MEMBERS ONLY

DIA Forms the Mother of All Bearish Engulfings

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on the open, quickly weakened and then plunged in the final hour. We all know where the blame went. Even though the Italian elections took the rap, note that the Euro has been falling since 4-Feb and Italian stocks are down around 10% over the past month. US...

READ MORE

MEMBERS ONLY

February has been Rough for the Consumer Discretionary SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After big gains in January, the market is having a tough time in February with relative weakness coming from the Consumer Discretionary SPDR (XLY) and Technology SPDR (XLK). Also notice that the defensive sectors are starting to outperforming (XLP, XLU and XLV).

Click this image for a live chart...

READ MORE

MEMBERS ONLY

XLU and XLP End Week Strong - IWM Hits Retracemet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a short, but wild, week for stocks. The major index ETFs started strong on Tuesday, plunged on Wednesday-Thursday and then rebounded on Friday. The Nasdaq 100 ETF (QQQ) hit a new low for 2013 during Thursday's dip, while the Russell 2000 ETF (IWM) and S&...

READ MORE

MEMBERS ONLY

RSI Hits Support Zone for the Biotech SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

XBI surged the first two weeks of January, and then corrected the next six weeks with a falling channel. The fall is ever so slight though. A move above 96.5 would break the channel trend line and signal a continuation of the bigger uptrend. The indicator window shows RSI...

READ MORE

MEMBERS ONLY

AD Lines and AD Volume Lines Pullback after Extended Moves

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The major index ETFs and indicators took hits this week, but there is no change in the overall picture. The major index ETFs, AD Lines and AD Volume Lines hit multi-month highs this month and pulled back sharply this week. Stocks were quite overextended after big moves from mid November...

READ MORE

MEMBERS ONLY

QQQ Tests January Lows - USO Hits New Low for 2013

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved lower again on Thursday with the Nasdaq 100 Equal-Weight ETF (QQEW) leading the way (down 1.22%). This means techs as a whole were relatively weak. Small-caps were also relatively weak with the Russell 2000 ETF (IWM) falling around 1%. Note that QQEW and IWM led on the...

READ MORE

MEMBERS ONLY

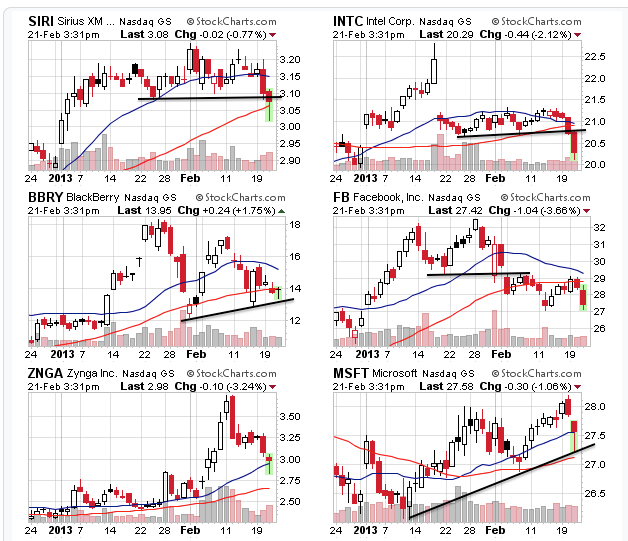

Intel and Facebook Breakdown, but Blackberry Firms at Trend Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

You can see a lot with CandleGlance charts. The 6 charts below come from the Nasdaq most active list today. Intel broke support with a sharp decline the last two days and Facebook broke down in early February. Blackberry is findng a bid as it firms near the three week...

READ MORE

MEMBERS ONLY

Charts of Interest: AMZN, COL, JBHT, NAT, NOC, PX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMZN Forms Bearish Wedge.

COL Tests Support in the Face of Sequester.

Plus JBHT, NAT, NOC, PX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think...

READ MORE

MEMBERS ONLY

QQQ Breaks Short-Term Support - TLT Firms Near Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were weak in early trading and then got slammed in the afternoon. In addition to overbought conditions, several factors contributed to the afternoon sell off. Industrial metals fell sharply over the last few days due to concerns with Chinese economic growth. Several industry group ETFs within the materials sector...

READ MORE

MEMBERS ONLY

MarketVectors Oil Services ETF Stalls with Three Inside Days

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

OIH surged to a new high with a long white candlestick last week, but suddenly stalled as the next three candlesticks formed inside this long candlestick. This is basically an extended harami pattern, which is potentially bearish. Also notice that OIH is up over 20% since mid November and a...

