MEMBERS ONLY

S&P 500 Leads Breadth Charge

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 and SPY are challenging their August highs again and large-cap breadth is stronger than breadth in mid-caps and small-caps. Since we seem to be on a day-to-day situation with the S&P 500 and this trading range, I will provide another short-term breadth update....

READ MORE

MEMBERS ONLY

A Classic Reversal Pattern with a Live Example - Plus 3 Stock Setups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Even though trend continuations are more likely than trend reversals, reversals do occur and chartists looking for price reversals should understand the classic patterns. While perusing through the charts today, I found a stock with a classic reversal pattern and a breakout in the works. Even though reversal patterns are...

READ MORE

MEMBERS ONLY

The Never-Ending Range, Low Vol Leadership and Credit Market Canaries

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As noted in Tuesday's commentary, the S&P 500 SPDR (SPY) and several big sector SPDRs remain locked in trading ranges. SPY fell back from range resistance with a modest decline on Tuesday (-.58%). It certainly could have been worst.

As the chart below shows, SPY...

READ MORE

MEMBERS ONLY

Volatile and Yet Not So Volatile

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks opened strong on Friday morning and then sold off ahead of a three day weekend. Well, the weekend has passed and stocks are set to open lower on Tuesday. What a surprise! August was volatile for the S&P 500. And yet it was also not volatile. The...

READ MORE

MEMBERS ONLY

Charting the Fab 5 for Clues on QQQ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today we will look at charts for the biggest stocks in the Nasdaq 100 ETF. Even though the big tech titans dominate QQQ, note that Pepsi (PEP) is the 10th largest stock and accounts for 2.3%. PEP is obviously part of the Consumer Staples sector.

The top five stocks...

