MEMBERS ONLY

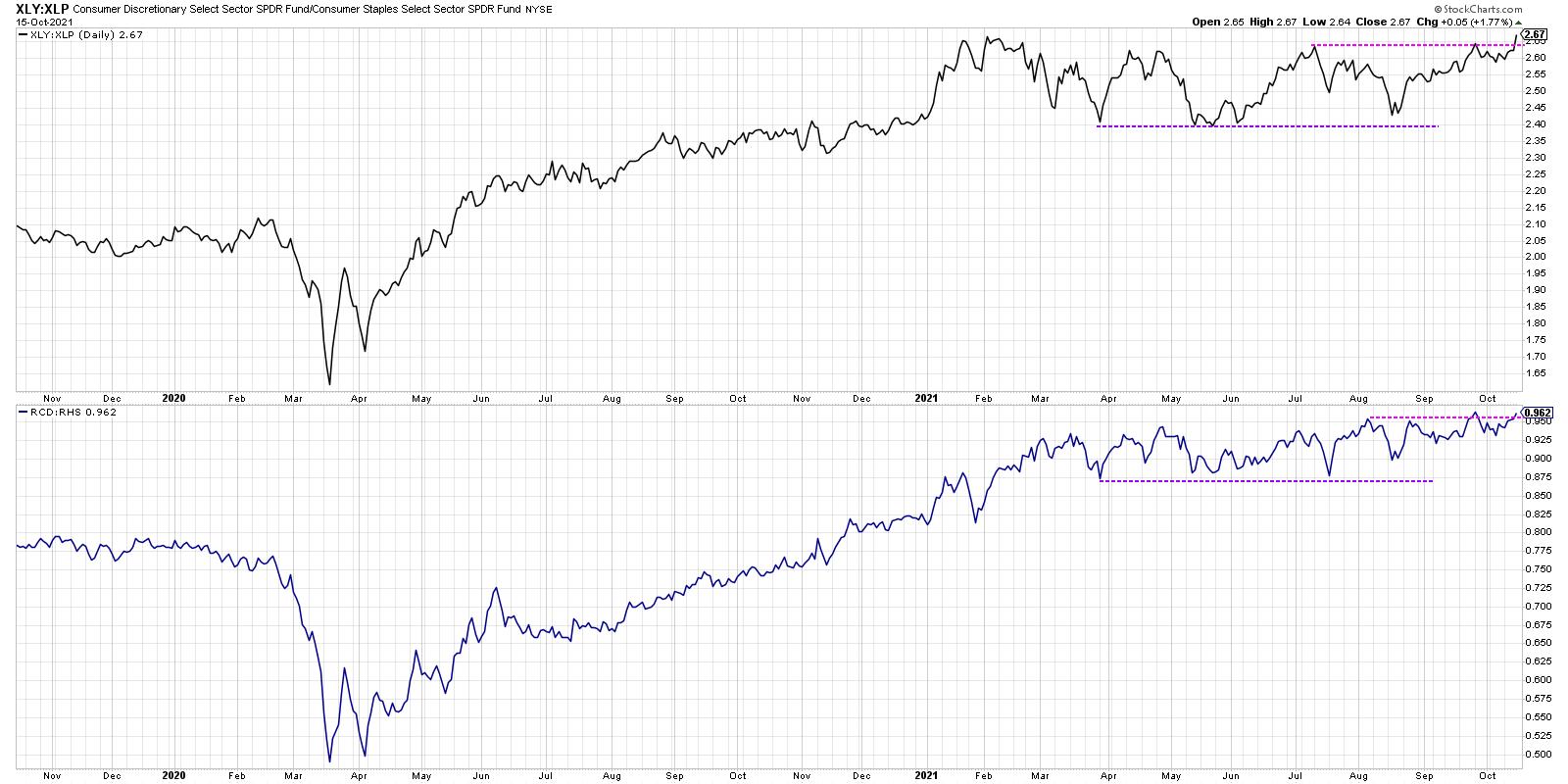

Three Charts to Watch Through Year-End

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This has been a confusing market in so many ways. The S&P 500 moved higher for the first nine months of the year, but many stocks had a very different experience over that time frame. Leadership themes have rotated a number of times, with growth- and value-oriented sectors...

READ MORE

MEMBERS ONLY

Why Gold Remains Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Gold has captivated human beings for millennia, infatuated with its appearance and it scarcity. Gold has also attracted investors for its value in hedging inflation and providing a stable store of wealth during periods of uncertainty.

While there are many narratives for gold related to transitory inflation, the Fed'...

READ MORE

MEMBERS ONLY

When In Doubt, Use a Checklist

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I recently gave a webcast on how to avoid one of the sneakiest and most prolific of the behavioral biases: confirmation bias. Here's how it works. Instead of gathering evidence and then making a decision, you reverse the two. You actually make your decision first and then you...

READ MORE

MEMBERS ONLY

Four Signs the Bull Market is Over

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Technical analysis is a windsock, not a crystal ball." - Carl Swenlin

For me, technical analysis is not about trying to predict the future. So when I'm asked to give my S&P 500 target for year-end, I try not to giggle as I answer....

