MEMBERS ONLY

Intermarket charts updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

All daily and weekly intermarket charts have been updated ( click here). Below for four charts featuring some highlights from last week.

Bonds had a big week as the 30-year Treasury Bond ($USB) surged over 2%.

The US Dollar Index ($USD) is overbought, but refuses to give up gains.

West Texas...

READ MORE

MEMBERS ONLY

SPY edges above flag resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

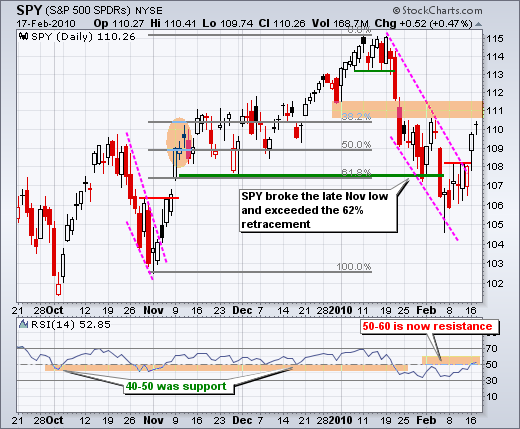

On the daily chart, SPY surged to resistance around 111 and then consolidated the last few days. The ETF appeared headed down after a sharp decline on Tuesday and weak open on Thursday, but recovered on Thursday afternoon and closed strong. This long-red-hollow candlestick represents a reversal day. Follow through...

READ MORE

MEMBERS ONLY

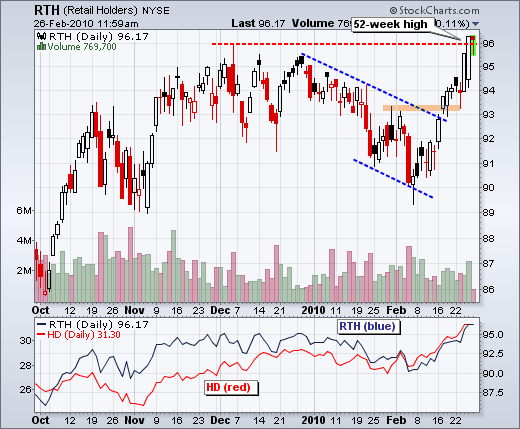

Home Depot powers Retail HOLDRS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail HOLDRS (RTH) recorded a 52-week high with help from Home Depot (HD). RTH broke above channel resistance in mid February and above its December highs this week. The indicator window shows both RTH and HD. Notice how HD also moved above its December high.

Click this chart for...

READ MORE

MEMBERS ONLY

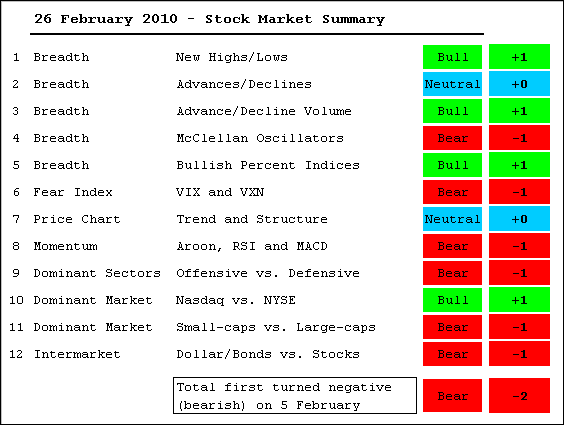

Medium-Term evidence remains slightly bearish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It remains a tricky period for the stock market. Overall, the market summary table comes in at -2, which is slightly bearish. There are, however, a few indicators that could go either way. The McClellan Oscillators both surged above +50 in mid February, but only for a day and I...

READ MORE

MEMBERS ONLY

Falling flag taking shape in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Before looking at the falling flag on the 60-minute chart, let's review some candlestick action on the daily chart. There is no change in the overall analysis as SPY appears to be developing a falling price channel. A break above 111.10 would throw cold water on this...

