MEMBERS ONLY

IWM and QQQ Surge above Broken Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on hopes of a deal in Washington. Is this hope justified or will we be back at a stalemate in a few days? Should traders fade the rally or does this rally have legs? Personally, I think this rally is based on short covering and there is little...

READ MORE

MEMBERS ONLY

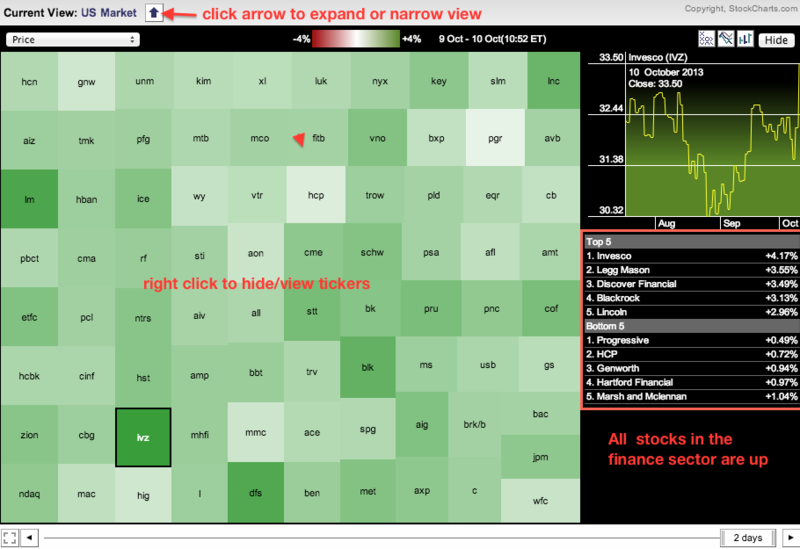

Finance Sector Lights Up Market Carpet with Green

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The finance sector is leading Thursday's market rebound with all stocks in the sector showing gains in early trading. The image below shows the market carpet for the finance sector and all components are green today. The top five are up over 3% and even the bottom five...

READ MORE

MEMBERS ONLY

GLD Fails at First Resistance - TLT Extends Falling Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks started the day weak, but caught a lunchtime bid and bounced off their morning lows. There was no follow through to this bounce as the major index ETFs fell back in the final hour and ended the day mixed. Large-caps gained as the Dow SPDR (DIA) and S&...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, APH, CL, CVS, FLO, TEVA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Forms Bullish Continuation Pattern.

APH Firms at Support with Good Volume.

Plus CL, CVS, FLO, TEVA

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here...

READ MORE

MEMBERS ONLY

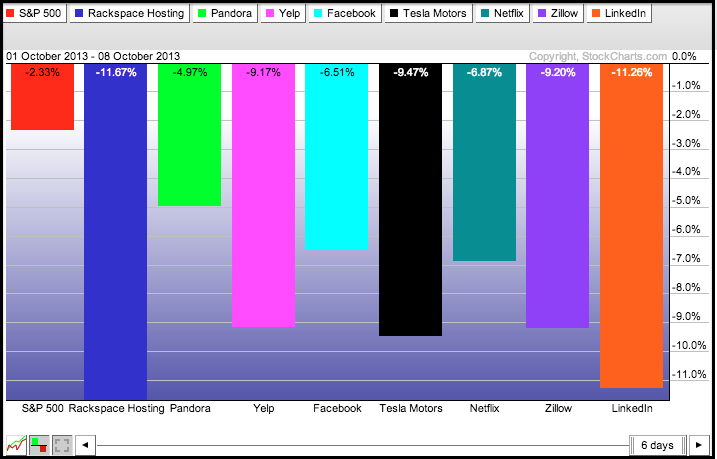

High Flyers Fall Hard as Traders Shun Risk

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After recording new highs just a few weeks ago, the darlings of the stock market were hit hard as traders sold risk and sought relative safety. LinkedIn (LKND), Tesla (TSLA), Yelp (YELP) and RackSpace (RAX) fell more than 9% in the last five days. All eight stocks in the PerfChart...

