MEMBERS ONLY

OBJECTIONABLE PRICE OBJECTIVES

Hello Fellow ChartWatchers!

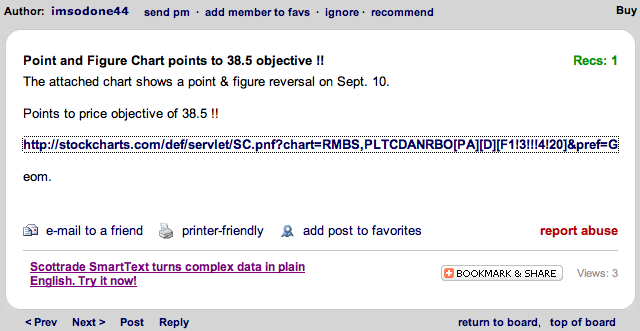

Every week we hear about a couple of message board posts that have appeared on some website somewhere which essentially says "StockCharts.com is saying that this stock will rise (fall) dramatically!" Here's a screenshot from a recent example:

We said that? What?...

READ MORE

MEMBERS ONLY

DON'T GIVE UP, BULLS!

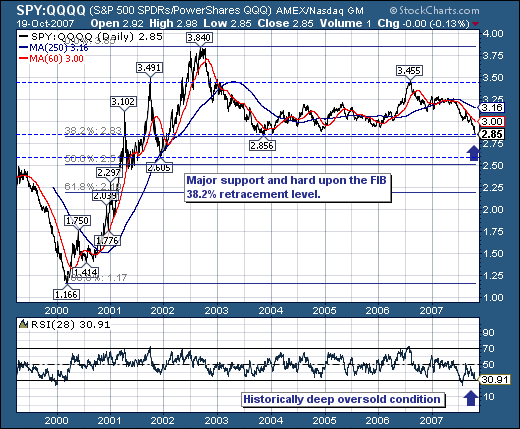

There has been clear technical damage on the major indices as a result of concerted selling. The NASDAQ 100, which has led the market higher for most of 2007, has been treated rather rudely over these past few weeks and that's never good. The reason? During periods of...

READ MORE

MEMBERS ONLY

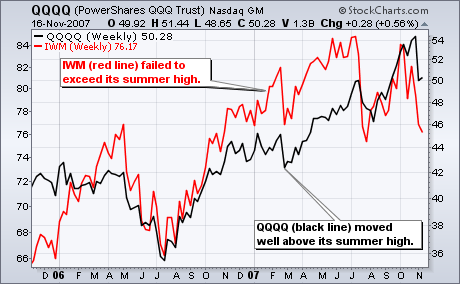

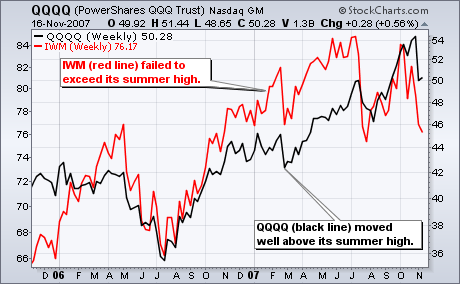

IWM FORMS BIG DOUBLE TOP

The Russell 2000 ETF (IWM) shows the beginnings of long-term downtrend. In stark contrast to QQQQ, IWM forged a lower low in August and a lower high in October. The inability to move above the summer highs showed relative weakness on the way up. The ETF is already testing support...

READ MORE

MEMBERS ONLY

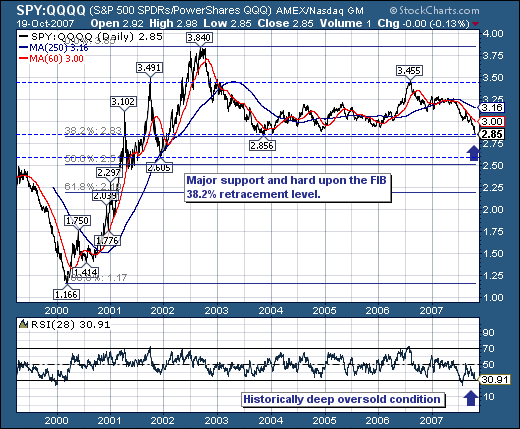

MARKET ENTERING OVERSOLD RANGE

Two weeks ago I stated that market strength was mixed, and that I thought that the correction had several more weeks to go before it was over. Since then further breakdowns of support have occurred, most notably on the Nasdaq 100 Index chart, which experienced a major break of its...

