MEMBERS ONLY

10 Must-See Charts for October 2025

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Grayson and Dave as they reveal their top 10 stock charts to watch this October....

READ MORE

MEMBERS ONLY

Dave's September 2025 Stock Picks: 3 Charts That Worked… and 2 That Didn’t

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave revisits five stocks from the September Top Ten Charts episode to see how they’ve evolved. He reviews NVDA, AXP, MSI, MRK, and the SIL, explaining which setups worked, which failed, and the lessons to carry forward. From short ideas that didn’t pan out to breakout patterns and...

READ MORE

MEMBERS ONLY

Dow Theory Bearish, But Some Transports Are Thriving

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dow Theory has flashed a bearish non-confirmation signal. Dave breaks down the implications of this ominous pattern and analyzes some of the key transportation stocks that have caused this macro divergence....

READ MORE

MEMBERS ONLY

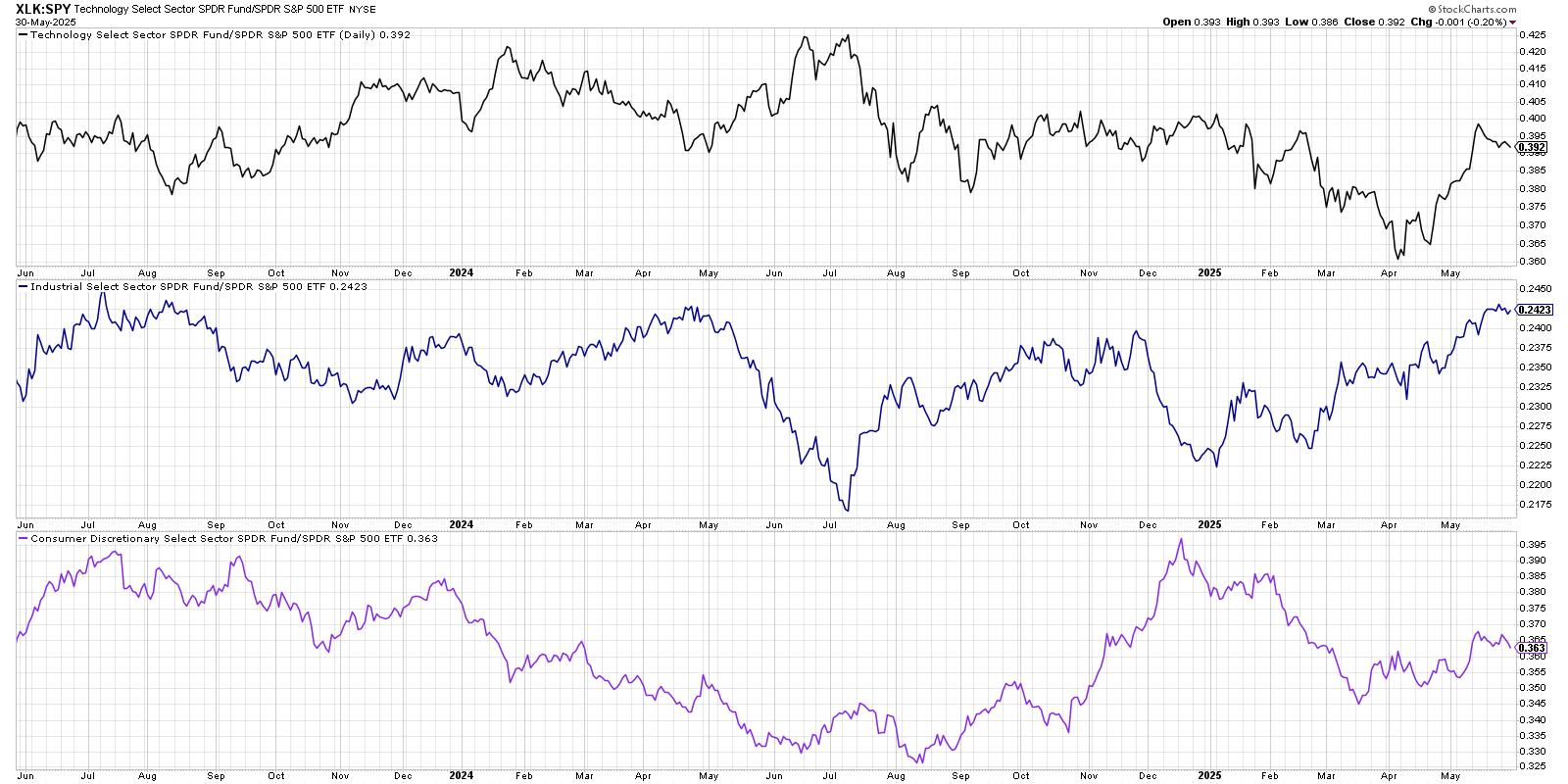

Offense Still Crushing Defense

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While technology stocks have stalled out over the last six weeks, other growth sectors have stepped into a leadership role. Here are the charts Dave uses regularly to track leadership themes, and identify when new sectors are improving in relative strength terms....

