Trillion-Dollar Walmart Hits New Highs Ahead of Earnings: What It Means for the Market

Key Takeaways

- The 4th best Dow name on the year, Walmart (WMT), reports Q4 results Thursday morning.

- The options market prices in a big move, and investors should focus on the reaction.

- Consumer Staples is off to a torrid 2026 start, but not all retail names are participating.

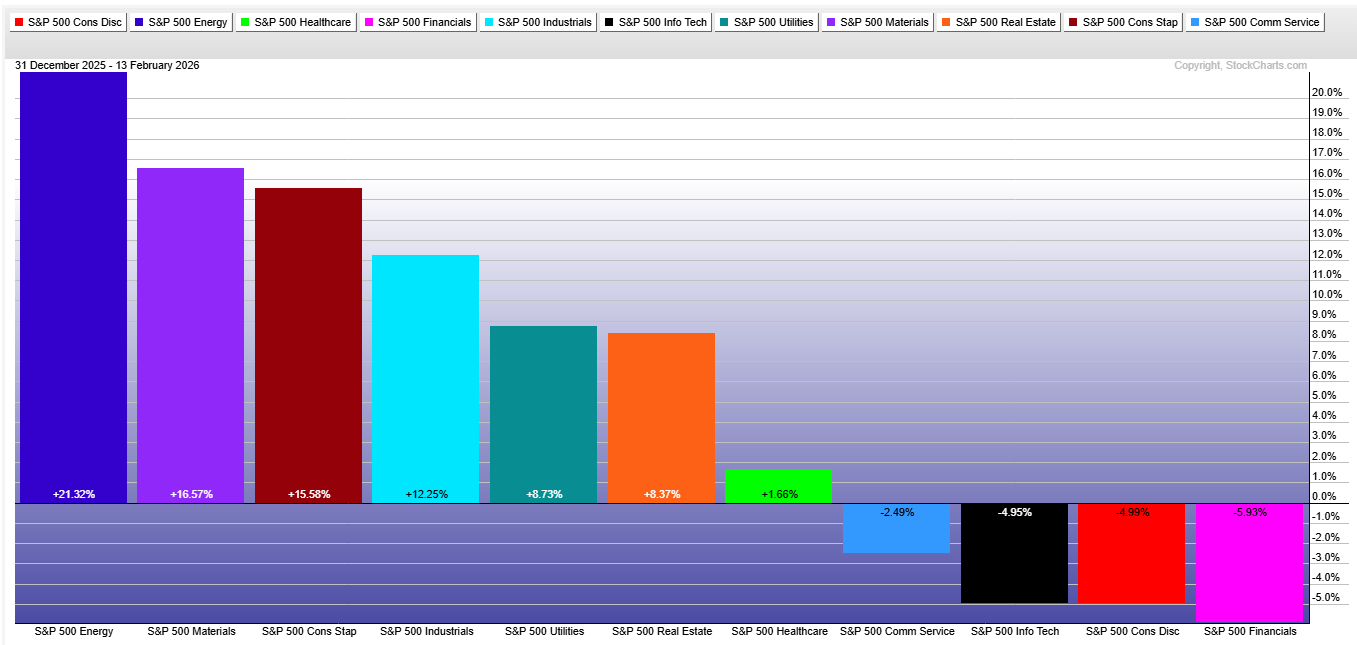

Skyrocketing cyclicals, plummeting software stocks, and record highs beyond our borders—that’s been the tale of the tape in recent weeks. Toss in a little extra bond buying, pressuring the benchmark 10-year Treasury yield back below 4.2%, and there’s a high level of unease at this stage of the global bull market.

Last week’s goose-egg December Retail Sales print did few favors to assuage concerns, while a decent January jobs report and CPI update were encouraging.

WMT Earnings, Q4 PCE Report On Tap

There are additional consumer reads this week, the most crucial being Walmart’s Q4 earnings due out Thursday before the bell. Shares of the now $1.07 trillion market-cap Consumer Staples company have been on a heater, up 20% so far in 2026. That’s its best start to a year since 1991. WMT is also the fourth-best DJIA name of the year.

More broadly, the Consumer Staples sector sports a 16% YTD advance through Presidents’ Day. The bar is high heading into the Q4 print… will WMT scale new heights, or is a rollback in the works? Let’s turn to the chart, but also properly frame WMT in light of the consumer and AI backdrops.

