MEMBERS ONLY

Greek Situation Continues to Drive Stocks, Bonds and Dollar

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Greek tragedy continues to drive the markets, and for good reason. EU leaders failed to come up with a definitive plan and the Greek parliament is set for a no confidence vote Tuesday. Should the Papandreou government survive this vote, another round of reforms will be pushed through and...

READ MORE

MEMBERS ONLY

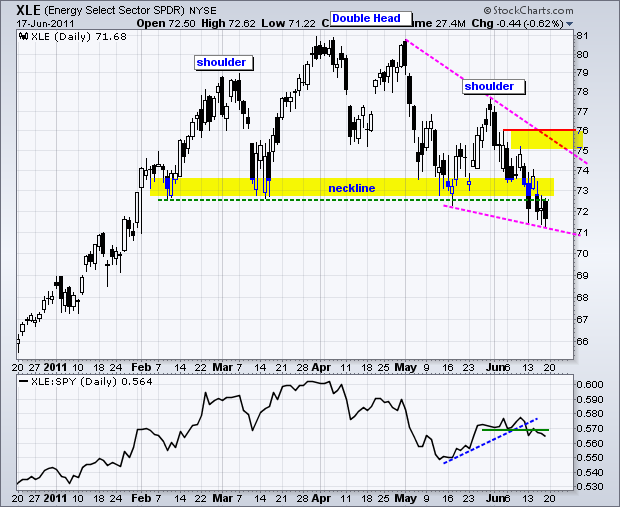

Energy SPDR Breaks Neckline Support

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Energy SPDR (XLE) has been one of the weakest sectors this month. In fact, the chart shows XLE breaking support from a large Head-and-Shoulders reversal pattern. The left shoulder peaked in March, the head peaked in April and the left shoulder peaked at the end of May. With a...

READ MORE

MEMBERS ONLY

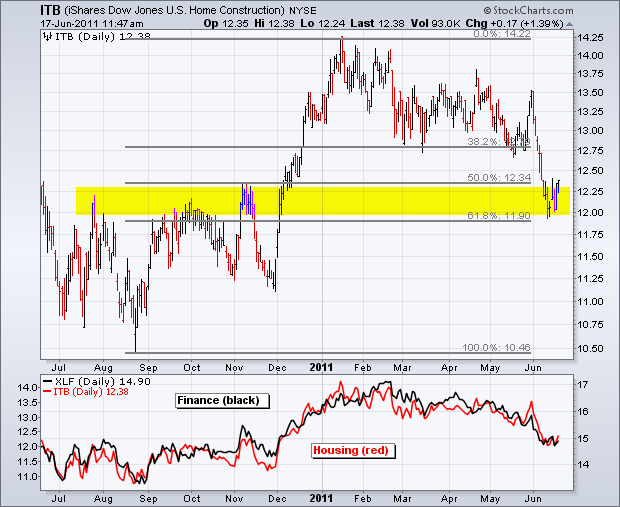

Finance and Housing Moving Step-for-Step

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Home Construction iShares (ITB) and the Finance SPDR (XLF) have been moving together the entire year. The indicator window shows XLF in black and ITB in red. Not much difference between these two price patterns. In the main window, ITB is testing support from broken resistance and the 50-62%...