READ MORE

MEMBERS ONLY

BEWARE THE ETF "TRAP"

Hello Fellow ChartWatchers!

Last month I had the pleasure of sitting in on several local Technical Analaysis User Groups and seeing how they used many different tools to do group stock analysis. It was a very educational experience for me and I strongly recommend that everyone reading this newsletter join...

READ MORE

MEMBERS ONLY

NET NEW HIGHS ARE DRAGGING

Even though the Nasdaq and the NY Composite hit new closing highs earlier this week, Net New Highs did not keep pace and this could become a problem. Net New Highs equals new 52-week highs less new 52-week lows. I apply a 10-day moving average to smooth the data series...

READ MORE

MEMBERS ONLY

MIXED MARKET

Two weeks ago I stated that a correction had begun, and that the initial selling had resulted in an initiation climax - a technical condition that indicated that the initial down pressure was probably near exhaustion, but that signaled the beginning of a new down trend. My expectation was that...

READ MORE

MEMBERS ONLY

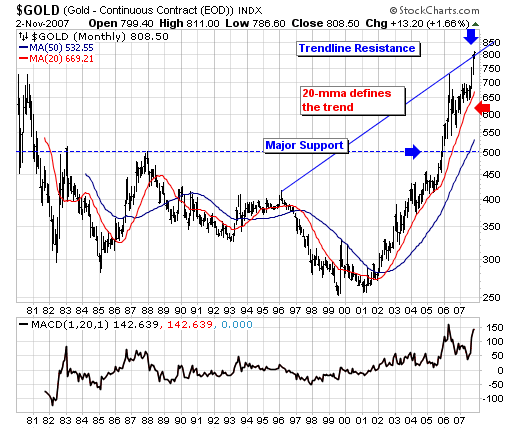

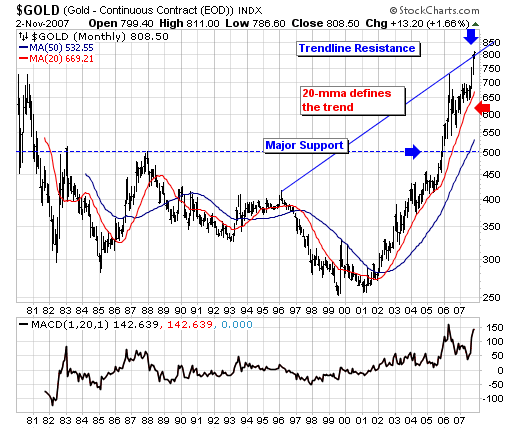

GOLD MARKET SOARING HIGH

The bull market in commodity has extended beyond what many had believed it would in such a short period of time; be it crude oil prices or gold prices or even wheat prices - the bull market has surprised in its violence. The question before all traders and investors alike...

READ MORE

MEMBERS ONLY

BEAR MARKET IN BANKS

Earlier today I showed the Bank Index on the verge of hitting a new low for the year. By day's end, it had fallen to the lowest level in two years (Chart 1). This puts the BKX on track to challenge its 2005 low. In case you'...

READ MORE

MEMBERS ONLY

JUST CHECKING IN

Hello Fellow ChartWatchers!

I'm pretty busy this weekend and just have time to mention the following things:

* We've just released John Murphy's entire 2006 collection of articles in CD-ROM format. The CD includes a new video intro from John as well as a private...

READ MORE

MEMBERS ONLY

AUGUST VS. OCTOBER - OPPOSITE ENDS OF THE SPECTRUM

The panic selloff and subsequent recovery in August was nearly a mirror image of what we've seen in October. First, let's start with August. If you recall, we discussed how long-term market bottoms are marked by extreme bearish sentiment. The sentiment we saw in August doesn&...

READ MORE

MEMBERS ONLY

ANOTHER LEG LOWER

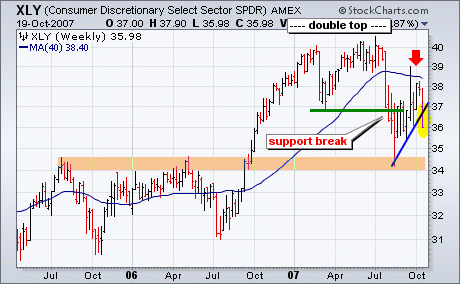

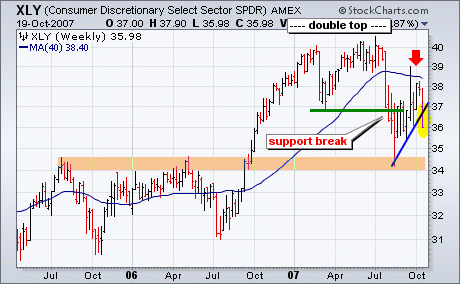

The Consumer Discretionary SPDR (XLY) and Finance SPDR (XLF) broke down this week to signal a continuation of downtrends that began in July. In other words, the Aug-Oct rally was just a countertrend advance within a larger downtrend. XLF and XLF moved into bear mode when double tops were confirmed...