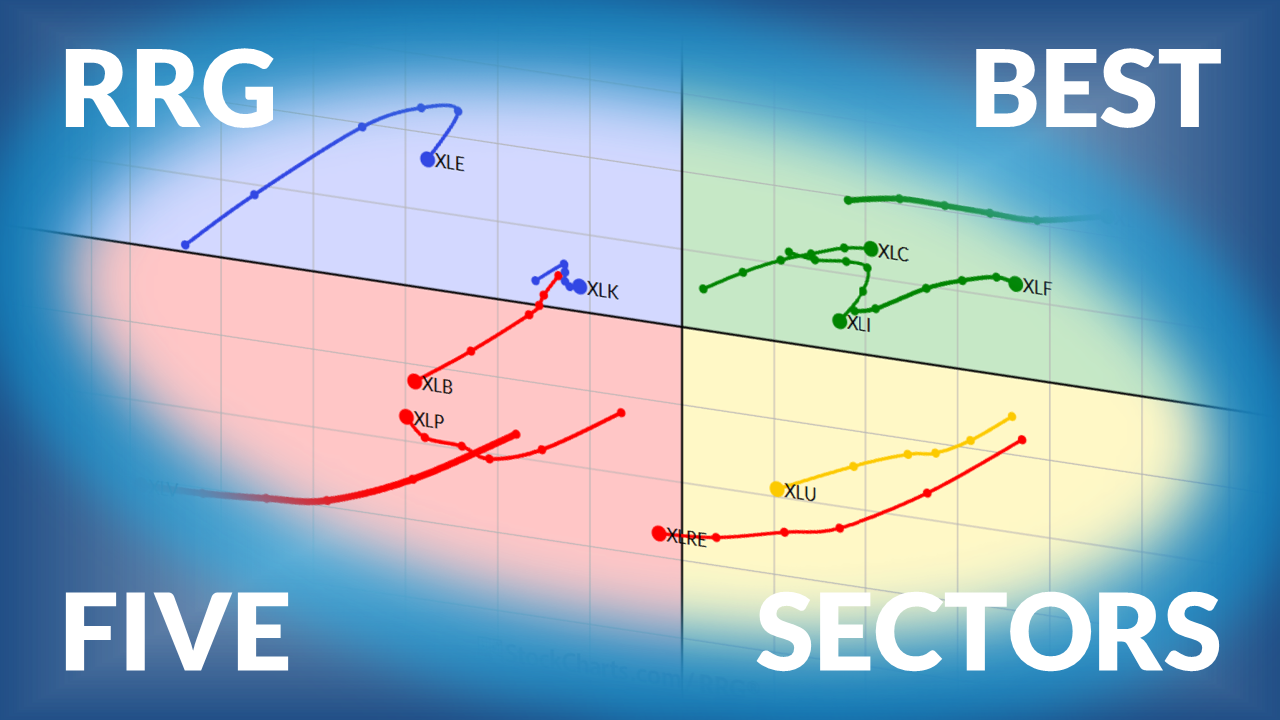

30 Trading Days Into 2026: Staples Among the Winners, Mega-Cap Tech Lags

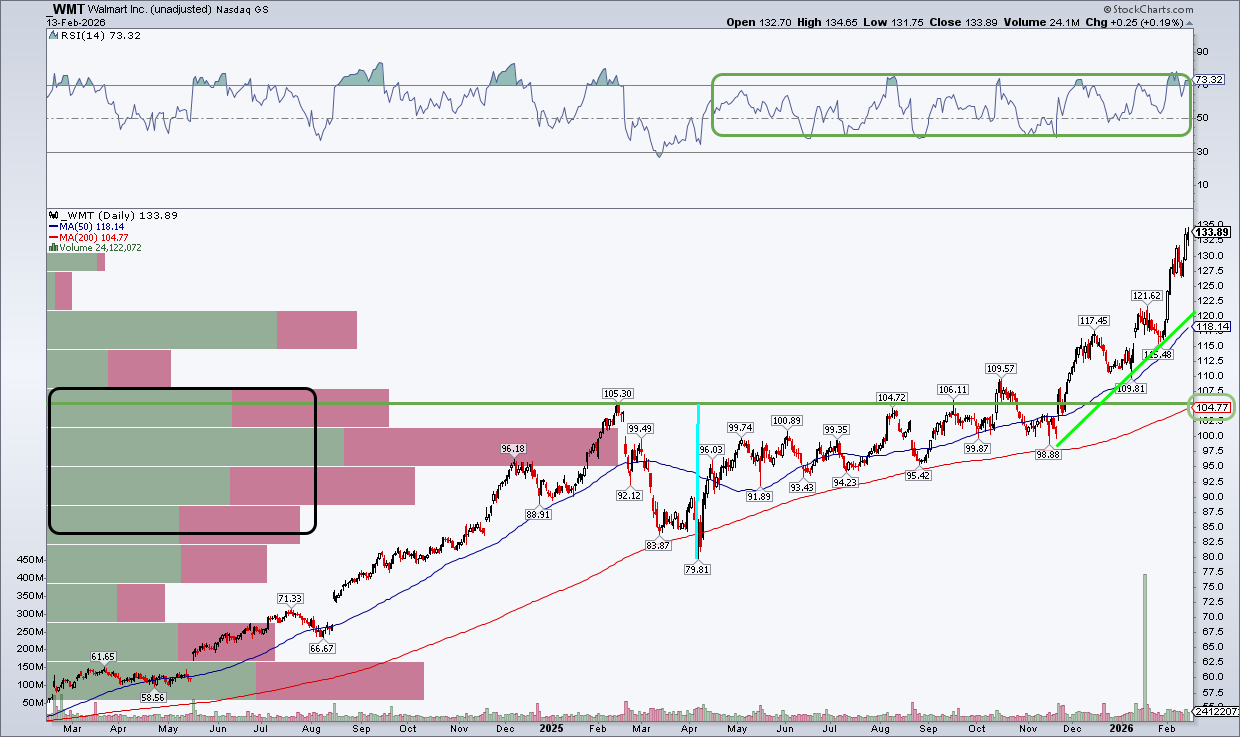

Notice in the chart below that shares are doing all the right things. WMT settled last week at an all-time high, above $132 for the first time on a weekly closing basis. The RSI momentum oscillator has been in the bullish zone of 40 to 80 going back to last April, while the long-term 200-day moving average is on the rise, suggesting that the bulls control the primary trend.

Also take a look at the volume-by-price profile on the left side of the chart. There aren’t a ton of shares traded until we get down to about the $105 level, which was the previous high from about a year ago. There was a high-volume spike a month ago, but that appears anomalous. More crucial, a near-term uptrend support line comes into play just above the rising 50-day moving average, further cementing the fast break higher.

While I like to see “overbought” conditions, so long as they correspond with a new high in price, the 73+ RSI may spook some traders. Indeed, WMT just recently achieved its measured-move upside price objective in the low $130s (based on the depth of the February–April 2025 drawdown and subsequent breakout). So a post-earnings pullback could certainly make sense. But are we expecting fireworks after the Thursday morning report? For that, let’s turn to the options market.

The Options Angle

WMT’s straddle is not at everyday low prices right now. The implied stock price swing is 4.8%, which is the most expensive pricing going back at least the last three years. Recall that shares of the largest Consumer Staples sector stock rose 6.5% after the Q3 report last November. Implied volatility is now just shy of 40%—almost twice that of the S&P 500.

You can find all the options details, along with trade simulators and other tools, in the StockCharts OptionsPlay Strategy Center and OptionsPlay Explorer.

Walmart: Where Household Spending Intersects with AI

But why is WMT so critical this earnings season? Well, as I hinted at earlier, it’s at the crossroads of the two most delicate macro factors swaying markets today. The K-shaped economy only seems to grow wider, and Walmart appears to be fundamentally benefiting from morphing household-spending trends.