READ MORE

MEMBERS ONLY

IWM and QQQ Break Short-Term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks took it on the chin with broad-based selling pressure on Tuesday. The Nasdaq 100 ETF (QQQ) and Russell 2000 ETF (IWM) led the way and broke short-term support levels. This means IWM and QQQ have joined SPY and DIA with downtrends. The Home Construction iShares (ITB) led the consumer...

READ MORE

MEMBERS ONLY

Utilities SPDR Battles Key Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) is battling the rising 200-day moving average for the third time in five months. Since surging above 38 in mid September, the ETF pulled back with a falling wedge. Buyers stepped in near the 200-day as the ETF moved above the wedge trend line early Tuesday....

READ MORE

MEMBERS ONLY

XLY Breaks Support and GLD Breaks Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak, bounced and then closed weak. Small-caps led the way lower with the Russell 2000 ETF (IWM) falling just over 1%. All sectors were down with the Consumer Discretionary SPDR (XLY), Finance SPDR (XLF), Basic Materials SPDR (XLB) and Healthcare SPDR (XLV) falling over 1%. Relative weakness in...

READ MORE

MEMBERS ONLY

Charts of Interest: AMT, ATML, COV, HD, JBLU

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMT Consolidates after Gap-Breakout.

ATML Fall on Expanding Volume.

Plus COV, HD, HON and JBLU

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is...

READ MORE

MEMBERS ONLY

S&P 500 Volatility Index Surges above August High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The volatility premium rose sharply as the VIX surged 50% and hit a three month high. The chart below shows the VIX rising from the 13 area to 19.41 in less than three weeks. While the VIX exceeded its August high, the S&P 500 has yet to...

READ MORE

MEMBERS ONLY

SPY Trends Lower as QQQ and IWM Consolidate

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It remains a tale of two markets. The Dow Industrials SPDR and the S&P 500 ETF are weak and in short-term downtrends. The Russell 2000 ETF and Nasdaq 100 ETF are holding up and remain in consolidation patterns since September 18th. QQQ and IWM bounced off short-term support...

READ MORE

MEMBERS ONLY

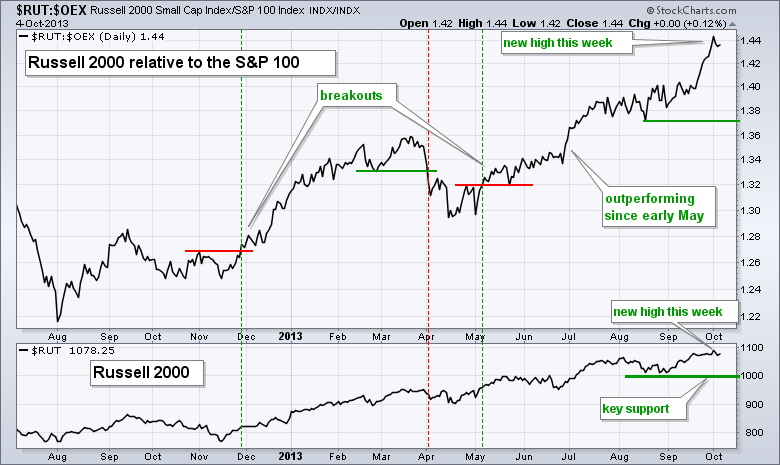

Relative Strength in Small-caps Supports the Current Bull Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ($RUT) and the Nasdaq ($COMPQ) are leading the relative performance game and this is positive for the stock market. The Russell 2000 represents small-caps and the Nasdaq represents the technology sector. Together, these two represent risk appetite because their stocks have higher betas, which translates into higher...

READ MORE

MEMBERS ONLY

Elder Impulse Bar Turns Green for the Networking iShares

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Networking iShares (IGN) declined sharply in late September, but managed to hold above its prior low and keep the rising channel in place. With a big surge on Friday, the Elder Impulse bar turned green to signal an upturn in momentum. Also notice that the StockCharts Technical Rank (SCTR)...

