MEMBERS ONLY

Markets, News and the Percentage of Stocks above the 50-day EMA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Markets and News.

* S&P 500 Gets Oversold Bounce.

* %Above 200-day EMA Plunges.

* Range Change for %Above 20-day EMA.

* %Above 50-day EMA Forms Small Divergence.

... Markets and News

...Writing a market commentary before the election seems a bit foolhardy, but the election results do not figure into my analysis....

READ MORE

MEMBERS ONLY

A Precious Metal that Actually Acts Precious

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold, silver and platinum suffered selling pressure over the last few years, but palladium attracted buying pressure and outperformed. It is one of the few precious metals trading near a 52-week high and in a long-term uptrend.

The first chart shows three year performance for the continuous futures contracts for...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - Assessing October

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Assessing the Damage in October.

* Testing the 10 and 12 Month MAs.

* S&P 500 Breaks Key Moving Average.

* Bonds Decline along with Stocks.

* Global Stocks Are Weak.

* REITs are Holding Up, But.

* Commodities Weaken.

* Gold Holds Breakdown on Monthly Chart.

* Dollar Strengthens against Euro.

* Note from the Art&...

READ MORE

MEMBERS ONLY

Campbell Soup is Looking Rather Bland

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Soup season is upon us, but Campbell Soup ($CPB) is having none of it as the stock trends lower and lags its sector, the Consumer Staples SPDR (XLP).

First and foremost, the long-term trend is down with a 52-week low in June, the 50-day below the 200-day and the 200-day...

READ MORE

MEMBERS ONLY

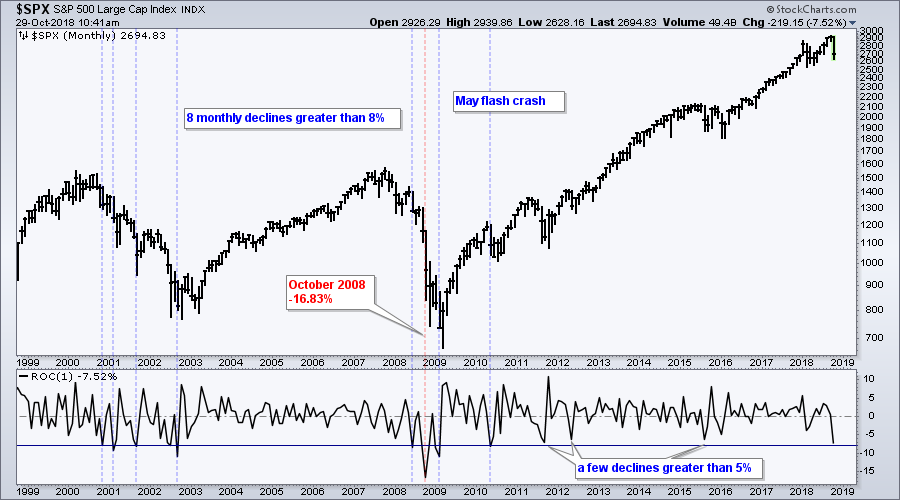

Comparing the Current Month with the Last 20 Years

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is down around 7.5% so far this month and this is shaping up to be the worst monthly decline in over five years. Keep in mind that there are still a few days left in October and the last monthly bar will not complete...

READ MORE

MEMBERS ONLY

SystemTrader - Update to RSI Mean-Reversion Strategy and Dealing with the Dreaded Drawdown

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Dealing with Drawdowns.

* Mean-Reversion with RSI, Chandelier and PPO.

* Universe, Market Regime and Ground Rules.

* Sample Signals for IJR.

* Testing the Big Four.

* Plotting the Drawdowns.

* Setting a Risk-of-Ruin Stop.

* Conclusions.

.... Dealing with Drawdowns.

The S&P 500 is currently in the midst of its worst monthly decline since...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - Oversold, But Broadsided

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Performance Overview.

* Oversold, But Broadsided.

