MEMBERS ONLY

Cracks Starting to Appear

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

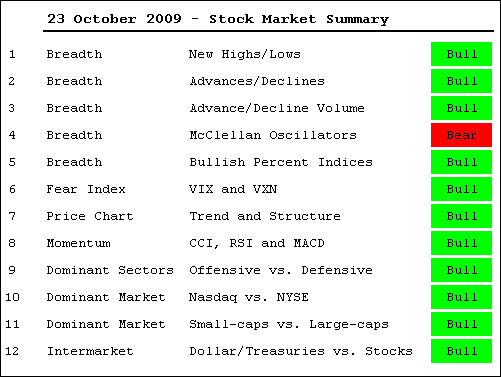

-Bulk of the evidence remains bullish

-Weak upside breadth on Monday and Thursday

-SPY and IWM reverse short-term uptrends

-A MACD(5,35,5) signal for SPY

-SPY remains in Wave 4 target zone

-NYSE AD Volume Line does not confirm

-Nasdaq AD Line fails to exceed September high

-Dollar...

READ MORE

MEMBERS ONLY

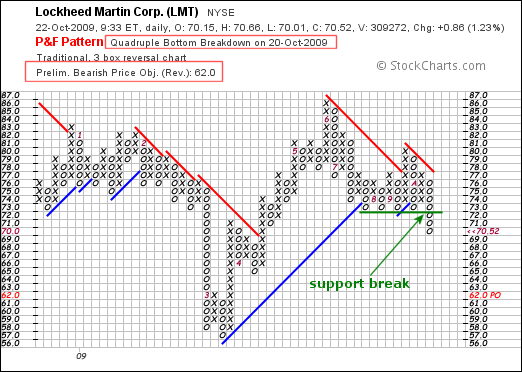

LMT Breaks Support on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Looking across the P&F scan page on Thursday, I came across Lockheed Martin (LMT) with a quadruple bottom breakdown. Actually, this is a quintuple bottom break down. After four bounces off support, LMT broke through on the fifth try. Based on traditional P&F targeting, the downside...

READ MORE

MEMBERS ONLY

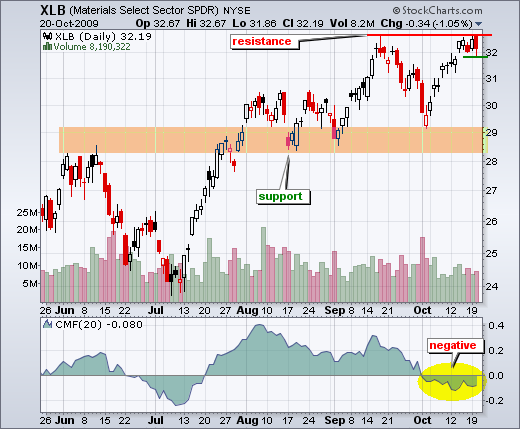

Negative Money Flow for XLB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the Materials SPDR (XLB) is challenging resistance from the September highs, Chaikin Money Flow remains in negative territory. In fact, CMF has been negative throughout October. This shows underlying weakness in the current advance. With XLB stalling near its September highs the last five days, a break below...

READ MORE

MEMBERS ONLY

Intermarket Chart Page Updated

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Stocks and the Dollar remain inversely correlated.

-Short-term interest rates are edging higher and this could lift the Dollar.

-Gold remains at high levels as the breakouts hold.

-Broken resistance turns into support for oil.

-Bonds bounced off a key support zone.

-Click here to view the charts....

READ MORE

MEMBERS ONLY

A big Support Test for KB Home

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A number of chart features are coming together to mark support around 15 for KB Home (KBH). First, the decline retraced 62% of the prior advance. Second, broken resistance turns into support. Third, the stock firmed the last three weeks. The only remaining wild card is the direction of the...

READ MORE

MEMBERS ONLY

MT Bullish, But ST Overbought

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Bulk of the evidence remains bullish

-IWM leads the pack

-SPY extends short-term uptrend

-Past MACD divergences in SPY

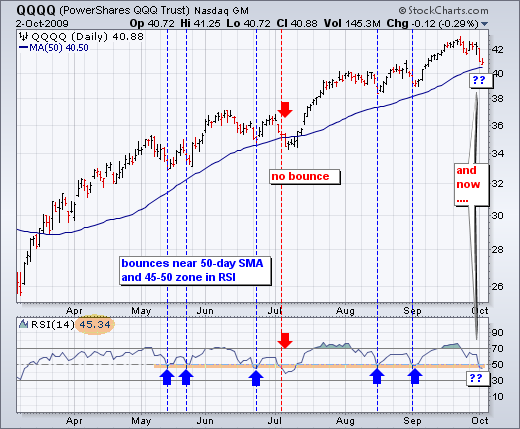

-MACD diverges for QQQQ

-Autozone (AZO) firms at support

-Oracle (ORCL) recovers after sharp decline

-Qualcom (QCOM) bounces after hammer

-Comcast (CMCSA) firms after sharp decline

-Nvdia (NVDA) retraces 50% of...

