MEMBERS ONLY

Breadth charts updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Nasdaq AD Line forms bear flag and hits resistance

-Nasdaq AD Volume failed to confirm new reaction high in the Nasdaq

-Nasdaq Net New Highs were weaker in November, but still positive overall

-NYSE AD Line bounced off support and remains in bull mode

-NYSE AD Volume line failed to...

READ MORE

MEMBERS ONLY

The split-month pattern in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is an interesting pattern taking shape on the daily charts of the major index ETFs. In September and October, notice how SPY advanced in the first half of the month and fell in the second half of the month. This is also the case for DIA, IWM and QQQQ....

READ MORE

MEMBERS ONLY

Bear flags on the 30-minute charts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks gapped down and pretty much stayed down on Thursday. After gapping up on Monday, SPY traded flat for three days and then gapped down on Thursday. A little consolidation after Monday's gap is normal, but giving it all back with such a sharp decline is not normal...

READ MORE

MEMBERS ONLY

An island reversal in MDY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap up on Monday and a gap down on Thursday morning, the S&P 400 MidCap ETF (MDY) has an island reversal working on the 30-minute chart. There were no trades around 127.6, which creates a floating island around 128. Even though this gap is negative,...

READ MORE

MEMBERS ONLY

SPY: Overbought AND Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY gapped up and moved above its October high on Monday to affirm the medium-term uptrend with a higher high. The gap is holding as SPY trades comfortably above 110. In addition, the Stochastic Oscillator remains above 80 for the second week. This makes SPY both overbought and bullish. It...

READ MORE

MEMBERS ONLY

Regions Financial Bounces off 200-day SMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Regions Financial (RF) is showing signs of life with a high-volume bounce off the 200-day simple moving average and a key retracement. Notice that the Sep-Nov decline retraced a Fibonacci 62% of the Jul-Sep advance. The stock firmed around 4.75 in early November and surged over the last three...

READ MORE

MEMBERS ONLY

Minding the gap in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) remains in a medium-term uptrend as it approaches the upper trendline of the rising channel. This trendline extends to around 112 this week and SPY could hit this level before starting a downswing. At this point, I consider SPY too strong to entertain...

READ MORE

MEMBERS ONLY

DIA enters retracement zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the advance above 100, the Dow Diamonds (DIA) entered the 50-62% retracement zone. Such retracements can be measured using the Fibonacci Retracements Tool on Sharpcharts. These zones can mark resistance areas and price action merits a close watch.

Click this chart for details....

READ MORE

MEMBERS ONLY

Video for Tuesday features...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-SPY Nears Channel Resistance

-Regional banks and the finance sector

-US Bancorp (USB) hits momentum-of-truth

-A bearish engulfing for Limited (LTD)

-Xerox (XRX) consolidates after surge

-Ciena (CIEN) surges on good volume

-Fluor (FLR) bounces off key retracement

- Click here for the video page...

READ MORE

MEMBERS ONLY

SPY Nears Channel Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) gapped up and closed strong to forge a higher high on Monday. The ETF has been channeling higher since August with a series of higher highs and higher lows. While each higher high affirms the medium-term uptrend, notice that SPY pulled back after...

READ MORE

MEMBERS ONLY

KRE and XLF warrant attention

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Regional Bank SPDR (KRE) was a boon to the market in late July and early August, but under performed the market from early August to mid November. In contrast, the Financials SPDR (XLF) performed in line with the market as it went on to new highs in September and...

READ MORE

MEMBERS ONLY

FLR bounces off key retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though Fluor has been trending lower since the August high, the decline looks like a correction after the April-August advance. First, the advance was big and some sort of correction or pullback can be expected. Second, notice that the decline retraced 62% of the prior advance and a falling...

READ MORE

MEMBERS ONLY

CIEN surges on good volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ciena is showing strength with a high volume wedge breakout. The stock surged from July to September and then corrected with a falling wedge the last two months. Sorry, no prizes for guessing how much this wedge retraced. After finding support near broken resistance, the stock broke the wedge trendline...

READ MORE

MEMBERS ONLY

XRX consolidates after surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big gap down in late September, Xerox established support around 7.25 and consolidated the last seven weeks. Within this consolidation, the stock surged in early November and then formed a flat flag. I am watching this pattern for clues on the next move. A break above flag...