* First Target for S&P 500.

* Nasdaq 100 Breaks 40-week SMA.

* FAANG Stocks Lead NDX Lower.

* Mid-caps and Small-caps Bear the Brunt.

* Downside Participation Expands Furthers.

* Utilities Buck the Selling Pressure.

* REIT ETF Remains with Breakdown.

* Treasuries Gets Some Safe-haven Love.

* Dollar Remains Strong...

READ MORE

MEMBERS ONLY

India and Brazil Hold Up, but Strong Dollar Hits Foreign Index ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* India and Brazil Remain Positive.

* The All Ords Index versus the Aussie ETF.

* Rupee Extends Decline Relative to US Dollar.

* Rupee Weighs on India ETF.

* Symbols for Currency Crosses.

... India and Brazil Remain Positive

... A few foreign stock indexes are holding up, but their Dollar denominated ETFs are underperforming because...

READ MORE

MEMBERS ONLY

This Software Stock is Holding up Well in October

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pickings are getting slim after sharp declines in October, but some stocks are holding up better than others. The Software iShares (IGV), in particular, held up better than most industry group ETFs and Adobe (ADBE) is a leader in this group.

The chart below shows Adobe falling sharply in...

READ MORE

MEMBERS ONLY

Watching Benchmark Lows for Clues on Performance - New Lows Expand in Indexes and Key Sectors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Setting Benchmark Levels for Comparison.

* Analyzing the Top Sectors and Benchmark Lows.

* New Lows Expand on Latest Dip.

* Discretionary, Finance and Industrials Lead New Low List.

* Software and Cyber Security Hold Up.

* CheckPoint, Fortinet and FireEye.

* Food and Charts for Thought.

... Setting Benchmark Levels

.... Chartists can set benchmark highs and...

READ MORE

MEMBERS ONLY

Using the Measured Move Technique for Citigroup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Citigroup (C) is leading the Financials SPDR (XLF) lower with a lower high in September and a rising wedge break in October.

The chart shows weekly bars for Citigroup over the last three years. The stock led the market higher in 2016 and 2017 with a gain exceeding 100% from...

READ MORE

MEMBERS ONLY

Big Sectors Weigh as Defensive Sectors Buck the Selling Pressure

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

One of my favorite methods for analyzing the sector SPDRs is with CandleGlance charts sorted by the Rate-of-Change indicator to rank performance. This is a great way to quickly separate the leaders from the laggards and analyze short-term price action.

The charts below show the 11 sector SPDRs and the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - Dow Theory and Primary Trends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Performance Overview.

* Correlations and Volatility Rise.

* Scanning and Measuring Participation.

* Bulk of the Evidence Remains Bearish.

* S&P 500 Battles 200-day.

* Dow Theory and Trends.

* Healthcare and Utilities Hold Up.

* Software, Defense and Health-related ETFs.

* Notes from the Art's Charts ChartList.

... Correlations and Volatility Rise

... The major...

READ MORE

MEMBERS ONLY

SystemTrader - Reducing Moving Average Whipsaws with Smoothing and Quantifying Filters.

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Trading SPY with S&P 500 Signals.

* Long and Long-Short Backtests.

* Smoothing to Reduce Whipsaws.

* Testing Different SMA Combinations.

* Bollinger Bands, Envelopes and Keltners.

* Backtesting the Filters.

* Final Thoughts and a Suggestion.

... Introduction

Yesterday I put the 200-day SMA through the wringer with some testing using the S&...

READ MORE

MEMBERS ONLY

October is Different from February

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 200-day SMA acts as a benchmark we can use to compare price movements. We can use the 200-day SMA to compare the current decline in the S&P 500 against past declines. We can also use the 200-day SMA to compare the decline in the S&P...

READ MORE

MEMBERS ONLY

SystemTrader - Testing and Flirting with the 200-day Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* A Self-Fulfilling Prophecy?

* Ranges Wreak Havoc on Moving Average Systems.