READ MORE

MEMBERS ONLY

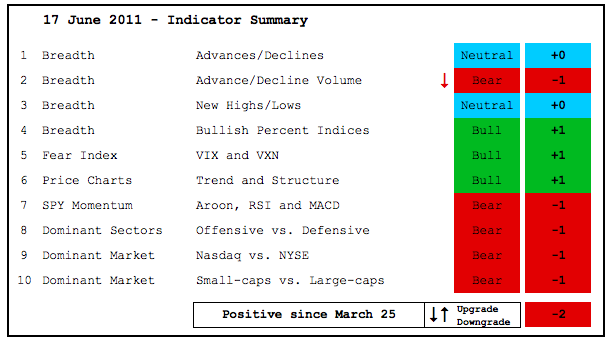

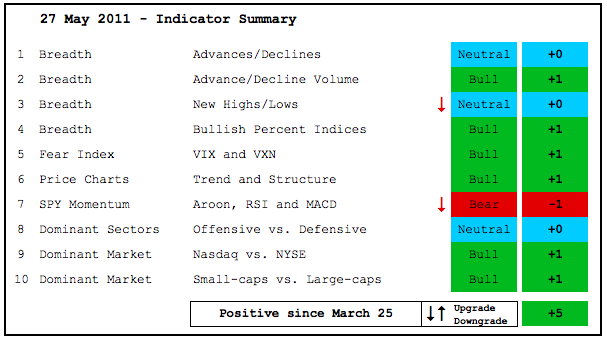

Indicator Summary Turns Negative as Breadth Weakens

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Believe it or not, there was only one downgrade to the indicator summary this week. The AD Volume Lines for the Nasdaq and NYSE broke below their March lows. Admittedly, these indicators barely broke their March lows with Wednesday's sharp decline. This could be an overshoot based on...

READ MORE

MEMBERS ONLY

SPY and IWM Form with Spinning Tops as QQQ Hits March Lows

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remain way oversold and ripe for a bounce in the coming days. On the daily charts, the S&P 500 ETF (SPY) and Russell 2000 ETF (IWM) formed spinning top candlesticks as both test support from the March lows. QQQ is also testing support here. Spinning tops signal...

READ MORE

MEMBERS ONLY

Dell Shows Relative Strength and a Bear Flag

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

While the stock market swooned over the last few weeks, Dell Inc (DELL) held its ground and did not break its late May lows. In fact, the stock has been edging higher the last three weeks. The indicator window shows the Price Relative rising to a new high for 2011....

READ MORE

MEMBERS ONLY

SPY Fails to Hold Gap and Forges 13 week Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) attempted to reverse course twice, but both surges quickly failed at 130 and the ETF moved sharply lower. Tuesday's surge was followed by a gap down on Wednesday and close below Monday's low. Blame is on Bad news (on...

READ MORE

MEMBERS ONLY

Chart of Interest: AMZN, CHK, DAL, KGC, RL, UAL, UTX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AMZN Firms after Support Break.

CHK Forms Harami with Two Inside Days.

KGC Forms Bull Flag after Surge.

Plus DAL, RL, UAL, UTX

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or...

READ MORE

MEMBERS ONLY

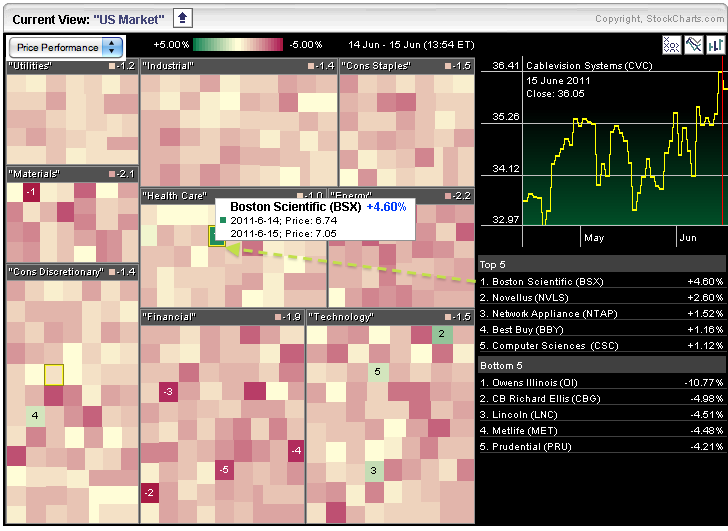

Five Stocks Bucking the Bears on the Market Carpet

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks were down rather sharply on Wednesday, but a few were bucking the trend with gains. These can be found by looking for a little green in the Sector Market Carpet. Boston Scientific (BSX), Novellus (NVLS) and Network Appliance (NTAP) are attracting buyers on a big down day.

Click this...

READ MORE

MEMBERS ONLY

Stocks Surge on Big Breadth as Bonds Break Down

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks surged with a broad advance that lifted most boats. Net Advances and Net Advancing Volume on both the Nasdaq and NYSE surged as well. These breadth surges were comparable to the breadth surges seen at the mid March and mid April lows. Also note that SPY formed a Harami...

READ MORE

MEMBERS ONLY

All Nasdaq Most Active Stocks are Moving Higher

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks finally caught a bid with the Nasdaq leading the way higher. The image below comes from the Free Charts Page. All Nasdaq most actives are up. 8 of 10 NYSE most actives are up with Citigroup and Bank of America as the only decliners. Users can click the PerfChart...

