The Claude Crash: How AI Triggered a Historic Selloff in Software Stocks

Key Takeaways

- 50% haircuts are becoming commonplace among guilty-until-proven-innocent enterprise software names.

- Selling has not cascaded across sectors and geographies, with the broadening trade still holding water.

- Key earnings events are on tap, and major support is not far off for the IGV ETF.

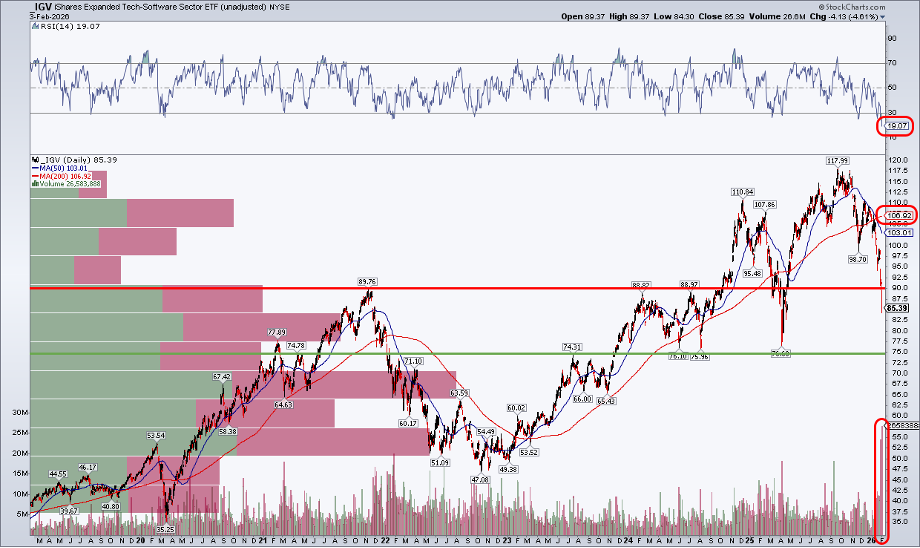

Step aside, Marc Andreessen. Artificial Intelligence is eating software. The iShares Expanded (Excoriated?) Tech-Software ETF (IGV) plunged 28% from its September 2025 peak near $118 to below $85 for a time this past Tuesday.

Names like Salesforce (CRM), Intuit (INTU), and Adobe (ADBE) have felt the brunt of the selling pressure. But it’s also happening to megacaps and once-darling story stocks — Microsoft (MSFT) is mired in a 26% drawdown, Palantir (PLTR) has lost a quarter of its peak value, while Oracle (ORCL) has been taken to the woodshed, down 56% from its September zenith.

Q4 Earnings Season: Muted Reactions for the Most Part

Taking a step back, the Q4 earnings season hasn’t been all that dramatic. Beats have been rewarded less than usual, while misses are not seeing the same nasty, palms-out action compared to previous reporting periods.

Rather, it’s more of an industry-level reaction to what’s happening at the enterprise level around the world. Here, we find that price offers clear clues about how powerful AI tools will be, so impactful that brand names that were once verbs in the office could become modern-day Yellow Pages.

That’s the narrative arrived at via price action. But is it time to write off large-cap software? Let’s take an unbiased view of IGV's technical situation.

IGV in the Technical Doghouse

Notice in the chart below that IGV shares are within 10% of a key long-term support area in the mid-$70s. Before even dissecting support and resistance levels, what might first jump out to you is the deeply oversold RSI oscillator at the top of the chart. The 19-reading following a 4.6% drubbing post-Groundhog Day is the lowest since August 2011, when macro fears spiked around the U.S. credit downgrade and European debt crisis — global events, not software-direct turmoil.

IGV: Bear-Market Territory

What’s more, after six straight down sessions (erasing more than $250 billion in the group’s market cap recently), Tuesday’s volume was the most in the ETF’s 25-year history. The fund is likely on pace to tally record weekly volume, too. Now, about 20% below the still-rising long-term 200-day moving average, there are obvious signs of capitulation. Instead of guessing where the ultimate low will occur, eyeing a reasonable target is a better risk-reward strategy.

The aforementioned $74–$77 zone stands out. That’s where IGV traded up to in mid-2023 before breaking out with a small gap the following November. From there, a pair of pullbacks from the upper $80s back to former resistance (the polarity principle) helped cement the mid-$70s as a pivot area in 2024. Shares reached $111 following the 2024 election, but then plunged to $77, retesting support, after “Liberation Day.”