* Backtesting Five Indexes.

* More Whipsaws than Strong Trends.

* Other Uses for the 200-day SMA...

... The S&P 500 broke its 200-day SMA with a sharp decline last Thursday and then rebounded over the last three days to reclaim this...

READ MORE

MEMBERS ONLY

This Entertainment Leader is Still Crushing It

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 fell to its lowest level since early July and pierced its 200-day moving average last week. Chartists looking for stocks that held up better during this decline can use these levels for comparison. Stocks that did not break below their August lows and 200-day moving...

READ MORE

MEMBERS ONLY

Ultra Beauty Turns After Pullback

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broad market environment is a bit shaky right now, but Ultra Beauty (ULTA) is holding up relatively well with a normal pullback after a big breakout.

First and foremost, the stock is in a long-term uptrend after a breakout, surge and 52-week high in September. Also note that the...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - The Straw that Broke the Bull's Back

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Performance Overview.

* Fattening Up and Surviving Drawdowns.

* Breadth Indicators Turn Bearish.

* Measuring and Comparing Downside Momentum.

* S&P 500 hits Oversold Extreme.

* The New Normal for QQQ?

* Pullbacks within Uptrends: XLV, XLK, XLY, XLU.

* Charts Going Nowhere: XLE, XLI.

* Chart Break Downs: XLC, XLP, XLRE, XLF, XLB.

* Notes from...

READ MORE

MEMBERS ONLY

Downside Participation Increases - Scanning for Odd Balls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Broadest Decline Since April.

* 16 Stocks Bucked the Selling Pressure.

* Scan Code for Advancing Issues.

* The Russell 2000 and Moving Averages.

* A Shift from Growth to Value?

... A Lopsided Move

... Chartists can measure participation using the AD Percent indicators. AD Percent equals the number of advances less the number of...

READ MORE

MEMBERS ONLY

Walmart Makes a Move with Good Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Walmart (WMT) is making waves again with a massive breakout in August and a small breakout on Tuesday.

WMT underperformed the market the first half of the year with a 25% decline from the January high to the May low. The stock firmed in May, began rising in June and...

READ MORE

MEMBERS ONLY

Nine Leading ETFs Become Short-term Oversold - Understanding the Chandelier Exit - 4 Stocks to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* XLF at Moment of Truth

* Three Stocks and a Third of XLF

* August-September Leaders are Oversold

* Understanding the Chandelier Exit

* SPY and QQQ Join Oversold Parade

* 9 Oversold Setups and 1 Example

* Stocks to Watch: HOLX, VRSK, AMJ, WMT

... The Financials SPDR (XLF) seems like a dangerous sector to be...

READ MORE

MEMBERS ONLY

This Biotech Bucked the Selling Pressure Last Week

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week was tough on stocks as the S&P 500 SPDR declined around 1%, the Nasdaq 100 ETF fell 3% and the Biotech iShares plunged 4.5%. Despite a rough week, note that some 180 stocks in the S&P 500 closed higher and bucked the selling...

READ MORE

MEMBERS ONLY

SystemTrader: A Rules-Based Approach for When to Cry Uncle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Defining the Broad Market Environment.

* Measuring Participation.

* Uptrends Versus Downtrends.

* Measuring Market Leadership.

* Weight of the Evidence.

... The Broad Market Environment

... For a long time now, I have been using three breadth indicators to define the broad market environment, bull market or bear market. As with trend-following, this system will...

READ MORE

MEMBERS ONLY

Utilities Shine as Market Takes a Turn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Utilities are not the most exciting stocks in the world, but the Utilities SPDR (XLU) is the third best performing sector since February and the second best performing sector last week. The could have further to run. Let's look at the charts.

The first chart shows weekly bars...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (with video) - Working with Assumptions and Predictions

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Performance Overview.

* The Perfect Storm or Just Coincidence?

* Working with Assumptions and Predictions.