What’s more, WMT is just as much a consumer play as it is an AI adopter. Tech advancements have turned Wally World into a data and systems juggernaut. With a new CEO at the helm and the stock freshly minted on the Nasdaq exchange, the company is embracing its tech bent. You can view all the WMT fundamentals on the StockCharts Symbol Summary page.

Are We Asking Too Much of Defensives & Value?

Here’s the thing: so many U.S. mega-cap charts are faltering that, if we lose the WMT domino, this year’s leaders (cyclicals, defensives, and value) could join growth names in drawdowns. The truth is, non-tech areas have done incredible heavy lifting YTD. How much more pressure can be put on smaller sectors like Consumer Staples, Energy, and Materials? Also, bear in mind that the back half of February is notoriously weak for the S&P 500.

At the same time, a 10% WMT correction would be hardly dramatic in the grand scheme of things. Such a dip would mean a trip to the 50-day moving average and the uptrend line annotated above. I’ll be curious to see how other, smaller retail stocks react to WMT earnings later this week.

The SPDR S&P Retail ETF (XRT) came on strong after “Liberation Day,” but the equal-weighted fund stalled out by last September. An XRT breakdown under $85 bodes poorly for the risk-on slice of the domestic stock market.

Upcoming Catalysts

Finally, the end of the week offers further consumer clues. The Q4 GDP report always includes key Personal Consumption Expenditure (PCE) data, which could move markets and retail stocks. Unfortunately, we still don’t have a firmed-up date for January Retail Sales or PCE.

On the earnings front, other Q4 reports are more scattered—Home Depot (HD) and Lowe’s (LOW) issue numbers next Tuesday and Wednesday. TJX Companies (TJX) reports on the 25th, with Target (TGT) not until March 3.

The Bottom Line

Consumer Staples’ YTD outperformance is seen as a potentially ominous sign. Along with other defensive sectors, leadership has shifted significantly in 2026 compared to earlier in the bull market. The stock price reaction always matters more than the revenue and earnings numbers themselves, and WMT’s Thursday morning move could mean big things for high-momentum Staples.

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional.