MEMBERS ONLY

How to Determine the Best Trade Entry Points

by Bruce Fraser,

Industry-leading "Wyckoffian"

Wyckoff is a complete Methodology which means that rules and processes guide when to enter a trade, how long to hold a position and when to exit the trade. We have explored the principles of stopping action, cause building and jumping into a trend. In Accumulation (as in Distribution) there...

READ MORE

MEMBERS ONLY

Distribution Power Waves

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the prior post we introduced the study of comparative waves of buying and selling. By judging the relative power of adjacent waves of buying and selling one can discern emerging strength, or weakness in the stock’s structure. The change in the power of rally waves and selling waves...

READ MORE

MEMBERS ONLY

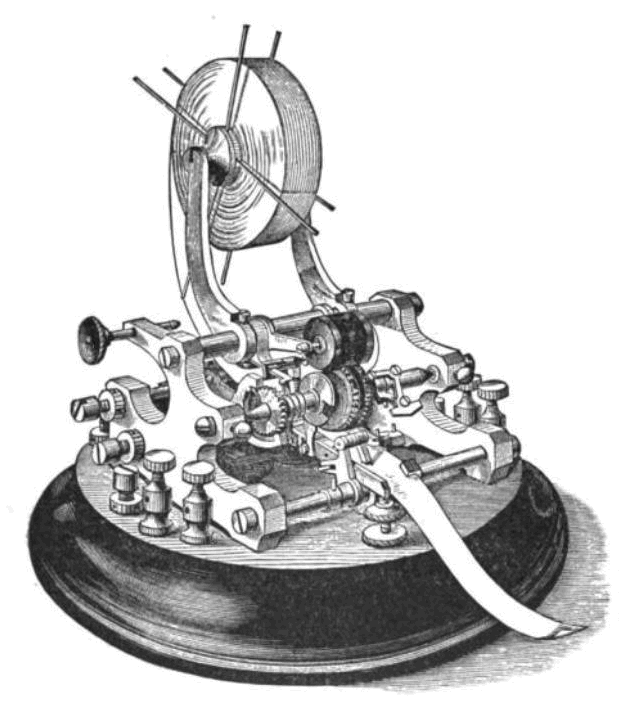

Judging Power Waves

by Bruce Fraser,

Industry-leading "Wyckoffian"

Determining the motives of the Composite Operator is the central mission of all Wyckoffians. There are numerous tools for this task. The present position and future trend of the market and the stocks within, are determined through the analysis of price and volume (‘the study of the tape’, Mr. Wyckoff...

READ MORE

MEMBERS ONLY

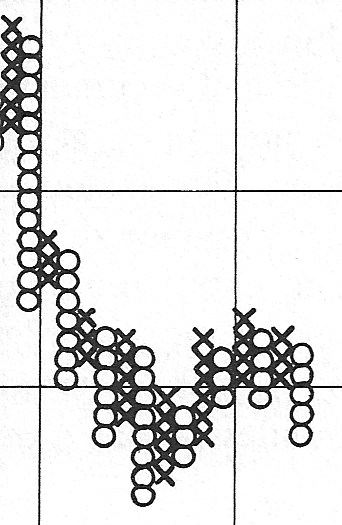

Point and Figure Analysis with Intraday Charts

by Bruce Fraser,

Industry-leading "Wyckoffian"

We have worked with Point and Figure charts in multiple time frames using 1 box and 3 box methods. This is akin to constructing daily and weekly bar charts. For many traders intraday analysis and trading is preferred. The good news is that PnF analysis is a powerful technique for...

READ MORE

MEMBERS ONLY

Crude Oil Update

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the blog post of December 17th titled ‘Crude Oil; How Low Can it Go?’ (click here for a link), we studied the bear market in crude oil of 2008-09, the bull market of 2009, and then the current bear market. The long term point and figure analysis for each...

READ MORE

MEMBERS ONLY

Wyckoff Time

by Bruce Fraser,

Industry-leading "Wyckoffian"

In trading and speculation we are all on the clock, the market clock. At times the market clock spins quickly and at other times it crawls. When a trend is unleashed time seems to move effortlessly. Time slows down when the market makes no progress while in a long drawn...

READ MORE

MEMBERS ONLY

The Point and Figure Distribution Paradox

by Bruce Fraser,

Industry-leading "Wyckoffian"

Counting Point and Figure Distributions is a bit of a paradox. Accumulation counts can grow very large and lead to advances that are multiples of their starting point. However, a stock under Distribution is bound by the zero line. Counting conventions for Distribution are therefore different from Accumulation.

Judicious counting...

READ MORE

MEMBERS ONLY

Point and Figure Pauses that Refresh

by Bruce Fraser,

Industry-leading "Wyckoffian"

Uptrends occasionally need a rest. We call these price congestion areas Reaccumulation trading ranges. Wyckoffians seek these areas out as an opportunity to get onboard the uptrend. Point and Figure analysis for Reaccumulations follow the conventions outlined in prior posts, with some minor variations. There is great value in becoming...

READ MORE

MEMBERS ONLY

Counting Monster Point & Figure Charts

by Bruce Fraser,

Industry-leading "Wyckoffian"

How does a Wyckoffian take a very large horizontal PnF count? A large count that forms over many years? Let’s do a case study on an outsized formation and see if it yields useful PnF count objectives. A big thanks to one of my teaching partners at Golden Gate...

READ MORE

MEMBERS ONLY

Point and Figure Magic

by Bruce Fraser,

Industry-leading "Wyckoffian"

It is a little like magic when Point and Figure counts work out. Long term counts, short term counts, big counts and little counts; PnF is a robust and useful tool. Many Wyckoffians in training do not trust the counts. It seems to me this is because it is so...

READ MORE

MEMBERS ONLY

Secrets of Point and Figure Distribution

by Bruce Fraser,

Industry-leading "Wyckoffian"

The procedure for the horizontal PnF counting of Distribution follows the same logic as counting Accumulation. A cause is built during Accumulation and Distribution that results in a trend. Point and Figure chart construction allows us to estimate the extent of a trend. This adds a powerful tactical tool to...

READ MORE

MEMBERS ONLY

Unlocking the Mysteries of Point and Figure Charts

by Bruce Fraser,

Industry-leading "Wyckoffian"

Point and Figure charts are familiar, but different. They have a relationship to classical bar charts while being unique. Their construction and interpretation requires skills that differ from traditional charting. And because of the mysteries of their construction, they yield information that other chart styles cannot. Namely, in our case,...

READ MORE

MEMBERS ONLY

Intro to Point and Figure Construction

by Bruce Fraser,

Industry-leading "Wyckoffian"

As we enter 2016, it seems like a good opportunity to introduce Point and Figure chart construction. In future posts we will spend more and more time on the techniques of PnF counting using the Wyckoff Method. We will create a foundation for the process of creating PnF charts that...

READ MORE

MEMBERS ONLY

Crude Oil; How Low Can it Go?

by Bruce Fraser,

Industry-leading "Wyckoffian"

On Monday of this week, the top four stories in the upper left hand column on DrudgeReport.com were about the weakness in oil prices. This may have been a bell ringer of an indicator. Some consider Drudge to have his finger on the pulse of the news, and in...

READ MORE

MEMBERS ONLY

The Illustrated Wyckoff

by Bruce Fraser,

Industry-leading "Wyckoffian"

In a continuation of our discussion of the overarching principles of the Wyckoff Method, let’s do a visual case study. There are three principle Laws that compose the Wyckoff Method*:

The Law of Supply and Demand

The Law of Cause and Effect

The Law of Effort and Result

We...

READ MORE

MEMBERS ONLY

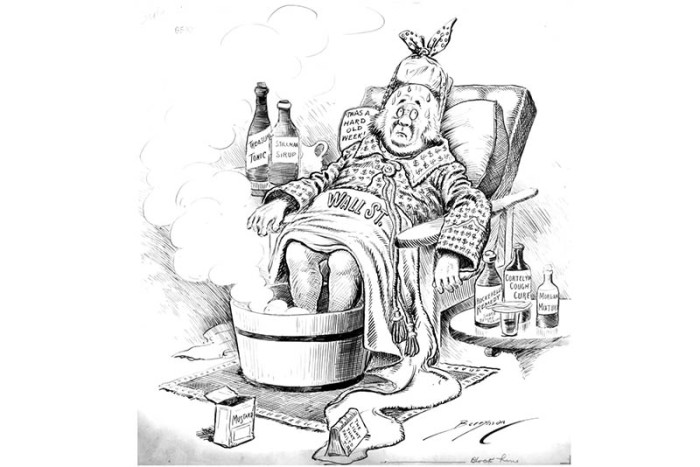

The Laws of Wyckoff

by Bruce Fraser,

Industry-leading "Wyckoffian"

