MEMBERS ONLY

May Starts out as a Big Risk Off Month for Intemarket PerfChart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

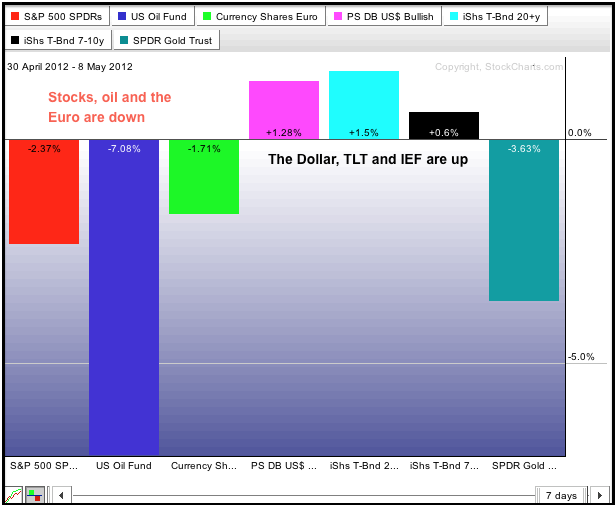

The PerfChart below shows the percentage change for seven intermarket ETFs. The three risk assets (stocks, oil, euro) are down, while the three safe havens are up (dollar, treasuries). Gold is going against the Dollar and along with the stock market.

Click this image for a live chart....

READ MORE

MEMBERS ONLY

SPY Bounces Off April Low as GLD Breaks Pennant Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) pierced its April lows with a sharp decline on the open and the bounced with an afternoon surge. Traders can expect this kind of volatility because bargain hunters and bottom pickers become active after sharp decline. SPY reached 135 on Tuesday's...

READ MORE

MEMBERS ONLY

SPY Firms after Becoming Oversold - GLD Forms Pennant

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big decline last week, stocks firmed on Monday and there is no change for the major index ETFs. A lot of news hit the fan over the past week and it looks like traders took a rest on Monday. The results of the Greek and French elections did...

READ MORE

MEMBERS ONLY

Charts: DHR, FITB, GOOG, LUV, MMM, SCHW, URBN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GOOG Forms Pennant after Sharp Decline.

MMM Hits Resistance and Declines into Gap Zone.

URBN Declines after Big Harami Pattern.

Plus DHR, FITB, LUV, SCHW

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock...

READ MORE

MEMBERS ONLY

Most Active Lists Show Mixed Market on Monday with Some Bullish Candlestick Patterns

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

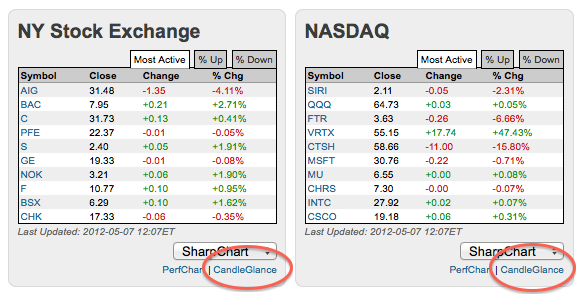

Even though stocks opened lower on Monday, market action quickly turned mixed, as evidenced on the most active tables for the Nasdaq and NYSE. Chartists can see the intraday action by clicking the CandleGlance links. BAC has a bullish engulfing working and Pfizer has an inverted hammer working on Monday....

READ MORE

MEMBERS ONLY

SPY Gaps Below Support and GLD Firms Within Range

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Uncertainty ratcheted up a notch in Europe as Hollande won the French election and the ruling coalition in Greece was dealt a setback. Asian stocks are down sharply, European stocks are down and Dow futures are down around 100 points. Oil, gold and the Euro are also down, while the...

READ MORE

MEMBERS ONLY

Industrials SPDR Traces Out Head-and-Shoulders Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap down and sharp decline, the Industrials SPDR (XLI) formed a lower high and broke wedge support. But that's not all. The chart below also shows a potential head-and-shoulders pattern taking shape. After hitting a 52-week high in March, the ETF declined all the way back...

