MEMBERS ONLY

SPY Fails at Key Retracement - GLD Fails to Hold Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The market started the week in risk-on mode, but made a sharp u-turn on Thursday with a move to risk-off. The major index ETFs were down sharply with small-caps (IMW) and mid-caps (MDY) leading the way. Both lost over 2.5% on the day. All sectors were down with the...

READ MORE

MEMBERS ONLY

Sector Carpet Sees Red after the Fed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below comes from the Sector Carpet. First, notice that all sectors are lower. Second, notice that the Basic Materials SPDR (XLB), Energy SPDR (XLE) and Technology SPDR (XLK) have the most red. The Consumer Discretionary SPDR (XLY) is not far behind. Third, notice that the defensive sectors (XLU,...

READ MORE

MEMBERS ONLY

XLV Forms Harami at Resistance as SCOTUS Looms

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks edged lower on Wednesday as the Fed failed to inspire a continuation of the current rally. Except for the Nasdaq 100 ETF (QQQ), which gained .08%, the major index ETFs closed fractionally lower. Seven of the nine sectors were down with the Industrials SPDR (XLI), Basic Materials SPDR (XLB)...

READ MORE

MEMBERS ONLY

Charts: AEO, BIDU, FFIV, FLEX, IDTI, LEN, OXY, STT, TOL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AEO Extends Consolidation with Tight Triangle.

BIDU Shows Relative Weakness.

JBLU Consolidates after High Volume Surge.

Plus FFIV, FLEX, IDTI, LEN, OXY, RIMM, STT, TOL

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock...

READ MORE

MEMBERS ONLY

CAKE Fails at Resistance as MACD Turns Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Cheesecake Factory (CAKE) moved sharply lower at the beginning of June and then rebounded with the market the last few weeks. This rebound, however, is running into resistance from the gap and prior high. Also notice that MACD turned down and is on the verge of breaking below its signal...

READ MORE

MEMBERS ONLY

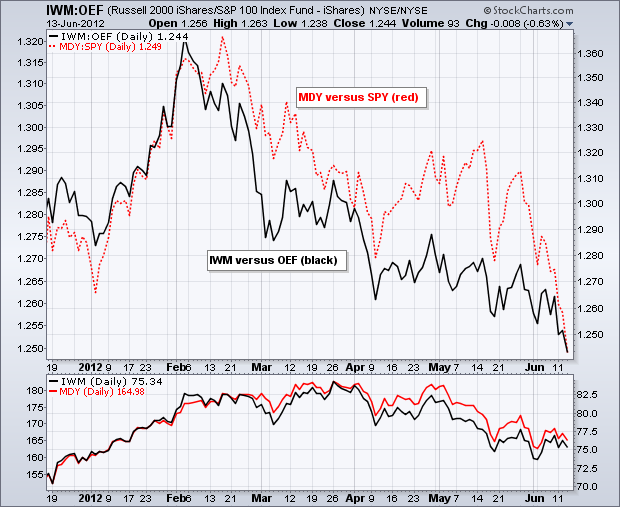

SPY, QQQ and IWM Hit Key Retracements

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher again on Tuesday, but performance was lopsided again. The Russell 2000 ETF (IWM) led the market with a 1.73% gain, but the S&P 100 ETF (OEF) lagged with a .37% gain. Seven of the nine sectors were up. Money moved out of the Consumer...

READ MORE

MEMBERS ONLY

A Rough Three Months for Commodities

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

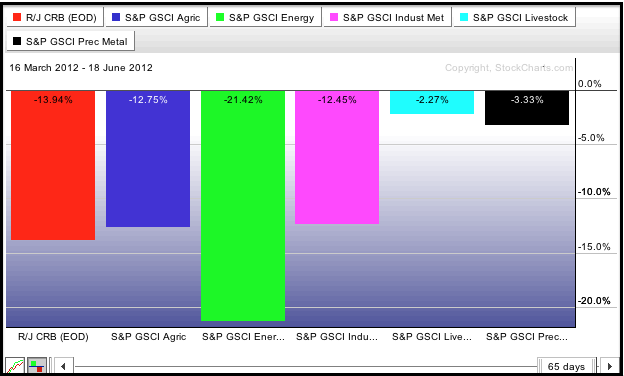

The PerfChart below shows the three month performance for five commodity indices and the CRB Index ($CRB). All five are down and $CRB is down around 14%. Blame it on energy, which is down over 21%. Precious metals have held up relatively well with a decline less than 4%.

Click...

READ MORE

MEMBERS ONLY

SPY Maintains Rising Wedge Uptrend - USO Finds Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a mixed day for stocks with the Dow Industrials SPDR (DIA) moving lower and the Nasdaq 100 ETF (QQQ) moving higher. The market was weighed down by the Finance SPDR (XLF) and Energy SPDR (XLE), but lifted by the Technology SPDR (XLK) and the Consumer Discretionary SPDR (XLY)...

READ MORE

MEMBERS ONLY

Charts of Interest: GFI, FICO, ISIL, ISRG, MOS, NYT, THC, TSN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GFI Forms Pennant.

ISIL Surges on Big Volume.

MOS Breaks Inverse HS.

Plus FICO, ISRG, NYT, THC, TSN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

Sector Summary Shows Hardware, Internet and Semis Leading

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

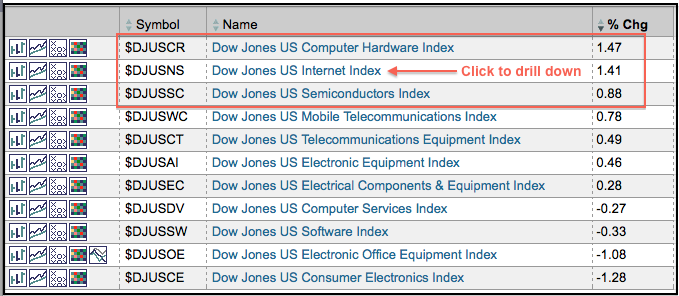

The image below, which stems from the sector summary at StockCharts.com, shows the key industry groups within technology sector. On Monday, computer hardware, internet and semiconductors were leading the way higher. Users can click on these names to see the individual stocks, which is a great way to identify...

READ MORE

MEMBERS ONLY

Bearish Wedge Takes Shape in SPY as TLT Holds Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

And the results are in! Pro-bailout party New Democracy won the Greek election with around 30% of the vote. They will now have three days to form a coalition with a parliamentary majority. Now comes the tough stuff. The new government will need to renegotiate the austerity package, pass this...

READ MORE

MEMBERS ONLY

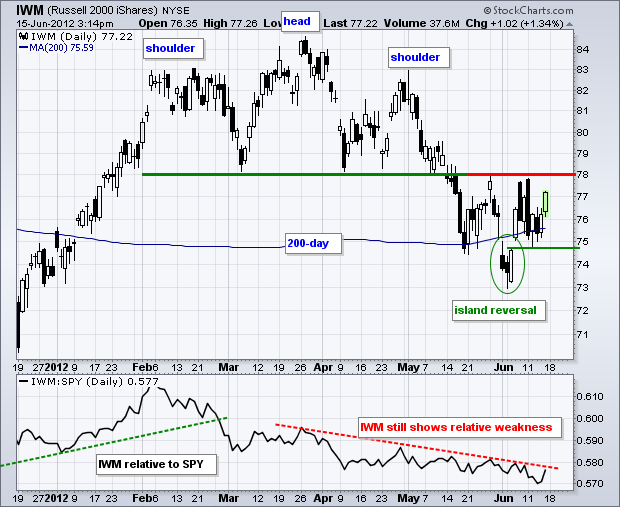

IWM Battles Broken Support and Relative Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 ETF (IWM) got a bounce at the end of the week, but remains in a trading range since the June 6th gap. There are two dynamics at work on this chart. First, the medium-term trend is down after the ETF broke neckline support from a head-and-shoulders pattern....

READ MORE

MEMBERS ONLY

Stocks with Big Gains and Big Prices Lead the Dow Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow surged over 150 points on Thursday and broke above its May high. With only 30 stocks, chartists can use the CandleGlance feature at StockCharts.com to find which stocks led the move. The Dow is a price weighed average and the stocks with the highest price have the...

