MEMBERS ONLY

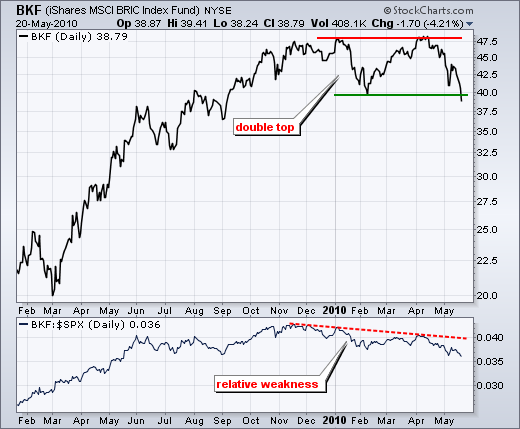

A double top for the BRIC ETF ($BKF)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The BRIC ETF (BKF) has a large double top working over the last 6-9 months. With the April-May decline, the ETF broke support from the February low to confirm this pattern. Based on traditional technical analysis, the projected decline is to the low 30s. The height of the pattern is...

READ MORE

MEMBERS ONLY

Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

How can the evidence remain bullish after the April-May decline? Looking back at the evidence in early February, which turned negative after the Jan-Feb pullback, these are the indicator that turned bearish: the McClellan Oscillators, the S&P 500 Volatility Index ($VIX), momentum, offensive sector performance, small-cap performance and...

READ MORE

MEMBERS ONLY

February lows within sight

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap down and 3.78% plunge, the S&P 500 ETF (SPY) is suddenly within a few percentage points of its February low. This reaction low defines the up trend on the weekly chart. A break below this low would reverse the uptrend that has been in...

READ MORE

MEMBERS ONLY

Apollo bucks the trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the stock market down sharply in early trading on Thursday, Apollo Group (APOL) sticks out a like a sore thumb with a 2+ percent gain. The stock appeared to break support last week, but recovered with a high volume surge on Monday. Today's gain in the face...

READ MORE

MEMBERS ONLY

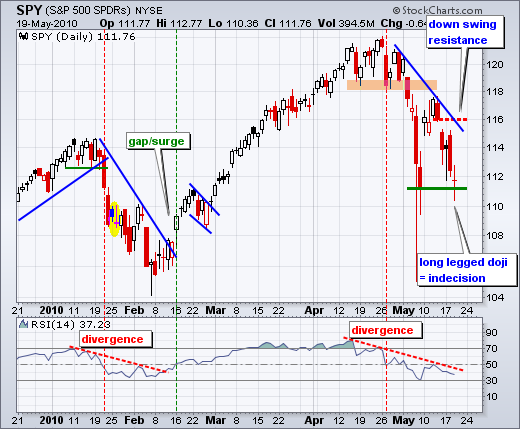

Testing the 7-May closing low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Indecision gripped the market yesterday as the S&P 500 ETF (SPY) formed a classic long legged doji. It is still unclear if these are bull legs or bear legs. The overall trend is down on the daily chart as SPY formed a lower high below 118 and gapped...

READ MORE

MEMBERS ONLY

Finance sector ekes out a gain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly lower on Wednesday, but the Financials SPDR (XLF) managed a small gain. A snapshot from the Market Summary page shows the nine sector SPDRs. XLF is the only gainer as the ETF test the early May lows.

Click this image for details...

READ MORE

MEMBERS ONLY

Failed bounce affirms downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a mild recovery day on Monday, stocks opened strong on Tuesday with many of the major index ETFs gapping up. And that was it. These opening gaps, though modest, did not last more than an hour as stocks moved lower the rest of the day. By the end of...

READ MORE

MEMBERS ONLY

Market Summary Carpet reflects recent rotations

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Market Summary can be viewed as a web page or as a Market Carpet. The snapshot below shows the Market Summary Carpet over the last 22 days (one month). There are a few green spots and lots of red. US Treasuries, the Dollar, Gold and Miners are the only...

