Three Ways to Trade NVIDIA: Which One Gives You the Best Risk/Reward

Key Takeaways

- Even though tech stocks took a hit, the broader market remained strong.

- NVIDIA's stock price is showing signs of strength beneath the surface.

- Options can offer more attractive risk-reward setups than purchasing underlying shares.

Tuesday wasn’t a great day for tech stocks, thanks to a couple of headlines that spooked investors. Softbank (SFTBY) announced it was selling its stake in NVIDIA (NVDA) to redirect funds to OpenAI, and earnings guidance from CoreWeave (CRWV) didn’t help sentiment either. Interestingly, the rest of the market wasn’t phased by the tech selloff. These two news pieces were enough to spark a wave of selling across tech stocks.

The Dow Jones Industrial Average ($INDU) closed at an all-time high. The best performing S&P 500 sector was Health Care, followed by Energy and Consumer Staples. Technology was the only sector that closed lower on Tuesday.

The Big Picture Still Looks Solid

Usually, when tech stocks sell off, it brings the entire market down with it. Not this time. Despite tech’s selloff, there wasn’t much damage done.

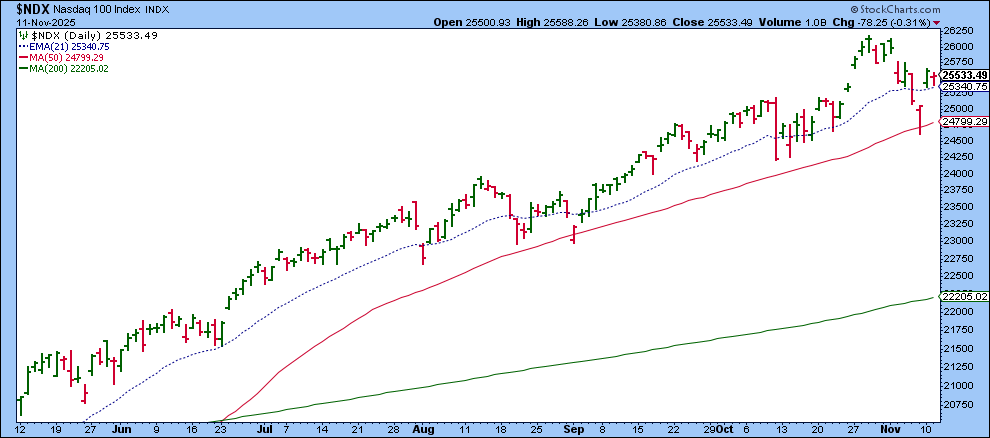

Take a look at the Nasdaq 100 Index ($NDX) chart below. Notice how it bounced off its 21-day Exponential Moving Average (EMA). This suggests the uptrend is still intact.

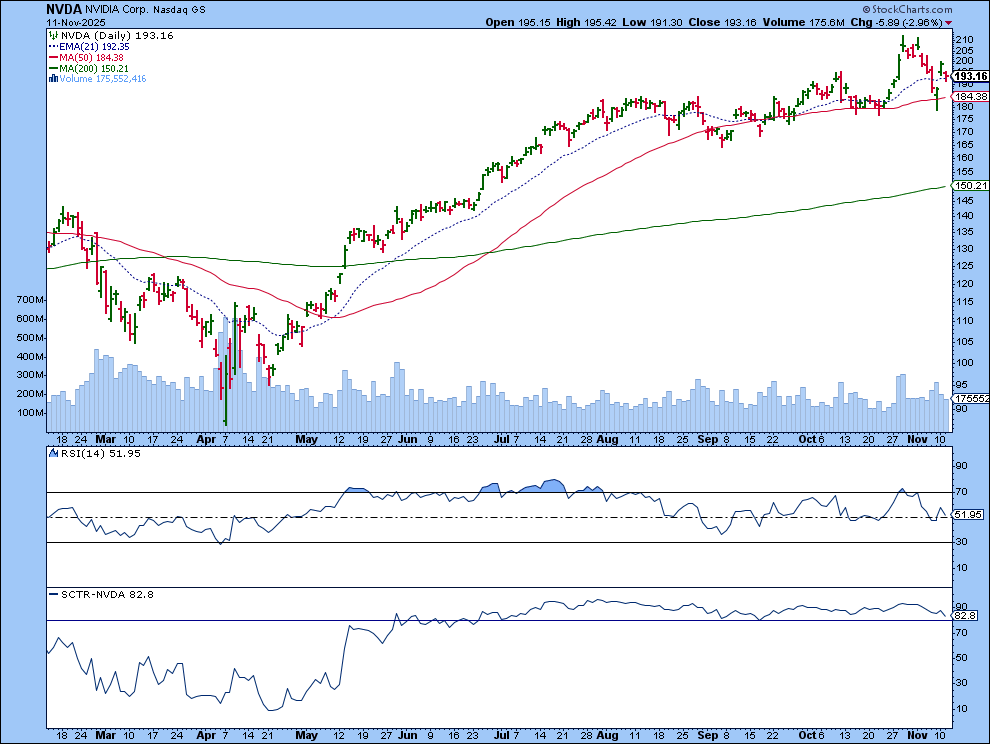

Now let’s zero in on NVDA, which was the most actively traded stock in the S&P 500 and Dow on Tuesday. Despite the pullback, NVDA is still holding above its 21-day EMA. The line has started to flatten a bit, and the Relative Strength Index (RSI) shows that momentum is slowing down slightly. Still with an RSI of about 52, it’s far from weak territory. NVDA has a StockCharts Technical Rank (SCTR) score of around 82, another indication that the stock is technically strong.

Thinking About Buying NVDA?

