MEMBERS ONLY

IWM Goes for a Breakout as QQQ Stalls in Resistance Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks followed up on Friday's gains with a strong open on Monday. There was not much follow through to this strong open, but the gains did hold for the most part. Short-term, I would say the cup is half full (bullish) until proven otherwise. A filling of Monday&...

READ MORE

MEMBERS ONLY

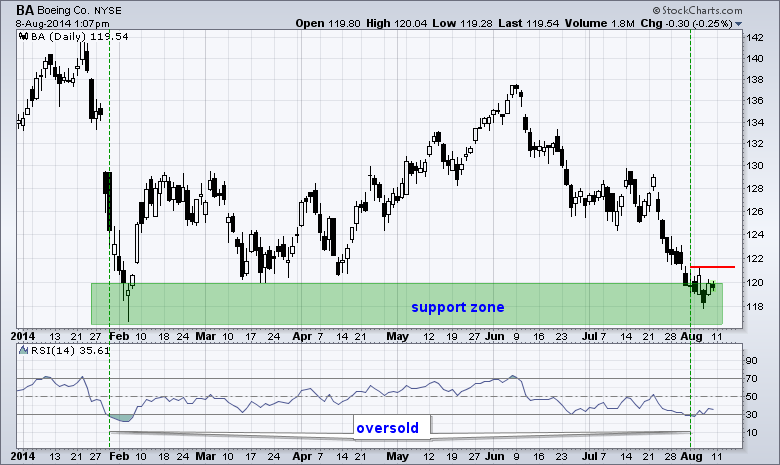

Boeing Hits Big Support Zone and Becomes Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a rough year for Boeing, but the stock may be poised for an oversold bounce. After a big plunge in January, the stock firmed for a few months and then worked its way higher in April-May. BA peaked in early June and fell back to support over...

READ MORE

MEMBERS ONLY

Stocks Remain Weak as Bonds Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I am going straight to the charts, but here is a summary. QQQ, IWM and SPY remain in downtrends. QQQ and SPY held the late July support breaks. IWM, however, is showing some relative strength over the past weeks and chartists should watch for a breakout. Treasuries continue to move...

READ MORE

MEMBERS ONLY

Lam Research Makes Three Bearish Scans $LRCX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can search pre-defined scans to find out if their favorite stock or ETF triggered any scans. The chart below shows Lam Research (LRCX) triggering three bearish scans today. The Elder bar turned red, the stock moved below the lower Bollinger Band and the Commodity Channel Index (CCI) moved below...

READ MORE

MEMBERS ONLY

Four Charts Setting Up for a Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are four setups today. We start with a big software stock showing weakness near two key moving averages. Second, there is a consumer services stock with a bullish wedge. Third, we feature a tech stock breaking out with strong volume patterns. And finally, there is a social media stock...

READ MORE

MEMBERS ONLY

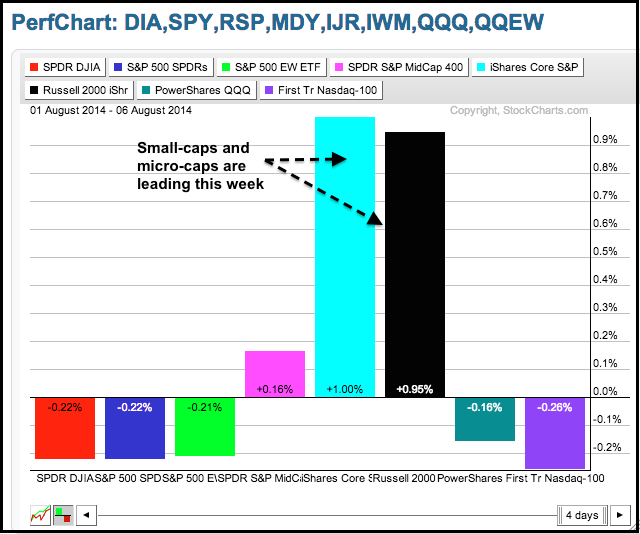

Small-Cap ETF Firms, but Remains Short of Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Wednesday, but small-caps and micro-caps are starting to show some relative strength. The PerfChart below shows the performance for eight major index ETFs this week. IWM and IWC are up around 1% and leading the pack. MDY is the only other one showing a gain. SPY,...

READ MORE

MEMBERS ONLY

Gold Miners ETF Gets a Momentum Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold Miners ETF (GDX) is reacting to strength in gold with a gap and 2+ percent surge. The chart below shows GDX forming a wedge above the 50 and 200 day moving averages. The ETF gapped up within this wedge and StochRSI surged above its July highs for a...

