MEMBERS ONLY

Charts of Interest: AMZN, AN, APOL, CCL, D, DE, FISV, MXIM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMZN Forms Big Hammer at Support.

CCL Traces out Big Bearish Engulfing.

DE Declines Six Days Straight.

Plus $AN, $APOL, D, DE, FSIV, MXIM

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF...

READ MORE

MEMBERS ONLY

A Triple Bottom Breakdown for QQQ on 30min PnF Chart

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Nasdaq 100 ETF (QQQ) broke below the prior two O-Columns to forge a triple bottom breakdown on the 30min PnF chart. This bearish signal suggests that the ETF is going lower with a downside price objective around 52.90. This can be see at the top of the chart....

READ MORE

MEMBERS ONLY

No commentary - Charts Updated - Back Tuesday

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

I am taking a day off of the commentary today, but the charts have been updated and posted below. Art's Charts will return in full on Tuesday.

Key Economic Reports:

Mon - Dec 19 - 10:00 - NAHB Housing Market Index

Tue - Dec 20 - 08:...

READ MORE

MEMBERS ONLY

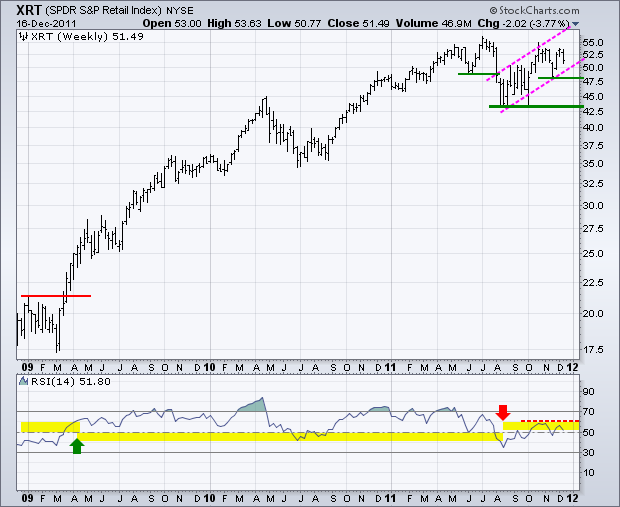

RETAIL SPDR COULD HOLD THE KEY IN 2012

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) remains one of the strongest ETFs in the market. As a core part of the consumer discretionary sector, retail is one of the most important industry groups and Christmas is perhaps the most important season. A lot is riding on the consumer this holiday season. The...

READ MORE

MEMBERS ONLY

NYSE McClellan Summation Index Turns Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a downturn in the stock market this week, the NYSE Summation Index ($NYSI) turned back down and broke below its 5-day EMA. This shows that breadth is deteriorating once again. The McClellan Oscillator also turned negative. Note that the Summation Index is a cumulative measure of the McClellan Oscillator....

READ MORE

MEMBERS ONLY

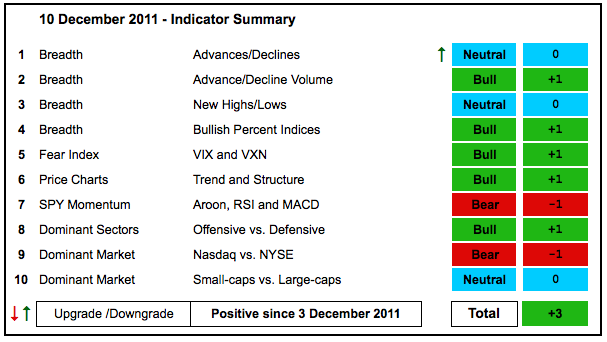

AD Volume Lines Weigh on Indicator Summary

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The market is about as mixed up as it can be right now. With a few downgrades this week, the indicator summary flipped back to negative territory (-2). There are still a few neutral readings out there that could go either way with a significant move. The AD Volume Lines...

