MEMBERS ONLY

Airline Index Perks Up with a Reversal Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Airline Index ($XAL) has been a real dog in 2015, but the index is showing signs of support and a double bottom could be emerging. The chart below shows $XAL peaking in January and moving lower the last six months. The 10-day EMA is below the 100-day EMA and...

READ MORE

MEMBERS ONLY

IWM Tests the Gap and RGI Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were weak across the board with the Dow Industrials leading the way lower. Big declines in IBM and UTX weighed on the senior Average. Both stocks are above $100 and the Dow is a price weighted average. This means the stocks with the highest price carry the most weight....

READ MORE

MEMBERS ONLY

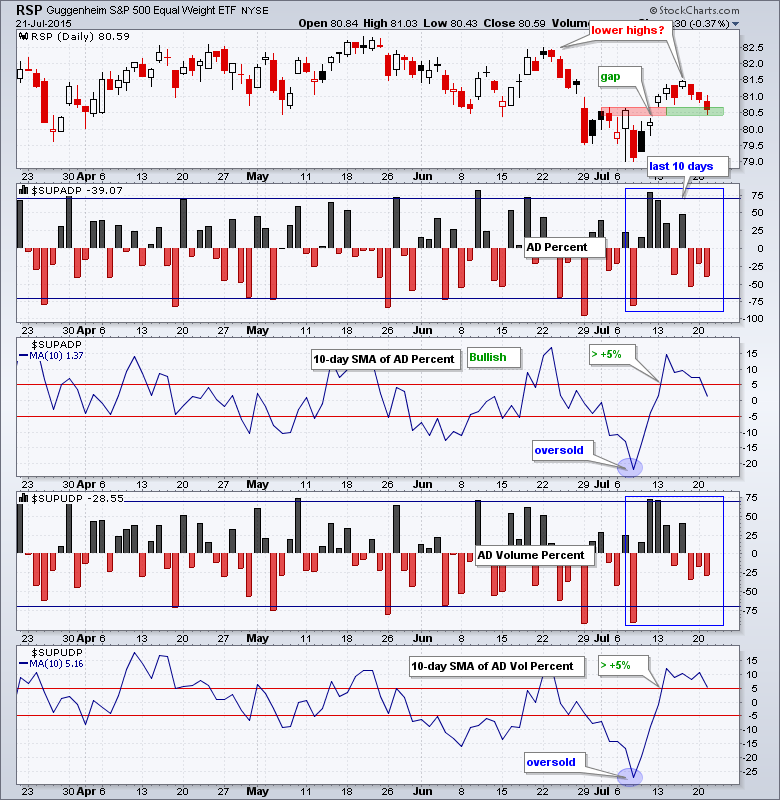

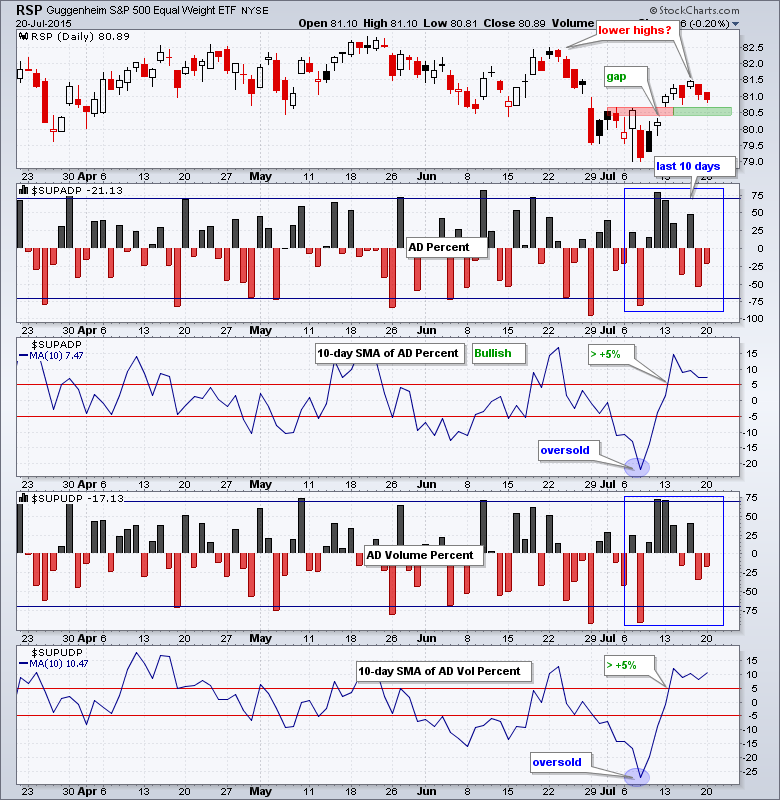

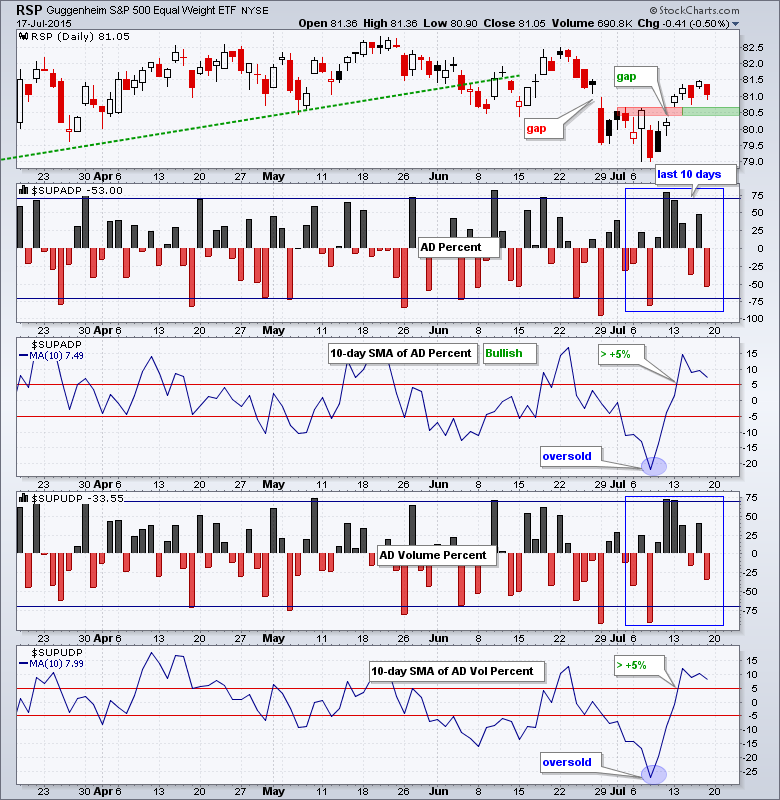

IWM and RSP Lag, USO and GLD Extend Downtrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Monday with small gains and small losses in the major index ETFs. DIA and QQQ edged higher, while IWM and MDY edged lower. Small-caps and mid-caps continue to show relative weakness. Note that QQQ hit a new high and SPY is challenging its May high, but...

