MEMBERS ONLY

Charts: AKAM, BMY, CSCO, EFTC, ISRG, STX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AKAM forms falling wedge. BMY traces out bull flag. CSCO breaks mid-December high. Plus EFTC, ISRG and STX.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

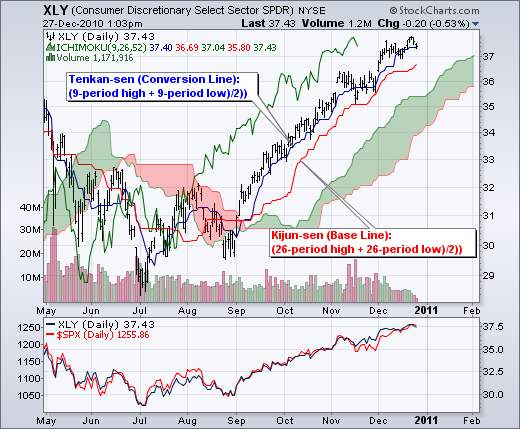

Ichimoku Conversion Line Remains Bullish for XLY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) remains in bull mode as the Conversion Line (blue) holds above the Base Line (red). The Kijun-sen (Base Line) equals: (26-period high + 26-period low)/2)). The Tenkan-sen (Conversion Line) equals: (9-period high + 9-period low)/2)). These two act like moving averages, one slower and one...

READ MORE

MEMBERS ONLY

Taking a Little Holiday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Commentary on Art's Charts will be updated on Tuesday and Wednesday this week....

READ MORE

MEMBERS ONLY

Year-to-Date Sector Leaders

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P Sector PerfChart shows the consumer discretionary and industrials sectors leading the way in 2010. All sectors are up for the year, but these two are clearly the big leaders. Energy and materials came in a distance third and fourth, respectively. In a surprising twist, technology (XLK)...

READ MORE

MEMBERS ONLY

Sellers Hibernate as SPY Plows Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change for the daily or intraday analysis. The uptrend and Santa Claus rally propelled the S&P 500 ETF (SPY) to a new 2010 high again on Wednesday. Once again, the tape rules the roost. Broken resistance from the November high turns into first support and...

READ MORE

MEMBERS ONLY

Charts of Interest: CAKE, COL, DELL, ERTS, GRMN, HRS, ISRG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

$CAKE tests support. $DELL shows strong OBV, $GRMN breaks wedge trendline. Plus $COL, $ERTS, $HRS, $ISRG.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

Regional Bank SPDR breaks Resistance with Strong Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Point & Figure charts provide clear support and resistance levels. The P&F chart below shows the Regional Bank SPDR (KRE) breaking above resistance that extends back to June (red 6 on the chart). The 2010 high around 30 marks the next target for this breakout.

Click this image...

READ MORE

MEMBERS ONLY

SPY Moves to New High for the Year

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The uptrend and Santa Claus rally propelled the S&P 500 ETF (SPY) to a new high for 2010. Once again, the tape rules the roost. Broken resistance from the November high turned into first support and held like a champ. There is really nothing much to add on...

READ MORE

MEMBERS ONLY

Intel Underperforms Nasdaq 100 in December

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remained strong overall in December, but Intel (INTC) has been a noticeable laggard. The pink line shows the INTC:$NDX ratio. This relative strength comparative rises when Intel outperforms the Nasdaq 100 ($NDX) and falls when Intel underperforms. Intel has been lagging since mid November, which is when this...

READ MORE

MEMBERS ONLY

SPY Continues Consolidation Above Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The song remains the same. Despite overly bullish sentiment and waning breadth, SPY continues to hold its gains and consolidate above the resistance break. Once again, price action or "the tape" rules the roost here. Chartists use all kinds of tools including momentum indicators, sentiment measures, breadth readings...