READ MORE

MEMBERS ONLY

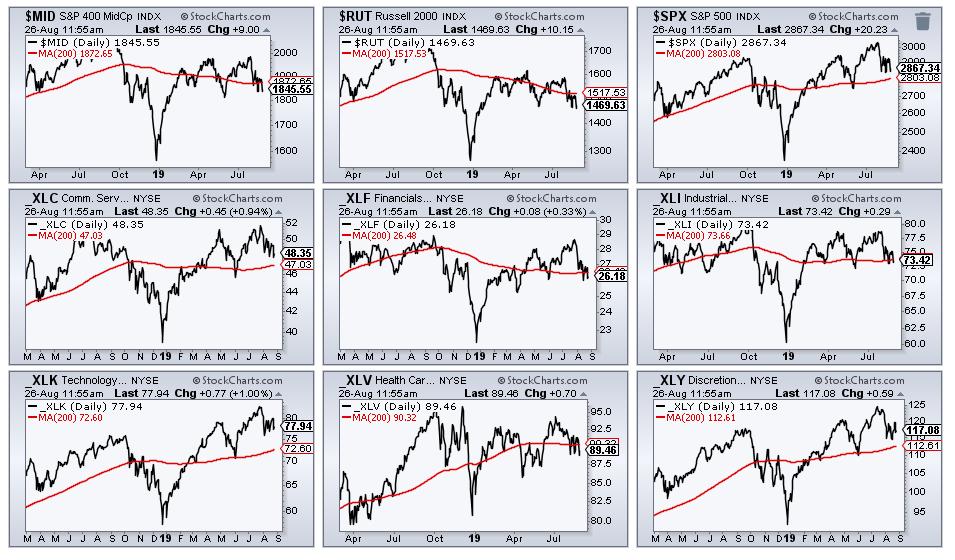

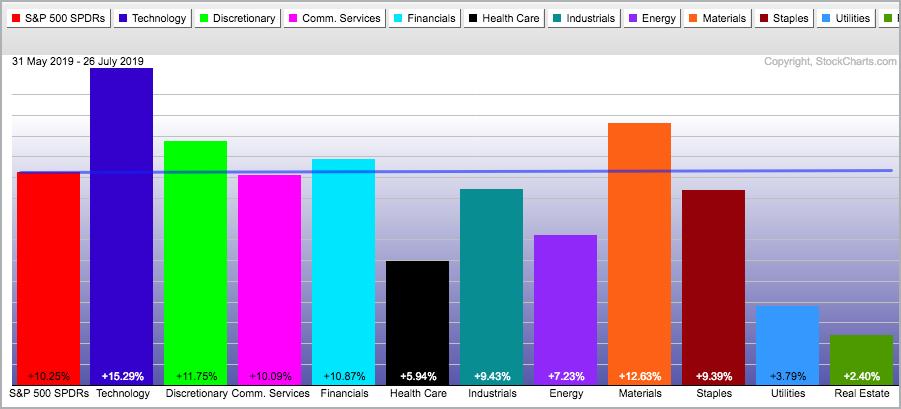

State of the Stock Market - Big Sectors Hold Strong

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The broader market may not seem bullish right now, but there is clearly a bull market somewhere within stocks. In particular, the S&P 500 and Nasdaq 100 are currently within five percent of all time highs, which were hit just five weeks ago. Moreover, they held well above...

READ MORE

MEMBERS ONLY

Ranking and Categorizing Dozens of Key ETFs into Five Chart Groups

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today I am breaking my ETF chart list into five groups and showing these groups in order of performance, strongest to weakest.

After analyzing and comparing these price charts, five clear groups emerged. First, there are ETFs with very strong uptrends that look very extended. Second, there are ETFs with...

READ MORE

MEMBERS ONLY

A Stable Stock in an Unstable Market

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The pickings are getting slim as the broader market destabilizes. The S&P 500 and Nasdaq 100 remain above their 200-day SMAs, but the S&P Mid-Cap 400 and Russell 2000 are below these key moving averages. The Consumer Discretionary SPDR (_XLY), Communication Services SPDR (_XLC) and Consumer...

READ MORE

MEMBERS ONLY

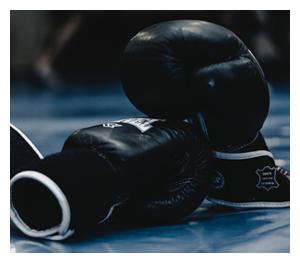

SPY and QQQ Hit the Canvas - Again

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard in early August with SPY and QQQ falling six to seven percent in six days. These declines started from new highs in late July, which is when these prizefighters were at peak performance. The sharpness of the declines is like a prizefighter getting blindsided and knocked...

READ MORE

MEMBERS ONLY

Bonds, Gold, the PPO and Extreme Conditions

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The 20+ YR T-Bond ETF (TLT) and Gold SPDR (GLD) are on a tear, but they are getting stretched by one key metric and could be ripe for a corrective period.

There are numerous ways to measure overbought (extended) conditions. Indicators like RSI (above 70) and the Stochastic Oscillator (above...

READ MORE

MEMBERS ONLY

State of the Stock Market - Meet Mr. Split

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The performance for the S&P 500, S&P Mid-Cap 400 and S&P Small-Cap 600 over the last 3, 6, 9 and 12 months pretty much says it all. The S&P 500 is positive on all four timeframes, the S&P Small-Cap 600...

READ MORE

MEMBERS ONLY

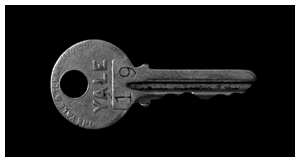

Technology Could Hold the Key Going Forward

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

As noted in a separate commentary, the State of the Stock Market is shaky. The Technology sector is holding up, but we are seeing weakness within Finance, Consumer Discretionary, Industrials and Communication Services. The Technology sector is the biggest sector in the S&P 500 SPDR (22%) and EW...

READ MORE

MEMBERS ONLY

Mirror, Mirror on the Wall, What's the Strongest Industry Group ETF of All?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