Three Principles or Laws govern the structure of the Wyckoff Methodology. Procedurally there are a series of Tests that determine buying and selling decisions. There are nine of these Tests, or thresholds, to be passed for making a buying decision, or a selling decision. The Nine Buying Tests and the...

READ MORE

MEMBERS ONLY

Wyckoff Walk Around the Clock

by Bruce Fraser,

Industry-leading "Wyckoffian"

We have just completed a walk around the classic market cycle. Let us take some time for review before we move on to other aspects of the Wyckoff Method. If we are all on the same page regarding the structure of prices during each stage of Accumulation, Markup, Distribution and...

READ MORE

MEMBERS ONLY

Redistribution - A Case Study

by Bruce Fraser,

Industry-leading "Wyckoffian"

The case study method is a preferred teaching tool in the Wyckoff classroom. Past real life market situations can be explored on an accelerated basis. Students are able to gain market experience (in the safety of the classroom) from a myriad of different and illustrative trading environments. Here is a...

READ MORE

MEMBERS ONLY

Redistribution, the Evil Twin

by Bruce Fraser,

Industry-leading "Wyckoffian"

Redistributions are messy. They come in many shapes and sizes and defy categorization. Therefore my job is particularly difficult here. Our mission is to find actionable characteristics in Redistributions that Wyckoffians can benefit from. Here is the problem in a nutshell. Recall that under Reaccumulation (pause in an uptrend) a...

READ MORE

MEMBERS ONLY

Redistribution Ruckus

by Bruce Fraser,

Industry-leading "Wyckoffian"

Bear markets are wild and wooly affairs; quick and painful, slow and tortuous, and every other kind of difficulty imaginable. Bear markets get less attention from market students than the other phases of price action. Amnesia sets in for investors after a bear market. Who among us can remember the...

READ MORE

MEMBERS ONLY

Trendapalooza

by Bruce Fraser,

Industry-leading "Wyckoffian"

When trendlines are drawn, with the Wyckoff Method, it is like putting on 3D glasses. With proper trend analysis two dimensional charts spring to life and reveal their innermost secrets and true intentions. Demand lines, Supply Lines, Overbought Lines, Oversold Lines, Support Lines and Resistance Lines; they all tell a...

READ MORE

MEMBERS ONLY

The Unfriendly Trend

by Bruce Fraser,

Industry-leading "Wyckoffian"

Once Distribution is complete, the Markdown Phase begins. Declining prices after the completion of Distribution can cause a ruckus. Sponsorship (of a stock, bond, commodity, ETF, etc.) by large and informed interests is necessary to drive prices higher and higher. Eventually large sponsors abandon ship, which they do through the...

READ MORE

MEMBERS ONLY

The Way of Wyckoff

by Bruce Fraser,

Industry-leading "Wyckoffian"

I am on the road this week so this will be a brief post. As you know, I continually emphasize the motives and roles of the Composite Operator. We call the C.O. a heuristic, or a useful fiction. There are many large interests at work in the markets simultaneously....

READ MORE

MEMBERS ONLY

Distribution Definitions

by Bruce Fraser,

Industry-leading "Wyckoffian"

In recent weeks we have covered much ground on the concept of Distribution. We now know that Distribution is a process, and that it takes time. Our mission, as Wyckoffians, is to become a keen observer of these Phases and Events within Phases, which are markers along the evolution of...

READ MORE

MEMBERS ONLY

Just Another Phase

by Bruce Fraser,

Industry-leading "Wyckoffian"

Let’s continue our discussion of Phases from the prior blog post by getting right into chart analysis. Please review ‘Context is King’ (click here for link) for more on Phases.