READ MORE

MEMBERS ONLY

Stocks, Gold and the Euro Firm after Becoming Oversold

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks got a bounce as the Euro finally firmed for a day. The seasonal patterns for the stock market are still bullish this time of year. These include yearend window dressing, the Santa Claus rally, historic returns in December, the January effect and the six-month cycle. It is also interesting...

READ MORE

MEMBERS ONLY

Oil Plunges as Risk-off Trade Remains in Force

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The risk-off trade remained in force on Wednesday with oil joining the sell-off in stocks, the Euro and gold. US Treasuries and the Dollar benefitted from a flight to safety. Concerns over Europe continue to dominate the headlines as Italian 10-year yields moved to 6.69%. Italy auctioned $3 billion...

READ MORE

MEMBERS ONLY

Charts of Interest: AEE, AMGN, CPN, CVX, GE, GGP

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AEE Forms Pennant after Sharp Decline.

CVX Breaks Support on High Volume.

GGP Stalls with Bull Flag.

Plus AMGN, CPN, GE

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Healthcare SPDR Forms Bull Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After a big surge in late November, the Healthcare SPDR (XLV) pulled back with the rest of the market and formed a falling flag the last few weeks. This is a bullish continuation pattern and a break above 34 would reverse the three week slide. Notice that XLV continues to...

READ MORE

MEMBERS ONLY

StockCharts Technical Rank Surges as Merck Breaks Flag Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Top ten lists for the StockCharts Technical Rank (SCTR) can now be found on the home page (scroll down). Merck (MRK) stands out from the list of stocks with the biggest SCTR change. The SCTR jumped 12.4 as the stock broke flag resistance and challenged its 2011 highs.

Click...

READ MORE

MEMBERS ONLY

SPY Remains within Falling Channel as UUP Surges

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The risk-off trade took hold in the markets with stocks and the Euro falling. Bonds and the Dollar surged, but oil bucked the trend with a big gain. I am not sure how long oil can hold up in the face of a strong Dollar and weak stock market. In...

READ MORE

MEMBERS ONLY

Retailer SPDR Tests Breakout and Near Term Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Retail SPDR (XRT) is under pressure today after a miss from Best Buy (BBY) and a lackluster Retail Sales report. XRT broke trendline resistance in early December and then consolidated. This breakout is holding, but barely. Consolidation support is set at 52 and a break below this level would...

READ MORE

MEMBERS ONLY

Charts of Interest: FLEX, MMM, TEVA, THO, TTWO, URBN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

FLEX Flexes its Muscles.

MMM Hits Big Resistance Zone.

TEVA Forms Bullish Pennant.

Plus THO, TTWO, URBN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think...

READ MORE

MEMBERS ONLY

SPY, GLD and USO Plunge as TLT and UUP Surge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the seasonal patterns are bullish, stocks remain under pressure and the stt trends are down. The bullish seasonals include the two-year cycle, the fourth year of a presidential term, the six-month cycle, the Santa Claus rally, yearend window dressing and the January effect. On the S&P...

READ MORE

MEMBERS ONLY

Silver ETF Breaks Flag Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Weakness in precious and industrial metals weighed on silver as the Silver Trust (SLV) broke flag support with a sharp decline Monday. This break signals a continuation of the breakdown from mid November. MACD moved below its signal line to turn momentum bearish. Resistance is set at the early December...

READ MORE

MEMBERS ONLY

SPY Challenges Resistance as GLD Tests Key Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

It looks like we had some sell-the-rumor and buy-the-news. Rumors of an EU breakdown were swirling on Thursday and this caused a sell-off in stocks. However, these rumors were squashed with an agreement to agree on fiscal constraints. Admittedly, we did not get a concrete agreement out of the EU...