READ MORE

MEMBERS ONLY

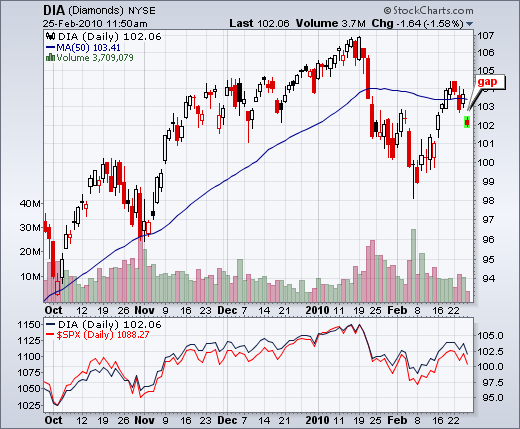

Dow Diamonds gaps down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After battling its 50-day moving average the prior five days, the Dow Diamonds (DIA) gapped down in early trading on Thursday. This gap reinforces resistance around the 50-day and is considered short-term bearish as long as it remains unfilled.

Click this chart for details....

READ MORE

MEMBERS ONLY

SPY and charts of interest

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

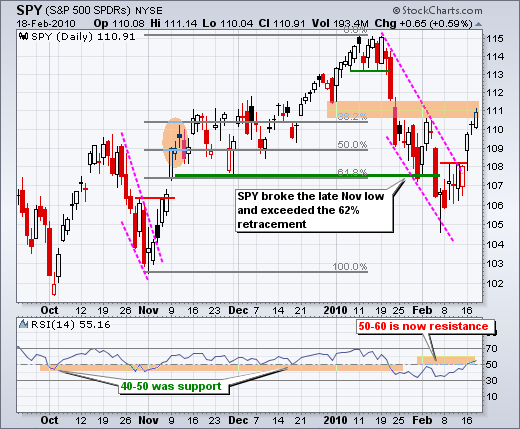

There is not much change on the daily chart. SPY hit resistance in the 111 area over the last few days. This resistance zone stems from broken support and the early February high. It also marks a 62% retracement of the January-February decline. Should a lower high form, I can...

READ MORE

MEMBERS ONLY

Raff Regression Channel for the Euro ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Since peaking in late November, bounces in the Euro ETF (FXE) have been limited to three days. In fact, except for one 3-day bounce in late December, bounces have actually been 1-2 days. The Raff Regression Channel with extensions defines the current downtrend. A break above the upper extension is...

READ MORE

MEMBERS ONLY

A crack in the bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After yakking about SPY resistance in the 111 area and RSI resistance in the 50-60 area for at least a week, it finally came to pass. With a broad decline on Tuesday, SPY backed off the potential resistance zone to turn it into a confirmed resistance zone. All major indices...

READ MORE

MEMBERS ONLY

Apple breaks wedge support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple (AAPL) met resistance at a key retracement zone last week and broke below the wedge trendline with a sharp decline today. Notice that Apple was turned back in the 50-62% retracement zone. With the wedge break, the next target is the support zone around 187.50.

Click this chart...

READ MORE

MEMBERS ONLY

SPY holds its gains

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the advance slowed over the last few days, the S&P 500 ETF (SPY) continues to hold its gains as buying pressure exceeds selling pressure. On the daily chart, SPY is up around 5% in the last two weeks and trading in a potential resistance zone around...

READ MORE

MEMBERS ONLY

A mixed up market in 2010

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The sector SPDR perchart reflects a mix market (at best) for 2010. The S&P 500 is down around 2.46% since January 6th. Of the nine sectors, only three are up (consumer discretionary, industrials and consumer staples. The other six sectors are down with technology and materials shows...

READ MORE

MEMBERS ONLY

SPY remains near resistance zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When marking support, resistance and reversal levels, zones are preferred to exact levels for two reasons. First, indices and ETFs are based on a basket of stocks. With more than one stock influencing price, we cannot expect support, resistance or reversal levels to be EXACT. Second, there are many buyers...

