MEMBERS ONLY

Nvidia Bounces off Broken Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Broken resistance turns into support. This is a classis tenet of technical analysis. Nvidia (NVDA) broke resistance around 12-12.5 in July and returned to this breakout area in late October. Notice that I drew a zone. Support and resistance levels are rarely exact. With a gap and surge today,...

READ MORE

MEMBERS ONLY

Video Update Posted

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's video includes:

-A short-term uptrend for SPY

-SPY holds medium-term support

-Elliott wave for the S&P 500 and Nasdaq

-Offensive sectors remain bullish

-Long-term rates peak

-Short-term rates trending lower

-Market Summary Update on Saturday

-Click here for the video page....

READ MORE

MEMBERS ONLY

And Now for the Employment Report

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Wall Street is waiting for sparks from the employment report, but we may have already seen the sparks with yesterday's rally. Nevertheless, there is still a chance for a sizable move today (1-2%). Therefore, I am going to wait for today's close (data) before updating the...

READ MORE

MEMBERS ONLY

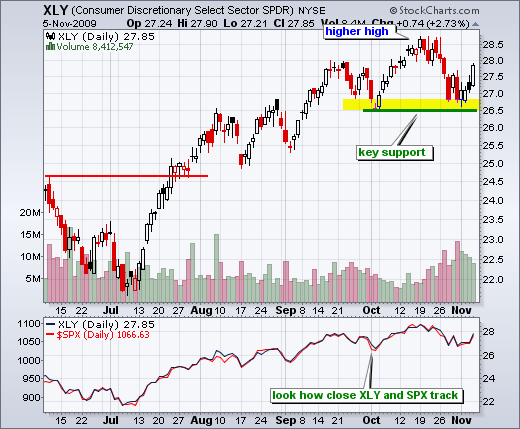

Offensive Sectors Still Holding Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the market summary table, I watch offensive sectors closely for clues on the overall market. Offensive sectors should keep pace with the market (S&P 500) during a bull run. Relative weakness or a bearish divergence would show underlying weakness. Offensive sectors include consumer discretionary, technology, finance and...

READ MORE

MEMBERS ONLY

Rates, Stocks and the Dollar

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 10-Year Treasury Yield ($TNX) is largely positively correlated with the S&P 500 - and also shows a propensity to lead the stock market. Notice how the 10-Year Treasury Yield peaked in July 2007 and stocks peaked in October 2007 (3 months later). Similarly, the 10-Year Treasury Yield...

READ MORE

MEMBERS ONLY

Breadth Charts Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Six of the eight indicators are bearish

-Nasdaq breadth is bearish

-NYSE breadth is mixed

-Click here for the breadth charts page...

READ MORE

MEMBERS ONLY

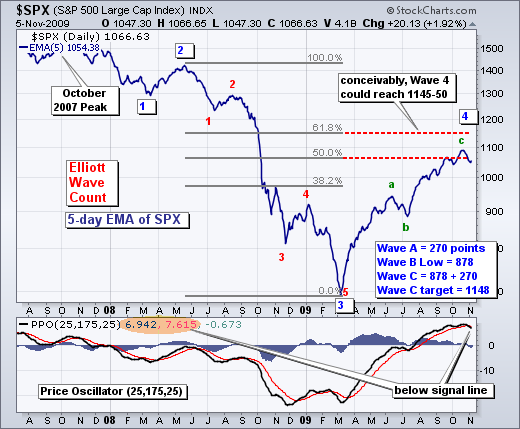

Elliott Counts for SPX and COMPQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 remains in a Wave 4 advance of a 5 Wave decline. I expect (think) Wave 4 will end in the 50-62% retracement zone and there are already signs of a reversal. Momentum is turning as the Percentage Price Oscillator (PPO) moved below its signal line...

READ MORE

MEMBERS ONLY

Short-term Breakout Holds for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a bounce over the last four days, MACD (5,35,5) crossed above its signal line on Thursday's close. Red dotted lines mark prior signals when MACD formed a bearish divergence AND crossed below its signal line. The last such signal occurred on October 21st. Green dotted...

READ MORE

MEMBERS ONLY

CCI Signals for Jones Apparel

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

On the Stockcharts.com scan page for Wednesday evening, there were 20 CCI sell signals among NYSE stocks. A CCI sell signal occurs with a plunge below -100. Conversely, a CCI buy signal triggers with a surge above +100. CCI for Jones Apparel (JNY) surged above +100 on July 23rd...

