MEMBERS ONLY

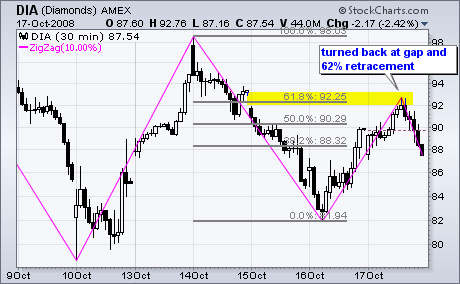

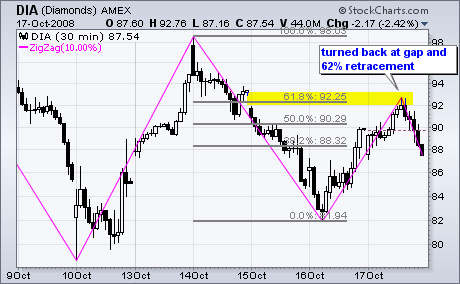

DIA RETURNS TO THE GAP

In a volatile week with huge swings, the Dow Industrials ETF (DIA) returned to Wednesday's gap with another 10% move. The magenta lines on the 30-minute chart show the zigzag indicator, which measures movements that are 10% or more. As you can see, there was an advance greater...

READ MORE

MEMBERS ONLY

VERY OVERSOLD MARKET

To say that the market is very oversold is not exactly breaking news because it has been oversold for at least a few weeks; however, the oversold condition has been steadily getting worse over that time, and we have perhaps reached the limit of how oversold the indicators will get...

READ MORE

MEMBERS ONLY

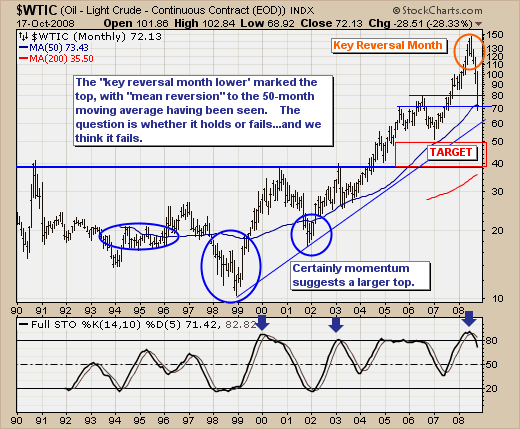

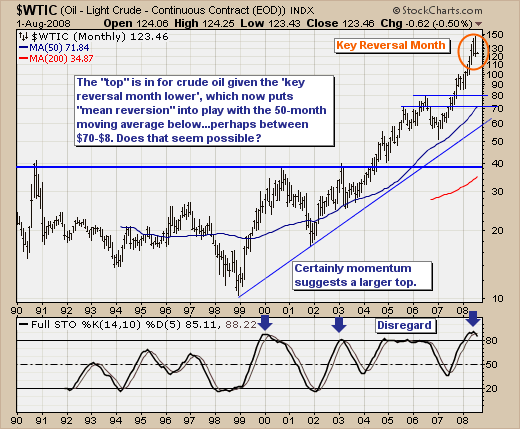

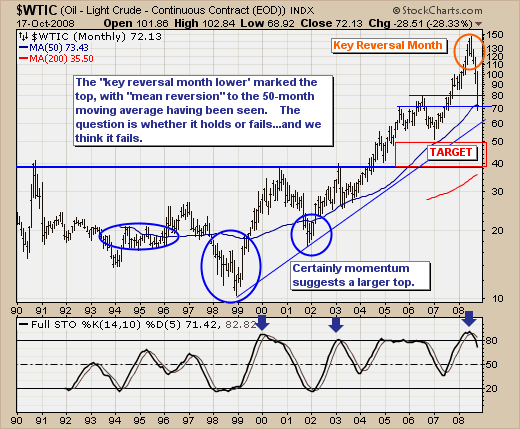

"JUMP OFF POINT" FOR CRUDE OIL?

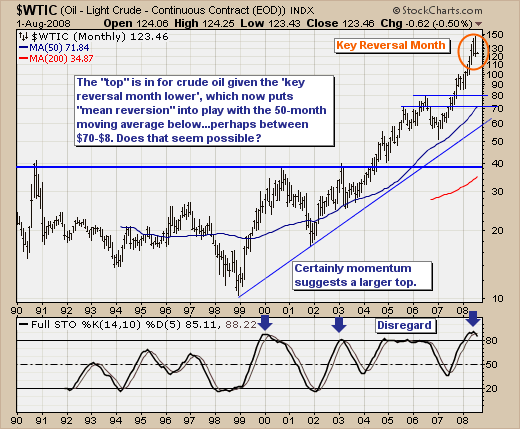

Quite simply, the trend is sharply lower. The massive de-leveraging taking place in the capital markets has not spared crude oil at all; however, this shouldn't be a surprise given the "bell ringing" at the top was none other than a "key reversal month"...