READ MORE

MEMBERS ONLY

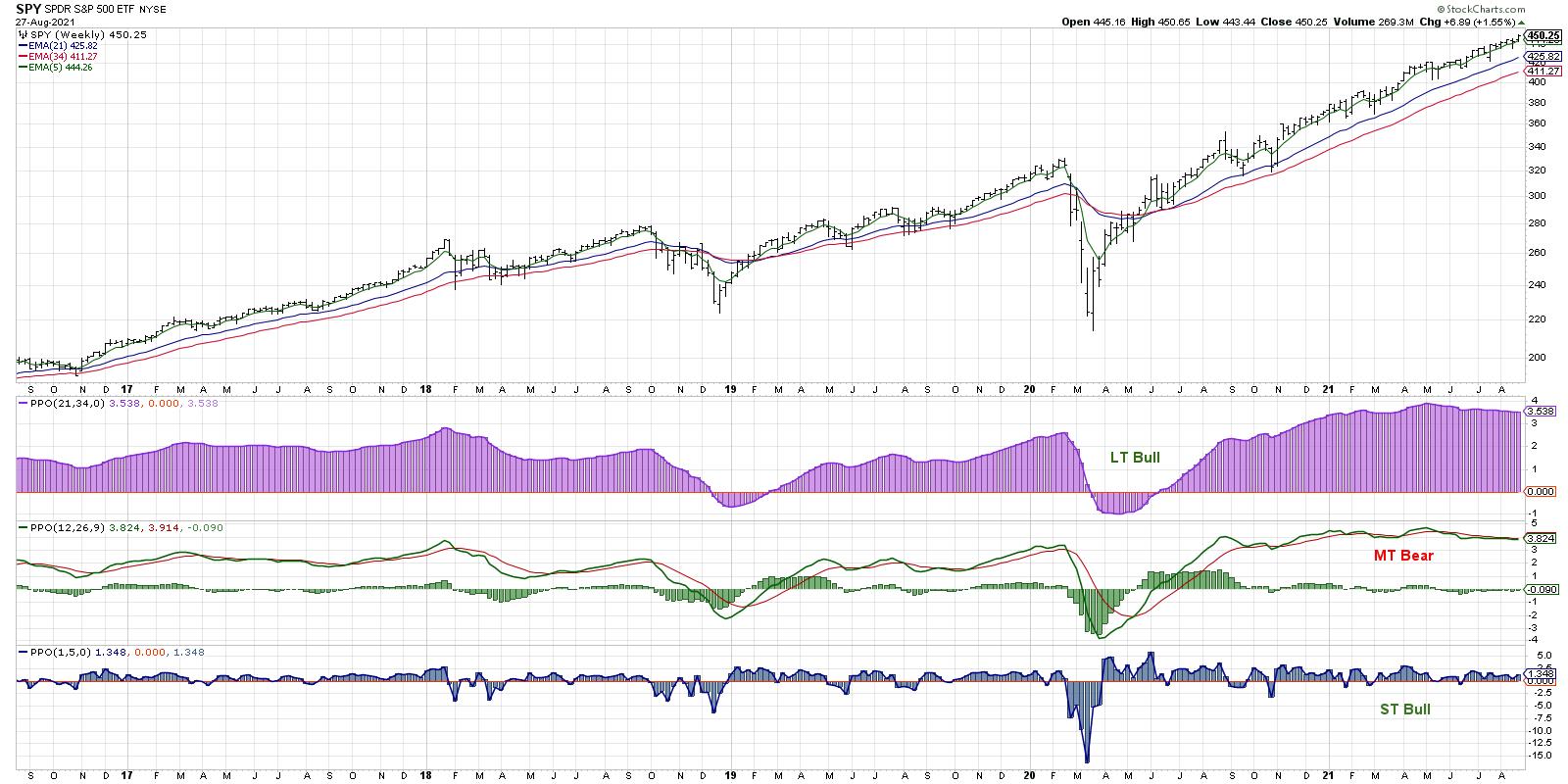

Three Reasons I'm a Little Less Bearish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My medium-term Market Trend Modelturned bearish in May and has remained consistently bearish ever since. The market hasn't seemed to notice and has continued to make new all-time highs in every subsequent month.

So how do we reconcile these two conflicting signals, with a model turned negative and...

READ MORE

MEMBERS ONLY

Why Is Bitcoin 42,000 So Important?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I recently recorded a "Choose Your Own Adventure" style approach to Bitcoin. I laid out four different scenarios for this crypto, from the uber-bullish move to 65,000 to the ultra-bearish scenario down to 24,000.

If you're interested, you can see the original video here...

READ MORE

MEMBERS ONLY

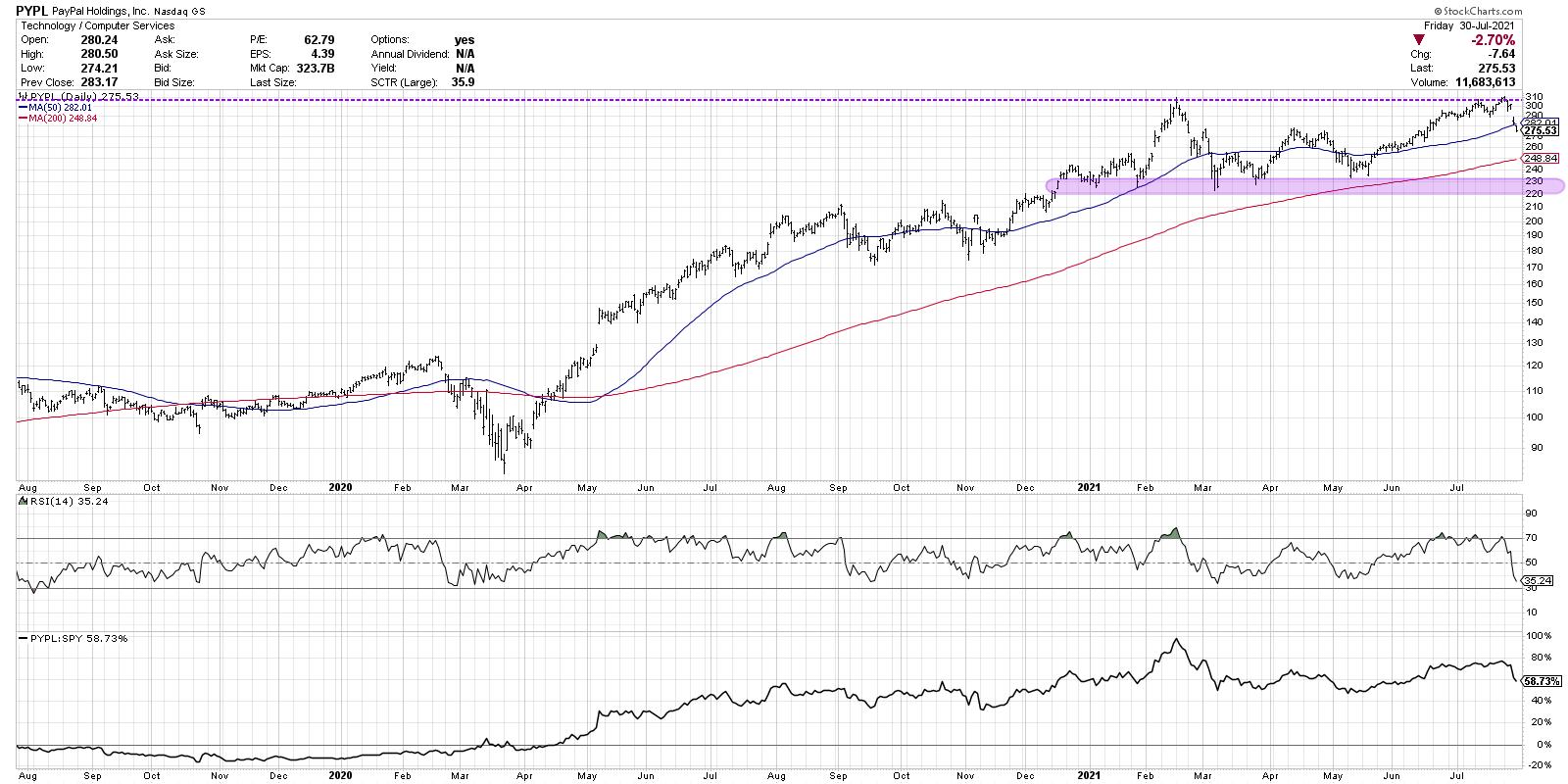

PayPal's Pullback May Be a Broader Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Markets in healthy uptrends, with improving bullish characteristics, see price breakouts follow through to further upside. Stocks like AAPL and AMZN and PYPL and others break above previous resistance levels and continue to push onward and ever upward.

