MEMBERS ONLY

Were There Technical Warnings Ahead of the Regional Banking Crash? Oh, Yeah!

by Carl Swenlin,

President and Founder, DecisionPoint.com

With the recent crash of the SPDR S&P Regional Banking ETF (KRE), you may wonder if there were adequate technical warnings ahead of the crash. Yes, there were. (To clarify, we're looking for reasons not to be long KRE.)

1. To begin, last April, the KRE...

READ MORE

MEMBERS ONLY

DP Trading Room: ETFs vs. Indexes

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the trading room discussing why DecisionPoint.com uses ETFs for signal changes versus actual Index readings. He also explains how the Price Momentum Oscillator (PMO) has different meanings when it is above or below the zero line....

READ MORE

MEMBERS ONLY

DP Trading Room: Carl's Detailed Look at Gold

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl is peppered with questions on Gold, Financials/Regional Banks, Bonds and Yields. He looks at Gold in all three timeframes and discusses why it will likely move even higher. Carl's take on the Banking crisis and...

READ MORE

MEMBERS ONLY

Will the Banking Sector Collapse Bring Down the Market?

by Carl Swenlin,

President and Founder, DecisionPoint.com

While the Banking Sector (KRE) collapsed this week due to the Silvergate and Silicon Valley Bank failures, we can see where participation has been deteriorating for more than a month. The bottom three panels on the chart below shows how the Percent of Stocks Above the 20/50/200EMAs began...

READ MORE

MEMBERS ONLY

DP Trading Room: Reading the Silver Cross Index

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the show with a detailed discussion of how we measure participation using %Stocks > 20/50/200-day EMAs and the Silver Cross Index/Golden Cross Index. We can see where the strength lies and whether it is...

READ MORE

MEMBERS ONLY

DP Trading Room: Not Too Late for Natural Gas

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the trading room by discussing how the Silver Cross Index works and its superior representation of market participation. He also reviews the market and "S&P 10". Both he and Erin discuss Natural Gas...

READ MORE

MEMBERS ONLY

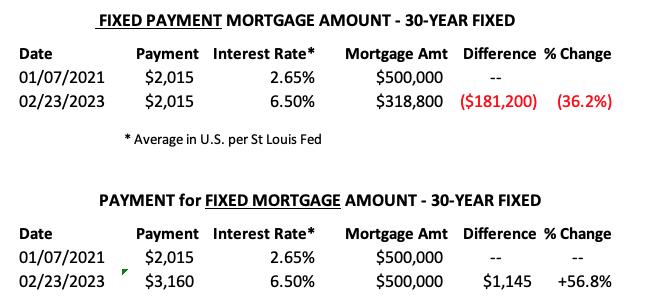

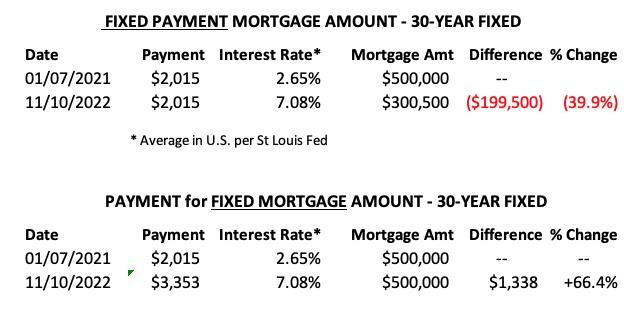

Mortgage Rates Continue Higher But Still Historically Low

by Carl Swenlin,

President and Founder, DecisionPoint.com

We watch the 30-Year Fixed Mortgage Interest Rate, because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure....

READ MORE

MEMBERS ONLY

It's Hard to Fight This Current

by Carl Swenlin,

President and Founder, DecisionPoint.com

The market is currently topping because the Silver Cross Index (SCI), which expresses intermediate-term participation, is overbought and topping. A Silver Cross is when the 20-EMA of a price index crosses up through the 50-EMA. The Silver Cross Index shows the percentage of stocks in a market or sector index...

READ MORE

MEMBERS ONLY

DP Trading Room: New Calculation for CPI Could Change Market Direction

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens with a discussion of a change that is occurring in the calculation of the CPI from here on out and how it could affect the market's direction tomorrow. Carl gives his opinion on the market...

READ MORE

MEMBERS ONLY

DP Trading Room: Trusting the Technicals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl looks at the Big 10 capitalized stocks and determines whether a bull market right now will have legs. Do we use common sense or technicals regarding a new bull market? Carl and Erin discuss. Both of them deep...