READ MORE

MEMBERS ONLY

AD Volume Lines Poised to Test Minor Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a rebound last week, stocks turned flat this week and treaded water ahead of the Greek elections. The AD Volume Lines established minor resistance levels with the late May highs and breakouts would be short-term bullish. However, this would not be enough to turn medium-term bullish again. Also note...

READ MORE

MEMBERS ONLY

XLP Hits New High and XLV Breaks Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks caught a bid on Thursday with the major index ETFs closing modestly higher. The Dow Industrials SPDR (DIA) led the way with a 1.19% advance. The Nasdaq 100 ETF (QQQ) lagged with a .37% advance. All sectors were up with the Energy SPDR (XLE) and Healthcare SPDR (XLV)...

READ MORE

MEMBERS ONLY

S&P MidCap 400 SPDR Forms Falling Flag ahead of Big Weekend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is a real gut check underway in the stock market. The S&P MidCap 400 SPDR (MDY) surged last week and then corrected the last 5-6 days with a falling flag/wedge. This could be a bullish continuation pattern, but one must wonder if the bulls have the...

READ MORE

MEMBERS ONLY

IWM Forms Falling Flag - XLY Shows Relative Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks moved higher in the first half of the day and then lower in the second half. With the afternoon decline outpacing the morning advance, the major index ETFs closed modestly lower. Mid-caps led the decline with the S&P MidCap 400 SPDR (MDY) losing 1.34%. Small-caps were...

READ MORE

MEMBERS ONLY

Charts of Interest: AES, APC, COV, LTD, MMM, SBUX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

LTD Forms Flat Flag after Sharp Decline.

MMM Forms Harami at Key Retracement.

SBUX Breaks Descending Triangle Support.

Plus AES, APC, COV

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise)...

READ MORE

MEMBERS ONLY

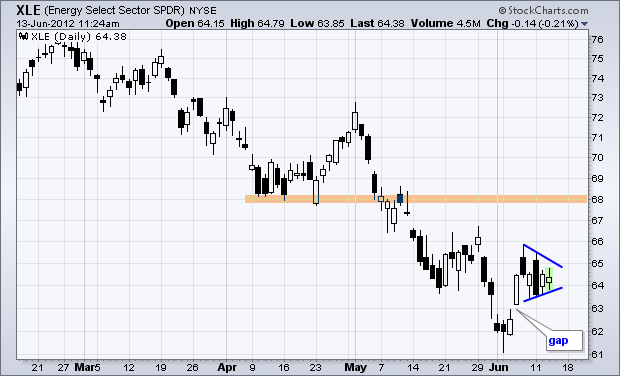

Energy SDDR Forms Pennant after Gap Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) remains in a downtrend overall, but signs of life are appearing as the ETF gapped higher last week and formed a pennant over the last five days. A break above this short-term consolidation could signal a continuation of the early June bounce and target further strength...

READ MORE

MEMBERS ONLY

IWM Forms Inverse HS Pattern - GLD Bounces off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded after Monday's bearish reversal day with the major index ETFs gaining over 1%. The Dow Industrials SPDR (DIA) led the way with a 1.61% gain, while the S&P MidCap 400 SPDR (MDY) lagged with a 1.01% gain. Eight of nine sectors were...

READ MORE

MEMBERS ONLY

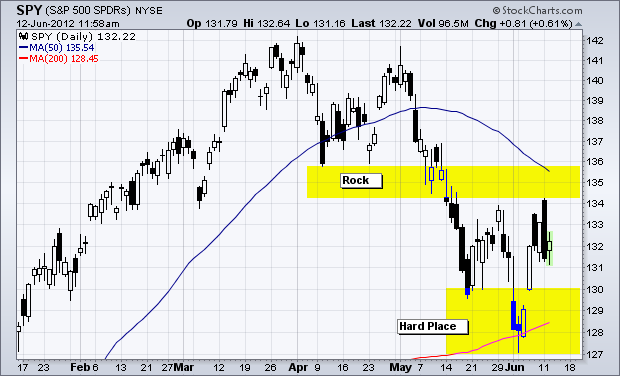

SPY is Stuck Between a Rock and a Hard Place

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

No wonder the S&P 500 ETF (SPY) cannot make up its mind on direction. The ETF broke key support in mid May and the 50-day moving average turned lower. Combined with Monday's high, these no mark the rock or resistance zone. The support zone, or hard...