Except that was not the upside follow through scenario that the markets...

READ MORE

MEMBERS ONLY

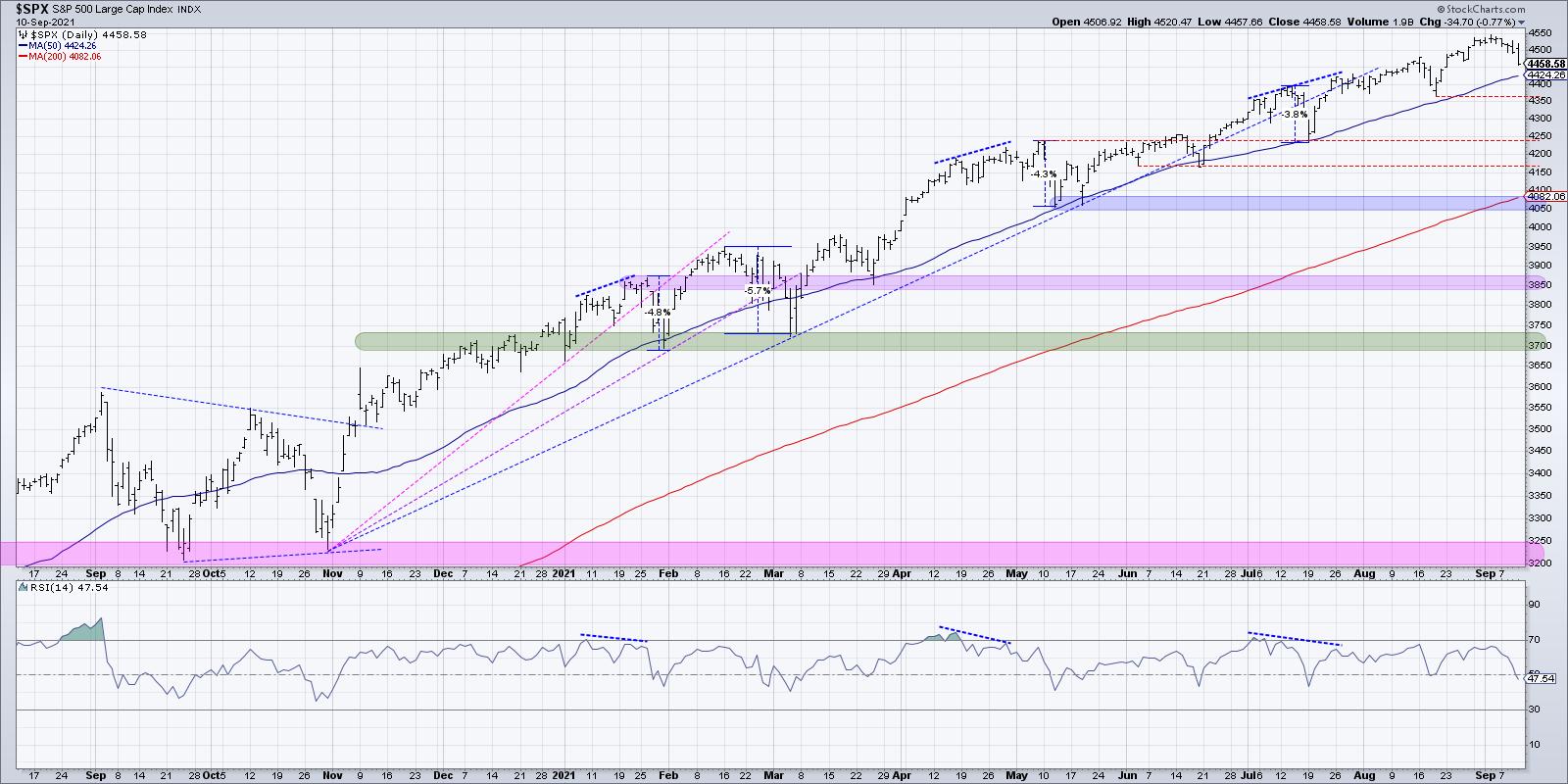

How the Impending Correction May Actually Play Out

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the S&P 500 and Nasdaq 100 indexes have pounded away at new all-time highs basically every month in 2021, investors are left to wonder when a correction may actually be coming. We were taught that markets don't just go straight up, but instead they move...

READ MORE

MEMBERS ONLY

What the Impending Correction May Look Like

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As the S&P 500 and Nasdaq 100 indexes have pounded away at new all-time highs basically every month in 2021, investors are left to wonder when a correction may actually be coming. We were taught that markets don't just go straight up, but instead they move...