READ MORE

MEMBERS ONLY

IWM Firms, but Remains Short of Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are no real changes in the trends so I just updated the charts.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

**************************************************************

SPY remains in a short-term downtrend after the support break in the 195-196...

READ MORE

MEMBERS ONLY

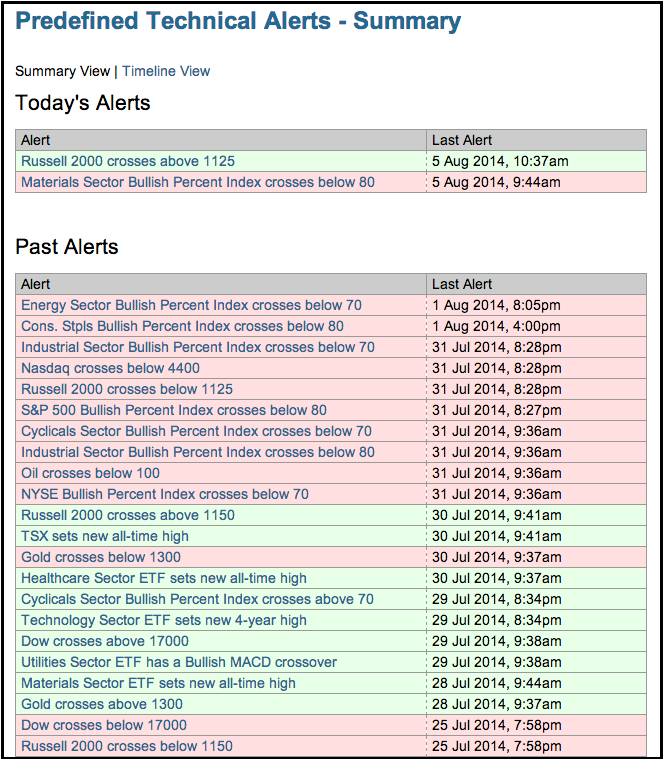

The Red Technical Alerts are Piling Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pre-defined technical alerts page is a great place see the positive and negative events of the last few days. The image below shows a green (positive) alert for the Russell 2000 and a red (negative alert for the Materials SPDR (XLB). Prior to today, there were eleven negative alerts...

READ MORE

MEMBERS ONLY

Four Chart Setups: Three Bulls and One Bear

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are four setups today. We start with a volatile networking stock challenging a channel trend line. Next, there is a major airline testing support. Third, we are featuring an apparel retailer showing resilience near support. And finally, there is a semiconductor equipment stock with a bearish pennant.

**This chart...

READ MORE

MEMBERS ONLY

XLY Forms Morning Star as Retails Catch a Bid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded on Monday with a broad advance that lifted most sectors and industry groups. The Materials SPDR and Energy SPDR led with 1+ percent gains. The Utilities SPDR lagged with a .54% loss. Of note, the Consumer Discretionary SPDR was the third strongest sector with a .97% gain. Strength...

READ MORE

MEMBERS ONLY

Potash Player Gets MACD Cross on Good Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intrepid Potash (IPI) fell to support in July, firmed for a few days and then surged above first resistance with good volume. Support stems from the March-April lows, and now the July low. The indicator window shows MACD moving above its signal line the last two days. This breakout is...

READ MORE

MEMBERS ONLY

SPY Breaks down to Join IWM in Short-Term Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with broad selling pressure last week. Small-caps were weak, but large-caps joined the party last week as both DIA and SPY broke below their July lows. DIA broke below its June lows as well and gave up its June-July gains in a hurry. The Industrials SPDR and...