READ MORE

MEMBERS ONLY

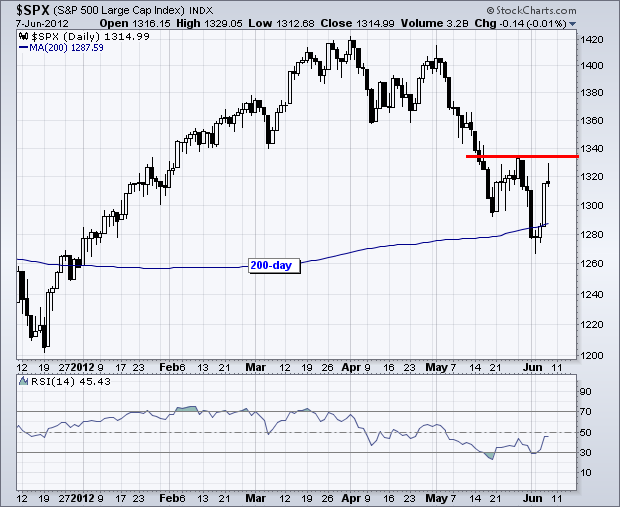

SPY Fails at Resistance with Bearish Engulfing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged on the open with the S&P 500 exceeding 1335 in the first 5 minutes of trading. Selling pressure hit after five minutes of euphoria and the index closed below 1308. $SPX swung 2% from high to low and closed down over 1% on the day. Overall,...

READ MORE

MEMBERS ONLY

Charts of Interest: AEO, BXP, DRI, F, HAS, HES, TE, TOL, VLO

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AEO Forms Triangle as Retail Sales Report Looms.

HAS Shows Weakness with Pennant Break.

TE Breaks Falling Wedge Resistance with Good Volume.

Plus BXP, DRI, F, HES, TOL, VLO

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell...

READ MORE

MEMBERS ONLY

Bearish Engulfings and Dark Clouds Litter the Pre-defined Scan Page

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a strong open and weak close on Monday, hundreds of stocks and ETFs formed either dark cloud patterns or bearish engulfing patterns. The chart below shows Home Depot (HD) forming a dark cloud near resistance and with the Stochastic Oscillator overbought. A move below 80 in the Stochastic Oscillator...

READ MORE

MEMBERS ONLY

SPY Poised to Break Late May High as GLD Holds Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak on Friday, but rallied throughout the day and closed strong. Rumors of a Spanish bailout fueled los toros (the bulls). Small-caps led the way higher with the Russell 2000 ($RUT) gaining over 1% on the day. All nine sectors were up with the Finance SPDR (XLF) and...

READ MORE

MEMBERS ONLY

German DAX Index Continues to Show Relative Weakness

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

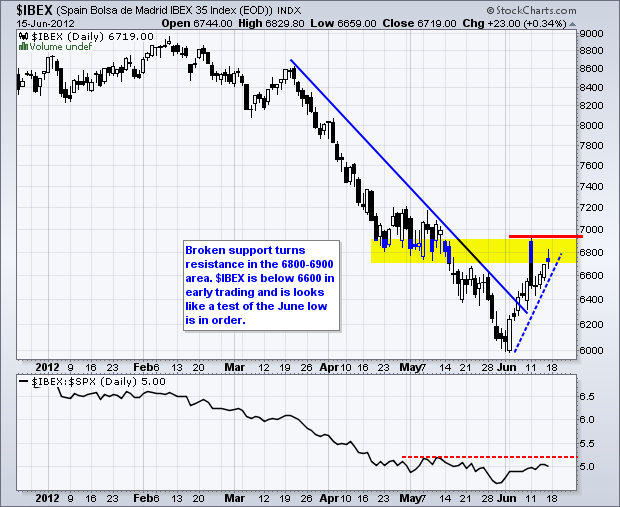

The German DAX Index peaked around 7200 in mid March and moved below 6000 in early June. That's over 15% in less than three months. Despite looking oversold, there are no signs of a reversl as the index remains below its late May high. In the indicator window,...

