MEMBERS ONLY

Charts of Interest: BAX, DHI, MXIM, NVDA, TIBX, XLNX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BAX Surges to Wedge Trend Line on Good Volume.

DHI Affirms Support with Big Bounce.

Plus MXIM, NVDA, TIBX, XLNX

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a...

READ MORE

MEMBERS ONLY

Dow Surges Above Flag Resistance with Triple Digit Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow is making a bold statement as it holds the resistance breakout from November and exceeds flag resistance. The Dow broke to new high with a move above 15700 in early November and the 15600-15700 area turns support. This level held on the throwback, which formed a falling flag....

READ MORE

MEMBERS ONLY

Techs and Small-Caps Show Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today looks like a big day. First, we get housing starts and building permits before the open. Second, we get the Fed policy statement at 2PM ET. This is also Chairman Bernanke's last Fed meeting and last press conference, which will be at 2:30PM. Trading is likely...

READ MORE

MEMBERS ONLY

Hard Drive Makers Lead Tech Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Reports of the death of the PC have been greatly exaggerated. Though not PC makers, the hard drive makers are strong with two hitting 52-week highs this week. Seagate (STX) and Western Digital (WDC) hit new highs and stand out on the predefined scans page. A search for STX shows...

READ MORE

MEMBERS ONLY

ITB Consolidates ahead of Data - SPY Surges off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got a bounce on Monday with the Russell 2000 ETF (IWM) leading the way. The entire bounce, however, occurred in the first twenty minutes of trading. Even though there was no follow thru to the opening surge, the major index ETFs did hold their gains and finished the day...

READ MORE

MEMBERS ONLY

Charts of Interest: CRM, CVC, CY, IBM, KSS, NNA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CRM Stalls at Support Zone.

CVC Forms Continuation Pattern after Breakout.

Plus CY, IBM, KSS and NNA

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy,...

READ MORE

MEMBERS ONLY

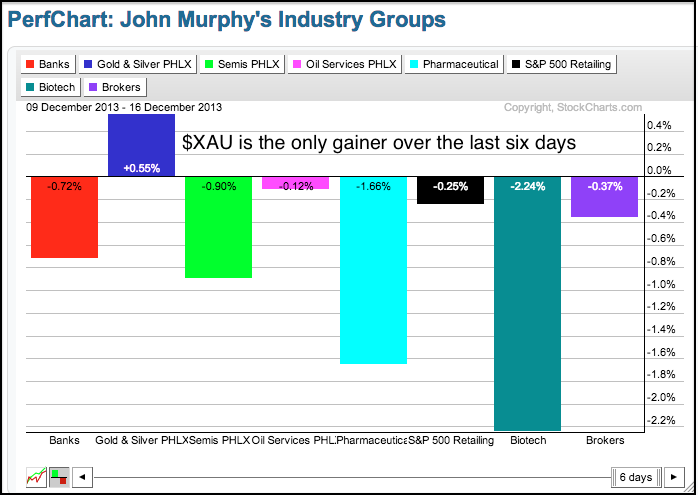

Gold&Silver Index Shows Short-term Relative Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PHLX Gold & Silver Index ($XAU) is actually showing some strength with a small gain over the last six days. Perhaps this is because most other industry group indices are down and XAU is a contrarian play. The PerfChart below shows John Murphy's eight industry groups since...

READ MORE

MEMBERS ONLY

Techs and Defensive Sectors Lead Market Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their correction as the S&P 500 ETF (SPY) saw its biggest weekly decline since August. The Russell 2000 ETF (IWM) led the major index ETFs lower with a 2% decline last week. In an interesting twist, the defensive sectors showed the biggest losses. The Healthcare SPDR...

READ MORE

MEMBERS ONLY

Delta and SW Airlines Lead Industrials Sector

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Sector MarketCarpet shows that Delta and Southwest, two airline stocks, are leading the industrials sector on Thursday. Airlines tend to move as a group and this means other airline stocks are likely strong as well. Note that both stock hit 52-week highs in late November and led the market...

READ MORE

MEMBERS ONLY

NYSE Breadth Weakens, but Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The December pullback weakened a few indicators, but the bulk of the long-term evidence remains bullish. Most notably, the NYSE AD Line formed a small bearish divergence, as did the NYSE AD Volume Line. The Nasdaq AD Line and AD Volume Line, however, did not form divergences and techs remain...

READ MORE

MEMBERS ONLY

Small-Caps Firm, but Techs Weaken as IGN Breaks Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks put in a mixed performance on Thursday as the Russell 2000 ETF (IWM) edged higher and the Nasdaq 100 ETF (QQQ) edged lower. The sectors were also mixed with the Consumer Staples SPDR (XLP) taking the biggest hit (-1.38%). Techs were under pressure from the Networking iShares (IGN)...