READ MORE

MEMBERS ONLY

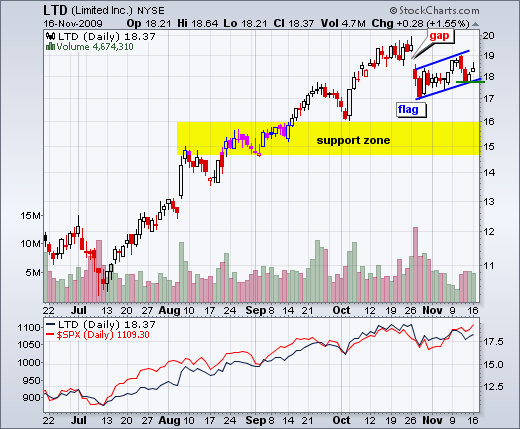

LTD traces out bearish setup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I featured Limited (LTD) two weeks ago with a small pennant, but the stock never broke pennant support for confirmation. Even though LTD edged higher, it looks like a bearish flag is now taking shape. The stock gapped down in late October and this gap zone acts as resistance. A...

READ MORE

MEMBERS ONLY

USB hits moment-of-truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

US Bancorp (USB) broke triangle resistance in mid October and broken resistance turned into support around 23. Even though the breakout is still holding, relative weakness in November is a concern here. SPY is up over 7% this month, but USB is down slightly. Moreover, the stock declined with pretty...

READ MORE

MEMBERS ONLY

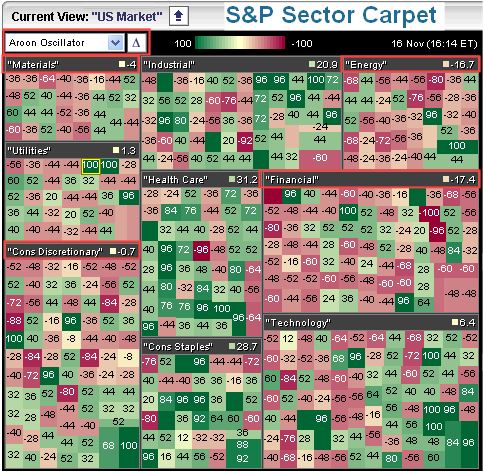

Scanning the Aroon oscillator in the market carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Friday's mailbag answered questions on the Aroon oscillator, which is a trend identification indicator. Basically, a strong uptrend exists when the oscillator is above +50 and a strong downtrend exists when the oscillator is below -50. Even with the market gains of the last few weeks, I was...

READ MORE

MEMBERS ONLY

Intermarket Chart Page Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Gold remains the strongest of the five intermarket securities

-The Dollar is at it again with a RSI divergence and harami on Thur-Friday

-Broken resistance around 1070 turns into first support for gold

-Oil formed a bull flag over the last few weeks

-Bonds continue to hold support

- Click...

READ MORE

MEMBERS ONLY

MACD Signal Summary for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a gain for the week, overall price action for the S&P 500 ETF (SPY) was indecisive last week. SPY surged Monday, stalled for two days, declined sharply on Thursday and stalled on Friday. For the week, the ETF formed a long white candlestick, a long black candlestick...

READ MORE

MEMBERS ONLY

PerfChart for 10 Currency ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Year-to-date, the WT Brazilian Real Fund (BZF) and the CS Australian Dollar Trust (FXA) are by far the top performing currency ETFs. Of these 10 currency ETFs, only the DB Dollar Bullish ETF (UUP) is in negative territory. Even the CS Japanese Yen Trust (FXY) climbed back into positive territory...

READ MORE

MEMBERS ONLY

Video Analysis for Friday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Short-term RSI signal for SPY

-Medium-term evidence remains bullish

-AD Volume Lines fall short

-Net New Highs diminish

-Small-caps lag

-Finance sector lags

-VIX nears October lows

-Short-term rates hit new low

-Wave 4 advance remains in place.

- Click here for the video page...

READ MORE

MEMBERS ONLY

Medium-term Market Summary

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite some warning signs, the bulk of the medium-term evidence remains bullish for stocks. Only three indicators are in bear mode. The AD Volume Lines broke support in late October, the McClellan Oscillators show deteriorating breadth, small-caps show relative weakness and the finance sector is relatively weak. The AD Lines...