READ MORE

MEMBERS ONLY

DP Trading Room: New Golden & Silver Cross Indexes

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens with an introduction to new data sets for Regional Banks (KRE), Semiconductors (SMH), Biotechs (IBB), and Retail (XRT). The new Golden Cross and Silver Cross Indexes and additional breadth data tell a different story than relative strength...

READ MORE

MEMBERS ONLY

Can You Name These Charts? Different Types of Investments, Same Psychology.

by Carl Swenlin,

President and Founder, DecisionPoint.com

Last month in our DecisionPoint Trading Room, I gave our viewers a pop quiz. I presented two similar charts without names or price scales and challenged them to identify them by the shape of the price indexes alone. The point I was trying to make was that, while they were...

READ MORE

MEMBERS ONLY

DP Trading Room: What's Up with These Yields?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl explores how yields are calculated with a few examples of yields that don't seem 'right'. He demonstrates how to add dividends and splits to your charts. Erin focuses in on two sectors that are...

READ MORE

MEMBERS ONLY

Major Stock Indexes Are Faltering

by Carl Swenlin,

President and Founder, DecisionPoint.com

At the end of November the Dow Jones Industrial Average ETF (DIA) advanced just above +20% from its October low and officially entered a new bull market; however, technically, an intermediate-term rising trend had not been established. There is a bottom above the September bottom (green arrows), but there is...

READ MORE

MEMBERS ONLY

DP Trading Room: Top Sectors & Industry Groups

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens the show with a reprise of his Tesla (TSLA) vs. Bitcoin discussion and the uncanny similarities as far as gains, losses, and price pattern, in spite of not really being related at all. Erin teases out the...

READ MORE

MEMBERS ONLY

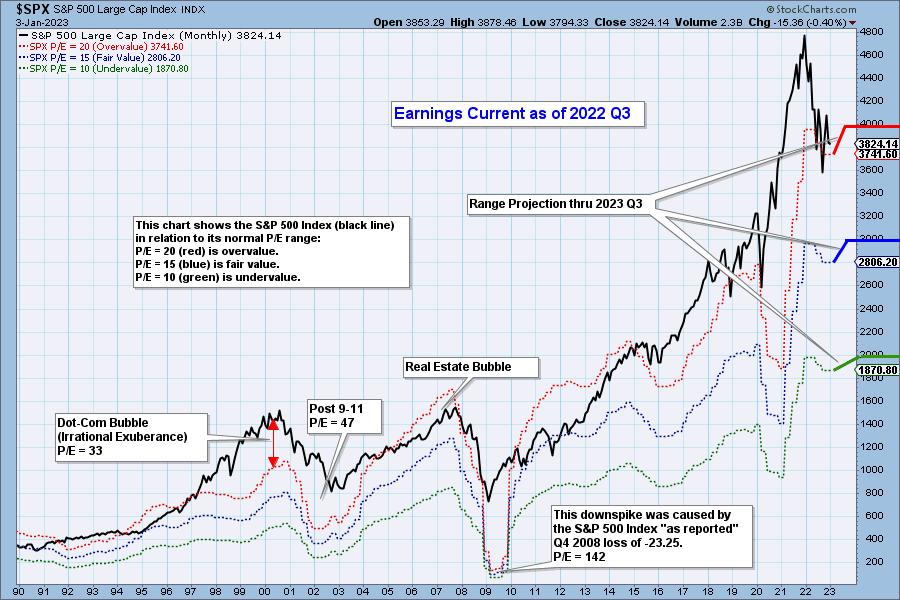

2022 Q3 Earnings: Market Still Overvalued

by Carl Swenlin,

President and Founder, DecisionPoint.com

Preliminary earnings numbers are in for 2022 Q3. To clarify, earnings results are collected for the three months after the end of the quarter. Meanwhile, "earnings season," the collection period for 2022 Q4, has just begun.

The chart below shows the normal value range of the S&...

READ MORE

MEMBERS ONLY

Put/Call Ratio is Telling Bears to Watch Out!

by Carl Swenlin,

President and Founder, DecisionPoint.com

If you're tuned in to the financial media, you may have heard that the put/call ratio is at an extreme. I don't usually pay a lot of attention to this indicator, as it's hard to interpret, but when I looked at it this...

READ MORE

MEMBERS ONLY

DP Trading Room: Silver Cross Index Warning Signals

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl reignites his discussion on watershed events, showing us how the Hunt Brothers' attempt to corner the market in Silver also raised Gold prices to historic levels. Of course, we know how this ended... not well for investors...