READ MORE

MEMBERS ONLY

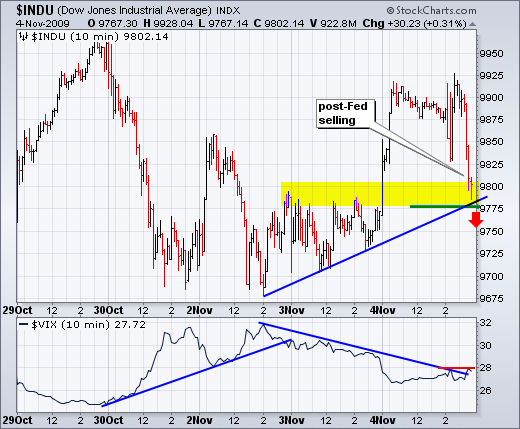

Another Post-Fed Sell Off

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While I don't like holding myself hostage to fundamental events, we need to be prepared for volatility when market-moving events hit the fan. Sometimes we can predict the news, such as the Fed policy statement remaining unchanged. Most of the time we cannot predict the news, such as...

READ MORE

MEMBERS ONLY

Merck Propels XLV Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With help from component Merck, the Healthcare SPDR (XLV) bounced off support around 28. The ETF established support here with reaction lows in early September, early October and now early November. It is safe to say that the trend is clearly up as long as this support level holds.

Click...

READ MORE

MEMBERS ONLY

Waiting on the Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

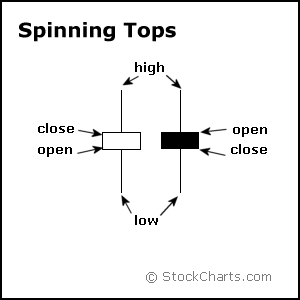

Objectively speaking, the medium-term uptrend in SPY remains in place. The ETF forged a higher high in October and has yet to break the early October low. After a sharp decline from 110 to 104, SPY firmed with a spinning top on Monday and a small white candlestick on Tuesday....

READ MORE

MEMBERS ONLY

QQQQ Turns Indecisive at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a sharp decline the prior two weeks, the Nasdaq 100 ETF (QQQQ) turned indecisive with a spinning top on Monday. This candlestick reflects a wide high-low range during the day, but little change from open to close. QQQQ surged above 41.5 in early trading, plunged below 40.8...

READ MORE

MEMBERS ONLY

Today's video features...

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-A volatile week ahead

-Spinning tops and indecision

-QQQQ stalls at support

-DIA and SPY stall above support

-SPY remains in short-term downtrend

-KRE breaks support and XLF tests support

-XLB and XLI hit double top support

-BBY forms bullish falling wedge

-Bear flags/pennants for JWM, LTD, RL and...

READ MORE

MEMBERS ONLY

Bear Flags and Support Tests

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-KRE breaks support and XLF tests support

-XLB and XLI hit double top support

-BBY forms bullish falling wedge

-Bear flags/pennants for JWM, LTD, RL and SBUX

****************************************************************

Regional Bank ETF Breakdown

The Regional Bank SPDR (KRE) was showing some relative strength by holding above support last week. No more....

READ MORE

MEMBERS ONLY

SPY Unable to Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY formed a spinning top to signal indecision on Monday. Perhaps more importantly, the ETF surged above 105 in early trading and failed to hold these gains. The inability to hold early gains shows weakness. Buyers were not strong enough to hold gains. Sellers were strong enough to push prices...

READ MORE

MEMBERS ONLY

Preparing for a volatile week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

We can expect above average volatility this week. First, earnings season remains in full swing. Second, the Fed issues its policy statement on Wednesday at 2:15 PM ET. Third, the employment report will be released on Friday at 8:30 AM ET. In addition to these biggies, we have...

READ MORE

MEMBERS ONLY

Spinning Tops for QQQQ-IWM-DIA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-DIA forms spinning top and bull flag.

-QQQQ forms spinning top at support.

-IWM forms spinning top below support break.

On the daily charts, the major index ETFs finished with spinning top candlesticks on Monday. These show indecision that could foreshadow a short-term bounce. Spinning tops form when the open...