READ MORE

MEMBERS ONLY

SPY Forms Harami in Oversold Territory

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) remains oversold, but unable to sustain a bounce. Last week's bounce attempts failed as the ETF moved to new lows on Friday. SPY did manage to firm on Monday with a spinning top. Also notice that the body of the spinning...

READ MORE

MEMBERS ONLY

Charts of Interest: AAPL, DOW, GMO, LLL, STEC, WINN

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

AAPL Returns to Support Zone.

GMO Firms at Key Retracement.

STEC Finds Support Near Large Gap.

Plus DOW, LLL, WINN

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all...

READ MORE

MEMBERS ONLY

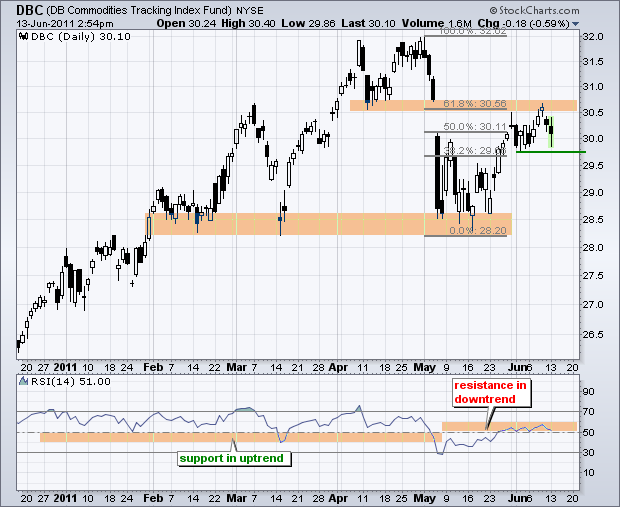

Commodity Index Fund Hits Price and Momentum Resistance

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Commodity Index Fund ($DBC) surged back above 30 in June, but is near resistance from broken support and the 62% retracement mark. Also notice that RSI is trading in its resistance zone (50-60) after becoming overbought. This is a make-or-break area for DBC.

Click this image for a live...

READ MORE

MEMBERS ONLY

Risk-Off Trade Remains in Force

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the stock market analysis as stocks became even more oversold on Friday. The S&P 500 ETF (SPY) opened weak with a gap down and closed weak. The ETF is now down around 5.5% in the last eight days, which compares to the...

READ MORE

MEMBERS ONLY

Predefined Scans Page Shows Surge in Bearish Scan Hits

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The Predefined Scans page features color coded bars so users can see when scans are active. Red bars show a decrease in hits. Green bars show an increase in hits. Today's intraday scan shows a sharp increase in the number of stocks making the cut in bearish scans....

READ MORE

MEMBERS ONLY

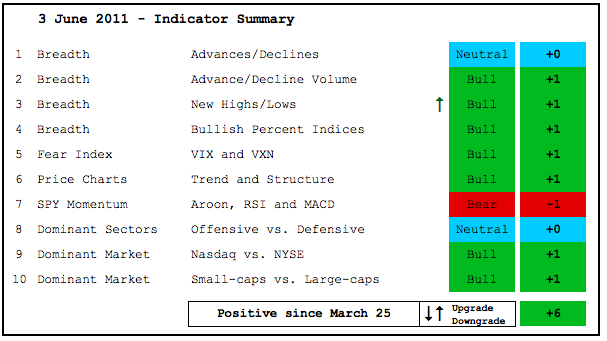

Indicator Summary Turns Flat as Decline Takes Toll

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a few more downgrades this week, the indicator summary moved to zero. The March decline was enough to turn the indicator summary negative, but this decline was a mere correction within the bigger uptrend. With the indicator summary on the verge of turning negative again, I must wonder if...

READ MORE

MEMBERS ONLY

SPY Firms as Intermarket Picture Gets Interesting

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There is no change in the analysis of the S&P 500 ETF (SPY). The ETF broke its April low and is now trying to firm around 129-130. After a 4.8% decline in six days, the ETF bounced with a feeble move above 129 on Thursday. A move...

READ MORE

MEMBERS ONLY

Less Selling Pressure, But No Buying Pressure

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks tried to firm again on Wednesday, but buying pressure remains weak or non-existent. Most of this firmness stems from less selling pressure. SPY is down around 4.8% the last six days as it moved below its April low. This makes it short-term oversold. At this point, the most...

