MEMBERS ONLY

Nasdaq Weakness Weighs on the Indicator Summary

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains firmly positive, but weakness in the technology and industrials sectors caused me to downgrade two of the ten indicators. These downgrades were simply from bullish to neutral. A few days of weakness is not enough to change the overall picture. The market remains in bull mode,...

READ MORE

MEMBERS ONLY

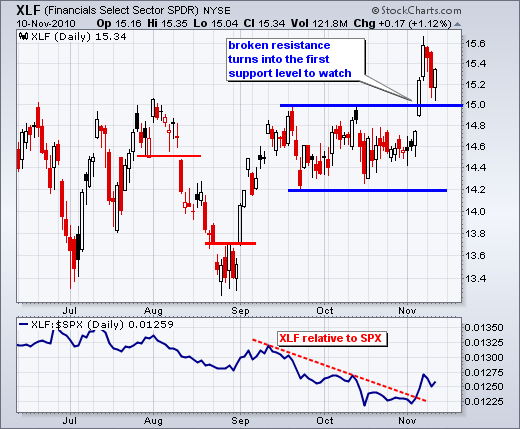

XLF Tests Resistance Breakout with Pullback

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Finance SPDR (XLF) broke resistance with a big surge last week and broken resistance now turns into the first level to watch for support. This is a basic tenet of technical analysis (broken resistance/support turns into support/resistance).

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Stocks Hold Up Despite Euro Support Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After breaking triangle resistance at the beginning of November, the Euro Currency Trust (FXE) gave it all back and broke support from the late October lows. This reversal of fortune is quite amazing. Since the surge above 142 late last week, FXE has fallen over 4% in six trading days....

READ MORE

MEMBERS ONLY

Utilities Show Relative Weakness as Rates Start to Rise $XLU

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With 30-year Treasury yields moving higher, the interest rate sensitive utilities sector may start feeling the heat. In contrast to the S&P 500, the Utilities SPDR (XLU) peaked in October and formed a lower high in November. The price relative confirms weakness as it moved to a new...

READ MORE

MEMBERS ONLY

Charts: AET, AFFX, DELL, HD, PDCO, PRU

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts: AET, AFFX, DELL, HD, PDCO, PRU

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own...

READ MORE

MEMBERS ONLY

SPY Recovers after Weak Open to Hold Channel Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY remains in an uptrend on the daily chart with a rising price channel over the last eight weeks. After surging above 122 last Thursday and then stalling for two days, the ETF formed a bearish engulfing pattern on Tuesday. However, there was no follow through as the ETF recouped...

READ MORE

MEMBERS ONLY

An evening star reversal for ATI plus 13 others on NYSE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Allegheny Technologies (ATI) formed an evening star over the prior three days. This bearish reversal pattern consists of three candlesticks: a long white candlestick, a small body candlestick and a long red candlestick to complete the reversal. The predefined scans page showed 14 such patterns forming on the NYSE and...

READ MORE

MEMBERS ONLY

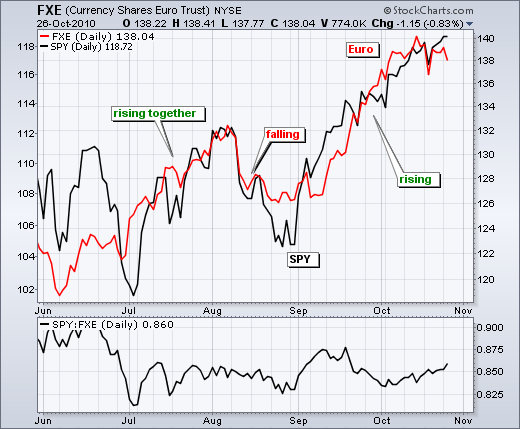

Bonds and Euro weigh on stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It is always difficult to pick the exact cause of an advance or decline in stocks, but the positive correlation between the Euro and stocks has been quite strong this year. The Euro Currency Trust (FXE) extended its three day slide with a move below 137.5 on Tuesday. Actually,...

