MEMBERS ONLY

Stocks Firm in Mixed Action - Dollar Goes for a Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Market action was mixed on Thursday with the Russell 2000 ETF (IWM) advancing around 1% and the S&P 500 ETF (SPY) advancing just .24%. Large-caps...

READ MORE

MEMBERS ONLY

Airlines, Telecoms and Biotech Lead Essential Industry Groups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Extra! and Pro users have access to the StockCharts Essentials ChartPack, which features 13 core chartlists with over 140 key charts. The image below shows the Essential US Industry Indexes in "summary" format and sorted by percent change. This makes it easy to distinguish between the leaders and...

READ MORE

MEMBERS ONLY

SPY Hits Top of Support Zone - UUP Consolidates at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks got an oversold bounce on Wednesday, but the short-term trends remain down and this correction is likely to extent. The Nasdaq 100 ETF (QQQ) led the...

READ MORE

MEMBERS ONLY

Charts of Interest: ARMH, AVGO, BBBY, CTSH, TIBX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ARMH Firms with Potential Triangle Forming.

AVGO Breaks Flag Resistance with Volume.

Plus BBBY, CTSH, TIBX

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version...

READ MORE

MEMBERS ONLY

Leveraged Gold ETFs Duke it Out on Ticker Cloud

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Want to see what's hot today? Check out the ticker cloud on the home page. The bigger the symbol, the more popular the chart. As you can see, the Direxion Gold Miners Bull 3X ETF (NUGT) and the Direxion Gold Miners Bear 3X ETF (DUST) are quite popular...

READ MORE

MEMBERS ONLY

Broad Based Decline Produces 90% Down Day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

It was a good old fashion flight to safety on Tuesday. Stocks moved broadly lower, while the safe havens moved higher. The 20+ Year T-Bond ETF (TLT)...

READ MORE

MEMBERS ONLY

Utilities Buck the Trend with Show of Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

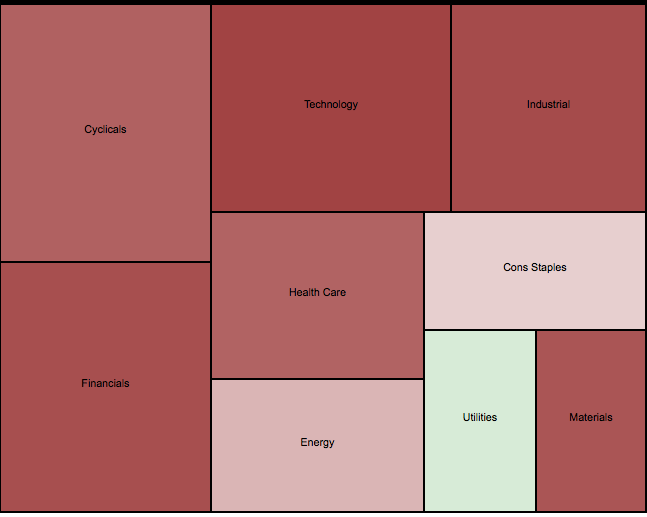

Looking for pockets of strength on a down day? Turn to the Sector Market Carpet. The first image shows the broad sector view with the utilities sector in light green. The other sectors are either red or a lighter shade of red, which means they are down. The second image...

READ MORE

MEMBERS ONLY

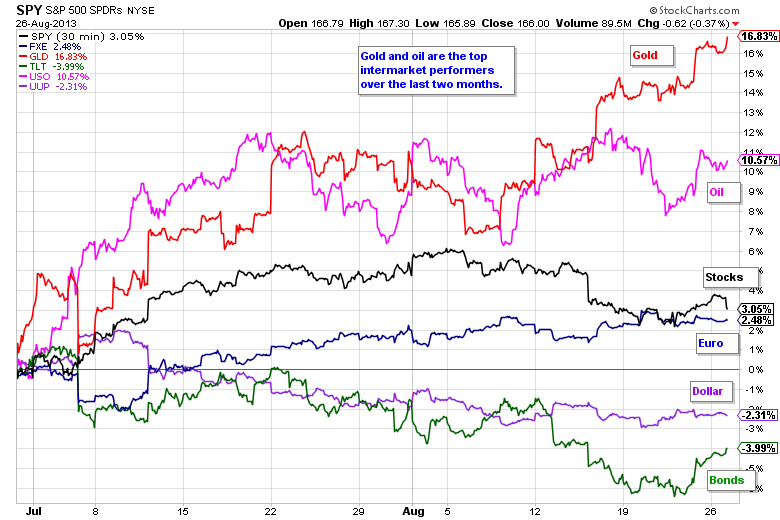

Oil and Gold Lead as Stocks Flounder

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Despite a worse-than-expected durable goods report, stocks opened firmed and advanced in early trading. The major index ETFs were in positive territory in the afternoon, but selling...

