MEMBERS ONLY

Charts: AFFX, ESRX, EXP, INTC, PAYX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AFFX bounces off support with good volume. ESRX breaks flag resistance. EXP forms long triangle. INTC bounces off support with good volume. PAYX forms bullish consolidation.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any...

READ MORE

MEMBERS ONLY

SPY rebounds on weaker breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulls are clearly not going down without a fight. While yesterday's rebound looked impressive, breadth fell short of the prior highs and the bulls appear to be loosing steam. The first chart shows the Nasdaq AD Volume Line and Net Advancing Volume. The AD Volume Line remains...

READ MORE

MEMBERS ONLY

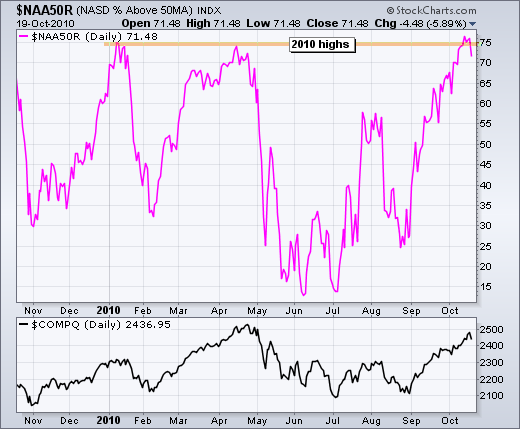

Nasdaq %Above 50-day SMA reaches overbought levels $NAA50R

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq %Above 50-day SMA ($NAA50R) is trading near the prior 2010 highs. This indicator surged to the mid 70s in January and again in April. Prior moves to this area signaled overbought conditions that led to a pullback.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

SPY gaps down to test short-term support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Big moves in the Euro and Apple weighed on stocks Tuesday. Apple declined after its earnings announcement, which was surely a buy-the-rumor sell-the-news event. The Euro Currency Trust (FXE) declined almost 2% after hitting a key retracement level last week. This was covered in Friday's Market Message. For...

READ MORE

MEMBERS ONLY

Homebuilder ETF fails at resistance $XHB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Homebuilders SPDR (XHB) surged to resistance at the end of Septmeber, but failed to follow through with a breakout in October. After trading flat for two weeks, the ETF is starting to move lower and showing relative weakness. Again.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

Charts: AKS, BSX, MDT, MSFT, SNDK, WY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BSX forms tight ascending triangle, MSFT breaks triangle resistance, MDT edges above consolidation resistance, SNDK forms bearish wedge. WY breaks triangle support.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE

MEMBERS ONLY

SPY holds flag breakout to affirm support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stalling is not the same as weakness. I noted yesterday that SPY gapped up on Wednesday and stalled. Hanging man candlesticks followed on Thursday and Friday as the stall extended. Such indecision can sometimes result in a short-term reversal, but some sort of downside break or catalyst is needed to...

READ MORE

MEMBERS ONLY

German DAX breaks ascending triangle resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The German DAX Index ($DAX) continues to lead the world with an ascending triangle breakout. These are bullish continuation patterns. The height of the pattern (±700) is added to the resistance breakout for an upside target. With resistance at 6350, this targets a move to around 7000.

Click this image...

READ MORE

MEMBERS ONLY

Nasdaq surges on negative breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Here's one for the record books. The Nasdaq was up 1.37% and the Nasdaq 100 was up 2.10% on Friday, but Net Advances were a negative 97. Despite big advances, there were more declining stocks on the Nasdaq than advancing stocks. Net Advancing Volume was positive...

READ MORE

MEMBERS ONLY

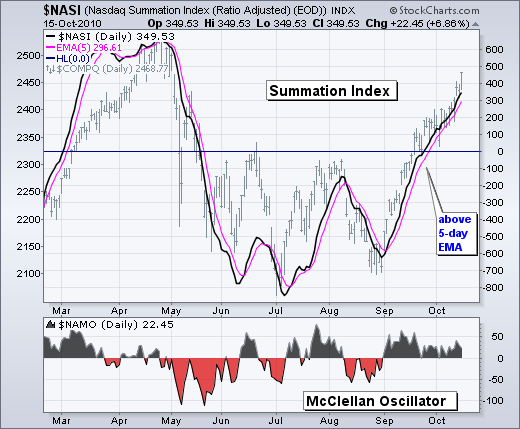

THE SMOOTHER COUSINS OF THE MCCLELLAN OSCILLATOR REMAIN BULLISH

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though stocks are overextended after a massive seven week run, we have yet to seen any evidence of weakness that would signal the start of a correction or pullback. Many momentum oscillators are also at or near overbought levels, but cumulative indicators, such as the McClellan Summation Index, continue...