READ MORE

MEMBERS ONLY

New Highs in QQQ and IWM Counter Weakness in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials SPDR and the S&P 500 ETF pulled back over the last two weeks, but the Nasdaq 100 ETF and Russell 2000 ETF held strong and hit new highs earlier this week. Relative strength in QQQ and IWM is more important than relative weakness in SPY...

READ MORE

MEMBERS ONLY

Momentum Weakens for IWM and QQQ - SPY Breaks Pennant

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved lower with broad-based selling pressure on Thursday. Stocks just don't seem to know what they want. It seems as if the shutdown, continuing resolution and debt ceiling are snowballing into a grand bargain of sorts, which would be positive for the markets, long-term at least. The...

READ MORE

MEMBERS ONLY

Banks Underperform on Industry Group PerfChart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows the performance for John Murphy's key industry groups over the past month. Eight of the nine are up, but the Banking Index ($BKX) is up the least and seriously underperforming. The Gold & Silver Index ($XAU) is down sharply.

Click this image for a...

READ MORE

MEMBERS ONLY

TLT Forms Falling Flag as SPY Consolidates with Pennant

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged lower on Wednesday, but the losses were fairly muted. The Russell 2000 ETF (IWM) fell .41% and the S&P 500 ETF (SPY) declined just .09% on the day. The sectors were mixed with small gains and losses. The Regional Bank SPDR (KRE) showed relative weakness with...

READ MORE

MEMBERS ONLY

Charts of Interest: DF, FFIV, INFY, PFE, XRAY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

DF Breaks Triangle Support to Continue Downtrend.

FFIV Bounces off Breakout Zone.

Plus INFY, PFE, XRAY

Video is at top. Individual charts are below.

Click here for iPad/iPhone Version

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or...

READ MORE

MEMBERS ONLY

Chuy's Makes the MACD Scan with a Bullish Cross

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chuy's Holdings (CHUY) is showing some promise with a bounce off support and bullish MACD cross. Notice that broken resistance turned into support in the 34 area and held from June to September. With the move above 37 this week, MACD moved above its signal line and momentum...

READ MORE

MEMBERS ONLY

IWM and QQQ Break to New Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Theshut down was not enough to derail the first trading day of the month phenomenon. There has been a bullish bias on the first trading day of the month for years now. Managers accumulate funds during the month and then deploy them at the beginning of the next month. With...

READ MORE

MEMBERS ONLY

Marking Momentum Support for the Russell 2000 ETF

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) surged to a new high with two long white candlesticks. Notice how the ETF opened weak on Monday and then moved higher and exceeded the September high. Also notice how StochRSI held support at .50 and moved back above .80 today. Chartists can now mark...

READ MORE

MEMBERS ONLY

IWM and QQQ Hold Support and Short-Term Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

There is a lot of uncertainty in the market place right now and this means every little news bite could trigger a price swing. There will eventually...

READ MORE

MEMBERS ONLY

Charts of Interest: ATML, CREE, FLIR, LULU, VMC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATML Tests Support with Bullish Candlestick.

Broken Resistance Turns Support for CREE.

Plus FLIR, LULU, VMC

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for...

READ MORE

MEMBERS ONLY

Sector Carpet Reveals Pockets of Strength within Healthcare

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below comes from today's sector Market Carpet. Notice that four of the top five performers in the S&P 500 come from the healthcare sector (ISRG, STJ, REGN and THC). All sectors were down on Monday, but Healthcare was the best performing sector because it...

READ MORE

MEMBERS ONLY

Short-term Uptrends Challenged as Shutdown Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stock futures are trading sharply lower as the first government shut down in 17 years looms on the horizon. This little shutdown charade is not the only...

READ MORE

MEMBERS ONLY

Top Up and Top Down SCTRs Highlight the Big Movers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

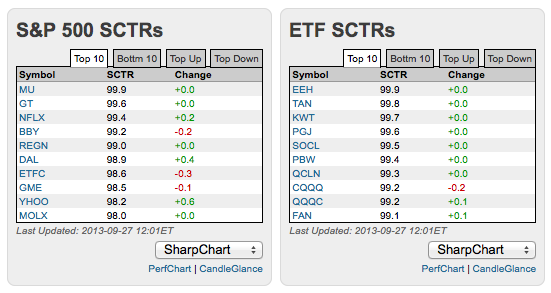

Looking for the relative movers and shakers in the market? Look no further than the StockCharts Technical Rank (SCTR) on the StockCharts home page. These tables can be found mid way down the home page. Today we can see Nasdaq OMX (NDAQ), Regions Financial (RF) and Microsoft (MSFT) showing relative...