READ MORE

MEMBERS ONLY

COMMODITES ARE LAST ASSET TO PEAK

A number of readers have asked if I thought the U.S. was in a recession or heading into one. Others have asked if I thought this recession would be worse than most. Although I'm not an economist, it is possible to make some judgements about the direction...

READ MORE

MEMBERS ONLY

DISPLAYING MORE THAN ONE STOCK ON A CHART

Hello Fellow ChartWatchers,

Recently we've gotten several questions about how someone can display more than one stock on a single chart. I thought I'd take time this week to go over the steps you can take to do that with our SharpCharts Workbench. Let's...

READ MORE

MEMBERS ONLY

SEPTEMBER WEAKNESS SPILLING OVER

Two weeks ago, I said to buy the bottom. Sometimes, you're just wrong. I was wrong. Technical analysis is to the study of price action to increase the odds of predicting future price action. It's not an exact science, there are no guarantees, and there are...

READ MORE

MEMBERS ONLY

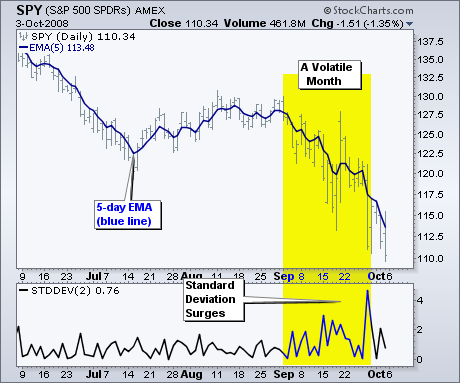

FILTERING THE NOISE

September was one of the most volatile months in recent memory. Bar charts and candlestick charts are great, but the wild high-low swings can interfere with basic trend analysis. Moving averages provide a good means to smooth this volatility by cutting through the daily noise. For those who want it...

READ MORE

MEMBERS ONLY

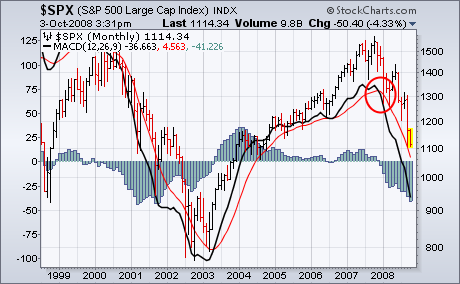

BUYING OPPORTUNITY?

In my September 19 article I said: "Our indicators and price action suggest strongly that we are beginning a rally that should last at least a couple of weeks. I also think that this week's deep low needs to be retested, and I am not convinced that...

READ MORE

MEMBERS ONLY

WHERE ARE WE NOW?

