MEMBERS ONLY

Indicator Summary Remains Negative as Support Breaks Hold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite a shallow bounce and some firmness the last two weeks, there is no change in the indicator summary. Current conditions remain bearish overall. The major index ETFs and the key sector SPDRs all broke down in May. The AD Volume Lines broke support from their March-April lows. Net New...

READ MORE

MEMBERS ONLY

A Rising Flag in SPY and a Descending Triangle in GLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were mixed and directionless on Thursday. Concerns in Europe and worse-than-expected economic reports buoyed the bears, while the prospects of further quantitative easing from the European Central Bank (ECB) and Fed put a bid in stocks. Don't be surprised if we see some big announcement out of...

READ MORE

MEMBERS ONLY

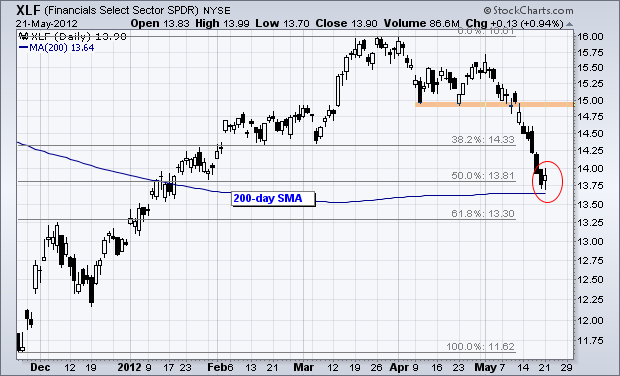

Finance Leads Lower in May - Utilities Hold Up Best

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P Sector PerfChart shows the percentage change for the nine sector SPDRs and the S&P 500 for the month of May. Eight of nine sectors are down with finance leading the day (down around 10%). The utilities sector sports the only gain as investors moved...

READ MORE

MEMBERS ONLY

SPY Fails to Follow Through as TLT Surges to New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with concerns in Europe again on Wednesday. Once again, the market failed to put together back-to-back gains and failed to follow through on Tuesday's advance. All major index ETFs were down with small-caps leading the way. Large-cap techs held up relatively well as the Nasdaq...

READ MORE

MEMBERS ONLY

Columbia Sportswear Forms Bearish Engulfing Near Resistance Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a rise the last three weeks, COLM hit a pocket of selling pressure and formed a bearish engulfing just below its April highs. This pattern formed even as the S&P 500 closed higher. Also notice that downside volume has consistently outpaced upside volume since late April. The...

READ MORE

MEMBERS ONLY

SPY Breaks Triangle Resistance, but Rising Flag Takes Shape

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

June is shaping up to be one critical month. Worse-than-expected economic reports this week would solidify the medium-term downtrends in the major index ETFs. Another Euro crisis after the Greek elections could keep buyers at bay even longer. A slight majority of US economic reports have been worse-than-expected the last...

READ MORE

MEMBERS ONLY

Alcoa Gaps Off Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After returning all the way to the December lows in May, Alcoa (AA) firmed last week and started this week with a gap higher. There is some support here, but the trend since early February is down and this gap is on low volume (so far).

Click this image for...

READ MORE

MEMBERS ONLY

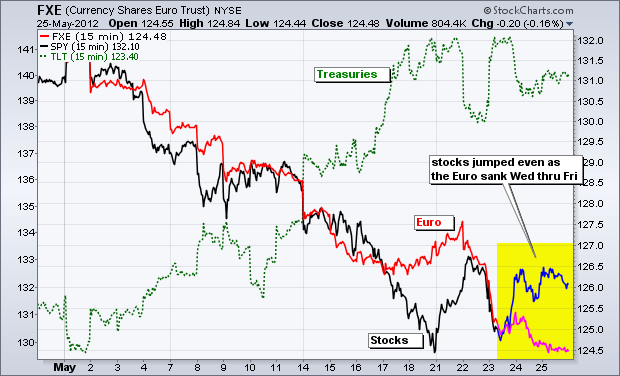

Stocks Prepare for Risk Rebound, but Euro and Treasuries Balk

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stock futures are up sharply this morning as the world takes a small bite of risk. Stocks are higher in Asia with Shanghai and Australia up just over 1%. European stocks are higher, but only modestly so with most major indices up around .50%. Oil futures are following the risk-on...

READ MORE

MEMBERS ONLY

Charts of Interest: ALTR, AMAT, BHI, FNSR, PNC, RIG

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Careful out there. It could be a very volatile week.

