MEMBERS ONLY

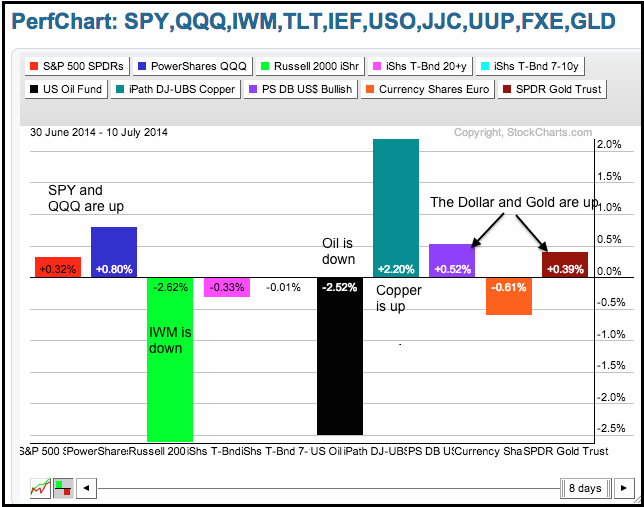

Intermarket PerfChart Shows Strange Happenings in July

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The intermarket PerfChart below shows July getting off to a rather strange start. SPY and QQQ are up slightly this month, but IWM is down sharply with a 2+ percent loss. Relative weakness in small-caps suggests that the equity market may be entering into a corrective period. Small-caps and momentum...

READ MORE

MEMBERS ONLY

Alaska Air Bucks the Selling and Remains Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Alaska Air (ALK) fell sharply in early June, established support just above 46 and bounced off this support zone the last few days. This is impressive considering the selling pressure that hit the market this week. Notice the hollow, or white, candles. These form when the close is well above...

READ MORE

MEMBERS ONLY

Semis Show Some Relative Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks firmed after a sharp two day decline in small-caps and momentum names. Firmness could be fleeting because stock futures are down after hours. If the second shoe drops here, I would expect the momentum names and small-caps to lead the way lower again. While I do not think this...

READ MORE

MEMBERS ONLY

Chart Setups: ACN, AEO, BSX, NEM, VIP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. First, we have a tech stock with a pennant break down. Second, we have a teen apparel retailer with a falling wedge. Third, there is a medical device company trading within an extended correction. Fourth, we feature a gold stock poised to challenge range resistance....

READ MORE

MEMBERS ONLY

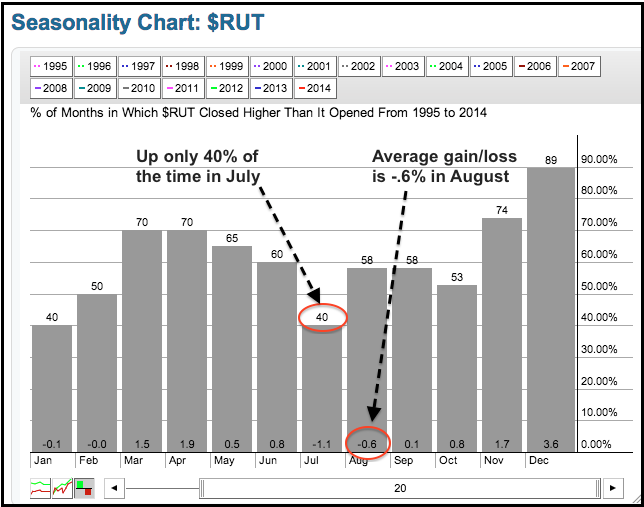

Russell 2000 Seasonality Turns Bearish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The high-beta names (i.e. momentum stocks) got hammered again on Tuesday. The Russell 2000 iShares fell over 1%, the Internet ETF fell 3%, the Solar Energy ETF declined over 3.5% and the Biotech SPDR lost 3.77%. It is beginning to look a lot like March. Note that...