READ MORE

MEMBERS ONLY

Google powers Nasdaq 100 above April high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a little help from Google (and Apple), the Nasdaq 100 surged above the April high this week to record a new 52-week high. Large techs are showing relative strength as one of the first groups to break this high. Google broke out of a long channel in mid September...

READ MORE

MEMBERS ONLY

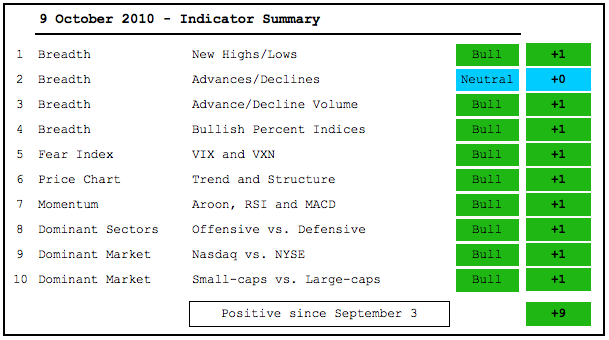

Indicator Summary remains positive for sixth week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a breakout in the Nasdaq AD Line, all ten indicators are now in bull mode. This indicator summary has been positive since September 3rd, going on six weeks now. DIA and QQQQ are challenging their April highs, but the Finance SPDR (XLF) remains below its summer highs. Once again,...

READ MORE

MEMBERS ONLY

SPY tests gap as finance leads lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The finance sector remains a thorn in the bull's hoof. Even though majority of the market is in bull mode, the Finance SPDR (XLF) remains a serious laggard. As noted in Wednesday's Market Message, XLF is the only one of the nine sector SPDRs that has...

READ MORE

MEMBERS ONLY

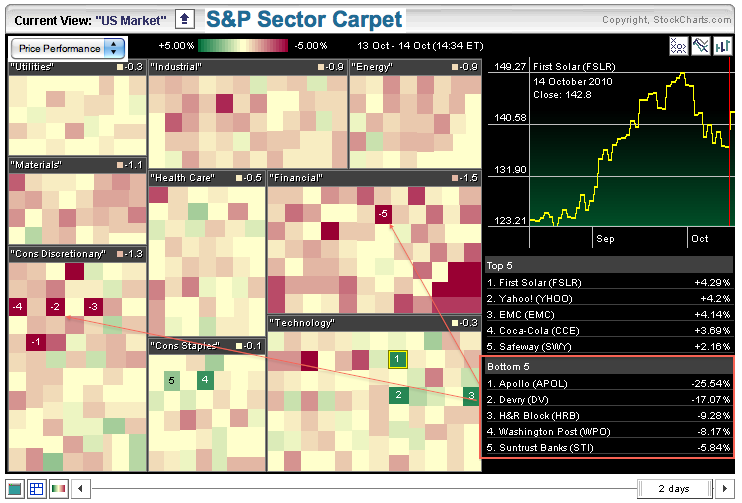

Finance and consumer discretionary sectors bloody the market carpet $XLK $XLY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The sector market carpet shows lots of red in the consumer discretionary and finance sectors. Four of the five biggest losers come from the consumer discretionary sector. The finance sector also has quite a few dark red squares, indicating stocks with relative weakness. Technology remains a bright spot with three...

READ MORE

MEMBERS ONLY

Charts: AN, BSX, CAG, GILD, LEAP, TIN, TLAB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AN forms a high volume hammer. BSX forms small ascending triangle. CAG breaks resistance on good volume. GILD breaks flag resistance. LEAP consolidates after breakout. TIN breaks triangle resistance on big volume. TLAB gaps to triangle resistance.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is...

READ MORE

MEMBERS ONLY

SPY is bverbought and built to stay that way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With another surge higher the last four days, the major index ETFs are overbought by most measures. SPY is up over 13% in seven weeks, 14-day RSI moved above 70 and CCI is near 180. RSI was last above 70 in mid April. At the time, the indicator oscillated around...