READ MORE

MEMBERS ONLY

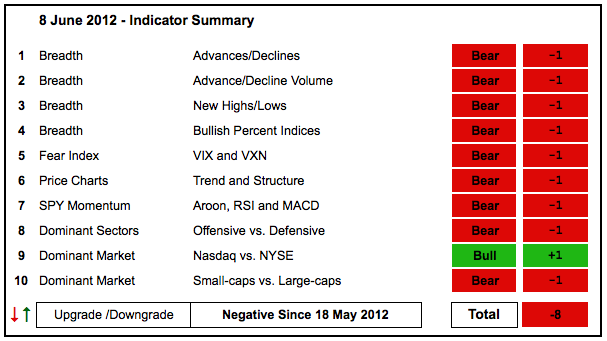

Oversold Bounce Not Enough to Influence Indicator Summary

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks bounced this week, but the bounce was clearly not enough to rattle the indicator summary, which remains firmly negative. The AD Volume Lines surged, but remain well below their May support breaks and in downtrend. The major index ETFs also surged, but have yet to negate the May support...

READ MORE

MEMBERS ONLY

SPY Fails at Late May High - TLT Bounces off Broken Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks asked for stimulus and failed to get what they wanted. The EU has yet to come forth with a concrete plan for EU banks, Bernanke did not offer hints of quantitative easing and the ECB stands ready to act. Allez, act already! Bernanke said the Fed would ease if...

READ MORE

MEMBERS ONLY

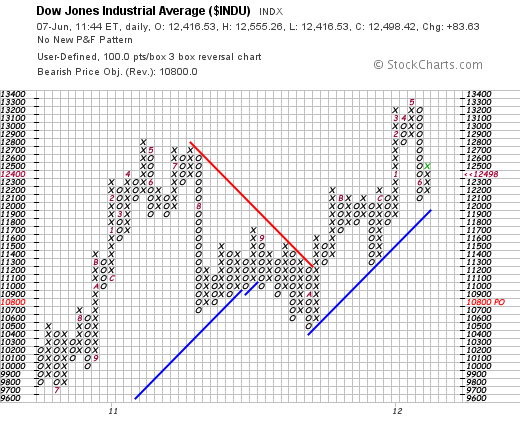

Dow Remains above Long Term Bullish Support Line on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a sharp decline in May-June, the Dow Industrials remains above the Bullish Support Line extending up from the October low. The red "A" marks the October column. This line sets support right at 12000. A break would reverse the current uptrend and require a red Bearish Resistance...

READ MORE

MEMBERS ONLY

SPY Gaps Up and Breaks May Trendline - GLD Stalls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was a classic stimulus-response rally on Wednesday. Wait, I did not see any actual stimulus. In reality, the market was anticipating stimulus in Europe, the US and elsewhere around the world. Rumors abound that the EU is poised to rescue Spanish banks and implement some sort of Euro-wide banking...

READ MORE

MEMBERS ONLY

Charts of Interest: ANN, BAC, CCL, DDS, LH, ROL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ANN Closes Lower and Shows Relative Weakness.

BAC Holds above Late May Low and Breaks Resistance.

ROL Shows Relative Strength with a Bull Flag.

Plus CCL, DDS, LH

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short...

