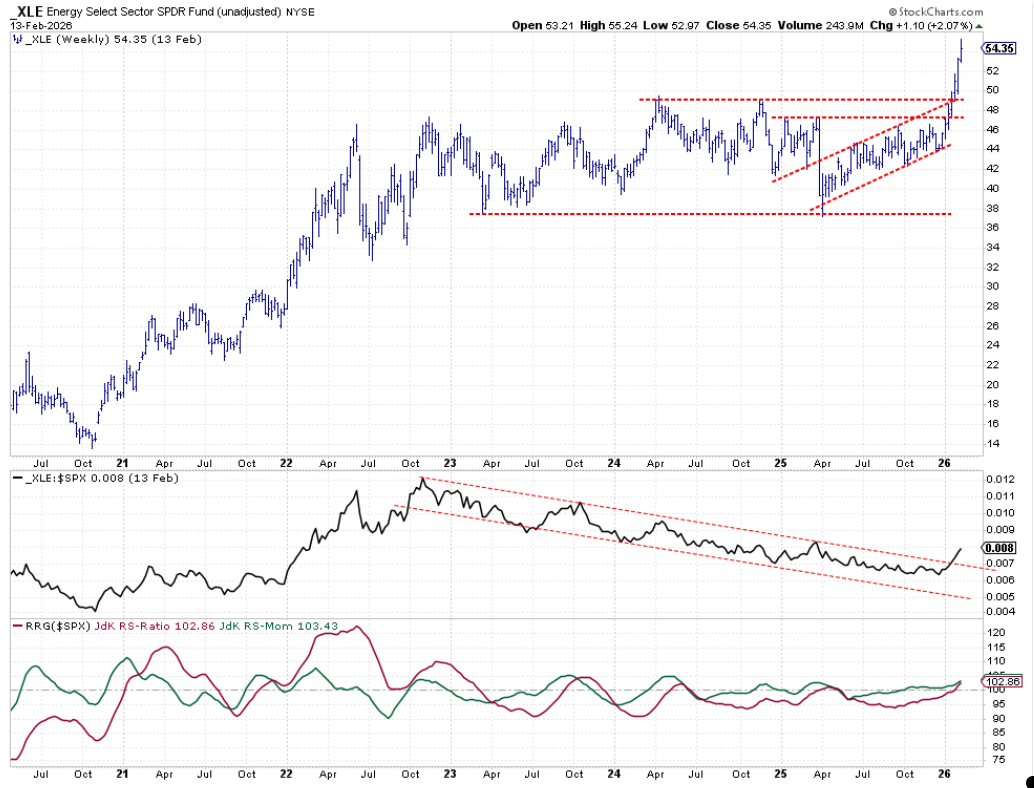

- (1) Energy - XLE [11%]