READ MORE

MEMBERS ONLY

Bonds Fall As ISM Rises

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ Year Treasury ETF (TLT) bounced off support last week, but fell today as the ISM Manufacturing Survey surged to 55.7. Readings above 50 favor economic expansion. Bonds fell and the 10-Year Treasury Yield ($TNX) rose with this positive economic news. Signs of strength in the economy increase...

READ MORE

MEMBERS ONLY

Intermarket Charts Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Highlights Include:

-Bonds and the Dollar surge as stocks fall

-Dollar forms small flag as RSI hits resistance

-Triangle support break for gold holds

-Bonds bounce off key support

-Click here for intermarket chart page...

READ MORE

MEMBERS ONLY

Palm Becomes Way Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With talk and release of the Pre, Palm was the talk of the town earlier this year. The stock tripled from its March low to its September high. October has been a rough month as PALM fell below 12 on Friday. While the chart shows a support break and close...

READ MORE

MEMBERS ONLY

Ford Tests Key Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Ford (F) beat earnings estimates this morning as the stock tests an important support area around 6.5-7. After breaking resistance with a big surge in July, the stock returned to broken resistance in September-October. Broken resistance turned into support with three bounces in the 6.5-7 area over the...

READ MORE

MEMBERS ONLY

SPY Becomes Oversold Again

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a pretty good bounce on Thursday, stocks gave it all back with an even bigger decline on Friday. This kind of price action is not normal for a bull market or medium-term uptrend. First, Thursday's bounce only lasted one day. Second, the next day's decline...

READ MORE

MEMBERS ONLY

Broken Resistance Turns Support for GDX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold Miners ETF (GDX) is in for a big test as broken resistance turns into support. GDX broke resistance around 41-42 with a big surge in September. This level turned into support, and held, in early October. After a sharp decline the last two weeks, GDX is once again...

READ MORE

MEMBERS ONLY

Breadth Starting to Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Breadth chart page updated

-Short-Term SPY analysis in separate post below

-Medium-term evidence remains bullish, but....

-Wave 4 stalls for the S&P 500

-Nasdaq hits wave 4 resistance

-IWM breaks October low

-SPY holds above October low

-OBV shows increase in downside volume

-Nasdaq AD Line breaks support...

READ MORE

MEMBERS ONLY

Breadth Charts Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The breadth chart page has been updated. There have been some changes with the sharp decline over the last two weeks. Highlights include:

-The Nasdaq AD Line broke below its early October low.

-Daily Net New Highs for the Nasdaq turned negative.

-The Nasdaq McClellan Oscillator plunged to its lowest...

READ MORE

MEMBERS ONLY

Dead-cat Bounce or More?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a 5% decline from the October high, the S&P 500 ETF (SPY) surged back above 106 on Thursday. Is this just a dead-cat bounce or should we expect more strength? Technically, the medium-term trend is still up. As such, a number of mean-reversion strategies turned bullish after...

READ MORE

MEMBERS ONLY

Bond Funds Outperform

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even if you do not trade Fidelity Funds, the Fidelity Funds Carpet can be useful for providing an overview of market action. All stock index funds, domestic equity funds and international funds are down over the last 10 days (lots of red). The only green (gains) can be found in...

READ MORE

MEMBERS ONLY

KRE Shows Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I was quite impressed with the ability of the Regional Bank SPDR (KRE) to firm over the last few days. The S&P 500 is down around 4.5% in four days and KRE is down only 2.3%. The first chart shows KRE and the S&P...

READ MORE

MEMBERS ONLY

SPY Becomes Oversold and Nears Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) is now down over 5% in the last seven days. With the medium-term trend still technically up and the ETF oversold, traders should be on guard for a bounce or consolidation. Bouncing usually begin with indecision.

The orange highlights show indecisive candlesticks marking...

READ MORE

MEMBERS ONLY

Small-caps Lead Decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

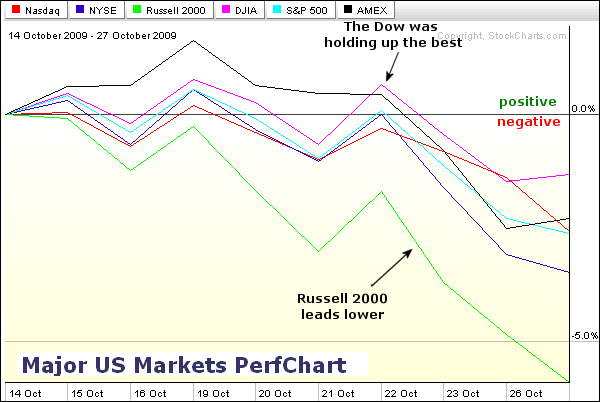

The Major US Markets Perfchart shows the Russell 2000 ($RUT) leading the way lower over the last two weeks. Notice that the Russell 2000 has not even been positive (above 0%) over the last 10 days. In contrast, the other major indices were in positive territory at some point over...