READ MORE

MEMBERS ONLY

Charts: BRCM, CB, CHK, DELL, ISRG, MMC, MMM, NBR, TEVA

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Downside Volume Increases for CB.

MMM Firms at Key Retracement.

TEVA Forms Bull Flag.

Plus BRCM,CHK,DELL,ISRG,MMC,NBR

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We...

READ MORE

MEMBERS ONLY

Internet ETF Forms Spinning Top Near Key Retracement

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The FirstTrust Internet ETF (FDN) has been moving lower with the rest of the market, but firmed the last two days. A doji formed on Tuesday and a small spinning top on Wednesday. This firmness is also occurring near the 62% retracement mark and the ETF is short-term oversold.

Click...

READ MORE

MEMBERS ONLY

Weak Closes Continue to Weigh on Stocks

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When it rains, it pours. Stocks were hovering in positive territory on Tuesday afternoon, but got hit with selling pressure in the final hour. Blame is on the economic outlook from Bernanke. After edging above 130 just after 3PM, the S&P 500 ETF (SPY) plunged and closed below...

READ MORE

MEMBERS ONLY

QQQ Breaks Ichimoku Cloud

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With the decline over the last several weeks, the Nasdaq 100 ETF (QQQ) broke below the Ichimoku Cloud for the third time since March. The ETF recovered quickly after the first two breaks. Also notice that the cloud is poised to turn red, which happens when the red line is...

READ MORE

MEMBERS ONLY

Finance Sector Pushes SPY Below April Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The April lows are starting to break. The Russell 2000 ETF (IWM), S&P MidCap 400 SPDR (MDY) and S&P 500 ETF (SPY) broke their April lows. The Dow Industrials SPDR (DIA) and the Nasdaq 100 ETF (QQQ) remain just above their April lows. Weakness in the...

READ MORE

MEMBERS ONLY

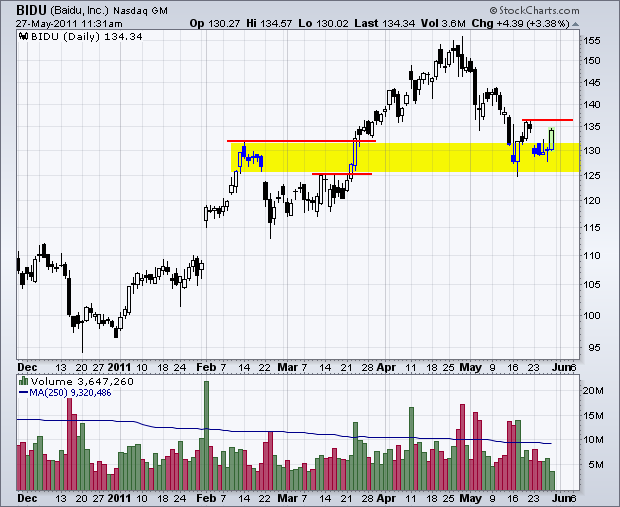

Charts: ATMI, BIDU, CHRW, PNRA, PMCS, SBUX

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

ATMI Firms at Key Retracement.

CHRW Breaks Support.

SBUX Forms Extended Triangle.

Plus BIDU, PNRA, PMCS

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to think for...

READ MORE

MEMBERS ONLY

SPY Tests Key Retracement and Important Low

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Stocks remain in corrective mode, but the bigger trends are still up. With a move below 131 on Friday, the S&P 500 ETF (SPY) has retraced around 62% of the March-May advance. Keep in mind that this advance forged a 52-week high, which affirms the larger uptrend. Support...

READ MORE

MEMBERS ONLY

RETAILERS BEAR BRUNT OF SELLING PRESSURE

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With economic indicators and employment statistics coming up short this week, retail stocks came under considerable selling pressure. Led by weakness in Wal-Mart and Home Depot, the **Retail HOLDRS (RTH)** is down some 7% the last few weeks. Chart 7 shows RTH breaking the trendline extending up from early September....

READ MORE

MEMBERS ONLY

Auto Nation Traces out Possible Head-and-Shoulders Reversal

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Auto Nation (AN) is tracing out a clear Head-and-Shoulders pattern, but remains short of a confirming support break. The most recent signal was a triangle breakout last week. AN has since moved back into triangle support. A move below 32.5 would break support and argue for a trend reversal....