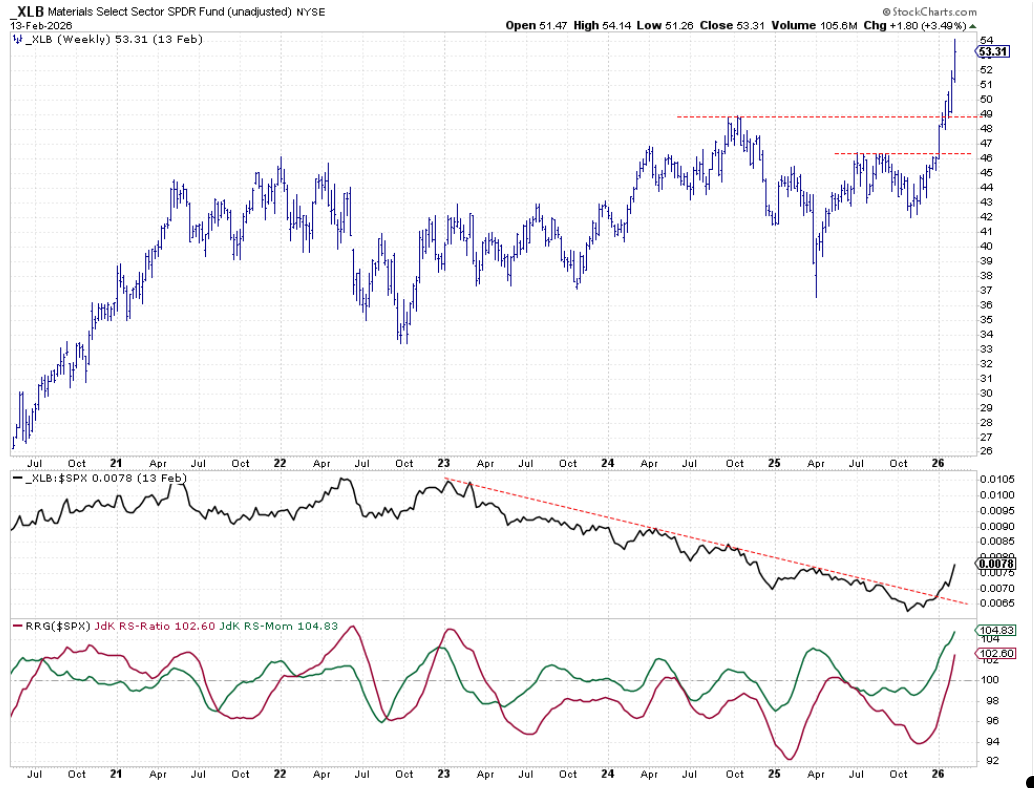

- (2) Materials - XLB [7%]

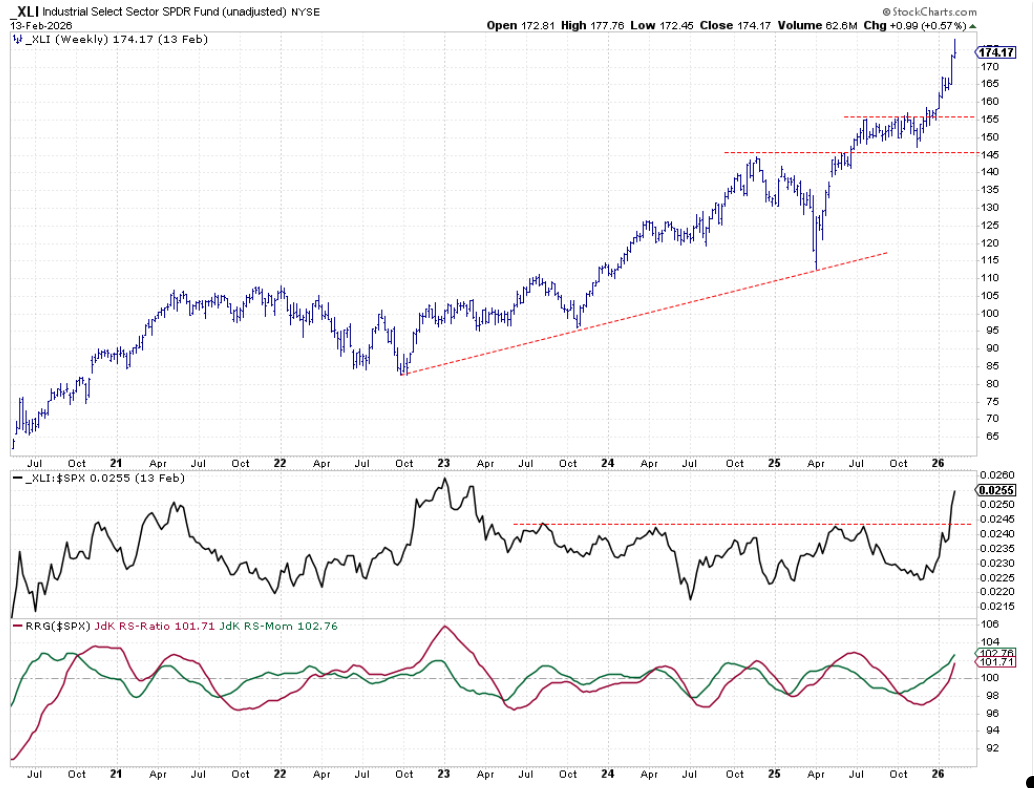

- (3) Industrials - XLI [30%]