READ MORE

MEMBERS ONLY

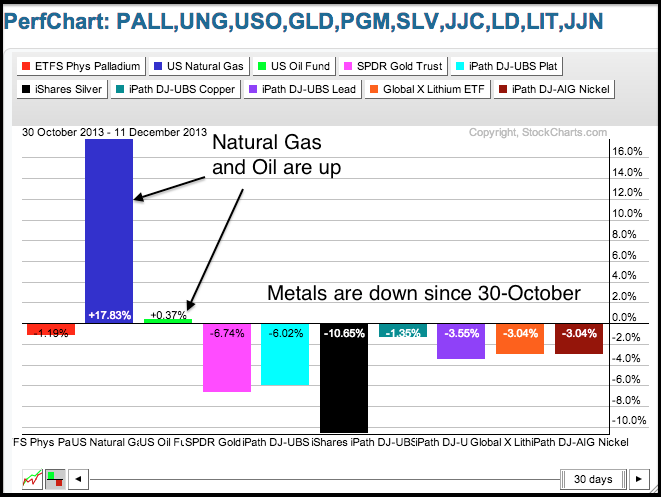

Natural Gas ETF Leads as Metals ETFs Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Natural Gas ETF (UNG) is on a tear with a 15+ percent gain since October 30th. The PerfChart below shows UNG with nine other commodity-related ETFs. The eight metal-related ETFs are down with the Gold SPDR (GLD) and Silver Trust (SLV) leading the way lower. The US Oil Fund...

READ MORE

MEMBERS ONLY

Correction Extends with Small-Caps Leading the Way

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their corrective ways as the major index ETFs fell over 1%. While most news outlets suggested that this was a taper tantrum, I am not so sure because stocks were up substantially in November, not to mention year-to-date. The prospects of a taper have been building for weeks...

READ MORE

MEMBERS ONLY

Charts of Interest: DDD, DNDN, EBAY, SYSS, TSM, XONE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

DDD Forms Dark Cloud at Prior High.

DNDN Edges Higher with Good Volume.

Plus EBAY, SYSS, TSM and XONE

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation...

READ MORE

MEMBERS ONLY

European Top 100 Index Breaks Channel and Underperforms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The European Top 100 Index ($EUR) broke below the lower trend line of a five month channel with a sharp decline this month. In addition, notice that the index broke below the mid November low and these breaks are holding. European stocks are also showing relative weakness as the price...

READ MORE

MEMBERS ONLY

Small-Caps Turn Laggards as IWM Fills the Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY and QQQ remain in short-term uptrends, but stocks are in a December funk of sorts. Small-caps are lagging as IWM filled its gap and failed to hold its breakout. As shown yesterday, the S&P 500 AD Line formed a bearish divergence and broke support. In Tuesday'...

READ MORE

MEMBERS ONLY

An Array of Patterns Takes Shape for TEVA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Teva Pharmaceuticals (TEVA) has been all over the place since early October, but two bullish patterns are taking shape and the stock could be poised for a breakout. First, the stock formed a massive island reversal with the late October gap down and the late November gap up. Second, the...

READ MORE

MEMBERS ONLY

Charts of Interest: BOOM, CVC, FLIR, K, LXK, SWC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BOOM Shows Relative Weakness.

CVC Breaks Out with Good Volume.

Plus FLIR, LXK, SWC

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should not

be construed as a...

READ MORE

MEMBERS ONLY

S&P 500 AD Line Forms Short-Term Divergence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered on Monday with the Nasdaq 100 ETF (QQQ) edging higher (.41%) and the Russell 2000 ETF (IWM) closing fractionally lower (-.03%). Seven sectors were up and two were down (XLU and XLY). Despite weakness in the consumer discretionary sector, the Home Construction SPDR (ITB) and the Retail...

READ MORE

MEMBERS ONLY

A Dark Cloud forms over Seagate

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Seagate Technology (STX), which is a Nasdaq stock with a three letter symbol, opened strong and closed weak to make the dark cloud scan list. These are potentially bearish patterns that require confirmation. A move below 49.5 would break the three week trend line and produce a bull trap,...

