MEMBERS ONLY

GE forms rising flag near support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GE is trying to bounce off its February low, but the bounce look feeble so far and the stock shows relative weakness. The stock shows relative weakness because the S&P 500 broke above resistance and GE remains below corresponding resistance. The support zone around 15-15.5 is holding...

READ MORE

MEMBERS ONLY

Market turns mixed after big advance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big advance the prior six days, trading turned mixed as the market consolidated its gains. Over the last seven days, IWM is up 7.74%, MDY is up 7.2%, QQQQ is up 6.13%, SPY is up 5.01% and DIA is up 4.88%. Even though...

READ MORE

MEMBERS ONLY

Apple challenges resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) remains one of the strongest stocks as it surges to resistance from the April-June highs. The stock formed a triangle over the last 2-3 months and broke the upper trendline today. Volume was light though. QQQQ traders should note that Apple accounts for 18.84% of the ETF....

READ MORE

MEMBERS ONLY

Breakouts and resistance challenges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

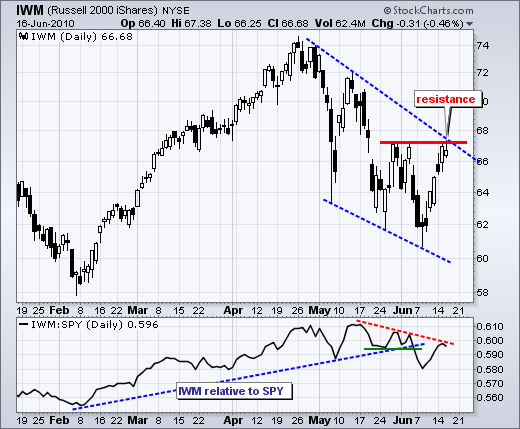

Stocks surged on Tuesday with the major index ETFs gaining over 2%. The gains were rather uniform with a range from 2.27% in the S&P 100 to 2.82% in the Nasdaq 100. Even though the Nasdaq and Russell 2000 gained more than the S&P...

READ MORE

MEMBERS ONLY

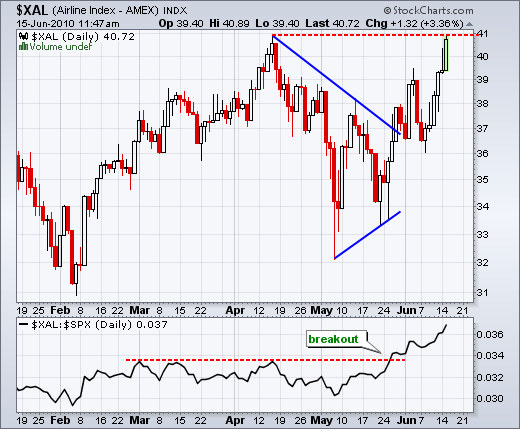

Airline Index closes in on 52-week high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Airlines continue to show relative strength and upside leadership. First, the Airline Index ($XAL) is challenging its April high with a big move on Tuesday. A break would forge a new 52-week high. Second, the price relative broke out in late May and recorded a new high this week.

Click...

READ MORE

MEMBERS ONLY

Selling pressure at resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading turned mixed as the Dow and S&P 500 tested important resistance levels. The S&P 500 and Nasdaq finished with small gains, but the Dow and Nasdaq 100 finished with small losses. The Russell 2000 and S&P 400 Midcap Index closed with modest gains...

READ MORE

MEMBERS ONLY

Commodities follow stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the exception of precious metals, commodity indices have gone the way of the stock market over the last eight weeks. The PerfChart below shows the S&P 500 six commodity related indices. Only the GSCI Precious Metals Index ($GPX) shows a gain since mid April.

Click this image...

READ MORE

MEMBERS ONLY

SPY surges off support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The surge over the last two days did not occur on the strongest breadth or volume, but support from the February low held and the bigger uptrend remains in place. As long as the bigger trend is up, the odds favor the bulls as SPY surges off support. Selling pressure...

READ MORE

MEMBERS ONLY

A lot of fill black candlesticks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Looking through the pre-defined scans page, it was surprising to see a high number of filled black candlesticks on Thursday. These candlesticks form when the close is below the open and the close is above the prior close. Even though the stock closed up for the day, the stock moved...