READ MORE

MEMBERS ONLY

Charts of Interest: AVP, COL, FLIR, JAH, LMT, MED, SYMC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

$COL forms bearish engulfing at key retrace. $FLIR breaks triangle resistance. $MED surges and forms bullish pennant. Plus $AVP, $JAH, $LMT, $SYMC.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE

MEMBERS ONLY

Trina Solar Consolidates at Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After declining from mid October to mid-November, TSL firmed near the 62% retracement mark over the last few weeks. The stock also has support here from the August consolidation. A break from the December range will trigger the next signal.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Uptrend Trumps Put-Call Ratio and Waning Breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sentiment readings show excessive bullishness and breadth has been dragging for two weeks, but the uptrends remain in place and seasonality is bullish. The first chart shows the 5-day EMA for the CBOE Total Put/Call Ratio ($CPC) dipping below .75 and nearing its bullish extreme (.70). Prior dips below...

READ MORE

MEMBERS ONLY

RISING RATES KEEP US DOLLAR STRONG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Dollar Index ($USD) remains within a long-term trading range, but the swing within that range is up after the November breakout. More importantly, the breakout is holding and rising rates are boosting the greenback. The first chart shows the US Dollar Index with resistance in the 88-89 area...

READ MORE

MEMBERS ONLY

Affymetrix Breaks Triangle Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big gap down in July, Affymetrix began the long process of digesting this big loss. A long triangle consolidation formed over the last five months. December has been good to the stock with a steady advance and breakout over the last two days.

Click this image for a...

READ MORE

MEMBERS ONLY

Indicator Summary Remains Firmly Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary. Stocks stalled this week, but held their gains and remain in uptrends overall. Breadth has started to wane as the NYSE AD Line failed to break above its November high. However, the other three breadth lines broke above their November highs (Nasdaq...

READ MORE

MEMBERS ONLY

SPY Breaks Flag Resistance on 60min Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no much change on the daily chart. SPY remains overbought with a few sentiment indicators showing excessive bullishness and breadth waning. The VIX is trading at low levels and in a long-term support zone, the CBOE Total Put/Call Ratio ($CPC) shows excessive bullishness and the NYSE AD...

READ MORE

MEMBERS ONLY

Utilities SPDR Battles Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) is underperforming the broader market as it battles resistance from broken support. Also notice that a rising wedge formed the last few weeks. A break below wedge support would signal a continuation of the downtrend that has been in place since late October.

Click this image...

READ MORE

MEMBERS ONLY

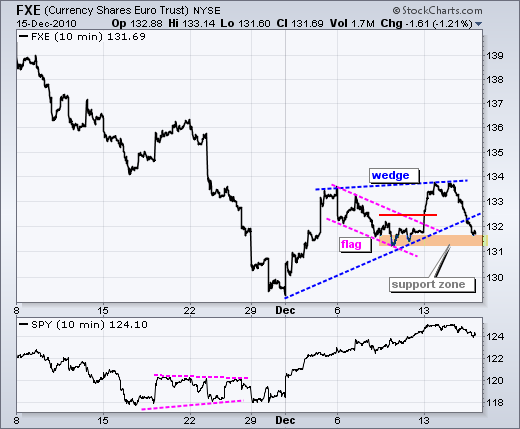

SPY Forms Small Falling Flag as Euro Fails to Hold Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro Currency Trust (FXE) broke wedge support as Forex traders returned to focus on Euro negatives (debt). This does not mean the Dollar has solved its problems. Merely, the focus has shifted back to the Euro. The chart below shows the flag breakout failing after just two days. A...

READ MORE

MEMBERS ONLY

Charts: ADBE, DELL, FRX, GILD, MYL, PSA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

$ADBE Shows Relative Weakness. $DELL Breaks Wedge Support. $MYL Breaks Resistance. Plus $FRX, $GILD, $PSA.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for...

READ MORE

MEMBERS ONLY

Hindenburg Omen Triggers as McClellan Oscillator Turns Negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a surge in NYSE new 52-week lows this week, the Hindenburg Omen has triggered once again. The last such signal was in mid August. There is some debate on the exact criteria and thresholds. The chart below details the criteria set forth from James Miekka. According to Miekka, the...

READ MORE

MEMBERS ONLY

Stocks Remain Strong as Interest Rates Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY remains overbought with a few sentiment indicators showing excessive bullishness, but there are simply no signs of signficant selling pressure. With yearend approaching and seasonal patterns largely bullish, stocks could simply remain overbought and hold their uptrends. I am concerned with the sharp rise in interest rates, but stocks...