READ MORE

MEMBERS ONLY

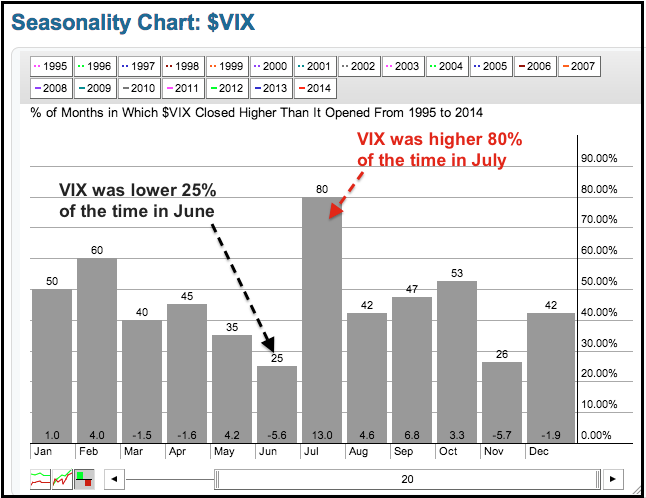

VIX Seasonality Shows a Strong Tendency in July

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are seasonal tendencies and then there are STRONG seasonal tendencies. Over the last 20 years, the S&P 500 Volatility Index ($VIX) has moved higher 80% of the time in the month of July. This follows the weakest month, June, which shows a rising VIX just 25% of...

READ MORE

MEMBERS ONLY

Small-Caps and Energy Lead Market Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After hitting new highs last week, stocks started this week with some selling pressure. Large-caps held up relatively well as SPY fell .76%. Small-caps and micro-caps bore the brunt of selling pressure as the Russell 2000 iShares and Russell MicroCap iShares fell more than 1.5% on the day. Six...

READ MORE

MEMBERS ONLY

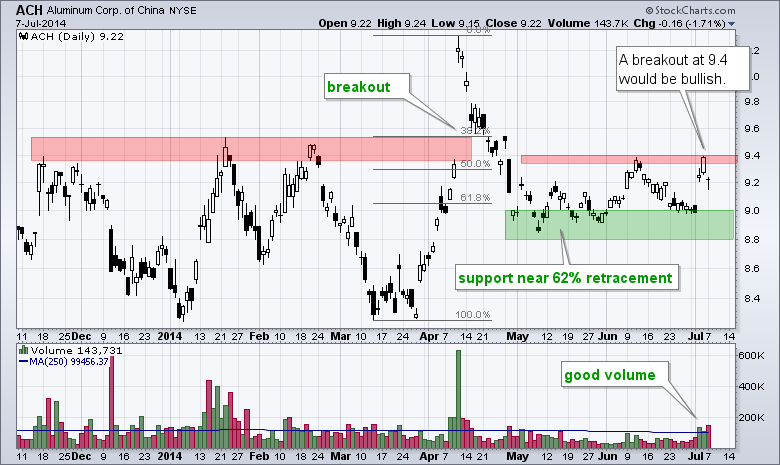

Chart Setups: ACH, CAKE, DE, GOGO, SNPS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. First, we start with a Chinese aluminum stock that is surging off a key retracement. Second, we have a restaurateur stalling at a key retracement. Third, there is an equipment manufacturer with a triangle consolidation. Fourth, we feature an inflight internet provider with a breakdown...

READ MORE

MEMBERS ONLY

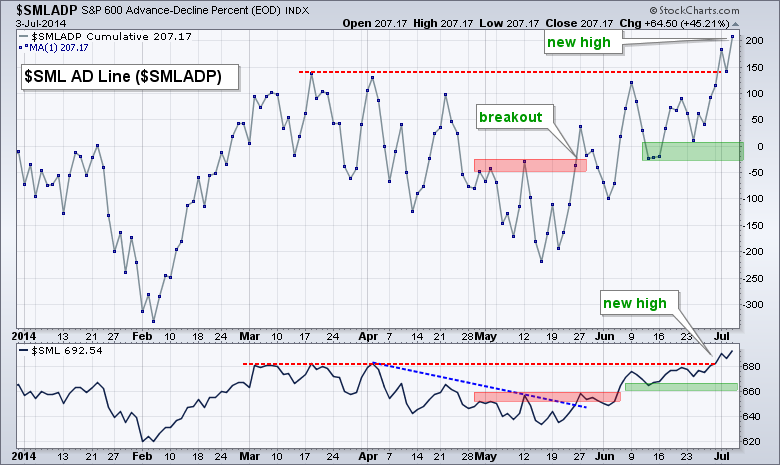

Small-Cap AD Line Hits New High as Advance Broadens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Another week and another gain. Most of the major index ETFs moved to new highs again last week to affirm the uptrends. IWM hit a new high intraday, but has yet to close above the March high. The Russell MicroCap iShares (IWC) is still a few percentage points below its...

