MEMBERS ONLY

Two Potential Double Tops to Watch Going Forward

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

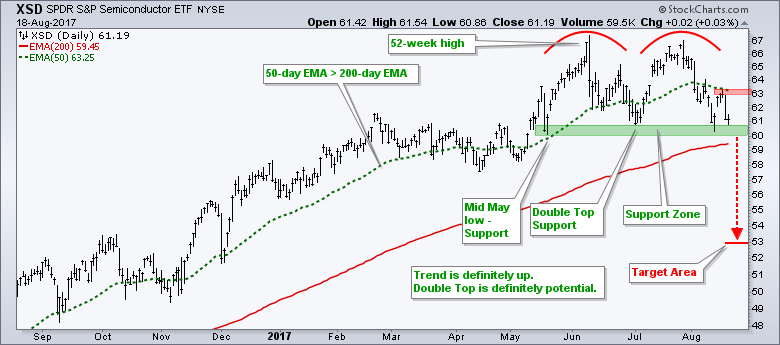

Doubles Tops are forming in two key ETFs, the Semiconductor SPDR (XSD) and the Consumer Discretionary SPDR (XLY), and chartists should watch these important groups for clues on broad market direction in the coming week or two. First, let's talk about the Double Top. These patterns form with...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - Those Noisy Small and Mid Caps (w/ Video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Those Noisy Small and Mid Caps

.... Correction Signals versus Bear Market Signals

.... High-Low and AD-Volume Lines Turn Down

.... SPY and QQQ Have Yet to Break Down

.... Non-confirmation between RSP and SPY

.... Small-caps Extend Oversold Readings

.... Utilities and Technology Leading

.... Finance and Staples Still Holding Up

.... Industrials-Healthcare-Materials Extend Corrections

.... TLT Extends...

READ MORE

MEMBERS ONLY

Medical Devices ETF Bids to End Correction - Analyzing the Top Stocks - Scanning a ChartList

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Medical Devices ETF Bids to End Correction

.... An ETF is Only as Good as it's Component Stocks

.... Scanning for Trends with a ChartList

.... Charting the Top Five IHI Stocks

.... Abbot Surges off Support

.... Thermo Fisher Consolidates after Gap

.... Danaher Bounces after Support Break

.... Boston Scientific Firms in Retracement...

READ MORE

MEMBERS ONLY

Mind the Gap in AMAT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The long-term trend for Applied Materials (AMAT), a big semiconductor equipment manufacturer, is clearly up and the short-term trend could be turning up again with a gap three days ago. The chart below shows AMAT hitting a 52-week high in early June and then forming a large triangle. This is...

READ MORE

MEMBERS ONLY

Transport ETF Holds Breakout, Semiconductor ETF Holds Support, Fab 5 Tech Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Transport ETF Bounces off Key Retracement

.... Airline ETF Returns to Breakout Zone

.... Railroad Stocks are in Uptrends

.... XSD Bounces of Support

.... Diodes and Skyworks Turn Up

.... Microsoft, Facebook and Apple Lead the Fab Five

.... Pfizer Shows Good Volume Trends

.... Thor Surges off Gap Zone ....

Transport ETF Bounces off Key Retracement...

READ MORE

MEMBERS ONLY

A Big Dow Component is Turning Up Again

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials is in a clear uptrend with a fresh 52-week high just last week. Note that this senior Average is hitting these new highs without much help from its second largest component, Goldman Sachs. For reference, the Dow Diamonds (DIA) is up around 13% year-to-date and GS is...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - A New High and a Big Decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... RSP Takes a Big Hit after New High

.... Small-caps and Mid-caps Lead Breadth Lower

.... AD Volume Lines Turn Down

.... SPY Closes below 50-day EMA

.... IJR Pulls Back within Grinding Uptrend

.... Sector Balance Remains Long-term Bullish

.... Finance, Technology and Utilities Lead

.... Industrials-Healthcare Correct within Uptrends

.... Consumer Staples is the Second Weakest...