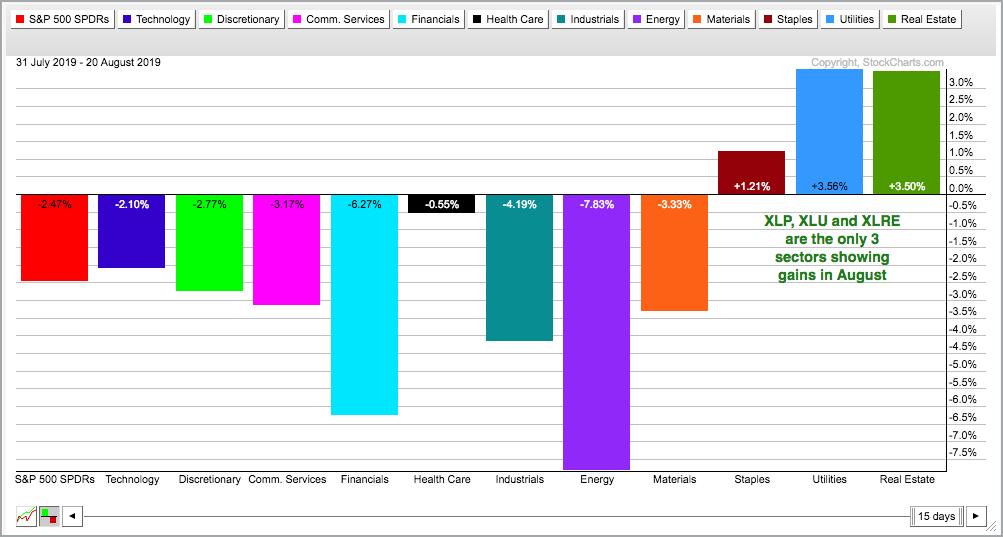

Taking a top-down approach to the stock market, we can break down the major indexes into sectors, the sectors into industry groups and the industry groups into individual stocks. There are eleven sector SPDRs and three clear leaders. The Utilities SPDR (XLU) and Real Estate SPDR (XLRE) hit new highs...

READ MORE

MEMBERS ONLY

Measuring Risk On/Off with Stocks, Treasuries, Junk Bonds, Low Volatility and High Beta

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Volatility is clearly on the uptick with the S&P 500 SPDR (SPY) moving more than 1% nine times since July 31st. This follows a period from early June to late July when the 1-day Rate-of-Change exceeded 1% just once, and the market moved steadily higher. Ah, the good...

READ MORE

MEMBERS ONLY

A Breakout for this Healthcare/Technology Hybrid

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Some stocks fit nicely into sectors and industry groups. And some don't. Cerner (CERN) is part of the Health Care SPDR (XLV), but it is really a technology stock that serves the healthcare industry. Namely, Cerner provides information technology solutions for the healthcare industry. More importantly, the price...

READ MORE

MEMBERS ONLY

A Bounce, a Second Shoe or a Broadening Formation?

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks rebounded on Friday with small-caps leading the way. The Russell 2000 surged 2.19%, while the S&P 500 advanced 1.44% and the Nasdaq 100 gained 1.59%. Despite these sizable rebounds, all three were down for the week and still down between 4.5% and 5....

READ MORE

MEMBERS ONLY

Ranking the 11 Sector SPDRs and Weighing the Breadth Evidence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