READ MORE

MEMBERS ONLY

CORRECTION UNDERWAY

Two weeks ago I wrote an article that stated that it was a good time for a pullback. As it turns out the pullback started four trading days later, and it appears now that a full blown correction is in progress. It will probably take at least two or three...

READ MORE

MEMBERS ONLY

TECHNOLOGY REIGN COMING TO AN END?

Over the past 18-months, the technology sector has outperformed the S&P 500 by a rather handy amount; however, we believe this trend towards technology out-performance is very close to ending. This has major implications in terms of "rotation" to be undertaken by mutual and hedge funds...

READ MORE

MEMBERS ONLY

TWO DOW CYCLICALS TUMBLE

The Dow Industrials were hit especially hard on Friday. A lot of that was due to big tumbles in two of its cyclical stocks - Caterpillar and 3M. Chart 3 shows Caterpillar falling 6% (on higher volume) to undercut its 50-day average. CAT appears headed for a retest of its...

READ MORE

MEMBERS ONLY

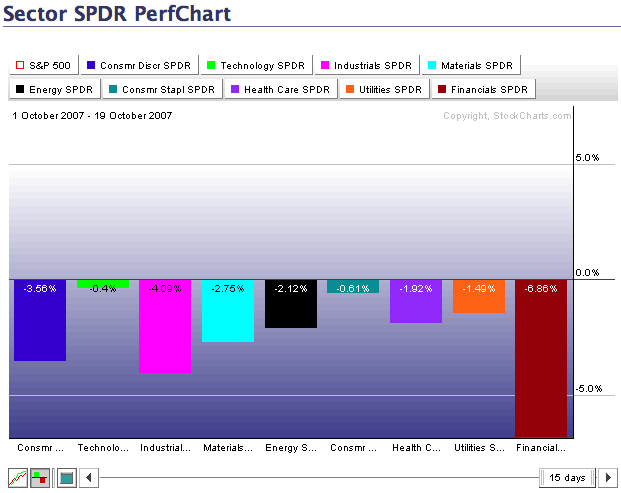

OCTOBER LIVING UP TO ITS SCARY REPUTATION

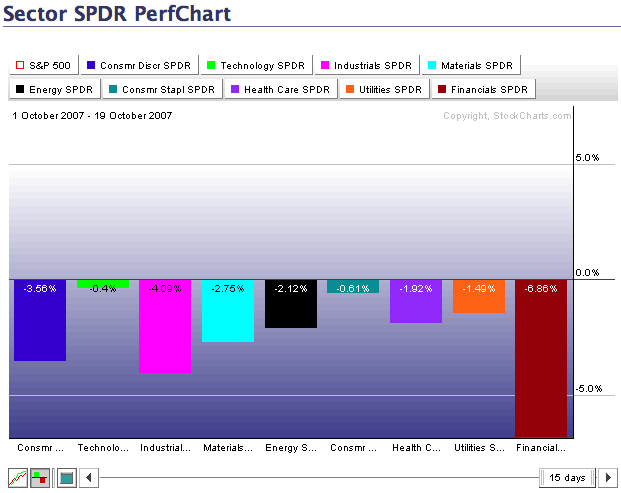

One thousand words:

All the sectors are moving lower this month led by the Financials. Click on the chart to explore more....

