MEMBERS ONLY

Do Semiconductors Still Compute?

by Bruce Fraser,

Industry-leading "Wyckoffian"

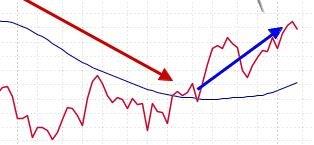

Semiconductor stocks have been top performers throughout most of 2016 and 2017. Often a strong Semiconductor group performance encourages speculation across the entire stock market and that has certainly been the case in 2017. Preceding the current 21-month uptrend in the Semiconductor ETF (SMH), a Reaccumulation formed and built a...

READ MORE

MEMBERS ONLY

Natural Gas Follows Crude?

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the prior post, we evaluated Crude Oil which appeared to have completed a Reaccumulation. Natural Gas has a family resemblance to Crude Oil, but seems to be in a slightly different position. Early in 2016 $NATGAS and $WTIC began important rallies that lasted through the year and then entered...

READ MORE

MEMBERS ONLY

Crude Oil Runs with the Bulls

by Bruce Fraser,

Industry-leading "Wyckoffian"

Crude Oil lends itself to Wyckoff Analysis and has the capacity to trend for long periods of time. Take some time now and review a case study on the long swings for this important commodity (click here for the study). Note how well the Point and Figure charts have been...

READ MORE

MEMBERS ONLY

Tesla Recharging?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Tesla is proving to be an excellent ongoing case study. We suspect that the Composite Operator (CO) is very active in the electric automobile manufacturer. Please take a few minutes and review two prior posts; ‘The Point and Figure Distribution Paradox’ (click here) and ‘Shorts Find Tesla Shocking’ (click here)...

READ MORE

MEMBERS ONLY

NASDAQ Composite. Trick or Treat?

by Bruce Fraser,

Industry-leading "Wyckoffian"

Recently we studied the NASDAQ Composite ($COMPQ) as it appeared to be on the verge of jumping into an uptrend after building a Cause. Now the $COMPQ is within one box of the minimum PnF count of our prior study ‘$COMPQ Up Close’ (click here). We evaluated two trading counts...

READ MORE

MEMBERS ONLY

GE's Wild Ride

by Bruce Fraser,

Industry-leading "Wyckoffian"

General Electric (GE) is a venerable old company in the Dow Jones Industrial Average. It was formed (Thomas Edison was the most famous of its founders) in 1892 and in 1896 it was among the first 12 stocks in the newly formed Dow Jones Industrial Average. Now GE is the...

READ MORE

MEMBERS ONLY

Dear Point and Figure Diary

by Bruce Fraser,

Industry-leading "Wyckoffian"

Dear Point and Figure Diary,

As you know, I made an entry into your pages on July 15th of this year (click for a link). At the time, it appeared that two Reaccumulation Point and Figure Counts (PnF) were stacking up. This suggested another rally phase ahead in the Dow...

READ MORE

MEMBERS ONLY

Chemistry Experiment

by Bruce Fraser,

Industry-leading "Wyckoffian"

Two strong sectors in September were Materials (XLB) and Industrials (XLI). During the second half of a business cycle expansion these themes typically do well, and that is the case here. The economy has begun to expand at a faster rate. These industries develop pricing power which allows them to...

READ MORE

MEMBERS ONLY

Group Dynamics

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s have a peak at some interesting sectors. At times, sectors can tip us off to the motives of the market. Sectors and Industry Groups have a general tendency to be either early, coincident or late business cycle beneficiaries. This business expansion has certainly been a long one and...

READ MORE

MEMBERS ONLY

$COMPQ Up Close

by Bruce Fraser,

Industry-leading "Wyckoffian"

The NASDAQ Composite ($COMPQ) has consolidated since early June. Two very prominent Buying Climax peaks arrived, one in June and the next in late July. They are labeled on the vertical chart and the Point and Figure chart. This has slowed the advance of the $COMPQ to a crawl. Meanwhile...