READ MORE

MEMBERS ONLY

Small Caps and Nasdaq Lead the Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

There is no change in the indicator table. All indicators remain in bull mode as the market remains strong. The Nasdaq AD Line and AD Volume Line...

READ MORE

MEMBERS ONLY

S&P 1500 AD Line Bounces to Establish Short-Term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

The major index ETFs managed to eek out another gain with the Nasdaq 100 ETF (QQQ) leading the way (+.78%). Yahoo! (YHOO), Ebay (EBAY) and Bed Bath...

READ MORE

MEMBERS ONLY

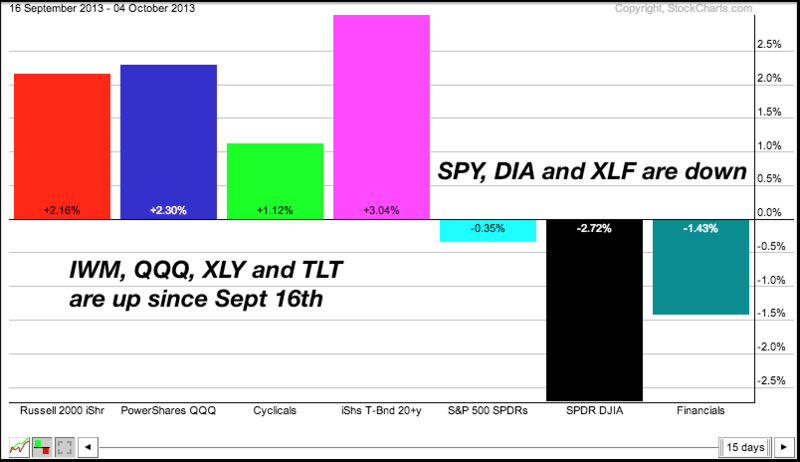

A September Surprise in Inter-market Correlations

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

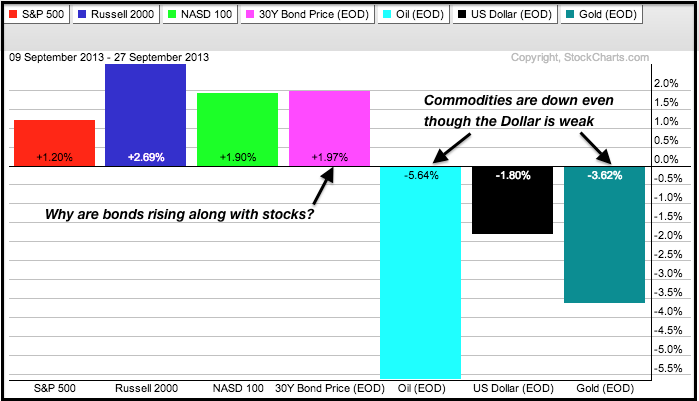

The PerfChart below shows six inter-market related ETFs. Notice that stocks are up with the Russell 2000 ETF (IWM) leading the way (blue). Bonds are also up for the month and this is strange because stocks and bonds are usually negatively correlated. On the other side, notice that gold, oil...

READ MORE

MEMBERS ONLY

A September Surprise in Inter-market Correlations (video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The PerfChart below shows six inter-market related ETFs. Notice that stocks are up with the Russell 2000 ETF (IWM) leading the way (blue). Bonds are also up for the month and this is strange because stocks and bonds are usually negatively correlated. On the other side, notice that gold, oil...

READ MORE

MEMBERS ONLY

IWM Shows Relative Strength as SPY Tests Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks edged lower with relatively mild selling pressure. The S&P 500 ETF (SPY) fell .26% and the Nasdaq 100 ETF (QQQ) lost .34% on the...