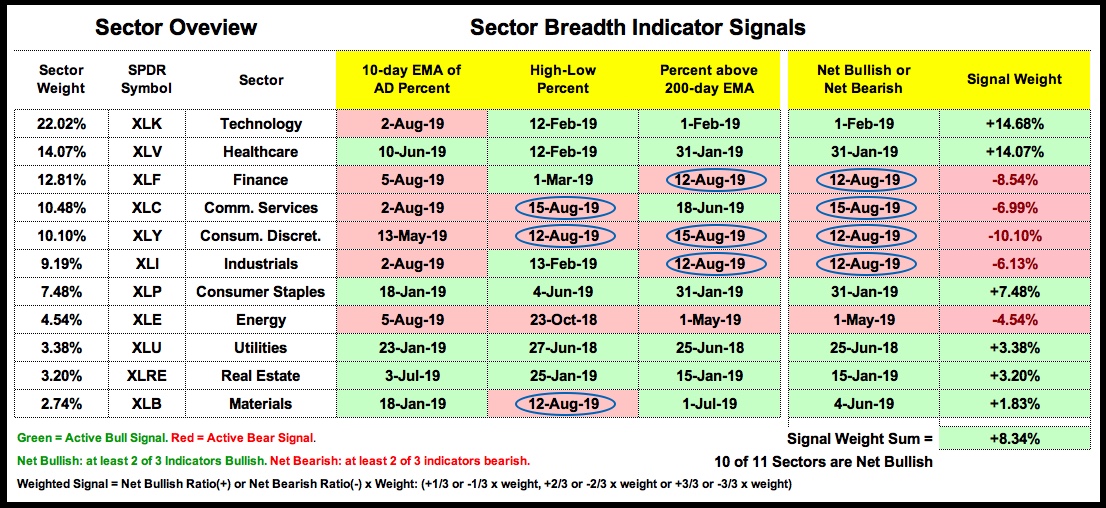

Sector Breadth Model Takes another Hit

Today I will rank and analyze the charts for the eleven sector SPDRs, but I will first cover the sector breadth table, which reflects the internal strength/weakness within each sector. Sometimes there is a discrepancy between the sector SPDR chart and the breadth...

READ MORE

MEMBERS ONLY

State of the Stock Market - Index and Sector Breadth Models Take Hits

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

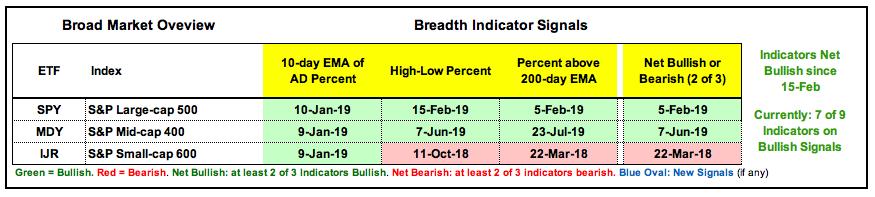

Watch for Rising Correlation

...The overall state of the stock market is the most important factor to consider when trading or investing in stocks. Broad market movements, by definition, affect most stocks. When the major stock indexes are trending lower, most stocks will also trend lower. Some will buck the...

READ MORE

MEMBERS ONLY

A Bearish Continuation Pattern Takes Shape in IWM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Russell 2000 iShares (IWM) has been underperforming for some time now and remains the weakest of the major index ETFs. The chart below shows IWM forming a lower high from May to July and a lower low from March to May. Adding a couple of trend lines to these...

READ MORE

MEMBERS ONLY

This Biotech Kept its Head while Others Lost Theirs

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

If you can keep your head when all about you are losing theirs ....Rudyard Kipling

The line above comes from the Poem, "If" by Rudyard Kipling. We can rephrase this when looking at stocks over the last few weeks.

If a stock can hold above the late July...

READ MORE

MEMBERS ONLY

Finding Sectors and Stocks that Held Up During the Onslaught

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new high in late July and then got pummeled in early August with a sharp decline that broke the 50-day EMA. Moving averages like this can serve benchmark levels that chartists can use to compare performance. Stocks and ETFs that did not break...

READ MORE

MEMBERS ONLY

The State of the Stock Market (with video) - A Pick up in Volatility

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Volatility reared its ugly head this week with the S&P 500 falling around 6% in six days and then rebounding with a sharp three-day bounce. This is the biggest decline since the May-June correction, and the sharpest decline since early December. Looking back, the S&P 500...

READ MORE

MEMBERS ONLY

Lockheed Martin Holds the Line

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit hard in August with the S&P 500 SPDR (SPY) moving below its 50-day line and mid July lows. Stocks and ETFs that did not break their 50-day lines and held above their mid July lows are showing relative "chart" strength. Lockheed Martin (LMT)...

READ MORE

MEMBERS ONLY

Charting Tariffs, Putting the Decline into Perspective and Considering a Mean-Reversion Bounce

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were pummeled on Monday with the S&P 500 falling the most (2.98%) since December 2018. The Russell 2000 and Nasdaq 100 also fell more than 3% with widespread selling pressure. I am not going to start the blame game (tariffs, the Fed, early August seasonal patterns,...

READ MORE

MEMBERS ONLY

Three Indicators to Measure Oversold Conditions in SPY

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 SPDR (SPY) is down sharply this morning and over the last six days. The ETF hit a new all time high less than two weeks ago and remains above its 200-day SMA, and its early June low. This suggests that the long-term trend remains up....

READ MORE

MEMBERS ONLY

Bearish Breadth Thrusts and Short-term Support Breaks could Signal Start of Corrective Period

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were hit with some of the strongest selling pressure since December as the S&P 500 fell 3.10% and the Nasdaq 100 fell 4.04%. These weekly declines were the largest since mid December. The Russell 2000 held up the best with a 2.87% decline, which...