AMAT Forms Harami at Oversold Levels.

PNC Stalls at Support.

RIG Becomes Oversold and Consolidates.

Plus ALTR, BHI, FNSR

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell...

READ MORE

MEMBERS ONLY

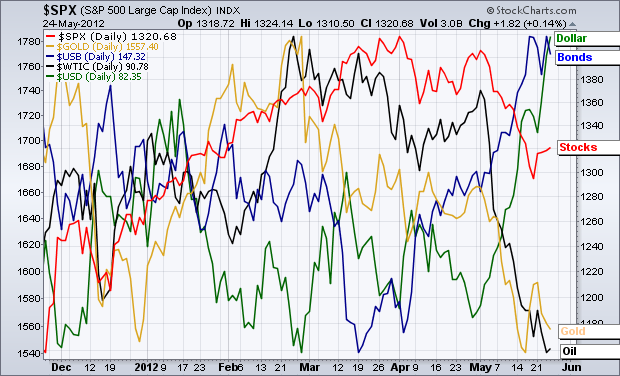

Dollar and Treasuries Lead as Gold and Oil Lag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This chart cover the recent shift to risk-off. The US Dollar Index ($USD) and the 30-Year US Treasury ($USB) are leading over the last six months as both trade near six month highs. Spot Gold ($GOLD) and Spot Light Crude ($WTIC) are lagging as both trade near six month lows....

READ MORE

MEMBERS ONLY

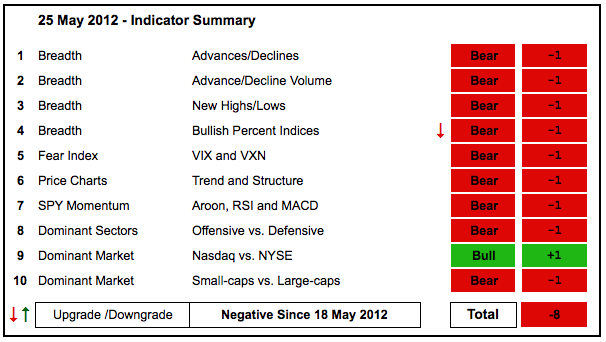

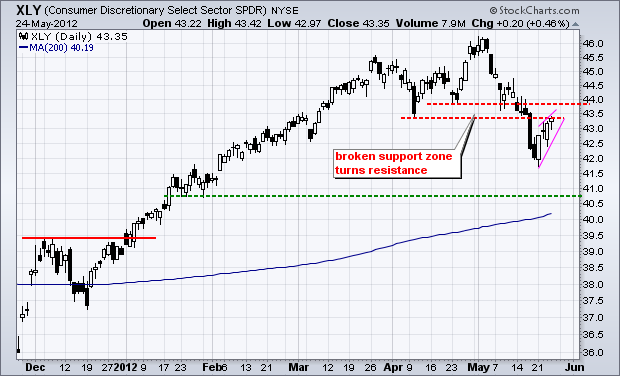

Five of Nine Sector Bullish Percent Indices Are Below 50% $BPDISC $XLY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary remains firmly bearish with nine of ten indicator groups now in the bearish camp. The Bullish Percent Index joined the bears as five of the nine sector BPIs moved below 50%. The AD Volume Lines clearly broke support to start downtrends this month. New lows expanded significantly...

READ MORE

MEMBERS ONLY

SPY Forms Pennant - GLD Bounces off Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After meandering for most of the day Thursday, stocks caught a late bid and moved higher in the final hour. Except for the Nasdaq 100 ETF (QQQ), which closed down .66%, the major index ETFs were slightly higher on the day. The sectors were mixed with the Technology SPDR (XLK)...

READ MORE

MEMBERS ONLY

Airline Index Leads Industry Groups with Big Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The image below shows the Market Summary Market Carpet zoomed in on the industry groups. (Note: click the heading to zoom in on a ground). Right away the Amex Airline Index ($XAL) stands out with a dark green square. This means it is leading with the biggest gains. On the...

READ MORE

MEMBERS ONLY

SPX Bounces off 1300 and Treasuries Remain Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Let the roller coaster ride begin! Stocks started the day weak with the major index ETFs falling over 1% in the first two hours of trading. After firming for a few hours, stocks moved sharply higher in afternoon trading. Most of the major index ETFs closed with small gains. The...

READ MORE

MEMBERS ONLY

Gold SPDR Fails To Hold Gains and Challenges Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold SPDR (GLD) gave back last week's gain with a sharp decline the last three days and is on the verge of breaking support. The next support zone resides in the 135-138 area. Gold remains hostage to the falling Euro as the Euro Currency Trust (FXE) fell...

