MEMBERS ONLY

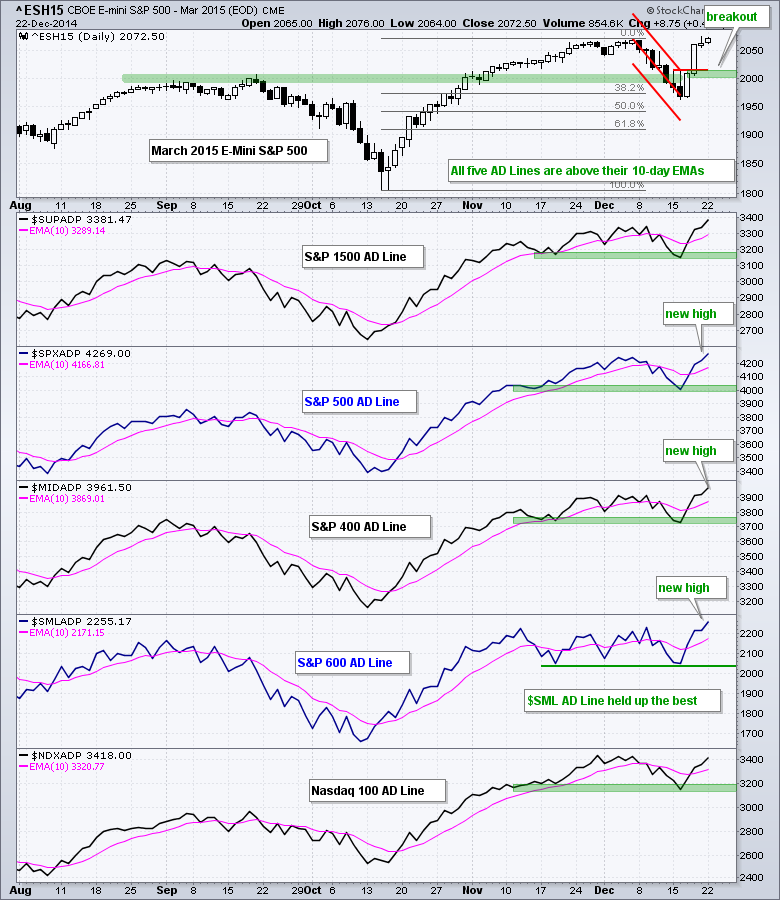

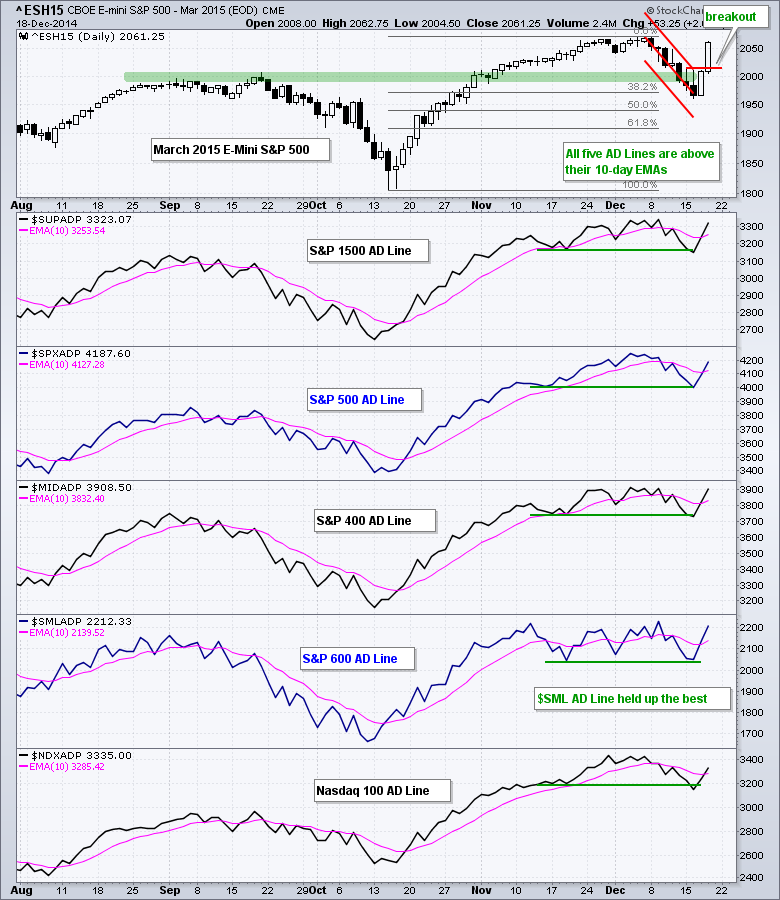

Four AD Lines Hit New Highs - GLD Breaks Down Further

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming note: I will be taking off the rest of the week and Art's Charts will return on Monday, December 29th. Have a great Christmas holiday! It was a mixed day on Wall Street with QQQ closing fractionally higher and IWM closing fractionally lower. Energy and healthcare led...