The natural conclusion is that another date with that area is in play this go-round.

Not Systemic Yet (But Don’t Ask Private Asset Management Companies)

For the market writ large, early-year price action and vibes across tech rekindle the China DeepSeek AI moment from January 2025. Then, it was the AI infrastructure and buildout names in the bears’ crosshairs. Chipmakers plunged, and questions arose about the profitability of the bull market’s winners.

That proved to be a short-lived panic, later outdone on a more macro scale the following March and April. Will this “Claude Crash” (my unofficial moniker for how Anthropic’s new add-in has crushed IGV) have a similar outcome? Will it turn systemic?

S&P 500 Holds Near Its Highs, Global Markets Remain Strong

IGV’s bearish episode is more focused and contained at the moment. The S&P 500 remains within a couple of percentage points of its all-time high, nearly hitting 7,000 just this past Tuesday morning. Global stocks are also in full-fledged bull market mode, even with ex-U.S. large caps such as SAP (SAP), Accenture (ACN), Spotify (SPOT), and Shopify (SHOP) all in 35%-plus declines of their own.

Stories can flip quickly. It wasn’t long ago when investors assumed the worst for Alphabet (GOOGL) and Apple (AAPL).

The upshot? Tune down the volume on commentaries, and focus on the charts.

Resource Sectors Doing All They Can

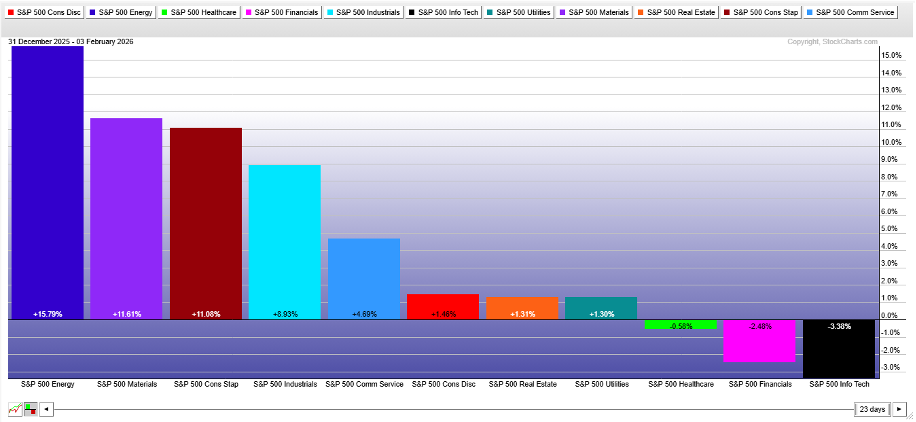

As such, there’s a sector-rotation aspect that has kept software selling confined (although pressure on private-equity stocks is tied to software's plunge). Yes, Information Technology is the worst-performing of the 11 S&P 500 sectors YTD, but real-economy areas like Energy, Materials, and Consumer Staples have picked up the slack.

While that triad accounts for just 10.1% of the S&P 500, all three are up by more than 11% thus far in 2026.

This is what the “broadening out” trade looks like in real time. It was never going to be a smooth ride — no elegant handoff from growth to value, large-cap to SMID-cap, or U.S. to ex-U.S. For new winners to emerge, some former-cycle winners would have to be dragged over the coals.

Software Earnings Events Could Spook Markets

For those playing the software space, either eyeing a bounce or pressing shorts, there are volatility catalysts ahead.

AppLovin (APP) reports Q4 results on Wednesday night, February 11, followed by Palo Alto Networks (PANW) on the 13th. The major earnings event comes on February 24, though. That’s when CRM, perhaps the poster child of enterprise software getting taken apart by the AI narrative, issues its fourth-quarter numbers. INTU reports the following afternoon. (Earnings dates are subject to change.)

You can research and prepare using the StockCharts Symbol Summary page. There, earnings data, fundamental valuation ratios, technicals, and SCTR scoring help you surround the trade.

The Bottom Line

Price action suggests AI will eat enterprise software. That has taken a bite out of private asset management stocks, too, but value areas and resource-related sectors are picking up the slack. The market cue is generally sanguine so far, and top-down traders must continue to monitor sector-rotation trends to manage risk.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.