A classic BCLX is followed by an AR which sets up the Distribution trading range for AKAM. Note how...

READ MORE

MEMBERS ONLY

Context is King

by Bruce Fraser,

Industry-leading "Wyckoffian"

Accumulation and Distribution Schematics are like road maps (click here for the Distribution schematics discussed in this article). They point toward where to go and how to get there. They are like road maps without the mileage to the next turn. Just to rev things up, each time a Wyckoffian...

READ MORE

MEMBERS ONLY

Just Charts

by Bruce Fraser,

Industry-leading "Wyckoffian"

A chart is worth a thousand words. So let’s study some charts. We continue our discussion of Distribution and review some additional examples. Our goal is chart reading mastery. The ability to see changing price conditions, in real time, is an important long term goal. This takes time, practice...

READ MORE

MEMBERS ONLY

Follow the Bouncing Ball

by Bruce Fraser,

Industry-leading "Wyckoffian"

In 1965 Wham-O came out with the Super Ball. About the size of a plum, this hard rubber ball was simply amazing. When dropped on a solid surface it was advertised to bounce back 92%. When slammed down it could be made to bounce over a two story building. For...

READ MORE

MEMBERS ONLY

Take the Fork in the Road

by Bruce Fraser,

Industry-leading "Wyckoffian"

Modern American sage, Yogi Berra, advises that when we come to a fork in the road we should take it. When stopping action stalls the price of a stock (commodity, ETF, etc.) a fork in the road is dead ahead. As Wyckoffians we are confronted with either the conditions of...

READ MORE

MEMBERS ONLY

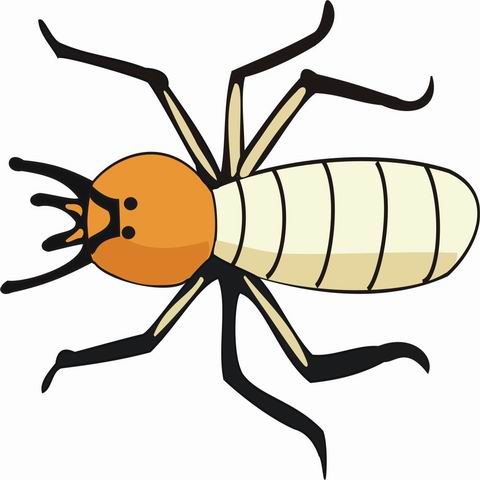

When Termites Get into Your Trends

by Bruce Fraser,

Industry-leading "Wyckoffian"

A trend is like a house on a foundation of wood. When the house is new the foundation is strong. Over time termites burrow in and infest the foundation. The house looks structurally sound even though the termites have compromised its underpinnings. Unexpectedly, one day the foundation gives way and...

READ MORE

MEMBERS ONLY

Reaccumulation Roundup

by Bruce Fraser,

Industry-leading "Wyckoffian"

During this and the next several posts we will focus our attention on Reaccumulation formations. These are among the most useful and powerful setups that a Wyckoffian can master. Let’s concentrate on charts in this post and become familiar with Reaccumulations in some of their many varied formations. Wyckoffians...

READ MORE

MEMBERS ONLY

Rev Up with Reaccumulation Trading Ranges

by Bruce Fraser,

Industry-leading "Wyckoffian"

In the course of every long uptrend there are extended pauses. The longer the trend, the more pauses there will be. In terms of duration they can last as little as a few months or as long as a year or more. They are designed to torture long term holders...

READ MORE

MEMBERS ONLY

Being a Chart Whisperer

by Bruce Fraser,

Industry-leading "Wyckoffian"

Trend analysis using trendlines (Wyckoff Method) is one of the most valuable skills of a Wyckoffian. The main idea is that a stock will advance at a set Stride, or rate of advance. Often (not always) the Stride can be detected early in the advance and this can help with...

READ MORE

MEMBERS ONLY

Making the Trend Your Friend

by Bruce Fraser,

Industry-leading "Wyckoffian"

The Wyckoff Method is primarily a trend following system. The orientation and goal is to discover and campaign the best leadership stocks for the biggest and best price moves. The jumping of the stock price out of the Accumulation and into an uptrend is an important event. Mr. Wyckoff developed...