READ MORE

MEMBERS ONLY

Volume By Price Resistance for the Dow

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Much has been make about Dow 10,000 this week, but technicians may want to focus about 500 points higher instead. The chart below shows Volume-by-Price for the Dow Industrials. Notice that the longest bar is around 10500-11000. This represents a potential resistance zone in the coming weeks or months....

READ MORE

MEMBERS ONLY

SHORT-TERM RATES AND THE DOLLAR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While there has been a negative correlation between the Dollar and stocks this year, there has been a positive correlation between the Dollar and short-term interest rates. The chart below shows the US Dollar Index ($USD) with the 1-Year Treasury Yield ($UST1Y). Both rose in January-February and then declined from...

READ MORE

MEMBERS ONLY

Best Buy Hits a Ceiling

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Point&Figure charts are great for showing support and resistance. Best Buy (BBY) hit a ceiling at 42 over the last five months. A breakout above resistance (another "X") would trigger a bullish signal and target further strength towards the next resistance level at 48.

Click this...

READ MORE

MEMBERS ONLY

New Highs Affirm Uptrend for Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Bulk of the evidence remains bullish

-SPY surges to new highs in October

-S&P 500 enters retracement zone on weekly chart

-NYSE AD Line hits new high

-VIX moves to new low

-MACD stays bullish despite divergences

-Russell 2000 and S&P 100 exceed September highs

-Bullish...

READ MORE

MEMBERS ONLY

Inter-market Leaders for 2009

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the Dow hitting 10,000 on Wednesday, it is a good time to check the intermarket PerfChart for 2009. West Texas Intermediate ($WTIC) is by far the biggest winner this year with a gain around 55%. Gold-Continuous Futures ($GOLD) is up around 24% and the Dow is up 11....

READ MORE

MEMBERS ONLY

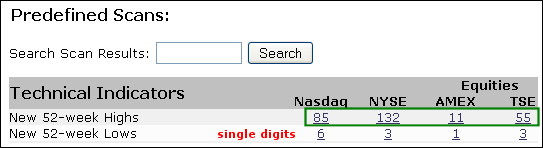

Net Highs Outpacing New Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The top of the predefined scan page says it all. New 52-week highs are outpacing new 52-week lows, by a wide margin. In fact, new 52-week lows are in the single digits for all four exchanges shown on the table. No sign of weakness here.

Click this image for more...

READ MORE

MEMBERS ONLY

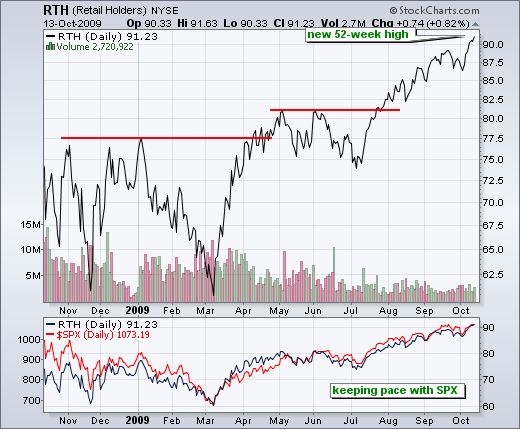

Retail HOLDRS Forge New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail HOLDRS (RTH) continues its up trend with another 52-week high on Tuesday. The chart below shows prices over the last 12 months and Tuesday's close in the highest. In the indicator window, notice that RTH is keeping pace with the S&P 500 (red line)...

READ MORE

MEMBERS ONLY

Semis Lead as SPY Hits Sept Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-SPY forms doji near September highs

-Short-term uptrend remains in place for SPY

-Treasury yields surge over the last two days

-Dollar ETF forms doji near September lows

-Homebuilders SPDR bounces off support

-Regional Bank SPDR breaks channel resistance

-Transport iShares hits retracement zone

-REIT iShares edges above channel trendline...

READ MORE

MEMBERS ONLY

Bonds Drop Sharply

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The intermarket chart below shows bonds (blue line) taking a hit last week. The 30-year Treasury Bond ($USB) fell back toward support from its September lows. Weakness in bonds is understandable with West Texas Intermediate ($WTIC) challenging its summer highs. Click here for John Murphy's Intermarket Perfchart.

