MEMBERS ONLY

SPY chart update

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As one may have guessed, there is no change in SPY. I am, however, providing updated daily and 60-minute charts. On the daily chart, SPY continued its January run with a close above 114 for the first time since September 2008. January is getting off to a good start -...

READ MORE

MEMBERS ONLY

DELL enters gap zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a pretty nice advance the last 4-5 weeks, DELL returned to the gap zone and retraced 62% of its prior decline. Resistance in this area is becoming apparent with four red candlesticks over the last eight days.

Click this chart for details...

READ MORE

MEMBERS ONLY

Waiting on the employment report

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change on the daily or 60-minute charts, both of which are currently bullish. SPY has been up 14 of the last 19 trading days with the ETF moving from ~109 to ~114 over this four week period (up ~4.5% since December 9th). Even though one could...

READ MORE

MEMBERS ONLY

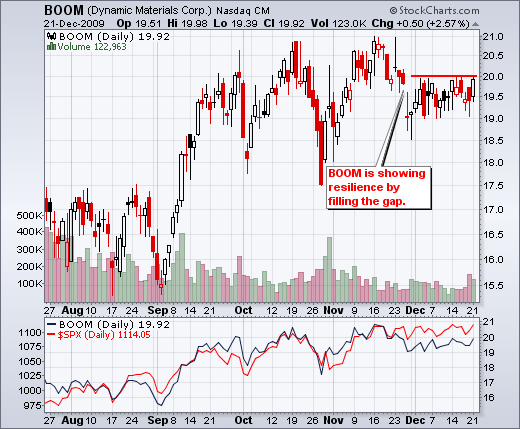

BOOM breaks resistance with volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dynamic Materials (BOOM) broke through resistance with a high volume surge over the last three days. In addition, the pattern from October to December looks like an inverse head-and-shoulders with neckline resistance around 21....

READ MORE

MEMBERS ONLY

No change in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in my SPY analysis, but I will post updated daily and 60-minute charts for your viewing pleasure. I will post a Market Message commentary later this afternoon....

READ MORE

MEMBERS ONLY

Semis lead industry groups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

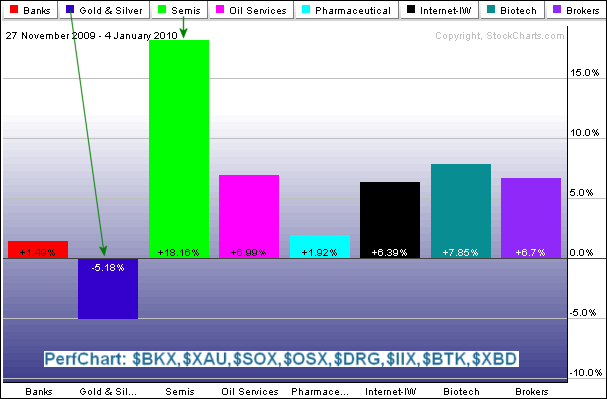

The Perfchart below shows eight industry groups over the last five weeks (25 trading days). Semis ($SOX) are by far the strongest group. Gold & Silver ($XAU) represent the weakest group. It is also notable that Banks ($BKS) are lagging the other advancing groups.

Click this chart for details...

READ MORE

MEMBERS ONLY

Charts of Interest

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

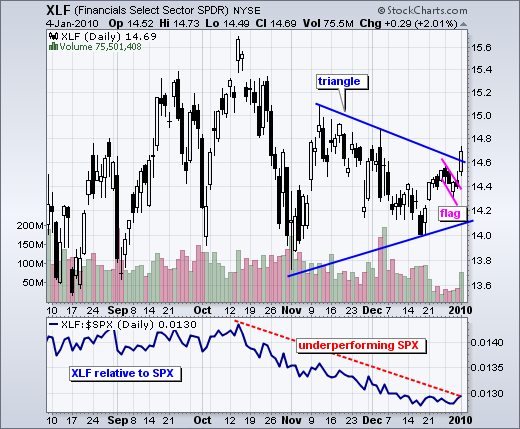

AMGN, ANF, DRYS, GERN, GT, IGT, MOT, S , SII, SVNT, XLF, XLY...