READ MORE

MEMBERS ONLY

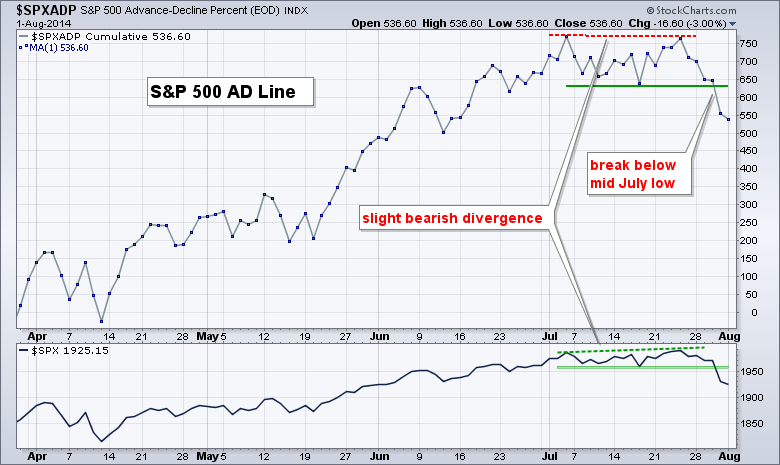

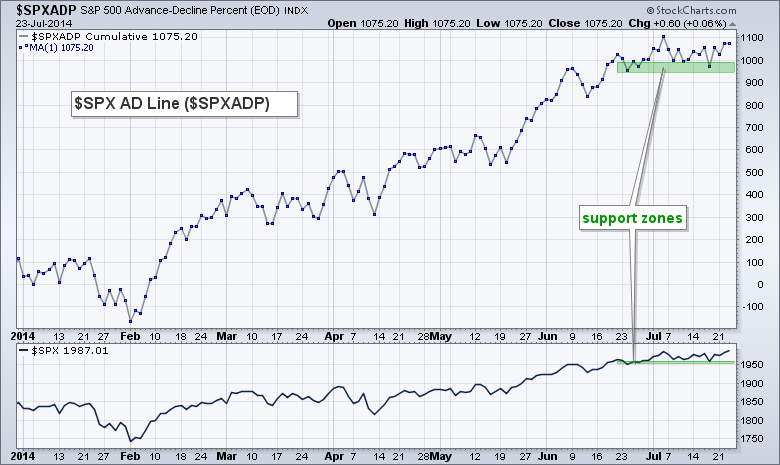

Nasdaq 100 and S&P 500 AD Lines Trigger Signals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

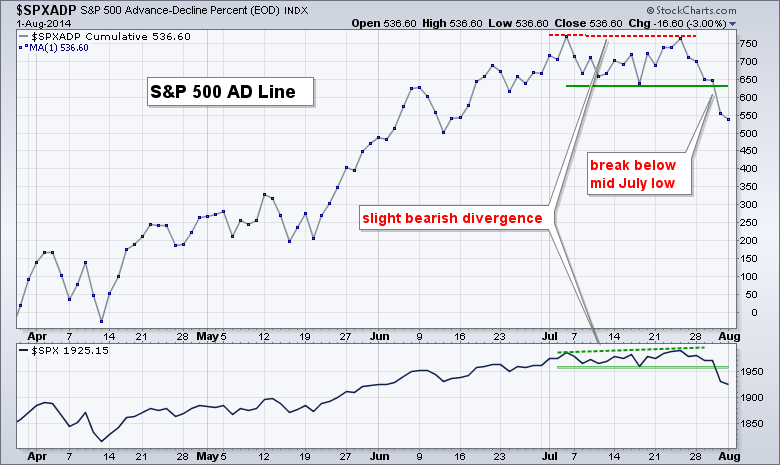

While the S&P 500 and Nasdaq 100 moved to new highs in late July, their respective AD Lines did not follow suit and formed small bearish divergences. The lower highs in the AD Lines indicate that breadth did not keep up with the underlying indices, which suggests narrowing...

READ MORE

MEMBERS ONLY

AD Line Breaks Down - Bonds Fail to Bouce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with broad selling pressure on Thursday as the major index ETFs opened weak and remained weak throughout the day. The inability to bounce indicates that buyers remained on the sidelines and did not step in to buy the dip. All sectors were down as were all 105...

READ MORE

MEMBERS ONLY

Utilities Sector Heads to Lagging Quadrant on RRG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