READ MORE

MEMBERS ONLY

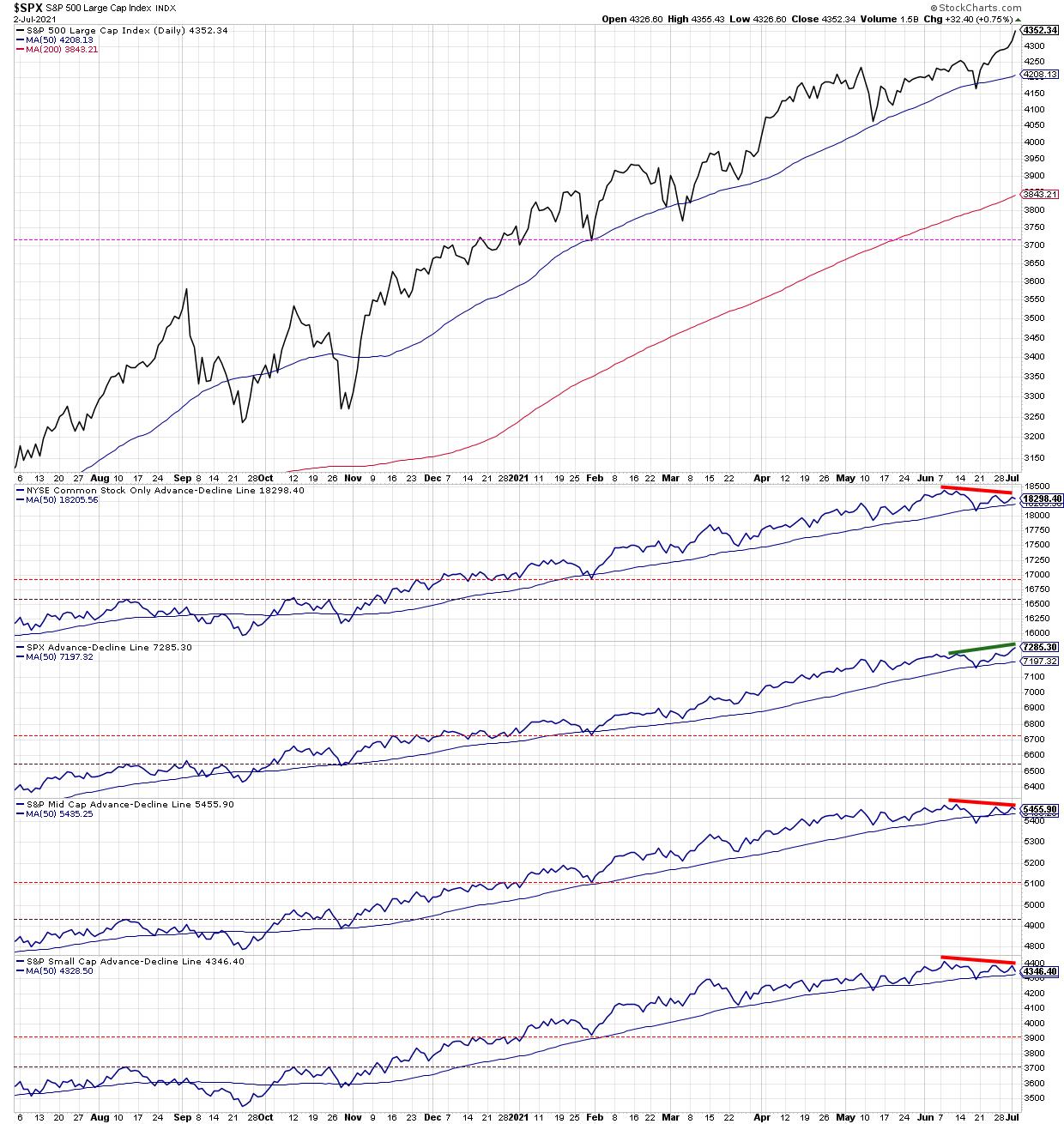

A Market with Bad Breadth is Still Going Up

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 is going higher. If you knew nothing else about the current market environment, you would consider that to be a bullish indication. As Paul Montgomery once said, "The most bullish thing the market can do is go up."

But if you look underneath...

READ MORE

MEMBERS ONLY

Four Lessons From Four Charts in My Office

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I have four paper charts hanging in my office. I use these as the background for most of my videos, and you can usually see one in the background when we shoot The Final Barevery afternoon.

I was recently asked why these four charts were worthy of display -- and...

READ MORE

MEMBERS ONLY

Three Key Charts for Falling Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In terms of key developments this week, I would argue that the ten-year Treasury yield breaking below 1.5% was perhaps the most significant. On The Final Bar this week, we've talked about the $140 level on the long bond ETF ($TLT) and how this rotation higher in...

READ MORE

MEMBERS ONLY

Introducing the FAME Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In John Murphy's classic text Technical Analysis of the Financial Markets, he explains that one of the three basic assumptions of technical analysis is that prices move in trends.For anyone that has looked at charts for any amount of time, this seems like an obvious truism. The...

READ MORE

MEMBERS ONLY

Three Key Lines for Three Key Charts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As I go through my normal routine of analyzing hundreds of charts every day, or when I'm preparing for my daily closing bell show, I often focus on the "line in the sand" for each chart. That is, what's the point at which you...

READ MORE

MEMBERS ONLY

Dead Cat Bounce on S&P 500?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When a market makes a quick move lower from an established peak, then quickly rebounds back to the upside, you will hear the dreaded phrase "dead cat bounce" emerge on trading floors. What is this pattern, and what can it tell us about next steps for the S&...

READ MORE

MEMBERS ONLY

Bullish Breakouts for Financials

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Last month, we recognized a bearish divergence on the chart of the 10-year Treasury Yield ($TNX). Soon after, bond prices rallied, pushing interest rates down to an ascending 50-day moving average. Now that this pullback has completed, we're seeing signs of rising rates, which has ripple effects for...

READ MORE

MEMBERS ONLY

Eli Lilly: Perfect Example of Price Distribution

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I look at hundreds of charts every single day. Every once in a while, I come upon a chart that I feel should be in future textbooks on technical analysis. One chart that seems to provide a perfect example of best practices in price analysis and investor behavior.

This week&...

READ MORE

MEMBERS ONLY

The Streaming Wars: T vs. NFLX

by David Keller,

President and Chief Strategist, Sierra Alpha Research

It's been a heavy earnings week, with many stocks gapping higher or lower based on investors' reactions to their quarterly results. With two particular stocks, AT&T (T) and Netflix (NFLX), this week was less about their ability to grow earnings and more about their potential...

READ MORE

MEMBERS ONLY

The Impact of Falling Interest Rates

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Over the last six weeks, we've seen a dramatic reversal from a rising rate environment to a falling rate environment. While this rotation makes perfect sense from a technical perspective, the fact that the ten-year yield has come down in the face of strong economic data this week...

READ MORE

MEMBERS ONLY

Improving Relative Strength for Homebuilders

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Relative strength is one of the most important parts of my technical toolkit. Basically, the idea is to lean into stocks that are working and lean away from stocks that are not working. If that sounds easy, simple and straightforward, that's because it is!

This week, I noticed...

READ MORE

MEMBERS ONLY

The Chart You Need to Stay Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I have learned over my career to be skeptical. I have learned to question my investment thesis and actively argue the other side of any position to challenge my own analysis. I have learned to actively search out people that disagree with me and try to see what they are...

READ MORE

MEMBERS ONLY

The Chart You Need to Stay Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I have learned over my career to be skeptical. I have learned to question my investment thesis and actively argue the other side of any position to challenge my own analysis. I have learned to actively search out people that disagree with me and try to see what they are...