* We've Seen this Movie Before (QQQ).

* New Lows Increase.

* More Uptrends than Downtrends.

* XLC Reverses Counter-trend Bounce.

* XLF Bounces off Support.

* XLI Holds Strong.

* XLE Remains with Breakout.

* XLY Becomes Short-term Oversold.

* Notes from the...

READ MORE

MEMBERS ONLY

This Medical Devices Stock Looks Poised to Play Catchup

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care SPDR (XLV) is the best performing sector over the last six months with a 21% gain and the Medical Devices ETF (IHI) is one of the top performing industry group ETFs with a 25% gain. There are dozens of healthcare stocks hitting new highs and showing big...

READ MORE

MEMBERS ONLY

Getting Perspective on Small-caps, the Energy SPDR and the Oil & Gas Equip & Services SPDR - plus Six Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-caps Become More Oversold.

* XLE Ends Another Long Correction.

* XES Forms Another Higher Low.

* Stocks to Watch: VZ, NOV, PSX, VLO, WMT, JPM.

... Small-caps are leading the market lower as the S&P SmallCap iShares (IJR) and Russell 2000 iShares (IWM) fell over 4% in the last five weeks....

READ MORE

MEMBERS ONLY

UnitedHealth Powers Healthcare Providers to New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Health Care SPDR (XLV) is the strongest sector over the last six months (+19%) and the HealthCare Providers ETF (IHF) is one of the strongest industry groups (+27%). UnitedHealth (UNH) is the top holding in IHF and accounts for 12.5% of the ETF. UNH has a small bullish...

READ MORE

MEMBERS ONLY

Biotechs are Leading the Market - 3 to Watch

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* QQQ Leads with New High.

* IJR Firms Near Broken Resistance.

* 3 Biotechs To Watch.

...QQQ Leads with New High

...The Nasdaq 100 ETF (QQQ) advanced to a new high on Monday and continues to show upside leadership. Note that QQQ has been leading pretty much all year now and is...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Split within Market Widens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* %Above 200-day EMA.

* IJR and MDY Correct as QQQ Breaks Out.

* XLC and XLF are Lagging.

* XLF and Treasury Yields.

* Utes and REITs become Short-term Oversold.

* Big Biotechs are Leading Again.

* JAZZ Hits Reversal Area.

* Notes from the Art's Charts ChartList.

...The stock market as a whole remains...

READ MORE

MEMBERS ONLY

QQQ Holds Up as Small-caps Extend Pullback

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* QQQ Holds Up as Small-caps Fall.

* Finance Sector Fails to Hold Breakout.

* Defining the Upswing in XLF.

* Regional Banks and Brokers Break.

* Home Construction Breaks Triangle Line.

...QQQ Holds Up as Small-caps Fall

...Stocks were hit with selling pressure late Wednesday and this pushed some key groups modestly lower. The...

READ MORE

MEMBERS ONLY

Alphabet (aka Google) Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Alphabet (GOOGL) fell around 10% from a recent high and this decline looks like a pretty normal correction within a bigger uptrend. Note that GOOGL is the biggest component (23.15%) in the new Communication Services SPDR (XLC). Facebook (FB) is the second largest weighting (17.69%) and Disney (DIS)...

READ MORE

MEMBERS ONLY

QQQ Perks Up as Tech-Related ETFs Stay Strong (sans SOXX)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Short-term Divided, but Long-term Bullish

* Small-caps Still Struggling

* SPY Leads as QQQ Breaks Wedge

* Tech-Related ETFs Hold Strong (sans SOXX)

* Chart Setups: ANET, QLYS, NFLX, LMT, RTN

More Uptrends than Downtrends

Large-caps continue to lead as SPY hit a new high last week and QQQ edged higher the last two...

READ MORE

MEMBERS ONLY

Regeneron Holds Break as Volume Picks Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Regeneron (REGN), a large-cap biotech stock, is part of the Health Care SPDR (XLV) and a top ten holding in the Biotech iShares (IBB), Both ETFs hit 52-week highs recently and show upside leadership. The stock is lagging in the 52-week high category, but the long-term trend is up and...

