MEMBERS ONLY

Elder Impulse breakout for Frontier Comm

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Frontier Communications (FTR) broke consolidation resistance with a surge above 7.6 in early April. Notice that this surge occurred with a green price bar, which indicates an upturn in the Elder Impulse System. The bars are currently blue as the stock consolidates. Look for another green bar to signal...

READ MORE

MEMBERS ONLY

Bullish and overbought

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is overbought and then there is OVERBOUGHT. Overbought conditions after a two week surge show early inning strength, but overbought conditions after a seven week surge show maturity in the late innings (baseball). I also noted in last night's Market Message that the CBOE Put/Call Ratio...

READ MORE

MEMBERS ONLY

Athens Index tests prior lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a potential rescue package from the EU and IMF, the Athens General Index ($ATG) fell rather sharply over the last three days and is testing its February low. Greek equities are not impressed.

Click this image for details...

READ MORE

MEMBERS ONLY

A new high for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With another strong week, the S&P 500 ETF (SPY) surged to a new closing high for the move. The ETF was up four of five days and gained over 2%. Reaction to last week's earnings reports and news was positive overall. With the new closing high,...

READ MORE

MEMBERS ONLY

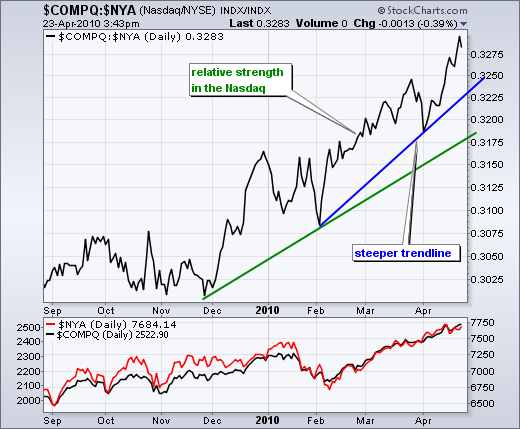

Nasdaq outperformance accelerates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq has been outperforming the NY Composite since December and outperformance is accelerating. The green trendline defines the first rate of outperformance. The blue trendline, which is steeper, defines the second rate of outperformance. Also notice how the Nasdaq:NY Composite price relative shot higher in April.

Click this...

READ MORE

MEMBERS ONLY

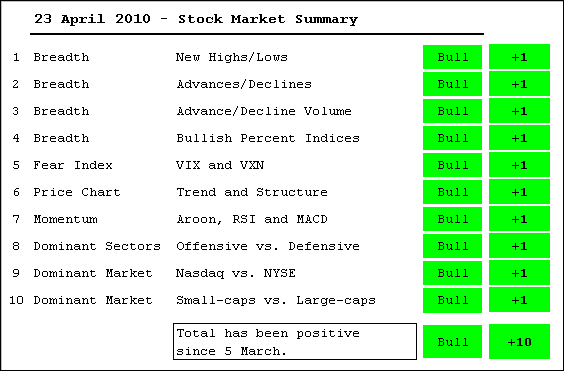

Medium-Term Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the Stock Market Summary this week. The bulk of the evidence turned bullish again on March 5th and remains bullish. All 10 indicators are in bull mode. The only potential negative is the frothiness of the current advance. Nasdaq outperformance surged this month and small-cap...

READ MORE

MEMBERS ONLY

Resilience rules the day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a gap down and weak open, the S&P 500 ETF (SPY) firmed throughout the morning and then surged in the late afternoon to close positive. Once again, the bulls remain resilient as even the smallest dips bring out the buyers. The consumer discretionary sector and small-caps led...

READ MORE

MEMBERS ONLY

Potash hits support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp decline the last five weeks, Potash (POT) hit support last week and bounced this week. A nice three candlestick reversal formed Thursday-Friday-Monday, but the stock fell back on Tuesday-Wednesday. Upside follow through would affirm support and trigger a short-term breakout.

Click this image for details...

READ MORE

MEMBERS ONLY

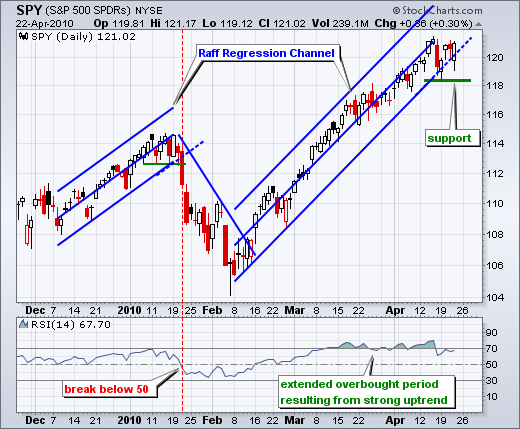

SPY stalls below prior high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change on the daily chart as SPY remains just above the Raff Regression Channel extension. SPY affirmed channel support with a reversal day on Monday and bounced on Tuesday. There was not much upside follow through after Tuesday's strong open as the ETF stalled around...