READ MORE

MEMBERS ONLY

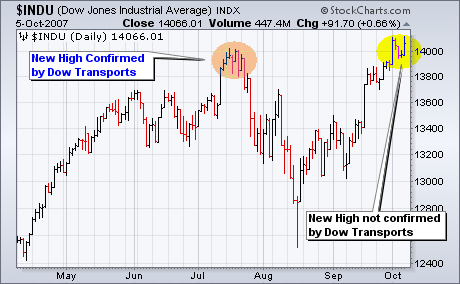

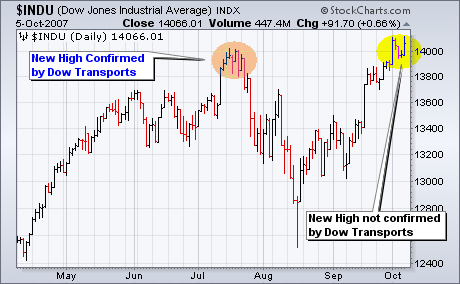

A BREAKOUT FOR THE DOW TRANSPORTS

Before looking at the chart for the Dow Transports, let's look at the Dow Theory situation. The Dow Industrials and Dow Transports both hit new highs in July and this marked a Dow Theory confirmation (bullish). Despite this bull market confirmation, both dropped sharply from mid July to...

READ MORE

MEMBERS ONLY

A GOOD TIME FOR A PULLBACK

The market has had a good run since the August lows, but it is challenging all-time highs, and the technical support has been somewhat anemic. With many indicators reaching into overbought territory, and overhead resistance becoming an issue, it looks like a good time for a pullback or consolidation to...

READ MORE

MEMBERS ONLY

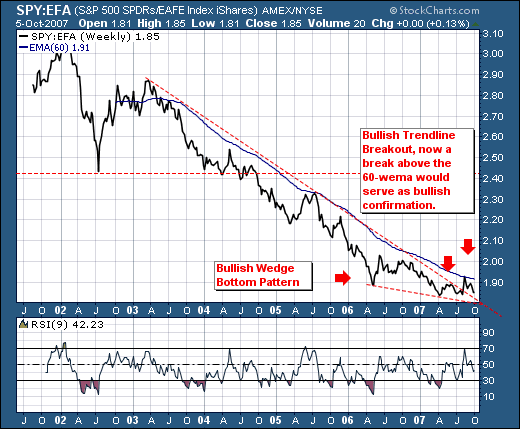

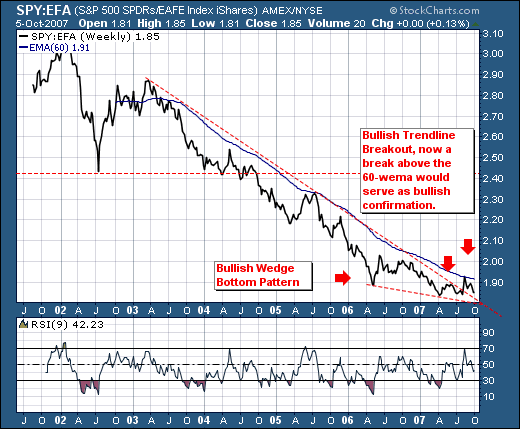

LISTENING TO THE COMMENTATORS

Last week, both the Dow Industrials and the S&P 500 broke out to new highs last week in show of modest strength; but what we find more interesting that this circumstance... is that the foreign markets aren't outperforming the US large caps. One only need understand...

READ MORE

MEMBERS ONLY

HEAD IN THE (TICKER) CLOUDS

Last week we launched our new Ticker Cloud feature. Have you seen it? It's a dynamic list of the most requested stocks we've seen over the past 15 minutes. Wanna see what everyone else is looking at? Get your head in the cloud!...

READ MORE

MEMBERS ONLY

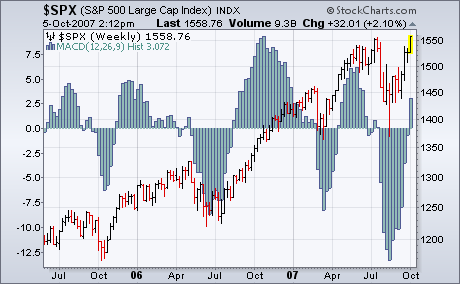

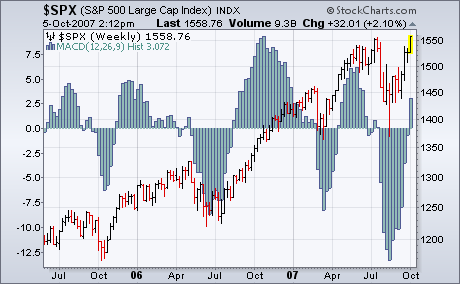

WEEKLY MACD LINES TURN POSITIVE

Last Friday, I wrote that the weekly MACD lines hadn't turned positive yet for the S&P 500, but were close to doing so. They turned positive this week. I wrote last Friday that "we need to see a positive crossing by the weekly (MACD) lines...