READ MORE

MEMBERS ONLY

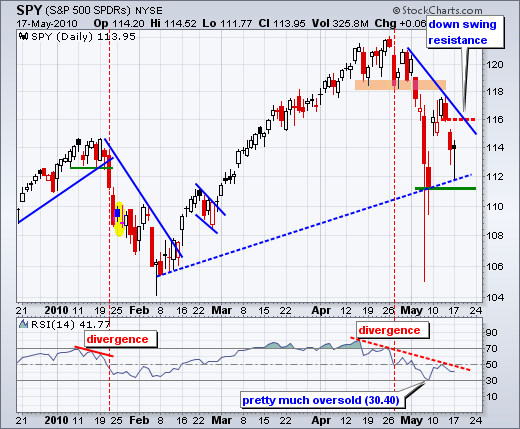

A test and recovery for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY continued lower on Monday morning with a dip below 112. This put SPY close to the 7-May close at 111.26 and within the 7-May candlestick body. After dipping below 112 in the late morning, buyers stepped into the market and pushed SPY to 113.95 on the close....

READ MORE

MEMBERS ONLY

An evening star for Netflix

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Netflix (NFLX) is up over 100% from its January lows, which makes it one of the top performers this year. However, signs of selling pressure are starting to creep in. First, the stock formed a bearish harami in late April and declined to 90. Second, a bearish evening star formed...

READ MORE

MEMBERS ONLY

First support test at hand

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Friday's action is continuing into Monday. As of 4AM ET, the Euro is getting slammed (1.227), gold is higher, US Treasuries are higher and oil is lower. Asian stocks followed Wall Street and Europe with sharp losses on Monday. European indices are down, but the losses are...

READ MORE

MEMBERS ONLY

FTSE FORMS LARGE BEARISH BROADENING FORMATION

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The London FTSE ($FTSE) has an expanding right triangle working over the last 7-8 months. These are akin to broadening formations, which are also bearish reversal patterns. After an advance from 3500 in March-09 to 5250 in October-09, the index moved into a volatile consolidation period. Notice the higher highs...

READ MORE

MEMBERS ONLY

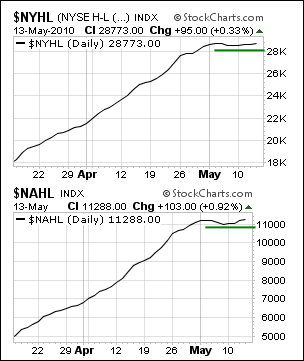

Cumulative Net New Highs flatten out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

From the breadth charts page, users can get a glimpse of the AD Lines and cumulative Net New Highs lines for the NYSE, Nasdaq and Amex. The image below shows the cumulative Net New Highs lines for the NYSE and Nasdaq. Both flatted over the last two weeks, but have...

READ MORE

MEMBERS ONLY

Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a drubbing over the prior two weeks, stocks rebounded with a sharp rally this week. For now, the drubbing was stronger than the rebound. However, the rebound established reaction lows in the AD Lines and the major index ETFs that should be watched for a possible trend reversal. A...

READ MORE

MEMBERS ONLY

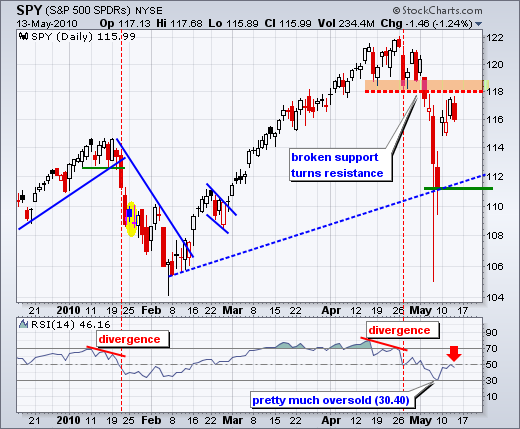

Cold feet at resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY edged above Wednesday's high yesterday, but late selling pressure drove the ETF below Wednesday's low. This weak close affirms resistance from broken support. If I were to write a bearish script, it would be pretty much just what is playing out on the daily and...