READ MORE

MEMBERS ONLY

DP Trading Room: Watershed Events in Gold & Crypto

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl answers the question: "How do we find overbought/oversold levels on the PMO?". Both he and Erin discuss rounded tops found throughout the market. Additionally, they talk the importance of knowing the trend and condition of...

READ MORE

MEMBERS ONLY

DP Trading Room: Overbought/Oversold Momentum

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl answers the question: "How do we find overbought/oversold levels on the PMO?". Both he and Erin discuss rounded tops found throughout the market. Additionally, they talk the importance of knowing the trend and condition of...

READ MORE

MEMBERS ONLY

New Bull Market for the Dow Industrials?

by Carl Swenlin,

President and Founder, DecisionPoint.com

As of today, the Dow Jones Industrial Average has advanced to just over +20% from its October low, which by some standards means it has entered a new bull market. Does that mean that the worst is over and that the rest of the market will follow suit? Maybe.

A...

READ MORE

MEMBERS ONLY

DP Trading Room: How Falling Wedges Work

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl begins the Trading Room with a discussion on what falling wedge chart patterns are and why they have the expectation of an upside conclusion. Erin and Carl both review how exponential moving averages (EMAs) work and why they...

READ MORE

MEMBERS ONLY

Industrials Sector Gets Golden Cross BUY Signal

by Carl Swenlin,

President and Founder, DecisionPoint.com

Today the Industrial Select Sector SPDR (XLI) 50-day exponential moving average (EMA) crossed up through the 200-day EMA (Golden Cross), generating an LT Trend Model BUY signal. While this is an encouraging event, we note that most indicators on the chart below are overbought -- specifically, the PMO, Silver Cross...

READ MORE

MEMBERS ONLY

DP Trading Room: Crypto Debacle

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl starts the show with a look at Bitcoin alongside the market overview. Erin finds two sectors with promise, as well as a review of the groups within. They finish with discussions on some viewer symbol requests!

This video...

READ MORE

MEMBERS ONLY

Mortgage Rates Drop Sharply - Time to Review XLRE

by Carl Swenlin,

President and Founder, DecisionPoint.com

by Erin Swenlin,

Vice President, DecisionPoint.com

We watch the 30-Year Fixed Mortgage Interest Rate because, for the most part, people buy homes based upon the maximum monthly payment they can afford. As rates rise, a fixed monthly payment will carry a smaller mortgage amount. As buying power has been shrinking, home prices have come under pressure....

READ MORE

MEMBERS ONLY

DP Trading Room: Tesla or Bitcoin?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens today's trading room with a chart that begs the question, "Bitcoin or Tesla?" He and Erin then follow with a detailed market overview and determine which Dow stocks are the best right now....

READ MORE

MEMBERS ONLY

The Usual Leaders Are Lagging

by Carl Swenlin,

President and Founder, DecisionPoint.com

As of today, five of the eight major indexes we track have IT Trend Model BUY signals. This is determined by the 20EMA being above the 50EMA (Silver Cross). This is a good start toward broad market recovery, but unfortunately, all eight indexes have LT Trend Model SELL signals, which...

READ MORE

MEMBERS ONLY

DP Trading Room: Market Still Holding Up

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl gives us his perspective on why this bear market bottom is different than prior bear market rallies. What is keeping him bullish? He and Erin look talk about the VIX and the current fear factor (or lack thereof)...

READ MORE

MEMBERS ONLY

DP Trading Room: Silver Cross Index Crossovers

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl and Erin discuss their study of the Silver Cross Index (SCI) positive and negative crossovers and how they are helping determine not only bias, but possible entries/exits in the market as a whole. Carl covers the bullish...

READ MORE

MEMBERS ONLY

DP Trading Room: Walk Through the Dow

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, after looking closely at the market and new positive divergences on DecisionPoint indicators, Carl opens a CandleGlance of the Dow 30 and discusses which stocks look the most encouraging. Erin dives into four sectors and their industry groups to...