If NVDA is one of the stocks in your watchlist and you’re wondering if this dip could be a buying opportunity, you have a couple of ways to play it. You could buy the underlying shares, or if you’re open to exploring options, there are some strategies to consider.

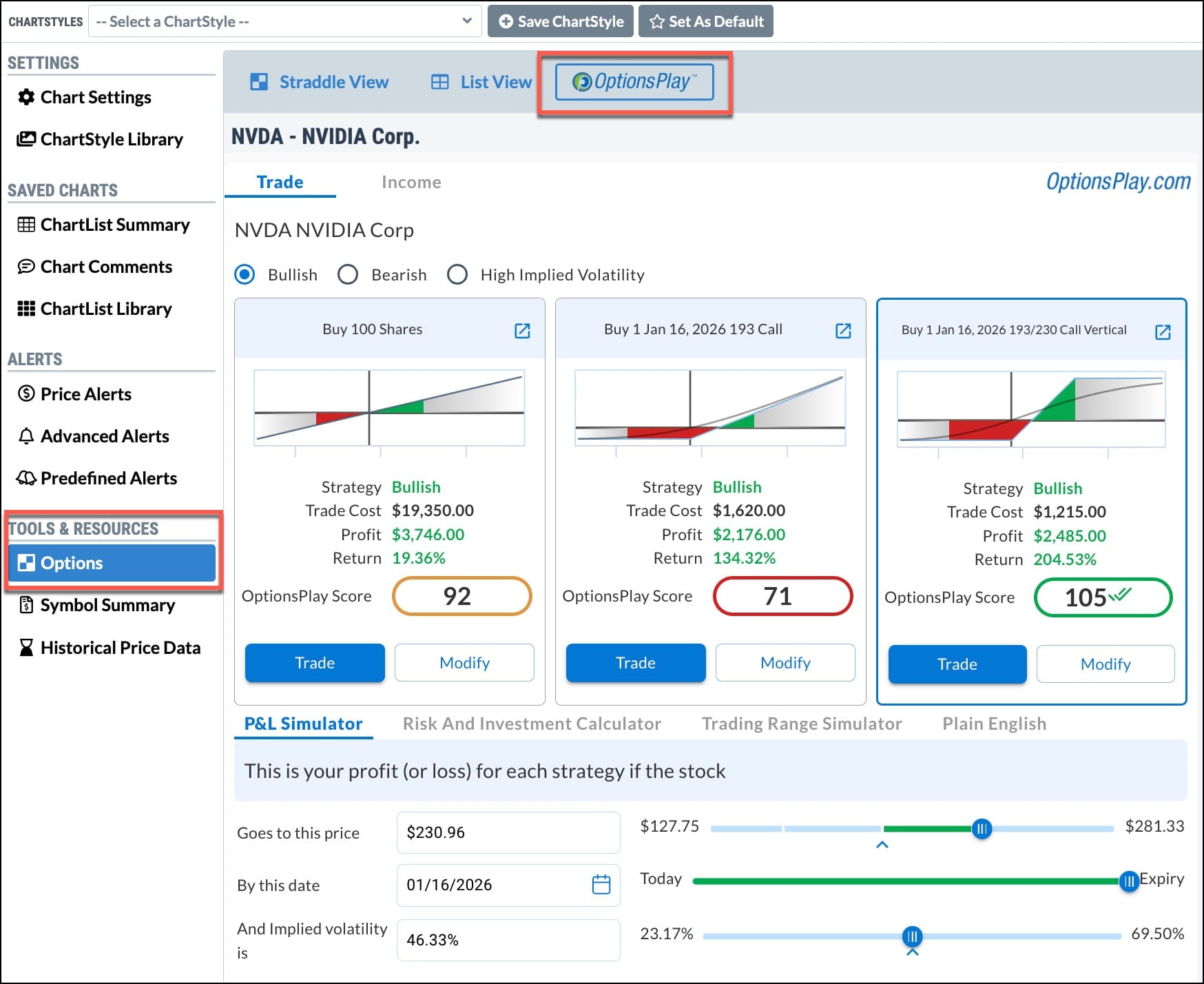

If you’re an OptionsPlay Add-On subscriber, you can open the OptionsPlay tool by clicking on Options (under Tools & Resources in the left menu), and then the OptionsPlay button you'll find at the top of the Options chain. Then compare the potential outcomes for:

- Buying 100 shares outright

- Buying a call option

- Buying a call vertical spread

If you look at the three choices more closely, you’ll see that if NVDA’s share price rises from $193 to $230.96, buying the 100 shares outright requires the biggest investment ($19,250) and gives you the lowest return (19.36%).

Alternatively, you could buy a 193 call option that expires in a couple of months. The option gives you the right (but not the obligation) to buy 100 shares of NVDA for $193. Now, if NVDA’s share price climbs before the contract expires, you could buy the shares for a discount. If, on the other hand, NVDA’s share price falls below $193, your maximum loss would be the premium you paid for the contract, which in this case would be $1,620.

The most cost-effective and potentially most rewarding setup of the three is the Jan 16 193/230 call vertical. You could buy the 193 call option and sell the 230 call option. Your cost would be reduced since you collect a premium from the short call. If the trade works in your favor, your potential return could reach 204%, while your maximum loss is limited to the $1,215 you invested.

One important point to note is that NVDA reports earnings on November 19, after the bell. Earnings announcements can give rise to big price swings, so this is a good time to evaluate your comfort with risk. Of the three choices, the call vertical has the best risk-reward tradeoff, but your choice depends on your comfort level.

Final Thoughts

Options can be an alternate way to gain exposure to high-priced stocks like NVDA without tying up a large portion of your capital. If you see a stock pulling back and want to “buy the dip,” but don’t want to commit the full share price, options give you flexibility with defined risk and the potential for a favorable return.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.