READ MORE

MEMBERS ONLY

Charts of Interest: AA, ATVI, IMMR, SCHL, SLW, SYMC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AA gets a Throwback to Broken Resistance.

ATVI Underperforms in September.

Plus IMMR, SCHL, SLW, SYMC

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for...

READ MORE

MEMBERS ONLY

Autozone Breaks Out of Bollinger Band Contraction (video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Autozone (AZO) surged off support and broke above the upper Bollinger Band with big volume on Wednesday. I found this stock because it made the predefined scans list (intraday). This move affirms support and opens the door for a continuation of the bigger uptrend.

Click this image for a live...

READ MORE

MEMBERS ONLY

Surging Treasuries Could Weigh on Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Tuesday with the Russell 2000 ETF (IWM) gaining ground, the Dow SPDR (DIA) loosing ground and the S&P 500 ETF (SPY) closing flat. Relative weakness in finance, technology and healthcare weighed on the market. Homebuilders offered a bright spot as the Home Construction iShares...

READ MORE

MEMBERS ONLY

Netflix Hits New High, but Forms Bearish Reversal Pattern (video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Netflix opened at a new on Monday, but selling pressure quickly took hold and drove prices below 203 by the close. This intraday reversal forged a bearish engulfing pattern just above first support. Follow through below last week's low would argue for a deeper correction towards the 260-270...

READ MORE

MEMBERS ONLY

SPY Gives Up Wednesday's Gain as TLT Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks were mostly lower on Monday with the finance sector weighing on the broader market. The Finance SPDR (XLF) fell 1.42% and the Regional Bank SPDR...

READ MORE

MEMBERS ONLY

Charts of Interest: ARUN, CLF, DE, GLW, NFLX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

$ARUN Shows Relative Weakness with Support Break.

$CLF Forms Trio of Bearish Candlestick Patterns.

Plus $DE, $GLW, $NFLX

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click...

READ MORE

MEMBERS ONLY

JP Morgan Traces out Bearish Reversal Pattern (video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

JP Morgan (JPM) broke short term support with a sharp decline on Monday. With a lower high taking shape, the stock is forming a larger head-and-shoulders reversal over the last few months. Also notice that JPM shows relative weakness and the Accumulation Distribution Line already broke the summer low.

Click...

READ MORE

MEMBERS ONLY

GLD, USO and UUP Weaken as TLT Bounces

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

The on-off-on taper talk is back on again. That didn't take long. The markets prepared for a Fed taper from April to August and the...

READ MORE

MEMBERS ONLY

Metals & Mining SPDR Backs off Resistance with Sharp Decline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

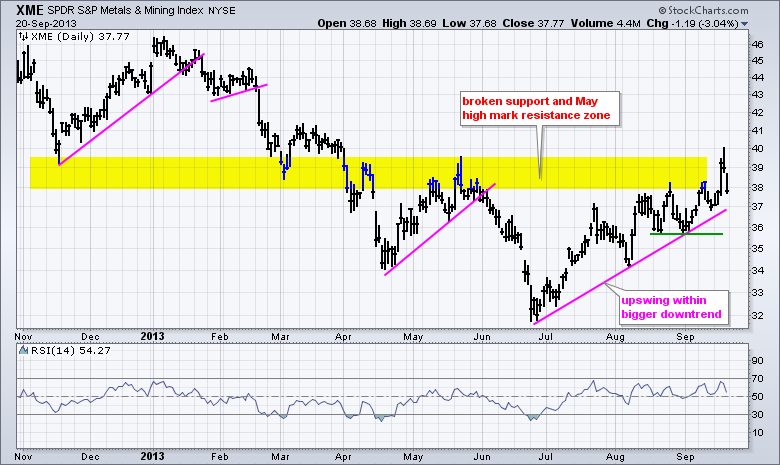

After bottoming in late June and advancing some 15%, the Metals & Mining SPDR (XME) hit resistance in the 39 area with a pop-and-drop this week. The chart below shows XME surging above 39 on the FOMC statement day and then giving most of it back with a decline below...

READ MORE