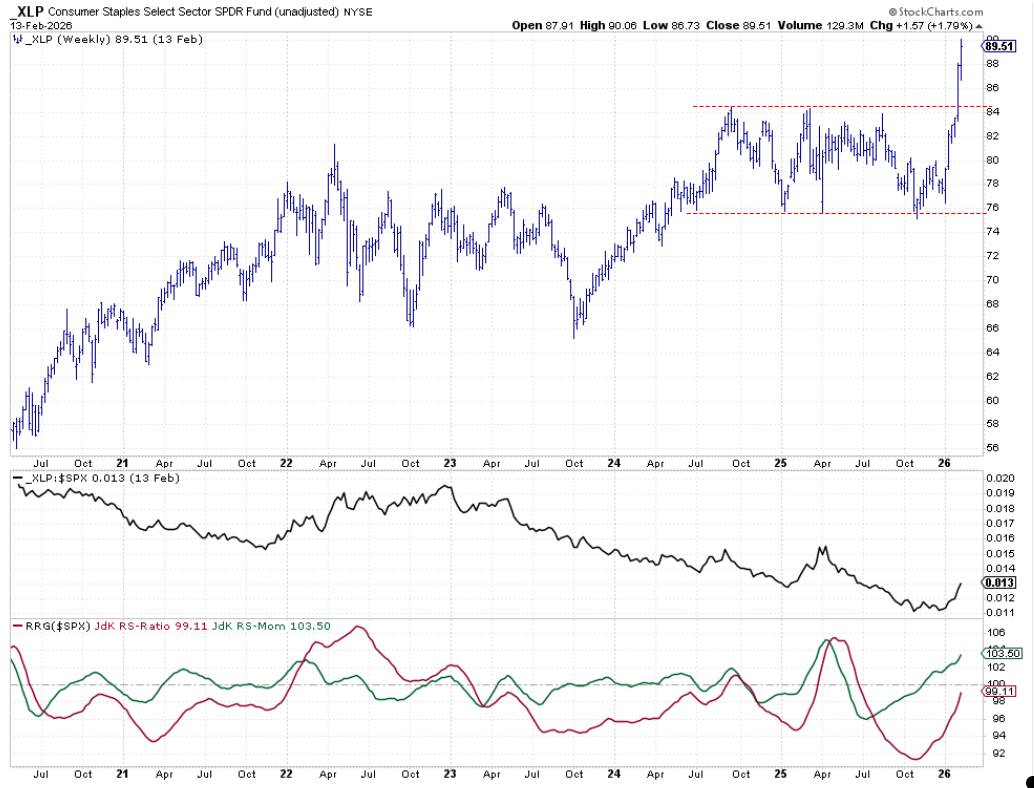

- (5) Consumer Staples - XLP* [19%]

- (4) Health Care - XLV* [33%]

