MEMBERS ONLY

SPY Breaks Flag Resistance - Copper Tests its Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks continued higher with the tech sector leading once again. In fact, three of the four offensive sectors led what was really a mixed market. XLK and XLF gained over 1%, while XLI advanced .61%. The Consumer Discretionary SPDR (XLY), however, only managed a .24% gain. Within tech, networking stocks...

READ MORE

MEMBERS ONLY

Charts: BOOM, BRCM, CERN, CHRW, CTXS, URBN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BOOM Forms Long Bullish Consolidation.

BRCM Forms Bull Pennant after Breakout.

Plus CERN, CHRW, CTXS, URBN

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell...

READ MORE

MEMBERS ONLY

Steel ETF Forms Piercing Pattern at Key Level

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Steel ETF (SLX) is perking up after a pullback to support. First, notice how broken resistance in the 46.5-47 area turned into support and held in November and December. With the January test, the ETF formed a piercing pattern on Tuesday and confirmed this candlestick reversal with another...

READ MORE

MEMBERS ONLY

Techs Lead as QQQ Breaks Bull Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After one day of selling pressure on Monday, stocks rebounded with the technology sector leading the way. Networking stocks held up well during Monday's decline and semiconductor stocks led the way on Tuesday. Even though we did not see new highs in the major index ETFs, note that...

READ MORE

MEMBERS ONLY

SPY Fails to Hold Breakout as TLT Extends Advance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with a broad-based selloff, but selling pressure was not that intense. The Russell 2000 ETF (IWM) led the way lower with a 1.05% decline and the Nasdaq 100 ETF (QQQ) held up the best with a .74% loss. All sectors were down with the Consumer Discretionary...

READ MORE

MEMBERS ONLY

Charts: AAPL, AN, CNX, EBAY, IBM, JOY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Firms near Key Retracement.

AN Breaks Trend Line with Volume Expansion.

Plus CNX, EBAY, IBM, JOY

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy,...

READ MORE

MEMBERS ONLY

F5, Juniper and Apple Buck the Selling Pressure

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Sector Market Carpet showed a lot of red on Monday, but there were a few green squares within the tech sector. In fact, a couple of networking stocks led as F5 Networks (FFIV) and Juniper (JNPR) scored big gains. Also notice that Xerox (XRX), Red Hat (RHT), Hewlett Packard...

READ MORE

MEMBERS ONLY

IWM Breaks Triangle Trend Line - XLE Hits Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a big miss for December non-farm payrolls, stocks managed to finish strong and end the week on an up note. The S&P MidCap SPDR (MDY) led the market with a .74% gain, while the Dow Diamonds (DIA) lagged with a .01% loss. The miss in non-farm payrolls...

READ MORE

MEMBERS ONLY

Flags are Flying Around and Within the Dow

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Diamonds (DIA) and several key stocks within the Dow formed bullish continuation patterns over the last two weeks and traders should watch these patterns for breakouts. DIA formed a falling flag and this pattern represents a rest after a sharp advance. Such a rest or pullback is actually...

READ MORE

MEMBERS ONLY

Only Two of the Nine Sector SPDRs are up Year-to-date

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks are off to a rough start in 2014 with seven of the nine sectors SPDRs under water. The Energy SPDR (XLE), Materials SPDR (XLB) and Consumer Staples SPDR (XLP) are leading the way lower. On the flipside, the HealthCare SPDR (XLV) and the Finance SPDR (XLF) show gains and...

READ MORE

MEMBERS ONLY

NYSE and Nasdaq AD Lines Hit New Highs to Affirm Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

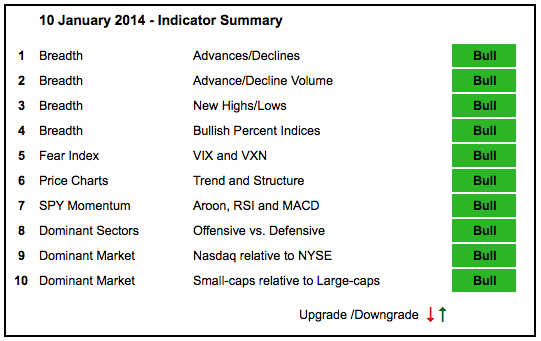

Stocks did not do much this week (as of Thursday) and there is no change in the indicator summary. The AD Lines and AD Volume Lines are in clear uptrends with new highs over the last few weeks. The offensive sectors are leading with XLF hitting a new high this...