READ MORE

MEMBERS ONLY

SystemTrader - Tempering Volatility by Using RSI to Rank Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- An Attempt to Lower the Drawdowns

---- Strategy Review

---- Consulting, Software and Data

---- Rate-of-Change versus RSI

---- A High-Flyer versus a Boring Uptrend

---- Testing with 14-day RSI Rank

---- Conclusions and Caveat Emptor

---- Scan Code ----

An Attempt to Lower the Drawdowns ----

Last week...

READ MORE

MEMBERS ONLY

Gold and Bonds are Moving in Tandem

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

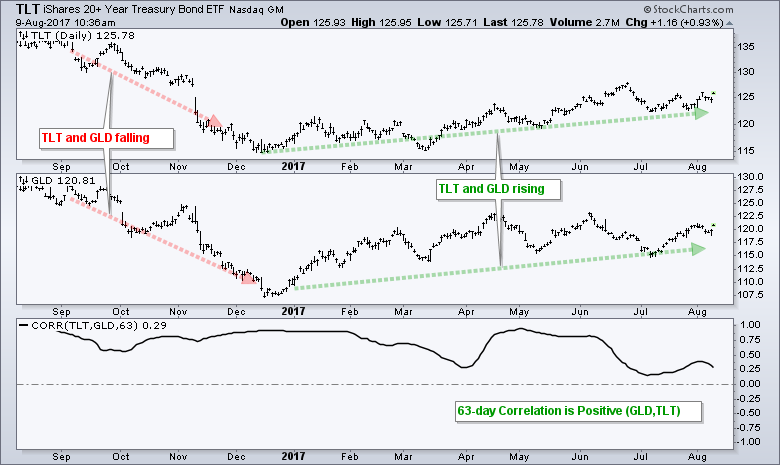

The Gold SPDR (GLD) and the 20+ YR T-Bond ETF (TLT) are both having good years with GLD up around 10% year-to-date and TLT up around 7%. As the chart below shows, these two are positively correlated over the past 12 months. The indicator window shows the 63-day Correlation Coefficient...

READ MORE

MEMBERS ONLY

Another Mean-Reversion Setup for Small-caps and Mid-Caps - Oil and XES Break Up - Six Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Another Mean-Reversion Setup for IJR and MDY

.... Crude and XES Get a Divorce

.... XES Tests June-July Lows

.... Interview with Tobias Levkovich

.... Lazard Hits Support after Pullback

.... Watts Water Technologies Turns Up

.... Analog Devices Consolidates within Uptrend

.... Qorvo Reveres Near Rising EMA

.... Two For the Road (CPSI and HLT) ....

Another Mean-Reversion...

READ MORE

MEMBERS ONLY

Correlation between Stocks and Bonds Turns Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

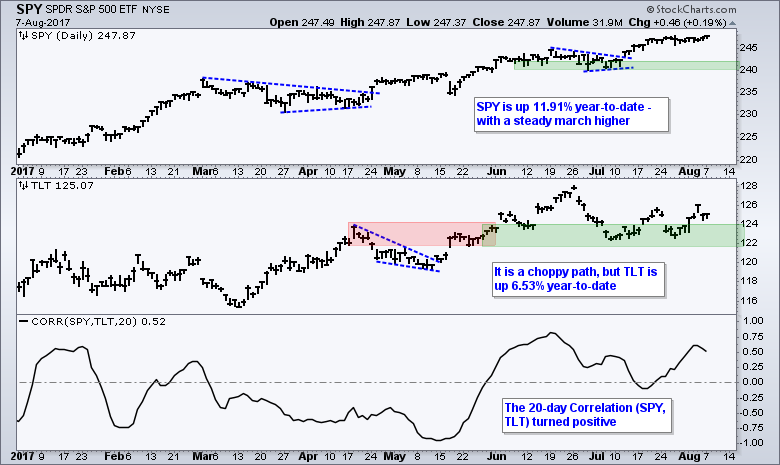

Stocks and bonds are both having a good year with the S&P 500 SPDR (SPY) up 11.91% year-to-date and the 20+ YR T-Bond ETF (TLT) rising 6.53% since January. The advance in SPY has been much steadier than the choppy advance in TLT, but both sport...