READ MORE

MEMBERS ONLY

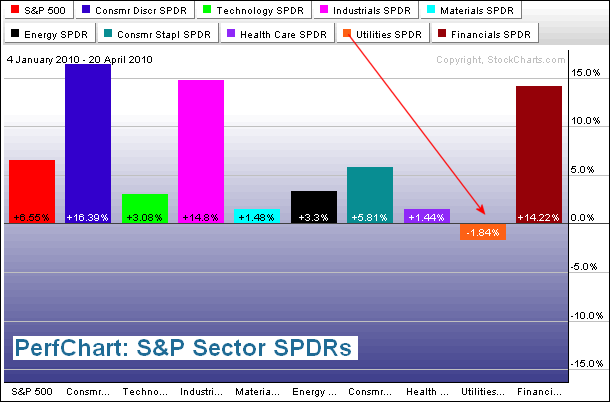

Utilities down for the year

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) is not partaking in the 2010 market advance. While the S&P 500 is up over 6% year-to-date, the defensive oriented XLU is down almost 2%. It is the only sector sporting a loss this year. In sharp contrast, the offensive oriented consumer discretionary sector...

READ MORE

MEMBERS ONLY

SPY holds channel support; Charts: APA,CCI,CTXS,DISH,FTR,LIFE,QCOM,SYMC,THC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We made it through the ash cloud and I am back at the office with my normal work setup (computers, big monitors, Nespresso, etc...). Office sweet office!

After a sharp decline on Friday, SPY recovered from early weakness on Monday and extended its gains on Tuesday. Once again, the pullback...

READ MORE

MEMBERS ONLY

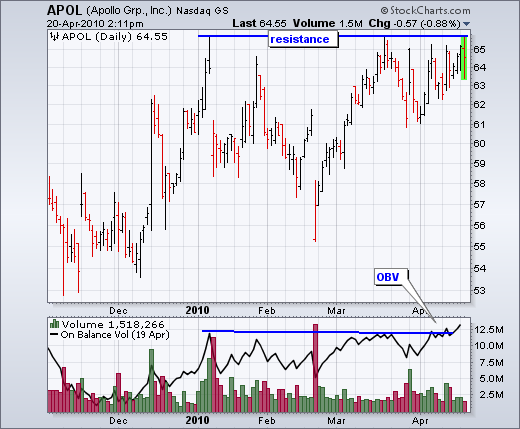

APOL consolidates near resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart for Apollo Group (APOL) sports a consolidation pattern that looks like an inverse head-and-shoulders. Resistance in the 65-66 area stems from reaction highs in January-March as well as the consolidation in April. A break above these highs would be bullish. Notice that OBV already broke resistance.

Click this...

READ MORE

MEMBERS ONLY

SPY hits channel support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp decline on Friday and further weakness early Monday, the S&P 500 ETF (SPY) recovered and managed to firm at the Raff Regression Channel. This channel defines the current advance and a break below would call for a re-evaluation of this uptrend.

Click this image for...

READ MORE

MEMBERS ONLY

Breadth and intermarket charts updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Note that Net Advances on the Nasdaq and NYSE plunged to their lowest levels since February. Net Advancing Volume on the NYSE and Nasdaq also plunged to its lowest level since February.

Click here for breadth charts and here for intermarket charts....

READ MORE

MEMBERS ONLY

Flying through the ash

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After being stranded for a few days, we finally caught a flight home that will arrive on Tuesday. Unfortunately, I will not be able to provide an SPY update on Tuesday. Normal updates will continue on Wednesday, provided we make it through the volcanic ash!...

READ MORE

MEMBERS ONLY

SPY hits short-term support zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I am almost back in the saddle. Vacations are great, but it usually takes a day or two to get re-acclimated to the market environment. Stocks remained strong the last two weeks as the major index ETFs hit new highs for the move last week. The Dollar slipped as the...

READ MORE

MEMBERS ONLY

SPX: now versus 1965 to 1980

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

From the historical charts at Stockcharts.com, we have cutouts of two large trading ranges. The S&P 500 was largely range bound from the mid 60s to the late 70s (~15 years) and from the late 90s until the present (~13 years). The current rally looks similar to...

READ MORE

MEMBERS ONLY

Gold-Dollar relationship challenged

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The nine year chart for the US Dollar Index ($USD) and Gold-Continuous Futures ($GOLD) shows a clear inverse relationship from 2002 until 2007. Gold advanced as the Dollar declined. This inverse relationship continued with the swings of 2008 and 2009 (Dollar down/gold up and visa versa). The potential conflict...