READ MORE

MEMBERS ONLY

NYSE AD Line Hits New High as Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

When does a short-term decline extend far enough to have medium-term or long-term consequences? That is the big question right now. As far as I can tell, the May decline has yet to do enough technical damage to change the medium-term outlook (2-6 months). As the indicator summary shows, the...

READ MORE

MEMBERS ONLY

SPY Firms Within Short Term Downtrend

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

And now for the employment report... There is not much to do but wait for the market's reaction to the jobs number. On the daily chart, SPY is trading within a falling channel. The last reaction high formed with a hanging man and long black candlestick. This is...

READ MORE

MEMBERS ONLY

Cornerstone OnDemand Bucks the Market with a Bullish Engulfing

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Despite yesterday's sharp decline, a number of stocks bucked the selling pressure by gaining on the day or forming bullish candlestick patterns. Cornerstone OnDemand ($CSOD), which debuted on March 17th, formed a bullish engulfing and gained on Wednesday. Follow through above resistance would confirm this pattern.

Click this...

READ MORE

MEMBERS ONLY

Charts of Interest: ADSK, CVX, ILMN, INTU, NVLS, STX, XOM

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

CVX Forms Bearish Wedge.

ILMN Bucks the Selling Pressure.

NVSL Forms Shooting Star.

Plus ADSK, INTU, STX, XOM

***********************************************

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need to...

READ MORE

MEMBERS ONLY

SPY Fails to Hold Breakout and Fills Gap

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) surged above the wedge trendline with a four day advance and then gave it all back in one day. Wednesday's decline was broad-based with the most negative breadth since March. This decline signals the start of an extended decline or a...

READ MORE

MEMBERS ONLY

Bearish Engulfing Scan Fills up as Stocks Decline Sharply

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are over 200 stocks across the various exchanges on Wednesday's bearish engulfing scan. From the NYSE, FedEx (FDX) formed a bearish engulfing on the first day of the month in both May and June. Wednesday's big bearish engulfing occurred on expanding volume.

Click this image...

READ MORE

MEMBERS ONLY

SPY Breaks Wedge Trendline with a Hanging Man

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

The S&P 500 ETF (SPY) made it four in a row with a surge and trendline breakout on Tuesday. SPY opened strong, dipped intraday and surged at the close. A hanging man candlestick formed with a small body and long lower shadow. These are potentially bearish candlestick reversal...

READ MORE

MEMBERS ONLY

Google Hits Key Retracement with RSI Divergence

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

Google ($GOOG) has been trending lower since mid January, but support may be at hand in the 515 area. Broken resistance and the 62% retracement combine to mark support here. Also notice that RSI has a bullish divergence working the last few weeks.

Click this image for a live chart...

READ MORE

MEMBERS ONLY

Charts: BBT, EXPD, GOOG, JBLU, LINTA, NWSA, UAL

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

GOOG Hits Retracement Support.

JBLU Forms Higher Low.

NWSA Challenges Resistance with Ascending Triangle.

Plus BBT, EXPD, LINTA, UAL.

***********************************************

This commentary and charts-of-interest are designed to stimulate thinking. This analysis is not a recommendation to buy, sell, hold or sell short any security (stock ETF or otherwise). We all need...

READ MORE

MEMBERS ONLY

SPY Challenges Wedge Trendline

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

With a three day bounce last week, the S&P 500 ETF (SPY) is poised to challenge the upper trendline of the falling flag/wedge. The ETF opened strong on Friday and then stalled the rest of the day to form a doji type candlestick denoting indecision. A little...

READ MORE

MEMBERS ONLY

Baidu Firms at Broken Resistance Zone

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

A basic tenet of technical analysis is that broken resistance turns into support. Biadu broke two resistance levels and these combine to form a support zone. With the stock firming the last two week, watch for a bounce above the mid May high to reverse the May slide.

Click this...

READ MORE

MEMBERS ONLY

Spots of Weakness, but Bulk of Evidence Remains Bullish

by Arthur Hill,

Chief Technical Strategist, TrendInvestorPro.com

There are areas of weakness in the stock market, but the bulk of the evidence remains bullish. The Nasdaq AD Line broke below its April low, but the NYSE AD Line remains in a clear uptrend. SPY momentum was downgraded to bearish as MACD(5,35,5) moved into negative...

READ MORE