READ MORE

MEMBERS ONLY

SPY Turns Indecisive as GLD Fails at Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a one day oversold bounce, stocks stalled on Tuesday as indecisive candlesticks formed on many charts. The Russell 2000 ETF (IWM) and the Russell Microcap Fund (IWC) closed lower and showed relative weakness. The S&P MidCap 400 SPDR (MDY), however, eked out a small gain and showed...

READ MORE

MEMBERS ONLY

AT&T, Disney, Pfizer, Wal-mart and Verizon Show Relative Strength within the Dow

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A review of the CandleGlance charts for the thirty Dow stocks shows only five components trading above their 20-day and 50-day moving averages: AT&T, Disney, Pfizer, Wal-mart and Verizon. Four of these five can be considered defensive stocks that hold up well during times of uncertainty.

Click this...

READ MORE

MEMBERS ONLY

XLF Forms Harami - SPY Scores Biggest Gain Since mid March

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded on Monday with mid-caps leading the charge and the S&P MidCap 400 SPDR (MDY) surging 3.82% on the day. All sectors were higher with materials, technology, energy and industrials gaining over 2%. Many of the hardest hit sectors and industry groups saw the biggest gains...

READ MORE

MEMBERS ONLY

Charts of Interest: CME, CTSX, HOTT, IMN, ISIL, LUV, SHLD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CME Surges off Key Retracement.

ISIL Forms Pennant after High Volume Surge.

LUV Breaks Flag Resistance on Big Volume.

Plus CTXS, HOTT, IMN, SHLD

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF...

READ MORE

MEMBERS ONLY

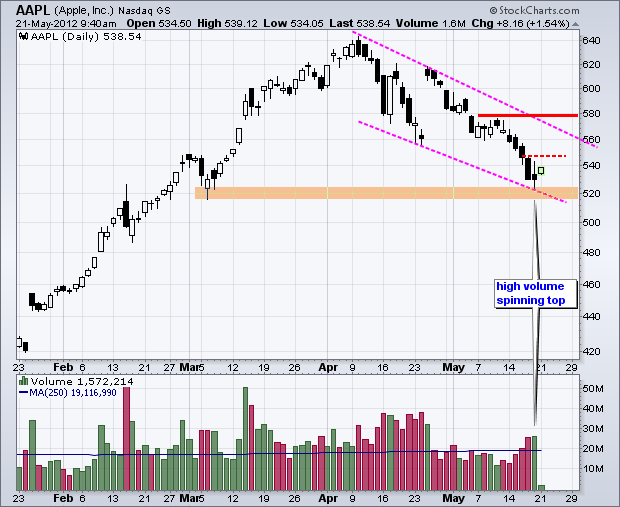

Apple Forms Spinning Top on High Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple suffered its biggest six week decline since 2008, but signs of firmness emerged as the stock formed a spinning top at the end of last week. Spinning tops represent indecision that can sometimes foreshadow a reversal. Also note that this candlestick formed with high volume. A move above Thursday&...

READ MORE

MEMBERS ONLY

Stocks Become Way Oversold as Euro and Gold Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Let the jawboning begin! The G8 came out with a very bold (not) statement over the weekend. In short, they urged Greece to stay in the Euro and said growth issues should be considered. Big deal. There is an EU summit scheduled for Wednesday and we can expect more grandiose...

READ MORE

MEMBERS ONLY

DOW THEORY SELL SIGNAL NOW IN FORCE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With big declines this past week, the Dow Industrials and Dow Transports both broke support levels and forged lower lows. Confirmed lower lows amount to a Dow Theory sell signal. The first chart shows the Dow Industrials forming a double top and breaking double top support with a decline below...

READ MORE

MEMBERS ONLY

30-year Treasury Yield Breaks Wedge Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 30-year Treasury Yield ($TYX) broke down with a sharp decline the last few weeks. This puts the yield near its 2011 lows and within striking distance of its 2008 lows, scene of the last crisis and flight to safety. Notice that treasury yields and the S&P 500...