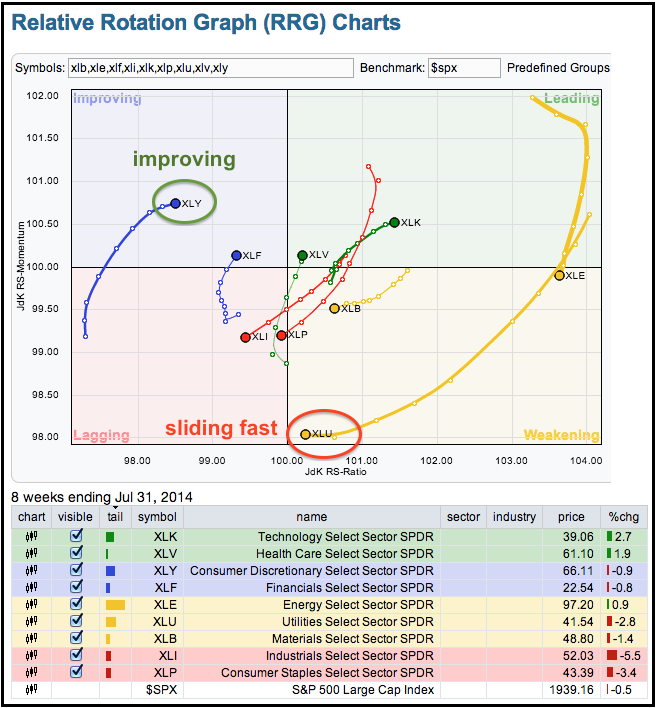

There is a new feature in town: Relative Rotation Graphs from Julius de Kempenaer. These graphs make it easy to see which sectors are improving, leading, weakening and lagging. Most recently, notice how the Utilities SPDR (XLU) moved from the leading quadrant to the weakening quadrant over the last eight...

READ MORE

MEMBERS ONLY

KRE Hits Key Retracement as T-yields Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

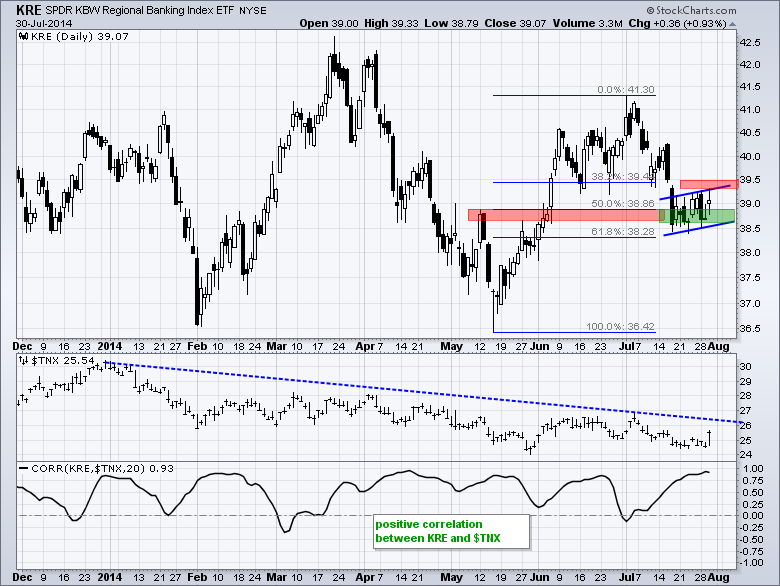

It was yet another mixed day on Wall Street. As with Tuesday, small-caps and micro-caps were up and showed some relative strength. QQQ and techs were also up, but DIA and the Equal-Weight S&P 500 ETF edged lower. Five of the nine sectors were up with consumer discretionary...

READ MORE

MEMBERS ONLY

IWM Firms near Key Retracement - Bonds Rally ahead of Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was another mixed day, but the usual performance mix got turned around. Note that the Russell 2000 iShares and Russell MicroCap iShares gained on the day, but the Nasdaq 100 ETF and S&P 500 SPDR lost ground. It is usually the other way around. I would not...

READ MORE

MEMBERS ONLY

Wynn Breaks Out with Good Volume and Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I was looking through the list of large-cap stocks with the biggest gains in their StockCharts Technical Rank (SCTR) and found Wynn Resorts with a huge move (+24.8 to 78). Wynn is now in the top 23 percent of large-caps for relative strength based on the SCTR. Looking at...

READ MORE

MEMBERS ONLY

Four Stocks Setting Up for a Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are four setups today. We start with a major pharma stock making a breakout bid after a bear trap. Second, there is a cosmetics stock with a bearish wedge taking shape. Third, we have an online travel stock with a bullish triangle. And finally, we finish with a teen...