READ MORE

MEMBERS ONLY

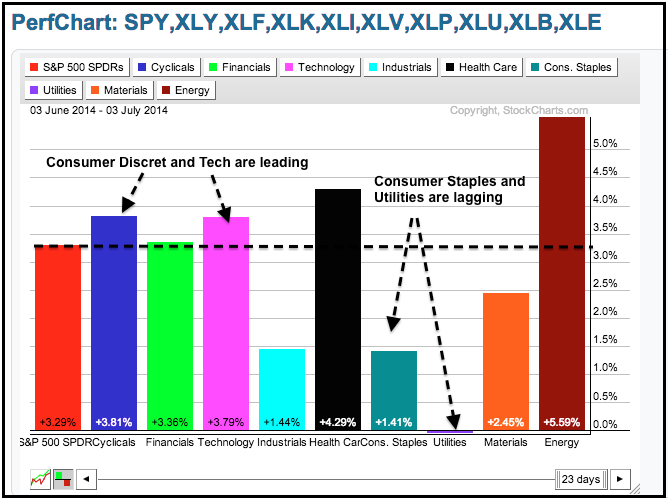

Consumer Discretionary and Tech Join the Leadership Circle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

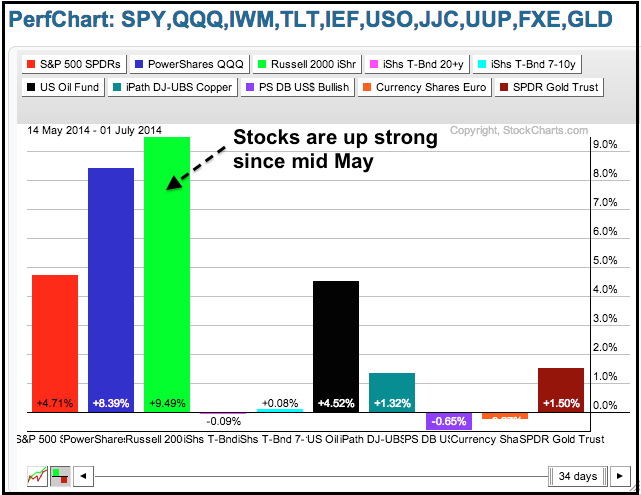

Relative weakness in the consumer discretionary sector was a concern a month ago, but not anymore. The first PerfChart shows the Consumer Discretionary SPDR (XLY), the Technology SPDR (XLK), the Energy SPDR (XLE) and the HealthCare SPDR (XLV) leading since June 3rd. XLY really came to life this past week...

READ MORE

MEMBERS ONLY

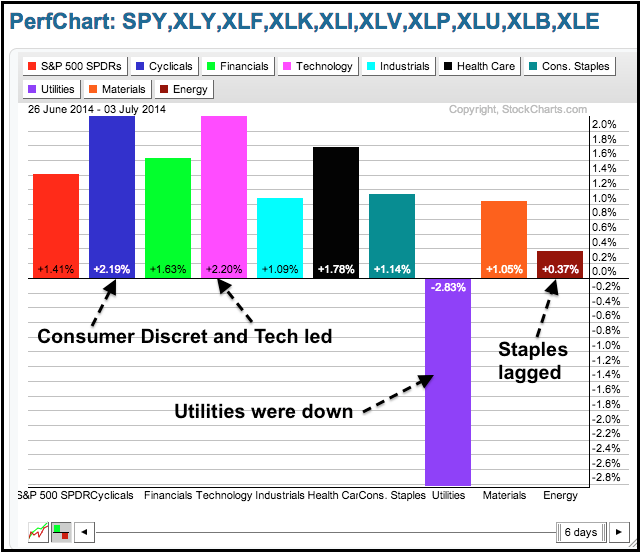

A Rough Week for Utilities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a short week, but stocks moved higher with eight of the nine sectors gaining. As the PerfChart below shows, the consumer discretionary and technology sectors led with 2+ percent gains. The utilities sector was the lone loser with a 2.83% loss. Also notice that the consumer staples...