READ MORE

MEMBERS ONLY

The State of the Stock Market - Short and Long Term Breadth Signals

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Today I am going to dive into breadth by looking at two indicator groups used for short-term market timing and three indicator groups for long-term market timing. Most of you are familiar with these indicators: AD Percent, Up/Down Volume%, High-Low Percent and %Above 200-day EMA. Stocks fell on Wednesday...

READ MORE

MEMBERS ONLY

The Fed, Treasury Yields, Housing and a Bullish Continuation Pattern

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

After an extended tightening cycle, the Fed is set to lower rates for the first time since December 2008 (yawn). It seems easy to equate easier Fed policy as bullish for housing, but the relationship between Treasury yields and the Home Construction iShares (ITB) is not as clear cut. First...

READ MORE

MEMBERS ONLY

All Time Highs, Sector Leadership, Wedges and Throwbacks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

This post will update some prior setups that are still working as we start the week. As noted in the State of the Stock Market on Friday, we are in a bull market right now and have been since mid February. Anyone basing their decisions on the current trend, aka...

READ MORE

MEMBERS ONLY

Fastenal Reverses off Key Level with RSI Failure Swing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Fastenal, an industrial staples company, is reversing off a key level with an RSI failure swing working. Never heard of that sector? Let me explain. The company is a wholesale distributor for industrial and construction supplies, including nuts, bolts, screws, washers and fasteners. It does not get much more basic...

READ MORE

MEMBERS ONLY

Relative Strength Based on Price Action

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Price action is not everything, it's the only thing. This is what Vince Lombardi might have said were he a trader or investor. Indicators are great for scans and sorting through hundreds of stocks, but nothing takes the place of price action. Moreover, our profits and losses are...