- (6) Communication Services - XLC

- (11) Real Estate - XLRE*

- (10) Utilities - XLU*

- (7) Technology - XLK*

- (8) Consumer Discretionary - XLY*

- (9) Financials - XLF*

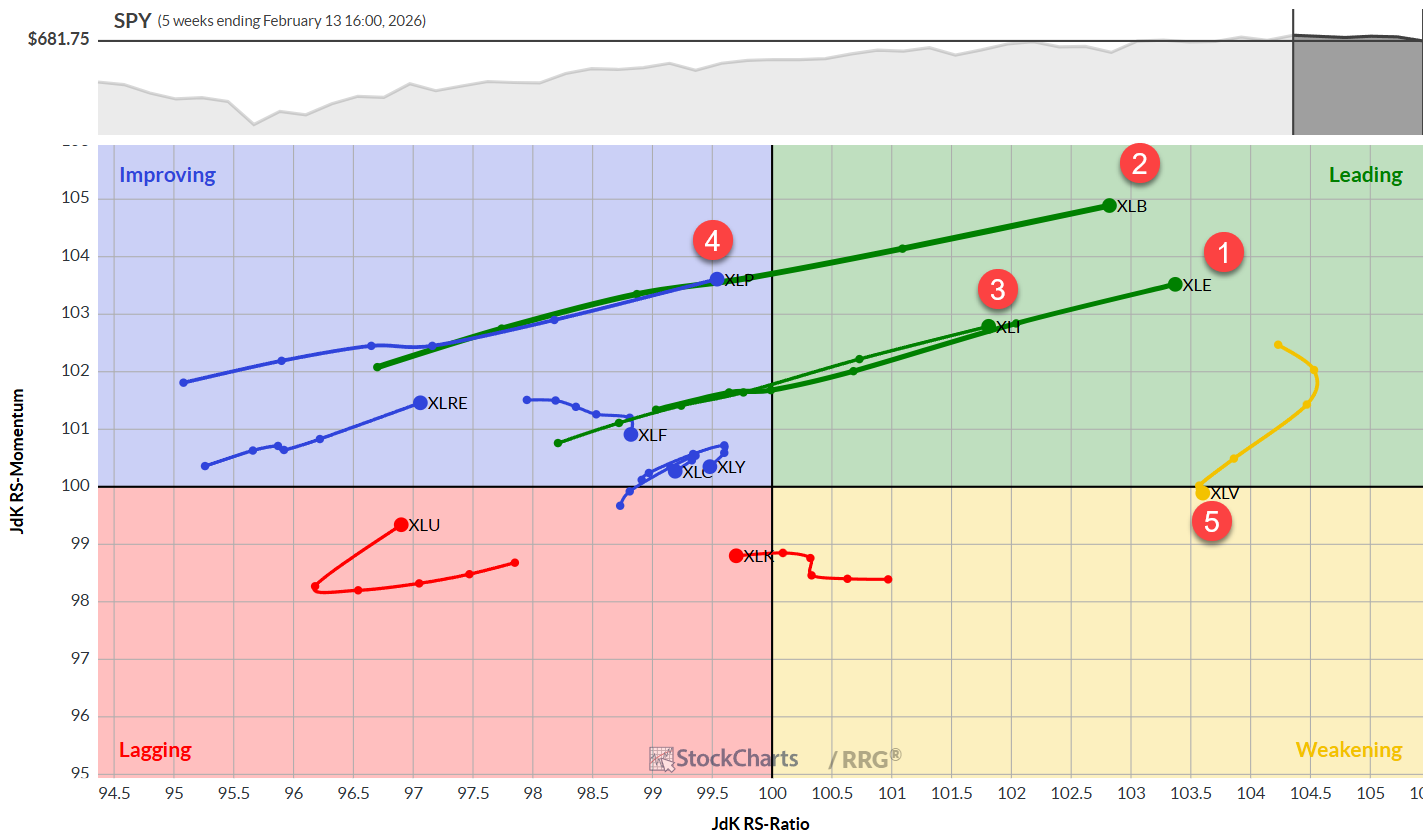

The Weekly RRG

On the weekly Relative Rotation Graph (RRG), three sectors, energy, materials, and industrials, stand out with long tails moving further into the leading quadrant, indicating strong momentum.

Consumer staples is rapidly improving and nearly crossing into the leading quadrant, while healthcare has shifted into weakening. Despite this, healthcare remains the strongest sector on the RS ratio scale for the weekly timeframe.