READ MORE

MEMBERS ONLY

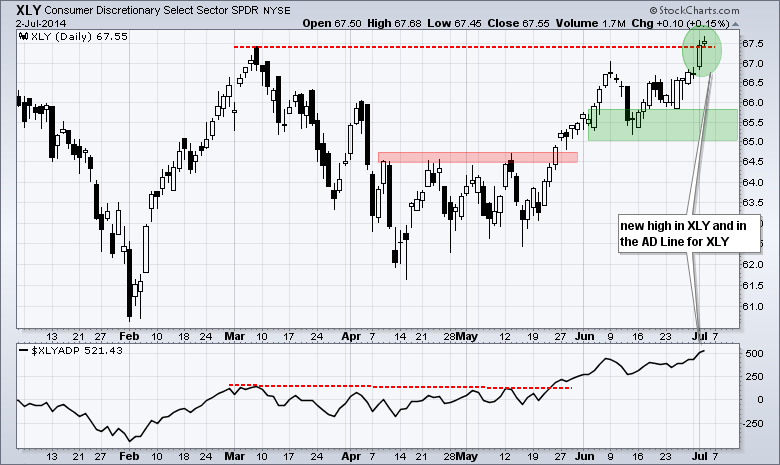

XLY Hits New High - TLT Fails to Hold Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks followed up Tuesday's gains with a mixed trading day on Wednesday. Small-caps and mid-caps came under selling pressure as MDY and IWM fell around .50%. Large-caps held on to their gains as SPY and QQQ finished fractionally higher. Indecisive trading the day before a three day weekend...

READ MORE

MEMBERS ONLY

Shooting Star Takes Shape in Apollo $APOL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apollo (APOL) hit resistance at broken support last week and then formed a shooting star this week. This shooting star represents a failed intraday rally. Notice how the stock surged to 32 on Tuesday and then fell to close near 31. This failure also occurred when the market rallied on...

READ MORE

MEMBERS ONLY

Small-Caps and Large Tech Lead Market to New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

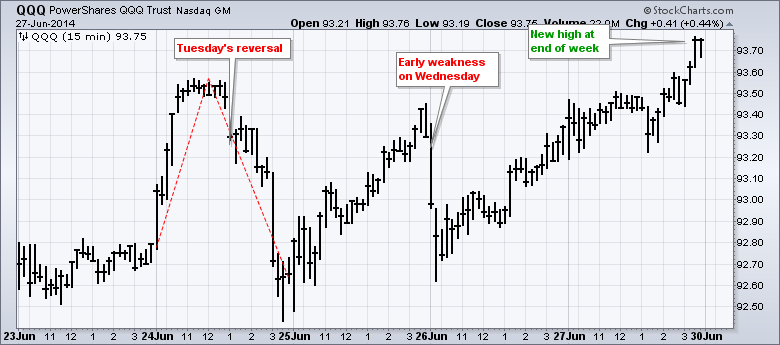

Stocks caught a big bid on Tuesday with small-caps and big techs leading the way. IWM and QQQ gained over 1%. The gains were not that excessive and this market advance continues to be quite incremental. In other words, the daily gains are not excessive, such as 2-3%, but the...

READ MORE

MEMBERS ONLY

Chart Setups: BRO, KSU NOR, NUS, PMCS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. First, we start with an insurance stock that formed a bullish consolidation after a breakout. Next up is a railroad with a triangle after a breakout. The third stock is a small aluminum company with a recent wedge breakout. Fourth, we feature a multi-level marketing...

READ MORE

MEMBERS ONLY

XME and GLD Break Out of Continuation Patterns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were again mixed on Monday. Large-caps lagged as the Dow Diamonds and S&P 500 SPDR closed fractionally lower. Small-caps led as the Russell 2000 iShares closed near last week's high. Techs also showed some relative strength as the Nasdaq 100 ETF hit another new high....

READ MORE

MEMBERS ONLY

Michael Kors Weighs on Retailers with Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Michael Kors (KORS) led the market in February with a massive gap and new high, but the stock has fallen on hard time in June with a trend line break and relative breakdown. On the price chart, KORS broke the internal trend line and support zone with a sharp decline...

READ MORE

MEMBERS ONLY

QQQ Leads with New High - GLD Forms High and Tight Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with bouts of selling pressure on Tuesday afternoon and Thursday morning, but finished the week on a strong note. Overall, the major index ETFs were mixed for the week. QQQ gained 1.06%, SPY was down .06% and IWM rose .08%. The sectors were also mixed with...