READ MORE

MEMBERS ONLY

Short-term rates move ahead of Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a quarter point hike in the discount rate, the Fed surprised some in the media, but few in the bond market. As one of the most interest rate sensitive asset classes, the bond market often moves before an actual Fed move. First, the Fed has been jawboning about the...

READ MORE

MEMBERS ONLY

Raytheon shows relative strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Raytheon (RTN) shows relative strength with a break above the January high. The S&P 500 and RTN are shown in the indicator window. Notice that RTN is trading above its January high, but the S&P 500 remains well below its January high. Defense is attracting money....

READ MORE

MEMBERS ONLY

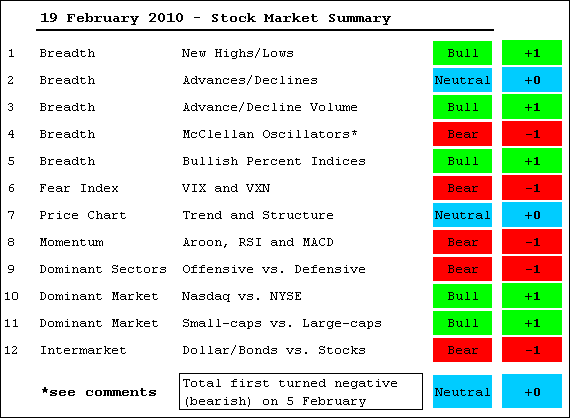

Bounce turns Market Summary Neutral

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Transition periods are tricky. The bulk of the evidence shifted towards the bears on February 5th, but the Market Summary Table shifted to +2 this week, which slightly favors the bulls. Three items are responsible for this shift. The McClellan Oscillators both moved above +50. The Nasdaq is outperforming the...

READ MORE

MEMBERS ONLY

SPY reaches Fibonacci Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though SPY closed at its highest close of the month, I still think the ETF is in a resistance zone and this oversold bounce is getting long on tooth. In short, yesterday's advance does not change my overall view. SPY was oversold in early February and this...

READ MORE

MEMBERS ONLY

Overbought RSI and resistance for RIMM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With an advance back to the low 70s, RIMM is one again trading near resistance. The stock was turned back here in mid October and mid December. Also notice that a harami formed on Friday-Tuesday and RSI become overbought last Friday. The 3 week trend is still up, but traders...

READ MORE

MEMBERS ONLY

Truth or Consequences time for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bounce over the last seven days does not look that strong and resistance is nigh. First, I pointed out mixed breadth and weak volume on Wednesday. Second, individual days show more indecision than strength. After plunging from 115 to 105 (high to low), SPY was oversold in early February...

READ MORE

MEMBERS ONLY

On Balance Volume surges for Juniper

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Juniper (JNPR) is down for the year, but On Balance Volume (OBV) is up so far in 2010. Joe Granville, creator of OBV, postulated that volume precedes price. This simple indicator broke resistance with a surge in early February. The stock is also showing signs of life with a little...

READ MORE

MEMBERS ONLY

Strong move on mixed breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started strong with a gap up on the open and finished strong with a close near their highs for the day. Overall volume was not that strong and Net Advancing Volume was mixed. NYSE Net Advancing Volume ($NYUD) finished at +877, while Nasdaq Net Advancing Volume ($NAUD) finished at...

READ MORE

MEMBERS ONLY

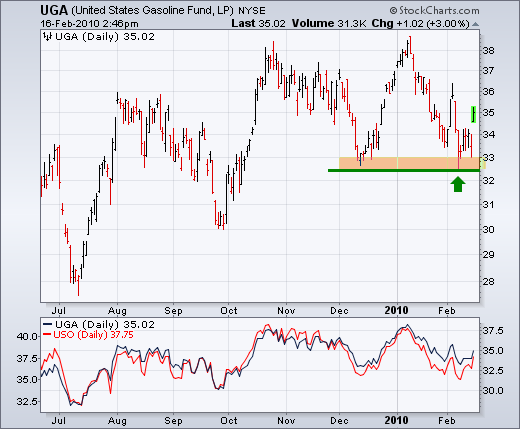

Gasoline ETF Surges off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Gasoline ETF (UGA) surged off support with a gap and big move on Tuesday. This successful support test keeps the overall uptrend in place. A break below the Dec-Feb lows would reverse the medium-term uptrend. Notice how closely UGA and USO track.