READ MORE

MEMBERS ONLY

Weekly Market Review and Outlook (with Video) - Where's the Selling Pressure?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Where's the Selling Pressure? (RSP).

* Dow Theory Bull Market Confirmation

* New Leadership Emerges (XLV, XLI, XLF).

* QQQ Gets its Flow Back.

* IJR Flags and IWM Tests Breakout.

* Finance Sector Joins the Fray.

* Notes from the Art's Charts ChartList.

Where's the Selling Pressure?

There are...

READ MORE

MEMBERS ONLY

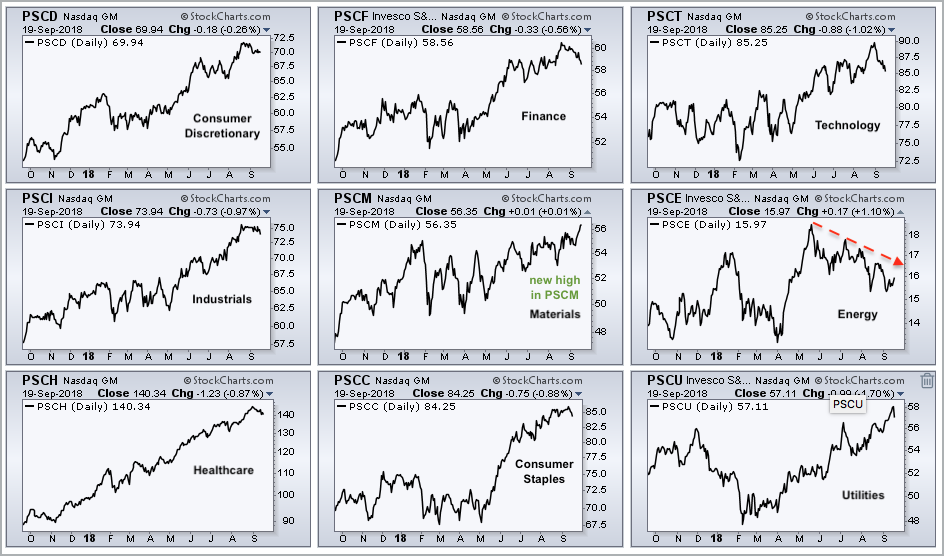

Materials Sector Heats Up, Watching SOXX and Two Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Small-cap Materials Take the Lead.

* An Abandoned Hammer in SOXX.

* FireEye, the Big Base and Volume.

* Arista Hits Support and Oversold Zone.

... Small-cap Materials Take the Lead

... There are nine small-caps sectors and the SmallCap Materials ETF (PSCM) is taking the lead. First, it is the only one of the...

READ MORE

MEMBERS ONLY

Will Rising Yields Boost the Finance Sector?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* 2-yr Treasury Yield Hits 10-yr High.

* The Mother of All Double Bottoms.

* Financials SPDR Extends Stall.

* Leaders and Laggards in Finance.

* Stocks to Watch: WMT, TRN and GILD.

...Big Moves in Treasury Yields

...Treasury yields moved sharply higher the last few weeks with the 2-yr T-Yield ($UST2Y) and the 5-yr...

READ MORE

MEMBERS ONLY

Disney Hits Potential Reversal Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Disney hit a new high in early August and pulled back into September. The stock is part of a strong sector, consumer discretionary, and this pullback reached a potential reversal area.

First and foremost, the long-term trend is up because the stock formed a higher low from October to April...

READ MORE

MEMBERS ONLY

Procter & Gamble Attempts to Turn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples SPDR (XLP) has been leading the market since early May and Procter & Gamble is the largest stock in the sector (12.58%). On the price chart, PG is in the midst of a long-term trend change and the short-term trend is also turning up.

First and...

READ MORE