READ MORE

MEMBERS ONLY

IGN Forms Flag - TLT Extends Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Thursday with the Nasdaq 100 ETF edging higher (.05%) and the S&P 500 SPDR (SPY) edging lower (-.07%). Five sector SPDRs were up and four were down. Finance and consumer staples led the way lower with small losses. Utilities, healthcare and energy led...

READ MORE

MEMBERS ONLY

Traders are Developing a Sweet Tooth for this ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Spot Sugar ($SUGAR) has been in a downtrend for years, but this commodity may be turning the corner with a higher low and falling wedge. The chart below shows the Sugar ETN (SGG) surging in February and then correcting with a falling wedge the last 3-4 months. The ETF reversed...

READ MORE

MEMBERS ONLY

KRE Forms Continuation Pattern as Stocks Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After an outside day and weak close on Tuesday, stocks rebounded on Wednesday and the major index ETFs closed modestly higher. Small-caps led the way lower on Tuesday and the way higher on Wednesday. Eight of the nine sectors were up with consumer discretionary, healthcare, materials and energy leading. Consumer...

READ MORE

MEMBERS ONLY

Chart Setups: AMCC, BMY, DKS, FISV, KEY, L

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are six setups today. First, we start tech stock that formed a high-tight flag. Second, there is a big pharma stock that is lagging the group, but formed a breakaway gap on big volume. Third, we have a bottom pick play for a sporting good store. Fourth, there is...

READ MORE

MEMBERS ONLY

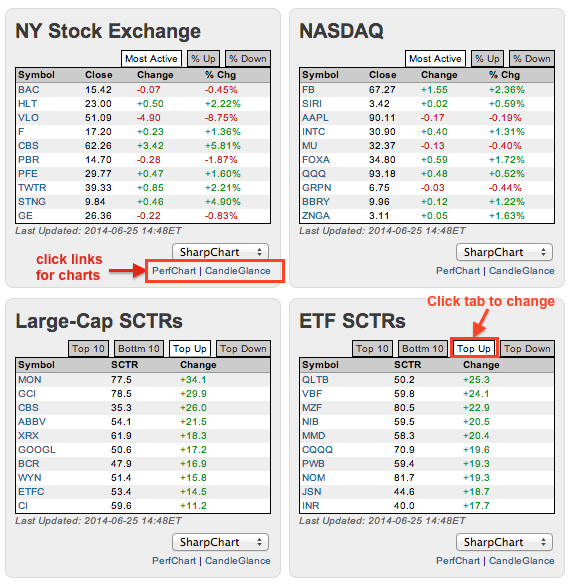

CBS and FB Lead Most Actives, while XRX and PWB Show Big Relative Moves

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can find stocks and ETFs on the move using the six tables in the middle of the home page. The image below shows four of these tables: most active Nasdaq and NYSE stocks, large-cap SCTR movers and SCTR movers for ETFs. Notice that Facebook and CBS are up strong...

READ MORE

MEMBERS ONLY

Industrials and Consumer Discretionary Sectors Weaken

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day strong, but peaked near midday and fell in the afternoon. The major index ETFs formed outside days with a bearish bias. This means Tuesday's high-low range was outside Monday's high-low range and Tuesday's close was weak. One day does not...