READ MORE

MEMBERS ONLY

A High-Volume Break Away Gap for Amgen

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Amgen is off to the races today with a gap and breakout on big volume. This gap comes after the November decline and looks like a breakaway gap. High volume validates this move and the gap/breakout is bullish as long as it holds.

Click this image for a live...

READ MORE

MEMBERS ONLY

Put-Call Nears Extreme as SPY Continues Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The CBOE Total Put/Call Ratio ($CPC) is nearing an extreme that coincided with the January and April peaks. Before looking at the details, keep in mind that market sentiment is hard to pin down. First, there are many ways to measure sentiment (VIX, Put-Call Ratio, Advisor Sentiment). Second, the...

READ MORE

MEMBERS ONLY

Charts: AEO, CL, HPQ, LLL, QLGC, RTN, WFR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AEO Forms Pennant at Key Support. HPQ Shows Relative Weakness. RTN Leads Weak Defense Group Lower. Plus CL, LLL, QLGC, WFR

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise)...

READ MORE

MEMBERS ONLY

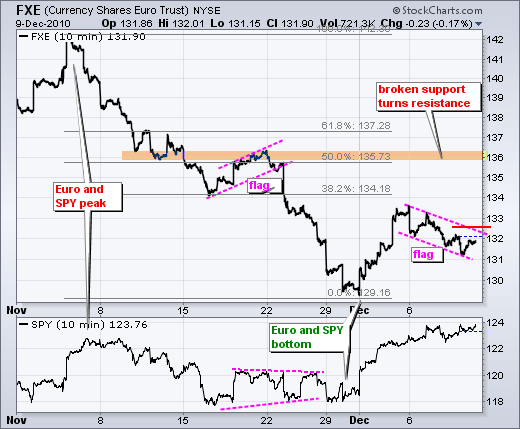

Currency CandleGlance Charts Show Euro Leading the Way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dollar is getting hammered on Monday with most other currencies moving higher. CandleGlance charts provide an easy way to reveal the leaders. The image below shows four or the 10 Candleglance currency charts. The Euro Currency Trust (FXE) is the clear leader with a 1.86% gain. Click on...

READ MORE

MEMBERS ONLY

SPY Remains Overbought and Bullish as Euro Edges Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the Euro declined last week, stocks remained strong and closed near their highs for the week. The first chart shows the Euro Currency Trust (FXE) peaking around 133.5 and falling below 132 last week. The decline is slow and the pattern looks like a falling flag. This...

READ MORE

MEMBERS ONLY

Lumber Moves Higher Along with Other Commodities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Homebuilders SPDR and the Home Construction iShares (ITB) both surged this week and we are also seeing strength in Lumber ($LUMBER). On one hand, this increases building costs. On the other hand, it shows an increase in demand and this could mean more construction. The late November low marks...

READ MORE

MEMBERS ONLY

Indicator Summary Remains Firmly Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary. Stocks held their gains this week and there was not much movement. Led by strength in the finance sector, the NYSE AD Volume Line moved above its November high. The November lows mark key support for the AD Lines and AD Volume...

READ MORE

MEMBERS ONLY

Bigger Uptrend Continues to Trump Short-Term Negatives

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I am still watching the falling flag in the Euro. A falling Euro is potentially negative for stocks and the short-term trend is clearly down as long as the flag falls. On the Euro Currency Trust (FXE) chart, a move above 132.5 would break flag resistance and provide the...

READ MORE

MEMBERS ONLY

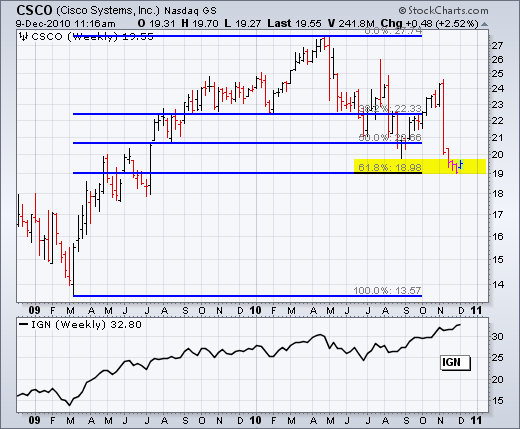

Cisco Hits Key Retracement on the Weekly Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the Networking iShares (IGN) trades near a 52-week high, Cisco (CSCO) flounders near a 52-week low. Who would have thunk it? Cisco is one of the top ten components in this ETF. This year's decline puts the stock at an interesting juncture: a key retracement on the...