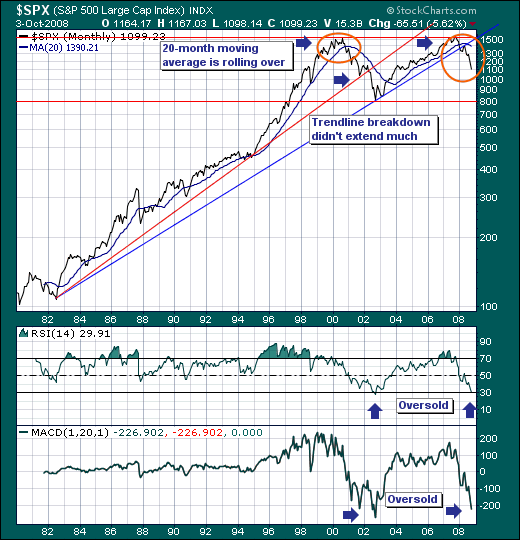

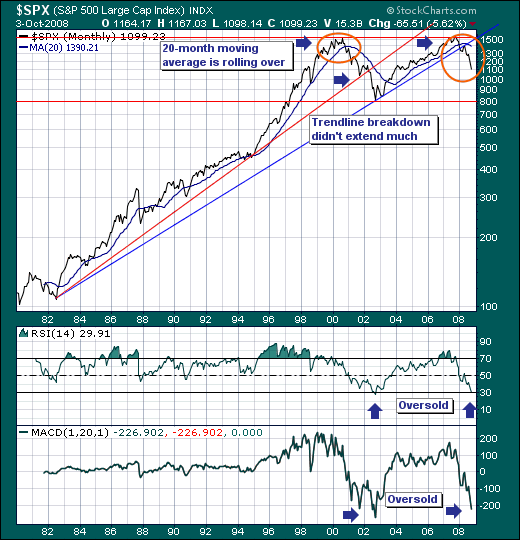

The bear market reasserted itself last week in a violent manner; trading sharply higher and lower in a matter of hours and days. This isn't your garden variety bear market as this one smells and feels much different given the enormity of the credit crisis. And there is...

READ MORE

MEMBERS ONLY

SELLING SHOULD HAVE BEEN DONE MONTHS AGO

Over the past couple of weeks, I've suggested taking no new action in the stock market. Part of my reasoning is that we've been recommending a bearish strategy for the past year and see no reason to change that. Selling should have been done earlier in...

READ MORE

MEMBERS ONLY

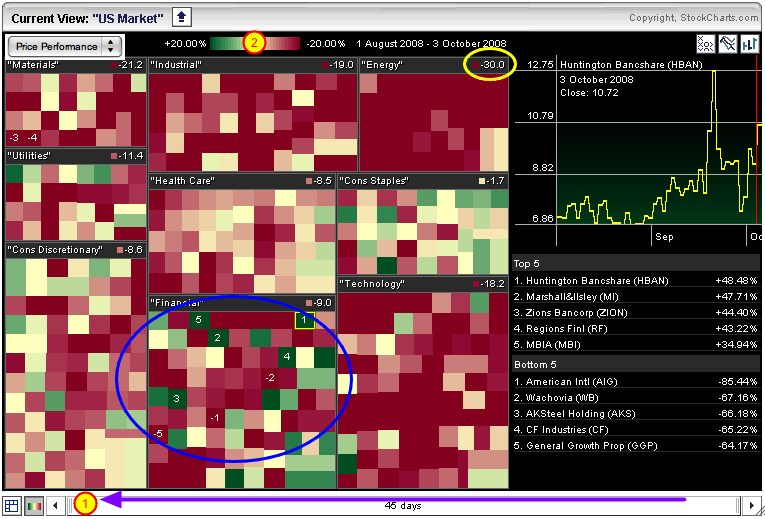

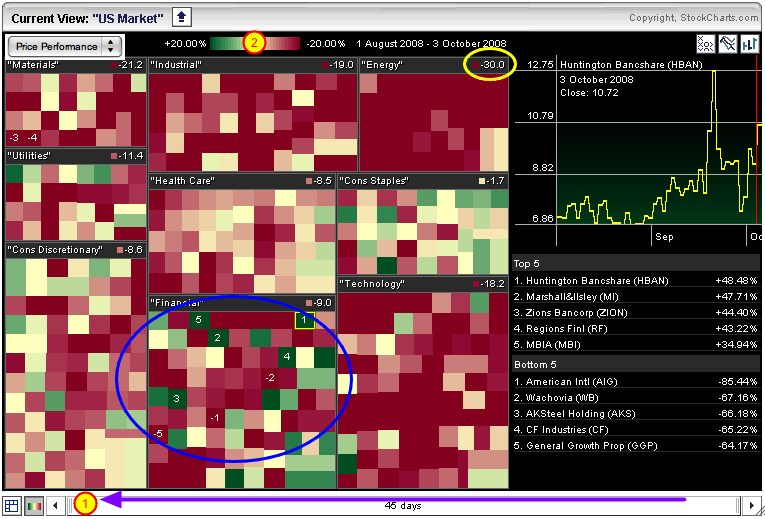

THE NEW LANDSCAPE

With all the changes happening in the financial world right now it's gotten really hard to keep up with the latest news. This bank is failing. That company is merging with this one. That sector is over exposed to the credit crunch. Etc., etc., etc.

One of the...