READ MORE

MEMBERS ONLY

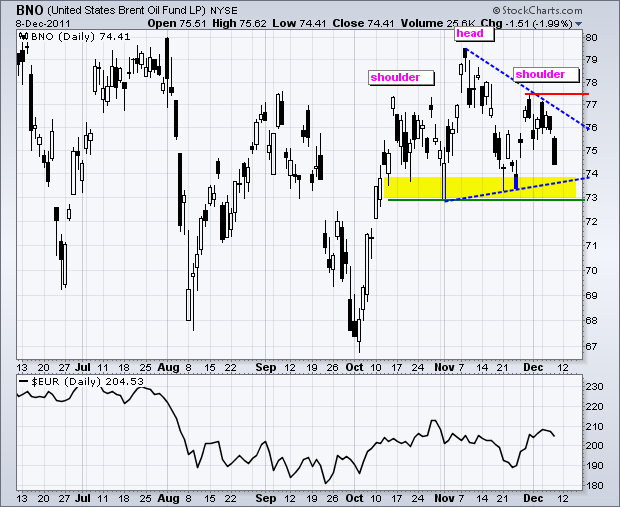

Brent Oil ETF Traces out Head-and-Shoulders Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Brent Crude ETF (BNO) hit resistance from the summer highs and formed a small Head-and-Shoulders pattern over the last two months. Neckline support is set at 73, a break of which would confirm the pattern. The alternative pattern is a Symmetrical Triangle and a break above the right shoulder...

READ MORE

MEMBERS ONLY

November Gaps and 50-day Lines Hold the Key

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is not much change in the indicator summary. I upgraded the NYSE AD Line because this chart looks just like the charts for the Nasdaq and NYSE AD Volume Lines. The Nasdaq AD Line remains bearish so the AD Lines as a whole are neutral. Basically, the NYSE AD...

READ MORE

MEMBERS ONLY

SPY Breaks Short-Term Support as TLT Breaks Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The negotiation marathon continues in Brussels. The 27-nation block fell apart as the UK and Hungary opted out of the current deal. Eurocrats are, however, making progress with the remaining 17 plus 6 or so. Nobody really expected an earth shattering agreement that would completely solve the problem. There will...

READ MORE

MEMBERS ONLY

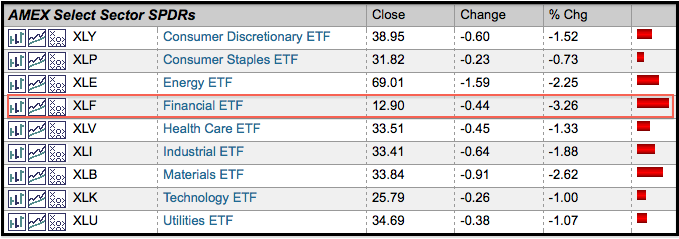

Finance Sector Leads Market Lower

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Once again, it is the finance sector feeling the heat from across the pond. This screenshot from the market summary page shows the nine sectors, and all are in the red. In afternoon trading on Thursday, XLF is the only one with a loss greater than 3%. Obviously, the banks...

READ MORE

MEMBERS ONLY

Stocks Consolidate as World Waits on Europe

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today is the day - or rather two days. The European Central Bank (ECB) will make its policy statement and the 2-day EU summit starts. There are plenty of good reads and opinions regarding the EU situation. At the end of the day it boils down to probabilities and realities....

READ MORE

MEMBERS ONLY

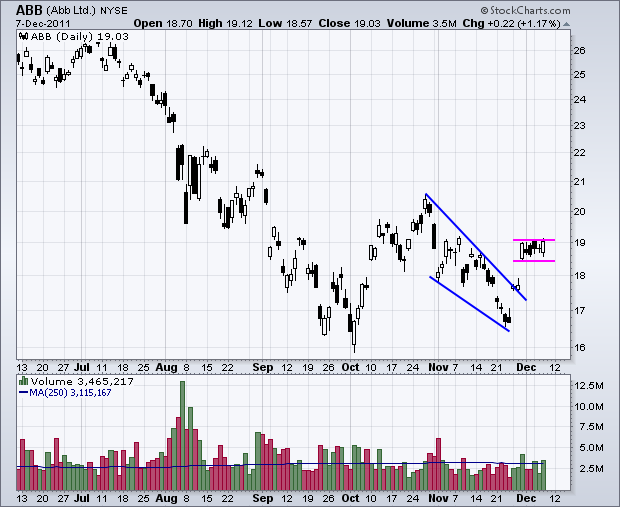

Charts of Interest: ABB, ABT, ECA, HPQ, XRAY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ABB Consolidates after Breakout Surge.