Click...

READ MORE

MEMBERS ONLY

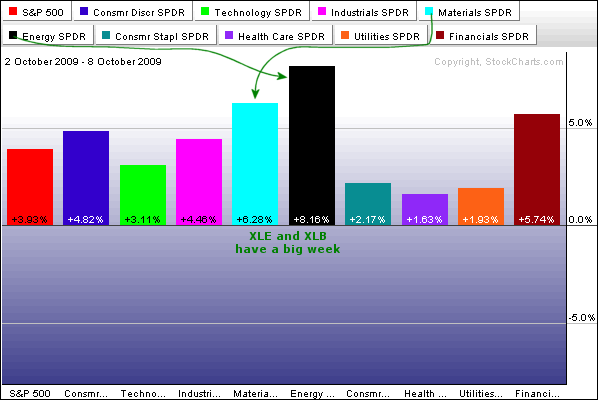

Materials and Energy Score Big

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) and the Materials SPDR (XLB) started October with a bang. Over the last five days, XLE is up over 8% and XLB is up over 6%. The Financials SPDR (XLF) comes in a close second with a 5.74% gain. All three easily outperformed the S&...

READ MORE

MEMBERS ONLY

Stocks Stall as Dollar Tests Prior Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Medium-term evidence remains bullishfor stocks

-SPY turns indecisive after sharp advance

-Using CCI for short-term signals in SPY

-Another bottom picking opp in the Dollar

-Oil advances to channel resistance

-Gold becomes overbought as GLD assets surge

-Bonds feel the heat of rising commodity prices

-Click here for the video...

READ MORE

MEMBERS ONLY

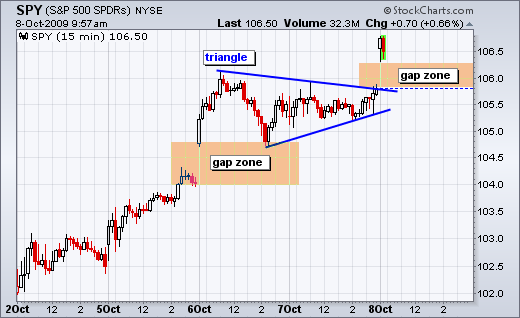

SPY Gaps Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY is at it again with its second gap this week. The ETF gapped higher on Tuesday and held the gap zone. After a triangle consolidation, SPY gapped above 106 this morning to create another gap zone that marks first support.

Click this image for more details....

READ MORE

MEMBERS ONLY

XLE Zigzags Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows the Energy SPDR (XLE) with a 5% Zigzag. This indicator filters out smaller fluctuations by only identifying moves of at least 5%. XLE is currently zigzagging up with higher highs and higher lows. A break below the October low would reverse this uptrend.

Click this image...

READ MORE

MEMBERS ONLY

Yield Curve Remains Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With short-term rates near zero and long-term rates around 4%, the yield curve is clearly positive. This sharply positive slope reflects loose monetary policy at the Fed that is designed to stimulate the economy. For reference, the yield curve was flat in October 2007 as short-term rates were near 4%...

READ MORE

MEMBERS ONLY

Setting Up for a Short-term Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Attempting a short-term low

-Setting short-term support for SPY

-Low Volume the last two Mondays

-Finance Sector Leads

-Regional Banks Lag

-Gold Miners ETF bounces off support

-AMAT forms hammer at support

-BG firms near key retracement

-CPWR forms bullish engulfing at support

-INTU maintains bullish bias

-NEM forms falling...

READ MORE

MEMBERS ONLY

Financials Light up Market Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Financial sector lit up the Market Carpet on Monday with the most green. Three of the top five gainers came from the Financial sector. The consumer discretionary sector was second with two of the top five gainers on Monday.

Click this chart for more details....

READ MORE

MEMBERS ONLY

QQQQ Tests the 50-day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a sharp decline over the last eight days, the Nasdaq 100 ETF (QQQQ) is testing support from the rising 50-day moving average and RSI is testing support around 45-50. QQQQ broke the 50-day moving average briefly in July, but held the 50-day during the May, June, August and September...

READ MORE

MEMBERS ONLY

Dow Tests 50-day Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a sharp decline the last seven days, the Dow Industrials is testing is 50-day moving average, which is currently at 9457. This is the first test of the moving average since the Dow surged in mid July.

Click this chart for details....