READ MORE

MEMBERS ONLY

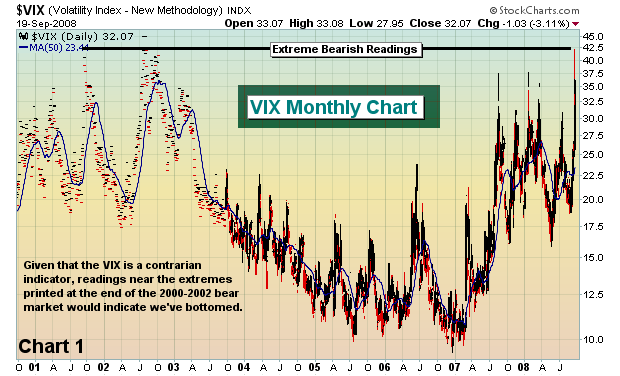

BUY THIS BOTTOM

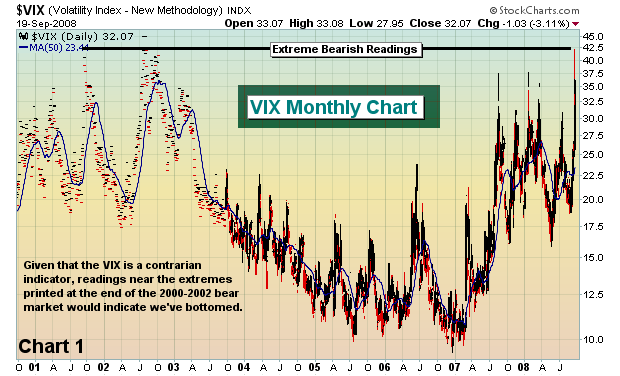

Market bottoms come in all shapes and sizes, but most have a few key ingredients. Without exception, critical market bottoms are borne out of excessive fear and panic. On Thursday, the VIX shot past 42. The last time we've seen the VIX that high, we were carving out...

READ MORE

MEMBERS ONLY

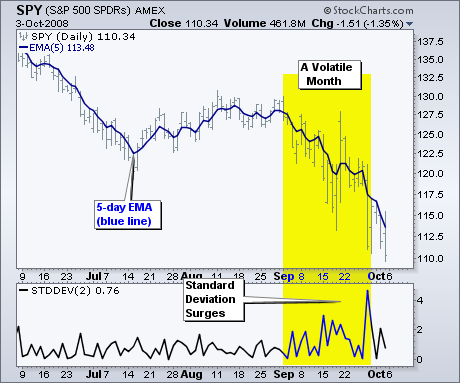

VOLUME AND VOLITILITY SURGE

Volume and volatility surges foreshadowed bear market rallies in November, January and March. Both surged again this week and the market took notice with a huge bounce over the last two days. The chart below shows the S&P 500 ETF (SPY) with volume and the S&P...

READ MORE

MEMBERS ONLY

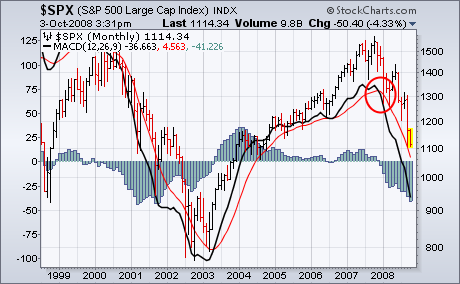

FINALLY A BOTTOM?

In my September 5 article I said that I thought is more likely that we would see a continued decline, rather than a retest of the July lows. This week the market blew out the July lows and was very near to crashing on Thursday. Then prices blasted up out...