READ MORE

MEMBERS ONLY

Charts: BA, BG, CTXS, ERTS, GCI, HOLX, MON, SEE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BA consolidates above breakout. BG forms pennant after engulfing. HOLX traces out a triangle. CTXS stalls near key retracement. ERTS surges off support with good volume. GCI gaps off support with good volume. MON forms harami cross at resistance. SEE forms rising wedge after sharp decline.

-----------------------------------------------------------------------------

This commentary and...

READ MORE

MEMBERS ONLY

A year for hard assets

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2010 is going to be known as the year of the hard assets. The PerfChart below shows the S&P 500, Silver, Gold, Oil, the Dollar and the Euro. Stocks are up, but lagging the three commodities. Both the Euro Index and the Dollar Index are down for the...

READ MORE

MEMBERS ONLY

Stocks to be tested as Euro comes under pressure

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the Euro taking a big hit on Friday-Monday, bullish resolve in the stock market will be tested right off the bat this week. The Dollar strengthened for three reasons. First, the employment report showed strong job creation, which is positive for the economy and puts upward pressure on interest...

READ MORE

MEMBERS ONLY

NIKKEI 225 FORGES INVERSE HEAD-AND-SHOULDERS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Although a little late to the party, the Nikkei 225 ($NIKK) is showing signs of life with an inverse head-and-shoulders pattern taking shape. Note that the S&P 500 formed an inverse head-and-shoulders from mid May to mid September and broke resistance in the second half of September. The...

READ MORE

MEMBERS ONLY

Homebuilders SPDR breaks resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Homebuilders SPDR (XHB) finally broke above resistance with a surge the last few days. XHB was one of the laggards because it had yet to break its July high. This changed on Thursday as the ETF broke resistance with a gap and long white candlestick. Also notice that the...

READ MORE

MEMBERS ONLY

Market surge produces five indicator upgrades

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

That certainly did not take long. Five indicators were downgraded from bullish to neutral last Friday. These indicators did not break down to warrant a bearish stance, but I downgraded them to neutral because they were not confirming the new highs seen in the major indices. That changed this week....

READ MORE

MEMBERS ONLY

SPY surges above upper trendline of rising channel

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the week strong and surged on Thursday with big gains in all major indices. All sectors were up with materials, energy, and finance leading the charge. These three were up over 3%. It is positive to see relative strength coming from the finance sector. On the daily SPY...

READ MORE

MEMBERS ONLY

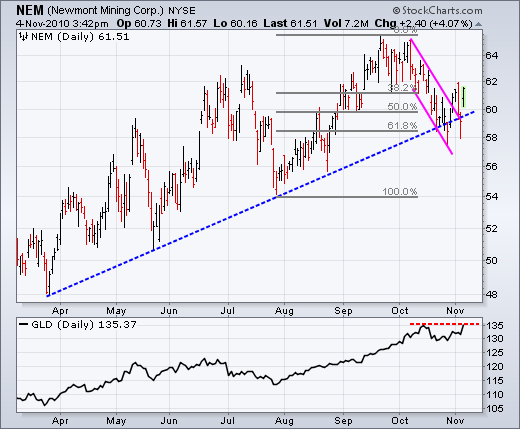

Newmont breaks flag resistance, but lags gold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After retracing around 62% of the prior advance, Newmont Mining (NEM) broke above flag resistance with a surge over the last few days. The breakout was under threat with Wednesday's pullback, but Thursday's surge keeps the flag breakout in play. There is one concern. NEM remains...

READ MORE

MEMBERS ONLY

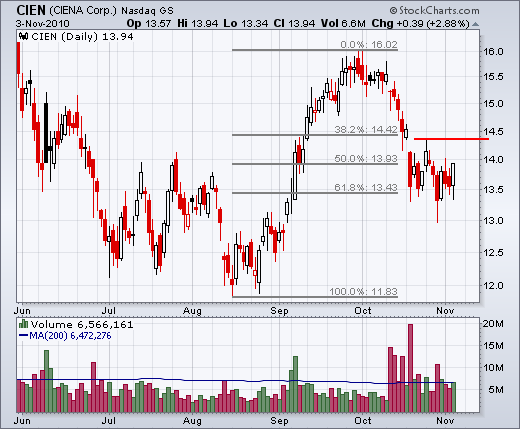

Charts: CIEN, CVS, FITB, GPS, HD, QLGC, WFC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

$CIEN firms at key retracement. $CVS forms bull flag. $FITB shows relative strength. $GPS, $HD, $QLGC and $WFC.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

SPY closes at new high for the move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Two down, one to go. The elections and the Fed have passed with little fanfare for stocks. Details of QE2 were released in the Fed policy statement. Bonds went one way and the Finance SPDR (XLF) went the other way. Funny how that worked. Bonds, which are direct beneficiaries of...