READ MORE

MEMBERS ONLY

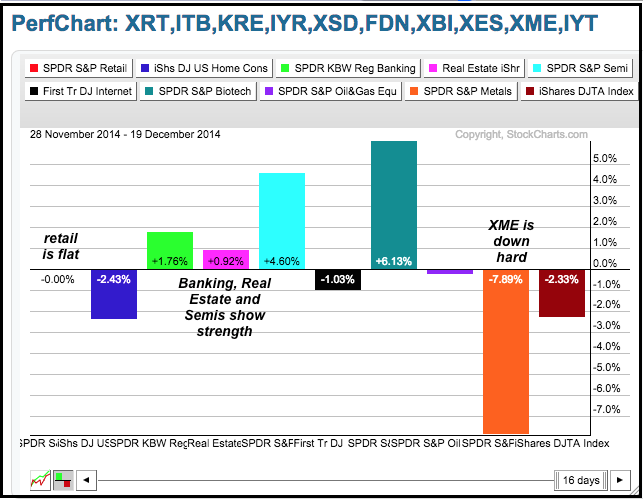

Three Leading Industry Group ETFs for December

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

December has been one mixed up month. The Nasdaq 100 ETF (QQQ) is down around 1.1%, the Russell 2000 iShares (IWM) is up around 2% and the S&P 500 SPDR (SPY) is up .30%. We can also see mixed results when looking at the Performance for 10...