READ MORE

MEMBERS ONLY

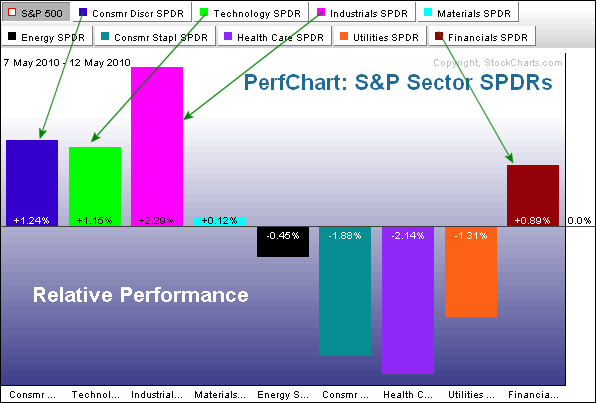

Markets returns to risk

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week was all about safety. This week is all about risk. The Sector PerfChart shows the offensive sectors outperforming the defensive sectors over the last four trading days. All sectors are up on an absolute basis. However, the consumer discretionary, technology, industrials and finance are up the most on...

READ MORE

MEMBERS ONLY

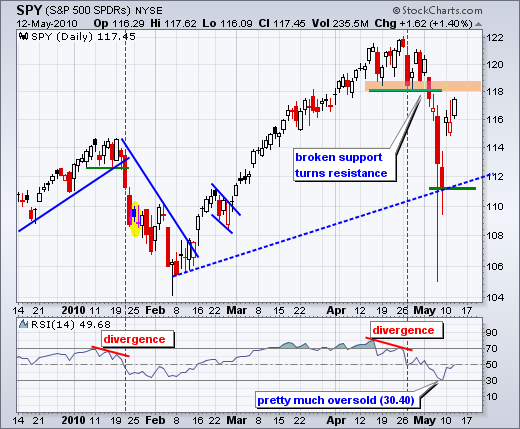

Bulls maintain short-term edge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After some indecision around 116, the bulls reasserted themselves and pushed SPY another 1.40% higher on Wednesday. Monday's gap is holding and the cup remains half full. Over the last three days, SPY is up 5.56%, QQQQ is up 7.07% and IWM is up 9....

READ MORE

MEMBERS ONLY

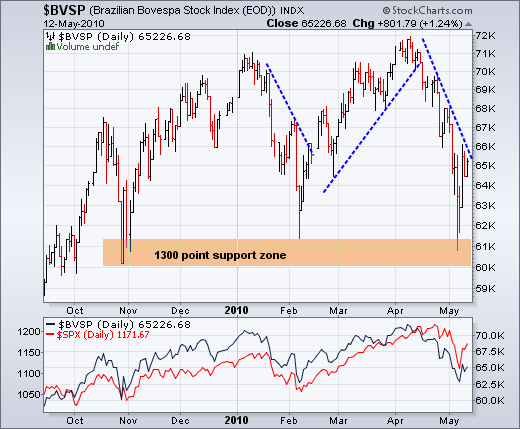

Bovespa Index tests support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Brazilian Bovespa Index ($BVSP) is testing support in the 62,000 area. There is a support zone from 60,000 to 61,300 that extends back to the late October low. The index has been swinging from this support zone to a resistance zone in the low 70,000...

READ MORE

MEMBERS ONLY

A moment of truth nears

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite the big bailout package from the EU over the weekend, the Euro moved lower on Tuesday as Forex traders renewed selling pressure. Gold surged as a substitute for fiat currencies. Once again we have both the Dollar and gold moving higher. I consider this negative for stocks and continued...

READ MORE

MEMBERS ONLY

A monster gap to retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As expected, the S&P 500 ETF (SPY) gapped above 115 on the open with a 4.08% opening surge. This is the third biggest opening gap (up) in years, perhaps ever. SPY gapped up 5.52% on 19-Sep-08 and 6.06% on 13-Oct-08. Guess what? These gaps did...