READ MORE

MEMBERS ONLY

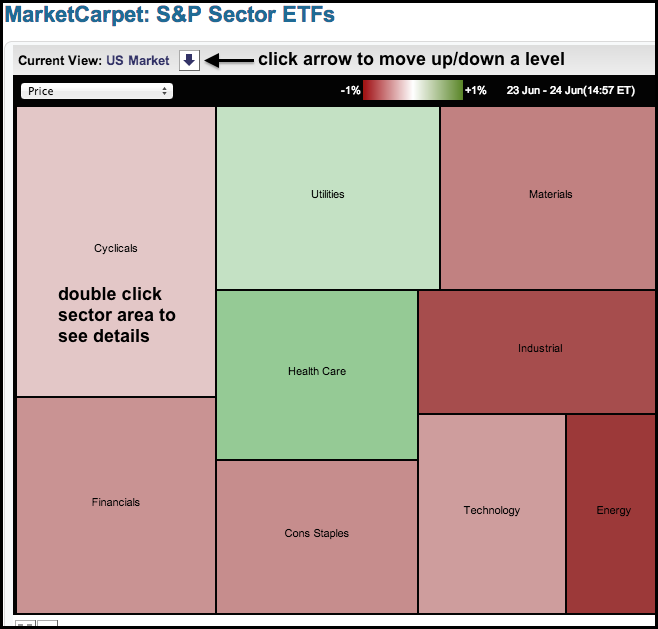

Sector MarketCarpet Turns Mostly Red, but Two Sectors Stay Green

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The MarketCarpet for the nine S&P sectors turned mostly red on Tuesday with seven sectors down and just two up. Utilities and healthCare were the only two holding on to their gains in the late afternoon. Notice that energy is the darkest red. This means stocks in this...

READ MORE

MEMBERS ONLY

Chart Setups: ASEI, BA, GMED, MENT, NTAP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. First, we start with an engineering concern that formed a triangle after a big surge. Second, there is a major aircraft maker with a gap and support break. Third, we have a healthcare stock with a bullish breakout in the works. Fourth, there is a...

READ MORE

MEMBERS ONLY

TLT Holds Wedge Break - UUP Hits Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

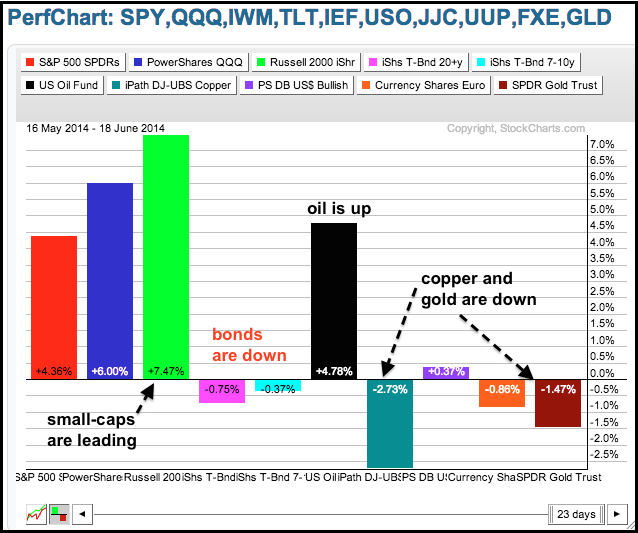

The energizer bunny continues to power the stock market higher. Stocks have been considered overbought several times over the last few weeks, but the uptrend simply trumps everything. Small-caps led the advance last week as the Russell 2000 iShares surged 2.3%. All sectors were up with energy and utilities...

READ MORE

MEMBERS ONLY

Tibco Establishes Support with Rare Red Hollow Candle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Tibco Software (TIBX) has been all over the place the last five weeks. The stock gapped up in late May, gapped down in early June, bounced to 21 and then gapped down again last Friday. Despite all this volatility, the stock may be at support now. Notice that a rare...

READ MORE

MEMBERS ONLY

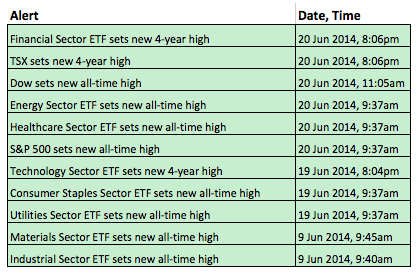

Eight of Nine Sector SPDRs Hit New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The overall picture remains bullish for stocks and sector participation is broad. Six of the nine sector SPDRs hit new highs this week, and seven of the nine hit new highs this month. The Consumer Discretionary SPDR is the only one that has yet to hit a new high and...

READ MORE

MEMBERS ONLY

Yields Move Higher Despite Dovish Fed - UUP Falls Back to Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks did not do much, but it was a most interesting day elsewhere. The major index ETFs closed fractionally higher and the sectors were mixed. The consumer discretionary, technology and finance sectors were fractionally lower. The energy, consumer staples and utilities sectors were modestly higher. Gold and silver miners surged...

READ MORE

MEMBERS ONLY

A Dark Cloud Forms Over Paychex

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Paychex (PAYX) is having all kinds of problems breaking through resistance in the 41.7 area. A bearish engulfing is taking shape today and this is the third bearish candlestick reversal pattern in six weeks. The late May and early June lows mark support in the 40.2-40.4 area...