READ MORE

MEMBERS ONLY

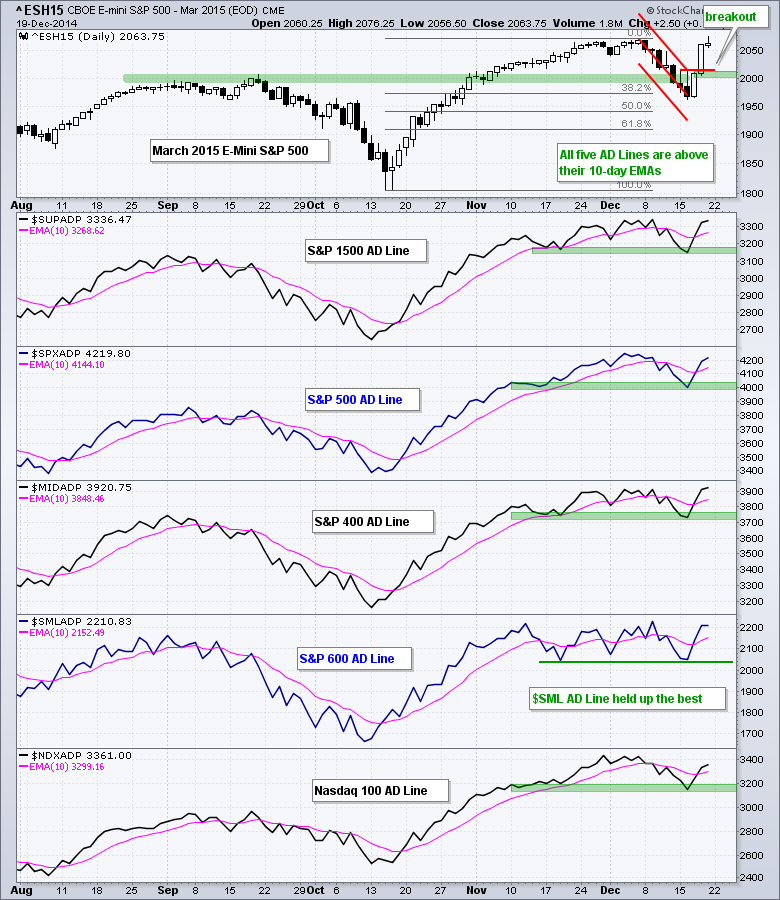

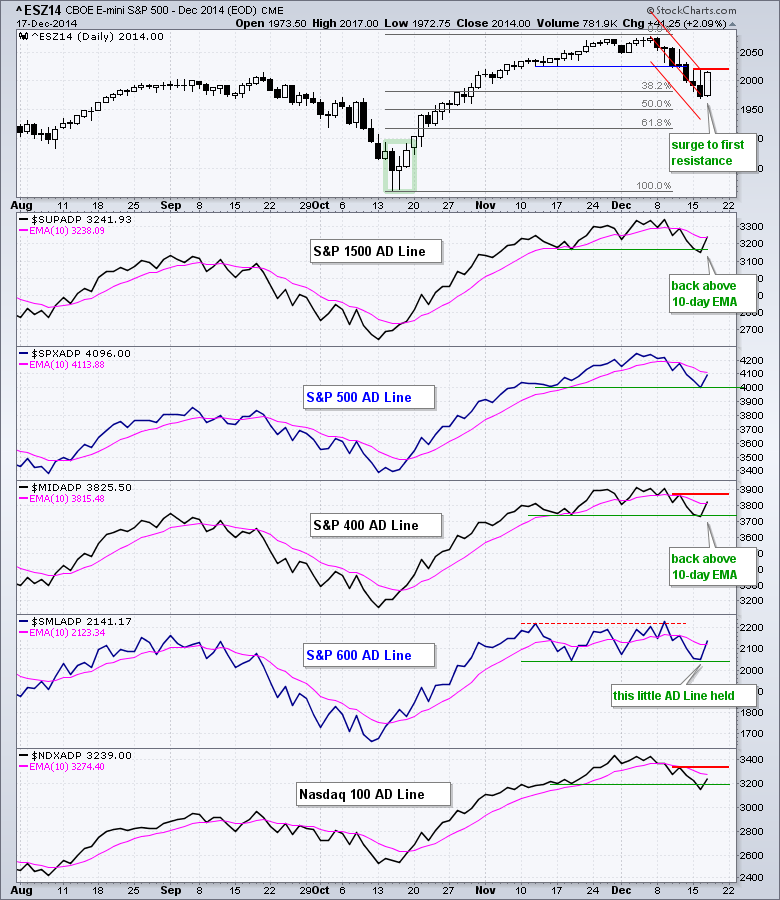

MidCap AD Line Leads - GLD Holds Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the week with selling pressure, but the bulls found their footing on Wednesday and produced a strong two-day surge. The Russell 2000 iShares (+3.65%) and Russell MicroCap iShares (+4.09%) led the charge and both have been outperforming the S&P 500 SPDR (SPY) this month....

READ MORE

MEMBERS ONLY

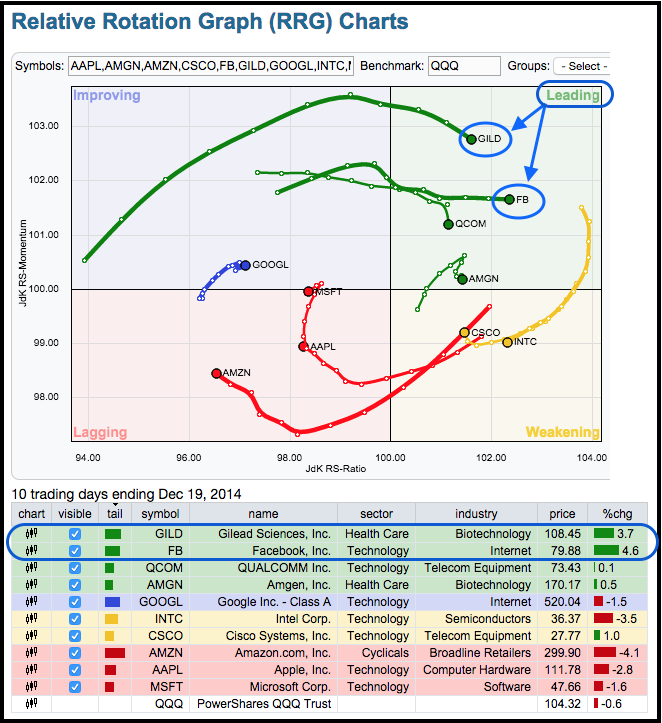

Two Nasdaq 100 Stocks With RS and Bullish Price Action

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can improve their odds by looking for stocks that show relative strength and bullish price action. It is a two-pronged approach that has stood the test of time. I use relative strength to narrow the field and then look for charts with bullish signals. The first image shows a...

READ MORE

MEMBERS ONLY

QQQ and SPY Gap thru Resistance - TLT Tumbles

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued higher with a broad advance that lifted most boats - again. The two-day surge in SPY is the biggest since 2011 and the two day decline in TLT is the largest since November 2013. Clearly, money moved out of the Treasury market and found its way into the...

READ MORE

MEMBERS ONLY

Small-Caps Lead Broad Market Advance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved sharply higher with a broad advance that lifted most boats. The Russell MicroCap iShares (IWC) and Russell 2000 iShares (IWM) led the charge with 3+ percent moves. As noted on Monday-Tuesday, small-caps have been outperforming in December and small-cap breadth was holding up better than large-cap breadth. Relative...

READ MORE

MEMBERS ONLY

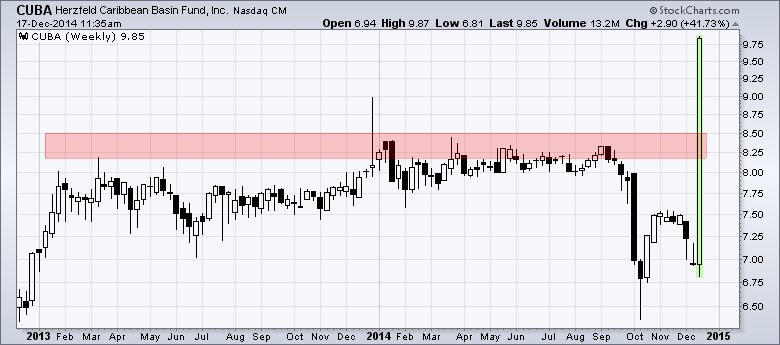

Caribbean Fund Surges to Multi-year High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Cuba is in the news today on the announcement that the US and Cuba will start talks to normalize ties. What does Cuba have to do with a Technical Analysis website? Well....I was looking at the most actives on the Nasdaq and saw CUBA with a 40+ percent gain...

READ MORE

MEMBERS ONLY

IWM Holds Up Better than SPY - TLT Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is less than 6% from its all time high and the Nasdaq 100 is less than 7% below its all time high. While the December decline looks dramatic on its own and the short-term trend is down, keep in mind that the major index ETFs...