READ MORE

MEMBERS ONLY

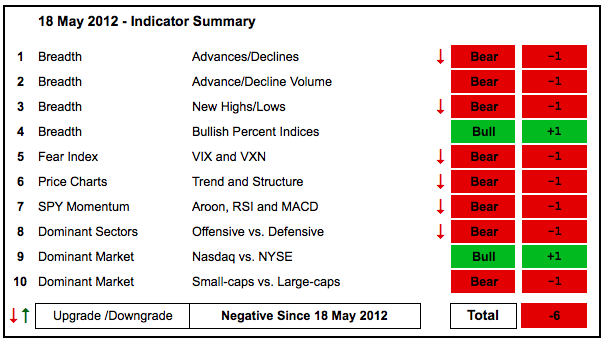

Indicator Summary Turns Negative as Selling Accelerates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a slew of downgrades, the indicator summary moved to -6 and decidedly negative for the first time since December. The bull run was long (5+ months), but the evidence has clearly shifted as selling pressure accelerated this week. Net New Highs for the NYSE turned negative and hit their...

READ MORE

MEMBERS ONLY

MidCaps Lead Lower with Support Break - Gold Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The decline in stocks accelerated on Thursday with QQQ and IMW falling over 2% and SPY loosing around 1.5%. This could be the beginning of the end, or it could simply be the middle of a free fall (see August 2011). Stocks are simply in falling knife mode. Of...

READ MORE

MEMBERS ONLY

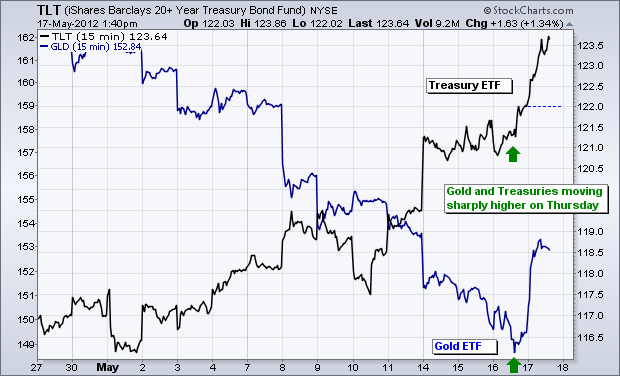

Gold and Treasuries Reverse Negative Correlation with Joint Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Gold SPDR (GLD) and the 20+ Year T-Bond ETF (TLT) have been negatively this month. Notice how TLT advanced from 116 to 123.5 and GLD declined from 161 to 150 the prior 11 days. This negative correlation changed today as both surged higher. TLT is up over 1%...

READ MORE

MEMBERS ONLY

SMH Breaks Neckline and IGN Moves Below December Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There it is again. Stocks opened with a little bounce and then worked their way lower the rest of the day. Every intraday bounce since May 11th has led to renewed selling pressure and lower lows. Buying pressure is weak on the bounce and none-existent after the bounce. The major...

READ MORE

MEMBERS ONLY

Charts of Interest: ADP, AFFX, AMZN, FL, LUV, ROK, WSM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMZN Stalls after Big Gap.

FL Forms Pennant after High Volume Support Break.

WSM Breaks Flag Support after Big Bull Trap.

Plus ADP, AFFX, FL, LUV, ROK

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any...

READ MORE

MEMBERS ONLY

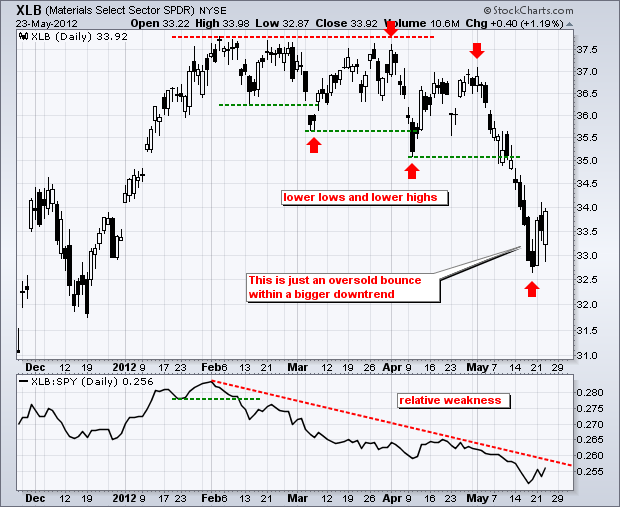

May-hem in the Markets with all Sectors Lower this Month

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

May has been nothing but mayhem for the market as all nine sectors moved lower. The PerfChart below shows the percentage change since May 1st. Over the last 11 trading days, the Finance SPDR (XLF), Energy SPDR (XLE) and Basic Materials SPDR (XLB) are leading the market lower. The three...