READ MORE

MEMBERS ONLY

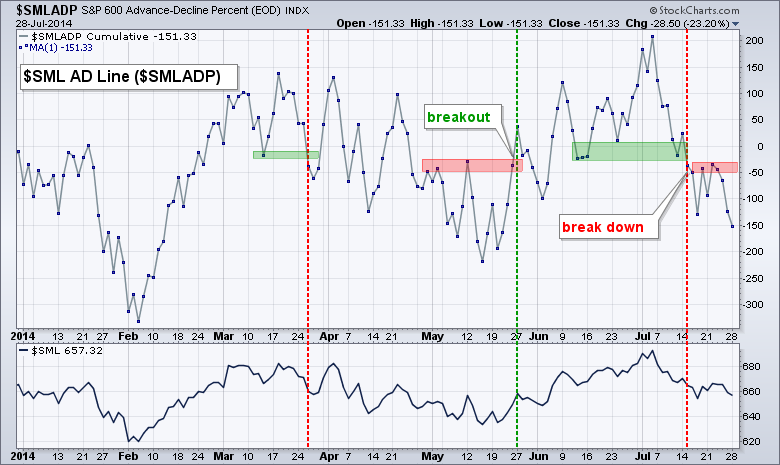

Small-Cap AD Line Extends Down Swing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Guess what? Stocks were mixed again on Monday. IWM edged lower and SPY edged higher. And I do mean "edged" because the gains and losses were minimal. Six of the nine sectors were higher with the Utilities SPDR leading (up 1.39%). The Home Construction iShares moved sharply...

READ MORE

MEMBERS ONLY

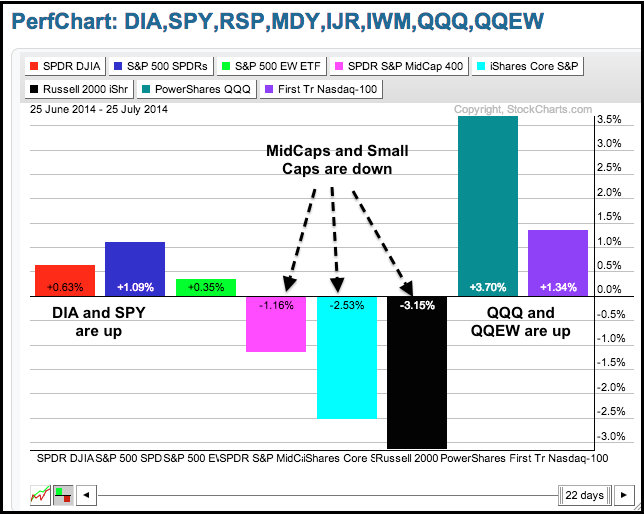

Mr Market is All Mixed Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the month mixed and remain mixed. Over the past month, QQQ is up 3.70%, SPY is up 1.09% and IWM is down 3.15%. The Technology SPDR is leading with a 4.12% gain over the past month. The Utilities SPDR is lagging with a 2....

READ MORE

MEMBERS ONLY

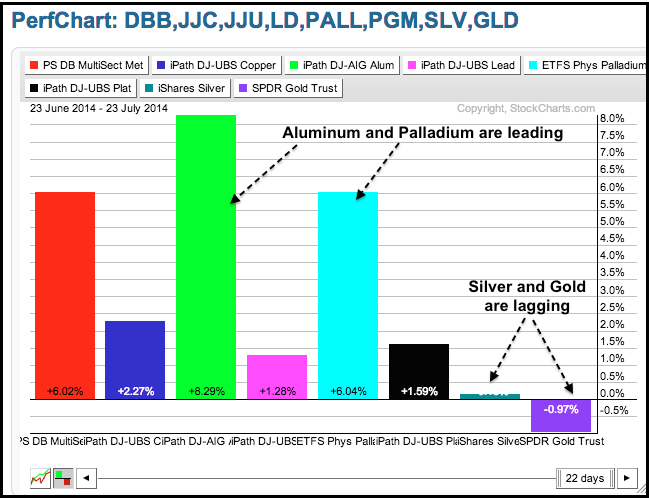

Precious Metals Lag their Industrial Counter Parts

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows the Base Metals ETF (DBB) along with seven other metal-related ETFs. Notice that the Aluminum ETF (JJU) and Palladium ETF (PALL) are the big leaders. Meanwhile, the Gold SPDR (GLD) and the Silver ETF (SLV) are the laggards. Gold is clearly precious and lagging. Aluminum is...

READ MORE

MEMBERS ONLY

Five Stock Setups - Three Bearish and Two Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. We start with an LED light company with a bearish continuation pattern. Second, there is a Chinese e-commerce stock with a bullish continuation pattern. Third, I am featuring a networking stock that hit resistance at a key retracement. Fourth, there is a consumer foods stock...

READ MORE

MEMBERS ONLY

S&P 500 AD Line Stalls - IWM Forms Rising Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mostly higher, but the gains were small and there were some pockets of weakness. QQQ hit a new high and remains the strongest of the major index ETFs. The sectors were mixed with six up and three down. Energy, materials and healthcare led the gainers. The Home Construction...

