MEMBERS ONLY

Commodity ETFs Under Pressure in 2010

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

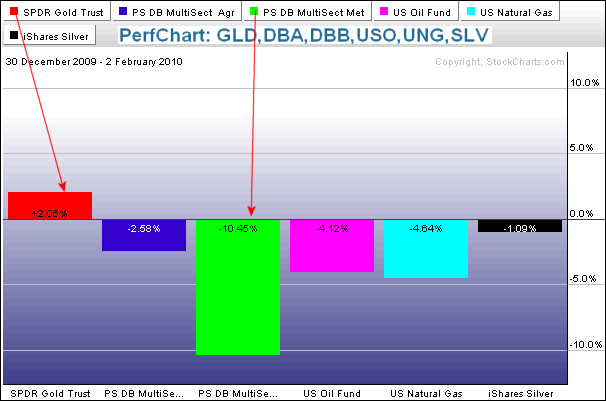

2010 has not been a good year for commodity ETFs so far. The PerfChart below shows six commodity ETFs from December 30th to February 2nd. Five of the six are down with the The DB Base Metals ETF (DBB) down over 10%. The Gold ETF (GLD) is the only gainer....

READ MORE

MEMBERS ONLY

SPY surges to short-term resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY hit the 62% retracement last week and bounced with two good moves this week. At this point, I still consider the medium-term trend up on the daily chart. SPY forged a higher high in early January and held support so far in February. Moreover, the ETF bounced at a...

READ MORE

MEMBERS ONLY

Nasdaq Net New Highs near zero

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

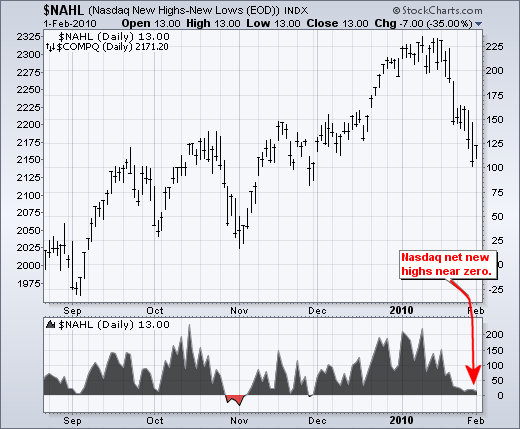

With the decline over the last few weeks, Net New Highs on the Nasdaq moved below +50. This indicator was above +200 in early January and is now flirting with negative territory. Net New Highs equals new 52-week highs less new 52-week lows.

Click this chart for details...

READ MORE

MEMBERS ONLY

SPY firms for a day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY took its decline to the brink of a support break, but manage to firm with a good bounce on Monday. This is enough to stave off a medium-term support break and keep the medium-term uptrend alive. The reasons for support around 108-109 remain unchanged. Support stems from the 62%...

READ MORE

MEMBERS ONLY

XLB leads oversold bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The harder they fall, the bigger they bounce. The Materials SPDR (XLB) led the sectors lower by declining around 15% from high to low the prior three weeks. In the process, the ETF was down 11 of the last 15 days. After becoming oversold on Friday (see RSI), the ETF...

READ MORE

MEMBERS ONLY

SPY hits 62% retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY opened strong and closed weak for the second time in two days. Another long red candlestick formed as the ETF closed below its late November low. Even though SPY broke support, keep in mind that the last true reaction low was in early November around 103 and SPY remains...

READ MORE

MEMBERS ONLY

Technology sector sees red

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

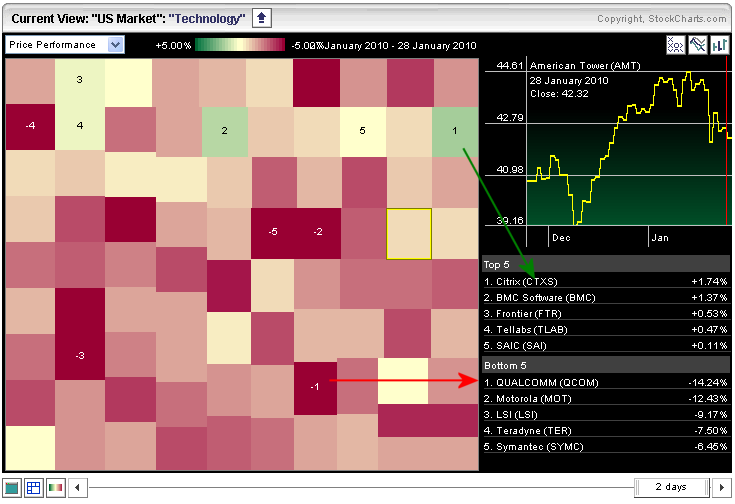

Within the S&P Sector Carpet, the technology sector showed a lot of red on Thursday. From the Sector Carpet, click on the technology heading to focus on this sector. Even though most stocks were down, there were still a few gainers with Citrix and BMC Software gaining more...