READ MORE

MEMBERS ONLY

Sector Carpet Shows a Sea of Red and a Few Stocks Bucking the Trend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were down sharply in early trading on Friday with the energy sector showing the most red in the Sector Carpet. There are, however, usually a few stocks bucking the trend and these can be found by looking for the isolated patches of green. Notice Micron (MU), Flour (FLR) and...

READ MORE

MEMBERS ONLY

AD Volume Lines Hold Support, But Bounce Looks Weak

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are no changes in the indicator summary, but I am watching the AD Volume Lines quite closely. Even though both bounced over the last few weeks and essentially held support from the March lows, this bounce has not been that strong. Failure to reach the March high and a...

READ MORE

MEMBERS ONLY

The Moment of Truth Arrives for Stocks and Treasuries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were under pressure on Thursday after a worse-than-expected ISM Services Index. This diffusion index came in at 53.5 for April, compared to 56 in March. Even though the index dropped, it remains well above 50 and indicative of economic expansion, not contraction. From ism.com, "A diffusion...

READ MORE

MEMBERS ONLY

Rising Wedge Threatens Island Reversal in the Basic Materials SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

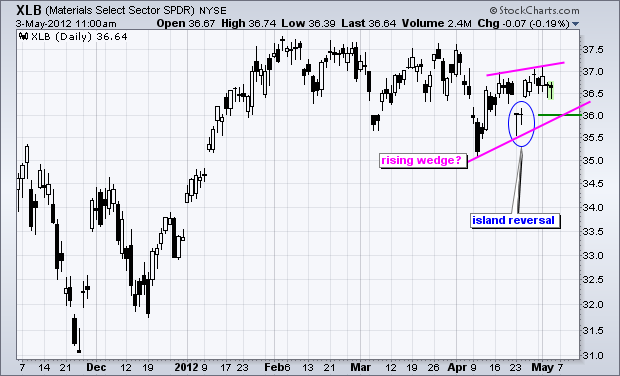

The Basic Materials SPDR (XLB) reversed higher last week with an island reversal, but stalled over the last 4-5 days and a rising wedge is taking shape. For now, the gap and island reversal dominate the chart. A move below 36 would fill this gap and break the wedge trendline....

READ MORE

MEMBERS ONLY

Charts of Interest: ATML, BWA, DWA, KFY, KMX, MD

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Upside Volume Picks up for ATML.

KFY Gaps up and Consolidates.

MD Forms Bullish Engulfing on High Volume.

Plus BWA, DWA, KMX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise)...

READ MORE

MEMBERS ONLY

SPY Holds Uptrend as TLT Consolidation Narrows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened weak after the ADP Employment report came in below expectations. Nevertheless, the market firmed and worked its way higher the rest of the day. Small-caps (Russell 2000) and techs (Nasdaq) finished with small gains, the S&P 500 and Dow ended the day with small losses. All...

READ MORE

MEMBERS ONLY

FirstTrust Internet ETF Gaps above Wedge Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The FirstTrust Internet ETF (FDN) broke out with a gap last week and that gap is holding. Mind that gap! The gap is bullish as long as it holds. Also notice that FDN broke resistance from the mid April highs and the Price Relative broke the trendline extending down from...

READ MORE

MEMBERS ONLY

TLT Tests Support after Strong ISM Index and USO Breaks Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It was pop and drop for stocks on Tuesday. Stocks surged on the heels of a better-than-expected ISM Manufacturing Index, but failed to hold early gains and fell sharply in the final hour. Small-caps (Russell 2000) and techs (Nasdaq) led the way lower. Traders may be getting cold feet ahead...

READ MORE

MEMBERS ONLY

Home Construction iShares Hits 52-week High and Components Follow Suit

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction iShares (ITB) is leading the market higher again with a fresh 52-week high this week. The chart below also shows the Price Relative (ITB:SPY ratio) hitting a new high. Below this chart is a snapshot from today's new high list. A sort by industry...

READ MORE

MEMBERS ONLY

Gold Recovers after Weak Open and TLT Holds Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks pulled back on Monday after the Chicago PMI came in below expectations and reached its lowest level since November 2009. Nevertheless, this key indicator came in at 56.20, which is well above 50 and indicative of economic expansion. Anything above 50 is positive. Don't forget that...