READ MORE

MEMBERS ONLY

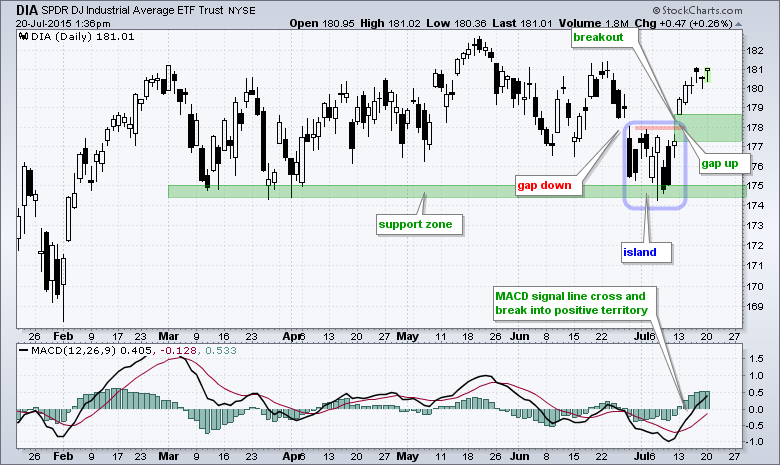

An Island Reversal for DIA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap and big surge, the Dow Diamonds (DIA) triggered a series of bullish signals that remain valid until proven otherwise. First, let's look at the bullish signals. DIA bounced off support in the 174-175 area in early July and broke resistance with a surge above 178....

READ MORE

MEMBERS ONLY

QQQ Leads, IWM Lags, USO and GLD Extend Downtrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged last week with a rather lopsided advance. QQQ surged over 5% and SPY was up around 2.45%. IWM lagged with a 1.31% gain and MDY gained just .35%. Small-caps and mid-caps lagged as large-caps led. Among the sectors, technology and healthcare led as energy and materials...

READ MORE

MEMBERS ONLY

Home Construction ETF Leads and Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

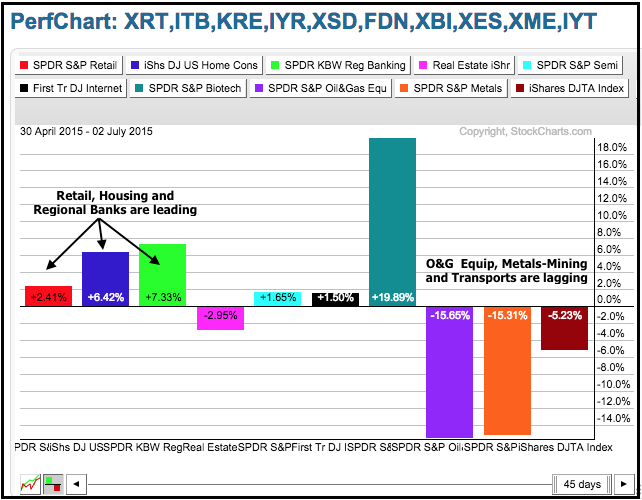

The mixed performance of ten key industry group ETFs reflects the flat performance in the S&P 500 since early May. Note that the S&P 500 is virtually unchanged since April 30. As the PerfChart below shows, six of the industry group ETFs are up and four...

READ MORE

MEMBERS ONLY

QQQ is Stymied by Performance Split and 3 Consolidations Hold the Key

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

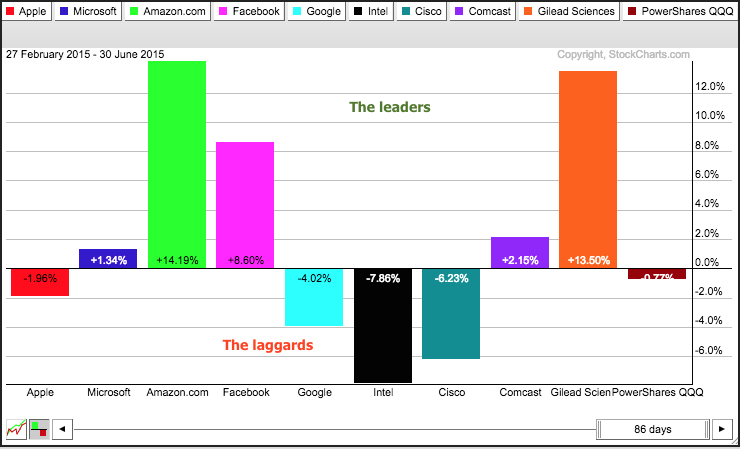

A look at performance for the top holdings in the Nasdaq 100 ETF (QQQ) explains a lot about performance since March. The PerfChart below shows the percentage change for QQQ and its top nine holdings. Note that this chart does not include Wednesday's price data, which is still...

READ MORE

MEMBERS ONLY

QQQ and IWM Firm at Support and USO Trends Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks managed to firm after Monday's rout and several ETFs formed inside days, which signal indecision. The Russell 2000 Growth iShares (IWO) and Russell MicroCap iShares (IWC) led the rebound and gained around .90% each. The sectors were mixed with energy, consumer discretionary and finance finishing with modest...

READ MORE

MEMBERS ONLY

SPY and QQQ Break Support, Euro Holds Firm, Bonds Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

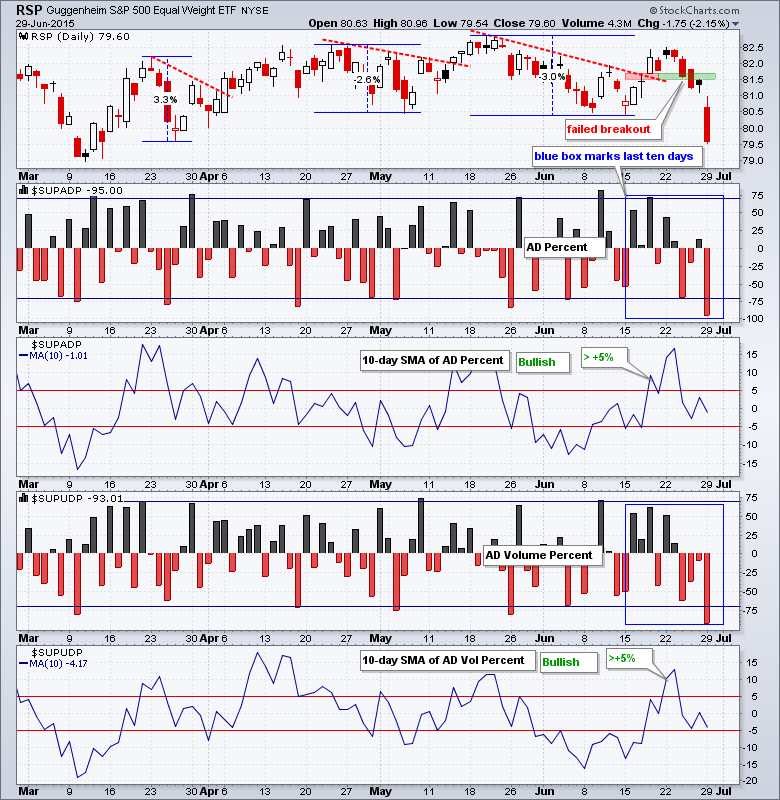

Stocks were hit with broad selling pressure as the major index ETFs fell sharply and all sectors moved lower. The declines in the major index ETFs were pretty even with each losing around 2%. DIA held up the best with a 1.95% decline and IJR fared the worst with...