READ MORE

MEMBERS ONLY

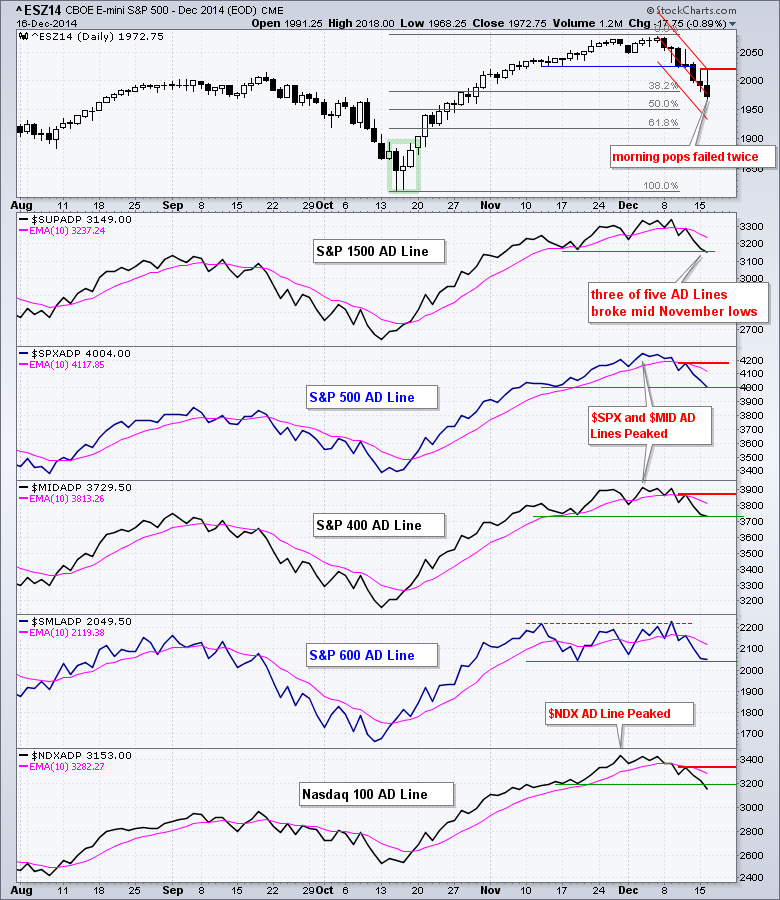

IWM and QQQ Join SPY with Support Breaks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though correlation is not always causation, selling pressure extended in stocks and oil got the blame. Light Crude Futures (^CLF15) fell another 3+ percent and hit $55.02 on the low. Stocks, and oil, got an early bounce Monday morning, but buying pressure soon dissipated and prices turned lower....

READ MORE

MEMBERS ONLY

IWM and QQQ Break Support - GLD Breaks Channel Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

QQQ broke pennant support on Friday and continued below 102 on Monday to break its support zone. The early December trend line and last week's highs mark resistance at 105. Apple continues to work its way lower and I am marking resistance at 112.

**************************************************************

IWM is still holding...

READ MORE

MEMBERS ONLY

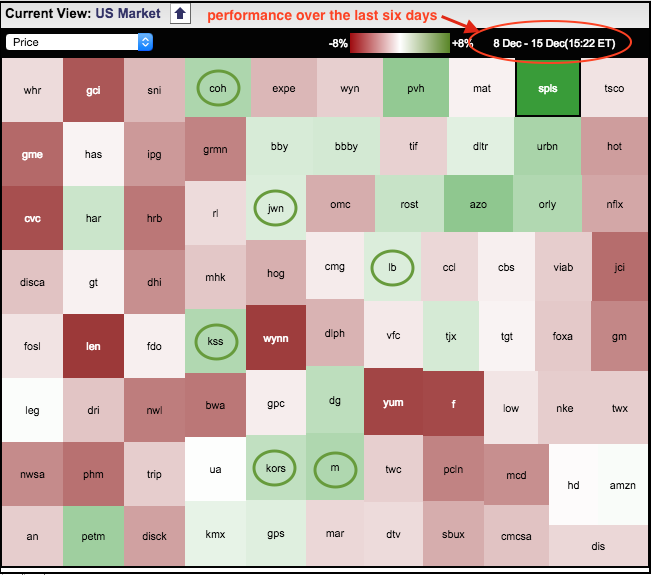

Several Consumer Discretionary Stocks are Bucking the Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 was hit pretty hard over the last six days with all nine sectors losing ground. There were, however, some pockets of strength in the consumer discretionary. The Sector Market Carpet shows performance for the consumer discretionary sector since last Monday, 8-December. Over a dozen green...

READ MORE

MEMBERS ONLY

IWM Tests Support and Shows Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks fell sharply last week as the S&P 500 suffered its largest weekly decline since May 2012. This was also the fifth weekly decline greater than 2.5% this year. Note that the prior four declines did not derail the bull market because the S&P 500...

READ MORE

MEMBERS ONLY

Good News Fails to Inspire Stocks - GLD Forms a Bull Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got good news with the employment report last Friday and the bounce was rather tepid. Stocks got more good news with retail sales on Thursday, but failed to hold the bounce. The inability to rise in the face of good news is negative. Perhaps the stock market is starting...