READ MORE

MEMBERS ONLY

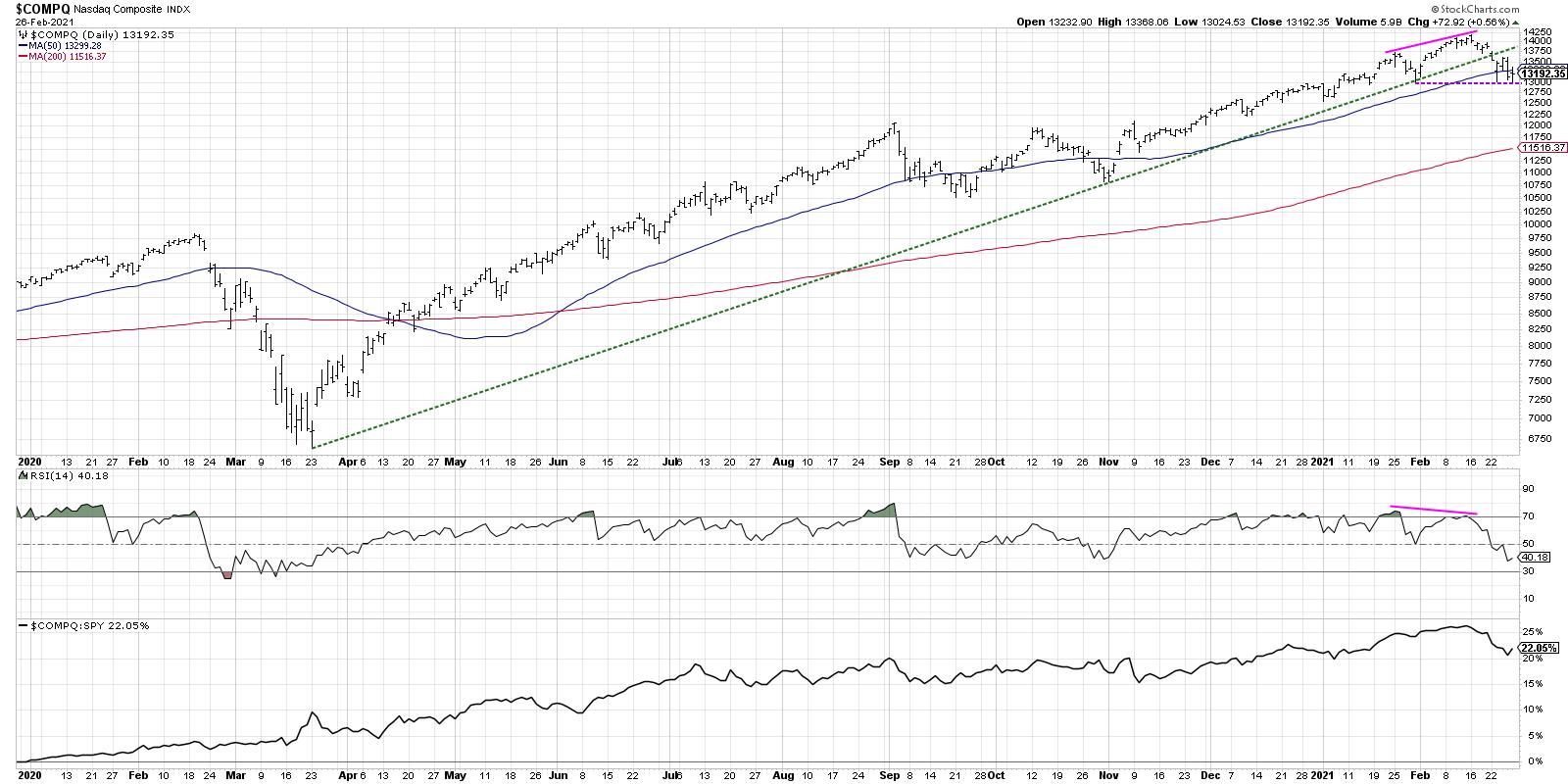

Nasdaq Rotates Toward Bearish Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I recently tweeted the three steps for the S&P to signal a rotation from bullish phase to bearish phase, especially on the tactical time frame. After taking some time to digest this week's distribution, I wanted to update that thesis with a four step "bull...

READ MORE

MEMBERS ONLY

Advance-Decline Lines Suggest Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've spoken recently of the bearish divergences emerging from breadth indicators, including the anemic new 52-week highs list, as well as a breakdown in the percent of stocks trading above their 50-day moving averages.

As we recorded Friday's episode of The Final Bar, it appeared that...

READ MORE

MEMBERS ONLY

Advance Decline Lines Flash Warning

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I've spoken recently of the bearish divergences emerging from breadth indicators,including the anemic new 52-week highs list, as well as a breakdown in the percent of stocks trading above their 50-day moving averages.

As we recorded Friday's episode of The Final Bar, it appeared that...

READ MORE

MEMBERS ONLY

Further Downside for Gold?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Back in early December, we discussed the three signals we would need to see to turn bullish on gold and gold stocks. Although the picture for gold turned more positive that month, a failure at resistance and a return below the 200-day moving average suggest further weakness may be in...

READ MORE

MEMBERS ONLY

Gold Hints at Further Downside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Back in early December, we discussed the three signals we would need to see to turn bullish on gold and gold stocks. Although the picture for gold turned more positive that month, a failure at resistance and a return below the 200-day moving average suggest further weakness may be in...

READ MORE

MEMBERS ONLY

Will 2021 Be Another 2010?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The end of the year tends to provide the perfect opportunity to reflect, renew and refocus. Hopefully, you've taken advantage of the Reflections 2020 specials on StockCharts TV, including my session on the Ten Questions You Should Ask Yourself at Year End!

I was asked recently by my...