READ MORE

MEMBERS ONLY

Charts of Interest: AXP, CRM, ENR, MDP, YUM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AXP Breaks Triangle Trend Line.

CRM Forms Bear Flag.

Plus ENR, MDP, YUM

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version

This commentary and...

READ MORE

MEMBERS ONLY

Bullish P&F Signals Outnumber Bearish Signals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Chartists can get an idea of the overall market trend by comparing the number of bullish P&F signals with bearish P&F signals. StockCharts provides this data every day on the predefined scans page. Notice that there are 87 Triple Top Breakouts on the NYSE and only...

READ MORE

MEMBERS ONLY

QQQ Leads with Gap/Breakout - GLD Breaks Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks started the week under selling pressure, but finished strong with a rally on Thursday and Friday. The major index ETFs closed up for the week with...

READ MORE

MEMBERS ONLY

Toll Brothers Battles Support and Outperforms its Peers

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the Home Construction iShares (ITB) battles broken support, Toll Brothers (TOL) is still holding support from the 2013 lows. The chart below shows TOL bouncing off support in mid August, but falling short of a breakout. The indicator window shows TOL relative to ITB using the price relative (TOL:...

READ MORE

MEMBERS ONLY

Evidence Remains Bullish as Nasdaq and Russell OutPerform

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The bulk of the evidence remains bullish, but recent weakness took its toll on SPY momentum as this indicator trio turned bearish. Momentum indicators are leading indicators and will be the first to turn. However, they are also the most prone to whipsaws and bad signals. Of note, the $COMPQ:...

READ MORE

MEMBERS ONLY

IWM Leads with Small Breakout - ITB Challenges the Neckline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks moved higher on Thursday with the Russell 2000 ETF (IWM) and S&P MidCap 400 SPDR (MDY) leading the way. Both gained over 1%. All...

READ MORE

MEMBERS ONLY

Industrial Metals and Precious Metals Lead Commodity Groups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The US Commodity Groups PerfChart shows the performance for five commodity groups and the CRB Index ($CRB). Energy prices weighed on the CRB Index as the GSCI Energy Index fell over 1% this past month. In contrast, the GSCI Industrial Metals Index ($GYX) and the GSCI Precious Metals Index ($GPX)...

READ MORE

MEMBERS ONLY

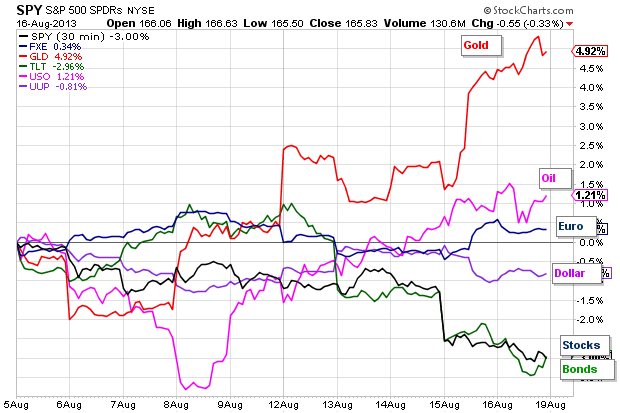

Stocks and Bonds Close Lower after Fed Minutes

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Stocks went on a wild afternoon run as the Fed minutes hit the tape. Despite a bounce attempt, the major index ETFs sold off and ultimately closed...

READ MORE

MEMBERS ONLY

Charts: BAC, BIIB, DDD, IDTI, PG, UAL, UPS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BAC Channels back to Broken Resistance.

BIIB Firms after Pullback.

Plus DDD, IDTI, PG, UAL, UPS

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version...

READ MORE

MEMBERS ONLY

High Volume Gap Provides Support for E*Trade on CandleVolume Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows E*Trade (ETFC) with CandleVolume charts to accent volume. Upside volume has been strong in general and the stock gapped above 14 with the biggest volume since the mid March gap down. This gap zone around 14 has turned support as the stock firms just above....

READ MORE

MEMBERS ONLY

S&P 500 ETF Recaptures the 50-day

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) broke below its 50-day moving average on Monday, but moved right back above on Tuesday. This moving average held from December to early June. SPY broke below in late June, but quickly recovered and recaptured the moving average. It looks like another battle...