READ MORE

MEMBERS ONLY

FALL SPECIAL AND FREE SHIPPING!

I realize that the long-term ChartWatchers out there already know how important our specials are, but I wanted to take a moment to mention it to our newer members. One thing that has never changed at StockCharts.com is our pricing. We have had the exact same price for our...

READ MORE

MEMBERS ONLY

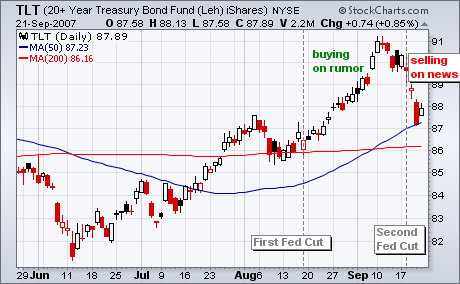

BEARS BURNED BY BERNANKE

It's been a very long time, but we can now unequivocably say that we have an accommodating Fed. The lowering of interest rates was the next piece of our bullish jigsaw that fit perfectly. It's all coming together. The bond market knew it was coming. You...

READ MORE

MEMBERS ONLY

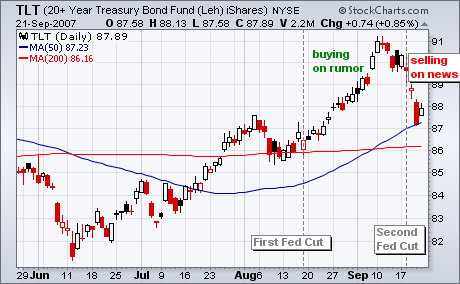

BONDS HIT SUPPORT

Buy-on-Rumor and Sell-on-News is a classic Wall Street axiom. In the internet heyday, Yahoo! would surge into its earnings announcement and then correct with a pullback near the actual announcement. The iShares 20+ Year Bond ETF (TLT) surged with the lead up to the Fed meeting on Tuesday and peaked...

READ MORE

MEMBERS ONLY

NEW BUY SIGNAL

Ever since the market hit its correction lows in August I have written three articles, each emphasizing that the odds favored a retest of those lows (see Chart Spotlight on our website). As it turns out, we haven't had any decline that I would classify as a retest,...

READ MORE

MEMBERS ONLY

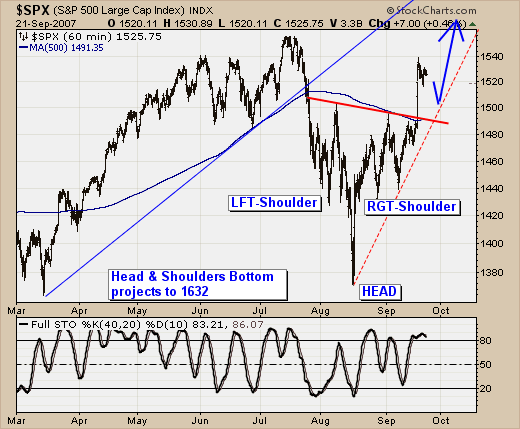

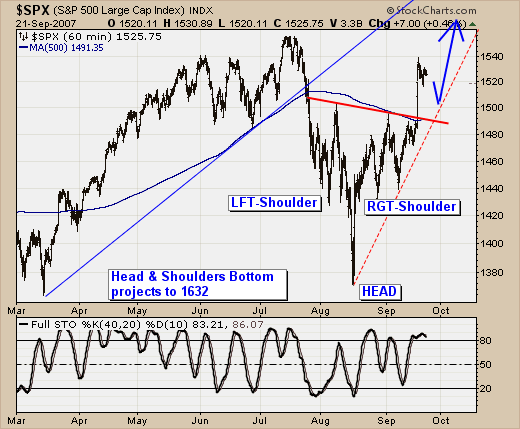

RIDING THE S&P SURGE

The "surge" of the past month in the S&P 500 is nothing short of astounding; and given the technicals involved - we believe prices are set to continue moving higher with a projection to 1630 into the October-December time frame. This represents a +6.8% rally...