READ MORE

MEMBERS ONLY

Bullish evidence weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a sharp decline over the last two weeks, it is hardly surprising that the bullish evidence weakened considerably since early January. Three indicators are considered bearish. The McClellan Oscillators both plunged below -50 to signal a sharp thrust in selling pressure. Momentum is bearish as MACD for SPY moved...

READ MORE

MEMBERS ONLY

SPY continues support test

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY opened strong and closed weak to form a long red candlestick. After three indecisive candlesticks Monday through Wednesday, Thursday's failed rally reflects the skittishness of traders/investors. Even so, SPY remains in a support zone around 109 (plus or minus 1 point). SPY has been fluctuating above/...

READ MORE

MEMBERS ONLY

Most actives reflect bounce in finance sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

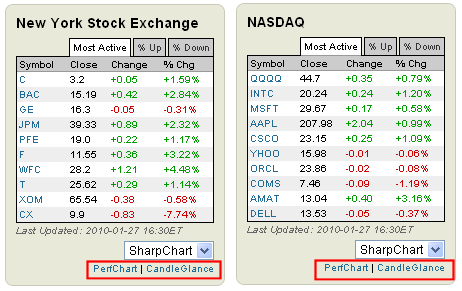

From the Free Charts page, users can access a quick list of the 10 most active stocks for the Nasdaq and NYSE. As Wednesday's lists show, the finance sector was strong on Wednesday. Four of the ten most active were from the finance sector and these four were...

READ MORE

MEMBERS ONLY

Charts worth watching

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ETFs: XLF, XLY, GDX, XHB, SMH, TLT

Stocks: A, DVN, ERTS, KBH, LAZ, PGN, PSA, QCOM, WFC...

READ MORE

MEMBERS ONLY

SPY continues to firm

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After becoming oversold with last week's decline, SPY firmed over the last three days and established some support around 109. There was an inside day on Monday, a failed rally candlestick on Tuesday and a strong close candlestick on Wednesday. Obviously, the strong close candlestick is the opposite...

READ MORE

MEMBERS ONLY

JP Morgan breaks support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

JP Morgan is leading the market and the finance sector lower with a break below its September-December lows. The stock first established support in the 40-41 zone in mid August and held this zone in September, October, November and December. January is proving different with a clear break on expanding...

READ MORE

MEMBERS ONLY

SPY remains on the canvas

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After two long red candlesticks and a sharp decline last week, the S&P 500 ETF (SPY) stalled the last two days. A small black candlestick formed on Monday and a failed rally candlestick formed on Tuesday. I call this a failed rally candlestick because the ETF hit 110....

READ MORE

MEMBERS ONLY

CHRW forms big triangle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CH Robinson (CHRW), a trucking company, formed a big triangle consolidation over the last nine months. The stock has recently been consolidating near triangle support and a break below 56 would be bearish.

Click this chart for details...

READ MORE

MEMBERS ONLY

SPY stalls in support zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a long red candlestick and sharp decline on Friday, the S&P 500 ETF (SPY) stalled with an inside day on Monday. Taken together, the red candlestick and smaller black candlestick form a harami, which is a potential reversal pattern. The inside day signals indecision that sometimes foreshadows...

READ MORE

MEMBERS ONLY

XHB hits resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Homebuilders SPDR (XHB) finished 2009 strong, but ran into resistance from its summer highs in 2010. The ETF first hit resistance around 16 in late July and traded in the 14-16 are the last 6-7 months. The stock has long-term support at 13.5 and a break below this...

READ MORE

MEMBERS ONLY

Mean reversion strategies kicking in

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week's three-day decline in the S&P 500 ETF (SPY) was the steepest 3-day decline since March, Despite two long red candlesticks and this 3.9% decline, I still consider the medium-term trend up. As long as the medium-term trend remains up, declines are viewed as...