READ MORE

MEMBERS ONLY

A new high for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

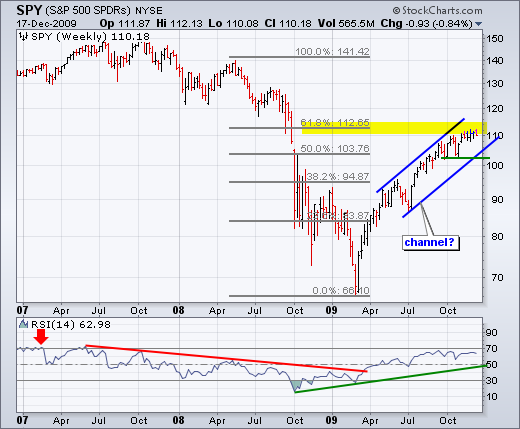

With another new 52-week high, SPY affirmed the underlying uptrend. The ETF broke resistance around 111 in late December and this breakout held the first day of 2010. A rising price channel has taken shape over the last five months. I am using the upper trendline extension for an upside...

READ MORE

MEMBERS ONLY

Cold weather lifts Gaz

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The iPath Natural Gas ETF ($GAZ) surged over 4% after a cold front slammed the Northeast. On the chart below, notice that GAZ broke resistance in mid December and broken resistance then turned into support.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

SPY hits first support zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY affirmed its uptrend with a break above consolidation resistance at 111 just before Christmas and a new 52-week high last week. The ETF was holding above 112 on New Year's Eve, but late selling pressure pushed SPY below 111.5 by the close. Even though a long...

READ MORE

MEMBERS ONLY

Techs lead the way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

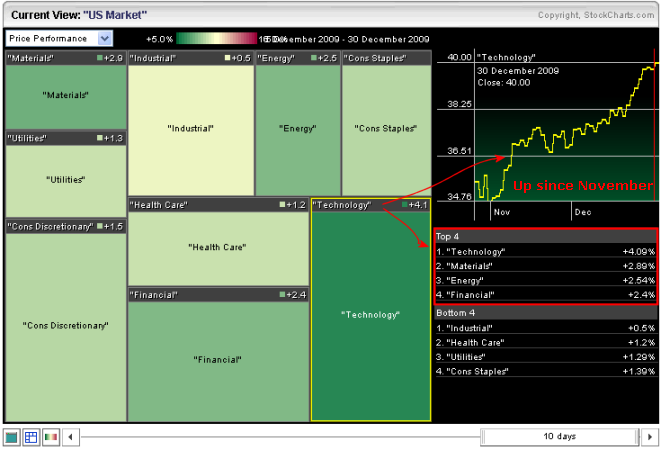

The technology sector has led the market higher over the last 10 days. Using the slider at the bottom, the Sector Market Carpet is set to show price performance over the last 10 days. Technology is the greenest of the nine sectors - followed by materials, energy and financials.

Click...

READ MORE

MEMBERS ONLY

Sector winners for 2009

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

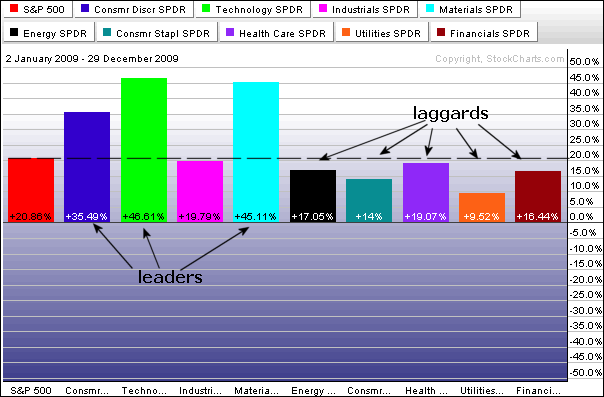

All sectors were up for the year, but some were up more than others. In fact, of the nine sectors, only three outperformed the S&P 500 over the last 12 months: consumer discretionary, technology and materials. The remaining six sectors were up less than the S&P...