READ MORE

MEMBERS ONLY

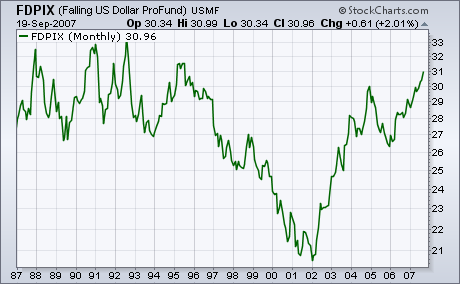

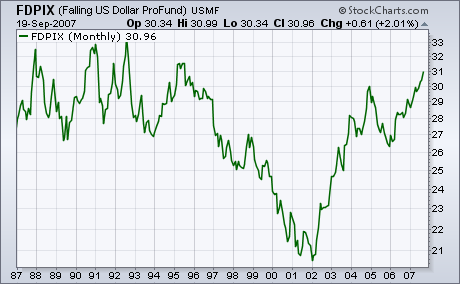

YOU CAN BUY A FALLING DOLLAR FUND

I first wrote about this inverse dollar fund in April 2006 and again on July 13 of this year. The ProFund Falling US Dollar Fund (FDPIX) is a mutual fund designed to trade in the opposite direction of the US Dollar Index. In other words, the fund rises when the...

READ MORE

MEMBERS ONLY

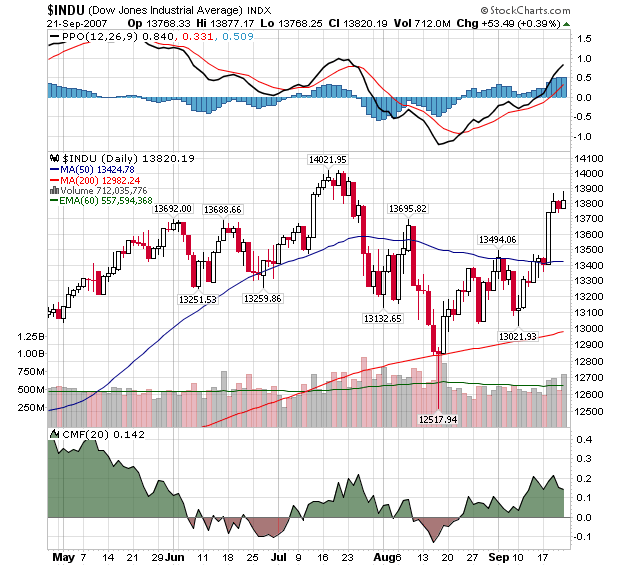

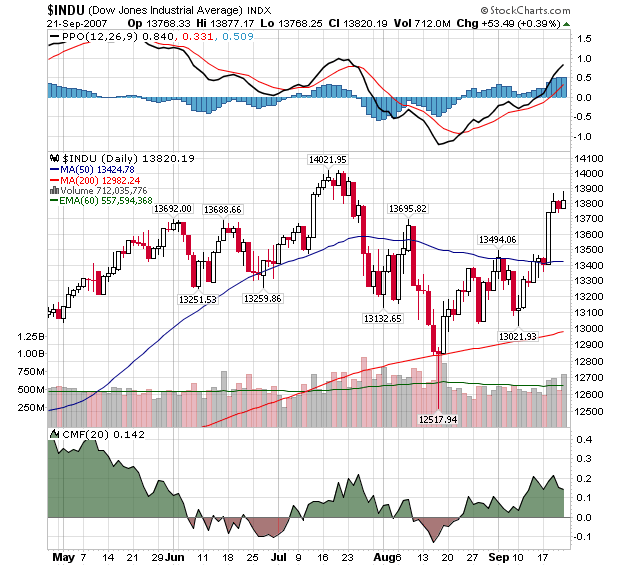

THE FED FIXED THINGS - OR DID IT?

The Fed's surprising move last Tuesday did wonders for the major averages and "wrecked" many technical forecasts in the process (oh well). As you can see below, Tuesday's rally moved the Dow well above the 50-day Moving Average (blue) which had been providing some...

READ MORE

MEMBERS ONLY

PREPARE FOR A WEAKER DOLLAR

The jobs report sent a jolt to the stock market on Friday. We believe it'll be a temporary jolt, but a jolt nonetheless. That data gave the Fed all the ammunition it needs to do what the market has been expecting for weeks - to cut the fed...

READ MORE

MEMBERS ONLY

FINANCE AND CONSUMER ETFs HAVE DOUBLE TOPS

The Finance SPDR (XLF) and Consumer Discretionary SPDR (XLY) formed large double tops this year, and both broke support in late July to confirm these bearish reversal patterns. Volatile trading ranges followed these support breaks (yellow ovals), but these ranges look like consolidations after a sharp decline. In other words,...