READ MORE

MEMBERS ONLY

An Ugly Price Relative, but a very Nice Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The price relative, or ratio chart, is handy for measuring relative performance, but it does not always reflect the trend for the underlying securities. For those unfamiliar, the RSP:SPY ratio measures the performance of the EW S&P 500 ETF (RSP) relative to the S&P 500...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - We've Seen this Movie Before

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Large-caps Continue to Lead

.... An Ugly Price Relative, but a Nice Uptrend

.... SPY and QQQ Stall Near All Time Highs

.... Small-caps: We Seen this Movie Before

.... Utes Outperform Bonds and Regionals Lag Badly

.... XLF Rises as 10-yr T-Yield Falls - KRE Lags

.... XLI Breaks Flag Resistance

.... XLP Breadth Weakens and...

READ MORE

MEMBERS ONLY

SystemTrader - Reworking the ChartCon Momentum Rotation Strategy - Cut your Profits and don't Worry about Stops

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

---- Reworking the Momentum-Rotation Strategy

---- Setting the Benchmark

---- System Ground Rules

---- Four Extra Filters

---- Consulting, Software and Data

---- Charts with Trading Signals

---- Rate-of-Change Ranking Results

---- Testing a Trailing Stop

---- Conclusions and Caveat Emptor

---- Scan Code ----

Reworking the Momentum-Rotation Strategy

I...

READ MORE

MEMBERS ONLY

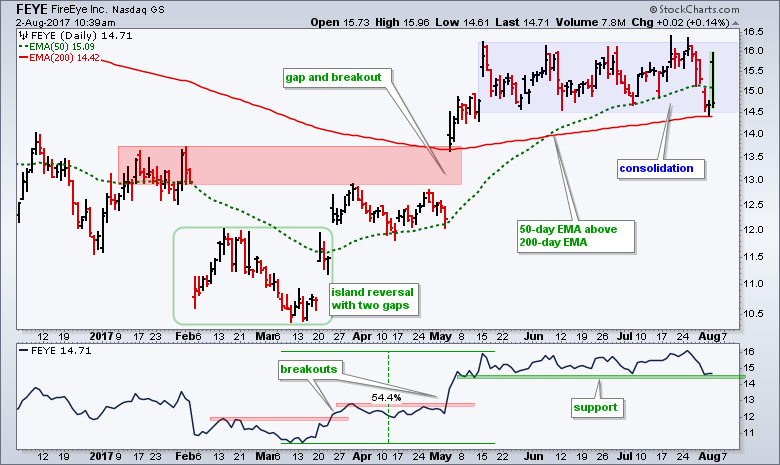

FireEye Battles Consolidation Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

FireEye reported earnings on Tuesday and surged on Wednesday morning with a strong open. The stock is trading well below the open now, but I wanted to highlight the bigger patterns at work. First, the long-term trend is up because the stock is above the 200-day EMA and the 50-day...

READ MORE

MEMBERS ONLY

Oil Could Hit Resistance Soon - Equipment and Services ETF Lags - Plus XOM, CVS, GS, SCHW, L, TRV and BMY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Oil Could Hit Resistance Soon

.... Oil & Gas Equipment & Services SPDR Lags Crude

.... Chevron Leads as ExxonMobil Lags

.... Goldman Finds Support as Schwab Turns Up

.... Loews and Travellers Lead Insurance Industry

.... Bristol Meyers Fills Gap with Big Move ....

Oil Could Hit Resistance Soon

The rally in crude could run...