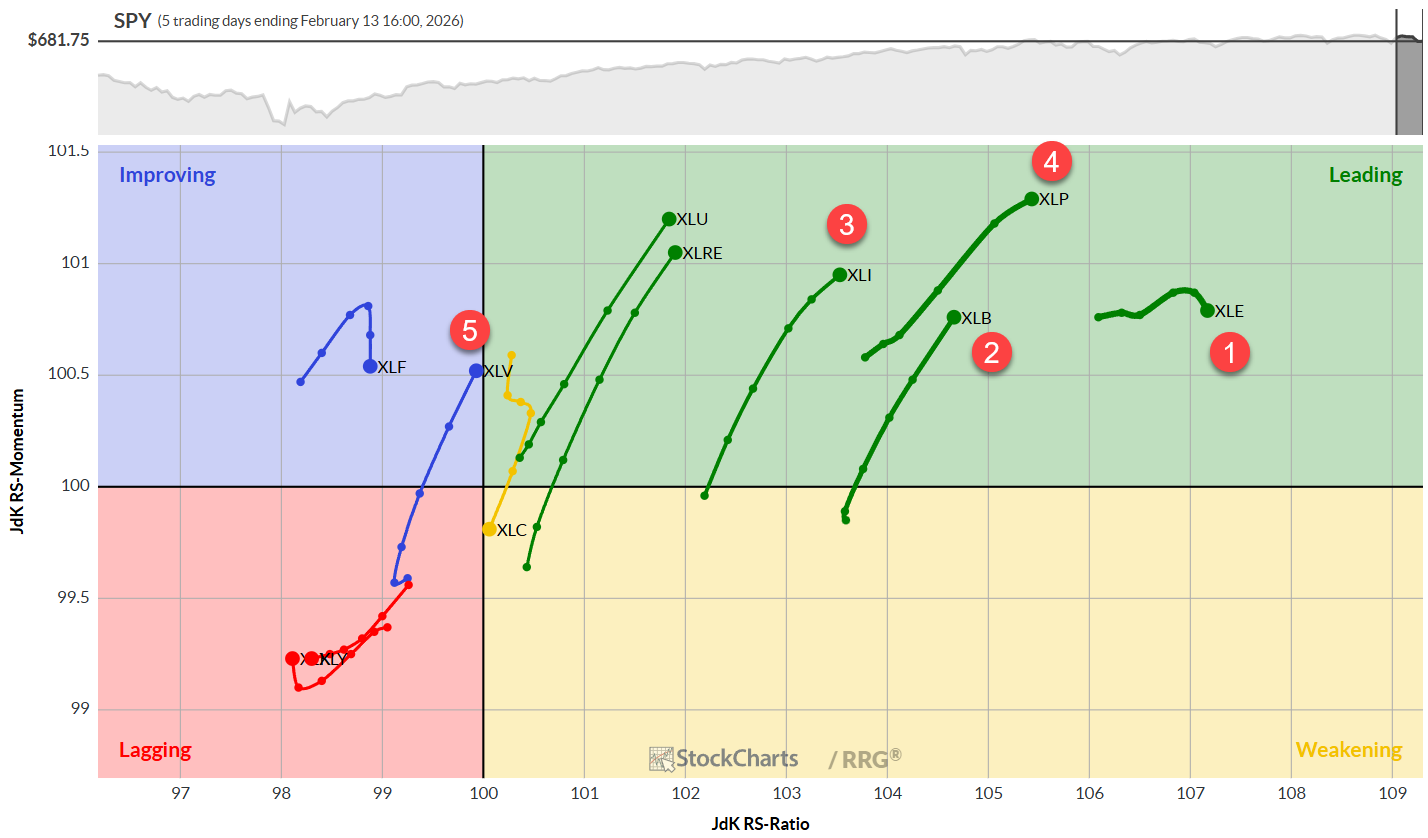

The Daily RRG

Switching to the daily RRG, energy remains the strongest sector in terms of RS-ratio, though it is losing some relative momentum.

Materials, industrials, and consumer staples are all in the leading quadrant with positive trajectories. Healthcare, currently the fifth sector in the portfolio, is moving through the improvement quadrant and is close to entering the leading quadrant.

Overall, all top five sectors are trending positively on both weekly and daily timeframes, except for healthcare on the weekly chart (mildly weakening) and energy on the daily chart (slightly losing momentum).

The majority of sectors now appear on the positive side of the RRG, indicating broader market participation.

Heavyweights Dragging the Market

Despite this broadening, heavyweight sectors such as technology, consumer discretionary, financials, and communication services are underperforming the S&P 500 and weighing on the market. This raises the question of whether increased participation from more sectors in a relative uptrend offset the drag from these heavyweights and, thus, help the S&P 500 maintain or increase its value.

Sector Highlights

Energy

Energy has continued its strong upward move, reaching new all-time highs for the third consecutive week. The sector has broken out of a long-term falling relative trend channel, driving its relative improvement.

Materials

Materials is mirroring energy’s performance, with strong follow-through after breaking above resistance around 40. The sector has also broken out of a relative downtrend that began in 2023.