READ MORE

MEMBERS ONLY

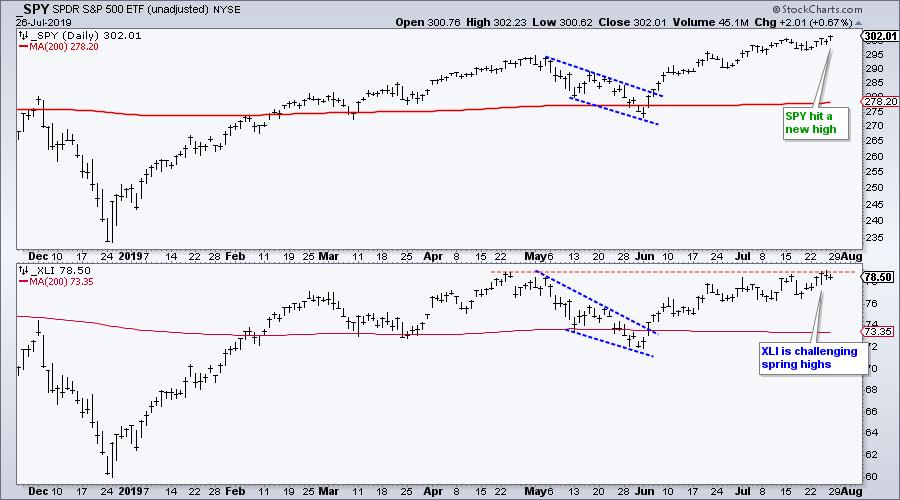

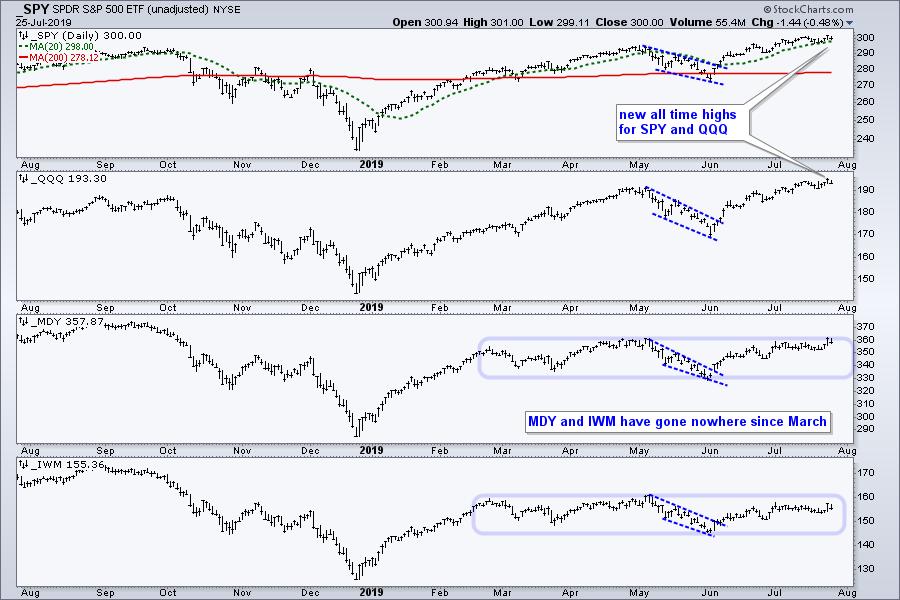

The State of the Stock Market - Large-caps Continue to Lead

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

... The S&P 500 SPDR hit another new all time high this week, while small-caps and mid-caps came alive, if just for one day. Even though small-caps and mid-caps are lagging since March, the new high in the S&P 500 affirms the bull market environment. Keep in...

READ MORE

MEMBERS ONLY

Healthcare Holds Breakout as XBI Hits a RAZ

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

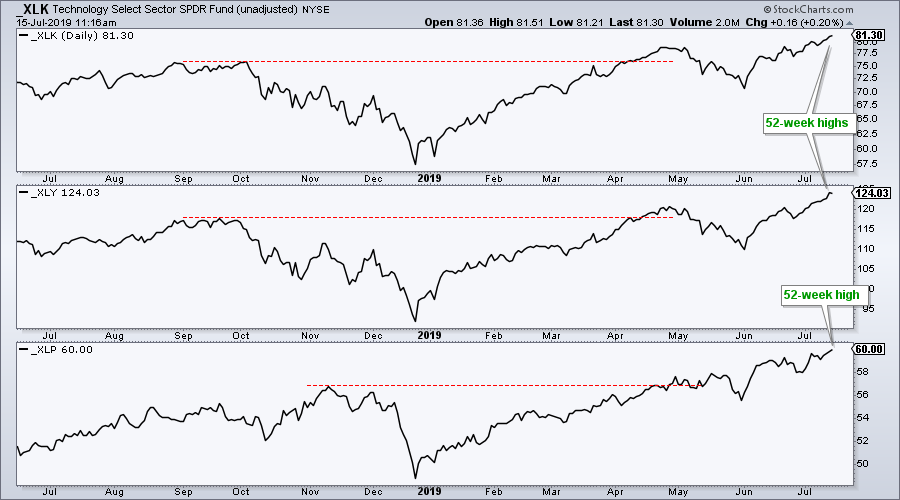

Healthcare is not exactly a leading sector right now, but the Health Care SPDR (XLV) sports a big triangle breakout on the weekly chart and this breakout is holding. Note that SPY, XLK, XLY and XLP hit new highs in July and these are the chart leaders right now. Even...

READ MORE

MEMBERS ONLY

Two Bearish Continuation Patterns for BioMarin

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Biotech ETFs, XBI and IBB, have underperformed the broader market the entire year. The chart below shows the S&P 500 SPDR (SPY) with higher highs in early May and July. The ETF also recorded fresh 52-week highs in May and July. The Biotech iShares (IBB) and Biotech...