READ MORE

MEMBERS ONLY

SPY Accellerates Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Should the S&P 500 ETF (SPY) continue weak and close lower again today, it would mark the sixth lower close in the last eight days. Late September-early October was the last such occasion. With the ETF down around 4% from its highs, it is already getting short-term oversold....

READ MORE

MEMBERS ONLY

Bearish Engulfings Mark Resistance for JNPR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Two big bearish engulfing patterns solidify resistance around 28-28.5 for Juniper Networks (JNPR). JNPR first established resistance at 28 with a doji. A few weeks later, the stock opened strong and closed weak to form its first high-volume bearish engulfing. After a pullback and second attempt at 28.5,...

READ MORE

MEMBERS ONLY

IWM Lags-SMH retraces-KRE Holds Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Intermarket chart page updated (here)

-Short-Term SPY analysis in separate post below

-Small-caps show relative weakness

-Regional Banks hold support

-Healthcare Providers ETF breaks support

-Cigna shows relative weakness

-Semiconductors HOLDRS pullback after higher high

-Intel turns indecisive at key retracement

-Texas Instruments forms triangle consolidation

-Click here for the...

READ MORE

MEMBERS ONLY

Setting Short-Term Resistance for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big surge in July, the S&P 500 ETF (SPY) has been zigzagging higher since early August. Consider the zigs as advances and the zags as declines. Each advance (zag) forges a higher high, while each decline (zig) reverses above its prior low. This series of higher...

READ MORE

MEMBERS ONLY

Intermarket Chart Page Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intermarket chart highlights include:

-Bonds plunge as Dollar bounces

-Dollar breaks short-term resistance as RSI approaches 50

-Gold breaks pennant/triangle support

-Oil declines as Dollar bounces

-Bonds test important support zone

Click here for the intermarket chart page....

READ MORE

MEMBERS ONLY

Email Alerts for Art's Charts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below shows the email alert for, Tuesday, October 27th. Each email contains the titles and the opening sentences for the day's blog entries. Alerts are sent out once per day around 12PM ET. You can sign up for alerts with the "SUBSCRIBE BY EMAIL"...

READ MORE

MEMBERS ONLY

Intel Hits Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a decline the last eight days, Intel (INTC) is showing signs of firmness near a support zone. First, notice that the decline retraced 62% of the prior advance. Second, notice that broken resistance turns into support. Third, notice that MACD has a bullish divergence working. A break above 20....

READ MORE

MEMBERS ONLY

SPY Forms Lower Low (Short-Term)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This is just a quick update on the short-term trend for SPY and last week's MACD signal. On the daily chart, MACD(5,35,5) formed a bearish divergence and moved below its signal line last Wednesday for a bearish signal. MACD remains below its signal line, which...

READ MORE

MEMBERS ONLY

Bollinger Band Contraction for PAYX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

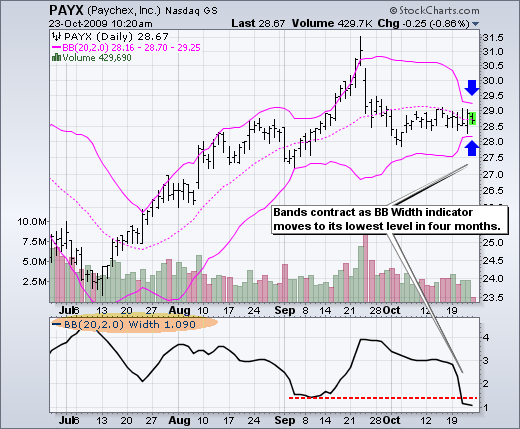

The Bollinger Bands are contracting as Paychex (PAYX) trades within a narrow range this month. First, you can see the bands narrowing significantly this week (blue arrows). Second, the Bollinger Band Width indicator is trading at its lowest level in over four months. A volatility expansion often follows a volatility...

READ MORE