READ MORE

MEMBERS ONLY

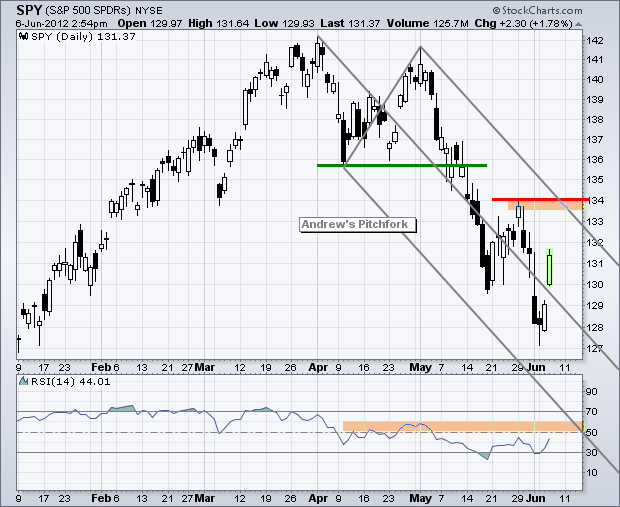

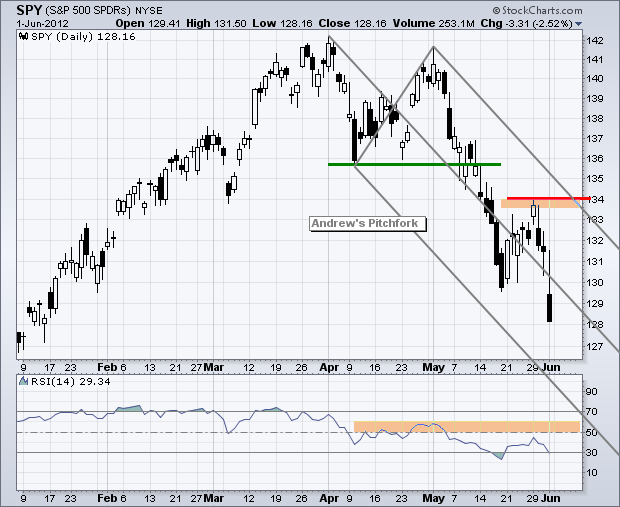

Marking SPY Resistance with Andrews' Pitchfork

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

SPY is getting a nice oversold bounce with a gap up and Andrews' Pitchfork marks resistance in the 133 area. The pitchfork traces out a falling channel extending down from the April-May highs and the upper line crosses the 133 level next week. You can read more on Andrews...

READ MORE

MEMBERS ONLY

Midcaps Lead Rebound as Gold Holds its Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks bounced on Monday with small-caps and mid-caps leading the way. The Russell 2000 ETF (IWM) gained around 1% and the S&P MidCap 400 SPDR (MDY) surged 2.05%. The chart below shows MDY forming a bullish engulfing as it surged back towards its 200-day moving average. While...

READ MORE

MEMBERS ONLY

Home Builders Turn Dark Green on the Market Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks are rebounded on Tuesday with homebuilders leading the way. The S&P Sector Carpet shows the Lennar (LEN) and Pulte (PHM) leading within the consumer discretionary sector. On the price charts, PHM is bounced off its April low and LEN formed a bullish engulfing pattern.

Click this image...

READ MORE

MEMBERS ONLY

Techs Firm as XLK Forms Harami in Retracement Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

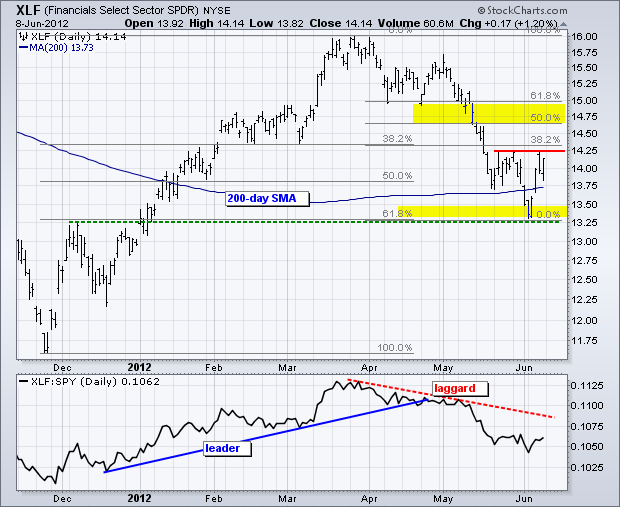

Stocks ended mixed on Monday with mid-caps showing relative weakness and large techs showing relative strength. The sectors were also mixed with five up and four down. The Finance SPDR (XLF) led the losers by falling almost 1%. Relative weakness in this key sector is a negative for the market...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, AMGN, AMZN, CIEN, ORCL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Shows Relative Strength.