READ MORE

MEMBERS ONLY

Charts of Interest: ADM, BHI, CMI, HPQ, MAN, MON, SKS

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BHI Breaks Pennant Resistance.

HPQ Consolidates after High Volume Surge.

MAN Breaks Pennant Support.

Plus ADM, CMI, MON, SKS

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Harman and Whirlpool Show Biggest Gains in StockCharts Technical Rank

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The StockCharts Technical Rank (SCTR) is updated throughout the day so traders can find stocks making significant technical moves when they happen. The table below represents a snapshot from April 30th at 12:21 PM ET. These are the stocks with the biggest technical rank moves within the S&...

READ MORE

MEMBERS ONLY

Big Economic Week Could Make or Break the Bulls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The short-term trend for stocks changed with Wednesday's gap and breakout. The medium-term and long-term trends were already up. This means that all three trends are up again and we could see a challenge to the March highs. While I hate to play the fundamental card, the fate...

READ MORE

MEMBERS ONLY

Consumer Staples Bullish% Index Shows the Most Strength

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Consumer Staples Bullish% Index ($BPSTAP) is the strongest of the nine sector SPDR Bullish Percent Indexes. It is interesting that the BPI for this defensive sector shows the most strength. In contrast, the Consumer Discretionary Bullish% Index ($BPDISC) is currently around 69%. You can read more in our ChartSchool...

READ MORE

MEMBERS ONLY

NYSE and Nasdaq AD Volume Lines Establish Key Support Zones

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

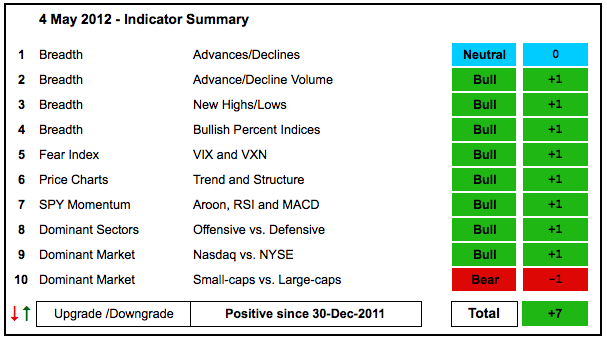

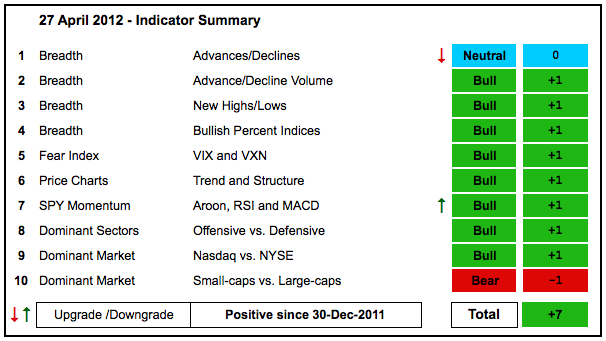

A couple of indicators flipped this week, but the net result is the same as the indicator summary remains at +7. The Nasdaq AD Line shows too much weakness to be considered bullish, but it is offset by strength in the NYSE AD Line. Momentum flipped back to bullish as...

READ MORE

MEMBERS ONLY

TLT Holds Support as Treasuries Remain Stubbornly Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The island reversals, up gaps and breakouts are holding. QQQ formed a lower low early this week, but IWM and SPY held above their early April lows. In fact, the recovery after Monday's gap down was so swift that I am going to draw my trendlines right through...

READ MORE

MEMBERS ONLY

SPY Forges Island Reversal - GLD Firms within Downswing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Fed made another policy statement with little change in its outlook or wording. Apple produced another blow out quarter. Even though neither event produced a surprise, Apple's coattails provided a big lift for the market overall. Most, if not all, of the gains came before the Fed...

READ MORE

MEMBERS ONLY

Charts: AMT, AMZN, ATVI, DELL, FDX, IGT, SLM, TER, UTX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Careful out there. It is earnings season.