READ MORE

MEMBERS ONLY

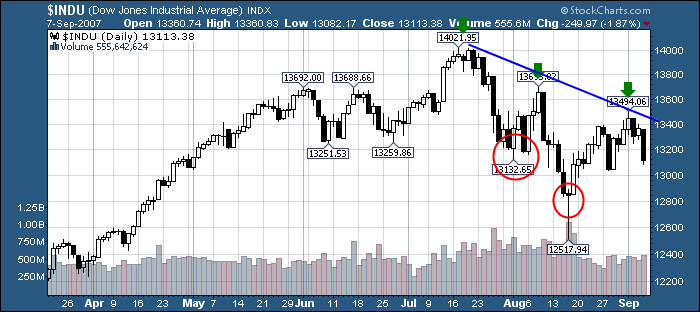

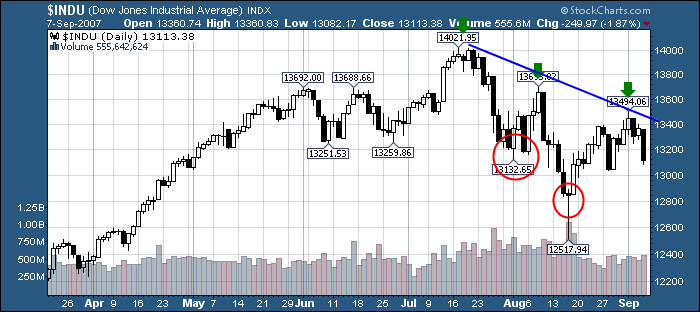

SCARY RETEST ON THE HORIZON

It is well known that October is the cruelest month on average, but sometimes September beats October to the punch. This may be one of those times. Looking at the chart below we can see that the market has bounced out of the August lows and has formed two short-term...

READ MORE

MEMBERS ONLY

BIOTECH ETF HOLDING ON

Although last week's broader market was under pressure, the long forgotten Biotech HOLDRs (BBH) showed surprising resilience, and, in fact, is on the cusp of a major breakout. If you'll recall, BBH has underperformed badly in the past, even while posting very good earnings. That puts...

READ MORE

MEMBERS ONLY

VIX STILL IN AN UPTREND

Earlier in the week I heard a TV commentator (masquerading as an analyst) give his interpretation of the CBOE Volatility (VIX) Index. His conclusion of course was bullish. He correctly pointed out that peaks in the VIX usually coincide with market bottoms. He then bullishly concluded that since the VIX...

READ MORE

MEMBERS ONLY

MARKET MOVING LOWER - DUH!

"The trend is your friend" or, in this case, the market's enemy. You may have noticed lots of vacillating in the traditional financial press this past week - gloom and doom after the market closes lower, supreme optimism the very next day when the market moves...

READ MORE

MEMBERS ONLY

EXTREME PESSIMISM MARKS BOTTOM

We've discussed in the past the tendency of the market to put in long-term bottoms when the bearish sentiment reaches extreme levels. Extreme bearishness is exactly what we saw on Thursday, August 16. Over the past 4 years or so, we've experienced many occasions when the...

READ MORE

MEMBERS ONLY

EXPECTING SHORT-TERM TOP

In my August 17 article, Looking For A Retest, I speculated that we would get a bounce from the extreme price lows hit in mid-August, but that a retest of those lows needed to occur before we could be reasonably certain that the completion of a solid bottom had been...

READ MORE

MEMBERS ONLY

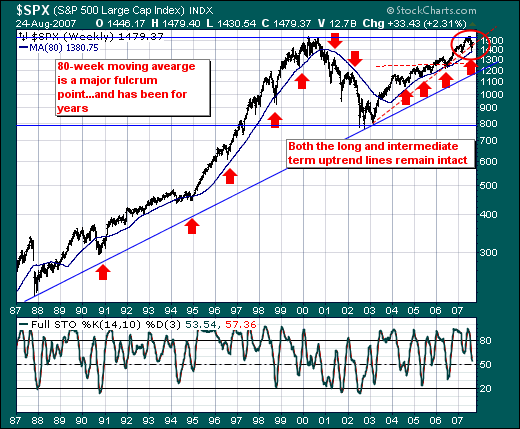

WHERE ARE WE IN THE CYCLE?