READ MORE

MEMBERS ONLY

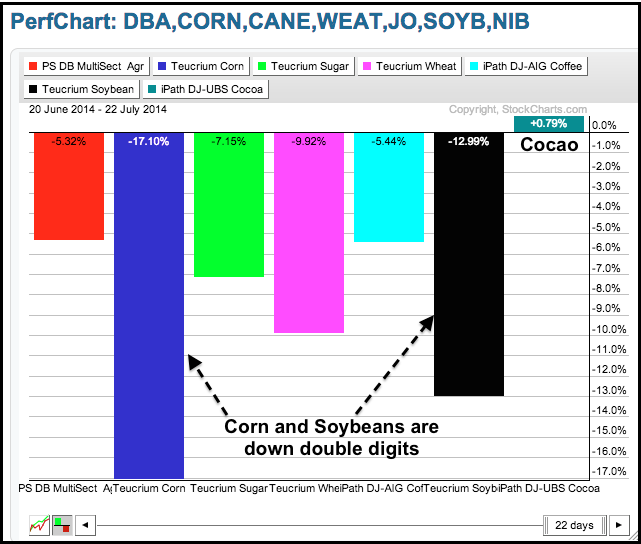

Cocoa Bucks the Selling Pressure in Agriculture ETFs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows the Multi-sector Agriculture ETF (DBA) along with six other agriculturally based ETFs. Five of the six got slammed over the past month with the Corn Trust ETF (CORN) and Soybean Fund (SOYB) posting double digit losses. The Cocoa Fund (NIB) is the lone winner with a...

READ MORE

MEMBERS ONLY

GLD Holds Support Break as UUP Extends Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher on Tuesday with modest gains in the major index ETFs. The Russell 2000 iShares led with a .84% gain and the Dow Diamonds lagged with a .33% gain. Seven of the nine sectors were higher with technology, energy and healthcare leading. The consumer staples and utilities sectors...

READ MORE

MEMBERS ONLY

Four Stocks Setting up for a Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are only four setups today because the pickings are slim during earnings season. Risk is always above average when a company reports earnings and I try to insure that the earnings report is at least a week away. Today, we have tech stock with a large triangle after a...

READ MORE

MEMBERS ONLY

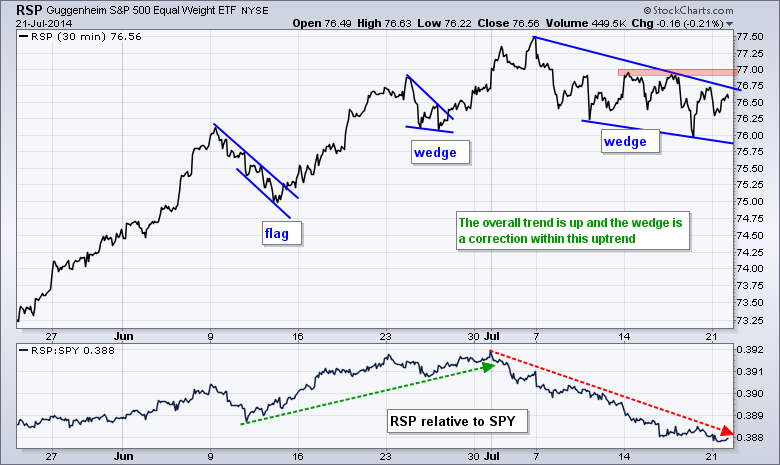

Correction Extends for Equal-Weight S&P 500 ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The July funk continues for stocks. After good gains on Friday, some selling pressure hit on Monday and the major index ETFs closed modestly lower. The Russell 2000 iShares fell .40% and the Nasdaq 100 ETF lost just .12% on the day. Eight of the nine sectors were down. The...