READ MORE

MEMBERS ONLY

Regional Bank SPDR holds support with harami

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After plunging on Monday, the Regional Bank SPDR (KRE) firmed on Tuesday to form a harami. This is essentially an inside day. Also notice that the ETF managed to firm near the 62% retracement mark. Wednesday's surged above Monday's high confirms the harami.

Click this image...

READ MORE

MEMBERS ONLY

SPY challenges resistance as Euro breaks out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro broke resistance as long-term rates fell back to support. The first chart shows the Euro Currency Trust (FXE) breaking above range resistance and moving above the triangle trendline. This bullish development for the Euro is a positive for stocks. Range support around 138-138.2 is now the first...

READ MORE

MEMBERS ONLY

A weekly outside reversal for Natural Gas $NATGAS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Natural Gas Continuous-Futures ($NATGAS) formed a large weekly outside reversal pattern last week. Combined with a falling wedge and support in the 3.3-3.5 area, Natural Gas is threatening a bounce within its long downtrend. Watch the MACD-Histogram for a move into positive territory to signal some upside...

READ MORE

MEMBERS ONLY

Strong Yen weighs on Nikkei

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nikkei 225 ($NIKK) failed at resistance as the Yen surged to new highs. The Nikkei 225 surged in September, but never broke resistance as a weak Dollar drove the Yen higher. It is possible that an inverse head-and-shoulders pattern is forming, but there are no signs of support or...

READ MORE

MEMBERS ONLY

SPY maintains uptrend ahead of elections and the Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

First note that I will be travelling on Tuesday and will not be able to write a commentary that day. The next commentary will be Wednesday morning. It is just as well because the markets will digest the week's first big event on Wednesday morning. The elections are...

READ MORE

MEMBERS ONLY

Linear Tech Leads Semis with Triangle Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Linear Tech (LLTC) formed a large triangle over the last three months and broke resistance with a surge this week. Also notice that the stock broke above its September highs. Semis are showing upside leadership and this is positive for the tech sector.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Five market indicators get downgrades

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains bullish overall, but five indicators were downgraded from bullish to neutral. First, the NYSE AD Volume Line peaked in mid October and is starting to lag. Second, the Nasdaq AD Line flattened as the Nasdaq continued higher. Third, the S&P 500, Nasdaq 100, VIX...

READ MORE

MEMBERS ONLY

SPY holds uptrend as big news week looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are likely to be some serious fireworks next week. This is one of the biggest news weeks that I can remember. First, we have election results on Tuesday. Second, the Fed meets on Wednesday. Third, there is the employment report on Friday. We can also throw in the ISM...

READ MORE

MEMBERS ONLY

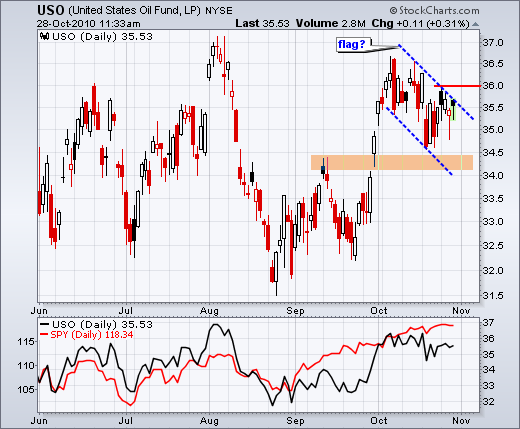

A bull flag takes shape in the USO Oil Fund

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a breakout and big surge towards the August highs, the USO Oil Fund (USO) took a breather with a pullback over the last few weeks. The falling zigzag in October looks like a falling flag, which is a bullish continuation pattern. The surge from 32.5 to 36.5...