READ MORE

MEMBERS ONLY

The January Effect Gets Earlier and Earlier

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

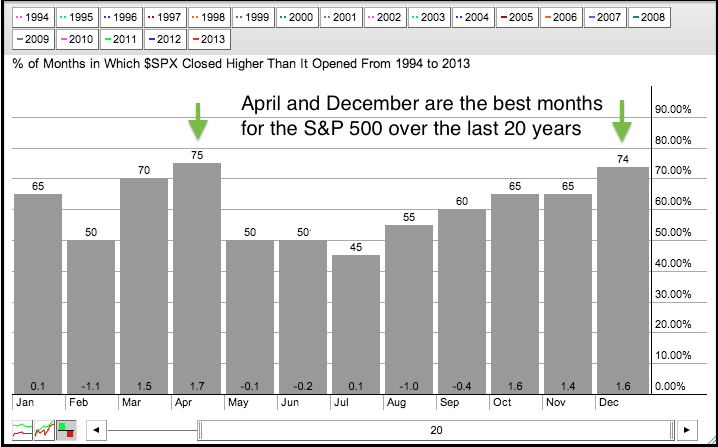

The "January effect" refers to the propensity for stocks to outperform in January and for small-caps to outperform large-caps in January. According to this theory, stocks tend to rise more in January than most other months and small-caps tend to rise even more. Chartists looking to test these...

READ MORE

MEMBERS ONLY

Yield Curve Steepens as 10-Year Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The yield curve is steepening as the 10-YR Treasury Yield ($TNX) surges more than the 2-YR Treasury Yield and the 3-Month Treasury Yield. A steepening yield curve confirms loose monetary policy and this could help banks, which make money by borrowing short and lending long.

Click this image for a...

READ MORE

MEMBERS ONLY

Breadth Indicators Hit New Highs and Small Caps Perk Up

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulk of the evidence remains bullish as stocks continue in strong uptrends. The Nasdaq AD Line and AD Volume Line hit new highs as techs led the market in November. The NYSE AD Line and AD Volume Line are lagging somewhat, but are nowhere close to breaking down and...

READ MORE

MEMBERS ONLY

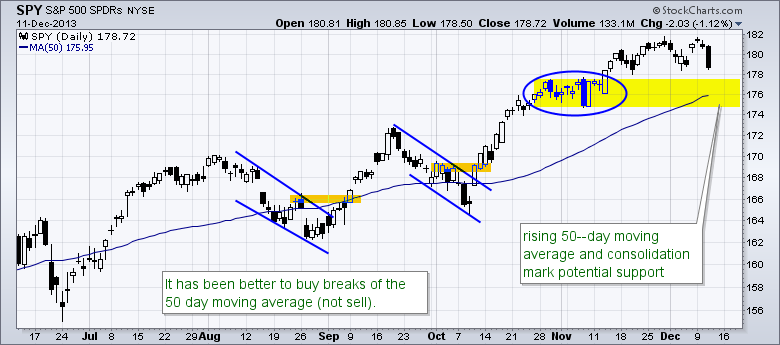

SPY Extends on Flag - $NATGAS Surges thru Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their corrective ways as the S&P 500 ETF (SPY) lost ground for the fifth consecutive day. Bespoke reports that 1996 was the last time the S&P 500 started December with a five day decline. Maybe so, but the index is down a mere 1....

READ MORE

MEMBERS ONLY

Facebook Challenges Key Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Facebook (FB) got a bounce over the last seven days and broke above the wedge trend line. This is the first step to ending the correction that started in mid October. The 50-day moving average is the next hurdle. A follow thru break above this moving average on good volume...

READ MORE

MEMBERS ONLY

IWM Hits Moment of Truth - TLT Falls Sharply

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks extended their mixed correction with weakness for the third day running. The declines, however, remain very modest and selling pressure has been contained. The Russell 2000 ETF (IWM) lost .27% on the day, while the Nasdaq 100 ETF (QQQ) edged higher with a .09% gain. Microsoft led QQQ higher...

READ MORE

MEMBERS ONLY

Charts of Interest: ATVI, CHRW, EMC, FFIV, TIBX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATVI Triangulates with Two Patterns.

CHRW Tests Key Support Level.

Plus EMC, FFIV and TIBX

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should not

be construed as...

READ MORE

MEMBERS ONLY

Lexmark Bounces off Support with Good Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Lexmark (LXK) presents a conundrum for traders. On the bullish side, the stock bounced off support near 35 with a three day advance on pretty good volume. Relative to the market, the stock is also holding up pretty well the last three days. On the bearish side, the stock shows...

READ MORE

MEMBERS ONLY

Tech Sector Shows Relative Strength During Correction

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs corrected over the last two days, but this correction turned mixed as the tech sector held up relatively well on Tuesday. Also notice that the declines in the major index ETFs were modest and not that significant, especially considering the big gains from November. The PerfChart...

READ MORE

MEMBERS ONLY

WTI Surges, but Brent-WTI Spread Remains Large

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Brent Crude ($BRENT) surged above $110 this week and WTI Crude ($WTIC) moved above $96, but the spread between the two remains wide. The chart below shows Brent trading some $18 higher than WTI. The indicator window shows the $BRENT:$WTIC ratio nearing 1.2 for the first time since...