READ MORE

MEMBERS ONLY

Big gap expected on the open

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock futures are trading sharply higher on news of a comprehensive $962 billion EU bailout package. As of 5AM ET, the Dow is up some 350 points, the S&P 500 is up 47, oil is up $3, gold is down $21, US bonds are down sharply, EU bonds...

READ MORE

MEMBERS ONLY

Financial SPDR enters retracement zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a sharp decline the last four days, the Financials SPDR (XLF) entered a key retracement zone that may offer support. The area around 14.86-15.29 marks a 50-62% of the February-April rally. XLF is also oversold after a 12% decline in four weeks.

Click this image for details...

READ MORE

MEMBERS ONLY

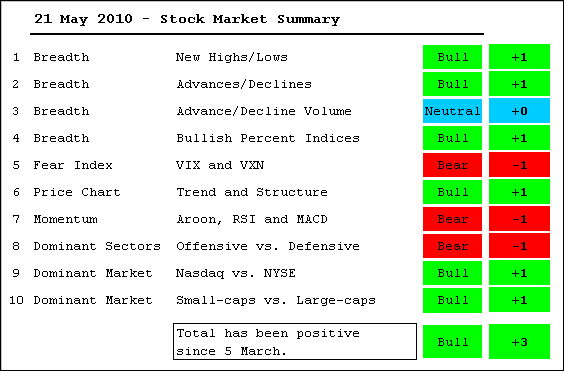

Indicator table remains net positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As deep as this week's decline has been, it was not enough to turn the position table net negative. The AD Lines and AD Volume Line were hit, but remain in uptrends and well above their February lows. Most of the Bullish Percent Indices are still above 50%...

READ MORE

MEMBERS ONLY

SPY closes near 50% retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the daily chart, the S&P 500 ETF (SPY) broke support from the mid April lows and plunged to the 50% retracement mark. I am not sure what to make of the intraday plunge below 106 - except that I would hate to have had a sell order...

READ MORE

MEMBERS ONLY

QQQQ returns to broken resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQQ) is gearing up for the first test since the support break at 49. With a decline back to 46.70, the ETF is now back to broken resistance from the January highs. This area now becomes a possible support level to watch in the coming...

READ MORE

MEMBERS ONLY

Friday could be a big day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I don't usually start with fundamental items, but Friday could be a real doozy. First, the German parliament is scheduled to vote on the Greek bailout. Needless to say, the German public is not too happy about subsidizing early retirement (55) and other Greek benefits. A NO vote...

READ MORE

MEMBERS ONLY

Wal-mart surges off support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a sharp decline in the stock market on Tuesday, Wal-mart managed a small gain near support and then surged on Wednesday with pretty good volume. This stock is a big part of the consumer staples sector.

Click this image for details...

READ MORE

MEMBERS ONLY

SPY breaks range support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) broke range support with a gap down and long red candlestick. Selling pressure was broad based as all nine sectors were down. Healthcare held up the best with a .58% loss. On the daily chart, the next support zone stems from broken resistance...

READ MORE

MEMBERS ONLY

CandleGlance of the most active

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The most active lists for Monday show 9-1 winners-losers for the NYSE and 8-2 for the Nasdaq. This table is updated throughout the day on the Free Charts page. Users can even click the CandleGlance link to see 10 small charts of these most active stocks. The image below shows...

READ MORE

MEMBERS ONLY

SPY bounces off range support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY is going everywhere and nowhere at the same time. The ETF has moved on either side of 120 nine times in the last three weeks. Overall, the ETF has been stuck in a range bound by 122 on the top and 118 on the bottom (about a 3.33%...

READ MORE

MEMBERS ONLY

An evening doji star for Home Depot

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Home Depot formed a rare evening doji star last week. Note the long white candlestick and surge above 36, the gravestone doji with the gap up and the long red candlestick last Monday. Also note the gaps on either side of the gravestone doji.

Click this image for details...

READ MORE

MEMBERS ONLY

SPY tests range support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY is starting the week with a support test around 118. Also note that the Dow SPDR (DIA) and Nasdaq 100 ETF (QQQQ) are near range support today. There were a few bearish developments last week. First, SPY gapped down on Monday morning and moved sharply lower to form a...