READ MORE

MEMBERS ONLY

Noble Drilling appears in bullish engulfing scan $NE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a weak open and strong close in stock market, 70 securities appears on the bullish engulfing scan for the Nasdaq and NYSE. The chart below shows Noble Drilling (NE) surging in early September, correcting into early October and then forming a bullish engulfing on Tuesday.

Click this image for...

READ MORE

MEMBERS ONLY

Stocks just love a weak Dollar

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Maybe it is just coincidence, but there sure is a strong negative correlation between the Dollar and stocks. Stocks started weak as the Dollar surged in early trading. The FOMC minutes hit the market in the afternoon and the Dollar swooned as QE2 became more of a reality. QE2 and...

READ MORE

MEMBERS ONLY

SMH challenges summer highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Semiconductor HOLDRS (SMH) continues to show relative strength as it surges to its summer highs. Reaction highs in June-July mark a resistance zone around 28.7. The indicator window shows the price relative (SMH:SPY ratio) bottoming in early September and moving higher the last 4-5 weeks.

Click this...

READ MORE

MEMBERS ONLY

SBUX surges through pennant resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After consolidating near a key retracement and forming four doji, Starbucks (SBUX) broke through pennant resistance with a surge early Tuesday. The June highs mark the next resistance level. A move below Tuesday's low would signal a breakout failure.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

Charts of Interest: CTAS, EBAY, EXPD, PFCB, RIMM, SBUX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CTAS shows 3 weeks of relative weakness. EBAY breaks flag support. EXPD forms rising flag on lower volume. PFCB consolidates after long red candlestick. RIMM retraces 50% rising wedge. SBUX stalls at key retracement with four doji.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is...

READ MORE

MEMBERS ONLY

Nasdaq Net Advancing Volume shows weakness $NAUD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A review of my short-term indicators confirms short-term uptrend, but there are some signs that the advancing is tiring. In particular, the 10-day SMA for Net Advancing Volume shows some weakness over the last two weeks. The charts below show this indicator for the NYSE and Nasdaq. The green line...

READ MORE

MEMBERS ONLY

XLK challenges head-and-shoulders resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Technology ETF (XLK) has been consolidating the last two weeks with a small inverse head-and-shoulders pattern. This pattern is best viewed using intraday charts. Neckline resistance resides around 23.3-23.5 and the ETF is testing this area for the fourth time since 27-Oct. A breakout would signal a...

READ MORE

MEMBERS ONLY

Sentiment reading gets quite bullish as SPY hits channel trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Survey data is often used to measure extremes in bullish sentiment or bearish sentiment. It is bearish when too many respondents are bullish and bullish when too many are bearish. These surveys spend most of their time between bullish and bearish extremes (i.e. without signals). The AAII survey and...

READ MORE

MEMBERS ONLY

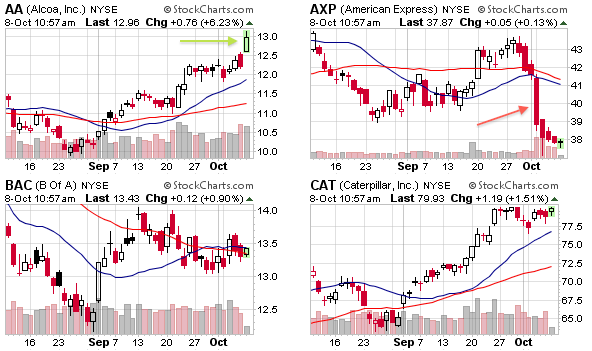

Alcoa breaks September highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Alcoa is showing upside leadership with a surge and break above short-term resistance the last few days. Upside volume has also been impressive. The charts below come from the Dow CandleGlance page, which shows small candlestick charts for all 30 Dow components.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Indicator Summary remains firmly positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains positive, but there are a couple of concerns. First, relative weakness in the finance cast a cloud over the current advance. Second, the Nasdaq has been underperforming the NY Composite the last two weeks. This may be just a pullback. Third, the Dow Industrials SPDR and...

READ MORE

MEMBERS ONLY

AMAT stalls with two inside days - harami

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a surge on Tuesday, Applied Materials (AMAT) stalled on Wednesday to firm an inside day and harami. This pattern extended on Thursday as the stock again traded within Tuesday's range. A consolidation within an 5-week uptrend is forming. Watch the boundaries for the next signal.