READ MORE

MEMBERS ONLY

Make-or-Break Time for Key Indicators

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Medium-term evidence remains bullish

-Wave 4 Hits the 50% Retracement

-Key Supports for SPY, QQQQ and IWM

-SPY is Already Short-term Oversold

-Volatility Indices Surge to Resistance

-Momentum Indicators Remain Bullish Overall

-McClellan Oscillators Turn Bearish

-Stocks and Bonds Disconnect

-China and Japan Lag

-Stocks: ADSK, AMZN, ANF, INTC, PENN...

READ MORE

MEMBERS ONLY

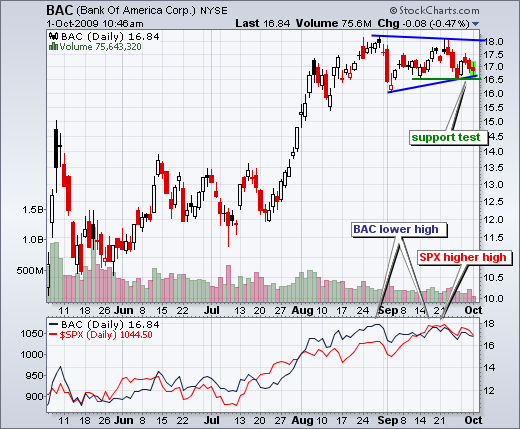

BAC Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bank of America (BAC) is testing support around 16.5 as the stock starts showing relative weakness. Support around 16.5 stems from the mid September lows and triangle trendline. BAC shows relative weakness because the stock failed to exceed its August high, but the S&P 500 formed...

READ MORE

MEMBERS ONLY

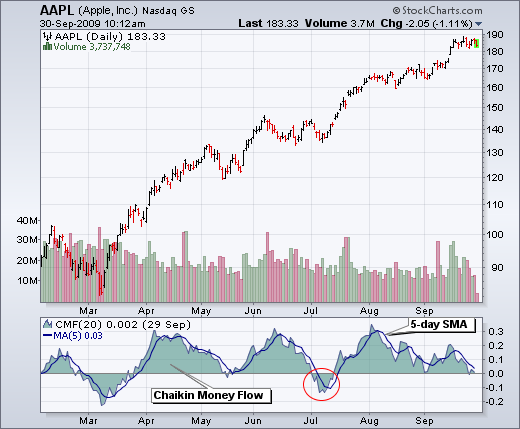

Money Flows Near Zero for Apple

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chaikin Money Flow for Apple (AAPL) has been positive from mid July to late September. There was a brief dip into negative territory last week, but Chaikin Money Flow recovered on Monday. Nevertheless, the 5-day SMA of the indicator is perilously close to turning negative for the time since July....

READ MORE

MEMBERS ONLY

A Bullish PnF Chart for Activision

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This long-term PnF chart for Activision extends back to 2003 when the stock was trading in the low single digits. After rising above 19, the stock went into corrective mode in 2008 and broke out in 2009. With the May-June (5-6 on the chart) breakout, ATVI has a bullish price...

READ MORE

MEMBERS ONLY

SPY Bounces, But Hits Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-SPY Bounces After Indecision

-SPY Hits Key retracement on Intraday Chart

-China and Japan Lag

-Net Advancing Volume Not that Strong

-Transport ETF Tests Broken Resistance

-Bollinger Bands Tighten for SMH

-Autonation (AN) Hits Support

-Ford (F) Breaks Wedge Resistance

-Gilead (GILD) Maintains Uptrend

-Intuit (INTU) Bounces off Support

-Lowe&...

READ MORE

MEMBERS ONLY

China and Japan Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Since early July, the Shanghai Composite ($SSEC) and the Nikkei 225 ($NIKK) have been lagging western European stock markets and the US. The PerfChart below shows the Shanghai Composite is actually down since July and the Nikkei is barely positive. In contrast, the US and western European indices are up...

READ MORE

MEMBERS ONLY

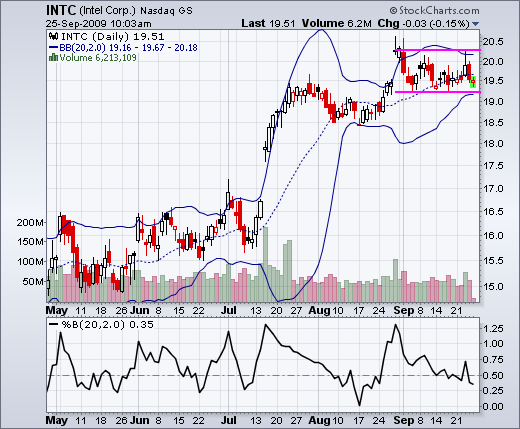

A Bollinger Band Contraction for Intel

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bollinger Bands have been contracting as Intel (INTC) consolidates over the last few weeks. The theory behind Bollinger Bands is that volatility contractions often give way to volatility expansions. Look for a range break to trigger the next directional signal.