READ MORE

MEMBERS ONLY

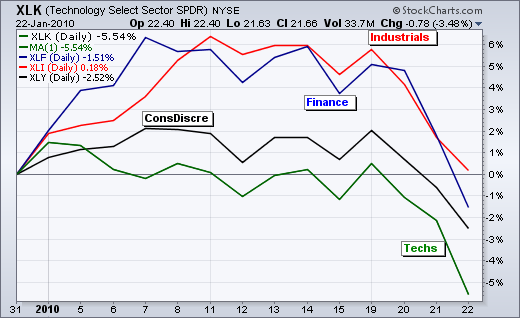

OFFENSIVE SECTORS TAKE A HIT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Offensive sectors took a hard hit in January. Offensive sectors include technology, consumer discretionary, industrials and finance. I call them the offensive sectors because their participation is key to a bull market. Technology represents growth and the appetite for risk. Consumer discretionary is the most economically sensitive sector. Industrials represent...

READ MORE

MEMBERS ONLY

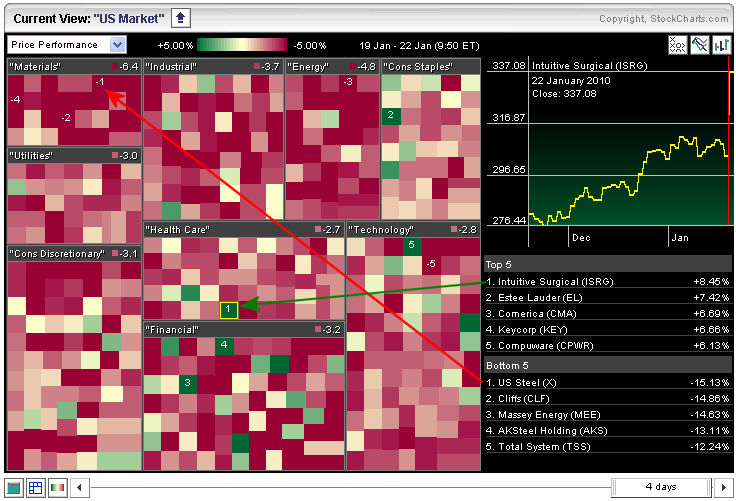

Steel stocks hit hard

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The s ector carpet over the last four days shows lots of red. Within the S&P 500, three of the five biggest losses came from steel stocks (US Steel, Cleveland Cliffs and AK Steel). There were, however, a few gainer that can be spotted with the green squares....

READ MORE

MEMBERS ONLY

Evidence remains bullish for stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulk of the evidence remains bullish for stocks, but this week's sharp decline put a dent in the bullish case. Some brief comments are posted after the jump. I will also be posting a market message later this afternoon.

-Net New Highs remain positive for Nasdaq and...

READ MORE

MEMBERS ONLY

Correction Targets for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After consolidating around 114 for a couple weeks, SPY broke short-term support with a long red candlestick on Thursday. Even though this looks like a convincing support break, it is still just a short-term phenomenon because the medium-term trend remains up. With a medium-term uptrend still underway, a short-term downtrend...

READ MORE

MEMBERS ONLY

All 30 Dow Stocks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The CandleGlance page for the Dow shows all 30 stocks trading in negative territory early Thursday. These mini-candlestick charts provide an quick means to see current action and candlestick setups. From the four charts below, we can see sharp declines in Alcoa, American Express, Bank of America and Caterpillar. Click...

READ MORE

MEMBERS ONLY

SPY breaks short-term support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the trend on the daily chart remains up, SPY broke short-term support and a correction appears to be unfolding. With the short-term support break, we can now start estimating a downside target for this correction. The last big move extends from the early November low to the early...

READ MORE

MEMBERS ONLY

UNH becomes overbought

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

United Health (UNH) remains in a clear, and strong, uptrend, but the advance could be getting frothy as RSI becomes overbought and red candlestick takes shape on Wednesday. Notice that RSI moved above 70 for the second time in two months (blue arrows). Tuesday's gap is holding for...

READ MORE

MEMBERS ONLY

SPY Battles 114

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The medium-term uptrend is not in jeopardy at this point, but there is a clear battle raging around 114 as SPY crossed this level six times in the last eight days. Three of the downside crosses featured some intense selling pressure. Last Tuesday's decline occurred with a gap...

READ MORE

MEMBERS ONLY

LEAP forms bullish engulfing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Direct from the StockScans candlestick page, Leap Wireless (LEAP) formed a bullish engulfing on big volume Friday. A bullish engulfing forms with a filled black or red candlestick and longer white candlestick. The white candlestick's open is below the prior close, but the stock rallies to close above...

READ MORE

MEMBERS ONLY

SPY bounces off support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the medium-term uptrend (daily chart). SPY is trading in the upper half of a rising price channel. Starting from around 103 in early November, the ETF broke resistance at 111 in late December and moved above 114 in early January. Even though SPY seems overextended...