READ MORE

MEMBERS ONLY

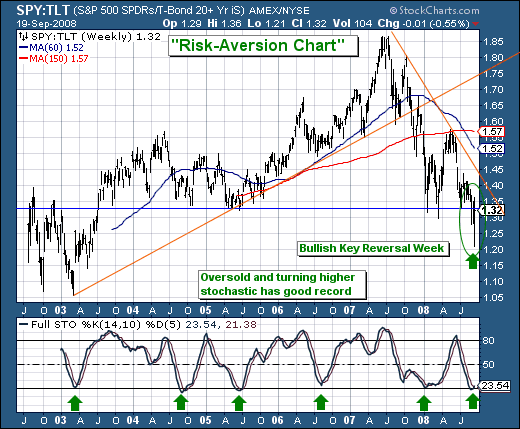

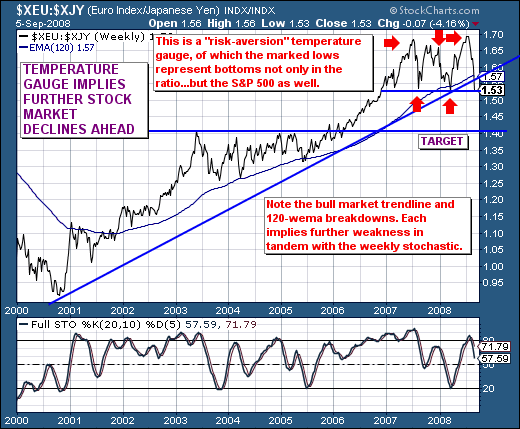

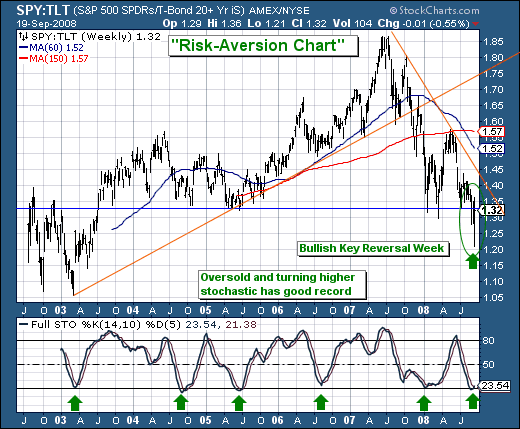

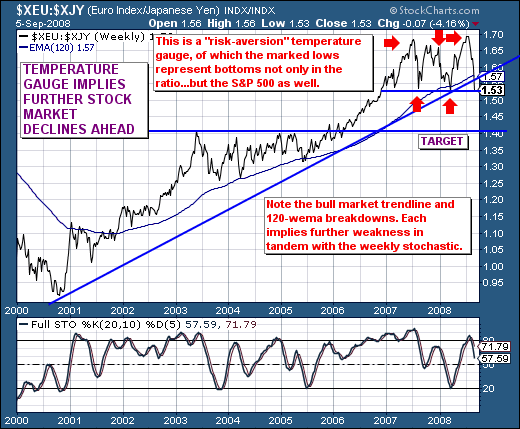

VIEWING OUR "RISK AVERSION" CHART

We'll admit last week was one of the more "interesting" trading weeks we have seen in a number of years, and if we must liken it to anything we've seen in our 25-years of trading - it would be the week before and of...

READ MORE

MEMBERS ONLY

FINANCIALS SURGE

A massive government rescue plan and a temporary ban on short selling has boosted the Financials Sector SPDR by nearly 12% (Chart 1). It's the day's strongest sector on a day when all sectors are in the black. Brokers (not shown) are up 12% and banks...

READ MORE

MEMBERS ONLY

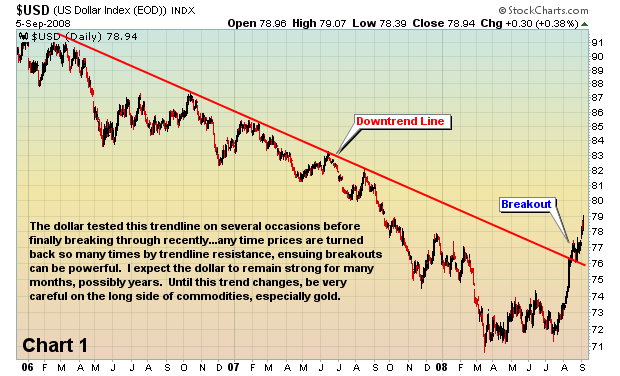

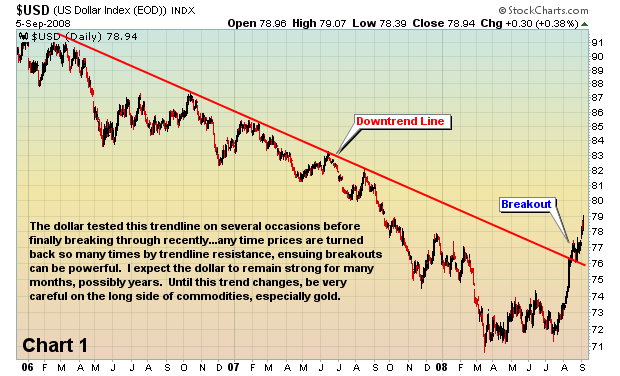

DOLLAR'S RISE CRUSHING COMMODITIES

The U.S. dollar couldn't move lower forever. It had to turn and when it did, we knew things might get ugly for commodities. Since the July 14th low in the dollar index, we've seen the greenback rise over 10% (see Chart 1). That has sent...

READ MORE

MEMBERS ONLY

MOMENTUM TURNS BEARISH FOR DIA

Stocks opened weak after Friday's employment report, but the bulls found their footing late morning and rallied for a mixed close. While it may seem positive that stocks firmed after bad news, keep in mind that stocks already priced in a lot of bad news with Thursday'...