READ MORE

MEMBERS ONLY

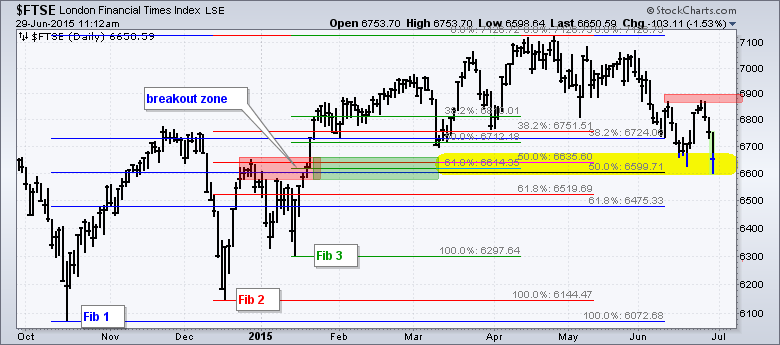

FTSE Hits Fibonacci Cluster Zone and LLoyds Forms Bull Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today's post is for our UK traders because it focuses on the FTSE and three of the biggest banks in the UK. Shares in Europe were sharply lower in early trading on Monday with the German DAX Index ($DAX) and French CAC Index ($CAC) losing around 3%. The...

READ MORE

MEMBERS ONLY

SPY and QQQ Reverse within Trading Ranges - UUP Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Last week was almost the week that wasn't. There wasn't much change in the major index ETFs and there was no solution for Greece. There were some other significant moves though. The Home Construction iShares (ITB) and the Regional Bank SPDR (KRE) had a good week...

READ MORE

MEMBERS ONLY

SPY Forms Lower High, USO Flags Lower and UUP Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 surged on Monday morning with a move from 2110 to 2130. That was it for the buying pressure. The index peaked late Morning on Monday and fell the next three and a half days. $SPX closed near 2102.5 on Thursday and is down slightly...

READ MORE

MEMBERS ONLY

SPY Tests Breakout, USO Flags and GLD Channels Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak and closed with with the S&P 500 losing around .74% on the day. Selling pressure was contained, but across the board as all sectors declined and most industry-group ETFs lost ground. The Materials SPDR (XLB) led the sectors lower with a 1.27% decline. It...

READ MORE

MEMBERS ONLY

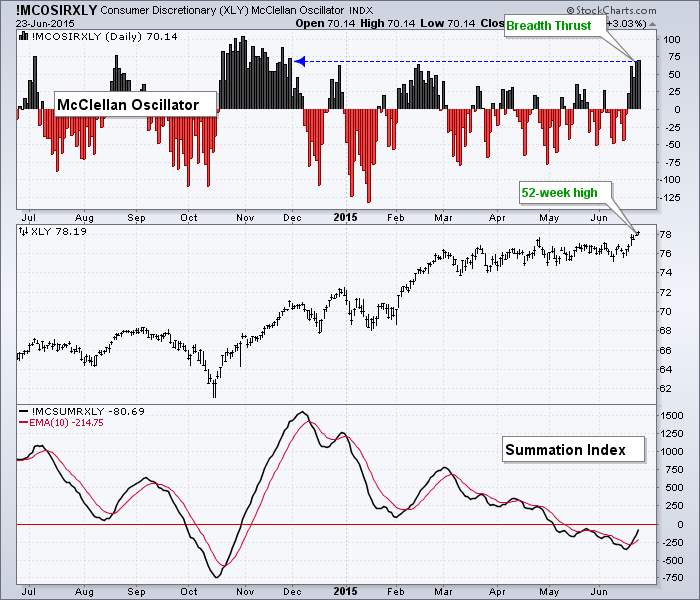

A Classic Sector Breadth Oscillator Surges to Highest Level of 2015

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

StockCharts users have access to the McClellan Oscillators and Summation Indices for the nine sector SDDRs and the major stock indices. Before showing how to find these symbols, let's take a look at the McClellan Oscillator and McClellan Summation Index for the Consumer Discretionary SPDR (XLY). The chart...

READ MORE

MEMBERS ONLY

UUP Surges to Resistance - USO Forms Smaller Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