Click this chart for details....

READ MORE

MEMBERS ONLY

A Post-Fed Blip in the Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Bulk of the Evidence Remains Bullish

-A Blip in the Uptrend

-Playing Short-term Pullbacks

-Big Picture Review

-Nasdaq McClellan Oscillator Lags

-Volatility Indices Testing Lows

-Dollar Gets Oversold Bounce

-Crude Breaks Support

-Gold Slips as Dollar Bounces

-Bonds Firm as Stocks Fall

-Breakouts Not Holding (ERTS and AZO)

-Click here...

READ MORE

MEMBERS ONLY

An Outside Reversal Day for SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bears were given something to chew on with an outside reversal day for SPY. First, a reversal formed when Wednesday's high was above Tuesday's high and Wednesday's close was below Tuesday's close. Second, an outside day occurred because Wednesday's...

READ MORE

MEMBERS ONLY

New Highs Outpacing New Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The predefined scan page provides a quick glimpse of underlying strength or weakness in the stock market. At the top of this page, new 52-week highs are comfortably outpacing new 52-week lows. Click the number (129 Nasdaq and 163 NYSE) to see a list of market leading stocks.

Click this...

READ MORE

MEMBERS ONLY

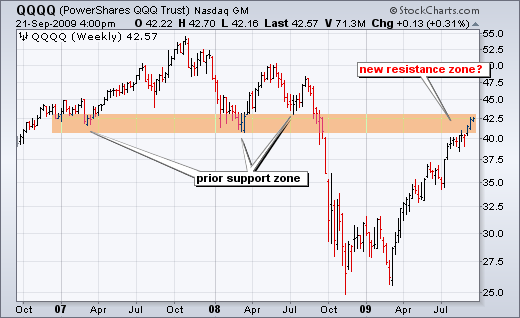

QQQQ Hits Prior Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Broken support turns into resistance. This basic tenet of technical analysis will be getting a test as the Nasdaq 100 ETF (QQQQ) reached broken support. For now, I would consider this "potential" resistance because the trend since March is clearly up.

Click this chart for details....

READ MORE

MEMBERS ONLY

Uptrend and Dollar Dominate Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Medium-term uptrend dominates decisions

-SPY is short-term overbought

-SPY forms bull flag on 60-minute chart

-Euro and stocks zigzag together

-Oil falls from resistance

-Bonds cue from commodities

-ATVI surges off support

-ERTS stalls at key retracement

-DYN breaks channel resistance

-HBAN battles breakout

-KEY pulls back after breakout

-Link...

READ MORE

MEMBERS ONLY

XLY Becomes Overbought and Stalls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) surged over 10% this month and then stalled with two doji at the end of last week. These candlesticks signal indecision that can foreshadow a short-term pullback. Also notice that 14-day RSI moved above 70 to become overbought for the first time since early August....

READ MORE

MEMBERS ONLY

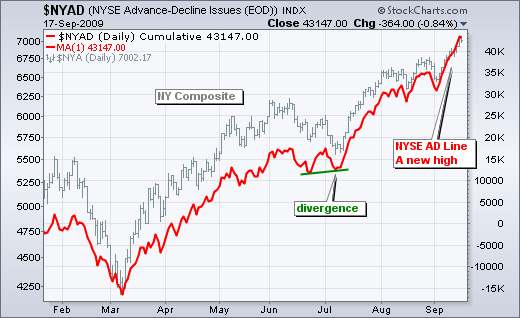

Breadth Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a surge over the last two weeks, the AD Line and AD Volume Line for the NYSE hit new reaction highs. The first chart shows the NYSE AD Line moving above its August highs with a sharp advance this month. The AD Line is a cumulative measure of Net...

READ MORE

MEMBERS ONLY

Precious Metals Lead Rydex Funds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Rydex Mutual Funds Market Carpet focuses on the 17 sector funds. September is all about hard assets. The leading sector funds are precious metals, energy services, basic materials and energy. Consumer produces, utilities and healthcare show the smallest gains.

Click this chart for details....

READ MORE

MEMBERS ONLY

Wave 4 Uptrend Remains in Place

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

-Evidence Remains Bullish For Stocks

-Wave 4 is Still Possible (me thinks)

-Current Uptrend is Still Actual (me knows)

-Net New Highs Expand Further

-Tech Sector0 Shows Relative Weakness

-AD Lines and AD Volume Lines Hit New Highs

-Volatility Indices Hit New Reaction Lows

-Stocks: XOM, APOL, AZO

-Video Link...

READ MORE