READ MORE

MEMBERS ONLY

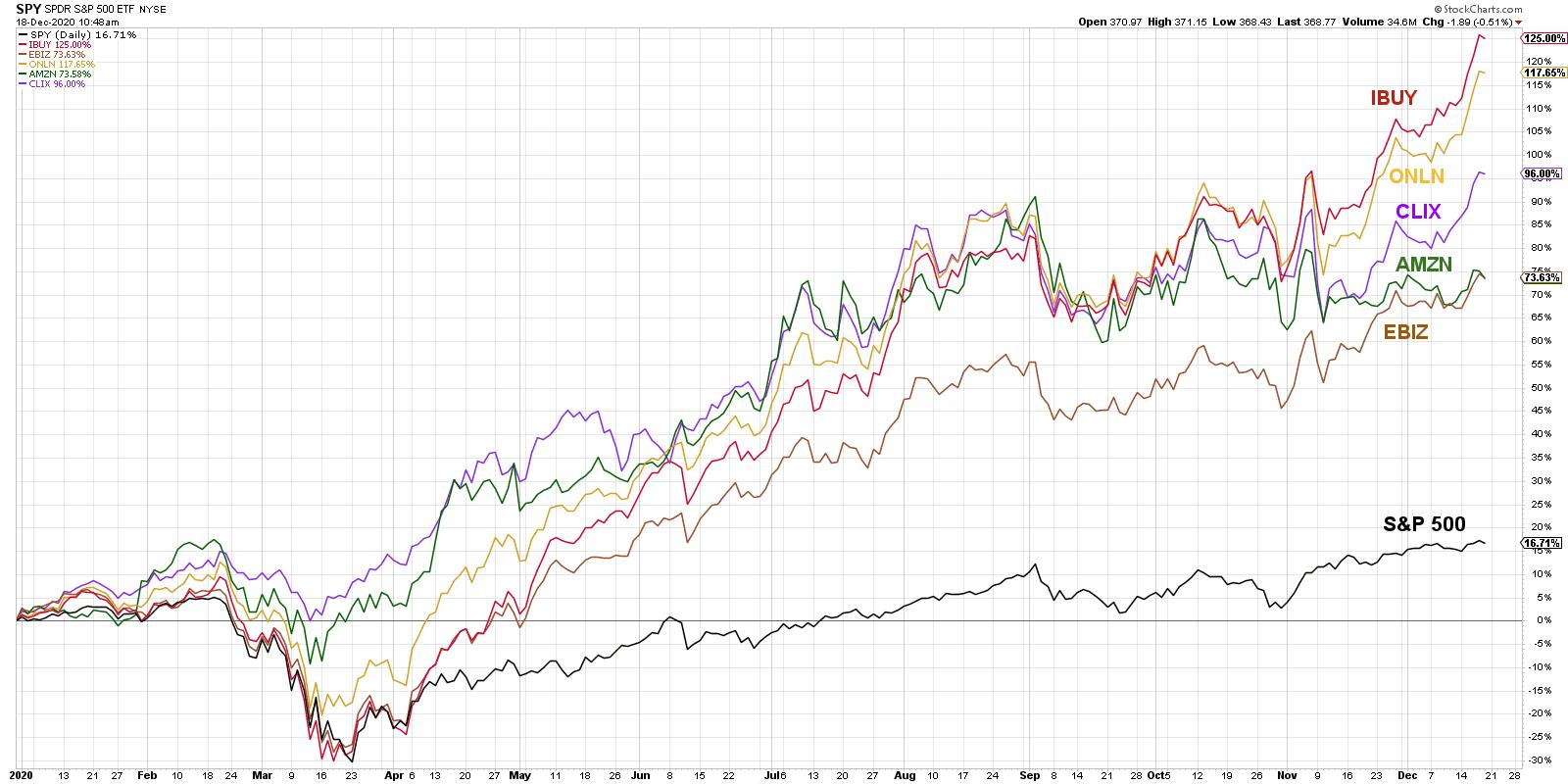

E-Commerce Names Driving Higher Into 2021

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors review the performance of stocks in 2020, e-commerce names like AMZN and SHOP exemplify the transition from brick-and-mortar stores to an online shopping experience. In the new year, potential stimulus packages and a rollout of the coronavirus vaccine should allow consumers to go back to old habits of...

READ MORE

MEMBERS ONLY

E-Commerce Names Charging Into 2021

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As investors review the performance of stocks in 2020, e-commerce names like AMZN and SHOP exemplify the transition from brick-and-mortar stores to an online shopping experience. In the new year, potential stimulus packages and a rollout of the coronavirus vaccine should allow consumers to go back to old habits of...

READ MORE

MEMBERS ONLY

Three Bullish Tells for Gold Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As much as people speak of gold's value as a safe haven, its performance in 2020 has done much to dispel that investment thesis. Recent months have seen gold and gold stocks underperforming the S&P 500. Is the pattern of new highs for stocks and new...

READ MORE

MEMBERS ONLY

Three Tells for a Bottom in Gold Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As much as people speak of gold's value as a safe haven, its performance in 2020 has done much to dispel that investment thesis. Recent months have seen gold and gold stocks underperforming the S&P 500. Is the pattern of new highs for stocks and new...