AMT Breaks Out to 52-week High.

DELL Hits Key Retracement.

SLM Forms Small Descending Triangle.

Plus AMZN, ATVI, FDX, IGT, TER, UTX.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell...

READ MORE

MEMBERS ONLY

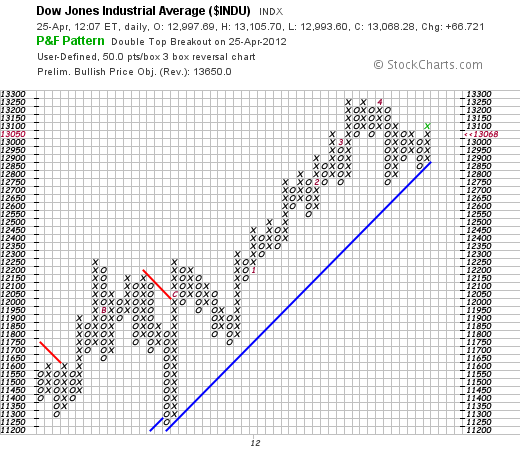

Dow Bounces off Bullish Support Line on P&F Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Dow Industrials remains in a long-term uptrend as it bounced off the bullish support line extending up from October 2011. This line and the April low combine to mark a key support zone in the 12850-12900 area. It would take a P&F print below the last O-Column...

READ MORE

MEMBERS ONLY

SPY Moves into Gap Zone as QQQ Stalls at Channel Trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Apple is stoking the street with a big move after reporting earnings. While a strong open is expected, what happens after the open, and after the Fed statement, is more important. Actually, I think Thursday's price action will hold the key to the next move in stocks. Trading...

READ MORE

MEMBERS ONLY

Citrix Gaps Down after Shooting Star Candlestick

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After hitting resistance in the 80-81 area in March, Citrix (CTXS) failed once again at this level with a shooting star candlestick last week. Notice the long upper shadow extending above 80. A down gap followed this bearish reversal candlestick and the next support zone resides around 71.

Click this...

READ MORE

MEMBERS ONLY

SPY Gaps Down and Breaks Wedge Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks are short-term oversold, it is turnaround Tuesday, Apple reports earnings today and the bigger trend (6 months) remains up. On top of all this, traders will also be gearing up for the start of the Fed meeting today and policy statement on Wednesday (12:30PM). Stocks moved lower on...

READ MORE

MEMBERS ONLY

Charts of Interest: AMX, ANF, APD, AZO, COH, GLW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

APD Breaks Rising Flag Support.

AZO Forms Pennant with Strong Up Volume.

LXK Forms Bullish Engulfing on Big Volume.

Plus AMX, ANF, APD, COH

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF...

READ MORE

MEMBERS ONLY

Apple CCI Becomes Oversold for Third Time in Twelve Months

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When it comes to the Commodity Channel Index (CCI), there is oversold and then there is OVERSOLD. Readings below -100 are average oversold, while anything below -200 is really oversold. For just the third time in twelve months, 20-day CCI for Apple moved below -200. Prior readings occurred in June...

READ MORE

MEMBERS ONLY

SPY Battles Rising Wedge Trendline as GLD Forms Pennant

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks look heavy as selling pressure hit Friday afternoon and remains early Monday. $SPX futures are down around 10 points in early trading (5AM ET). Bonds and the Dollar are up, while gold and oil are down. Stocks surged last Tuesday, but gave back these gains with a decline on...

READ MORE

MEMBERS ONLY

ENERGY SECTOR IS THE WEAKEST OF THE NINE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) broke key support in late March with a sharp decline and has yet to reach the next key support level. The chart below shows XLE consolidating in the 69 area over the last two weeks. This consolidation looks like a rest within the downtrend. A break...

READ MORE

MEMBERS ONLY

QQQ Remains within Falling Flag Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) managed to firm after Monday's sharp decline, but remains within a short-term downtrend defined by a falling flag. It would take a move above resistance at 67 to reverse this fall. Chartists can also watch for the Commodity Channel Index (CCI) for confirmation....