ECA Bounces off Support for Potential Double Bottom.

XRAY Forms Bullish Pennant.

Plus ABT and HPQ.

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Broadcom Forms Bullish Engulfing on Good Volume

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Broadcom (BRCM) came across the bullish engulfing scan on Wednesday. After becoming oversold with a sharp decline in November, the stock firmed the last two weeks and formed a bullish engulfing on Wednesday. This white candlestick completely engulfed the prior black candlestick. Volume was also above average. Follow through above...

READ MORE

MEMBERS ONLY

SPY Holds Uptrend, TLT Breaks Support and UUP Consolidates

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The stock market held its breadth yesterday as the major index ETFs were barely changed the entire day. No change in the short-term uptrend means the short-term uptrend remains in play. According to the financial press, stocks are waiting for clues from Europe, which will start to flow on Thursday....

READ MORE

MEMBERS ONLY

Charts of Interest: AGU, ALTR, AMCC, JCOM, MAS, SHAW

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AGU Consolidates after Island Reversal.

MAS Challenges Flag Resistance.

SHAW Forms Small Flag after Breakout.

Plus ALTR, AMCC, JCOM

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

Stocks Hold Short-Term Uptrends as Gold Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This could be the week that breaks the bear's back or triggers a sharp reversal at resistance. While US ties to Europe are relatively small as a percentage of GDP, Europe's influence on the stock market and Dollar has been relatively large. Today's headlines...

READ MORE

MEMBERS ONLY

Home Construction iShares Leads with a Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction iShares (ITB) is one of the strongest industry group ETFs in the market right now. The chart below shows ITB breaking above its mid-November high with a surge the last few days. In the indicator window, the Price Relative confirms relative strength with a move to its...

READ MORE

MEMBERS ONLY

SPY Surges over 7% and GLD Follows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

That was one heck of a rally last week. SPY and QQQ surged over 7% and IWM was up over 10%. Was last week's surge an August-September surge or an October surge? A 7% surge in SPY compares to the beginning of October, which preceded a huge advance....

READ MORE

MEMBERS ONLY

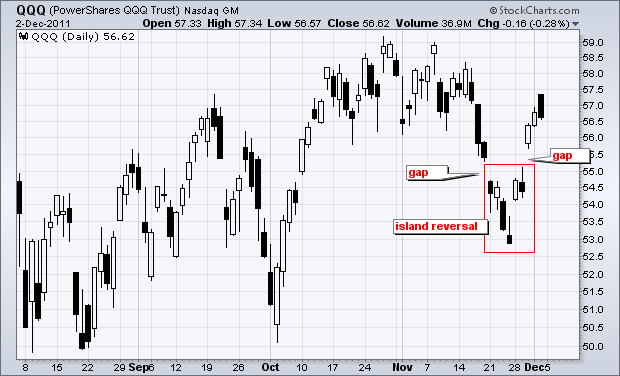

QQQ Forms Island Reversal with Big Move

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While gaps are not what they used to be, there were a few island reversals on the charts this week. The chart below shows the Nasdaq 100 ETF (QQQ) with a large island reversal over the last three weeks. A bullish island reversal forms with a gap down, a consolidation...

READ MORE

MEMBERS ONLY

Market Surge Turns Indicator Summary Positive

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With this week's big move, the indicator summary flipped from negative to positive. There are clearly some judgment calls at work here. It really boils down to accepting this week's surge as the real deal. The alternative is that it was just one heck of a...