READ MORE

MEMBERS ONLY

IWM Hits Channel Trend Line - USO Bounces off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks marched higher again on Tuesday with small-caps leading the way. The Russell 2000 ETF (IWM) gained .88% and the S&P Small-cap ETF (IJR) advanced 1.10% on the day. Techs also participated with the Nasdaq 100 ETF (QQQ) hitting a new high for 2013. Eight of the...

READ MORE

MEMBERS ONLY

Retail SPDR Leads with a 52-week High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market may be overbought and sentiment may seem overly bullish, but buying pressure continues to outpace selling pressure. Case-in-point: the Retail SPDR (XRT) surged to a fresh 52-week high on Tuesday and the price relative (XRT:SPY ratio) is challenging its November high. Strength in retailers is a...

READ MORE

MEMBERS ONLY

Charts of Interest: AEO, ARO, CY, ESRX, NVDA, V

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CY Forms Descending Triangle.

NVDA Surges above Resistance on Good Volume.

Plus AEO, ARO, ESRX, V

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for...

READ MORE

MEMBERS ONLY

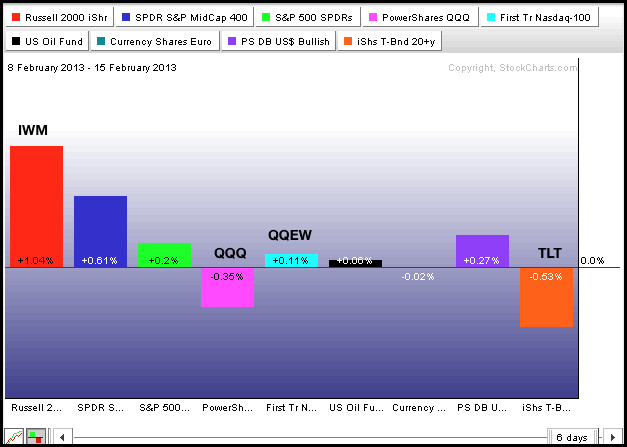

IWM Holds Channel and QQQ Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

US stocks held up last week, but the advance certainly slowed. IWM led the market with a 1.04% gain last week. SPY was mostly flat with a .20 advance. QQQ declined .35% and QQEW lagged SPY with a .11% gain. Relative weakness in the Nasdaq 100 Equal-Weight ETF (QQEW)...

READ MORE

MEMBERS ONLY

QQQ Hesitates, but the ETF is not Lost Just Yet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) just can't seem to find its mojo this year, but the 2013 trend is still up and the bulls still have the edge, albeit a slight edge. First, note that QQQ has been trending higher since mid November. A three month uptrend means...

READ MORE

MEMBERS ONLY

Targeting the Lower Channel Trend Line for the Silver Trust

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Gold, oil and silver fell sharply on Friday as the G20 meeting started in Moscow. The chart below shows the Silver Trust (SLV) forming a lower high in late January and plunging to the early January low. The lower trend line of the falling channel marks the next support level...

READ MORE

MEMBERS ONLY

Nasdaq and NYSE AD Volume Lines Hit 52-week Highs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary because the market did not move much this week. Despite little movement, IWM, MDY, XLF and several other key ETFs hit new highs. The uptrend, or rather grind higher, continues. Note that the Nasdaq AD Volume Line and NYSE AD Volume Line...

READ MORE

MEMBERS ONLY

KOL Perks up with Trend Line Break - TLT Sets Bear Trap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was another mixed day overall,but the Russell 2000 ETF (IWM) edged to another 52-week high with a .25% gain. The ETF is now up seven of the last ten days this month. Even though the daily gains have been relatively small, IWM is up 3.08% since its...

READ MORE

MEMBERS ONLY

Oil & Gas Equipment/Services SPDR Surges to 52-week High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Oil related stocks remain red hot as the Oil & Gas Equipment/Services SPDR (XES) surged over 2% on Thursday and exceeded its 2012 high. The uptrend just gets steeper as the advance accelerated the last five weeks. XES is overbought like the rest of the market, but showing no...

READ MORE

MEMBERS ONLY

A Bearish Failure Swing Lurks in SPY - FXE Forms Bear Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Guess what? Stocks were mixed again on Wednesday. The Dow Industrials SPDR (DIA) edged lower, while the S&P 500 ETF (SPY) and other major index ETFs edged higher. Once again, "edged" is the key word here because price movements were miniscule. Nevertheless, the Russell 2000 ETF...

READ MORE

MEMBERS ONLY

Charts of Interest: AFFX, ARO, JCP, LULU, LXK, TIBX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

JCP Shows Interesting Volume Trend the Last Five Weeks.

LULU Forms Pennant Near Support.

Plus AFFX, ARO, TIBX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to...