READ MORE

MEMBERS ONLY

RSI Overbought? Why That Could Signal Big Gains Ahead

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he explains how traders often get into trouble by thinking of “overbought” stocks as being bearish setups. While an RSI over 70 can often lead to short-term pullbacks, Dave explains that they can also signal the strength of a long-term uptrend phase. He uses Motorola Solutions (MSI)...

READ MORE

MEMBERS ONLY

Pullback or Pitfall? Let the 21-Day EMA Be Your Guide

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave explains how the 21-day exponential moving average can help confirm trend phases, validate signals from other moving averages, and serve as an essential risk management tool for traders....

READ MORE

MEMBERS ONLY

Mapping the Road Ahead: Four Scenarios for the Nasdaq 100

by David Keller,

President and Chief Strategist, Sierra Alpha Research

While August and September are traditionally a weak period for stocks, the Nasdaq 100 has continued to drive higher. We lay out four potential scenarios for the QQQ over the next six weeks, from the very bullish to the super bearish....

READ MORE

MEMBERS ONLY

Two Volume Indicators Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Dave explains why volume indicators, including the Accumulation/Distribution Line and Chaikin Money Flow, still matter in today’s markets. Using NVDA’s earnings, the S&P 500, WMT, and EAT as examples, he shows how volume trends can reveal accumulation or distribution beneath the surface, even when price...

READ MORE

MEMBERS ONLY

New Stocks Breaking Out While Big Tech Falters!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Mega-cap growth stocks like META, MSFT, and AAPL are showing weakness, but breadth conditions remain strong as other areas of the market push higher. In this episode, David Keller, CMT explores leadership rotation in August 2025, highlighting failed breakouts, key breadth indicators, and how to use scans on StockCharts to...

READ MORE

MEMBERS ONLY

Three Key Macro Charts I’m Watching on Vacation

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Here are the key levels to watch in the S&P 500 as well as META, MSFT, and AAPL. As long as the index and stocks hold above key support levels, the uptrend in stocks is in good shape. ...

READ MORE

MEMBERS ONLY

The Good, the Bad, and the Sideways

by David Keller,

President and Chief Strategist, Sierra Alpha Research

As U.S. equity indexes hit new highs, not all stocks are keeping pace. Explore these three stocks that are at key technical junctures with charts that highlight trend shifts, risk levels, and actionable signals....

READ MORE

MEMBERS ONLY

Top 10 Stock Charts for August 2025 You Need to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares ten actionable stock charts for August 2025 that he’s watching closely. From breakout setups to key reversals, David highlights tickers like Tesla, Meta, Caterpillar, Motorola, and Newmont Mining that show compelling technical patterns. He also walks through how to manage the full trading process...

READ MORE

MEMBERS ONLY

3 Types of Breakouts To Upgrade Your Portfolio

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Use this StockCharts scan to identify three categories of stocks and ETFs that are making new three-month highs....

READ MORE

MEMBERS ONLY

Catch Big Moves Early With This Breakout Scan!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Follow along as Dave shares the one stock scan he runs every week to uncover potential breakout candidates. He explains the three types of chart setups that frequently appear, each with their own trading implications, and walks through how he structures trades according to type. He also illustrates how to...

READ MORE

MEMBERS ONLY

Is META Breaking Out or Breaking Down?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The chart of Meta Platforms, Inc. (META) has completed a roundtrip from the February high around $740 to the April low at $480 – and all the way back again. Over the last couple weeks, META has pulled back from its retest of all-time highs, leaving investors to wonder what may...

READ MORE

MEMBERS ONLY

A Wild Ride For the History Books: 2025 Mid-Year Recap

by Grayson Roze,

Chief Strategist, StockCharts.com

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Markets don't usually hit record highs, then risk falling into bearish territory, and spring back to new highs within six months. But that's what happened in 2025.

In this special mid-year recap, Grayson Roze sits down with David Keller, CMT, to show how disciplined routines, price-based...

READ MORE

MEMBERS ONLY

Three Bearish Candle Patterns Every Investor Should Know

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* The shooting star pattern indicates a short-term rotation from accumulation to distribution.

* The bearish engulfing pattern suggests sellers have taken control, suggesting further weakness.

* The evening star pattern is a three-candle formation that illustrates an exhaustion of buying power.

There is no denying that the broad markets remain...

READ MORE

MEMBERS ONLY

From Hammer to Harami: Using StockCharts to Crack the Candlestick Code

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he reviews three common candle patterns traders can use to identify potential turning points. From bullish engulfing patterns to evening star patterns, Dave gives insights on how to leverage these powerful candle signals to anticipate market shifts. He also shows combining candle patterns with conventional technical analysis...