READ MORE

MEMBERS ONLY

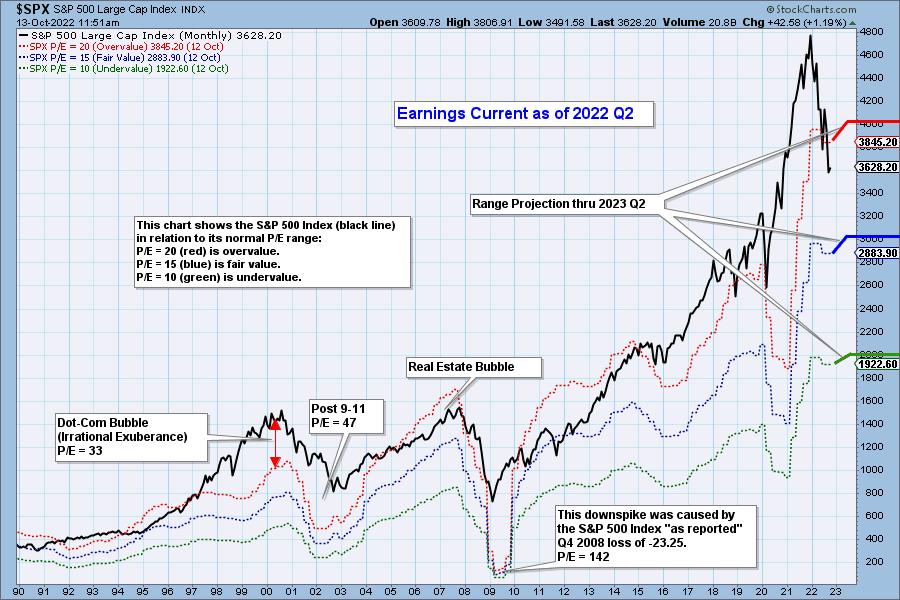

2022 Q2 Final: Earnings Have Peaked

by Carl Swenlin,

President and Founder, DecisionPoint.com

The following chart shows us the normal value range of the S&P 500 Index, indicating where the S&P 500 would have to be in order to have an overvalued P/E of 20 (red line), a fairly valued P/E of 15 (blue line), or an...

READ MORE

MEMBERS ONLY

DP Trading Room: What is a Market Climax?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl goes into detail on how DecisionPoint Climax Analysis works. Climax identification can give you clues into market behavior for the next few days, but it is more than that. Meanwhile, Erin covers sectors and dives into industry groups...

READ MORE

MEMBERS ONLY

DP Trading Room: Bear Market Rally Ahead

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl discusses the implications of short-term vs. intermediate-term indicators' reactions to last week's rally and what they will likely look like after today's rally. Good stuff on the charts right now! Erin dives into...

READ MORE

MEMBERS ONLY

DP Trading Room: Carl Explains the VIX!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl reacts to a viewer question about why he thinks the market will likely retrace 55% or more from the bull market high. He focuses on earnings, which he goes through in detail. We also got a bonus discussion...

READ MORE

MEMBERS ONLY

How Interest Rates are Squeezing Home Buyers

by Carl Swenlin,

President and Founder, DecisionPoint.com

I knew well ahead of the 2006-2007 real estate crash that problems were coming, but I didn't really understand the cause. I thought that the price of houses was going to deter buyers, but buyers didn't care about the price of a home, they only cared...

READ MORE

MEMBERS ONLY

DP Trading Room: Home Affordability Down 50%!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl takes an in-depth look at the damaging mortgage rates and their effect on home buyers. He gives his unique perspective on overall market conditions and discusses the "Golden Cross" Index and "Silver Cross" Index...

READ MORE

MEMBERS ONLY

DP Trading Room: S&P "Ten" Leading the Market?

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl covers what the market was up to and reviews Friday's indicators. He looks at the top ten capitalized stocks in the S&P to see which, if any, were leading the market higher. Apple (AAPL)...

READ MORE

MEMBERS ONLY

Decline Stalled by Short-Term Technicals

by Carl Swenlin,

President and Founder, DecisionPoint.com

For the last three trading days the SPY decline has stalled, and price has settled on the 390 level, at which we can see an horizontal line of support and a rising trend line converging to support price. The VIX is somewhat oversold, but nothing to write home about.

The...

READ MORE

MEMBERS ONLY

DP Trading Room: Dividend Investing

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens things with a discussion regarding the benefits of dividend investing, particularly if/when we finally begin to see an end to the current bear market conditions. He gives us his perspective on today's market action...

READ MORE

MEMBERS ONLY

DP Trading Room: DP Indicators Called It!

by Erin Swenlin,

Vice President, DecisionPoint.com

by Carl Swenlin,

President and Founder, DecisionPoint.com

On this week's edition of The DecisionPoint Trading Room, Carl opens this week's show by covering the major markets and asset classes. He reviews the mega-cap stocks that are leading the market lower. DP indicators came through on warning that there was trouble ahead; Carl explains...

READ MORE