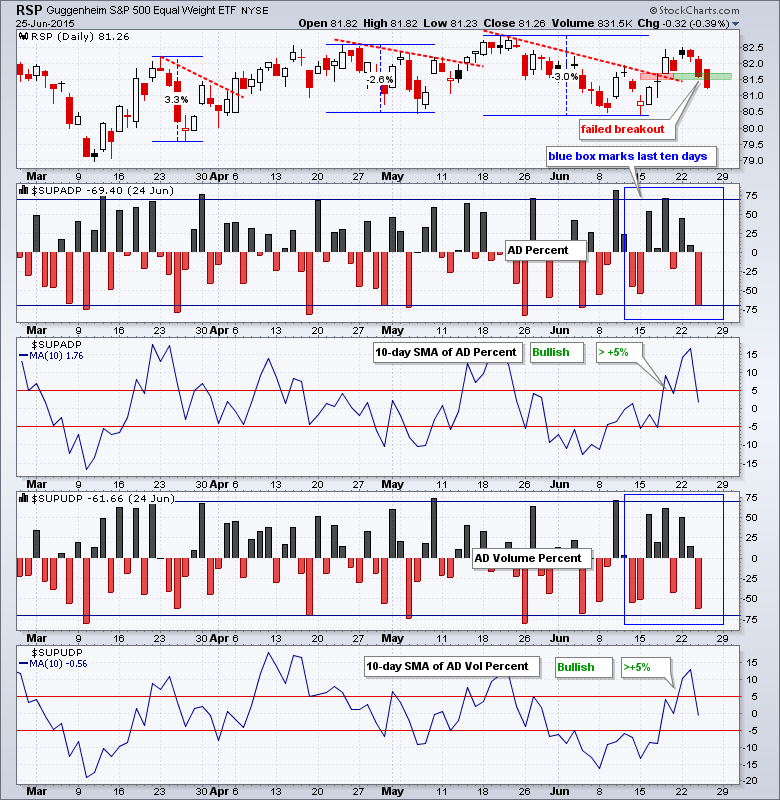

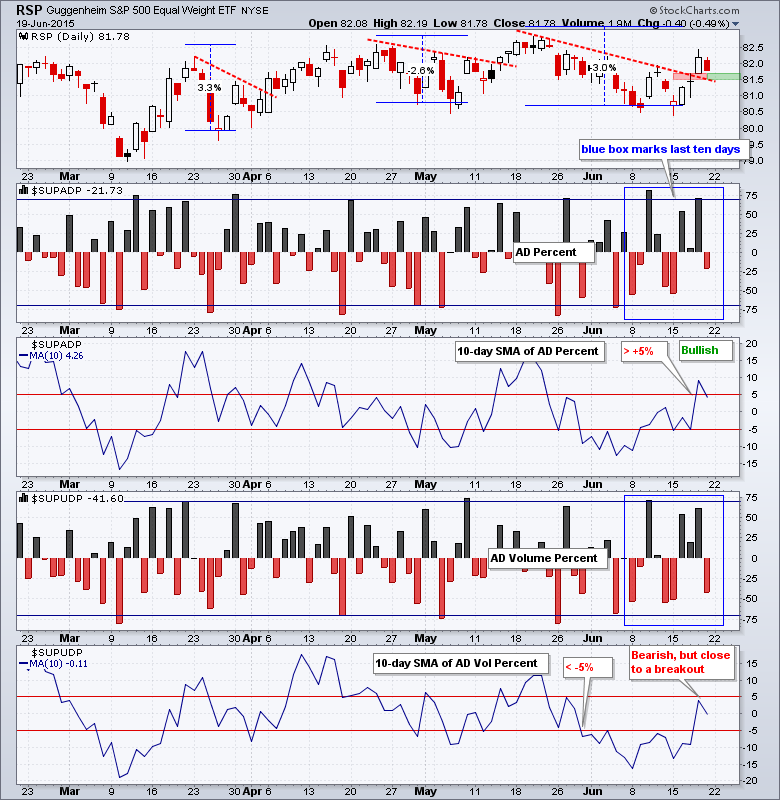

Stocks meandered on Tuesday with the major index ETFs finishing mixed. The Nasdaq 100 Equal-Weight ETF (QQEW) and Equal-Weight S&P 500 ETF (RSP) edged lower, while the Nasdaq 100 ETF (QQQ) and S&P 500 SPDR (SPY) edged higher. The sectors were also mixed with weakness in...

READ MORE

MEMBERS ONLY

IWM Hits Another New High - GLD Fails to Hold Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged out of the gate and then settled into a trading range the rest of the day. The gains were modest, but they held with QQQ and IWM leading the way. Note that the Nasdaq and Russell 2000 both hit new highs again on Monday. It is hard to...

READ MORE

MEMBERS ONLY

Vertex Goes for a Continuation Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Vertex (VRTX) is part of the healthcare sector, which is one of the strongest sectors in the market. It is also part of the biotech industry, which is one of the strongest industry groups in the healthcare sector. This puts strong sector and industry group performance in its favor. On...

READ MORE

MEMBERS ONLY

IWM Leads as USO and UUP Trend Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There sure was a lot of noise last week, but this noise was not enough to affect small-caps and techs. The Russell 2000 and Nasdaq hit new highs and this is bullish for the market overall. Despite a mixed week, the Russell 2000 iShares (IWM) and the Nasdaq 100 Equal-Weight...

READ MORE

MEMBERS ONLY

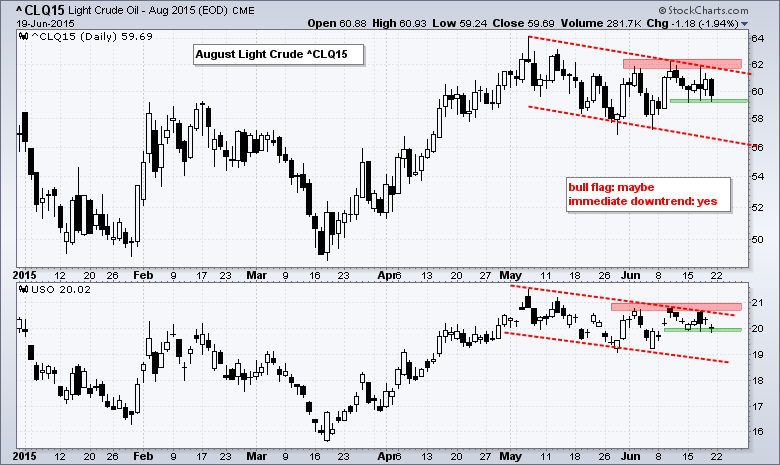

Flags Fall for Light Crude and Brent

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil surged in early June and looked poised to break flag resistance. A little follow through last week was all that was needed. US stocks did their part as the Russell 2000 and Nasdaq hit new highs. The Dollar did its part as the US Dollar Index fell 2.8%...

READ MORE

MEMBERS ONLY

IWM Leads with New High - USO Remains Subdued - GLD Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged with the major index ETFs gaining over 1% on the day. IWM and QQQ led with 1.5% advances. DIA and SPY gained around 1%. Eight of the nine sectors were up with solid gains coming from consumer discretionary, finance and healthcare. Energy lagged as oil remained in...

READ MORE

MEMBERS ONLY

IWM Leads with Higher High - USO Trends Lower with Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Wednesday with QQQ and SPY posting small gains, and IWM and MDY posting small losses. The sectors were mixed with small gains coming in consumer discretionary, materials and consumer staples. The beaten down utilities sector got the biggest bounce, but it remains in a downtrend overall....

READ MORE

MEMBERS ONLY

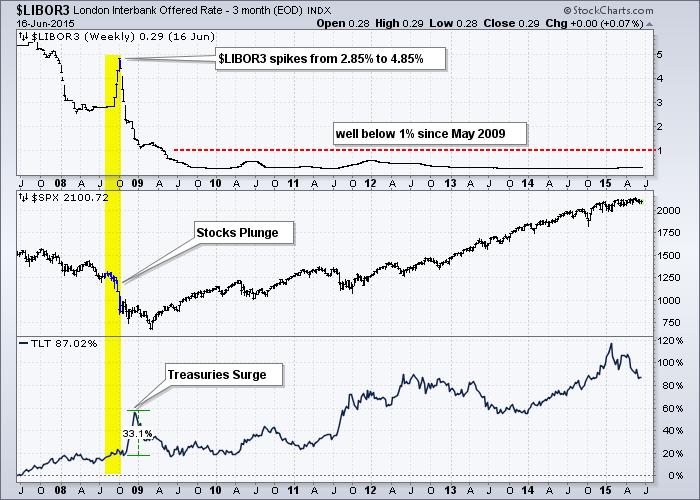

A Key Gauge to Watch for Signs of Contagion

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Many of us remember the financial crisis in 2008 when Lehman collapsed and the credit markets froze. The S&P 500 plunged some 40% and the 20+ YR T-Bond ETF (TLT) surged over 30% in a flight to quality. This was a true financial crisis and the markets reflected...

READ MORE

MEMBERS ONLY

IWM Continues to Lead, SPY Fills One Gap, UUP Turns Quiet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

June has been anything but dull for the stock market, on a short-term basis at least. SPY sports three swings of at least 2% over the last ten days. After gapping down on Monday, stocks firmed and rallied from Monday morning to Tuesday afternoon. Tuesday's bounce was enough...

READ MORE

MEMBERS ONLY

SPY Gaps for Fourth Time, QQQ Tests Support, USO Challenges Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened sharply lower, bounced a bit and then traded flat the rest of the day. The major index ETFs spent the entire day in negative territory and closed with modest losses. Dow futures are down around 100 points at 4:30AM ET on reports that Greece will not submit...

READ MORE

MEMBERS ONLY

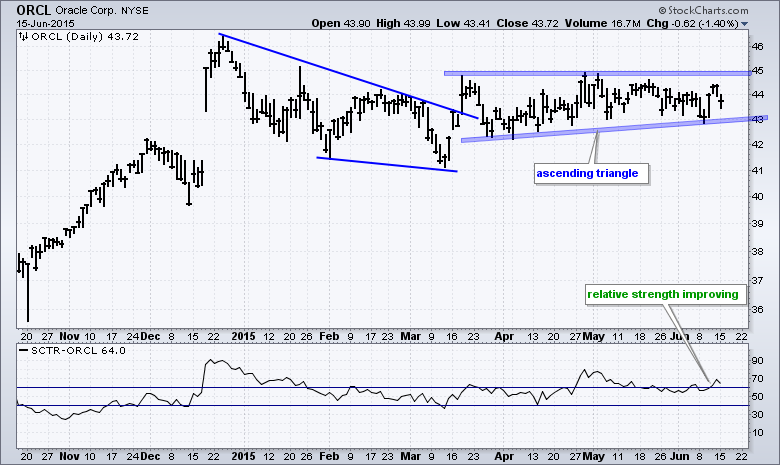

The Golden State Trade with Oracle and Under Armour

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Two stocks associated with the Golden State Warriors are showing promise as Step Curry leads his team to a 3-2 lead in the series. The Warriors play in the Oracle Arena and Oracle (ORCL) is making waves with an ascending triangle. Admittedly, the pattern is a little long and the...