READ MORE

MEMBERS ONLY

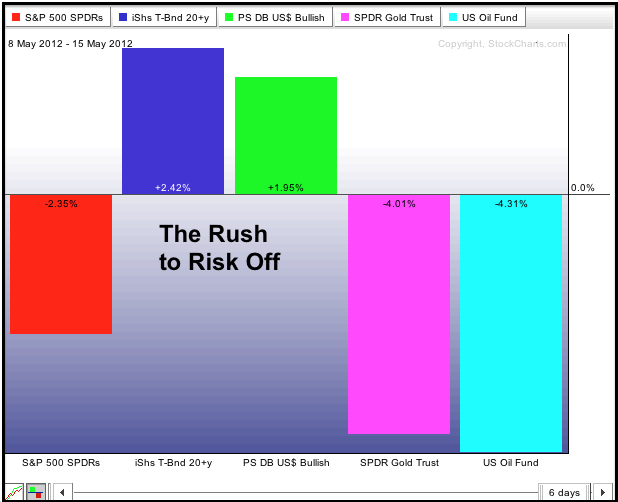

Dollar and Treasuries Lead the Risk-off Trade

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

US stocks opened strong on Tuesday, but buyers lost their nerve again and the major index ETFs closed near their lows for the day. Treasuries continued higher as investors sought relatively safety ahead of June elections in Greece. Needless to say, the Dollar soared and the Euro plunged. Commodities plunged...

READ MORE

MEMBERS ONLY

A Bollinger Band Squeeze for Google

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big decline in April, Google ($GOOG) consolidated the last few weeks and the Bollinger Bands narrowed significantly. This could be called a Bollinger Band squeeze or volatility squeeze. The next directional signal depends on the band break. A move above the upper band would be bullish, while a...

READ MORE

MEMBERS ONLY

IWM Breaks Wedge Support with Gap as TLT Hits New High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The risk-off trade was in full force on Monday: treasuries and the Dollar moved higher as stocks, oil and the Euro moved lower. Stocks opened weak, bounced a little and then closed weak as buyers lost their nerve. The major index ETFs remain in short-term downtrends, but are getting oversold...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, ABC, CAH, CVG, IMN, NKE, XRX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Declines to Support on Low Volume.

ABC Surges off Support with Big Volume.

Plus CAH, CVG, IMN, NKE, XRX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

QQQ Forms Rising Pennant as TLT Remains Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The risk-off trade has been dominant since May and shows no signs of changing this week. The world is openly talking about a Greek exit from the Euro, perhaps within a month. The fear is not so much the Greek exit, but rather the affect it will have on Portugal...

READ MORE

MEMBERS ONLY

Activision Gaps up on Big Volume $ATVI

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were under pressure the last three days, but ATVI bucked the trend with an advance and gap on high volume. This gap off support is bullish as long as it holds. Resistance at 13 marks the next challenge.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

AD Volume Lines Break Support as Indicator Summary Slips

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The indicator summary moved to +4 because of two downgrades. Of note, the AD Volume Lines broke support to turn bearish. Despite these breaks, the NYSE AD Line remains in bull mode and the Net New Highs indicators are still considered bullish. We have yet to see enough selling pressure...

READ MORE

MEMBERS ONLY

Major Index ETFs Set to Test March-April Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A disappointing outlook from Cisco (CSCO) weighed on the tech sector Thursday. In particular, the company sighted future concerns on government spending in the US and Europe. A $2 billion derivatives loss from JP Morgan Chase (JPM) is weighing on stock futures early Friday. This loss could expand another $1...

READ MORE

MEMBERS ONLY

Consumer staples stock Heinz Hits 52-week High with Breakout $HNZ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples SPDR (XLP) remains one of the strongest sectors and Heinze is part of that strength with an ascending triangle breakout. With a surge the last two weeks, the stock broke above its January-February highs and entered uncharted territory. Relative strength in consumer staples stocks shows a preference...

READ MORE

MEMBERS ONLY

IWM Tests March-April Lows as UUP Hits April High

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Several major index ETFs are testing their March-April lows and these support zones could produce oversold bounces. The Russell 2000 ETF (IWM), Dow Industrials SPDR (DIA), Rydex S&P Equal Weight ETF (RSP) and S&P MidCap 400 SPDR (MDY) are all testing support from the March-April lows....

READ MORE

MEMBERS ONLY

Charts of Interest: AEP, AN, CNX, GFI, ITT, UIS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CNX Bounces off Consolidation Support with big Volume.

GFI Forms Bullish Engulfing.

USI Forms within Gap Zone.

Plus AEP, AN, ITT

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE