MEMBERS ONLY

Two Year Yield Gets Hit Hard on Fed Taper Change

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Treasury market was thrown for a loop this week as the Fed unexpectedly decided not the taper. The chart below shows the 2-Year Treasury Yield ($UST2Y) bearing the brunt of this "adjustment". Notice how the yield advanced as tapering talk took hold from April to August. After...

READ MORE

MEMBERS ONLY

Nasdaq Lags NY Composite, but Nasdaq Breadth is Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary got another upgrade this week as SPY momentum improved. All indicators are in bull mode and the majority have been bullish since early December, which is one long run for bullish technicals. The NYSE AD Line is the lone laggard because it has yet to clear its...

READ MORE

MEMBERS ONLY

XLI, XLF, XLB and XLY Lead the Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

After big moves on Wednesdays, the markets took a breather on Thursday and traded relatively flat. Stocks were flat, treasuries pulled back a little, gold stalled, the...

READ MORE

MEMBERS ONLY

Regional Bank SPDR Breaks Flag Trend Line (video)

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Regional Bank SPDR (KRE) perked up with a bounce above 36 on Tuesday, but gave it back with a sharp decline on Wednesday-Thursday. Broken support and the late August gap ultimately held as resistance. The flag break signals a continuation lower. Also notice that KRE shows relative weakness as...

READ MORE

MEMBERS ONLY

Fed Spurs Buying Binge in Stocks, Gold and the Euro

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

It is amazing what a mere 10-15 billion Dollars can do. The Fed has been buying $85 billion worth of bonds for months now. With mere thoughts...

READ MORE

MEMBERS ONLY

Charts of Interest: CY, FSLR, GIS, SCTY, WDC, WY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CY Bounces off Broken Support.

FSLR Forms Small Inverse HS Pattern.

Plus GIS, SCTY, WDC, WY

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for...

READ MORE

MEMBERS ONLY

Falling Dollar Boosts Commodities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dollar fell sharply on Wednesday and this provided a big boost to precious metals, copper and oil. The screen shot below comes from the Intraday Market Summary Page. The Silver Trust (SLV) led precious metals with a 6.44% surge. The Copper ETF (JJC) advanced over 3% and the...

READ MORE

MEMBERS ONLY

Region Banks Catch a Bid as IWM Exceeds August High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks continued to plow higher as the Russell 2000 ETF (IWM) advanced around 1% and the Nasdaq 100 ETF (QQQ) gained .67% on the day. Eight of...

READ MORE

MEMBERS ONLY

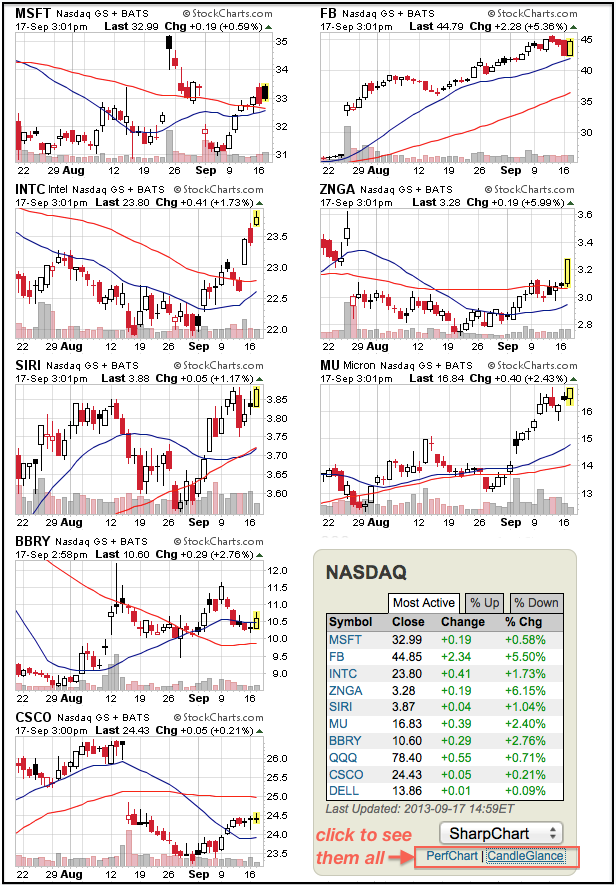

Most Active Stocks Power the Nasdaq Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq is moving higher with eight of the ten most active stocks advancing. DELL and QQQ are also up, but I am leaving them out of the top ten. Facebook (FB) is leading the charge with a 5+ percent gain, and Intel is up over 1.5% on the...

READ MORE

MEMBERS ONLY

SPY Challenges August Highs as Gold Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

It was pop and drop for the stock market on Monday. Stocks opened strong on news that Lawrence Summers withdrew his name from contention for the Fed...

READ MORE

MEMBERS ONLY

Charts of Interest: ATVI, EBAY, DANG, PMCS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATVI Holds Channel Breakout.

EBAY Shows Relative Weakness.

Plus DANG and PMCS

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version

This...

READ MORE

MEMBERS ONLY

Six Sector SPDRs Record Multi-year Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The screenshot below comes from the Predefined Technical Alerts Summary. There is a lot of strength in the stock market with the Russell 2000 and Nasdaq hitting multi-year highs. Also note that six sector SPDRs also recorded multi-year highs....

READ MORE

MEMBERS ONLY

QQQ Holds Breakout as Treasuries Remain Weak

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks remain strong overall and look to get stronger because S&P 500 futures are trading around 1% higher in pre-market (4AM). Stocks and gold are...

READ MORE

MEMBERS ONLY

Intel Breaks Out with Second Gap in Two Weeks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intel is on the move with its second gap of the month. Intel started September strong with a small gap and surge above 22.50. After a small three day pullback this week, the stock continued higher again with a gap above 23. Relative strength is also improving as the...

READ MORE

MEMBERS ONLY

NYSE Breadth and SPY Momentum Improve

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary got a few upgrades this week. In particular, we saw an improvement in NYSE breadth. The NYSE AD Line held above its June low and surged over the last two weeks. With this advance, Net New Highs improved and the Cumulative Net New Highs line moved above...

READ MORE

MEMBERS ONLY

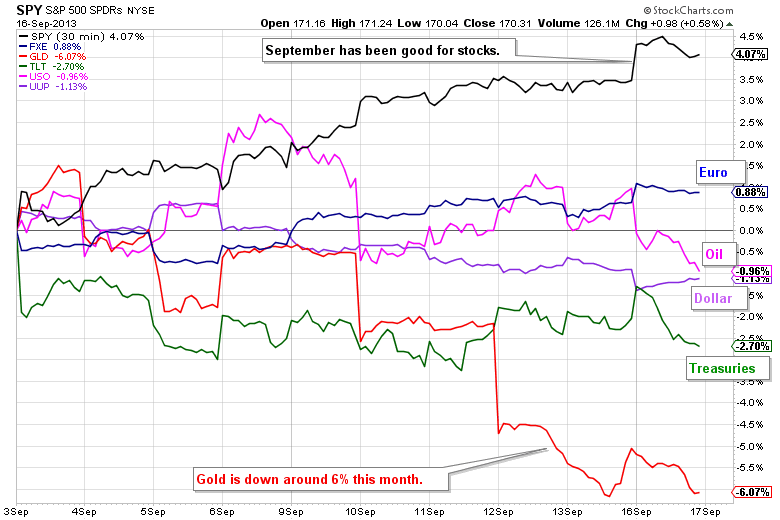

Gold and Treasuries Lag in September, Stocks Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks took a breather on Thursday with the major index ETFs edging lower. The Russell 2000 ETF (IWM) led the way with a .73% decline. Seven of...

READ MORE

MEMBERS ONLY

XLY, XLF and XLI Lead the Sectors in September

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It has been a good month for eight of the nine sectors. Eight of the nine are up month-to-date with the Consumer Discretionary SPDR (XLY), Industrials SPDR (XLI) and Finance SPDR (XLF) among the leaders. It is positive to see three of the four offensive sectors leading during a broad...

READ MORE

MEMBERS ONLY

September Starts with Bang as XLY, XLI and XLF Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks were mostly higher on Wednesday, but the gains were small and there were pockets of weakness in the market. The Dow Industrials SPDR (DIA) led the...

READ MORE

MEMBERS ONLY

Charts of Interest: PCQ, PFE, PEP, SSP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CQP Firms above Prior Low.

PFE Bounces off Key Retracement.

Plus PEP and SSP

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone...

READ MORE

MEMBERS ONLY

S&P 1500 AD Line Breaks Short-Term Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The video and chart below shows the AD Line for the S&P 1500 breaking above its mid August highs with a surge the last few days. This move appears to have ended the short-term downtrend that began in early August.

Click here for a live chart...

READ MORE

MEMBERS ONLY

AD Line and AD Volume Line Break Short-Term Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks put in another solid performance with the Russell 2000 ETF (IWM) and the S&P MidCap 400 SPDR (MDY) gaining around 1%. All nine sectors...

READ MORE

MEMBERS ONLY

Finance SPDR Breaks Key Trend Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Finance SPDR (XLF) is starting to perform with a nice surge over the last two weeks. Notice how the ETF broke the August trend line and filled the late August gap to signal an end to the current correction. The Vortex Indicators confirmed as +VI moved above -VI.

Click...

READ MORE

MEMBERS ONLY

QQQ Leads with New High - ITB Challenges Support Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

The bulls got into gear on Monday and pushed stocks higher across the board. The Russell 2000 ETF (IWM) led the major index ETFs with a 1....

READ MORE

MEMBERS ONLY

Charts of Interest: ALK, AZO, GE, MHK, SXT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ALK Corrects with Falling Wedge.

AZO Lags the Market with Flat Flag.

Plus GE, MHK, SXT.