READ MORE

MEMBERS ONLY

Chevron Leads Energy Sector with Breakout $CVX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chevron appears to be ending its correction and resuming its bigger uptrend with a five-day surge and breakout. The stock surged to a 52-week high in December and then retraced 61.8% of the prior advance with a decline into April. The decline basically ended in April because the stock...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - Breadth is Bullish Enough

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Market Breadth is Bullish Enough

.... New Highs Still Outpacing New Lows

.... SPY Notches another New High

.... Equal-weights Keep Pace on the Chart

.... QQQ Surges to New High

.... Majority of Sectors Confirm New Highs

.... XLY and XLK Lead Recent Surge

.... Regional Banks Weigh on Finance Sector

.... 10-yr T-Yield Makes Breakout Attempt...

READ MORE

MEMBERS ONLY

Customizing CandleGlance with 6 Homebuilders, Diamonds are Not Bearish and 3 Asian ETFs Poised for an Upturn

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Steady Uptrends for Six Homebuilder Stocks

.... Flags, Throwbacks and Diamonds (plus DHI)

.... Several Asia Markets Hit New Highs

.... Philippines, Malaysia and Indonesia ETFs Turn Up ....

Steady Uptrends for Six Homebuilder Stocks

CandleGlance charts are great for comparing price charts of related stocks. Chartists can enter up to 12 symbols in...

READ MORE

MEMBERS ONLY

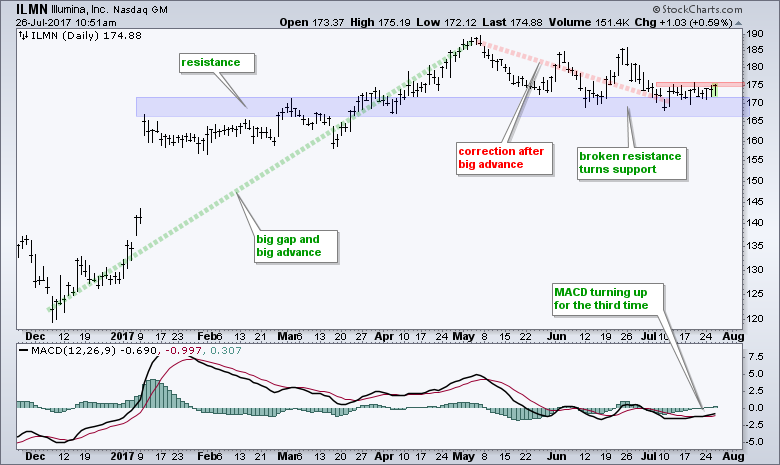

Illumina Makes a Bid to End its Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Biotech stocks are leading the market with the Biotech iShares (IBB) and Biotech SPDR (XBI) hitting 52-week highs this week. Even though Illumina (ILMN) is lagging its benchmarks a bit, it is firming at support and could be poised to end its correction. The chart shows ILMN advancing from 120...

READ MORE

MEMBERS ONLY

SPY Hits Another New High - Are Rates Turning Up? - Regional Banks Lead Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Long-term Uptrends Resume (SPY)

.... Back in the Saddle without News

.... Are Rates Turning Up and Bonds Turning Down? ($TNX, TLT, IEF)

.... Regional Banks Surge (plus USB, FITB, ZION)

.... Vulcan Materials and Martin Marietta Turn Up ....

Long-term Uptrends Resume (SPY)

Stocks resumed their long-term uptrends with solid advances over the last...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - Analyzing the Correction Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Evidence for Market Correction Builds