READ MORE

MEMBERS ONLY

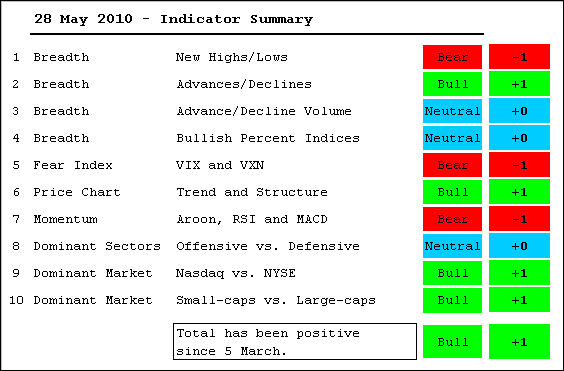

Indicator Summary turns negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Small-caps broke down this week and the Bullish Percent Index indicator turned bearish. These two were enough to turn the indicator summary negative for the first time since March 5th. Techs were also hit hard this week, but the $COMPQ:$NYA ratio remains in an uptrend. In addition, the consumer...

READ MORE

MEMBERS ONLY

SPY gaps and closes strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged with a broad rally that lifted most boats. All major indices were up 3% or so. The Russell 2000 (+3.48%) slightly outperformed the S&P 500 (+2.95%). The Russell 2000 should have been up 5% on a day like today (damper number 1). All sectors...

READ MORE

MEMBERS ONLY

Bullish Percent Indices below 50%

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stockcharts.com tracks the Bullish Percent Indices (BPI) for six major indices and 10 sectors. The BPIs for the major indices are below 50% and eight of the ten sectors have BPIs below 50%. Only telecom and utilities have BPIs above 50%. These numbers can be found at the bottom...

READ MORE

MEMBERS ONLY

Stocks give back their gains

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged in early trading with SPY moving above 108 in the morning, but gave back these gains, and more, with an afternoon plunge. There it is again: another late round of selling pressure. A lack of buying pressure and a small increase in selling pressure is all it takes...

READ MORE

MEMBERS ONLY

Dow breaks Ichimoku cloud

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ichimoku Clouds, a form of Japanese technical analysis, show a trend reversal in the Dow Industrials. The senior average broke below the cloud formation and the "Standard Line" moved below the cloud formation. This is the red line, which is a moving average of the 26-day high-low range....

READ MORE

MEMBERS ONLY

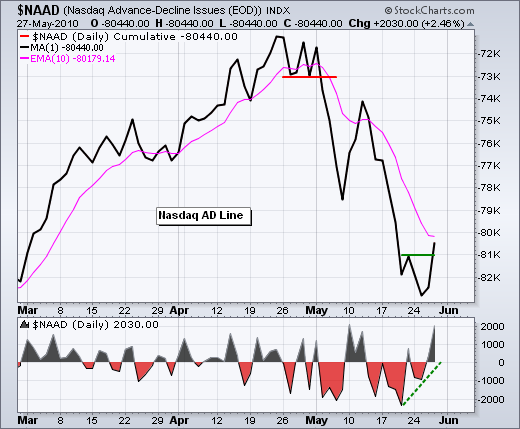

A lopsided bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market rebounded on Tuesday, but the bounce was rather lopsided as techs lagged significantly. The S&P 500 and the Dow gained over 1%, but the Nasdaq and Russell 2000 finished slightly negative. Small-caps and techs are starting to show relative weakness and this is not a...

READ MORE

MEMBERS ONLY

VIX bounces off support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 Volatility Index ($VIX) surged in May and broke above its January-February high. After a pullback, the index found support near broken resistance and bounced the last few days. Also notice that the S&P 500 hit resistance near broken support.

Click this image for...

READ MORE

MEMBERS ONLY

Oversold and near the Feb low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was another day of heavy selling pressure, but not as heavy as Friday. The AD Lines and AD Volume Lines for the Nasdaq and NYSE all moved to new lows for the move. Even with these new lows, selling pressure is less than it was in May. The first...

READ MORE

MEMBERS ONLY

An evening star for IBM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a short-term reversal in stocks over the last three days, the evening star scan was about as full as it's been in a long time. IBM formed an evening star with a long white candlestick on Wednesday, a gap-stall on Thursday and a gap-decline on Friday. Volume...

READ MORE

MEMBERS ONLY

SPY fails at resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard on Friday with the major indices losing 3-5%. The Dow held up the best with a 3.15% loss, while the Russell 2000 fared the worst with a 5% loss. Stocks started with a sharp gap down and continued lower throughout the day. Buyers were nowhere...