READ MORE

MEMBERS ONLY

Dr. Henry O. (Hank) Pruden 1936-2017

by Bruce Fraser,

Industry-leading "Wyckoffian"

Technical analysis education suffered a great loss with the recent passing of Dr. Henry O. (Hank) Pruden. A consummate educator, in 1976, Hank combined his incredible capacity for inspiring students with his personal passion for Technical Market Analysis. The result was the very first graduate course, at an accredited university,...

READ MORE

MEMBERS ONLY

Working up WDAY

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method is well suited to the concept of campaigning stocks. When a campaign works, a stock may be held for months to years while participating in a major uptrend. Mr. Wyckoff’s goal was to hold the campaign stock until the chart (tape) indicated selling by the large...

READ MORE

MEMBERS ONLY

Transports Hit the Wall

by Bruce Fraser,

Industry-leading "Wyckoffian"

The ‘Dow Theory’ involves the study and comparison of the Dow Jones Industrial Average and the Dow Jones Transportation Average. When both averages are in ‘lockstep’ in a major uptrend, the market is said to be in a Bull Market. When both are in a downtrend, a bear market is...

READ MORE

MEMBERS ONLY

Range Bound NDX

by Bruce Fraser,

Industry-leading "Wyckoffian"

Mr. Wyckoff called his charting methodology ‘Tape Reading’. Determining the present position and probable future direction of prices from their own action. Prices have tendencies which can be detected on the charts. Context is the idea that recent price action will provide clues about what to expect next. This is...

READ MORE

MEMBERS ONLY

Wyckoff the International Language

by Bruce Fraser,

Industry-leading "Wyckoffian"

Golden Gate University’s technical analysis courses are in demand from students around the globe. The Wyckoff classes that Dr. Pruden and I teach welcomes students from many countries. These students, applying the Wyckoff Methodology, present stock case studies to the class. Often the international students highlight stocks listed on...

READ MORE

MEMBERS ONLY

A Dollar for Your Thoughts

by Bruce Fraser,

Industry-leading "Wyckoffian"

The dollar has been sinking since the end of 2016. Recently there has been much attention and commentary from the financial community on the impact of this weakness. A falling dollar typically helps U.S. exporters by lowering the price of their goods in world markets. A lower dollar imports...

READ MORE

MEMBERS ONLY

Campaigning Gold

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method is designed for the campaign oriented trader. Discipline, patience and vision are the skills required to conduct a bull or bear campaign from start to finish. Wyckoff provides outstanding tools for executing on such a trading orientation. Point and Figure offers a technique for estimating the extent...

READ MORE

MEMBERS ONLY

The Hustling Russell

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoffians need to stay flexible and be willing to change their minds. It is an acquired skill to re-analyze charts with fresh eyes. We should practice this each day. Recently we studied the mid-capitalization and the small-capitalization indexes (click here for a link to the post). Here let’s re-analyze...

READ MORE

MEMBERS ONLY

Point & Figure Diary

by Bruce Fraser,

Industry-leading "Wyckoffian"

Regular readers have been following the epic saga dating back to 2011, when Dr. Hank Pruden published his Point and Figure (PnF) count for the new bull market. This count projected to a range of 17,600 to 19,200 for the Dow Jones Industrial Average ($INDU). When this objective...

READ MORE

MEMBERS ONLY

FANGtastic Trendlines

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method for constructing Trendlines is unique. They inform our analysis and support sharper tactics. Trendlines and Trend Channels bring a chart to life. We have used significant amounts of ink drawing and discussing trendlines in this column (below are links to prior columns on Trendline construction and analysis)...

READ MORE

MEMBERS ONLY

WFM Is Swallowed Whole

by Bruce Fraser,

Industry-leading "Wyckoffian"

Whole Foods Market agreed to be acquired by Amazon.com, Inc. on June 16, 2017. This ‘disruptive’ move by Amazon.com roiled the retail stocks, which were already sagging badly. The price drops extended throughout the retail brick-n-mortar stocks. Investors in these retail stocks feared that AMZN would strategically leverage...