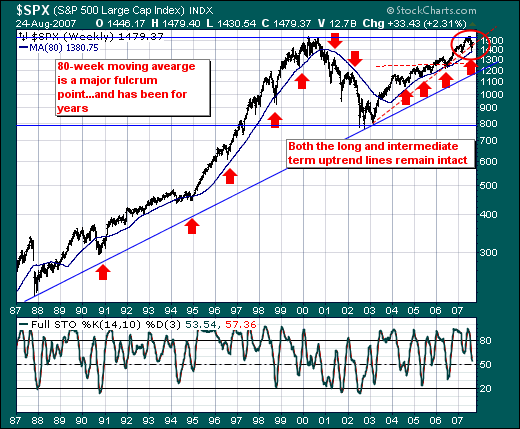

Given the volatility of the capital markets these past two weeks, we think it instructive to step back and take a longer-term viewpoint of the stock market to discern where we may be in the cycle. In doing so, we find the S&P 500 large caps - the...

READ MORE

MEMBERS ONLY

DATA FEED UPGRADE UPDATE

We are continuing to make progress in our efforts to get a second data feed into our offices. A second data feed should help us avoid the kind of problems we had several weeks back. Unfortunately, two things are conspiring to slow our progress: the phone companies and the stock...

READ MORE

MEMBERS ONLY

WHERE'S THE VOLUME?

Friday's higher prices continued the market rally that started the previous Thursday. The three charts below show major market ETFs all back above their 200-day moving averages, which removes any immediate threat of a bear market. All have recovered more than half of their July/August decline, The...

READ MORE

MEMBERS ONLY

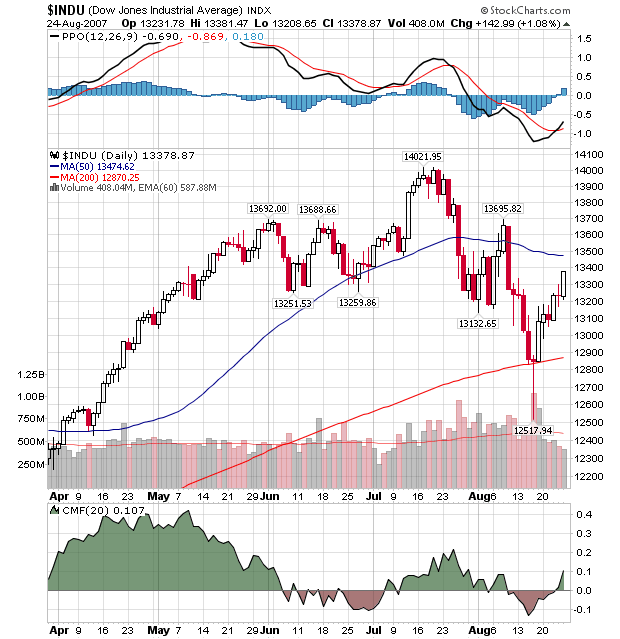

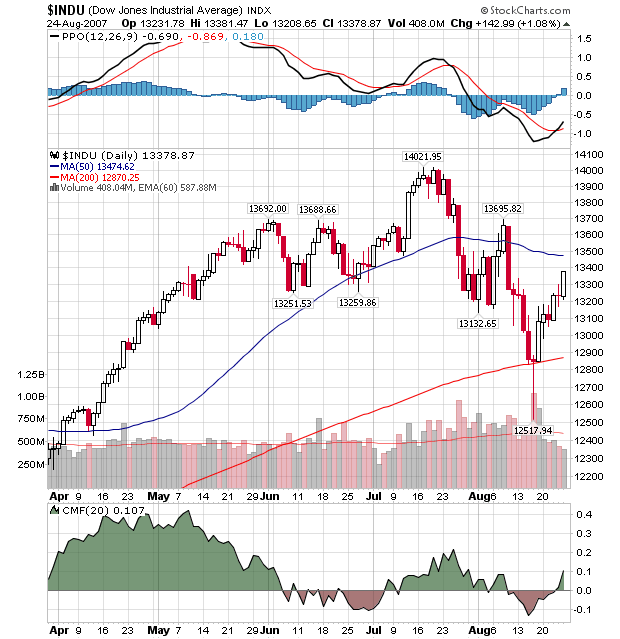

DOW TECHNICALS TURNING POSITIVE, BUT...

Last week, some significant positive technical developments occurred on our GalleryView chart of the Dow:

After recovering to remain above the 200-day moving the previous week (see the red candle whose shadow dipped all the way to 12,517?), the Dow has rebounded nicely with a nice string of tall...

READ MORE