READ MORE

MEMBERS ONLY

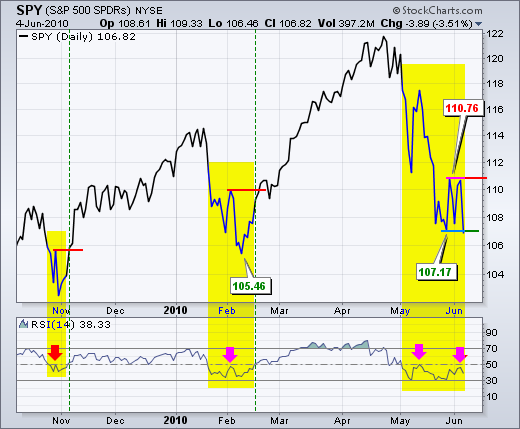

RSI remains bearish for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Relative Strength Index remains below 50 and bearish for the S&P 500 ETF (SPY). Bounded momentum oscillators trade within a defined range. RSI trades between zero and one hundred with fifty as the centerline. Think of this level as the 50 yard line in a football game....

READ MORE

MEMBERS ONLY

XLY and XLK show relative strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The sector perfchart provides an easy means to identify the leaders and laggards. Even though all sectors are down over the last three weeks (since May 13), some are down more than the S&P 500 (laggards) and some are down less (leaders). It is positive to see the...

READ MORE

MEMBERS ONLY

Indicator Summary remains positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no real change in the indicator summary. The market remains split with some bearish indicators and some bullish indications. This is normal after a severe correction that tests the viability of the long-term bull market (March 2009 to present). Chart-wise, the February lows are holding and this keeps...

READ MORE

MEMBERS ONLY

Techs and small-caps lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the Dow gained just .06% and the S&P 500 was up .46%, the Nasdaq gained .96% and the Russell 2000 was up 1.05%. Techs and small-caps doubled the gains seen in the large-cap dominated S&P 500. Relative strength in these two groups is...

READ MORE

MEMBERS ONLY

Natural Gas ETF surges above April high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Natural Gas Fund (UNG) is perking up with a little break above the April-May highs today. However, like the commodity itself, UNG remains in a long-term downtrend. After consolidating the last two months, the breakout argues for an oversold bounce that could retrace 50% of the prior decline....

READ MORE

MEMBERS ONLY

A pretty impressive rally

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After declining on Friday and Tuesday, stocks rallied throughout the day on Wednesday. This is especially impressive when we consider that European stocks were down sharply and the Euro was getting hit on Wednesday morning. Stocks managed to shrug off bad geopolitical news and rally. There was even a dip...

READ MORE

MEMBERS ONLY

Bollinger Bands contract for Micron

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Micron Technology (MU) is testing support with a consolidation over the last four weeks. Support in the 8.25-8.5 area stems from the February lows. The stock has been trading between 8.25 and 9.5 since May 10th. Also notice that the Bollinger Bands are narrowing. Look for...

READ MORE

MEMBERS ONLY

SPY breaks wedge support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weakness in Asia and Europe led to a weak open on Wall Street, but stocks managed to firm in the first hour and tech stocks led a morning rebound. These gains were holding in the early afternoon, but selling pressure in the final hour pushed stocks sharply lower. Small-caps and...

READ MORE

MEMBERS ONLY

3 Inside Days for Microsoft

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After becoming oversold and plunging on high volume last week, Microsoft is starting to firm with three inside days. Notice the long red candlestick on high volume four days ago. Was that a selling climax? The stock has traded the last three days in the upper half of the long...

READ MORE

MEMBERS ONLY

Getting cold feet already

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week's reversal and breakout at 110 were positive, but the five week trend remains down. Participants got cold feet on Friday as SPY moved back below 110 by the close. Nevertheless the ETF is holding the majority of last Thursday's gains. A move below 106....