READ MORE

MEMBERS ONLY

Gold Nears July Low as Dollar Firms at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a two week surge at the end of November, stocks started December with some selling pressure. Small-caps and micro-caps led the two week surge, and the Monday pullback. The Russell 2000 ETF (IWM) fell 1% and the Russell Micro Cap ETF (IWC) fell 1.44%. The sectors were mixed...

READ MORE

MEMBERS ONLY

Charts of Interest: AMT, AN, CY, FB, PLCM, TER

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMT Bounces off Key Retracement with Volume.

AN Forms Flag after Wedge Break.

Plus CY, FB, PLCM and TER.

Individual charts are below video.

Sorry but your browser doesn't support HTML5 video.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should...

READ MORE

MEMBERS ONLY

SCTR Surges as Gap Breaks Wedge Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gap is making some waves with an island reversal in early November and wedge breakout here in early December. Also notice that the SCTR surged above 40 and is on the verge of breaking into the upper half of its range. Click here for the current SCTRs for the S&...

READ MORE

MEMBERS ONLY

Small-Caps Start to Lead - Dollar Hits Support Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Trading was a bit strange last week, but stocks remain in short-term uptrends and still show no signs of sustained selling pressure. First, the trading week was short because of the Thanksgiving holiday and shortened day on Friday. Second, volume levels were low. Third, trading was rather mixed with the...

READ MORE

MEMBERS ONLY

The Squeeze Play is On for Qlogic

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big surge in October, Qlogic (QLGC) moved into a consolidation as volatility contracted. Notice that the Bollinger Bands contracted and the Bandwidth moved to its lowest level of the year. The stock is showing some signs of buying pressure with two white candles over the last five days....

READ MORE

MEMBERS ONLY

Home Construction SPDR Makes the Aroon Bull Scan

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction SPDR (ITB) is making a bid to break resistance as Aroon Up surges above Aroon Down. Also notice that Aroon Up hit 100, which suggests that a new uptrend may be emerging. Note, however, that this is the third time in three months that Aroon Up has...

READ MORE

MEMBERS ONLY

Skyworks Solutions Breaks Cup-with-Handle Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The cup-with-handle pattern is a bullish continuation pattern that was popularized by William O'Neil of IBD. The handle marks a small consolidation near resistance and the breakout confirms the pattern. With the cup measuring around three points from low to high, chartists can project a three point move...

READ MORE

MEMBERS ONLY

Pre-defined Technical Alerts Page Lights Up Green

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened higher on Monday with several ETFs hitting new highs and new all time highs. Chartists can follow these milestones on the Predefined Technical Alerts page. In addition to several major stock indices, note that XLY, XLV, XLI and XLF recorded new highs on Monday. Also note that oil...

READ MORE

MEMBERS ONLY

IWM Revives and Surges to New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Programming note: I am taking some holiday this week and Art's Charts will not be updated on Tuesday, Wednesday and Friday. The market is closed on Thursday and will close early on Friday (1PM). Stocks were relatively mixed last week, but some groups led the market and the...

READ MORE

MEMBERS ONLY

Finance Sector Leads with a Fresh 52-week High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

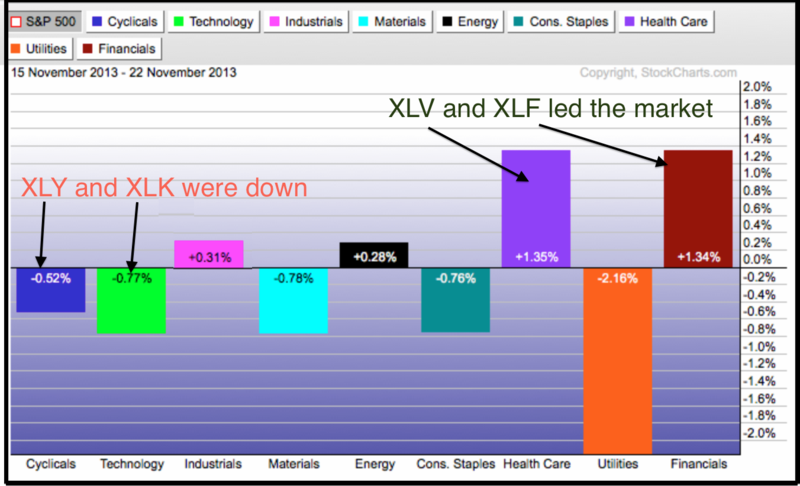

Three of the nine sector SPDRs hit new highs this week with the Finance SPDR (XLF) leading the way. The Energy SPDR (XLE) and the Healthcare SPDR (XLV) also recorded new highs. Even though XLF has been underperforming the S&P 500 since summer, this key sector is showing...

READ MORE