READ MORE

MEMBERS ONLY

SPY stalls after 5-day surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a five day surge from 110 to 113, the S&P 500 ETF (SPY) took a breather on Tuesday with a small decline. SPY was trading in positive territory in the afternoon, but got hit with a late sell-off that pushed prices into negative territory. A small bearish...

READ MORE

MEMBERS ONLY

Evidence remains bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As the market summary table shows, the bulk of the evidence is firmly bullish. In fact, the Nasdaq AD Line is the only negative out there right now and the table is almost all green. The weight of the evidence has favored the bulls since inception (September). At +11, the...

READ MORE

MEMBERS ONLY

Tuesday video features...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Evidence remains bullish

-Net New Highs expand in December

-NYSE AD Line hits 52-week high

-Nasdaq AD Volume Line hits 52-week high

-McClellan Oscillators surge above 50

-Bullish Percent Indices move higher

-Volatility indices move to new lows

-Trend and momentum are bullish

-Offensive sectors show strength overall

-Techs and...

READ MORE

MEMBERS ONLY

December is for Dollars

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Perfchart below shows the DB Dollar Bullish ETF (UUP) with nine other currency ETFs. Even though the Dollar is still down for the year, it is up around 4% for December. The Euro and Yen, which represent our two biggest trading partners, are down the most.

Click this chart...

READ MORE

MEMBERS ONLY

Not many sellers out there

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in SPY as the ETF edged higher on Monday. Trading remains thin, but there are still more buyers than sellers out there. Even though low volume levels, overbought conditions and sustainability may be a concern, there can be no turn until selling pressure overcomes buying pressure....

READ MORE

MEMBERS ONLY

Shanghai leading at yearend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though year has a few days left, the Shanghai Composite ($SSEC) is one of the top performing indices in 2009. The Perfchart below compares the performance of this Chinese index against six other major indices. The Australian All Ords Index ($AORD) is a distant second and the S&...

READ MORE

MEMBERS ONLY

Intermarket Update: dollar, gold, oil, bonds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Bonds breakdown as stocks hit new high

-Dollar getting short-term overbought

-Gold finds support near broken resistance

-Oil recovers after early December drop

-Bonds break support with sharp decline

*****************************************************************

Dollar getting short-term overbought

After a big surge the last four weeks, the US Dollar Index ($USD) is short-term overbought and...

READ MORE

MEMBERS ONLY

A 52-week high for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher with a classic Santa Claus rally last week and the bulls remain in control. Techs and small-caps led the rally as QQQQ and IWM advanced around 5% in the last five trading days. Though not as strong, the S&P 500 ETF (SPY) advanced over 2%...

READ MORE

MEMBERS ONLY

Glancing at the sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The CandleGlance sector page provides an easy means to see all eight Sector SPDRs on one page. One can identify sectors hitting new highs (leading) and sector trading below their prior highs (lagging). CandleGlance groups are also good candlestick spotting.

Click this chart for details...

READ MORE

MEMBERS ONLY

10 Most Active Perfchart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Free Charting Tools page shows the most active lists on the left side. There is a Perfchart link at the bottom of each list that will show the 10 most actives together. Over the last 200-day days, Ford (F) is the big winner with a gain in excess of...

READ MORE

MEMBERS ONLY

Happy Holidays!

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the short-term or medium-term picture. Updated charts are shown below. The next commentary will be on Monday, December 28th. Happy Holidays!...