READ MORE

MEMBERS ONLY

Dovish Fed Puts Bid into Stocks, Bonds and Gold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Yellen Fed came out with a dovish statement on Wednesday. This put a bid into utilities, gold, bonds and stocks. The Dollar and Treasury yields moved lower. The gains in the major index ETFs were modest, but enough to extend the short-term uptrends. The Utilities SPDR surged over 2%...

READ MORE

MEMBERS ONLY

Chart Setups: ARMH, CERN, JNPR, LSCC, TASR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are five setups today. First, we start with a semiconductor stock forming an inverse head-and-shoulders pattern. Second, there is a healthcare stock with a bull flag taking shape. Third, we feature a networking stock with a Bollinger Band squeeze. The fourth stock also comes from the semiconductor group and...

READ MORE

MEMBERS ONLY

Utility Stocks Show Big Relative Gains on SCTR Table

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The utilities sector is on fire Wednesday with several stocks sporting big gains in their StockCharts Technical Rank (SCTR). Northeast Utilities (NU), DTE Energy (DTE) and AES Corp (AES) have double digit gains in their SCTR. Notice that this table can be sorted by clicking the column heading. This makes...

READ MORE

MEMBERS ONLY

UUP Bounces off Support as GLD Hits Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It seems that there are higher yields in our future. The economy is plugging along, the labor market is improving and inflation is on target. The Consumer Price Index (CPI) rose .4% in May and this was the largest increase since February 2013. It also puts the CPI on target...

READ MORE

MEMBERS ONLY

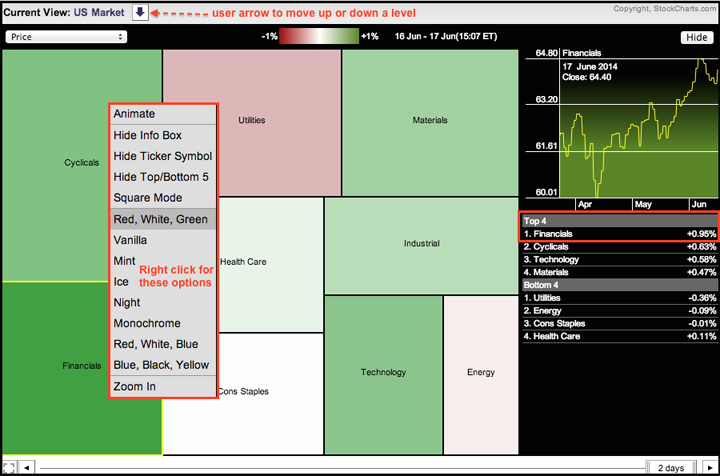

Finance Sector Lights up the MarketCarpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Sector MarketCarpet shows the Finance SPDR (XLF) catching the strongest bid because it is the darkest green. The Utilities SPDR (XLU) is the weakest with an average loss of .36%. Hover over the carpet and right click to see formatting options. Click the arrow in the upper right to...

READ MORE

MEMBERS ONLY

Chart Setups: DSX,GME,HMC,IMMR,NKE,UAL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today we have six setups. We start with a shipper that broke resistance and successfully tested this breakout with a high volume bounce. Next we have a video game retailer consolidating after a gap. Third up is a Japanese automaker with a bull flag. The fourth slot goes to a...

READ MORE

MEMBERS ONLY

Finance Sector Corrects as Fed and Settlements Loom

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Monday, but the major index ETFs managed to eek out small gains. Small-caps showed some relative strength as the Russell 2000 ETF gained .48% on the day. The sectors were mixed with weakness in finance, industrials and materials. Energy and utilities were strong. Strength in oil...

READ MORE

MEMBERS ONLY

Chemtura Hits Rising Three Methods Scan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Rising Three Methods candlestick pattern is a bullish continuation pattern with four candlesticks: a long white candlestick, three candlesticks with small bodies and a long white candlestick that signals a continuation higher. The three small candlesticks mark a short correction or pullback. The chart below shows Chemtura with this...

READ MORE

MEMBERS ONLY

It Could be a Big Week for Housing Stocks and Treasuries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It could be a big week for housing-related stocks and Treasury bonds. The Home Construction iShares (ITB) is at a critical juncture because it is testing the early June breakout after last week's pullback. We will get new data points for housing starts and building permits on Tuesday....

READ MORE