READ MORE

MEMBERS ONLY

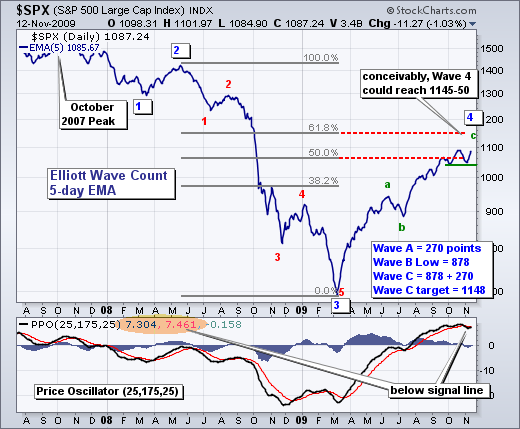

Nasdaq and S&P 500 Elliott Wave

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Nothing has changed regarding my interpretation of the Elliott Wave counts for the Nasdaq and S&P 500. Both indices are in Wave 4 advances or a 5 Wave decline. The Wave 4 target zone for the S&P 500 is 1080-1150, while the target zone for the...

READ MORE

MEMBERS ONLY

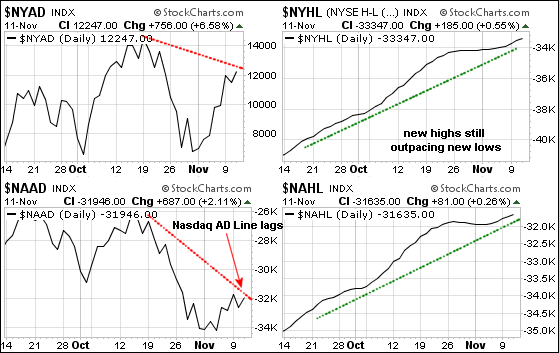

Warning signs in breadth charts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are some potential warning signs in the breadth indicators. First, the Nasdaq AD Volume Line and the NYSE AD Volume Line both bounced, but remain well below their October highs. Lower highs could be forming. Second, October Net New Highs were above +200 for the Nasdaq and above +400...

READ MORE

MEMBERS ONLY

Short-term RSI Signal in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp advance, I noted how doji can sometimes foreshadow a reversal. Doji signal indecision as the bulls and bears battle it out for control. What happens after the doji produces the winner. With yesterday's decline, one could argue that the bears now have the upper hand....

READ MORE

MEMBERS ONLY

Nasdaq AD Line Is Lagging

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the surge over the last 1-2 weeks, the NY Composite and the Nasdaq are both trading back near their October highs. However, the Nasdaq AD Line remains well below its October high and shows some relative weakness. The NYSE AD Line is also below its October highs, but still...

READ MORE

MEMBERS ONLY

SPY Stalls for Second day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

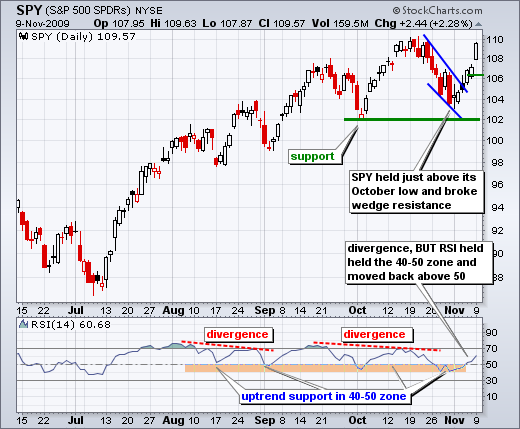

There is no change in the SPY analysis. Stocks stalled over the last two days with SPY forming two doji. These signal indecision and can sometimes foreshadow a short-term reversal. At this point, I consider this indecision as a rest within the short-term and medium-term uptrends. Medium-term support remains at...

READ MORE

MEMBERS ONLY

A Bull Flag for Cisco

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Cisco (CSCO) led the market higher with a big move above 24 last week. While the S&P 500 continued higher the last three days, Cisco stalled with a falling flag taking shape. Bullish flags slope down and form after a sharp advance. A break above 24 would signal...

READ MORE

MEMBERS ONLY

Doji Signals Indecision and Rest

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a 5+ percent surge the prior five days, stocks took a breather on Tuesday as the S&P 500 ETF (SPY) formed a doji on the day. Doji are small candlesticks that look like a plus sign (+). They show little change from open to close and a relatively...

READ MORE

MEMBERS ONLY

Yield curve widens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The difference between the 10-Year Treasury Yield ($TNX) and the 3-month Treasury Yield ($IRX) widened significantly since early October. Short-term rates fell ($IRX), while long-term rates rose ($TNX). As a result, the yield curve is the steepest it's been in months.

Click this chart for details....