READ MORE

MEMBERS ONLY

Dynamic yield curve remains steep

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As the dynamic yield curve shows, the Treasury yield curve remains inordinately steep. The 3-month T-Bill Rate ($IRX) is around .50% and the 30-year Treasury Yield ($TYX) is currently around 4.6%. Long-term rates are nine times higher than short-term rates. This means monetary policy at the Fed remains loose....

READ MORE

MEMBERS ONLY

Tuesday video features...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Six weeks and seven gaps

-Homebuilders on the hot seat

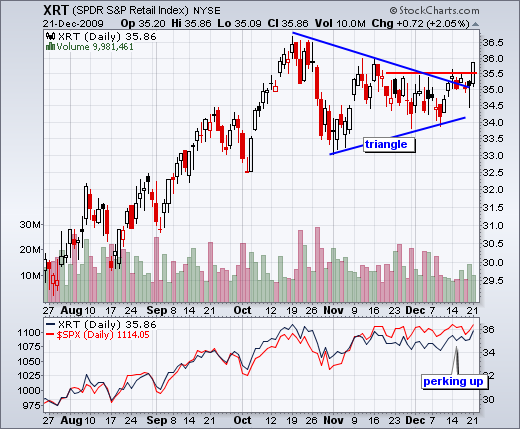

-Retail SPDR breaks triangle

-Oil Service HOLDRs hits resistance

-Charts of Interest

BOOM, CERN, EBAY, EP, GE , GERN, HCBK, ISIL, LSI, QCOM, SVNT

- Click here for the video page...

READ MORE

MEMBERS ONLY

Charts of Interest

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

boom, cern, ebay, ep, ge , gern, hcbk, isil, lsi, qcom, svnt...

READ MORE

MEMBERS ONLY

OIH hits resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a rally the last two weeks, the Oil Service HOLDRs (OIH) is bumping up against resistance from the October trendline and the late November highs. Also notice that this bounce retraced around 62% of the decline from mid November to early December. With the ETF starting to stall, traders...

READ MORE

MEMBERS ONLY

XRT breaks triangle resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) is getting into the holiday spirit with a triangle breakout on Monday. The ETF has been lagging the broader market over the last two months. Notice that the S&P 500 is trading near a 52-week high, but XRT remains below its mid October high....

READ MORE

MEMBERS ONLY

Homebuilders in the spotlight

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Homebuilding stocks will be in the spotlight with two upcoming reports. Existing Home Sales will be reported on Tuesday (10 AM ET) and New Home Sales will be released on Wednesday at 10 AM ET). The homebuilding ETFs have been lagging the broader market over the last three months, but...

READ MORE

MEMBERS ONLY

Six weeks and seven gaps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

"6 Weeks and 7 Gaps" sounds like the title for a movie with Harrison Ford. SPY moved back to the top of its trading range with a gap up on Monday. Needless to say, there is no change in the medium-term trend (up). With yesterday's close...

READ MORE

MEMBERS ONLY

Semis lead Nasdaq higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Santa Claus rally got off to a good start with the Semiconductors HOLDRS (SMH) leading the way higher. SMH broke flag resistance with a surge over the last two days. Also notice that semis are outperforming the broader market as the price relative moved higher in December.

Click this...

READ MORE

MEMBERS ONLY

Dollar and stocks change it up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Dollar surges and stocks hold their gains

-Dollar Index hits first resistance zone

-Gold hits trendline and retracement support

-Oil nears resistance from broken support

-Bonds tests very important support zone

The relationship between the Dollar and stock is changing. From March to November, there was a clear inverse relationship...

READ MORE

MEMBERS ONLY

SPY holds range support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a gap down and sharp decline on Thursday, the S&P 500 ETF (SPY) firmed on Friday and remains in the middle of its 6-week trading range. This means there is no change in the medium-term trend (up). SPY moved to a new reaction high in mid November...