READ MORE

MEMBERS ONLY

BREAKDOWN POINTS TO LOWER PRICES

On August 15 I wrote an article pointing out that an ascending wedge had formed on the S&P 500 chart. I noted that this is a bearish formation, and that the most likely resolution would be a breakdown from the wedge followed by a price correction. The breakdown...

READ MORE

MEMBERS ONLY

MORE S&P 500 DECLINES AHEAD?

The world's temperature gauge for risk is what we refer to as the "carry-trade" indicator...or the Euro/Yen Spread. When this spread is rising, then the world is said to be putting the carry-trade on and expanding risk profiles; conversely, when the spread is falling....

READ MORE

MEMBERS ONLY

FIBONACCI LINES - HOW MUCH IS "TOO MUCH"?

How high is "too high?" How low is "too low?" Think back to any time that you've owned a stock and think about when you started to get worried about it's performance. At what point did "your gut" start to...

READ MORE

MEMBERS ONLY

THE DOLLAR GOES GREEN AND MAX PAIN REVISITED

The dollar has bottomed and is beginning to trend higher for the first time in several years. Dropping crude oil prices are pushing gas prices lower at the pump and the dollar is strengthening. That's a combo that should make most consumers feel wealthier in time. Europe'...

READ MORE

MEMBERS ONLY

ASCENDING WEDGE IMPLIES CORRECTION IMMINENT

The rally that began off the July lows has not demonstrated the kind of strength we normally expect from the deeply oversold conditions that were present at its beginning. Instead, the meager price advance has served only relieve oversold compression and advance internal indicators to moderately overbought levels. In the...

READ MORE

MEMBERS ONLY

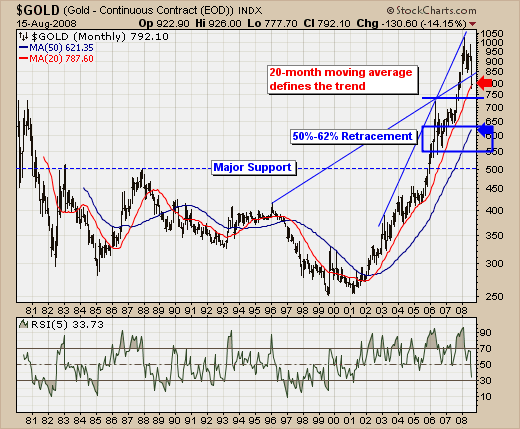

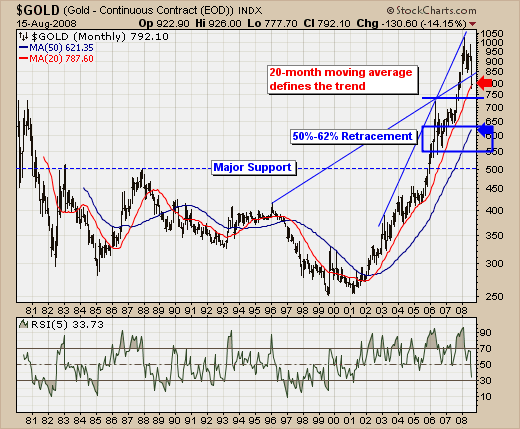

GOLD FUTURES - GOOD TIME TO BE A BUYER?

The past month in the commodity markets has been a treacherous as we have seen it in recent years; and not one commodity has been spared. That said, our focus is upon gold futures given they have dropped from a high of $1,033.90 to their current level of...

READ MORE

MEMBERS ONLY

TWO SECTOR LEADERS ARE STAPLES AND HEALTHCARE

Until proven otherwise, the two strongest market sectors are still consumer staples and healthcare. And both are defensive categories. Chart 1 shows the Consumer Staples Select (SPDR) trading at a new eight month high after breaking through its spring high. It's nearing a test of its record high...

READ MORE

MEMBERS ONLY

"WEATHERING" THE MARKET

When was the last time you saw a 100% accurate weather forecast for your area? Chances are that at least some of the weather predictions your local weather person tells you won't come to pass. In many cases, most of the predictions are wrong. So why do we...

READ MORE

MEMBERS ONLY

EARLY BULLISH SIGNS EMERGING?

Spotting tops and bottoms is perhaps the best reason for utilizing technical and sentiment indicators in your investing and trading arsenal. The first signs of a bottom forming can be subtle and I'm beginning to see a few. Consumer discretionary stocks, which have been relative laggards during the...