.... Seasonality for Stocks versus Bonds

.... High-Low Percent Turns Negative

.... Selling Pressure Ticks Up

.... Correction Could be Starting for SPY

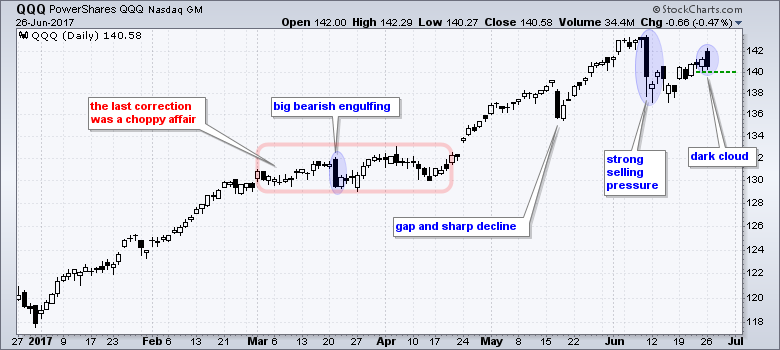

.... QQQ Extends Correction

.... Small-caps Continue to Struggle

.... Five of Nine Sectors in Corrective Mode

.... XLY and XLK Lead Correction

.... Staples and Utilities Fall Hard

.... Finance and...

READ MORE

MEMBERS ONLY

Homebuilders March Higher - Customizing CandleGlance - Plus 2 Housing Stocks, 3 Biotechs, 3 Cyber Security Plays and 3 for the Road

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Home Builders Continue to March Higher

.... Customize your CandleGlance Charts

.... Caesarstone and USG May Play Catchup

.... High and Tight Flags for Two Biotechs (AMGN, GILD)

.... 3 Cyber Security Stocks (PANW, FTNT, PFPT)

.... Three Charts for the Road (DOX, WEN, VLKAY)

The Home Construction iShares (ITB) is one of the strongest...

READ MORE

MEMBERS ONLY

Goldman Goes for a Breakout $GS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Goldman Sachs (GS) appears to be ending its correction as it bounces off the rising 200-day moving average. The chart shows GS hitting a 52-week high in March and then declining into June. I consider this a correction because the stock was entitled to a pullback after a massive advance...

READ MORE

MEMBERS ONLY

A Bullish Failure Swing for RSI on XLE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) continues to firm after an extended decline and RSI could trigger a bullish signal this week. On the price chart, XLE shows signs of stabilization with an outside reversal five weeks ago and an inside week last week. Notice that XLE is firming near support from...

READ MORE

MEMBERS ONLY

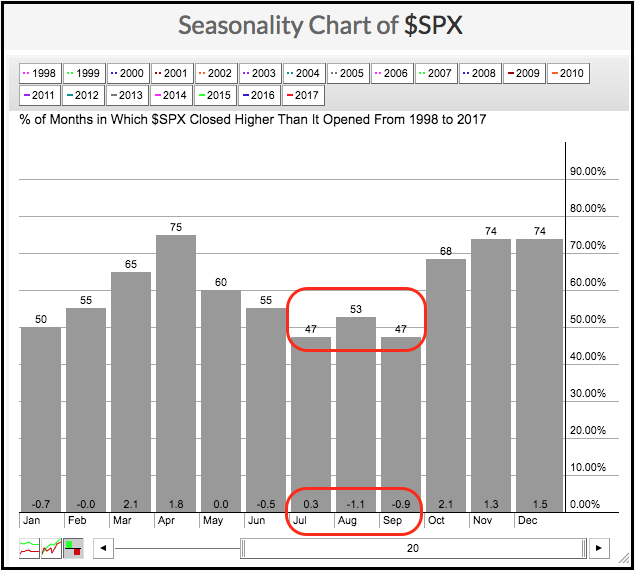

S&P 500 Seasonality and the Dog Days of Summer

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows the seasonal tendency for the S&P 500 over the last twenty years (1998 to 2017). The number at the top of each bar shows the percentage of months the S&P 500 advanced for that particular month, while the number at the bottom...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook - QQQ Starts Correction as SPY and IJR Hold Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Weekly Market Review & Outlook

.... SPY has Yet to Start a Correction

.... Small-caps Continue to Drift Higher

.... QQQ Forms Second Big Engulfing Pattern

.... S&P 500 Enters Weakest 3-month Stretch

.... So Does 10-yr Yield!