READ MORE

MEMBERS ONLY

Long-term support for the Euro

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Euro Index ($XEU) appears to be in a long-term downtrend with the next support zone around 117-120. With a lower high in December, a falling channel is taking shape. The lower trendline extends to 115 and there is support around 117-120 from the 2004-2005 lows. Should the index bounce...

READ MORE

MEMBERS ONLY

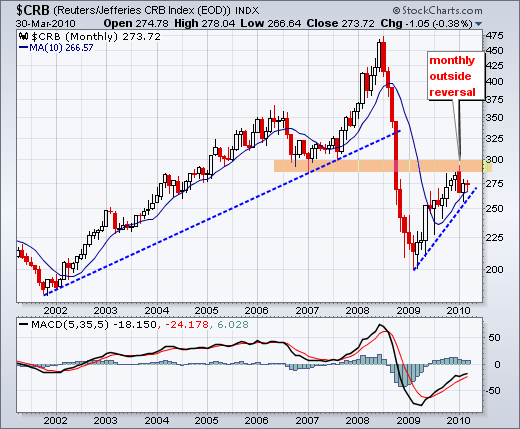

CRB forms monthly outside reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The CRB Index ($CRB) advanced with the stock market in 2009, but hit resistance from broken support and formed a monthly outside reversal. This is also known as a bearish engulfing. The combination of resistance and reversal could cap this rally. A monthly close below the rising 10-month SMA would...

READ MORE

MEMBERS ONLY

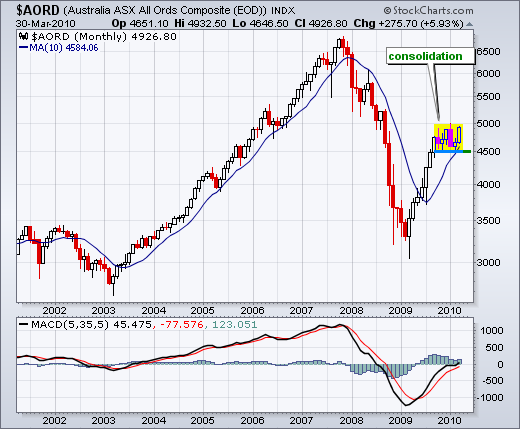

All Ords establish support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Australian All Ords Composite ($AORDS) has been rallying with the rest of the world over the last 14 months. With a stall around 4500-5000 the last six months, the index established support at 4500. "No worries" for the bulls as long as this support level holds.

Click...

READ MORE

MEMBERS ONLY

Stocks follow interest rates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Are rising rates bullish or bearish for the stock market? Those answering bearish may want to consider the chart below. Over the last five years, there appears to be a positive correlation between the 10-Year Treasury Yield ($TNX) and the S&P 500. Both rise and fall together. Also...

READ MORE

MEMBERS ONLY

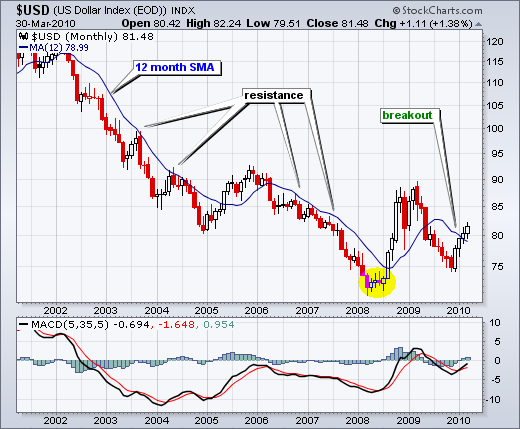

Dollar Index breaks 12-month SMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 12-month SMA provides a pretty good clue on the overall direction for the US Dollar Index ($USD). There have been six crosses since 2002. Downside breaks captured long downtrends in 2002-2004 and 2006-2007. The upside breaks produced relatively short rallies that lasted almost a year. The current rally is...

READ MORE

MEMBERS ONLY

XLE and XLU come up short

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the advance over the last 13 months, the Energy SPDR (XLE) and the Utilities SPDR (XLU) retraced less than 50% of the prior declines. Excluding the Financials SPDR (XLF), these retracements were the shallowest of the eight sector SPDRs, which makes these two chart laggards over the last few...

READ MORE

MEMBERS ONLY

XLP nears 2007 high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples SPDR (XLP) is the only one of the nine sector SPDRs challenging its 2007 high. The other 8 sector SPDRs are not even close. While XLP may be lagging in percentage terms, its advance over the last 13 months is the strongest in chart terms because the...

READ MORE

MEMBERS ONLY

IWM hits pre-Lehman consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the massive rally over the last 13 months, the Russell 2000 ETF (IWM) hit levels note seen since Lehman brothers dominated the news. IWM was trading in the 63-75 range just before the Lehman bankruptcy and is nearing 70. This area could mark resistance.

Click this image for details...