Industrials

Industrials has maintained strong momentum after breaking above 155 earlier in 2026. The sector’s relative strength line is catching up, and it has surpassed resistance levels not seen since late 2023.

Consumer Staples

Consumer Staples is showing strong follow-through after breaking above resistance last week, holding near $90 after surpassing $84. The relative strength line is improving, but a higher low is needed to confirm a trend change.

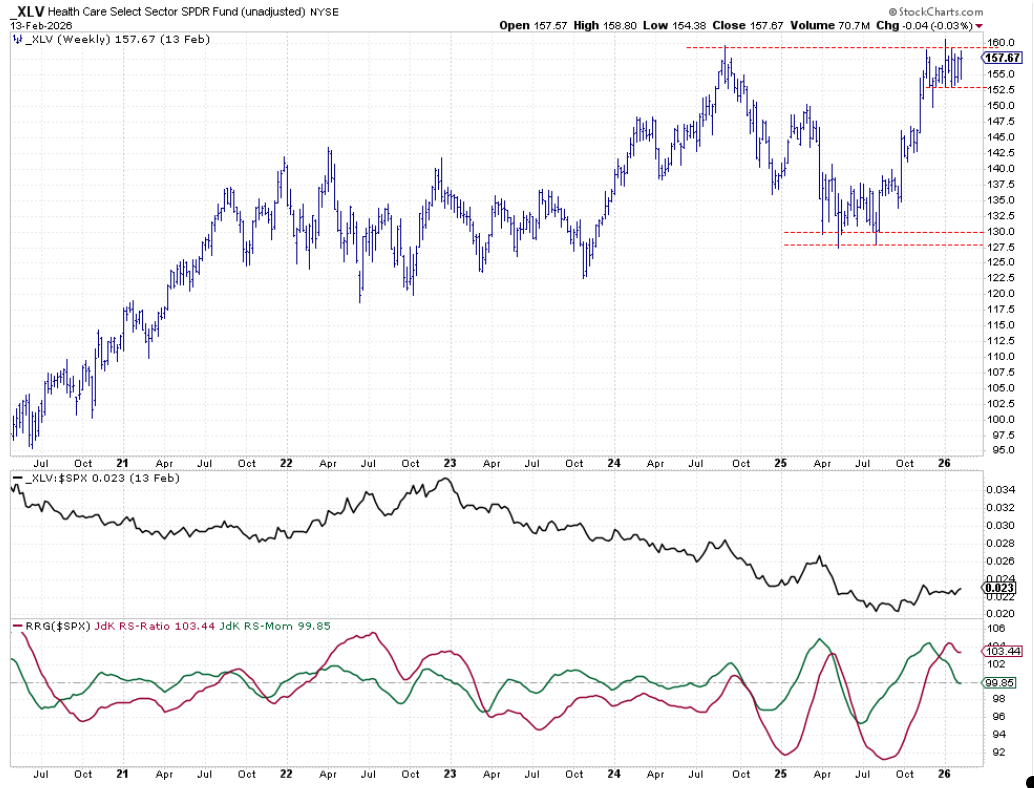

Healthcare

Healthcare is the only top-five sector yet to break above its resistance area (158–160). A small trading range is forming, and while there has been some improvement since October last year, a new higher high is needed to confirm an uptrend. RS-ratio remains above 100, but RS-momentum is declining.