READ MORE

MEMBERS ONLY

IWM AND QQQQ HIT RESISTANCE

The Russell 2000 ETF (IWM) and Nasdaq 100 ETF (QQQQ) were stifled at resistance this week and the bulls are getting a test. After surging above 69, IWM met resistance at broken support and the 62% retracement mark. QQQQ met resistance at 46 in early July and this level held...

READ MORE

MEMBERS ONLY

RALLY LACKS CONVICTION

The rally that began nearly three weeks ago, out of the jaws of a potential crash, has become rather unimpressive in the last two weeks. As I said in my last article, the rally seemed to be contrived from the beginning, and support for the rally has faded rather than...

READ MORE

MEMBERS ONLY

QUESTIONS FOR THE FUTURE

This past July-2008 was a very important month for the capital markets; crude oil peaked and traded lower by -11%. This is rather substantial to be sure, and one would be reasonable to believe that the demand/supply equation coupled with a daily technical oversold condition would push crude prices...

READ MORE

MEMBERS ONLY

ECONOMISTS ARE LATE AS USUAL

In a recent Market Message, I discussed how the stock market is a leading indicator of the economy and why it isn't a good idea to use economic forecasting to trade the stock market. Historically, the market turns down at least six months before the economy. Chart 1...

READ MORE

MEMBERS ONLY

USING KELTNER CHANNELS

Hello Fellow ChartWatchers!

Let's start the month of August off right with a good, old-fashioned education article about the modern version of a good, old-fashioned chart overlay, Keltner Channels! Here we go...

Keltner Channels are a set of three lines that are overlaid on top of the price...

READ MORE

MEMBERS ONLY

POOR SENTIMENT, MAX PAIN AND THE BOWLEY TREND

Tuesday afternoon marked a short-term bottom. In my opinion, we're going to print AT LEAST one more low in time; however, the sentiment had deteriorated on Tuesday to a point where we normally we see a rebound. In addition, there was TONS of net put premium (in-the-money put...

READ MORE

MEMBERS ONLY

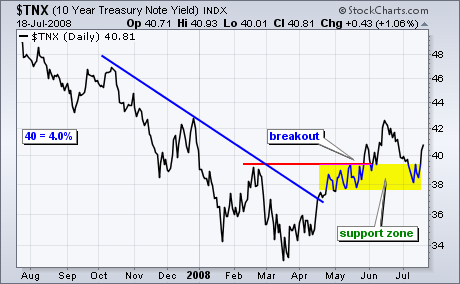

BAD NEWS FOR BONDS

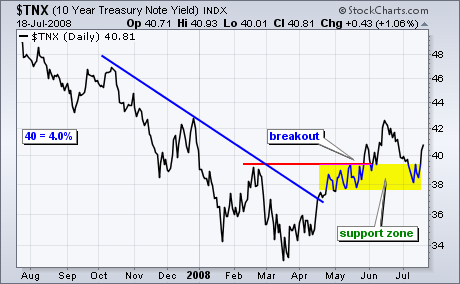

After the Producer Price Index (PPI) surged on Tuesday, it was little surprise to see big gains in the Consumer Price Index (CPI) on Wednesday. Bernanke warned of inflation in his congressional testimony last week and the PPI-CPI figures confirm. The CPI surged 5% year-on-year and 1.1% month-on-month. That...

READ MORE

MEMBERS ONLY

DISASTER AVERTED, SO FAR

In my July 3 article I warned that the market was oversold, dangerous, and vulnerable to a crash. On Tuesday of this week, the S&P 500 opened down, breaking significant support, and kept moving lower. I thought to myself, "This is it. Crash in progress." Then...

READ MORE

MEMBERS ONLY

RALLY FORTHCOMING IN HOUSING MARKET?

Last week may very well have been an important turning point in the US stock market, with the Dow Industrials and the Russell 2000 Small Caps as forming bullish "key reversal" patterns to the upside. This would suggest an increased probability of further strength on the order of...

READ MORE

MEMBERS ONLY

SHORT-TERM SELL SIGNALS GIVEN

This week's downturn in crude oil prices has had a depressing effect on the entire commodity group. Chart 1 shows the CRB Index (plotted through Thursday) breaking a three-month up trendline (and its 50-day moving average). The 12-day Rate of Change (ROC) line (top of chart) has fallen...

READ MORE

MEMBERS ONLY

PINNING DOWN YOUR ANNOTATIONS

Hello Fellow ChartWatchers!

This week I wanted to tell you about a new feature we've just rolled out in our ChartNotes chart annotation tool. It is called "pinning" and it allows you to prevent any of your saved annotations from scrolling to the left over time....