.... 10-yr T-Yield Bounces within Downtrend

.... TLT Forms Big Bearish Engulfing, but...

.... T-Bonds and the Dollar...

READ MORE

MEMBERS ONLY

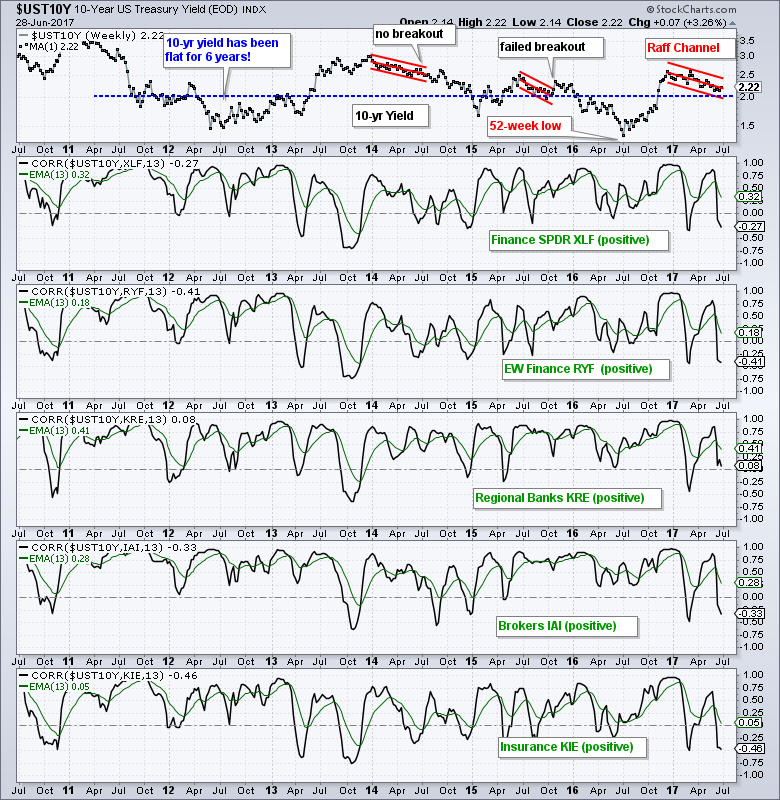

The Great Rate Debate - 4 Regional Banks and 3 Steel Stocks Bid to End Corrections

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... The Great Rate Debate

.... Correlations Do Not Reflect Magnitude

.... BB&T Takes Two Steps Forward and One Step Backward

.... Fifth Third, Huntington and PNC Financial

.... Three Steel Stocks on the Move ....

The Great Rate Debate

Are yields rising, falling or flat? This depends, as always, on your timeframe. Chartists...

READ MORE

MEMBERS ONLY

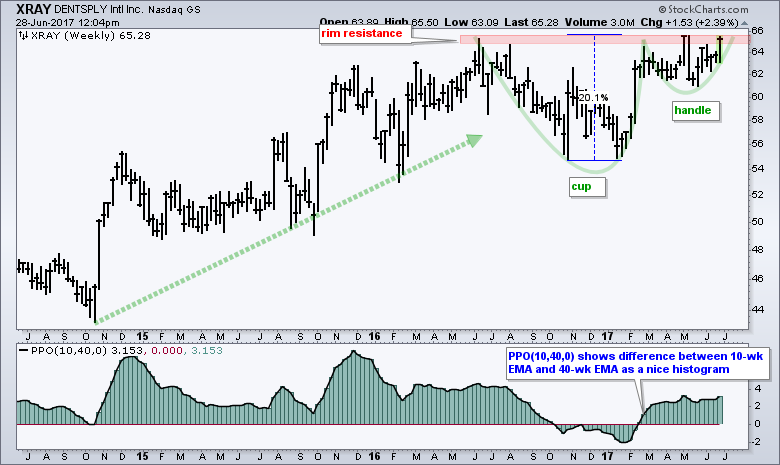

XRAY Traces Out a Classic Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Dentsply International (XRAY) has a large cup-with-handle pattern forming over the last twelve months and the stock is on the verge of breaking rim resistance. Popularized by William O'Neil of Investors Business Daily, the cup-with-handle is a bullish continuation pattern. This means it forms as a consolidation after...