READ MORE

MEMBERS ONLY

A Double Island Reversal for the Finance SPDR

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a gap up on Monday and another on Wednesday, the Finance SPDR (XLF) formed two island reversals over the last three weeks. The first island formed on Friday-Monday (red circle). The second island formed from 21 to 29 November (blue oval). Notice the gaps on either side of these...

READ MORE

MEMBERS ONLY

SPY and GLD Consolidate after Big Moves as TLT Hits Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This market is just itching to continue higher. As I write, the Dow futures are of over 100 points. Hints of a European deal are in the air, the US economic numbers have been pretty good and central banks are printing money. What more could a stock market want? Even...

READ MORE

MEMBERS ONLY

Watson Pharma Forms Monster Bearish Engulfing Patterm

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though the market moved sharply higher on Wednesday, Watson Pharma could not hold its early gain and closed weak. Wednesday's black/filled candlestick completely engulfed the prior white/hollow candlestick to form a bearish engulfing. Also notice that volume surged. You can read more on candlesticks in...

READ MORE

MEMBERS ONLY

IWM Surges over 10% in Three Days as Treasuries Correct

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Coordinated action from five central banks sparked a massive rally in the finance sector (+6.17%) that extended to the rest of the market. All sectors were up. Seven of nine were up more than 3%. Utilities and consumer staples were up less than 3%. The materials, energy, finance and...

READ MORE

MEMBERS ONLY

Charts of Interest: AMZN, BBY, FDX, LOW, LUV, RL, WY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

BBY Forms Dark Cloud at Key Retracement.

FDX Breaks Flag Resistance.

RL Traces out Bear Wedge.

Plus AMZN, LOW, LUV, WY

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

JP Morgan Surges off Support with Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As one of the big money-center banks, JP Morgan (JPM) clearly benefited from the coordinated central bank action on Wednesday. The chart below shows JPM bouncing off support with a big gap on big volume. JPM closed near the high of the day. The gap is bullish as long as...

READ MORE

MEMBERS ONLY

IWM Trades with Tight Range as TLT Holds its Breakout

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Guess what? Reports indicate that the Euro-zone bailout fund is smaller than EU finance ministers once thought. There is also a "secret" report suggesting that Italy is on the verge of blowing up the Euro zone. Yes, the rumors continue to fly. These latest rumors are putting a...

READ MORE

MEMBERS ONLY

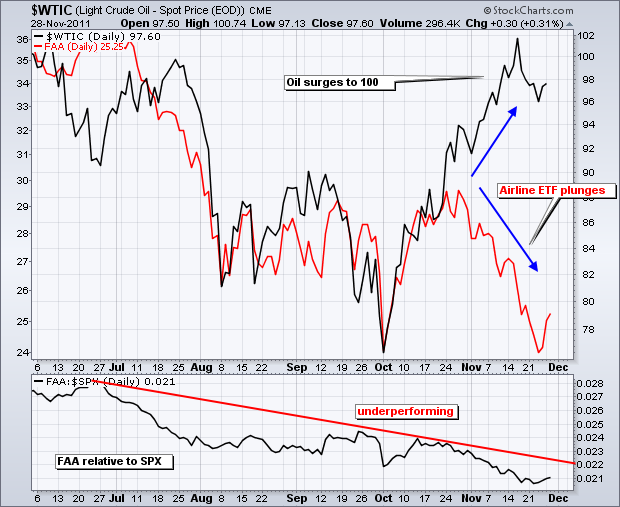

Airlines and Oil Go their Separate Ways

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Airline ETF (FAA) and Spot Light Crude ($WTIC) were moving in the same direction from July to mid October, but went their separate was in late October. Spot Light Crude surged above 100 in November as the Airline ETF tested its early October low. Airlines are clearly not happy...

READ MORE

MEMBERS ONLY

Stocks Gap Up and Hold Gaps as SPY Forms Island Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened strong and finished strong with a broad advance on Monday. While it is still considered an oversold bounce within a bigger downtrend, there is room for further upside before resistance from broken support levels comes into play. SPY gapped up to form an island reversal over the last...

READ MORE