READ MORE

MEMBERS ONLY

Cheesecake Factory Forms Lower High on Big Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though exchange volume remains relatively light, Cheesecake Factory (CAKE) is trading above average volume and falling sharply. Notice that CAKE formed a lower high in early February and the next support zone resides in the 32.25-32.5 area.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

XLF Grinds to Another New High - TLT Forms Triangle

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed again on Tuesday. The Nasdaq 100 ETF (QQQ) edged lower because Apple was weak, but the S&P 500 ETF (SPY) edged higher because financials were strong. Volume was below average again, but I would not read too much into this because we seem to be...

READ MORE

MEMBERS ONLY

Utilities SPDR Quietly Challenges October High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) bottomed along with the broader market in mid November and advanced the last three months, but the advance has lagged in more ways than one. XLU is up less than SPY and SPY is already above its October high. Nevertheless, XLU is in a clear uptrend...

READ MORE

MEMBERS ONLY

Charts of Interest: DD, FB, GT, ILMN, INTC, PCS, SCTY, SSYS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

DD Breaks Wedge Resistance with Good Volume.

SCTY Surges above Triangle Trend Line.

Plus FB, GT, ILMN, INTC, PCS, SSYS

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all...

READ MORE

MEMBERS ONLY

Gold and GDX Break Down - USO Breaks Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Monday with the S&P 500 ETF (SPY) edging lower (.02%) and the S&P 500 Equal-Weight ETF (RSP) edging higher (.03%). Yes, it was a mixed, and dull, day. The sector SPDRs were also mixed and the moves were small. The Gold Miners...

READ MORE

MEMBERS ONLY

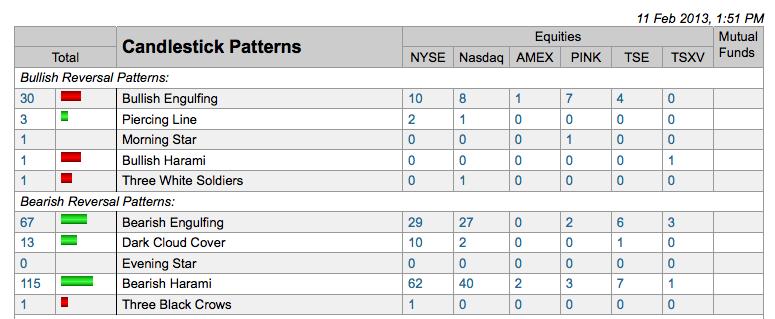

Bearish Candlestick Reversal Patterns Increase on Predefined Scans Page

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There was an uptick in the number of bearish candlestick reversals on Monday afternoon. As the screen shot below shows, there were 67 bearish engulfing patterns as of 1:51PM ET. There were also 13 dark cloud patterns and over 100 harami, which are like inside days. Chartists can click...

READ MORE

MEMBERS ONLY

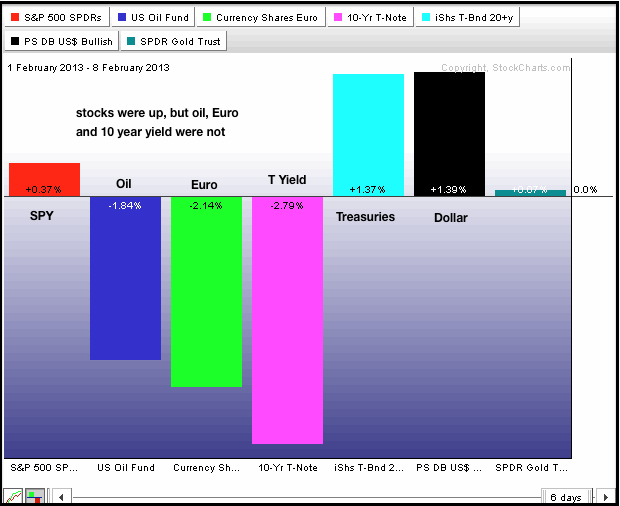

Treasuries Rise and Euro Falls, But Stocks Remain Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks bucked the intermarket headwinds and mixed economic data to finish positive again last week. The S&P 500 ETF (SPY) and the Russell 2000 ETF (IWM) are now up six consecutive weeks. The Nasdaq 100 ETF (QQQ) also got into the bull mood with a close above its...

READ MORE

MEMBERS ONLY

Watch the Rising Trend Line on the NYSE McClellan Summation Index

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The NYSE Summation Index ($NYSI) has been rising since the latter part of November and recently exceeded its September high. The trend here is clearly up with the November trend line marking first support. Even though the summation index flattened over the past week, it has yet to break this...

READ MORE

MEMBERS ONLY

Indicator Summary Shows No Weakness, But Stocks are Overbought

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the indicator summary because the market did not move much this week. Stocks have been in a stalling pattern the last two weeks. The medium-term and long-term trends are clearly up, but this stall could signal the start of a corrective period that could last...