READ MORE

MEMBERS ONLY

GLD and TIP move step-for-step

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold ETF (GLD) and the Inflation-Protected Bond ETF (TIP) show a positive correlation over the last few months. Both advanced from August to November, fell in December and bounced in January. Looks like gold is following the inflation outlook.

Click this chart for details...

READ MORE

MEMBERS ONLY

Evidence remains bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though stocks seem overbought and ripe for a correction, there is still more evidence of buying pressure than selling pressure. This means that a correction would be just that - a pullback within a bigger uptrend. It is hard to say when a correction might hit because everyone seems...

READ MORE

MEMBERS ONLY

SPY tests short-term support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY is meeting resistance in the 115 area with a gap down on Monday and some weakness on Thursday. This is not enough to affect the medium-term uptrend. Short-term, the ETF is testing the lower trendline of a rising price channel. Support is marked in the 113-113.5 area. A...

READ MORE

MEMBERS ONLY

XLV hits another new high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Money continues to flow into the healthcare sector as the Healthcare SPDR (XLV) recorded another 52-week high this week. XLV bounced off support in early November and surged over 12% in the last 12 weeks. Even though the advance is getting overextended, there are currently no signs of weakness in...

READ MORE

MEMBERS ONLY

SPY channels higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Both the daily and 60-minute charts show SPY within rising channels. The daily chart captures the bigger uptrend, while the 60-minute chart captures the short-term uptrend. After an advance from 109 to 115 in 5-6 weeks, the ETF is short-term overbought and ripe for a pullback or consolidation. A breakdown...

READ MORE

MEMBERS ONLY

XLK gets off to rough start

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

2010 has not been nice to the technology sector. The PerfChart below extends from January 4th until January 12th. Of the nine sectors SPDRs, and the S&P 500, the Technology SPDR (XLK) is down the most (over 2%). The Industrials SPDR (XLI) and Financials SPDR (XLF) are off...

READ MORE

MEMBERS ONLY

Dow Transports hit new 52-week high

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After breaking resistance in December, the Dow Transports consolidated a few weeks and then broke to a new 52-week high this week. Volume has also been strong since early December as many up days occurred with above average volume. And finally, broken resistance turned into support around 4090-4000.

Click this...

READ MORE

MEMBERS ONLY

XLB hits 62% retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a huge advance since March 2009, the Materials SPDR (XLB) has retraced 62% of the prior decline, which extended from May 2008 to March 2009. There is also potential resistance from broken supports around 34-36.

Click this chart for details...

READ MORE

MEMBERS ONLY

SPY chart update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in SPY. Both the short-term and medium-term trends remain up, but both are getting overextended and ripe for a pullback or consolidation. Even though this is not reason enough to turn bearish, it does argue for caution on the bullish side. I am off on Monday-Tuesday-Wednesday...

READ MORE

MEMBERS ONLY

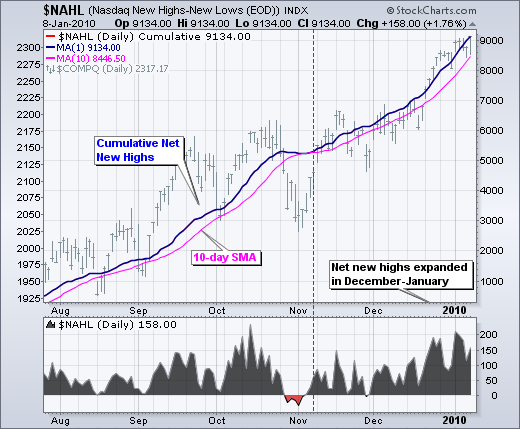

New highs expand in December-January

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the advance over the last 3-4 weeks, Net New Highs expanded to their highest levels since October. Net New Highs equals new 52-week highs less new 52-week lows. The bulls have a clear edge when Net New Highs are positive and rising. Conversely, the bears have an edge when...

READ MORE

MEMBERS ONLY

Evidence remains bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulk of the medium-term evidence remains bullish for stocks. Commentary featuring some of these indicators can be found in the Market Message later today.

There is a brief run down of the 12 indicator groups after the jump. Updated breadth charts can be found on the breadth charts page....

READ MORE

MEMBERS ONLY

QQQQ holds Ichimoku support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The strength of the current rally can be seen with QQQQ and the Ichimoku cloud indicator, which marks a support zone. Notice how QQQQ bounced near the top of the cloud in July and in the middle of the cloud in early November. Cloud support is currently in the 42....

READ MORE