READ MORE

MEMBERS ONLY

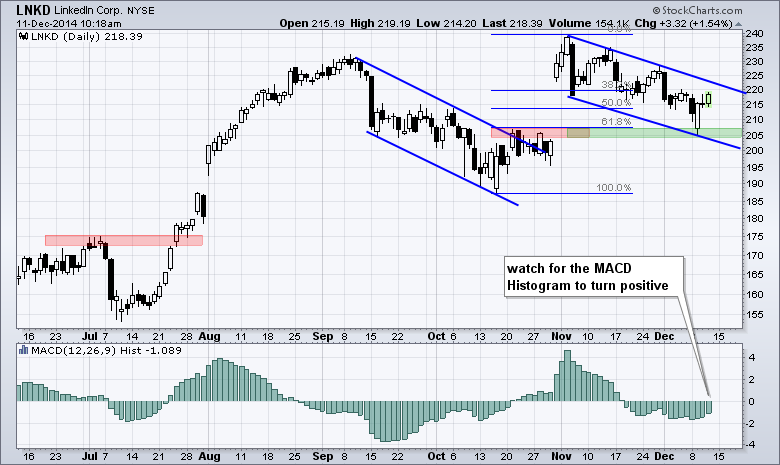

LinkedIn Tests Breakout and Gap Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

LinkedIn broke out and surged to a new high in early November, and then corrected the last five weeks with a falling channel. This channel retraced 62% of the prior surge and almost filled the gap, but didn't. Throw in support from broken resistance in the 205 area,...

READ MORE

MEMBERS ONLY

A Key Test for SPY and QQQ - Plus CVT, MBLY, RF, STLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are plenty of reasons for Wednesday's sell off: plunging oil, weakness in junk bonds, bank exposure to the energy sector, Greek drama and the usual Euro stuff. One thing was clear: there were more sellers than buyers on Wednesday. I do not know the reasons behind every...

READ MORE

MEMBERS ONLY

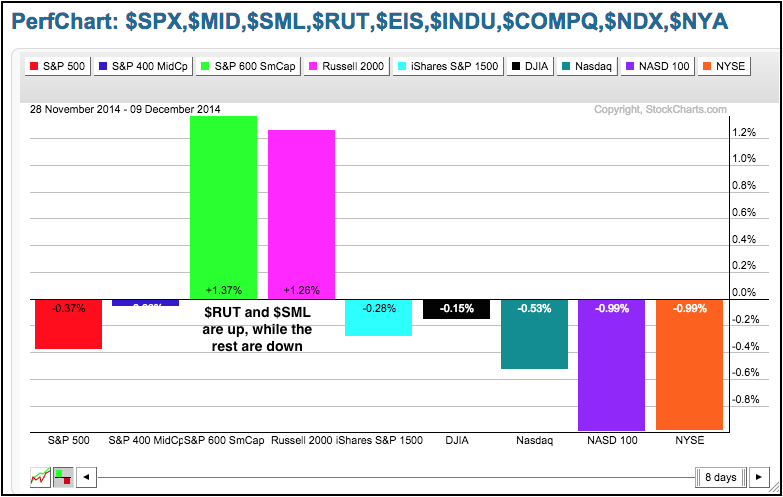

Small Caps are Starting to Outperform

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Small-caps are starting to live up to their reputation for outperformance in December. Even though the month is far from finished, the PerfChart below shows the Russell 2000 and the S&P Small-Cap 600 with 1+ percent gains so far. In contrast, the other seven indices are actually down...

READ MORE

MEMBERS ONLY

IWM Challenges Again - Small-Cap Breadth Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs were mixed on Tuesday, but the leadership role flipped in favor of small-caps. DIA, SPY and QQQ moved lower, while IWM and IJR edged higher. Moreover, small-caps opened weak with the rest of the market and came roaring back once participants figured out that most small-caps...

READ MORE

MEMBERS ONLY

IWM Swings To Support - GLD Gets a Wedge Break - Plus AWI, BWA, CBS, SCCO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved lower on Monday with small-caps and energy shares leading the way. The Russell 2000 iShares (IWM) declined over 1% and the SmallCap Energy ETF (PSCE) declined over 7%. Even though the energy sector accounts for just 3.5% of IWM, an oversize decline like 7.6% will definitely...

READ MORE

MEMBERS ONLY

IWM Extends Consolidation - Watching the Wedge in GLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got a big dose of good news on Friday as non-farm payrolls added over 300,000 for the second time this year. The employment report capped off a strong week for economic indicators. Despite a positive news week, stocks were quite flat and Friday's gains were contained....

READ MORE

MEMBERS ONLY

Small-caps Underperform Despite December Seasonal Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