READ MORE

MEMBERS ONLY

SPY Remains Near Resistance as Euro Forms Falling Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A surge in interest rates should be bullish for the Dollar, but the Dollar barely moved on Wednesday and Forex vigilantes could turn their sites on the Dollar. As noted in Wednesday's market message, bonds plunged because proposed legislation in DC would increase spending and decrease revenues. While...

READ MORE

MEMBERS ONLY

Charts: BSX, DELL, EK, GILD, KFT, MDT, MOT, PEP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

EK bounces on uptick in volume. GILD bounces off broken resistance. MOT breaks wedge resistance. Plus BSX, KFT, MOT, PEP. See the About Page for details on the commentaries in Art's Charts.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation...

READ MORE

MEMBERS ONLY

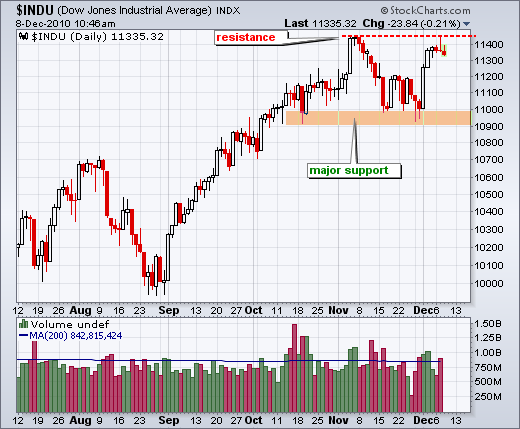

Dow Industrials Hits Resistance from November High $INDU

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials remains in an uptrend overall, but the senior Average is hitting some resistance from the November highs just above 11400. It is possible that a trading range takes shape after the sharp advance from 10000 to 11400. Key support is based on the lows extending from mid...

READ MORE

MEMBERS ONLY

SPY Stalls as Interest Rates and the Dollar Move Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the relationship is not perfect, stocks and the Euro still have a pretty good positive correlation. This means both rise and fall together. The clear discrepancy is from 23-Nov to 30-Nov when the Euro fell sharply and SPY held support from its mid November lows. In a sense, stocks...

READ MORE

MEMBERS ONLY

$XLU Underperforms and Hits Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a bounce the last five days, the Utilities SPDR (XLU) remains an underperformer since September. Notice how the price relative peaked and moved lower the last 3 months. On the price chart, the ETF is running into resistance from broken support around 31.30.

Click this image for a...

READ MORE

MEMBERS ONLY

SPY Forges a Narrow Range Day at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, SPY formed a very small candlestick with the narrowest range in over a week. The most popular narrow range indicators are NR-4 and NR-7, which refer to the narrowest high-low range in four or seven days. A narrow range shows indecision that can sometimes foreshadow a...

READ MORE

MEMBERS ONLY

Charts: $NATGAS, CHK, NXY, DLTR, EBAY, SUSS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Natural Gas surges as cold hits $NATGAS. CHK bounces off support. NXY challenges resistance. Plus DLTR, EBAY, SUSS.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Tech Sector Lags Offensive Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Except for technology, the offensive sectors are leading the market over the last two weeks. Relative to the S&P 500, consumer discretionary, industrials and finance are all positive on this relative strength PerfChart. Utilities, consumer staples and healthcare, which make up the defensive sectors are lagging.

Click this...

READ MORE

MEMBERS ONLY

Euro Hits Resistance and SPY Becomes OverBOUGHT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The positive correlation between stocks and the Euro remains in place. The Euro got an oversold bounce last week and this helped propel stocks higher. Strong economic numbers on Wednesday also helped the bullish cause. Even though the Euro is getting a bounce, rising interest rates in the US and...

READ MORE