READ MORE

MEMBERS ONLY

QQQ and SPY Hold Breakouts Ahead of Jobs Report

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

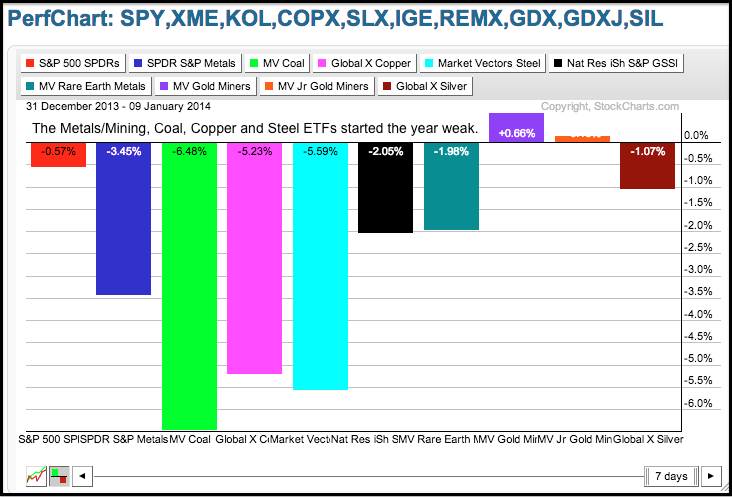

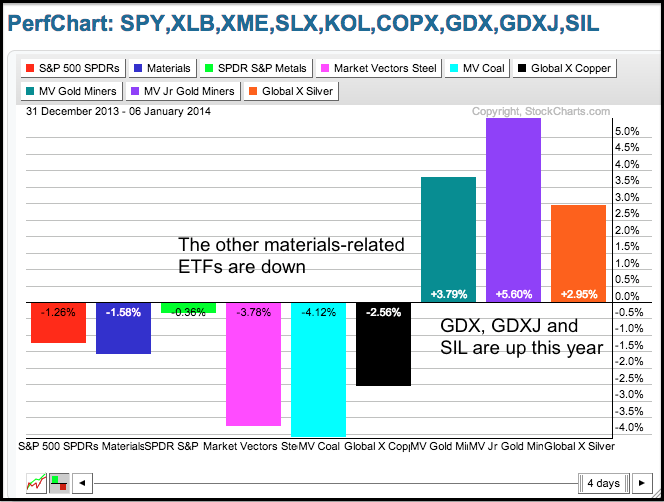

Stocks continued their mixed ways with the Russell 2000 ETF (IWM) closing fractionally higher (-.03%) and the Nasdaq 100 ETF (QQQ) edging lower (-.33%). The technology sector led the way lower as networking, internet and semis came under selling pressure. Materials-related stocks extended their declines with the Coal...

READ MORE

MEMBERS ONLY

Airlines Lead Market, but Shooting Stars Could be Forming

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

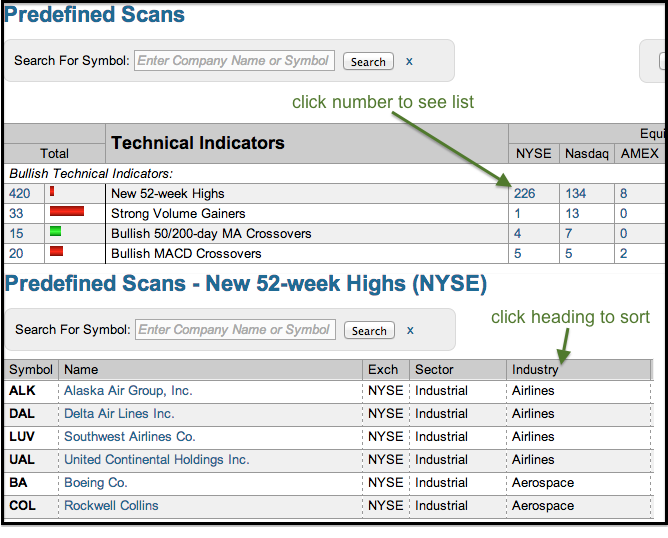

Stocks were under mild selling pressure early Thursday, but airlines bucked the trend with good gains and fresh highs. A look at the predefined scans page shows several airlines and two airline-related stocks making the 52-week high list today. Despite new highs and uptrends, also note that UAL, DAL, LUV...