READ MORE

MEMBERS ONLY

Indicator Summary Weakens along with Small Caps

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

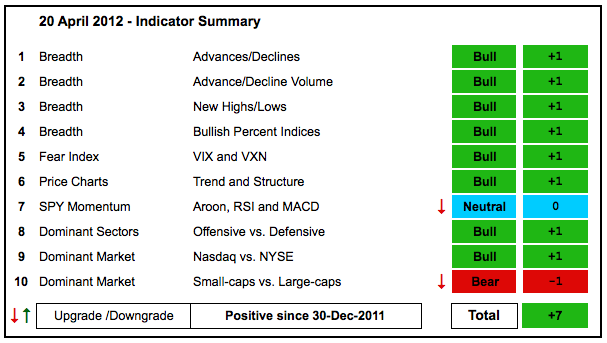

The indicator summary dipped to +7 this week after two downgrades. The bulk of the evidence is still bullish, but a few indicators weakened with the April decline. The NYSE AD Line and AD Volume Line briefly broke their March lows. The Energy Bullish% Index ($BPENER) dipped below 50% to...

READ MORE

MEMBERS ONLY

IWM Breaks Flag Trendline, UUP Forms Triangle After Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks weakened over the last two days as IWM broke its rising flag trendline and SPY tested its rising flag trendline. QQQ remains in a downtrend as Apple continues to weigh. On the 60-minute chart, SPY broke support with a sharp decline in early April to start a short-term downtrend....

READ MORE

MEMBERS ONLY

Biotechs, Internet and Networking Lead Market Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

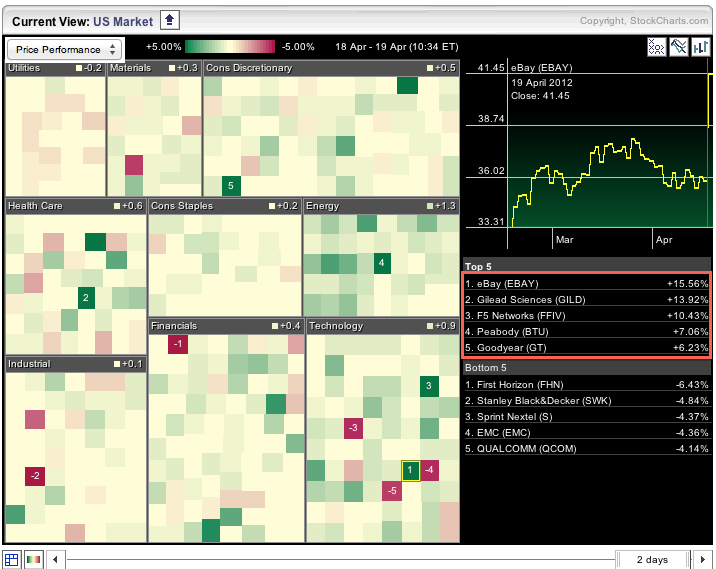

The Sector Market Carpet shows big gains in three stocks powering these industry groups. EBAY is up over 15% and leading the internet group. FFIV is up over 13% and leading the networking group. Both groups are part of the technology sector. GILD is up over 10% and leading the...

READ MORE

MEMBERS ONLY

SPY and IWM Continue within Rising Flags as GLD Stalls

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The moment of truth is drawing near. After a bounce the prior five days, the major index ETFs consolidated on Wednesday. DIA and SPY formed inside days to signal short-term indecision. Also note that rising flag patterns formed in DIA, SPY and IWM. A break below rising flag support levels...

READ MORE

MEMBERS ONLY

Charts of Interest: AMAT, GRMN, HRB, HUM, STT

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Careful out there. It is earnings season.

AMAT Consolidates in Key Retracement Zone.

GRMN Forms Flat Flag after Breakdown.

STT Breaks Short-term Resistance with Volume.

Plus HRB and HUM.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell...

READ MORE

MEMBERS ONLY

Morgan Stanley Consolidates at Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Morgan Stanley fell to support with a sharp decline from late March to early April and then consolidated the last eight days. While the stock market bounced, MS remained flat and is lagging the market the past week. Watch the consolidation boundaries for the next directional signal.

Click this image...

READ MORE