READ MORE

MEMBERS ONLY

More Pie. Bigger Sky!

by Bruce Fraser,

Industry-leading "Wyckoffian"

In 2011 Dr. Hank Pruden published a remarkable Point and Figure chart study, which called for a new bull market in stocks. The horizontal PnF counting method, as applied by Dr. Pruden, revealed a price objective of 17,600 / 19,200. That count produced a whopping 11,100 Dow Jones...

READ MORE

MEMBERS ONLY

Shorts Find TSLA Shocking

by Bruce Fraser,

Industry-leading "Wyckoffian"

Tesla has just achieved a market capitalization that is larger than either Ford or General Motors. Currently Tesla manufactures just two different models (with a third on the way). How is it possible that Tesla has a valuation that exceeds these two Detroit behemoths? As a Wyckoffian I will tell...

READ MORE

MEMBERS ONLY

Another Stupid Chart Trick

by Bruce Fraser,

Industry-leading "Wyckoffian"

Time for another ‘Stupid Chart Trick’ (click here for a prior chart trick). I have counted about one zillion (this might be a slight exaggeration, but barely) Point and Figure chart formations. As a consequence of this personal passion, I have devised some counting conventions that have proven to be...

READ MORE

MEMBERS ONLY

Segmenting PnF Counts

by Bruce Fraser,

Industry-leading "Wyckoffian"

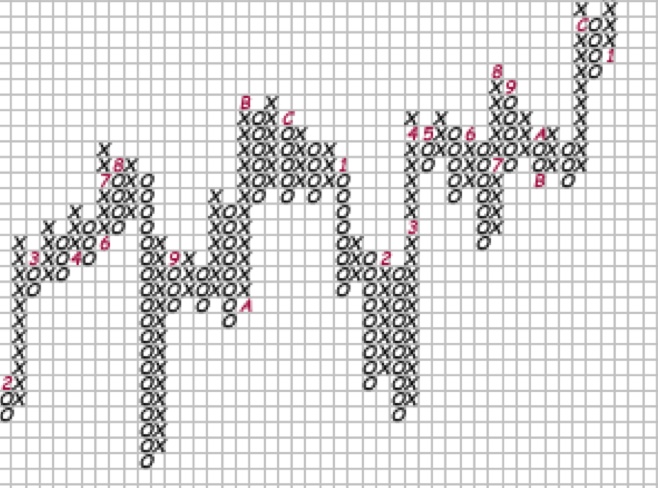

Wyckoffians often break up a large Point and Figure count into smaller count objectives. A large count objective usually requires a significant period of time to be fulfilled and pauses will occur along the way. Sometimes these pauses result in a period of Reaccumulation prior to moving on to higher...

READ MORE

MEMBERS ONLY

The New Nifty Fifty

by Bruce Fraser,

Industry-leading "Wyckoffian"

The ‘Nifty-Fifty’ era for stocks started in the 1960s and went into the early 1970s. These fifty or so stocks were consistent out-performers. Their earnings, sales and stock price growth stood apart from most other stocks. These stocks grew in value, year after year. They became known as ‘One Decision’...

READ MORE

MEMBERS ONLY

Pedaling Wyckoff

by Bruce Fraser,

Industry-leading "Wyckoffian"

Horizontal Point and Figure analysis is one of the great mysteries of technical analysis. Very few do this analysis, and even fewer do it correctly. An incorrect procedure leads to bad counts. But when it is done properly PnF is magical. We have spent much time here establishing proper counting...

READ MORE

MEMBERS ONLY

Junk is in the Eye of the Beholder

by Bruce Fraser,

Industry-leading "Wyckoffian"

High yield bonds came into their own in the 1980’s and have become ever more important to the functioning of the economy. They are often referred to as ‘Junk Bonds’ because they are bonds of lower quality. Investors are attracted to them for the higher yields offered over treasury...

READ MORE

MEMBERS ONLY

Around the World in 21 Ways

by Bruce Fraser,

Industry-leading "Wyckoffian"

The EAFE Stock Market Index includes the large and mid-cap stocks of 21 developed countries throughout the world. The U.S. and Canada are excluded from this index. The stocks in the EAFE represent more than $1.9 trillion of market capitalization.