READ MORE

MEMBERS ONLY

QQQ Triangulates, IWM Leads, USO Challenges Bull Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved up at the beginning of the week and down towards the end of the week. The end result was mixed for the major index ETFs as QQQ fell around .50% and IWM gained .42%. The sectors were mixed with finance showing strength and energy showing weakness. Strength in...

READ MORE

MEMBERS ONLY

SPY Stalls at Resistance - USO Hits Flag Trend Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were flat on Thursday as the market digested Wednesday's big gain. The major index ETFs closed slightly higher with IWM gaining .25% and MDY leading with a .60% advance. The sectors were mixed with modest gains in industrials, materials and healthcare. Energy weakened as the USO Oil...

READ MORE

MEMBERS ONLY

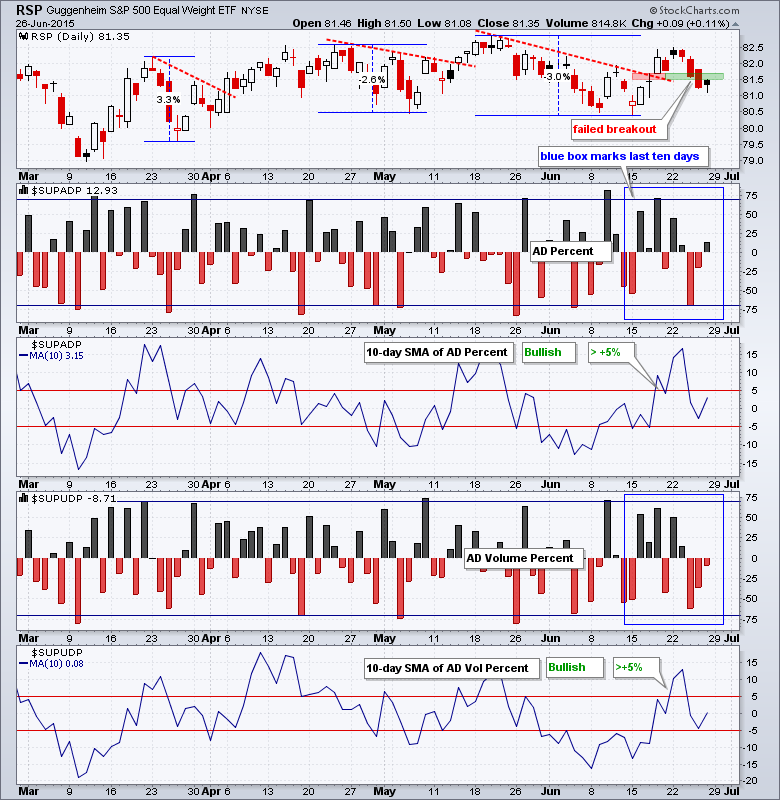

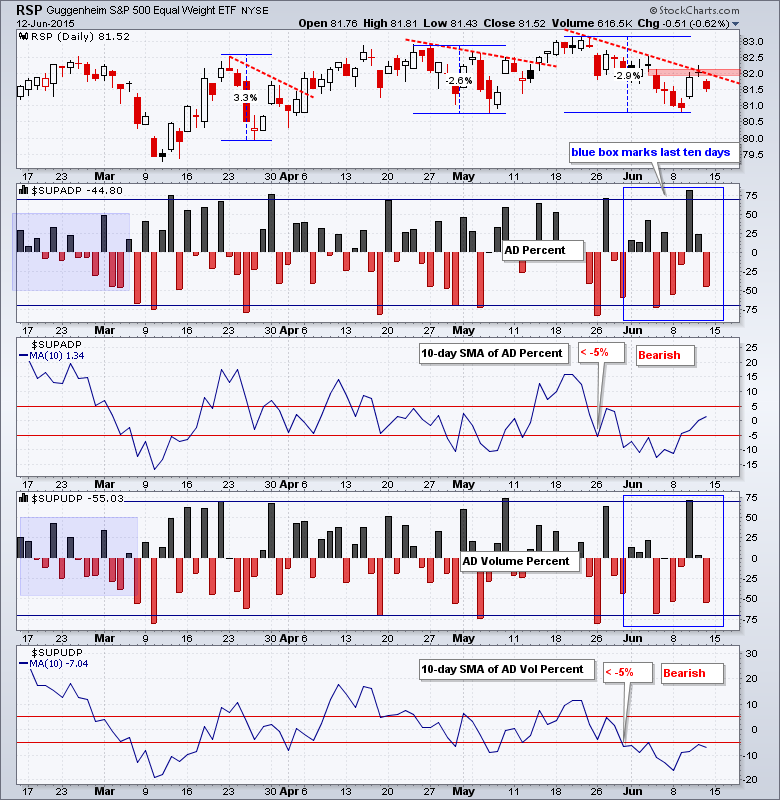

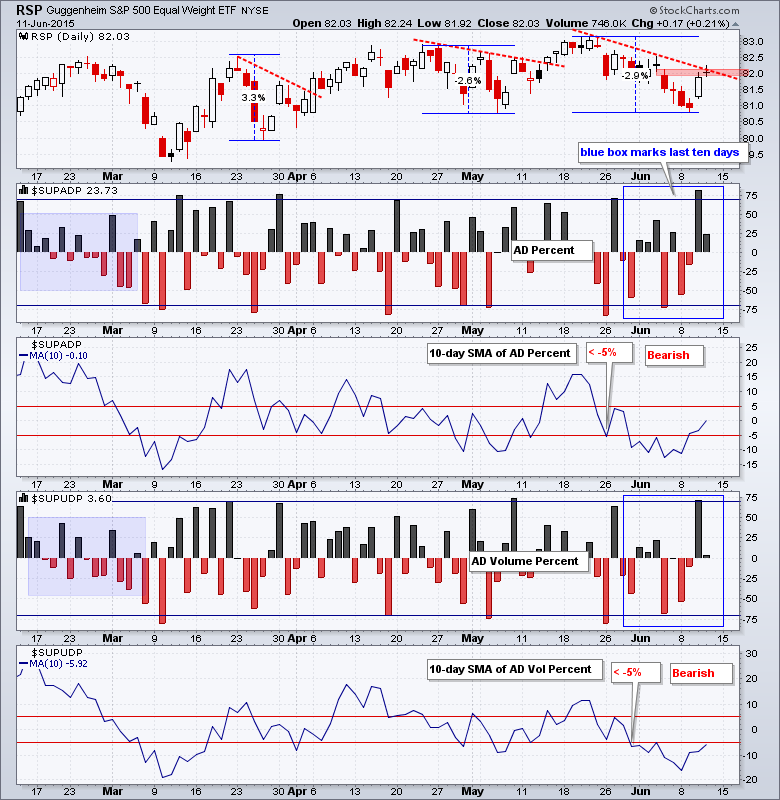

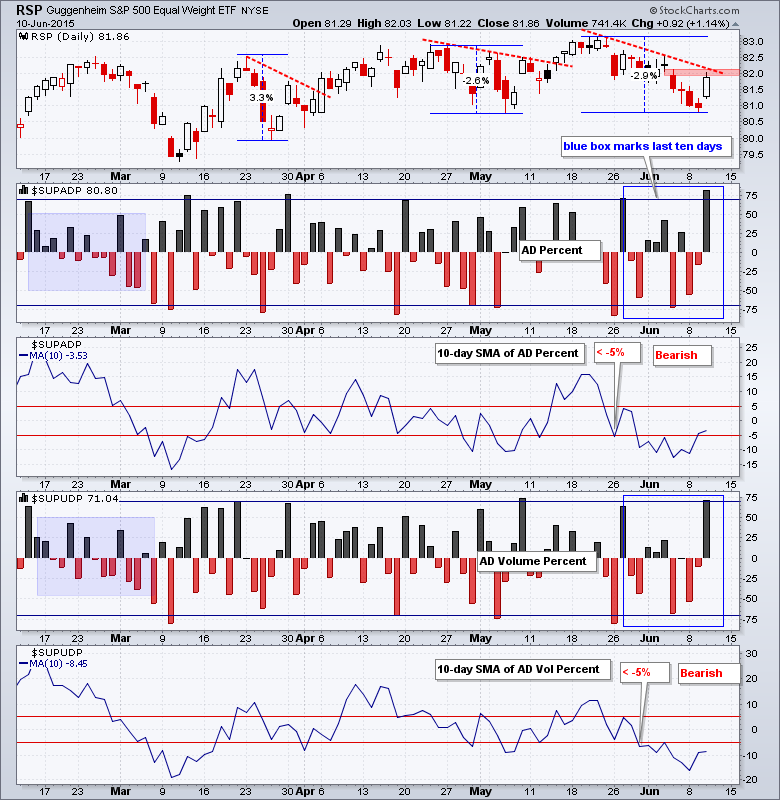

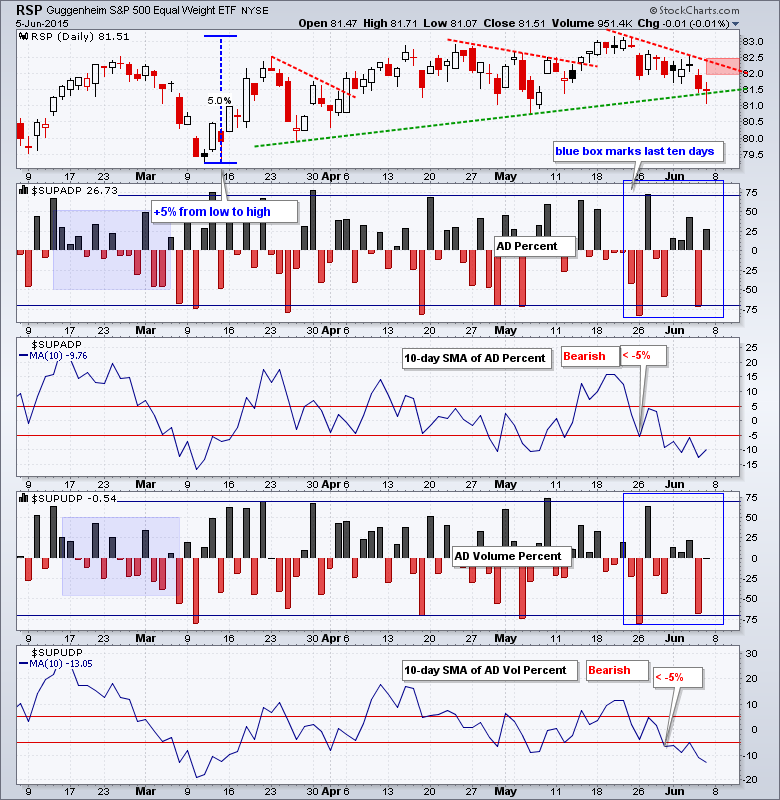

A Breadth Up Thrust - IWM Leads - USO Challenges Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

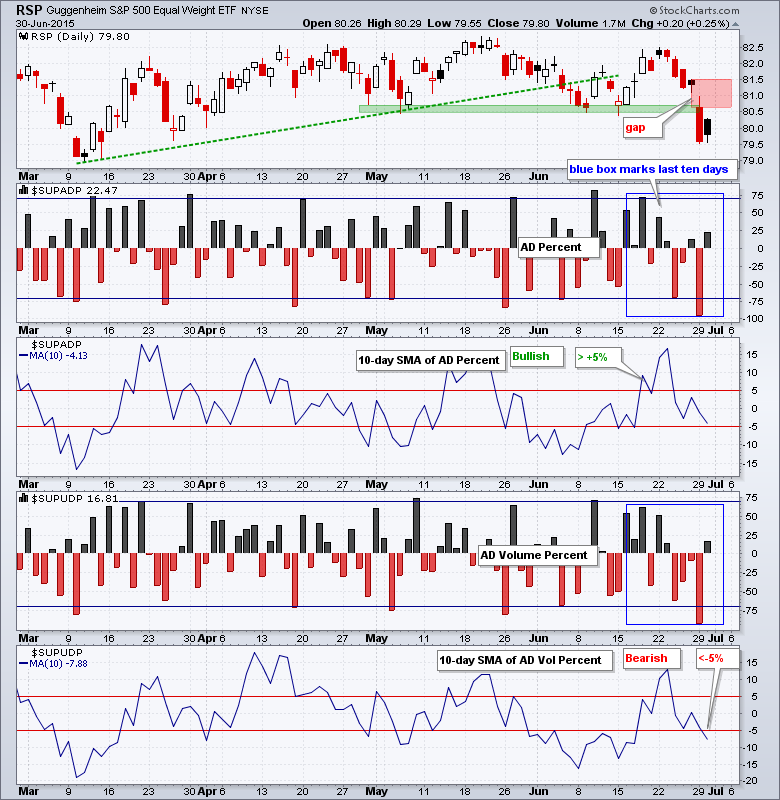

Stocks surged with the major index ETFs opening strong and finishing strong. We did not see a pop and drop, and this is positive. The gains were relatively even with IWM gaining 1.25%, QQQ advancing 1.37% and SPY surging 1.20%. All sectors were up with technology and...