READ MORE

MEMBERS ONLY

Selling Pressure Extends for Stocks and Treasuries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Selling pressure continued in both stocks and Treasuries on Monday. These two were negatively correlated most of the last two years, but have been positively correlated the...

READ MORE

MEMBERS ONLY

Charts of Interest: CAKE, HCA, HTZ, IACI, WDC

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CAKE Stalls Below Prior High.

HCA Extends Flag Correction.

Plus HTZ, IACI, WDC

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone Version

This commentary and...

READ MORE

MEMBERS ONLY

Children's Place Tests Neckline Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Children's Place formed a head-and-shoulders reversal pattern from late May to August and is currently testing neckline support. Notice that downside volume is outpacing upside volume and On Balance Volume (OBV) broke its June low this month.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Gold Benefits from Weakness in Stocks and Bonds

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure hit the stock market for the second week running as the major index ETFs lost ground. The Russell 2000 ETF (IWM) fell 2.27% last week, while the Nasdaq 100 ETF (QQQ) lost just 1.31%. Even though these are small losses in the grand scheme of things,...

READ MORE

MEMBERS ONLY

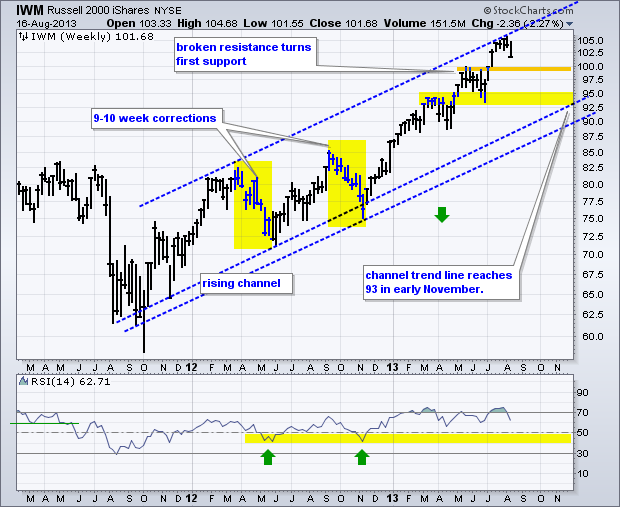

Russell 2000 ETF Starts Correction within Bigger Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) moved sharply lower this week to start a short-term downtrend, but this is still considered just correction within a bigger uptrend. There are simply no signs of a major top at this moment. Tops often form with major reversal patterns or consolidation, a bearish divergence...

READ MORE

MEMBERS ONLY

Market Carpet Shows Retailers Lagging and Homebuilders Leading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below shows the Market Carpet for just the consumer discretionary sector (cyclicals). Notice that Pulte (PHM) and Lennar (LEN) are leading on Friday, while Nordstrom (JWN) and Kohl's (KSS) are lagging. Chartists can double click on any symbol in the market carpet to expand that section...

READ MORE

MEMBERS ONLY

Net New Highs Turn Negative on Naz and NYSE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with broad selling pressure over the past week, but this is not enough to affect the overall uptrends. As we saw in November and June, corrections are normal in uptrends. The challenge, as always, is distinguishing between a normal correction and the start of something more (extended...

READ MORE

MEMBERS ONLY

Selling Pressure Increases as Breadth Indicators Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Selling pressure certainly intensified on Thursday with an across the board decline. The high-beta Russell 2000 ETF (IWM) led the major index ETFs lower with a 1.82 percent decline. All sectors were down with the Consumer Discretionary SPDR (XLY) leading the way. It is negative to see this economically...

READ MORE

MEMBERS ONLY

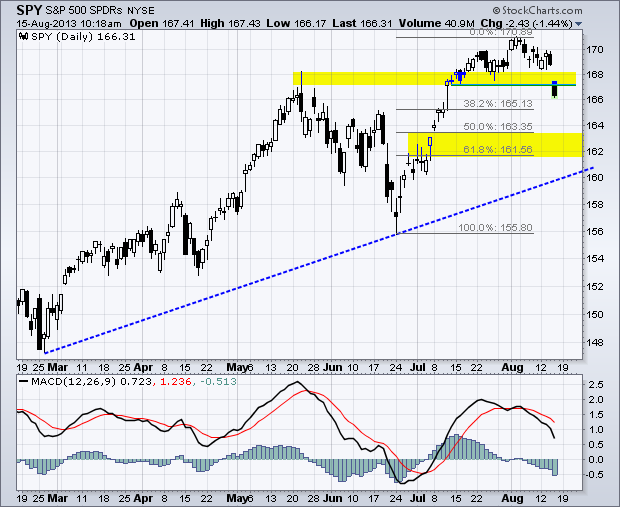

SPY Breaks Support with Gap Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After weeks of indecision, the S&P 500 ETF (SPY) made a decisive move with break below the late July low. The gap and support break are short-term bearish as long as they hold. Using the Fibonacci Retracements Tools, chartists can estimate next support in the 50-62% retracement zone,...