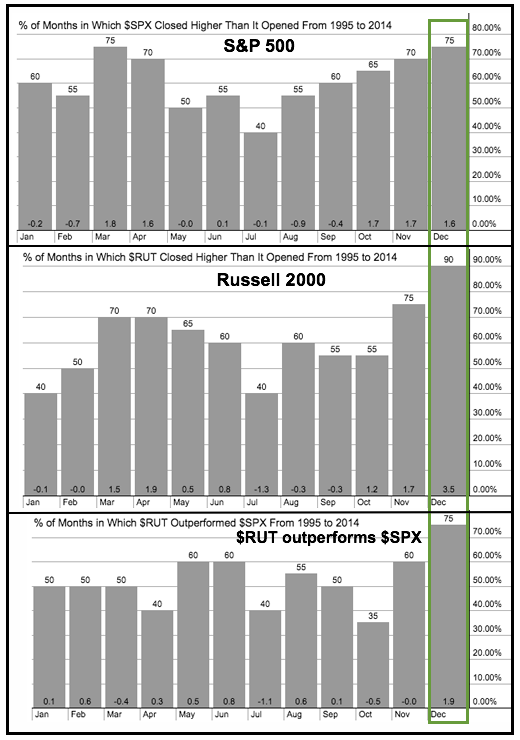

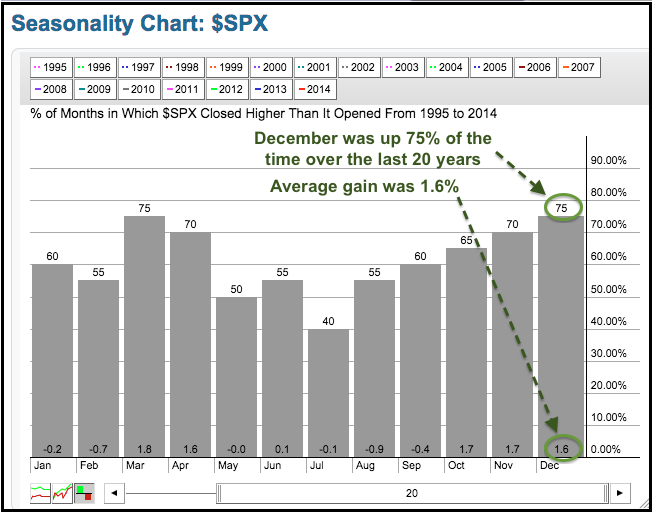

There are two bullish seasonal patterns at work right now. First, stocks have shown a strong tendency to advance in December. Second, small-caps have shown a strong tendency to outperform large-caps in December. Over the last twenty years, the S&P 500 has risen 75% of the time and...

READ MORE

MEMBERS ONLY

Russell MicroCap iShares Goes for P&F Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

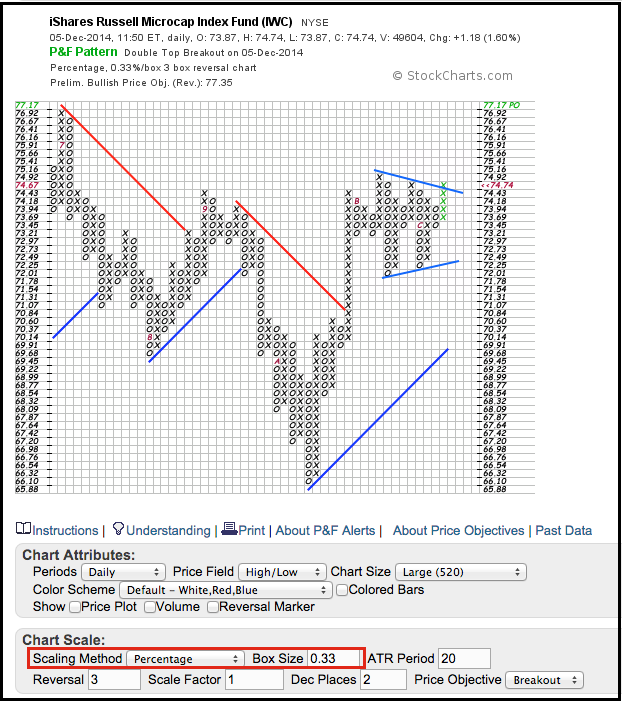

The Russell MicroCap iShares (IWC) is leading the market higher on Friday and breaking above a triangle trend line. The P&F chart shows the ETF surging in October and then consolidating in November. The red A marks the beginning of October and the red B marks the beginning...

READ MORE

MEMBERS ONLY

Stocks Stall in Uptrends - A Big Day for Treasury Bonds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The market went into a risk-off mode on Thursday with the Russell 2000 iShares (IWM) losing .48% and the 20+ YR T-Bond ETF (TLT) surging .84% ahead of today's employment report. Even though the surge in Treasuries shows a certain flight to safety, I do not blame the...

READ MORE

MEMBERS ONLY

Seasonality Tool Says 'Tis the Season

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There has been a lot of chatter about the seasonal pattern for the S&P 500 in December, and it is bullish. StockCharts users do not need to rely on the chatter because they can chart seasonal patterns using our Seasonality Tool and see for themselves. The chart below...

READ MORE

MEMBERS ONLY

Three of Five AD Lines Hit New Highs - Plus ETFC, EXPE, FAST, HCBK, SCHW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued higher on Wednesday with small-caps leading for the second day running. Seven of nine sector SPDRs were higher with industrials, energy and materials leading. Energy is getting an oversold bounce, while industrials are showing some leadership as XLI nears a 52-week high. Tech stocks were helped with strength...

READ MORE

MEMBERS ONLY

Small-Caps Bounce as Bonds Fall - UUP Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded with small-caps leading the way. SPY and QQQ finished with modest gains, while IWM jumped 1.2%. Despite one day of relative strength, small-caps still lag their large-cap brethren over the last few weeks. All nine sector SPDRs were up with finance, energy and healthcare leading. An oversold...