Currently there is a worldwide movement toward nationalism....

READ MORE

MEMBERS ONLY

The Big AAPL

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoffians are always on the search for Causes being built. A trend will end and a Cause will start. A Cause will end and a trend will start. The Wyckoff Method is centered around the interpretation of these conditions and the appropriate tactics. The Composite Operator (C.O.) is our...

READ MORE

MEMBERS ONLY

Zim's Group

by Bruce Fraser,

Industry-leading "Wyckoffian"

In 1987 Hank Pruden decided to take a break from teaching the Technical Analysis Courses at Golden Gate University. He offered me the job of teaching these courses during his absence. I was honored by his invitation and accepted. His sabbatical went on for three years and I believe it...

READ MORE

MEMBERS ONLY

Financial Sector Update

by Bruce Fraser,

Industry-leading "Wyckoffian"

We looked at the Technology Sector (XLK) in the last post (click here for a link). Another very important market sector is the Financials. Here is a high-altitude view of the Financial Sector from a Wyckoffian perspective.

(click on chart for active version)

The Financial Select Sector ETF has a...

READ MORE

MEMBERS ONLY

Animal Spirits

by Bruce Fraser,

Industry-leading "Wyckoffian"

Leadership in the Technology Sector is generally a very good sign for the entire stock market. It bodes well for the market when technology stocks, as a group, are leadership as a rally starts. Speculative animal spirits are heightened by the emerging leadership of the Technology Sector. Conversely when technology...

READ MORE

MEMBERS ONLY

Crude Oil's Slippery Slope

by Bruce Fraser,

Industry-leading "Wyckoffian"

Crude oil is on a slippery slope downward. Was this completely unexpected or were there clues of the impending decline? The stock market is a discounting mechanism. Stocks traditionally light the way by starting to move prior to the underlying economic events. That, of course, is the argument for Technical...

READ MORE

MEMBERS ONLY

NASDAQ 100 Index. A Current Case Study.

by Bruce Fraser,

Industry-leading "Wyckoffian"

Point and Figure charts are generated from price volatility, unlike a vertical (bar) chart, which is plotted as a function of time. This is particularly valuable to Wyckoffians who are always on the search for a Cause being built. Causes lead to Effects; Accumulation results in Markup and Distribution turns...

READ MORE

MEMBERS ONLY

Get to the Point and Figure

by Bruce Fraser,

Industry-leading "Wyckoffian"

Sector activity can illuminate important thematic trends unfolding within the market. Point and Figure studies identify large Accumulation and Distribution Structures related to these themes poised to be campaigned over many months and years. The Sector can be campaigned using Exchange Traded Funds (ETFs). Also, by drilling down into the...

READ MORE

MEMBERS ONLY

Three Legged Stool

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s do an integration case study. We have spent much time on two robust processes; Point and Figure analysis and Vertical Bar Chart analysis. Recently Relative Strength studies have been added to the mix. A stool has three legs, any fewer would make it unstable. Our Wyckoff stool has...

READ MORE

MEMBERS ONLY

Bonds. Shaken, Not Stirred.

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is time to circle back and update our studies of the US Treasury Bond market. On October 7, 2016, we did a Wyckoffian analysis of Treasury Bonds as they appeared to be at a critical juncture. Take a few minutes now and go back to that post (click here...

READ MORE

MEMBERS ONLY

Avoidance Strategy

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoffian mission is to trade and invest in the best stocks in the leading Industry Groups. We have been studying examples of leadership characteristics using Wyckoff Analysis in combination with Relative Strength. Recall that our workflow is to drill down from Sector to Industry Group to Stock. Always seeking...

READ MORE

MEMBERS ONLY

Sectors. Groups. Stocks.

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s continue our discussion about using Relative Strength Analysis to find leading stocks. A blend of Wyckoff analysis and Relative Strength analysis offers an efficient method for zoning in on the best leading stock candidates. In the prior post, Industry Group analysis was explored. Here we will jump into...

READ MORE