READ MORE

MEMBERS ONLY

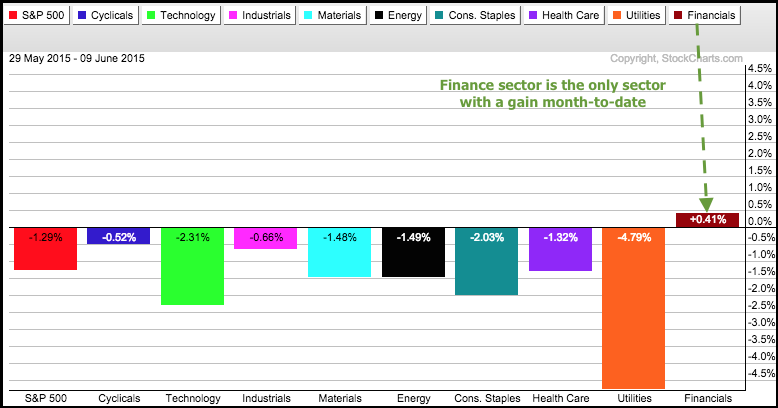

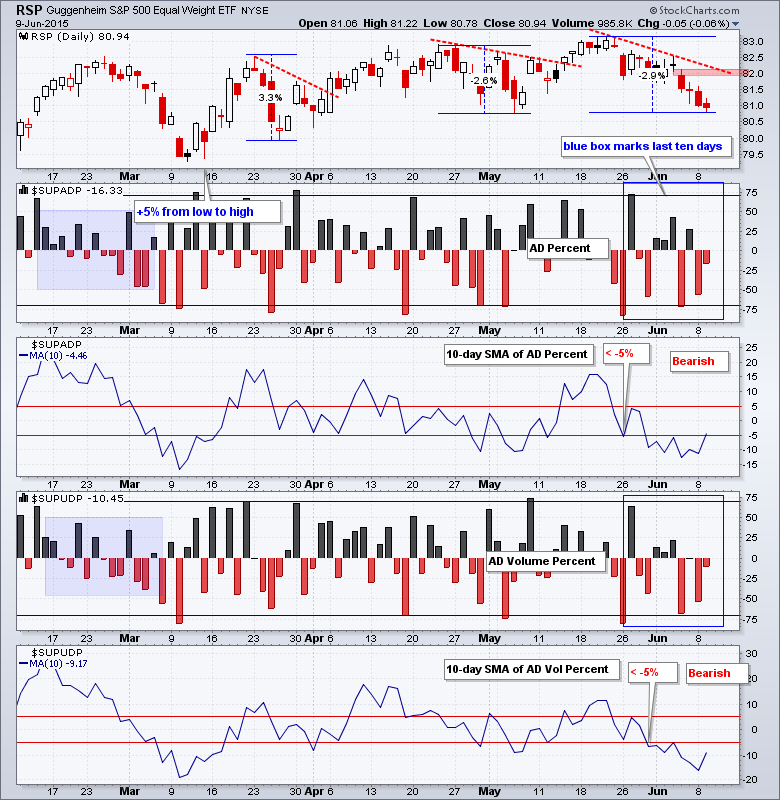

Only One of the Nine Sector SPDRs is up this Month

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Eight of the nine sector SPDRs are down month-to-date and the S&P 500 SPDR (SPY) is also down (as of the 9-June close). One sector, however, is bucking the trend with a small gain. The Finance SPDR (XLF) is up around a half percent and easily outperforming the...

READ MORE

MEMBERS ONLY

SPY Downtrend Gets Oversold - IWM Triangulates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading was rather quiet on Tuesday as the S&P 500 dipped in early trading, rebounded into positive territory by noon and then traded flat. The major index ETFs finished flat with fractional losses in IWM (-.30%) and SPY (-.01%). The sectors were mixed with small gains...

READ MORE

MEMBERS ONLY

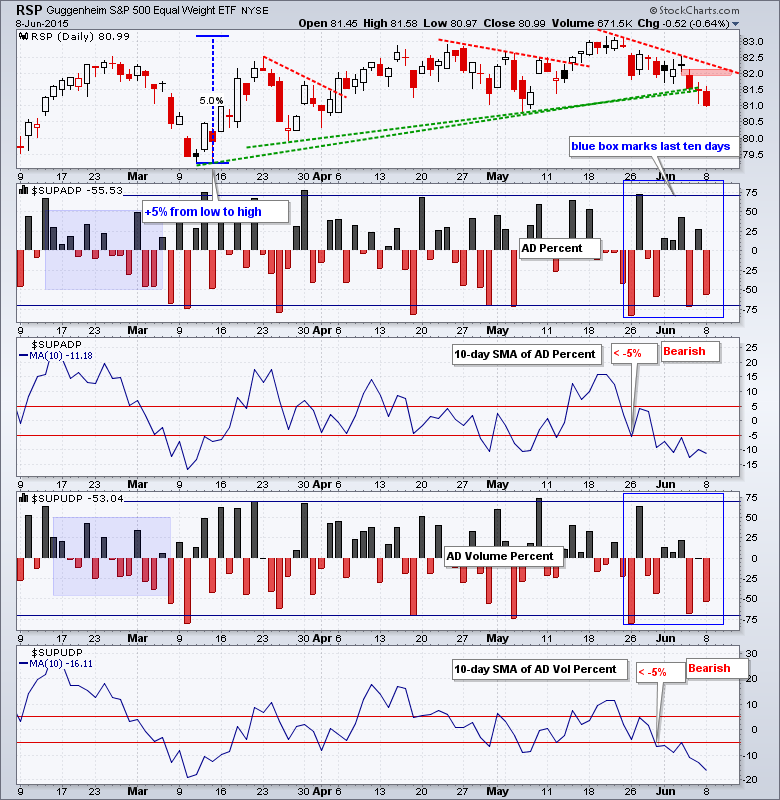

Sector Balance Tilts to the Bears - IWM Holds Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak and remained weak as the S&P 500 extended its two week slide. This slide started with the gap down on Tuesday, May 26th, the day after Memorial Day. Tech stocks led the way lower as QQQ lost around 1%. Small-caps held up relatively well as...

READ MORE

MEMBERS ONLY

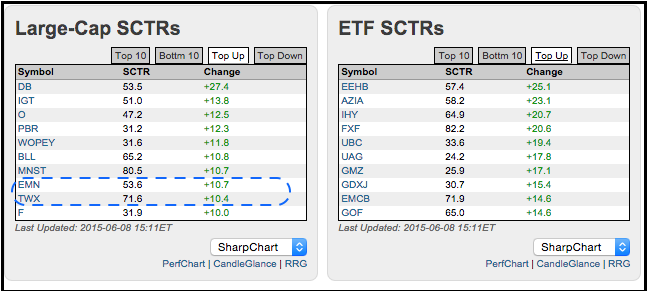

Time Warner and Eastman Chemical Lead SCTR Gainers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists looking for the "relative strength" movers and shakers of the day can focus on the stocks and ETFs with the biggest changes in their StockCharts Technical Rank (SCTR). Small tables can be found in the bottom half of the home page and full listings can be found...

READ MORE

MEMBERS ONLY

Market Remains Very Mixed - Small-Caps and Mid-Caps Lead Though

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed most of the week and the major index ETFs finished mixed. The S&P 500 SPDR (SPY) and Nasdaq 100 ETF (QQQ) edged lower, while the Russell 2000 iShares (IWM), S&P MidCap SPDR (MDY) and S&P SmallCap iShares (IJR) closed modestly higher...