READ MORE

MEMBERS ONLY

SPY Holds its Breakout - USO Extends Plunge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Wednesday as investors digested the strong ADP report and the prospects of further tapering down the road. Actually, strong job numbers and tapering are nothing new. These realities were simply reinforced with the ADP report and the FOMC minutes, which showed that most policy makers favor...

READ MORE

MEMBERS ONLY

Charts: AAN, CIEN, JBLU, MEDI, SWK, WAG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAN Bounces off Support on Good Volume.

CIEN Challenges Resistance.

Plus $JBLU, MEDI, SWK and WAG.

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell...

READ MORE

MEMBERS ONLY

A Bearish Continiation Pattern Triggers for the Oil&Gas Equip&Services SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weakness in oil continues to weigh on the Oil & Gas Equip & Services SPDR (XES) as the ETF broke flag support. The chart below shows XES hitting resistance at the 50% retracement and breaking flag support over the last three days. This signals a continuation of the prior decline...

READ MORE

MEMBERS ONLY

SPY Breaks Wedge Trend Line - GLD Stalls at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Turnaround Tuesday took hold as stocks bounced to end the 2014 slump, which lasted a whole three days. The gains, however, were relatively muted as participants held back ahead of Friday's employment report. The employment numbers will start coming in with the ADP Report today, the Challenger report...

READ MORE

MEMBERS ONLY

Retail SPDR Lags as SCTR Breaks Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new high in late December, but the Retail SPDR (XRT) fell short of its prior high and could be forming a lower high, which is the first step to a downtrend. The June trend line and December low mark key support in the...

READ MORE

MEMBERS ONLY

QQQ Forms Bull Flag - GLD Toys with First Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their correction with relatively mild selling pressure. The Russell 2000 ETF (IWM) led the decline with a .81% loss, but the S&P 500 SPDR (SPY) only lost .29% on the day. The sectors were mixed with the Consumer Discretionary SPDR (XLY) and Industrials SPDR (XLI) edging...

READ MORE

MEMBERS ONLY

Charts: AAPL, BMY, EA, GME, WDAY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Hits Key Level as Volume Ticks Higher.

BMY Forms a Pennant.

Plus EA, GME, WDAY

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell...

READ MORE

MEMBERS ONLY

Two Key Moving Averages Define the Trend for the Coal ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Coal ETF (KOL) got a summer bounce, but stalled in the autumn and then hit resistance from the falling 200-day moving average. The 50-day moving average joined the battle as it met the 200-day at the end of December. With a sharp downturn the last three days, KOL appears...

READ MORE

MEMBERS ONLY

XLF Starts Strong and UUP Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

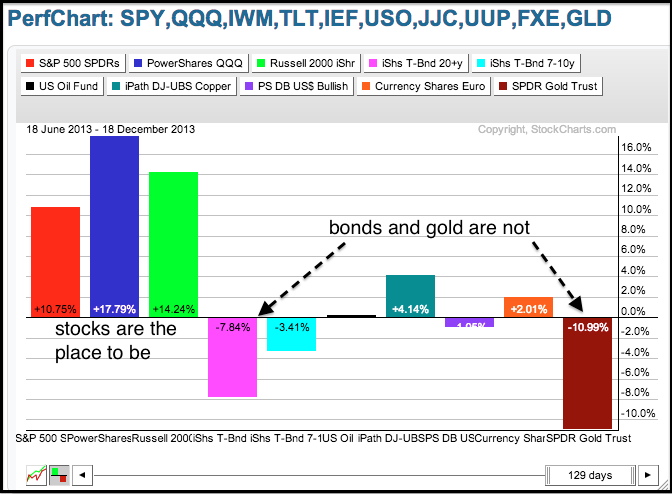

Stocks got off to a rough start in 2014, but the big trends were unaffected by this relatively shallow pullback. In fact, a two day pullback after an eleven day advance is pretty normal. Techs were hit Thursday and Friday as the Nasdaq 100 ETF (QQQ) fell 1.5%. Small-caps...