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for...

READ MORE

MEMBERS ONLY

In Honor of Joe Granville; Volume May Lead Price for BAC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Bank of America (BAC) hit a 52-week high in late July and then corrected with a falling flag or channel the last five weeks. Despite this correction, the indicator window shows On Balance Volume (OBV) remaining strong and hitting a new high last week. This suggests that BAC is still...

READ MORE

MEMBERS ONLY

SPY and IWM Extend Bounces and Near Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks started September with strength as the Nasdaq 100 ETF (QQQ) and the Russell 2000 ETF (IWM) advance around 2% in a shortened week. All sectors were...

READ MORE

MEMBERS ONLY

Home Construction iShares Bounces, but Remains Short of Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Treasury yields fell after Friday's jobs report and interest rate sensitive stocks got a bounce as utilities, REITs and homebuilders moved higher. My focus is on the Home Construction iShares (ITB) because this group is important to the consumer discretionary sector and housing is key to the overall...

READ MORE

MEMBERS ONLY

Walgreen Forms Inverse Head-and-shoulders Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big surge from November to May, Walgreen (WAG) consolidated with an inverse head-and-shoulders pattern. This version of the head-and-shoulders is a bullish continuation pattern. Also notice that the pattern from mid June to September looks like a cup-with-handle. A breakout at 51 would confirm and signal a continuation...

READ MORE

MEMBERS ONLY

Techs Lead as Nasdaq AD Volume Line Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator table. Relative weakness in interest rate sensitive stocks is weighing on the NYSE as the NYSE AD Line and NYSE Net New Highs lag their Nasdaq counterparts. Stocks remain in corrective mode, but there are clear pockets of strength out there. Notice that...

READ MORE

MEMBERS ONLY

10 Year Yield Approaches 3% - UUP Builds on Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks edged higher with techs leading the way again. The Nasdaq 100 Equal-Weight ETF (QQEW) advanced .49%, but the S&P 500 ETF (SPY) advanced just...

READ MORE

MEMBERS ONLY

Steel ETF Challenges 200-day Moving Average

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Steel ETF (SLX) is making some noise with a break above the flag trend line and challenge to the 200-day SMA. This moving average flattened just below resistance, which extends back to the May highs. With the 50-day turning up, price action is looking bullish and a flag breakout...

READ MORE

MEMBERS ONLY

Techs Lead as QQQ Bounces off Support - USO Forms Wedge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Techs took the lead on Wednesday with semiconductor and networking stocks scoring nice gains. The Nasdaq 100 ETF (QQQ) relative strength with a 1% gain, while the...

READ MORE

MEMBERS ONLY

Charts of Interest: AKAM, BHI, CME, EXPD, NBR, VMC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AKAM Forms Cup-with-handle Pattern.

BHI Challenges Wedge Resistance.

Plus CME, EXPD, NBR, VMC

Video is at top. Individual charts are below.

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version...

READ MORE

MEMBERS ONLY

Altera Leads Semis with Rim Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Altera (ALTR) is showing upside leadership with a breakout and 52-week high on good volume. Overall, the pattern at work looks like a cup-with-handle, which is a bullish pattern. The rim breakout completes the pattern and argues for higher prices. Broken resistance turns first support to watch on a throwback....

READ MORE

MEMBERS ONLY

Stocks Hit with Pop and Drop as Early Gains Fade

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks got the old pop and drop on Monday. The major index ETFs opened higher on the heels of Asian and European strength. It was also the...

READ MORE

MEMBERS ONLY

Utilities SPDR Breaks Pennant Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) broke down as the 10-year Treasury Yield ($TNX) moved back above 2.8% on Monday. XLU was already in a downtrend after the lower high in July and mid August breakdown. After stalling with a pennant, the ETF broke pennant support to signal a continuation lower....

READ MORE

MEMBERS ONLY

SPY and QQQ Test Support Zones

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

It is the beginning of the month and stock futures are trading sharply higher this morning. The German DAX Index ($DAX) was up 1.74% on Monday,...

READ MORE

MEMBERS ONLY

Charts of Interest: ESRX, LINTA, SCCO, SCHL, SCHW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ESRX Corrects with Falling Wedge.

LINTA Firms at Support Zone

Plus SCCO, SCHL, SCHW

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version

This commentary...

READ MORE

MEMBERS ONLY

Gold Miners ETF Forms Big Bearish Engulfing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold Miners ETF (GDX) came under intense selling pressure earlier this week with a bearish engulfing and short-term support break. These two down days occurred on high volume. Also notice that the ETF is hitting resistance from the highs extending back to late April.

Click this image for a...

READ MORE

MEMBERS ONLY

Evidence Remains Bullish, but Pockets of Weakness Remain

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

August was not a nice month for stocks. The S&P 500 is on schedule to post its biggest monthly loss since May 2012. Even though the overall trend is up and the bulk of the evidence remains bullish, I get the feeling that this correction could extend because...

READ MORE