Click this chart for more details....

READ MORE

MEMBERS ONLY

IWM and QQQQ Show Resilience

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today I am starting with the Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQQ) because both are showing resilience with pretty good advances over the last two days. Both broke above wedge trendlines and finished near the high for the week. It is positive to see small-caps and large-techs...

READ MORE

MEMBERS ONLY

Atmos Energy gets oversold bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Atmos Energy came across the oversold RSI scan as 14-day RSI moved above 30 on Thursday. Also notice that the stock bounced right back to its 200-day moving average.

Click this chart for details...

READ MORE

MEMBERS ONLY

Evidence remains bearish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On balance, the evidence still favors the bears at this stage. We are, however, still in a transition period or the early stages. The evidence favored the bulls from early September to February 5th. On February 5th, the sum total turned negative to favor the bears for the first time...

READ MORE

MEMBERS ONLY

SPY gets a bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

These daily SPY updates are short-term in nature and subject to change as new price data and information come to light - which is hourly. The objective of this analysis is education. It is not meant as a recommendation to buy, sell or sell short. The only advice I have...

READ MORE

MEMBERS ONLY

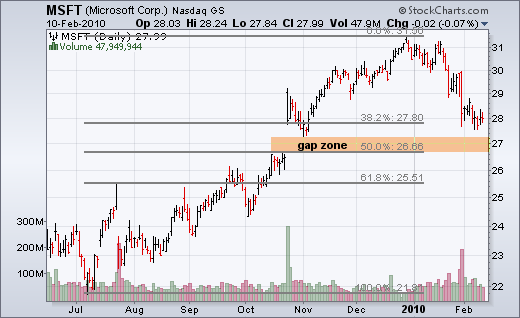

Microsoft firms near the gap zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp (~10%) decline this year, Microsoft (MSFT) is nearing its first support zone around 27-28. Support here stems from the October gap and the 38% retracement. MSFT firmed around 28 over last four days and yesterday's range was the narrowest of the last six days.

Click...

READ MORE

MEMBERS ONLY

Oversold and firming

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today I am going to show four daily charts: SPY, RSP, IWM and QQQQ. This is an interesting quartet. SPY broke the late November low and exceeded the 62% retracement. The decline from 115 to 105 was the deepest since March and did enough technical damage to turn medium-term bearish...

READ MORE

MEMBERS ONLY

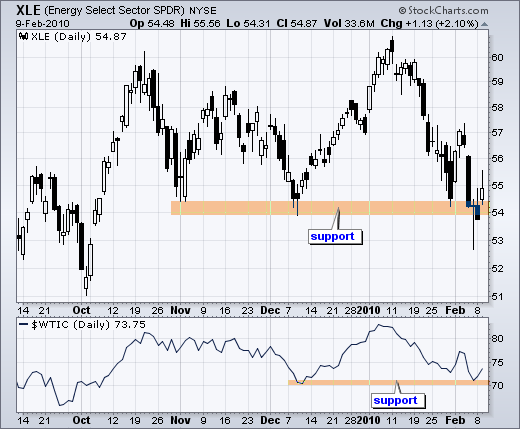

Energy SPDR and Oil Test Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) and West Texas Intermediate ($WTIC) are both testing support from their December lows. XLE bounced off the 54 area in early November and early December to establish support. Oil bounced off 70 in early December to establish support. Successful tests would be bullish, but breaks by...

READ MORE

MEMBERS ONLY

A hesitant bounce for SPY plus 5 stock charts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The medium-term and short-term trends are both considered down at this point. SPY broke below its late November support zone with the biggest decline since early last year. After a selling climax of sorts on Friday, the ETF bounced back above 107 on Tuesday. This bounce was, however, an indecisive...