READ MORE

MEMBERS ONLY

IWM Holds Channel as QQQ Bounces off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market is holding up, but some external indicators are not. First, the US Dollar Fund (UUP) surged over the last few days and broke short-term resistance. Also note that bear trap from last Friday-Monday. Second, the Euro is falling has tensions heat up in Italy and Spain. Berlusconi,...

READ MORE

MEMBERS ONLY

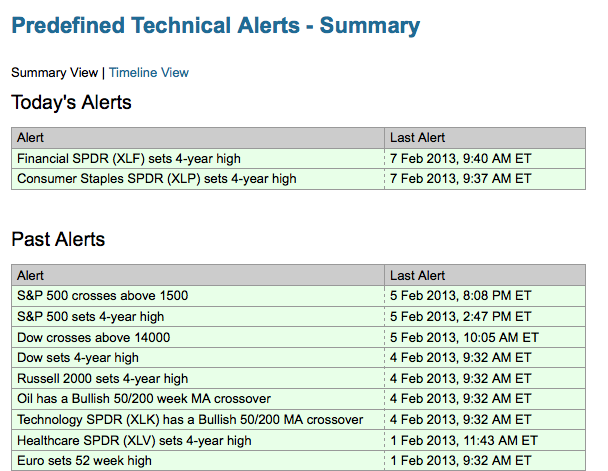

Technical Alerts from StockCharts Remain Positive in February

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The predefined technical alerts at StockCharts.com have been decidedly positive since January 2nd. You can view the history on the summary page. February continues to be a good month with eleven positive alerts and zero negative alerts. These realtime alerts are color coded for an easy assessment. You can...

READ MORE

MEMBERS ONLY

Charts of Interest: AA, AEO, INTC, TEVA, USB

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AA Bounces off Gap Zone.

AEO Breaks Wedge Resistance.

Plus INTC, TEVA, USB

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think for ourselves when it...

READ MORE

MEMBERS ONLY

Intermarket Picture Picking up - TLT Bases as UUP Breaks Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed on Wednesday as the Nasdaq 100 ETF (QQQ) edged lower and the S&P 500 ETF (SPY) edged higher. Trading was seriously subdued in the sector SPDRs. Utilities SPDR (XLU) provided the biggest advance (.30%), while the Technology SPDR (XLK) provided the biggest loss (.03%). These...

READ MORE

MEMBERS ONLY

Intel Traces out Bear Flag after Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Intel (INTC) recorded a 52-week low in mid November and bounced with the rest of the market over the next two months. This bounce abruptly ended with a gap down to the mid November trend line. With a feeble rise the last few weeks, Intel formed a bear flag and...

READ MORE

MEMBERS ONLY

Apple Bounces within Pennant Pattern - QQQ Challenges Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded with a big bang as the Nasdaq 100 ETF (QQQ) led the market higher. Yes, you read right. Microsoft, Intel, Cisco, and Dell all gained on the day and were on the most active list. Could the Dell LBO revive the old Winteldell machine? We shall see. Gains...

READ MORE

MEMBERS ONLY

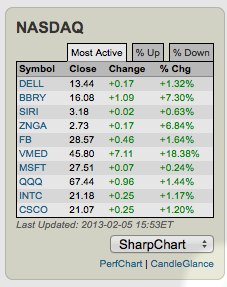

Nasdaq Parties Like its 1999 - MSFT, DELL, INTC and CSCO Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A look at the ten most active stocks shows four old school tech stocks leading the charge. Microsoft, Dell, Intel and Cisco are all up and active. This table comes from the FreeCharts page. Chartists can see small candlestick charts for all ten by clicking the CandleGlance link or a...

READ MORE

MEMBERS ONLY

Bollinger Bands Narrow for Gold - QQQ Breaks Channel

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Although European issues got the blame for Monday's stock market decline, weakness should not come as a surprise because stocks were quite overbought and ripe for a corrective period. In addition to overbought conditions, two historical tendencies came into play on the second trading day of the month....

READ MORE

MEMBERS ONLY

Charts of Interest: ADBE, APOL, CCL, GES, ILMN, JCOM, NVDA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ADBE Stalls and Underperforms in January.

APOL Forms a Bear Flag.

Plus CCL, GES, ILMN, JCOM, NVDA

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is

not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise).

We all need to think...

READ MORE

MEMBERS ONLY

Dollar and Gold Surge along with Treasuries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some fears in Spain and Italy triggered a move away from risk as the US Dollar Fund (UUP) and the 20+ Year T-Bond ETF (TLT) surged on Monday. Even though the Dollar is up sharply, also note that the Gold SPDR (GLD) is up and gold is attracting money.

Click...

READ MORE