READ MORE

MEMBERS ONLY

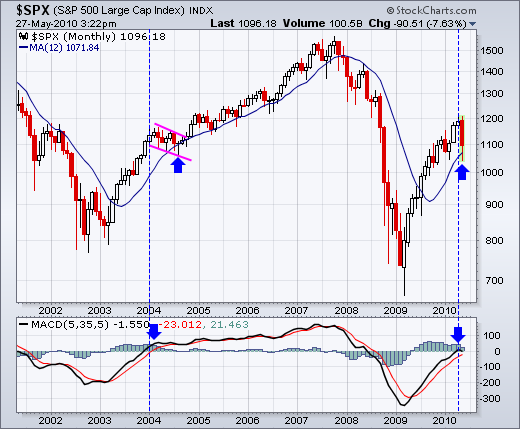

S&P 500 tests 12-month moving average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the May decline, the S&P 500 tested the rising 12-month moving average for the first time since breaking above in July. Also notice that MACD (5,35,5) turned positive for the first time since the first half of 2008. The bulls are in good shape as...

READ MORE

MEMBERS ONLY

Indicator Summary remains positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Indicator Summary remains positive, just barely. I changed the name to better reflect the actual contents of the table. Two lagging indicators turned this week. Net New Highs turned bearish as the 10-day SMA moved into negative territory. The Bullish Percent Indices turned neutral because some moved below the...

READ MORE

MEMBERS ONLY

A reversal and breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

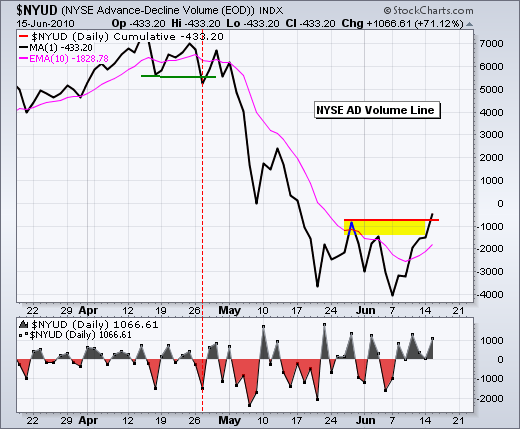

Stocks surged with a broad rally that lifted most boats. Over 90% of NYSE stocks advanced and over 85% of Nasdaq stocks were up on the day. Over 97% of NYSE volume was attributed to advancing issues. Over 90% of Nasdaq volume went into advancers. All major indices were up...

READ MORE

MEMBERS ONLY

$SPX is stuck in the middle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Talk about the lost decade. With the May decline, the S&P 500 is trading in the middle of its 10 year range. Note that this is a semi-log scale that reflects percentage change. We are looking at the mother of all consolidations.

Click this image for details...

READ MORE

MEMBERS ONLY

Inverse HS forms on 30-minute chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY followed through on Tuesday's reversal day with a surge above 109 in early trading, but failed to hold early gains and closed in negative territory for the day. It looks like a redux of Friday-Monday. While the inability to follow through is not positive, the two long...

READ MORE

MEMBERS ONLY

Retail SPDR establishes clear resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) is finding support just above the rising 150-day EMA with two white candlesticks in the last four days. There was a follow through attempt on Wednesday, but the ETF closed weak to establish resistance instead. Look for a move above Wednesday's high to reverse...

READ MORE

MEMBERS ONLY

Another big recovery candlestick

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pieces are in place for a short-term bounce, but we have yet to see the catalyst that actually reverses the 5-week downtrend. On the daily chart, SPY opened weak with a gap below last week's low and then rallied to close near the high for the day....

READ MORE

MEMBERS ONLY

A test of the February lows looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, SPY remains in a 4-5 week downtrend with support from the February lows close at hand. Support in the 106 area is confirmed by the February lows, the May flash-crash low and Friday's piercing line. In addition, SPY was oversold after a 10+ percent...

READ MORE

MEMBERS ONLY

Garmin forms triangle consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a gap down and sharp decline in early May, Garmin (GRMN) formed a triangle consolidation the last few weeks. The gap and support break around 36 are bearish. A break below triangle support would signal a continuation of this decline.

Click this image for details...

READ MORE

MEMBERS ONLY

Materials SPDR tests February low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Materials SPDR (XLB) was one of the hardest hit sector SPDRs over the last four weeks. After a 15+ percent decline, the ETF is testing support from the February low. A big bullish engulfing pattern formed on Friday as the ETF opened weak and closed strong. Notice how the...

READ MORE

MEMBERS ONLY

Oversold and near support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The decline over the last four weeks was severe, but still within the realm of a bigger uptrend. The weekly chart still sports a series of higher highs and higher lows. A break below the February low is needed to end this series and call for the end of the...

READ MORE