READ MORE

MEMBERS ONLY

SPY stalls at channel trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) and Nasdaq 100 ETF (QQQQ) are trading near the upper trendline of a rising price channel that extends back to August. I drew the lower trendlines first, created a second parallel trendline and then moved it up to match the reaction highs. After...

READ MORE

MEMBERS ONLY

Falling Dollar boosts Gold and Oil $GLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weakness in the Dollar over the last few days spurred buying in gold and oil. The chart below shows the Gold ETF (GLD), US Oil Fund ETF (USO) and DB Dollar Bullish ETF (UUP) over the last seven days. Gold took off first with a move on March 26th. Oil...

READ MORE

MEMBERS ONLY

Gone fishing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I will be on vacation the first two weeks of April. The next posting to Art's Charts will be on Monday, April 19th. See you then - refreshed and rejuvenated!...

READ MORE

MEMBERS ONLY

SPY forms third indecisive candlestick

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY hit 117 eleven days ago and then stalled the last 10 days. Daily ranges were relatively wide from March 19th until March 26th (six days). The daily range narrowed this week with three indecisive candlesticks. This is hardly surprising considering the four day trading week, the Good Friday employment...

READ MORE

MEMBERS ONLY

Juniper slows to a crawl

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging above 30 in early March, Juniper slowed to a crawl the last six days. Notice that Bollinger Bands (10,2) are contracting and the Standard Deviation is at its lowest point since early February, which is when the surge started.

Click this image for details...

READ MORE

MEMBERS ONLY

SPY continues to stall

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Yesterday I showed a rising price channel extending from August and SPY was consolidating near the upper trendline. No change on that front as SPY continued its stall with another relatively narrow range day. Monday's high-low range was the narrowest in seven days (NR7). This is the range...

READ MORE

MEMBERS ONLY

New highs still outpacing new lows $BA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A look at the predefined scans page shows new 52-week highs outpacing new 52-week lows by a wide margin. In fact, new lows are quite minimal, which is hardly surprising considering the current rally is some 55 weeks old. The Aerospace group is well represented with Boeing (BA), General Dynamics...

READ MORE

MEMBERS ONLY

SPY hits channel trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I will start with the chart shown in yesterday's Market Message. There is no new price action so the analysis has not changed. SPY hit the upper trendline of a rising price channel and stalled over the last two weeks. Stalling is not the same as weakness though....

READ MORE

MEMBERS ONLY

Shanghai Composite breaks resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It's been a long time coming, but the Shanghai Composite ($SSEC) finally broke above 3100 resistance. The index has been lagging the S&P 500 the last six weeks as it traded flat. Today's break above 3100 takes the index to its highest level since...

READ MORE

MEMBERS ONLY

Uptrend continues as bullish sentiment increases

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is really no change on the daily chart. SPY remains in a medium-term uptrend with a higher low in February and higher high in March. The ETF is also in a short-term uptrend with a sharp advance from the February low. Since moving above 116 eight days ago, the...

READ MORE

MEMBERS ONLY

Shooting stars popping up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

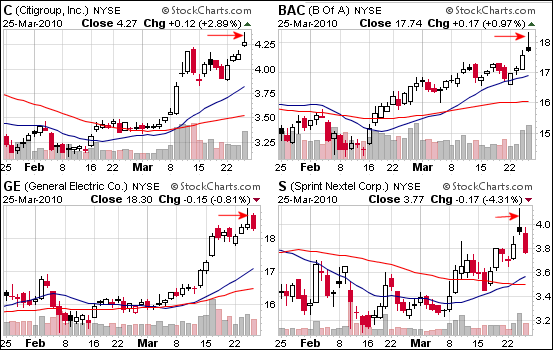

Shooting star candlesticks are popping up after a couple of volatile days. A CandleGlance view of Thursday's most active list shows shooting stars in the four most active stocks. GE and S formed shooting stars on Wednesday. C and BAC formed shooting stars on Thursday. Click here for...

READ MORE

MEMBERS ONLY

Medium-Term Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the Stock Market Summary this week. All indicators are in bull mode, but there were some signs of less strength this week. The NYSE AD Volume Line did not exceed last week's high. Nasdaq Net Advances dipped to their lowest (negative) level since...

READ MORE

MEMBERS ONLY

SPY gives up early gains

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading is turning rather volatile, which is just one more sign that a pullback or corrective period may begin soon. SPY first crossed above 116.5 seven days ago. Since this first cross, the ETF has dipped to around 115 and surged above 118. Yesterday's close at 116....

READ MORE

MEMBERS ONLY

SPY stalls within uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As with the end of February, SPY is currently stalling within an uptrend. The ETF moved above 116 six days ago and has traded on either side of 116.5 the last six days. The pink ovals show periods with a red candlestick, recovery candlestick and a subsequent gain. The...

READ MORE