READ MORE

MEMBERS ONLY

Buyers Pull Back as SPY and IWM Consolidate Near Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak and remained weak, but selling pressure was not that intense as the major index ETFs closed modestly lower. The Dow SPDR (DIA) and S&P Midcap SPDR (MDY) led the way by falling around .75 percent. All sectors were lower with the Consumer Discretionary SPDR (XLY)...

READ MORE

MEMBERS ONLY

Charts of Interest: ACN, AMD, DGX, KMB, TXT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ACN Breaks Triangle Support with High Volume.

AMD Bounces off Support with Good Volume.

Plus DGX, KMB, TXT

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/...

READ MORE

MEMBERS ONLY

Home Construction iShares Breaks Neckline Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Rising rates are taking their toll on the Home Construction iShares (ITB) as the ETF broke neckline support on Wednesday. The head-and-shoulders pattern extends almost the entire year and today's breakdown confirms the bearish reversal. The indicator window shows the price relative (ITB:SPY ratio) moving to a...

READ MORE

MEMBERS ONLY

ITB Tests Neckline Support - No Follow Through for GLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks meandered on Tuesday with the major index ETFs finishing mixed on the day. The Nasdaq 100 ETF (QQQ) advanced .56% on the heels of Apple, while the Russell 2000 ETF (IWM) fell .13% on the day. Treasuries were the big movers as a positive retail sales report prompted another...

READ MORE

MEMBERS ONLY

S&P 1500 AD Line Holds Short-term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 1500 AD Line ($SUPADP), which is a key breadth indicator, has yet to break support and remains in bull mode. Notice how the AD Line established lows from mid July to early August. These lows mark a support zone that chartists should watch for clues on...

READ MORE

MEMBERS ONLY

SPY Bounces off Support - USO Bounces within Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak on Monday, but quickly recovered and edged into positive territory. The overall gains were rather paltry with the Nasdaq 100 ETF (QQQ) gaining .24% and the Russell 2000 ETF (IWM) advancing .53%. The sectors were mixed with small gains and losses. The Technology SPDR (XLK) stood out...

READ MORE

MEMBERS ONLY

Charts of Interest: CY, DE, FST, INTC, MXIM, SWKS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CY Consolidates after Big Surge.

DE Bounces off Support with Good Volume.

Plus FST, INTC, MXIM, SWKS

Video at end of commentary

**This chart analysis is for educational purposes only, and should not

be construed as a recommendation to buy, sell or sell-short said securities**

Click here for iPad/iPhone...

READ MORE

MEMBERS ONLY

US Oil Fund Forms Bull Flag in Uptrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After surging and breaking resistance in July, the US Oil Fund (USO) pulled back with a falling flag the last few weeks. USO made its first move with a surge over the last two days. A follow through breakout above flag resistance would signal a continuation higher. Chartists can also...

READ MORE

MEMBERS ONLY

AD Volume Line Breaks Support - GLD Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Shanghai Composite ($SSEC) and the Hang Seng Index ($HSI) surged over 2% on Monday, but the Nikkei 225 ($NIKK) fell and US stock futures are trading lower. Chinese shares are up because there were some positive economic reports late last week. Gold is also up and going for a...

READ MORE

MEMBERS ONLY

Finance Sector Starts Underperforming

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Finance SPDR (XLF) was one of the best performing sectors from April to late July, but was the weakest sector over the last two weeks. The PerfChart below shows XLF with a loss over the last ten trading days. In contrast, notice that the S&P 500, Consumer...

READ MORE

MEMBERS ONLY

NYSE Lags Nasdaq, but Technicals Remain Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks stalled over the last two weeks, but this was not enough to derail any indicators or the overall uptrend in the major index ETFs. Note that the major index ETFs hit new highs over the last two weeks, while XLK, XLY and XLI hit new highs to lead the...

READ MORE

MEMBERS ONLY

Greenback Extends Downtrend - Gold Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were all over the place on Thursday. The major index ETFs opened higher, quickly pulled back and then moved back into positive territory in the afternoon. The end result was uneventful as the Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQ) advanced around 1/2 percent. A gain,...

READ MORE