READ MORE

MEMBERS ONLY

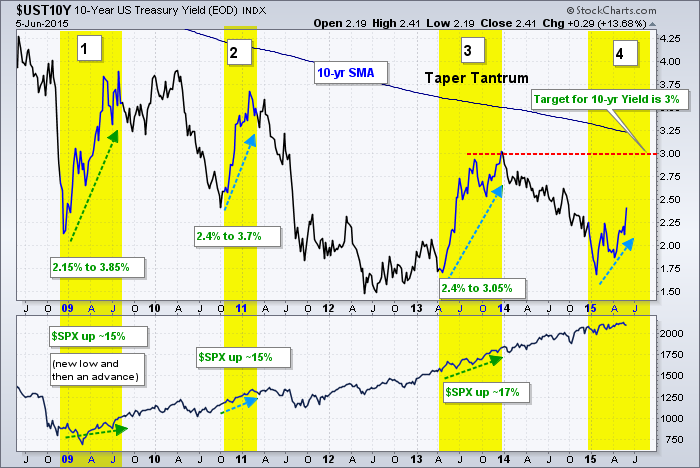

Should the Stock Market Worry about Rising Rates?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There have been four big surges in the 10-year Treasury Yield since the bull market for the S&P 500 began in 2009. These big moves certainly sent shock waves through the bond market, but the stock market was not rattled because the S&P 500 produced double...

READ MORE

MEMBERS ONLY

QQQ forms Cup with Handle - Oil Fails to Hold Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks just couldn't bear the pressure any longer and sold off on Thursday. The S&P 500 opened weak and finished weak for a .86% decline on the day. Overall, the decline is not that big and the index is still less than 2% from an all...

READ MORE

MEMBERS ONLY

Small-caps Lead as IWM Breaks Out - UUP Hits Moment of Truth

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks chopped around again on Wednesday, but managed to hold their early gains and close positive. The S&P 500 surged to 2121 in the first hour, fell back to 2112 around lunchtime and then finished at 2114 for a small gain. The Russell 2000 iShares (IWM) and the...

READ MORE

MEMBERS ONLY

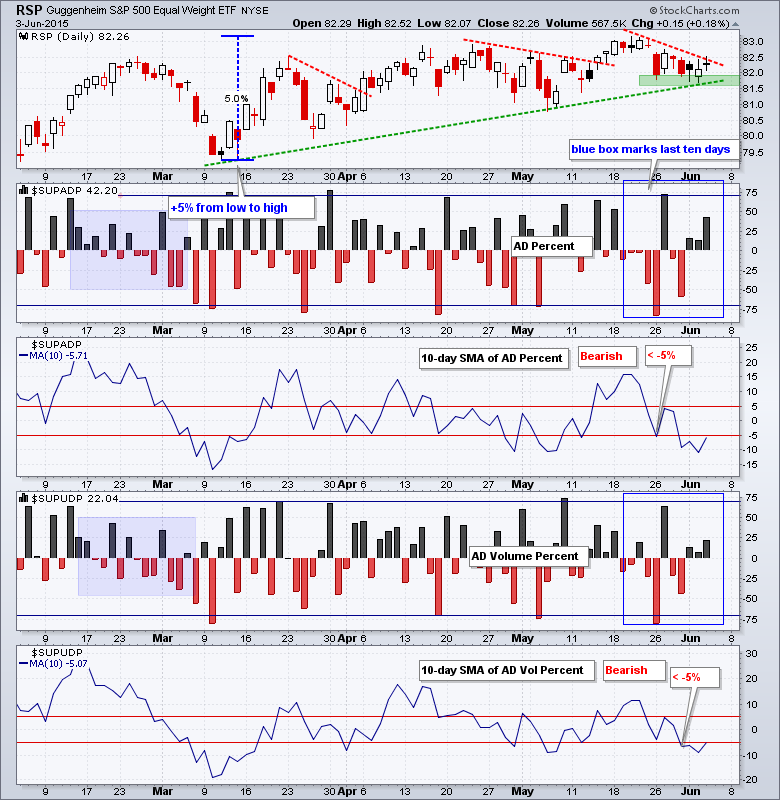

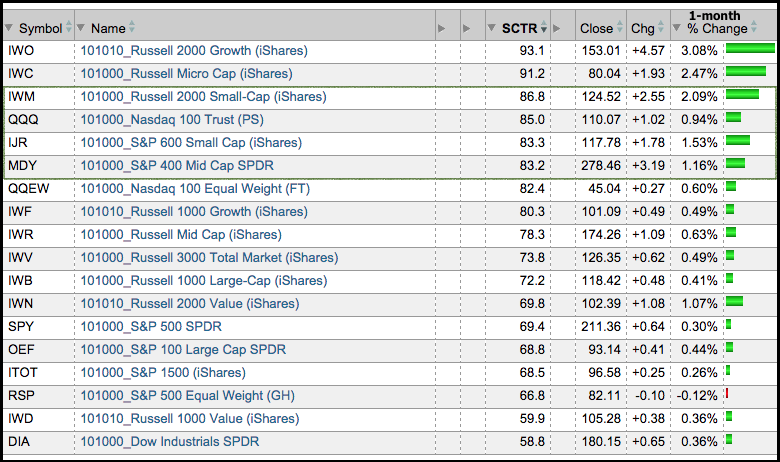

Don't Look Now, but Small-cap SCTRs are Leading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

May was a strong month for big tech stocks, small caps and mid caps. It was such a big month that the Russell 2000 iShares, S&P SmallCap iShares and S&P MidCap SPDR are in the top third of the SCTR table below. Notice that the Russell...

READ MORE

MEMBERS ONLY

Oil Gets a Break, IWM Perks Up and Bonds Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks chopped around again on Tuesday with the S&P 500 falling to 2100 on the open, bouncing back to 2117 in the early afternoon and settling around 2110 by the close. Overall, the major index ETFs ended the day mixed. DIA and QQQ edged lower, while IWM and...

READ MORE

MEMBERS ONLY

Three of Five Sectors in Short-term Downtrends - SPY Triangulates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks chopped around on Monday with the S&P 500 trading in an 18 point range the entire day. The major index ETFs finished with small gains led by the Russell MicroCap iShares (+.40%). The sectors were mixed with energy, materials and consumer staples showing some weakness. Healthcare, industrials...

READ MORE

MEMBERS ONLY

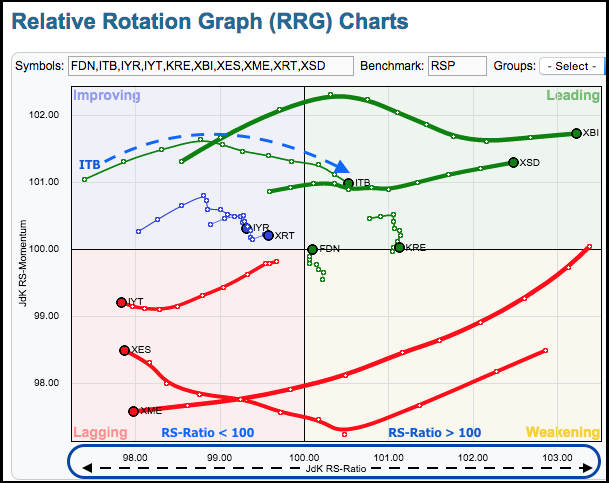

Home Construction ETF Moves Into Leading RRG Quadrant

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction iShares (ITB) is showing some improvement in relative performance with a move from the improving quadrant to the leading quadrant over the last few days. The image below shows a daily Relative Rotation Graph (RRG) with ten industry group ETFs and the Equal-Weight S&P 500...

READ MORE