AMZN Retraces 50-61.80% of Prior Surge.

ORCL Firms Just above Support Zone.

Plus $AMGN, $CIEN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

Utilities SPDR Leads and Forms a Bullish Cup-with-Handle Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Utilities SPDR (XLU) is virtually alone at the top as it trades near a 52-week high. A bullish cup-with-handle is taking shape and a break above resistance would signal a continuation higher. After showing relative weakness from January to mid March, the ETF started outperforming in mid March as...

READ MORE

MEMBERS ONLY

Gold Breaks Resistance as Oil Becomes Severely Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Friday produced yet another round of economic reports that were below expectations and the stock market moved sharply lower. Even though EU issues may be lurking behind the scenes, don't forget that US economic reports have been falling short for two months now. While the employment numbers were...

READ MORE

MEMBERS ONLY

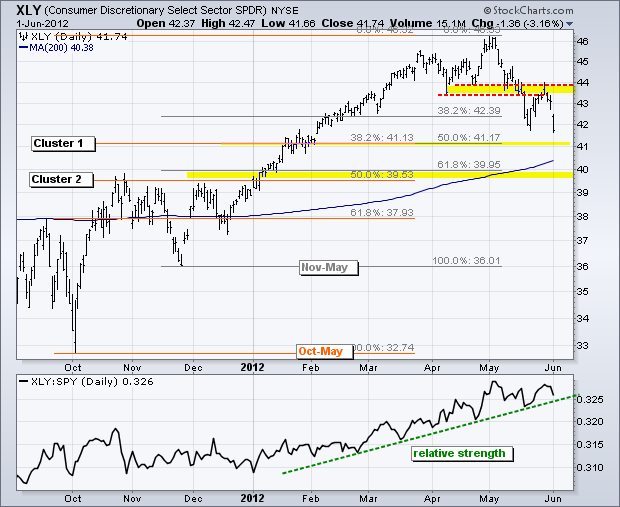

CONSUMER DISCRETIONARY SPDR GETS SQUASHED

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

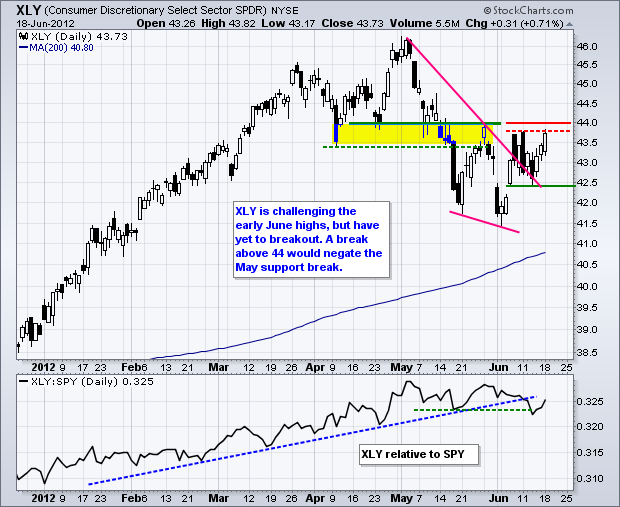

After a failure at broken support, the Consumer Discretionary SPDR (XLY) looks set for a move towards a Fibonacci cluster. The chart below shows XLY breaking support and becoming oversold in mid May. The ETF then bounced back to broken support and this area turned into resistance. It is not...

READ MORE

MEMBERS ONLY

5 and 7 Year Treasury Yields Dropping Like Rocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The chart below shows five different treasuries yields. Notice that five and seven year yields are falling the fastest as money moves into medium-term treasuries. After peaking on March 19th, the 5-year Treasury Yield ($UST5Y) and the 7-year Treasury Yield ($UST7Y) are down over 38% in less than three months....

READ MORE