READ MORE

MEMBERS ONLY

Gold Miners ETF Challenges First Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold Miners ETF (GDX) remains in a downtrend overall, but the ETF is showing signs of life with a resistance challenge to start the year. Resistance in the 22-23 area stems from broken support, the August trend line and the early December high. GDX needs to clear this zone...

READ MORE

MEMBERS ONLY

AD Lines and AD Volume Lines Surge to New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks finished the year strong as the major index ETFs and offensive sector SPDRs hit new highs. These new highs were confirmed with new highs in the AD Lines and AD Volume Lines. Net New Highs also expanded as the High-Low Lines hit new highs. New highs all around can...

READ MORE

MEMBERS ONLY

UUP Challenges Resistance as GLD Forges Bear Trap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with selling pressure on the first trading day of the year. A little profit taking after a sharp eleven day advance is pretty normal. While this decline could extend further and retrace a portion of the December surge, I am viewing it as a small correction and...

READ MORE

MEMBERS ONLY

A Double Wedge Break For Bank of America

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bank of America (BAC) is starting the New Year with a breakout on the price chart and surge in the StockCharts Technical Rank (SCTR). The SCTR is up over 15 points and back above 70, which made it easy to spot on the SCTR table when sorted by change. On...

READ MORE

MEMBERS ONLY

Charts: COP, FSLR, GPS, LUB, PG, TSM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

COP Firms on Good Volume.

FLSR Continues to Show Relative Weakness.

Plus GPS, LUB, PG, TSM

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell...

READ MORE

MEMBERS ONLY

Intraday AD Lines Confirm Market Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Seasonality worked quite well over the last two weeks as the major index ETFs surged from December 16th to yearend. All were up 4% or more over the last eleven trading days. The Russell 2000 ETF (IWM) and Dow Diamonds (DIA) led with gains exceeding 5%. All sectors moved higher...

READ MORE

MEMBERS ONLY

HealthCare and Consumer Discretionary Sectors Duke it Out for Top Honors

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Discretionary SPDR (XLY) and the HealthCare SPDR (XLV) are the top performing sectors year-to-date. Both are up over 40% and easily outperforming the S&P 500 SPDR (SPY), which is up a mere 29%. The Industrials SPDR (XLI) will take third place and the Finance SPDR (XLF)...

READ MORE

MEMBERS ONLY

Baker Hughes Breaks Key Line on Intraday P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Baker Hughes (BHI) perked up over the last few weeks by establishing support in the lows 50s and triggering three bullish P&F signals. First, notice that the stock forged a Triple Top Breakout at 53.7. Second, BHI triggered a bullish Catapult with a move above 54. Third,...

READ MORE

MEMBERS ONLY

Nasdaq AD Line Confirms Underlying Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

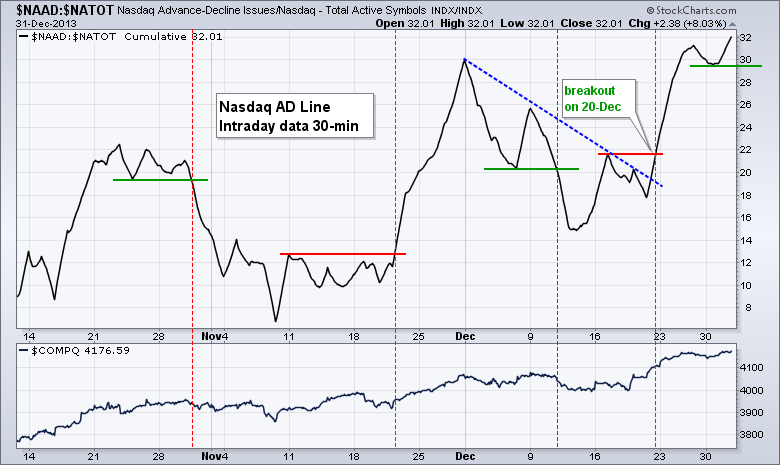

The Nasdaq AD Line extended its year long uptrend with a surge and new high in December. The chart below shows the AD Line with a series of rising peaks and rising troughs (higher highs and higher lows). Also note that this new high in the AD Line confirms the...