READ MORE

MEMBERS ONLY

Broker-Dealer iShares Forms Classic Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Broker-Dealer iShares (IAI) surged to the September high and then stalled with a three week consolidation. With a downward slope, this consolidation looks like a falling flag, which is a bullish continuation pattern. A breakout at 41 would signal a continuation higher and project a move to new highs....

READ MORE

MEMBERS ONLY

Small-Caps Lead Pullback - Plus GILD and TMUS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly lower on Monday with small-caps and mid-caps leading the decline. Large-caps held up relatively well with SPY losing just .69% on the day. Retail stocks suffered a black Friday hangover as the Retail SPDR (XRT) fell over 2%. The ETF, however, was up some 15% from its...

READ MORE

MEMBERS ONLY

Solar ETF Triggers Bearish Continuation Signal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Lower energy prices may be making solar less competitive and putting pressure on solar-related stocks. The chart shows the Solar Energy ETF (TAN) breaking down in Sep-Oct, consolidating with a triangle and breaking triangle support with a sharp two-day decline. This break signals a continuation of the prior decline and...

READ MORE

MEMBERS ONLY

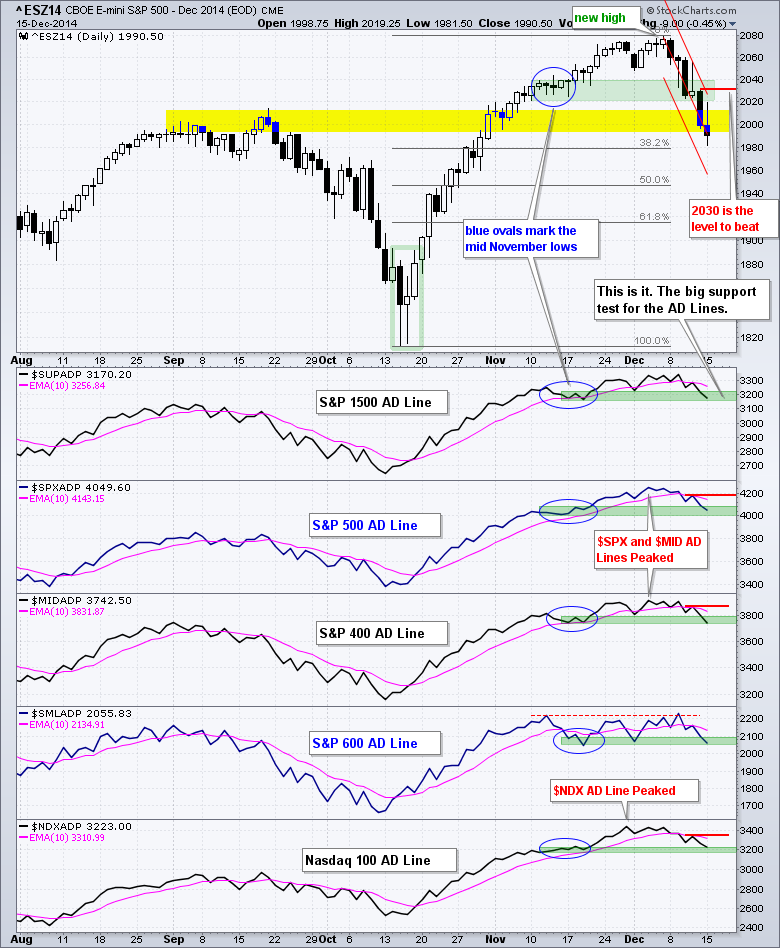

An AD Line Diverges and Three Risk Indicators Turn Negative

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with some selling pressure on Friday, but SPY ended the week with a small gain and QQQ ended the week at a new high. The gains continue to be incremental and the advance is slowing, but it is still an advance and selling pressure remains subdued in...

READ MORE

MEMBERS ONLY

XME Fails at Resistance and Lags Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Metals & Mining SPDR (XME) got a bounce with the stock market in the second half of October, but struggled in November with a trading range between 34 and 36.5. This struggle turned to weakness as the ETF gapped down on Friday and fell sharply. A follow through...

READ MORE

MEMBERS ONLY

The Noose Narrows on the Oil & Gas Equip & Services SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil remains weak overall and so do the energy related ETFs (XLE, XOP, XES). The chart below shows the Oil & Gas Equip & Services SPDR (XES) hitting a new low in October and then consolidating with a triangle. The pink lines show the Bollinger Bands narrowing like a noose...

READ MORE

MEMBERS ONLY

Fastenal Follows Through on Big Island Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Fastenal continues to improve on the chart with two bullish patterns and signs of accumulation. First, a big island reversal formed at the stock gapped below 43.5 in early October and gapped back above this level in late October. Second, the stock broke pennant resistance with a move above...