READ MORE

MEMBERS ONLY

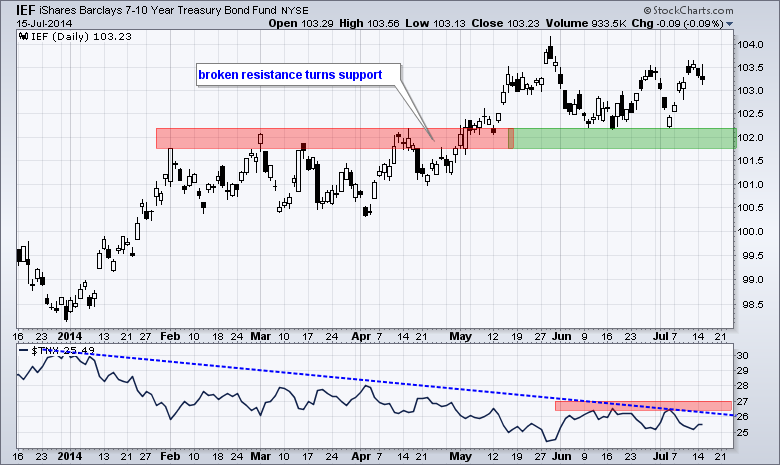

Narrowing Yield Spread Weighs on Regional Banks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Regional Bank SPDR (KRE) failed to hold its flag breakout and then broke support with a sharp decline this week. It would now appear that KRE formed a rising wedge that peaked below the January high. This week's wedge break signals a continuation of the prior decline...

READ MORE

MEMBERS ONLY

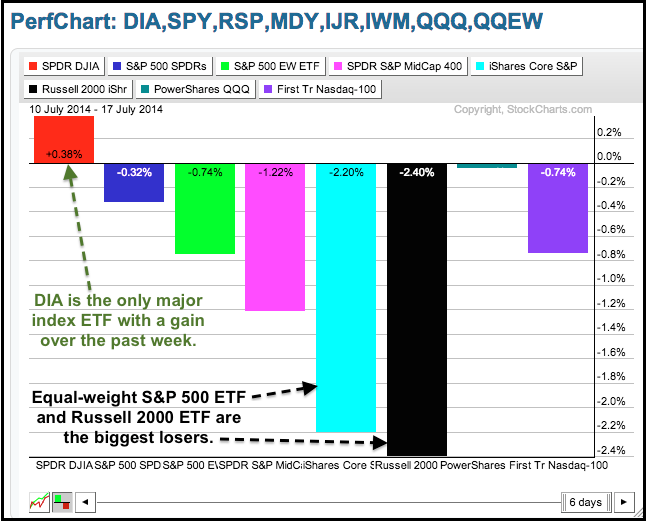

Rough Week Leaves DIA the Last Man Standing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks came under selling pressure over the past week with small-caps bearing the brunt. The PerfChart below shows the performance for eight major index ETFs over the past week. Seven are down and only one is up. The Dow Diamonds (DIA) has the only gain. The Russell 2000 iShares (IWM)...

READ MORE

MEMBERS ONLY

ITB Breaks Support - IWM Continues to Lead Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened slightly lower and then slid as news reports suggested that the Malaysian airliner was shot down. There was a small bounce around midday and stocks again came under selling pressure in the afternoon. Small-caps led the way lower as IWM fell around 1.5%. All sectors were lower...

READ MORE

MEMBERS ONLY

Charts: A Bull Flag, an Inverse HS and a Support Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are only three setups today because the pickings are slim during earnings season. Risk is always above average when a company reports earnings and I try to insure that the earnings report is at least a week away. Today, we have a semiconductor stock with a bull flag. Second,...

READ MORE

MEMBERS ONLY

KRE Forms Outside Day - Dollar Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened strong and then stalled. SPY and QQQ managed to hold their gains and close slightly higher. IWM did not and closed fractionally lower. Seven of the nine sector SDPRs were higher with technology, energy and materials leading the way. The Technology SPDR gained almost 1% with help from...

READ MORE

MEMBERS ONLY

Stocks Get Whipsawed by Fed, but Uptrends Remain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks, gold, the Dollar and bonds got whipped around during congressional testimony from Fed Chair Janet Yellen. Stocks opened strong, took a deep dip and the recovered some of that dip with an afternoon advance. It is hard to read into price action driven by Fed comments and the overall...

READ MORE

MEMBERS ONLY

A Rather Dull Advance for the S&P 500

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 is up over 6% since mid April, but this advance has been about as boring as they get. Note that this key benchmark has not moved more than 1% since April 16th (hat tip crossingwallstreet.com). The old Wall Street adage, "never short a...

READ MORE

MEMBERS ONLY

Chart Setups: APOL, FISV, JOY, SNPS, XRAY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. First, we have an education provider with a break down. Second, there is a tech stock breaking out of a bullish continuation pattern. Third, we feature a mining equipment play with a bullish wedge taking shape. Fourth, there is another tech stock with an ascending...