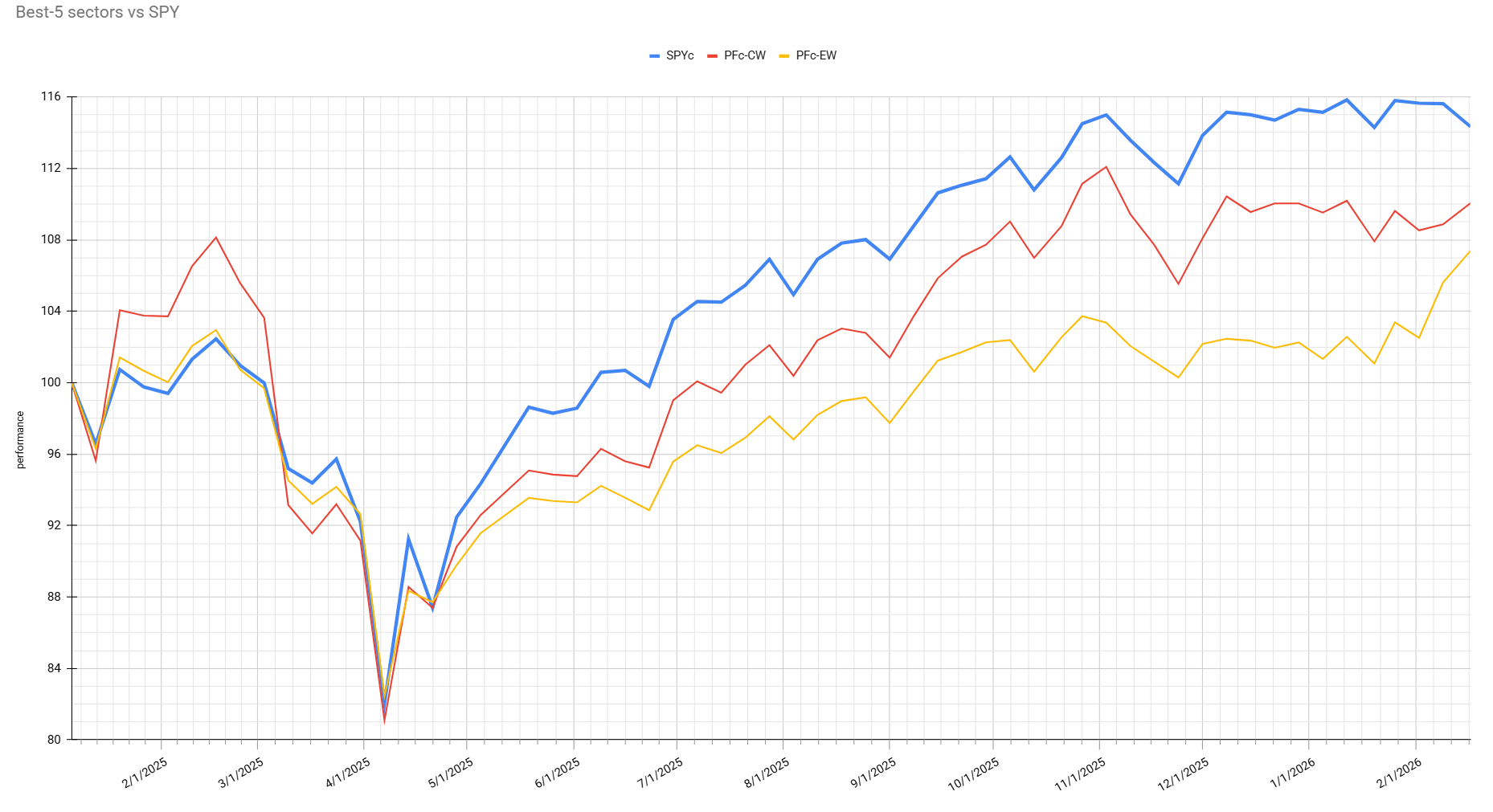

Performance Overview

The performance graph, which tracks the S&P 500 (blue), cap-weighted performance (red), and equal-weighted performance (yellow), reveals that equal-weighted performance surged last week. Cap-weighted performance also improved, even as the S&P 500 declined. The absence of heavyweight sectors in the top five has allowed for more active bets in other sectors, which are now generating additional gains.

The market cap-weighted portfolio is still trailing the S&P 500, but the gap has narrowed to just over 4%, down from more than 7% a few weeks ago. The equal-weighted portfolio, while still nearly 7% behind the S&P 500, has made significant progress, having been almost 14% behind at the start of the year. Since then, it has gained nearly 7% relative to the S&P 500.

Conclusion

The sector rotation landscape is shifting, with energy, materials, and industrials leading the way, while traditional heavyweights like technology and financials are lagging. Broadening participation across more sectors is helping portfolios catch up to the S&P 500, but whether this trend can continue in the face of underperforming heavyweights remains to be seen.

#StayAlert, -Julius