Click this...

READ MORE

MEMBERS ONLY

Range resistance turns first support for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change on the daily chart so I will go directly to the 60-minute chart. Whether or not SPY holds its breakout depends on the market's reaction to the employment report. The news is not what is important here. It is the market's reaction...

READ MORE

MEMBERS ONLY

Intermarket Perfchart Reflects Risk-on Trade

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The risk-on trade remains alive and well in October. As the Perfchart below shows, stocks, oil and gold are strong, while bonds and the Dollar are weak. The relationships reflect a market that is embracing risk. Strength in the Dollar and bonds would start to suggest otherwise.

Click this image...

READ MORE

MEMBERS ONLY

Charts of Interest: ADSK, AN, ARO, DDS, ETR, GILD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADSK forms small descending triangle. ARO breaks out on good volume. AN tests support, DDS underperforms within consolidation. ETR shows weakness with expanding volume. GILD forms bull flag near resistance.

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold...

READ MORE

MEMBERS ONLY

SPY turns indecisive with a doji

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, SPY broke above range resistance with a gap and long white candlestick on Tuesday. These developments affirmed the medium-term uptrend and reinforced short-term support around 113. The bulls are on firm footing as long as this breakout holds. I still have the ABC correction in the...

READ MORE

MEMBERS ONLY

Weak Dollar is bullish for stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When it comes to stocks, it's all about the Dollar the last four weeks. The chart below shows the Euro Currency Trust (FXE) rising along side the S&P 500 ETF (SPY). The bottom window shows the Dollar Bullish ETF (UUP) falling. A weak Dollar makes US...

READ MORE

MEMBERS ONLY

SPY breaks flag/wedge resistance with gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, the S&P 500 ETF (SPY) broke above range resistance with a gap and long white candlestick on Tuesday. This move clearly keeps the uptrend alive. SPY broke above its summer highs in late September and this breakout held. Even though the ABC correction was...

READ MORE

MEMBERS ONLY

Five stocks with tight consolidations and one breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Charts of Interest: CSCO, DDS, ERTS, FITB, MI, STT

-----------------------------------------------------------------------------

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for ourselves when it comes to trading...

READ MORE

MEMBERS ONLY

SPY and RSI test short-term support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the daily chart analysis. An ABC correction could be taking shape, but there is no confirmation because the short-term trend remains up. A short-term trend reversal is needed for the earliest possible indication that a bigger decline is starting. On the 60-minute chart, SPY is...

READ MORE

MEMBERS ONLY

StochRSI becomes oversold for $QQQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a move below last week's lows, the Nasdaq 100 ETF (QQQQ) broke below consolidation support and StochRSI became oversold for the first time since late August. This oversold reading looks like a sign of weakness because it is occurring along side the support break.

Click this image...

READ MORE

MEMBERS ONLY

SPY holds range as Nasdaq breadth weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The NYSE AD Volume Line moved to a new high last week, but the Nasdaq AD Volume Line failed to exceed its prior high and traded flat. We also saw a little relative weakness in the Nasdaq and techs relative to the broader market last week. The 23-Sept lows now...

READ MORE

MEMBERS ONLY

OIL AND GASOLINE ETFs BREAK RESISTANCE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil finally started making up for lost time. Despite strength in stocks and weakness in the Dollar throughout September, oil remained below its mid September high the latter part of the month. Broken support around 34 turned into resistance and was holding. Things suddenly changed as the USO Oil Fund...

READ MORE

MEMBERS ONLY

$EBAY appears on bearish engulfing scan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bearish engulfing scan on the pre-defined scans page at StockCharts.com featured 105 Nasdaq stocks and 177 NYSE stocks. The chart below shows EBAY with a rather large bearish engulfing pattern on Thursday. Trendline support is set at 24. Follow through below this level would confirm the bearish engulfing....

READ MORE

MEMBERS ONLY

SPY fails to hold early surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is still no change on the daily chart. SPY continues to stall around 114-115 and has yet to break support. Even though the trend is clearly up here, I am leaving the ABC correction possibility on the chart. SPY is also near channel resistance and overbought. The upper trendline...

READ MORE