READ MORE

MEMBERS ONLY

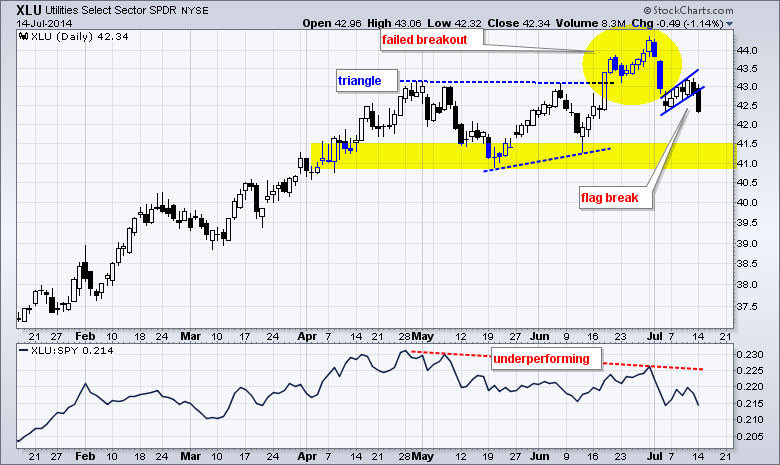

XLU Breaks Flag Support - GLD Reverses Short-term Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

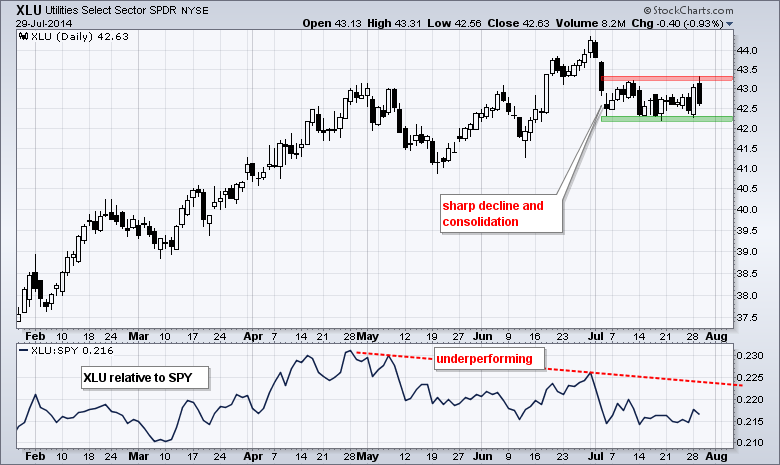

Stocks started the day strong and then stalled as buying and selling pressure equalized. The major index ETFs finished with modest gains. Seven of the nine sectors were higher with technology, energy and finance leading. The utilities sector moved sharply lower with a 1+ percent loss. The chart below shows...

READ MORE

MEMBERS ONLY

Solar Energy ETF Tests Key Moving Averages

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a wedge breakout in late May, the Solar Energy ETF (TAN) is testing this breakout and two key moving averages in July. Notice how the 50-day and 200-day moving averages converge in the 40-41 area. TAN is currently above both and the 50-day is above the 200-day. The bias...

READ MORE

MEMBERS ONLY

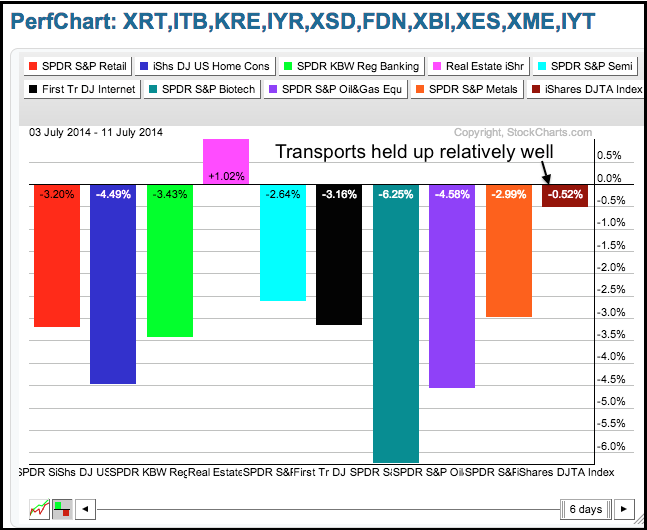

Transports Hold Up Well - SPY Bounces off First Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a rough week for stocks. Small-caps led the major index ETFs lower as IWM lost around 4%. The finance sector was relatively weak as XLF declined around 1.5% on the week. The Home Construction iShares and the Retail SPDR were two of the weakest industry group ETFs....

READ MORE