READ MORE

MEMBERS ONLY

Wyckoff Power Charting. Let's Review

by Bruce Fraser,

Industry-leading "Wyckoffian"

Previous posts have been devoted to the process of Accumulation. What distinguishes Power Charting with the Wyckoff Method from other chart pattern recognition tools is our focus on tracking the footprints of the Composite Operator. A long term trend requires intelligent Accumulation of very large quantities of shares prior to...

READ MORE

MEMBERS ONLY

Jumping the Creek

by Bruce Fraser,

Industry-leading "Wyckoffian"

Prices behave differently when a trend begins. Each price bar tells a story during the sideways action of an Accumulation Range and each bar tells a different story when the trend starts. A big, long trend is born inside the inconspicuousness of an Accumulation area. The keen eyed Wyckoffian is...

READ MORE

MEMBERS ONLY

Francis Bacon Reveals the Nature of Trends

by Bruce Fraser,

Industry-leading "Wyckoffian"

Francis Bacon said; “As in nature things move violently to their place and calmly in their place…”. It seems that Mr. Bacon understood the stock market very well. Stocks tend to move calmly, gently, listlessly in their trading ranges and then they move violently into trends. A tipping point between...

READ MORE

MEMBERS ONLY

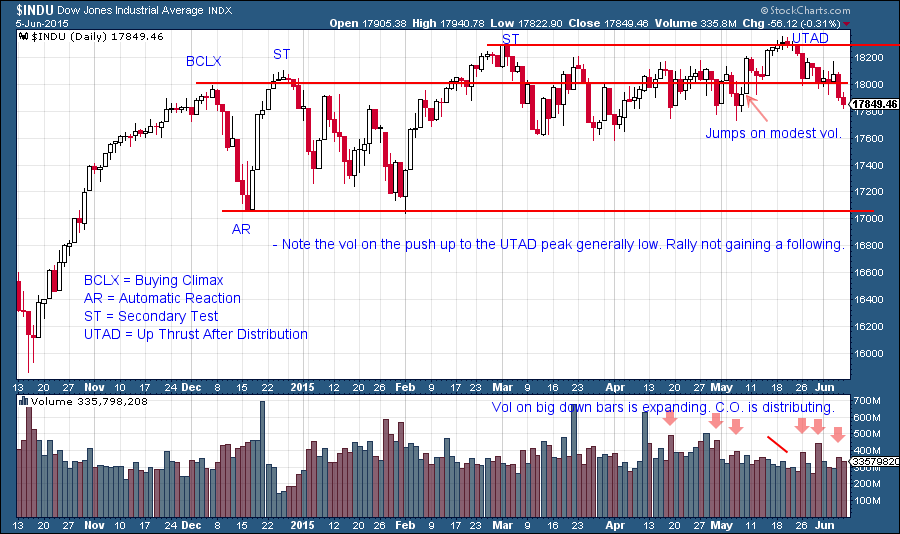

Fun With Current Charts, Wyckoff Style

by Bruce Fraser,

Industry-leading "Wyckoffian"

Accumulation, Markup, Distribution and Markdown are the four basic stages of the Wyckoff Cycle. Prior posts have been focused on the primary phases of Accumulation. There is still more to do, but let’s take a break and explore the current market circumstances, which are very interesting. Consider this an...

READ MORE

MEMBERS ONLY

Accumulation Phase; Absorbing Stock Like a Sponge

by Bruce Fraser,

Industry-leading "Wyckoffian"

What are the conditions that need to be in place prior to a long and sustained rally in a stock? That is an important question to ask because it is not a random accident when a stock rises bigger, better and faster compared to most other stocks. When large, informed...

READ MORE

MEMBERS ONLY

The Stopping Action of a Downtrend

by Bruce Fraser,

Industry-leading "Wyckoffian"

A downtrend occurs when the supply (of shares) is greater than the demand. The float of a stock is the total number of shares owned by investors and traders in the marketplace. With the exception of corporate buybacks and secondary offerings, the float of a stock is relatively constant and...

READ MORE