READ MORE

MEMBERS ONLY

Three of Five Offensive Sectors Lead within Small Caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

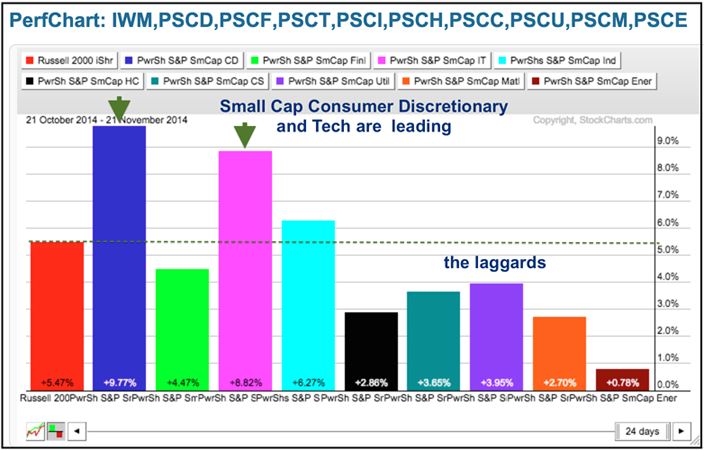

The PerfChart below shows the nine small-cap sector ETFs and the Russell 2000 iShares (IWM). Notice that the SmallCap Consumer Discretionary ETF (PSCD) and the SmallCap Technology ETF (PSCT) led over the last five days with bigger gains. Throw in the SmallCap Industrials ETF (PSCI) and three of the four...

READ MORE

MEMBERS ONLY

Large-caps Rule, TLT Makes Breakout Bid and UUP Exits the Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged out of the gate on Friday, but fell back in the afternoon and closed off their highs. The action was mostly positive, but small-caps again underperformed as the S&P SmallCap iShares (IJR) closed fractionally lower. Large-caps still rule the rally. All sectors were up with industrials,...

READ MORE

MEMBERS ONLY

Baby Steps, New Highs and Bullish Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued to take baby steps higher with the S&P 500 and Dow Industrials closing at all time (closing) highs. Even though the Russell 2000 and S&P Small-Cap 600 remain below their prior highs, they are less than 4% from these highs and both formed bullish...

READ MORE

MEMBERS ONLY

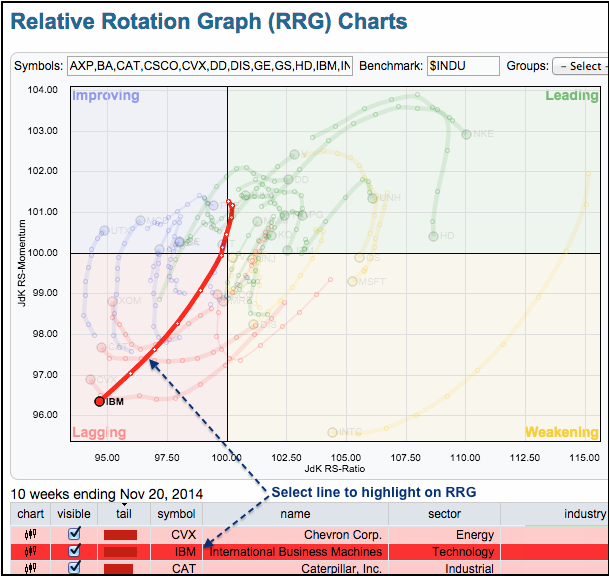

Big Blue Stays Red on the Relative Rotation Graph

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is up over 7% the last five weeks, but IBM is down and flirting with new lows. The chart below shows the Relative Rotation Graph (RRG) with all thirty Dow stocks. With the Dow Industrials as the benchmark, we are seeing the relative performance rotations...

READ MORE

MEMBERS ONLY

Small-caps Continue to Underperform - Plus C, CAT, FAST, FB, IBM, X

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Small-caps weighed on the stock market again as IWM fell over 1%. Techs were also a bit weak with QQQ falling a half percent and SPY held up the best with a fractional loss. Despite a mixed and overbought stock market, there were some positive takeaways on Wednesday. The Retail...

READ MORE

MEMBERS ONLY

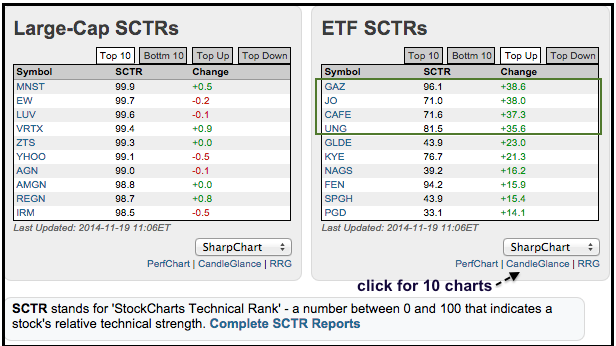

Natural Gas and Coffee Lead ETF SCTRs with Big Moves

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is a little gem in the middle of the home page that shows the biggest moves for the StockCharts Technical Rank (SCTR). Clicking "Top Up" will show the biggest relative performance gainers, while clicking "Top Down" will show the biggest relative performance losers. Today we...

READ MORE

MEMBERS ONLY

Incremental Gains Continue - Bulk of Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher on Tuesday with the major index ETFs posting modest gains. Incremental gains are the hallmark of this advance since late October. SPY is up ten of the last twelve days and the total advance is around 2%. Sure, upside momentum is slowing and buying pressure is waning,...

READ MORE

MEMBERS ONLY

SPY Stalls, IWM Corrects and TLT Consolidates - Plus FAST, EXPR, UHS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered again in mixed trading. Small-caps were weak as IWM fell .83%, but large-caps held firm as SPY and DIA closed with fractional gains. If you are looking for that small correction, look no further than small-caps because IWM is down around 2% in the last three days. If...

READ MORE