READ MORE

MEMBERS ONLY

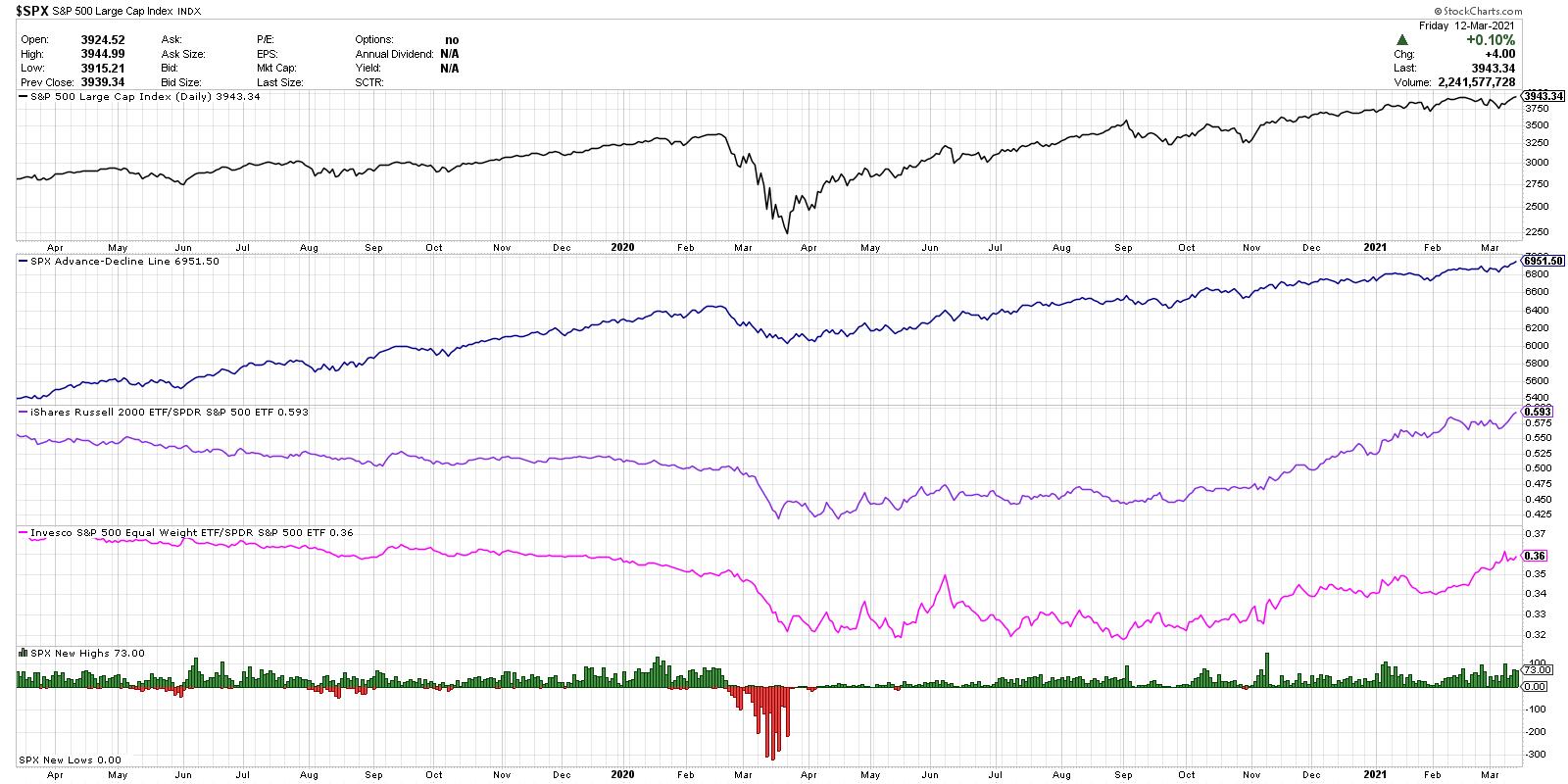

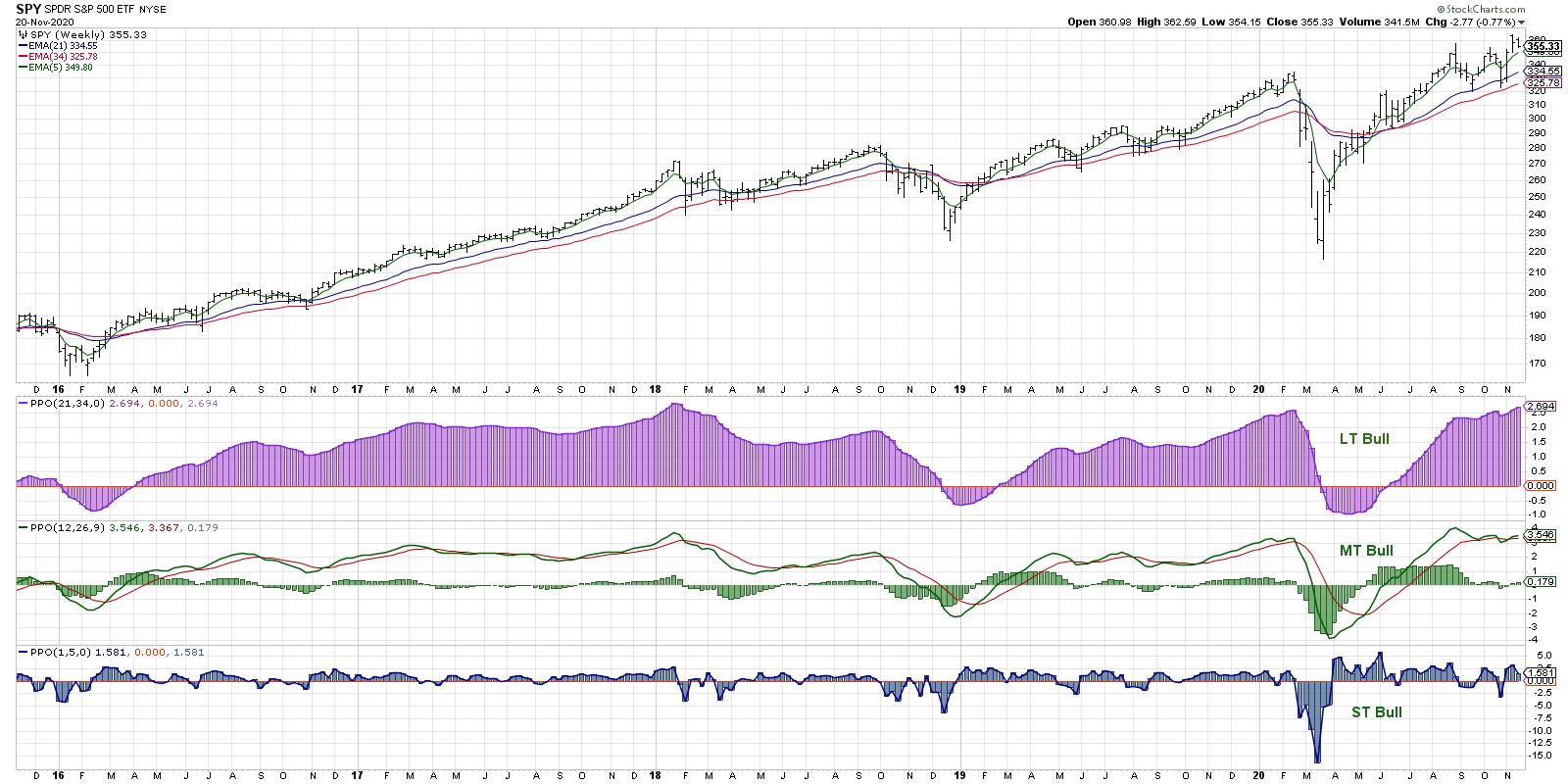

Bull Markets Die on Euphoria

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." - Sir John Templeton

My macro process has three key steps: Price, Breadth and Sentiment. While most measures of price and breadth indicate the bull market is in decent shape, the third...

READ MORE

MEMBERS ONLY

Sentiment Suggests Exhaustion of Buyers

by David Keller,

President and Chief Strategist, Sierra Alpha Research

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria." - Sir John Templeton

My macro process has three key steps: Price, Breadth and Sentiment. While most measures of price and breadth indicate the bull market is in decent shape, the third...