READ MORE

MEMBERS ONLY

Charts: AA, CDE, CVS, JPM, LUB, MOT, SFD, UNM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading our own accounts. First, it is the only way to...

READ MORE

MEMBERS ONLY

SPY bounces off channel support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change on the daily chart. Even though the advance has grown laborious, SPY remains in an uptrend. The surge above 114 on September 20th marked the easy part of the advance. Since this surge, SPY has worked its way higher within a rising price channel. All kinds...

READ MORE

MEMBERS ONLY

A head-and-shoulders pattern for Greek equities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The DJ Greece Index ($GRDOW) shows a potential head-and-shoulders pattern evolving over the last five months. This version is a continuation pattern. A move below the October low would confirm the pattern and target lower prices.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

SPY Channels Higher as Euro Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There were some serious rumblings in the intermarket arena on Tuesday. Bonds plunged, long-term rates surged, the Euro declined sharply and the Dollar bounced. Forget about the Fed and QE2. These are already priced into the market. Bonds and the Dollar are looking ahead of QE2. Long-term rates are rising...

READ MORE

MEMBERS ONLY

An ascending triangle for Vertex

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a trendline breakout in August, Vertex Pharma (VRTX) traced out a potentially bullish ascending triangle. Notice the higher low in early October and the equal highs in August and September. A break above the September high on good volume would confirm this bullish pattern.

Click this image for a...

READ MORE

MEMBERS ONLY

Charts: AKS, ALTR, AMKR, HOLX, HRS, MAS, POOL, WHR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts: AKS, ALTR, AMKR, HOLX, HRS, IDCC, MAS, POOL, WHR

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to...

READ MORE

MEMBERS ONLY

Yields tick higher as SPY and Euro stall

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I continue to watch bonds and the Euro for clues on equities. The first chart shows the Euro Currency Trust (FXE) surging on the open, but failing to break last week's high and falling back. It is possible that we have a lower high taking shape after last...

READ MORE

MEMBERS ONLY

Oil Services and Internet Lead the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

John Murphy's industry group perfchart shows oil services and internet stocks leading the market since August 27th. It's a rather motly pair. Banks are the biggest laggards. In a bit of a surprise, gold and silver stocks ($XAU) are also lagging the broader market.

Click this...

READ MORE

MEMBERS ONLY

Euro breakout would be bullish for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro Currency Trust (FXE) and the S&P 500 ETF (SPY) have been positively correlated throughout 2010. This positive correlation is especially strong since late August. Both are up over 10% since late August. Why the positive correlation? First, a weak Dollar is beneficial to US exports because...

READ MORE

MEMBERS ONLY

Energy Fund ETF backs off range resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Multisector Energy Fund (DBE) has been stuck in a trading range since late May. Range support is set near 25 and range resistance near 22. With the October pullback, the ETF has failed at resistance and showed weakness. Look for a break above this week's high to...

READ MORE

MEMBERS ONLY

Indicator Summary remains firmly bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary, which remains firmly bullish. With all ten indicators in bull mode, it would take a few weeks to turn the tide bearish. I am not predicting this. I am merely reinforcing the lagging nature of this indicator summary. It is not designed...

READ MORE

MEMBERS ONLY

Intermarket picture heats up as yields move higher and Euro stalls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The intermarket picture is getting quite interesting. First, the 10-year Treasury Yield ($TNX) broke wedge resistance to signal a continuation of last week's breakout. A bullish breakout in yields means a bearish breakdown in bonds. Frankly, I am not sure how or if this will affect stocks. The...

READ MORE

MEMBERS ONLY

Russell 2000 ETF forms bearish engulfing as MACD turns down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a strong open Thursday morning and a sharp move lower in the afternoon, the Russell 2000 ETF has a bearish engulfing pattern working on the day. The bulls started in control, but the bears clearly took control in the afternoon. Also notice that the MACD-Histogram turned negative three days...

READ MORE