READ MORE

MEMBERS ONLY

Could Copper Play Catch Up in 2014?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Copper ETN (JJC) is poised to challenge resistance after a channel breakout this month. Notice that the ETF successfully tested the spring-summer lows with a 5+ percent bounce this month. A break above the spring-summer highs would forge a higher high and argue for the start of an uptrend....

READ MORE

MEMBERS ONLY

Relative Weakness in Retail is Offset by Three Key Groups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows one-month performance for ten industry group ETFs. Even though I am concerned with relative weakness in the Retail SPDR (XRT), this concern is offset by relative strength in three other groups. It has been a good month for stocks with the Home Construction SPDR (ITB) and...

READ MORE

MEMBERS ONLY

Pre-defined Technical Alerts Page Lights Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a strong open on Monday, the pre-defined technical alerts page is showing lots of green for the stock market. Notice that five sector SPDRs hit new highs, three major indices hit new highs and the S&P 500 Bullish Percent Index surged above 80. The table below today&...

READ MORE

MEMBERS ONLY

SPY Breaks to New High - IWM Starts to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming Note: I will be taking time off between Christmas Eve and New Years. The next commentary for Art's Charts will be on Thursday, January 2nd. I wish everyone a very Merry Christmas season and a Happy New Year!

Stocks finished the week on a strong note as...

READ MORE

MEMBERS ONLY

Tech Stocks Take Charge as 2014 Approaches

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

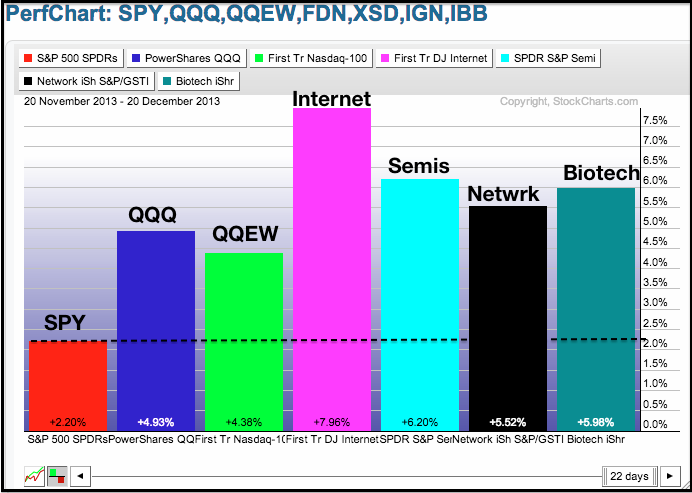

Key industry group ETFs within the technology sector are leading the market. This shows a healthy appetite for risk and bodes well for the economy. The PerfChart below shows one-month performance for the S&P 500 ETF (SPY) and six tech-related ETFs. The Nasdaq 100 ETF and the Nasdaq...

READ MORE

MEMBERS ONLY

Small-Caps Lag, but Bulk of Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After correcting the first two weeks of December, stocks caught a big bid after the FOMC policy statement and the major index ETFs recouped their prior losses. SPY fell from 182 to 178 and then surged to 182 on Wednesday. These moves were enough to propel the Nasdaq AD Line...

READ MORE

MEMBERS ONLY

Intraday AD Lines Fail to Breakout - TLT Stalls at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After big gains on Wednesday, stocks corrected a bit to digest these gains on Thursday. The Russell 2000 ETF (IWM) and the S&P MidCap 400 ETF (MDY) fell back with losses around .75% on the day. DIA edged higher with a fractional gain, while SPY edged lower. Eight...

READ MORE

MEMBERS ONLY

Sector Summary Reveals the Leading Steel Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A top-down browse through the sector summary shows that steel stocks are up in a down market on Thursday. Starting with the sector overall, chartists can see which sectors are leading and which are lagging. After clicking "materials sector", chartists will be taken to the industry groups within...

READ MORE

MEMBERS ONLY

SPY Surges to Consolidation Resistance - GLD Breaks Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Fed finally decided to taper and the markets are reacted in a big way. Note that the Fed merely reduced its quantitative easing from $85 billion per month to $75 billion. It is, however, a start that marks a change in Fed policy. I think stocks were just waiting...

READ MORE