READ MORE

MEMBERS ONLY

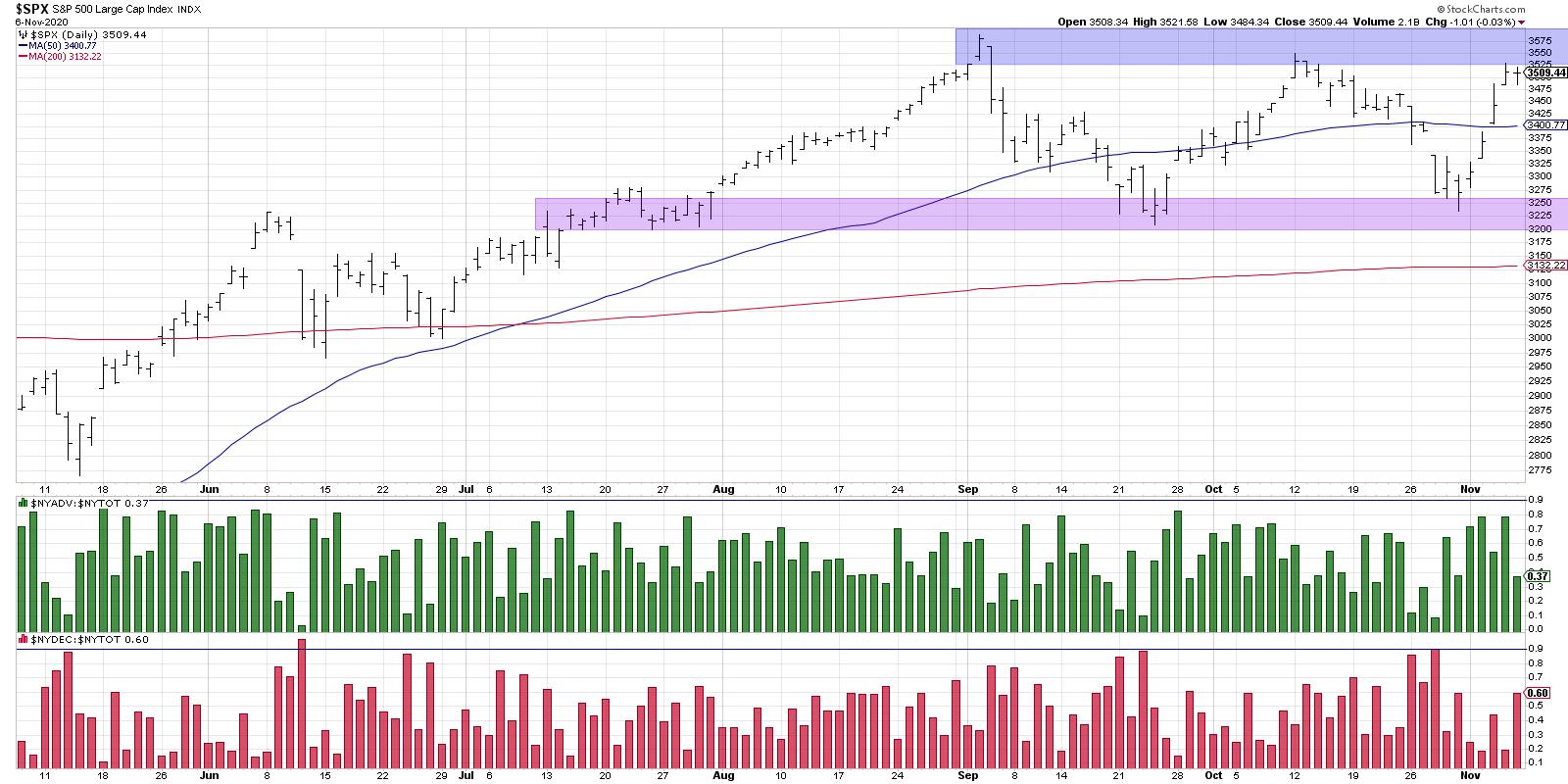

Improving New Highs Would Validate Further Upside

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 wrapped a rather volatile week by settling in at the upper end of the 3200-3600 range. One key breadth indicator shows clear similarities to the bull run in early October, and also provides a prescription for bulls looking for validation of further upside.

*** This article...

READ MORE

MEMBERS ONLY

Bulls Need More New Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P 500 wrapped a rather volatile week by settling in at the upper end of the 3200-3600 range. One key breadth indicator shows clear similarities to the bull run in early October, and also provides a prescription for bulls looking for validation of further upside.

Breadth equals...

READ MORE

MEMBERS ONLY

Three Takes on the Presidential Cycle

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This past Monday, I asked three experts on the Presidential Cycle - Bruce Fraser, Jeff Hirsch, and Tom McClellan - to share their take on market trends around the election season. They delivered in a big way, and the result was a masterclass in how to learn from market history....

READ MORE

MEMBERS ONLY

Three Takes on the Presidential Cycle

by David Keller,

President and Chief Strategist, Sierra Alpha Research

This past Monday, I asked three experts on the Presidential Cycle - Bruce Fraser, Jeff Hirsch, and Tom McClellan - to share their take on market trends around the election season. They delivered in a big way, and the result was a masterclass in how to learn from market history....

READ MORE

MEMBERS ONLY

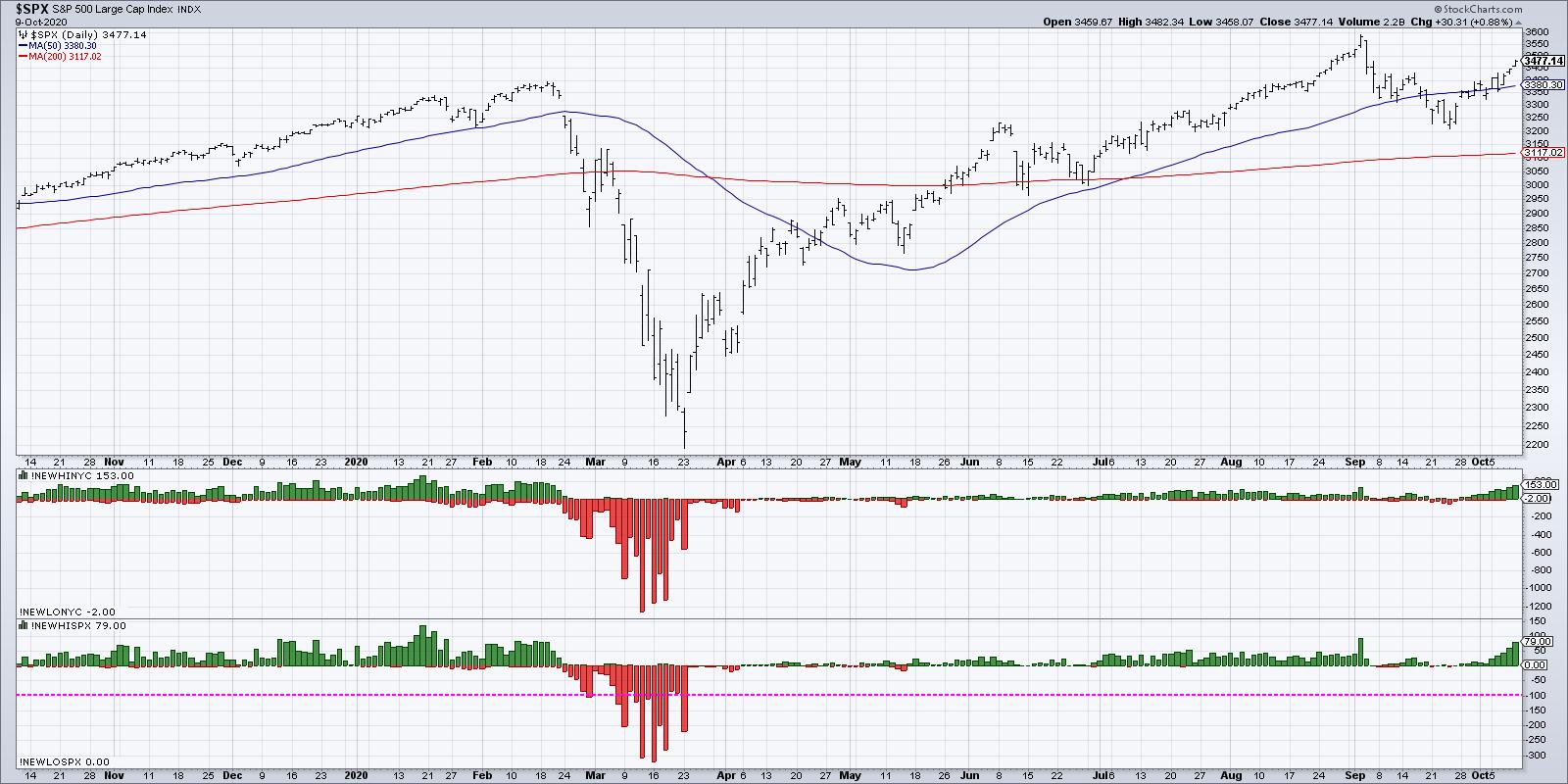

Expanding New Highs are Bullish

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I would currently describe myself as a "cautious bull," in that I recognize that the market is trending higher, I'm prepared to follow that trend as long as it continues, and I'm always looking for some signs of potential weakness and/or exhaustion.

Over...

READ MORE

MEMBERS ONLY

Bullish Expansion of New Highs

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I would currently describe myself as a "cautious bull," in that I recognize that the market is trending higher, I'm prepared to follow that trend as long as it continues, and I'm always looking for some signs of potential weakness and/or exhaustion.

Over...

READ MORE