READ MORE

MEMBERS ONLY

Bearish Candles Hit Big Tech Stocks - Plus two Brokers, Two Big Banks and More

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... QQQ and Facebook hit with Dark Clouds

.... Alphabet and Amazon Form Engulfing Patterns

.... AMAT Forms Bearish Pennant

.... A Feeble Bounce for Apple

.... Etrade and Schwab Stall after Breakouts

.... Citigroup Leads, but JP Morgan Shows Short-term Strength

.... Cypress Forms Engulfing within Correction ....

There were quite a few bearish candlestick patterns on...

READ MORE

MEMBERS ONLY

HCA Healthcare Bounces off Breakout Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

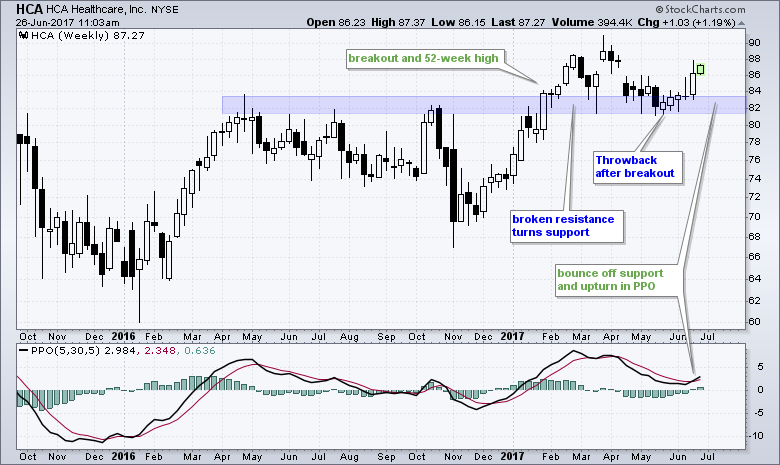

HCA Healthcare (HCA) is turning up at a key level and showing signs that the long-term uptrend is resuming. HCA is in a long-term uptrend because it broke out in January and recorded a 52-week high. This breakout zone turned into support around 82 as the stock fell back to...

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - Two of Nine Sector SPDRs Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... SPY Breaks out of Flag Pattern

.... QQQ Holds the Gap as IJR Forms Bull Flag

.... Industrials and Healthcare Lead with New Highs

.... Tech, Discretionary and Finance Lag a Bit

.... First Supports for Materials, Staples and Utilities

.... Energy - Enough Said

.... Tech ETF Bounce from Oversold Levels

.... Insurance and Regional Banks...

READ MORE

MEMBERS ONLY

ADRs, ETFs and Currency - Analysis for EEM, Poland, China, Italy and Spain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Vodafone in Dollars vs Pounds

.... Index versus ETF versus Currency

.... Emerging Markets ETF Hits Top of Channel

.... Poland ETF Stalls within Uptrend

.... China A-Shares ETF Breaks Out

.... Italy and Spain Consolidate Gains ....

Vodafone in Dollars vs Pounds

Today I will take a look at some international ETFs. Before looking at...