READ MORE

MEMBERS ONLY

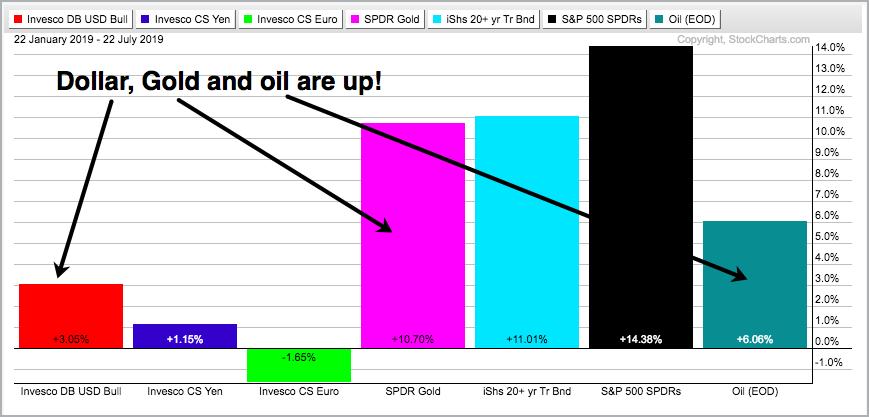

Gold, the Dollar and their Strange Correlation

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

What if you knew the Dollar would be up 3% over the last six months? What would your prognosis be for oil and gold? Most pundits would not have a bullish forecast for gold and not expect much from oil. Nevertheless, the Gold SPDR (GLD) is up 10.70% the...

READ MORE

MEMBERS ONLY

Ebay Holds the Break

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A consolidation within an uptrend is considered the pause that refreshes. Stocks often become overbought after a sharp advance in a short period of time and need to work off these overbought conditions with a correction. Corrections are of two types: price or time. The stock can decline and retrace...

READ MORE

MEMBERS ONLY

The State of the Stock Market - Bull Market Affirmed

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

* Bull Market Affirmed.

* Short-term Twilight Zone.

* Index Table Remains Bullish.

* YouTube Video.

* Small-cap Breadth Remains Weak.

* IWM: Bearish Trend line Break or Bull Wedge?

* Sector Table Remains Bullish.

* 83 Stocks in Strong and Steady Uptrends.

* Art's Charts ChartList Update.

... Bull Market Affirmed

... The S&P 500 advanced...

READ MORE

MEMBERS ONLY

Four Stocks Poised to Continue their Uptrends

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The first step to finding great stocks is establishing the bigger trend for the market, the sector, the industry group and the stock. It is not as hard as it sounds. First, the S&P 500 is clearly in a long-term uptrend because it is above the rising 200-day...

READ MORE

MEMBERS ONLY

Semis are Back in Gear and this Stock is Poised to Extend Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

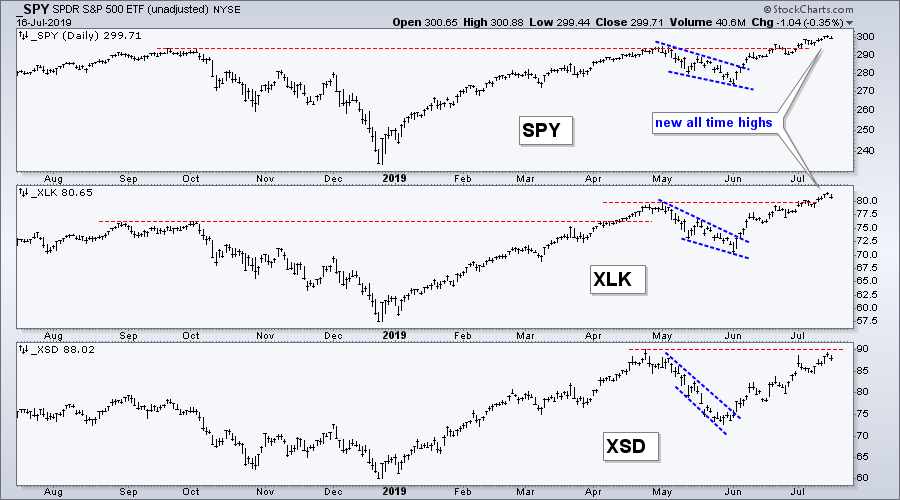

The S&P 500 SPDR and Technology SPDR (XLK) hit new highs this month. Thus, the S&P 500 is signaling a bull market and the technology sector is leading. The Semiconductor SPDR (XSD), which is a broad-based semiconductor ETF, is also showing leadership as it challenges its...

READ MORE

MEMBERS ONLY

The Consumer Staples Sector is Leading and this Stock is About to Break Out

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 hit a new 52-week high last week and three sectors joined the index with new highs of their own: the Technology SPDR, the Consumer Discretionary SPDR and the Consumer Staples SPDR. Note that I am basing the new highs on price chart using unadjusted prices,...

READ MORE