READ MORE

MEMBERS ONLY

ORLY forms a triangle consolidation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a decline from mid November to mid December, O'Reilly Automotive (ORLY) formed a triangle consolidation. The stock is holding up better that the S&P 500 since January, but a triangle break is required for the next directional signal.

Click this chart for details...

READ MORE

MEMBERS ONLY

SPY analysis and charts of interest

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY started the day strong, but finished weak and closed with a modest loss. Even though there was no follow through on Monday, the ETF remains short-term oversold and ripe for a bounce or consolidation. Overall, the 3-4 week pattern looks like a zigzag decline with three legs (decline, bounce,...

READ MORE

MEMBERS ONLY

Finance leads sectors lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Sector SPDR section of the Market Summary shows the Financials SPDR (XLF) and the Materials SPDR (XLB) leading the market lower today. Despite Friday's intraday reversal, there was no follow through as all sectors moved lower on Monday.

Click this chart for details...

READ MORE

MEMBERS ONLY

A reversal day for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY plunged below its late November low on Thursday and firmed on Friday with a reversal candlestick. Even though it is not a picture perfect hammer, the essence of the pattern is clearly there. SPY opened at 106.56, plunged below 105 intraday and recovered to close at 106.66,...

READ MORE

MEMBERS ONLY

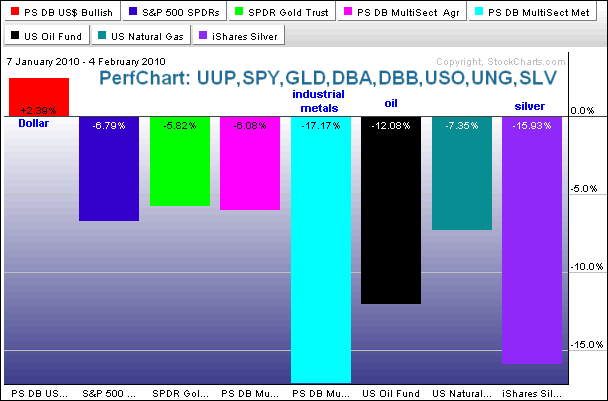

Commodities weighed down by Dollar and stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

In addition to stock markets around the world, we have seen a rout in various commodity groups over the last 3-4 weeks. Strength in the Dollar is partly to blame. Weakness in global equities also bodes ill for the commodities. A downturn in global equities would imply a future downturn...

READ MORE

MEMBERS ONLY

A MACD cross for PSA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Public Storage (PSA) came across the Bearish MACD Crossover on the predefined scans page. The chart below shows PSA gapping down and closing weak with high volume. MACD moved from positive territory to negative territory as it crossed back below its signal line.

Click this chart for details...

READ MORE

MEMBERS ONLY

Evidence turns bearish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I started this evidence table in September and the bulk of the evidence was net positive from September to January. Signs of weakness started appearing in the second half of January and the evidence turned net negative this week. To the model's credit, the evidence stayed net positive...

READ MORE

MEMBERS ONLY

SPY gaps and breaks support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) failed at short-term resistance and broke medium-term support with a sharp decline on Thursday. A support zone around 108 held up for the prior six days, but wilted with a long red candlestick yesterday. Even though SPY remains above the last two reaction...

READ MORE

MEMBERS ONLY

Stericycle bounces off broken resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stericycle (SRCL) broke resistance with a surge last year and returned to broken resistance this year. It looks like broken resistance is turning into support as the stock surged with good volume on Wednesday. Also notice that the Dec-Jan decline retraced 50% of the prior advance.

Click this chart for...

READ MORE

MEMBERS ONLY

SPY stalls at short-term resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY surged off support with two good gains on Monday-Tuesday, but ran into short-term resistance on Wednesday and stalled with a doji. The doji looks like a big plus sign (+). With little change from open to close, the horizontal portion is small or just a line. Vertical lines represent the...

READ MORE