READ MORE

MEMBERS ONLY

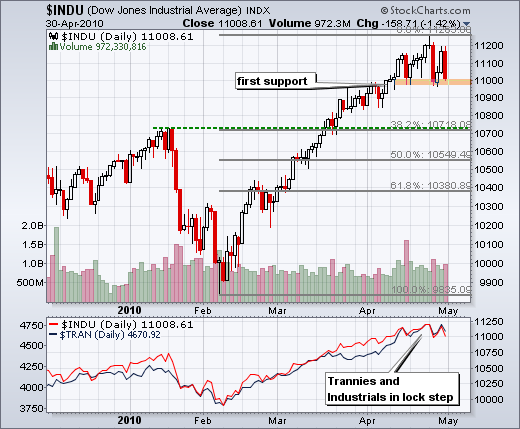

A SUPPORT TEST FOR THE DOW NEXT WEEK

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the third long red candlestick in three weeks, the Dow Industrials is once again testing support in the 11000 area. The senior average first exceeded 11000 on April 14th and then moved into a trading range. While a support break would be short-term bearish, it would not be enough...

READ MORE

MEMBERS ONLY

France and China Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The French CAC 40 ($CAC) and the Shanghai Composite ($SSEC) are down year-to-date and lagging other world indices. In contrast, the Nikkei 225 ($NIKK) is up 3.59% this year and the S&P 500 is leading with a 8.22% gain this year.

Click this image for details...

READ MORE

MEMBERS ONLY

Medium-Term Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the Stock Market Summary this week. The bulk of the evidence turned bullish again on March 5th and remains bullish. All 10 indicators are in bull mode. Selling pressure hit the market hard on April 16th and April 27th, but the market rebounded the very...

READ MORE

MEMBERS ONLY

SPY moves into a trading range

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Overall, the trend on the daily chart remains up. SPY forged a higher high last week and held short-term support this week. Even a break below this week's low would not be enough to reverse the medium-term uptrend because we should allow room for a correction or pullback...

READ MORE

MEMBERS ONLY

Copper hits support zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Copper ($COPPER) fell with the stock market over the last two weeks. And like the stock market, copper firmed on Wednesday with a support zone around 330-340. The indicator window shows copper with the S&P 500. Notice how closely these two have been tracking over the last eight...

READ MORE

MEMBERS ONLY

To bounce or not to bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

That is the question. The S&P 500 ETF (SPY) became short-term oversold after a sharp decline on Tuesday and then firmed with an indecisive candlestick on Wednesday. Taken together, we have a harami or inside day. In addition, the ETF has support around 118.5 from last week&...

READ MORE

MEMBERS ONLY

Sprint goes for 8 straight

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Sprint (S) advanced the last seven weeks and broke triangle resistance in the process. This is the longest weekly string in over 2 1/2 years. Volume has been pretty impressive too.

Click this image for details...

READ MORE

MEMBERS ONLY

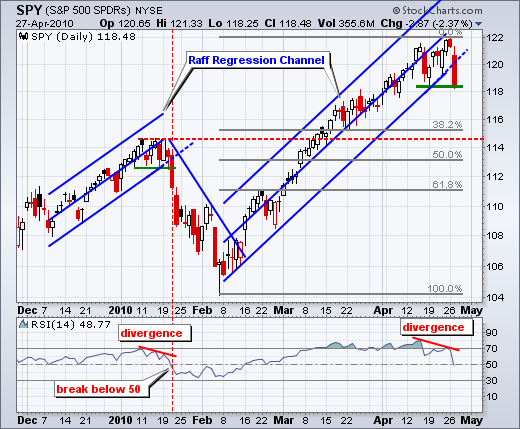

SPY breaks channel support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap down and long red candlestick, the S&P 500 ETF (SPY) broke below the lower trendline of the Raff Regression Channel. This is the second long red candlestick (sharp decline) in two weeks. In fact, the channel break is starting to look similar to the mid...

READ MORE