READ MORE

MEMBERS ONLY

Video for Tuesday features...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-SPY challenges October highs

-Defining the short-term uptrend for SPY

-Impressive breadth for NYSE, not for Nasdaq

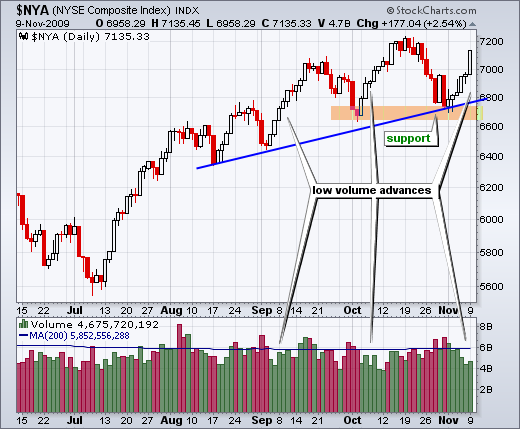

-Low volume rally the last three days

-XLF and WFC surge off support

-XHB and KBH firm at key retracements

-Click here for video page...

READ MORE

MEMBERS ONLY

XHB and KBH Hit Retracements

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The homebuilders have been relatively weak since mid September. While SPY is within striking distance of a new high for the year (2009), the Homebuilders SPDR (XHB) remains well below its September and October highs. Since mid September, the ETF retraced 50% of its prior advance with an ABC decline....

READ MORE

MEMBERS ONLY

XLF and WFC Surge off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Financials SPDR (XLF) confirmed last week's harami with a gap breakout. XLF hit support in late October and formed a big spinning top on November 2nd. With the short-term trend down, the stock formed a long red candlestick on Wednesday and two inside days on Thursday-Friday. The...

READ MORE

MEMBERS ONLY

Uninspiring Volume - Mixed Breadth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Breadth and volume are the first ports of call after a big move. Before going any further, I must emphasize that breadth and volume are indicators. I view breadth as an important indicator, more important than volume. However, as indicators, both breadth and volume are still secondary to price action,...

READ MORE

MEMBERS ONLY

SPY Challenges October Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap and big advance on Monday, the S&P 500 ETF (SPY) is already challenging resistance from its October highs. I would not consider this major resistance, but rather potential resistance because the medium-term and short-term trends are up. Support levels are important in uptrends because they...

READ MORE

MEMBERS ONLY

You know it's a big day when...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

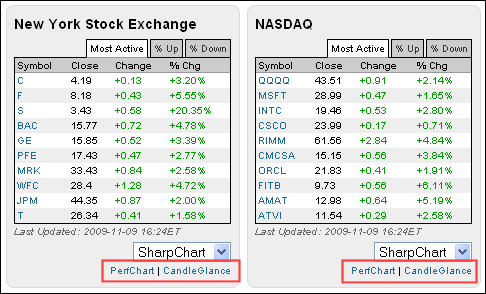

The 10 most active stocks on both the NYSE and Nasdaq are all up, and up big. In the middle of the stockcharts.com home page, you can follow the most actives throughout the day. You can even view a Perfchart to compare performance or see all 10 mini-charts by...

READ MORE

MEMBERS ONLY

Intermarket Chart Page Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Highlights include:

-US Dollar Index fails to hold gains as short-term rates decline

-Gold surges to new highs and remains leader of the pack

-Oil forms a bull flag and continues to benefit from Dollar weakness

-A medium-term downtrend for bonds as $USB tests support

-Click here for the intermarket...

READ MORE

MEMBERS ONLY

MT and ST Up-trends for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As the headline notes, both the medium-term and short-term trends are up for the S&P 500 ETF (SPY). Yes, SPY held above its early October low and RSI held the 40-50 zone. With a big move on Thursday, SPY broke wedge resistance and RSI moved back above 50....

READ MORE

MEMBERS ONLY

Bulk of Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It's the bulls by a nose. After the October decline, the bulk of the medium-term evidence was teetering on the edge of turning bearish. However, a sizable bounce this week brought the bulls back from the brink. As a result, the bulk of the evidence remains bullish. Many...

READ MORE

MEMBERS ONLY

LONG-TERM RATES MOVING BEFORE STOCKS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 10-Year Treasury Yield ($TNX) is largely positively correlated with the S&P 500 - and also shows a propensity to lead the stock market. The chart below shows the 10-Year Treasury Yield peaking in July 2007 and stocks peaking in October 2007, three months later. Similarly, the 10-Year...

READ MORE