READ MORE

MEMBERS ONLY

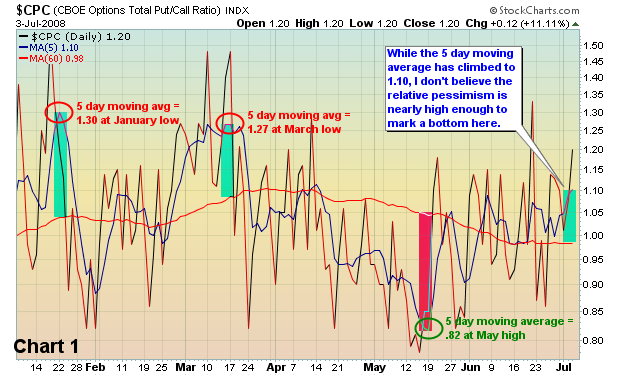

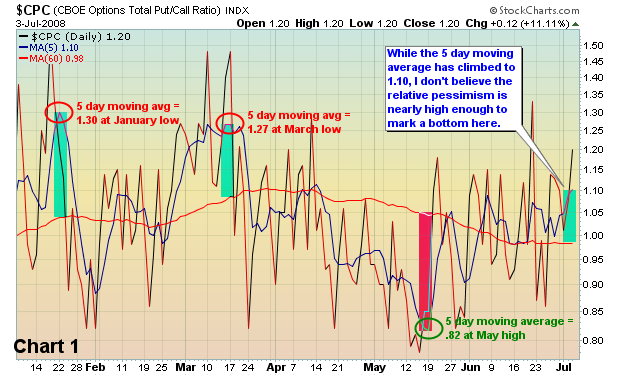

PANIC AND FEAR? NO SIGNS JUST YET

I'm the conservative type. I'm also nervous. I never like to see the market fall precipitously while market participants yawn. In a nutshell, that's what we've been seeing. Yes, the talking heads will say the sky is falling, but unfortunately for bulls,...

READ MORE

MEMBERS ONLY

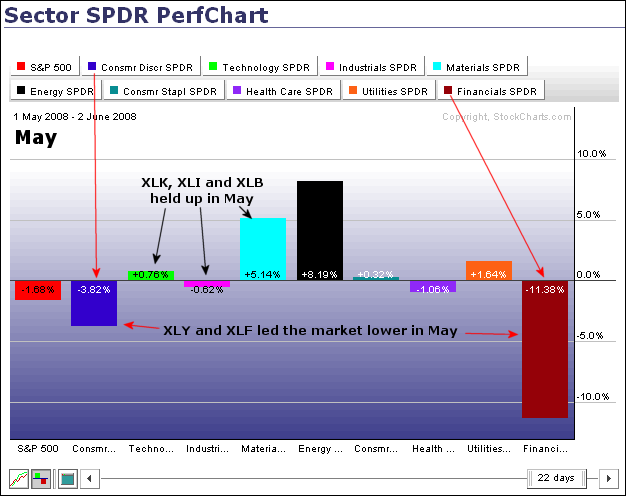

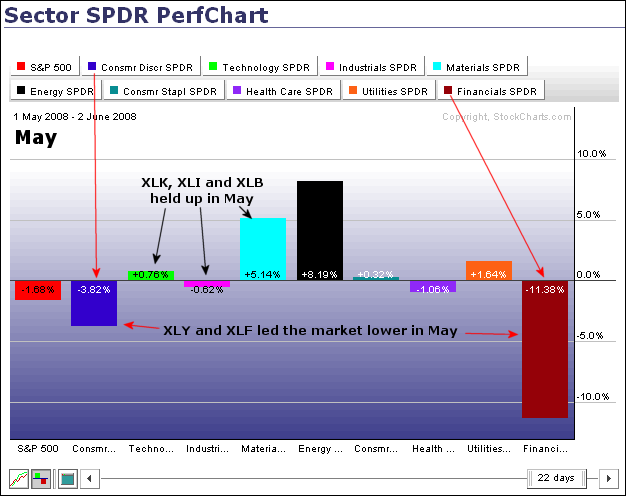

BEAR MARKET EXPANDS!

Sector performance in May and June shows the bear extending its grip into other key sectors. The Financials SPDR (XLF) and the Consumer Discretionary SPDR (XLY) woke up the bear with dismal performances in May. The first PerfChart shows sector performance from 1-May until 2-June, which is basically the month...

READ MORE