READ MORE

MEMBERS ONLY

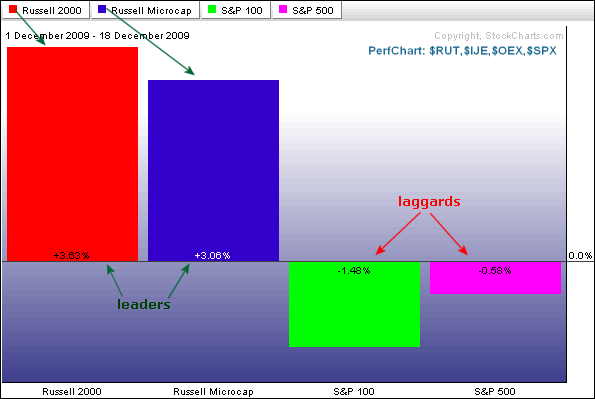

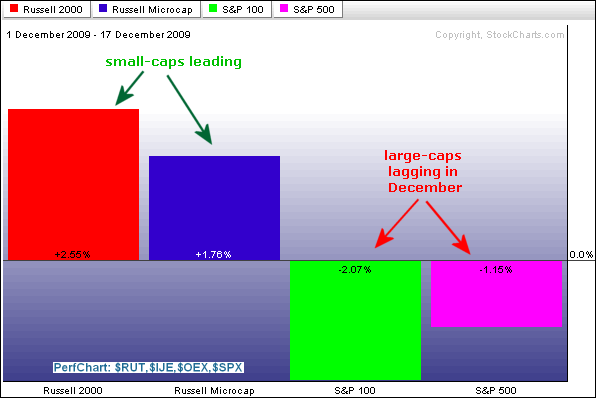

The January effect starts early

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

According to the Stock Trader's Almanac, the January effect is the historical tendency of small-caps to outperform large-caps from mid December until April. Notice that this period coincides with the bullish six month cycle that extends from November to April. Historically, the strongest period of small-cap outperformance runs...

READ MORE

MEMBERS ONLY

10-Year Treasury Yield hits resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 10-Year Treasury Yield ($TNX) broke above the August trendline with a surge in December. Because bonds moving opposite of yields, this corresponds to a sharp decline in US Treasury Bonds. The 10-Year Treasury Yield is now meeting resistance from the Sep-Oct-Nov highs and a breakout here would call for...

READ MORE

MEMBERS ONLY

Friday video features...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Bulk of evidence remains bullish

-Small-caps outperforming large-caps

-SPY and DIA hit retracement resistance

-March-December uptrends holding

-VIX hits support

-Nasdaq AD Volume Line tests October high

-NYSE AD Line hits new high

-Net New Highs remain positive

-Click here for the video page...

READ MORE

MEMBERS ONLY

Evidence remains bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulk of the evidence remains bullish for the stock market. In fact, I have even seen some strengthening in the bullish case over the past week. The Nasdaq AD Volume Line is challenging its Sep-Oct highs so I upgraded the AD Volume Lines from bearish to neutral. I also...

READ MORE

MEMBERS ONLY

Mar-Dec uptrend in place

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The four major index ETFs remain in clear uptrends on the weekly charts, but all are near potential resistance levels. These charts are grouped in two pairs. First, the S&P 500 ETF (SPY) and the Dow Diamonds (DIA) show similar characteristics. Both have retraced around 62% of the...

READ MORE

MEMBERS ONLY

Volatility indices find support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the S&P 500 and Nasdaq bump resistance from their October-November highs, the S&P 500 Volatility Index ($VIX) and Nasdaq 100 Volatility Index ($VXN) are finding support near their October-November lows. These volatility indices are negatively correlated with the stock market. Stocks have been moving up...

READ MORE

MEMBERS ONLY

Breadth remains mixed overall

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the bullish side, Net New Highs remain positive for both the Nasdaq and the NYSE. There were fewer Net New Highs in November-December than in October. Even though participation in the advance narrowed in November-December, new 52-week highs are still exceeding new 52-week lows. The bulls still have the...

READ MORE