READ MORE

MEMBERS ONLY

MACD Histogram Teeters as AT&T Breaks Wedge Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

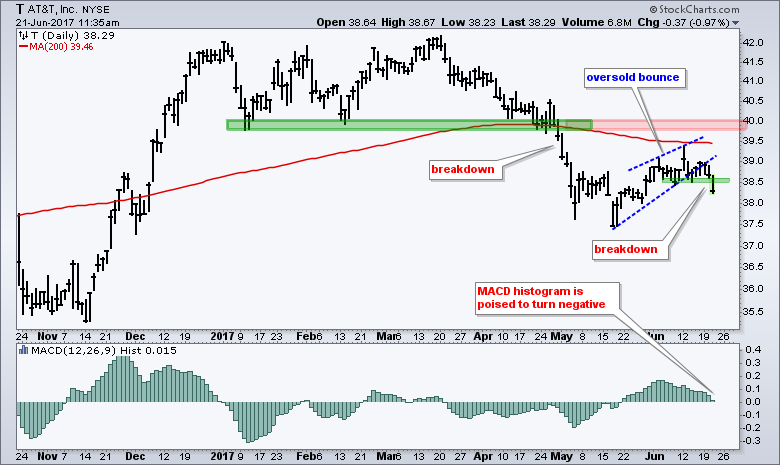

Despite a strong stock market in 2017, AT&T ($T) is having a tough time with a breakdown in early May and a sharp decline below the 200-day SMA. The stock rebounded after a double-digit decline with a bounce back to the 200-day SMA, which is now falling. Thus,...

READ MORE

MEMBERS ONLY

Market Shows Broad Strength, Techs Get Mojo Back, Bank ETFs Stall and 12 Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Big Techs Regain their Mojo

.... Finance, Healthcare, Industrials and Materials Lead

.... Short-term Yields Diverge from Long-term Yields

.... Bank ETFs Stall after Breakouts

.... Two Big Pharma Stocks: BMY and MRK

.... 3 Hospital Stocks: HCA, LPNT, THC

.... Four Networking Stocks: ARRS, CIEN, CSCO, FNSR

.... XRX Breaks Out, FEYE Forms Flag and RLGY...

READ MORE

MEMBERS ONLY

Breakout in Biotech SPDR Signals Trend Continuation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech SPDR (XBI) is starting to lead the market again with a consolidation breakout and 52-week high. The chart shows the ETF hitting an initial 52-week high in February and then consolidating for four months. It looks like this consolidation is ending and the bigger uptrend is resuming with...

READ MORE

MEMBERS ONLY

Charles Dow and Leonardo Fibonacci Walk into a Bar

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bar was 61.8 inches off the floor, but Leondardo still did not see it. All (bad) joking aside, I would like to look at corrections through the eyes of Charles Dow and Leonardo Fibonacci. These two may seem miles apart at first glance, but the numbers suggest otherwise....

READ MORE

MEMBERS ONLY

Weekly Market Review & Outlook (w/ Video) - New Highs for Major Index ETFs and New Sector Leadership

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* New Highs in Six Major index ETFs

* Index AD Lines Hit New Highs

* Mid-cap and Small-cap AD Volume Lines Lag

* SPY Forms High Flag as QQQ Tests Support

* IJR Leads for Four Weeks

* Finance and Materials Lead New High List

* Finance and Regional Bank SPDRs Hold Breakouts

* Chemicals Lead Materials...

READ MORE

MEMBERS ONLY

SystemTrader - Putting the VIX Through the Wringer and Testing Signals with SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

.... Does the VIX Add Any Value?

.... Setting the Benchmark

.... System Ground Rules

.... Consulting, Software and Data

.... Normalizing the VIX with the PPO

.... Testing Different PPO Extremes

.... Testing with the VIX PPO Histogram

.... Conclusions and Caveat Emptor ....

Does the VIX Add Any Value?

The S&P 500 Volatility Index ($VIX)...

READ MORE

MEMBERS ONLY

Celgene Holds Breakout Zone and Turns Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Celgene (CELG) is a large biotech stock that is part of the Biotech iShares (IBB) and the Biotech SPDR (XBI). Overall, I would suggest that the long-term trend is up because the stock hit a 52-week high in mid-March and the 50-day EMA is above the rising 200-day EMA. The...

READ MORE