READ MORE

MEMBERS ONLY

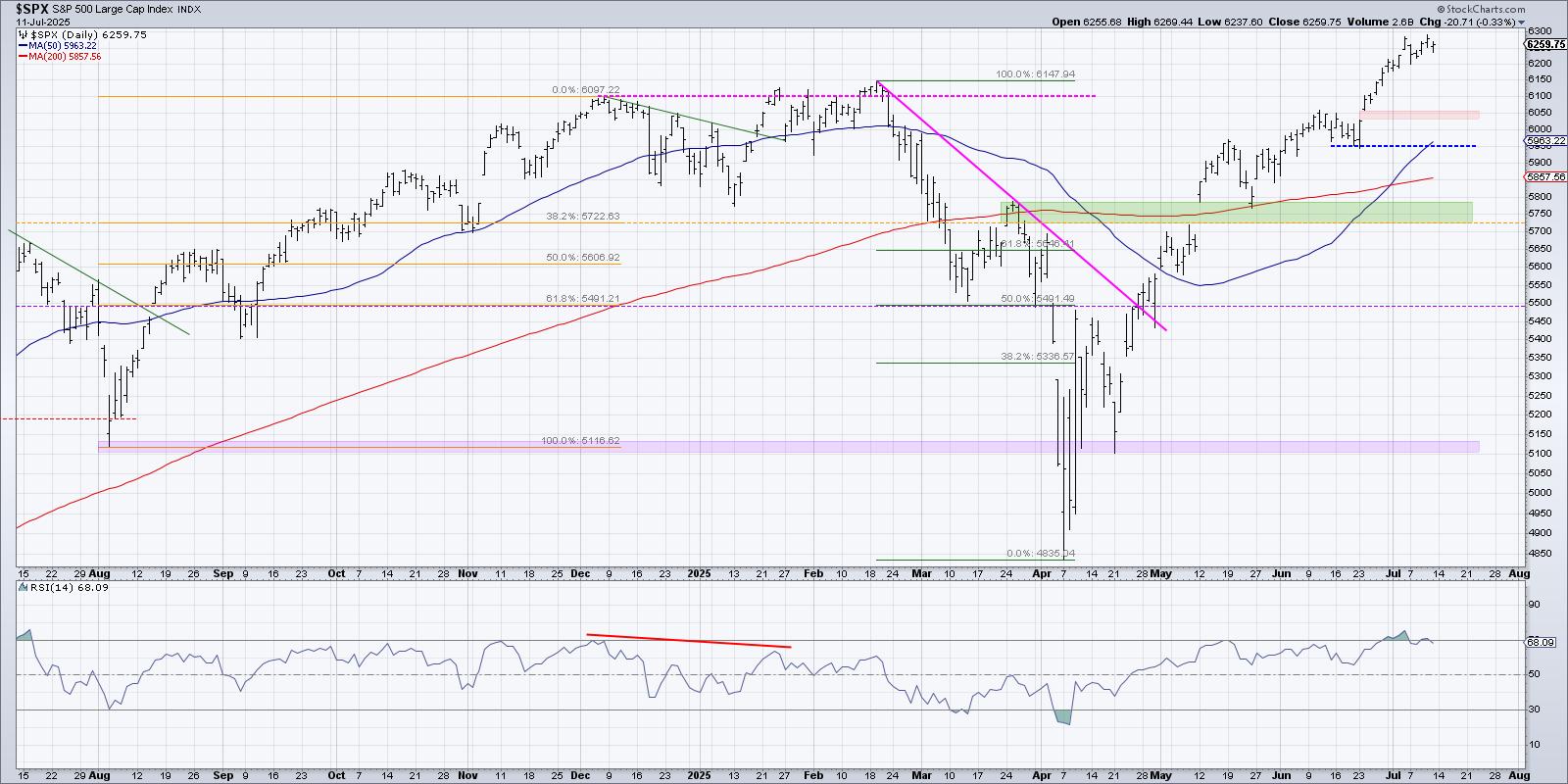

What Happens Next for the S&P 500? Pick Your Path!

by David Keller,

President and Chief Strategist, Sierra Alpha Research

The S&P continues to push higher, with the equity benchmark almost reaching 6300 this week for the first time in history. With so many potential macro headwinds still surrounding us, how can the market continue to reflect so much optimism? On the other hand, when will bulls wake...

READ MORE

MEMBERS ONLY

How to Find Compelling Charts in Every Sector

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Over a number of years working for a large money manager with a rich history of stock picking, I became more and more enamored with the benefits of scanning for constructive price charts regardless of the broad market conditions. Earlier in my career, as I was first learning technical analysis,...

READ MORE

MEMBERS ONLY

Breakout Watch: One Stock in Each Sector to Watch Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

When sector performance shifts gears from one day to the next, it's best to be prepared with a handful of stocks from the each of the sectors.

In this hands-on video, David Keller, CMT, highlights his criteria for picking the top stocks in 10 of the 11 S&...

READ MORE

MEMBERS ONLY

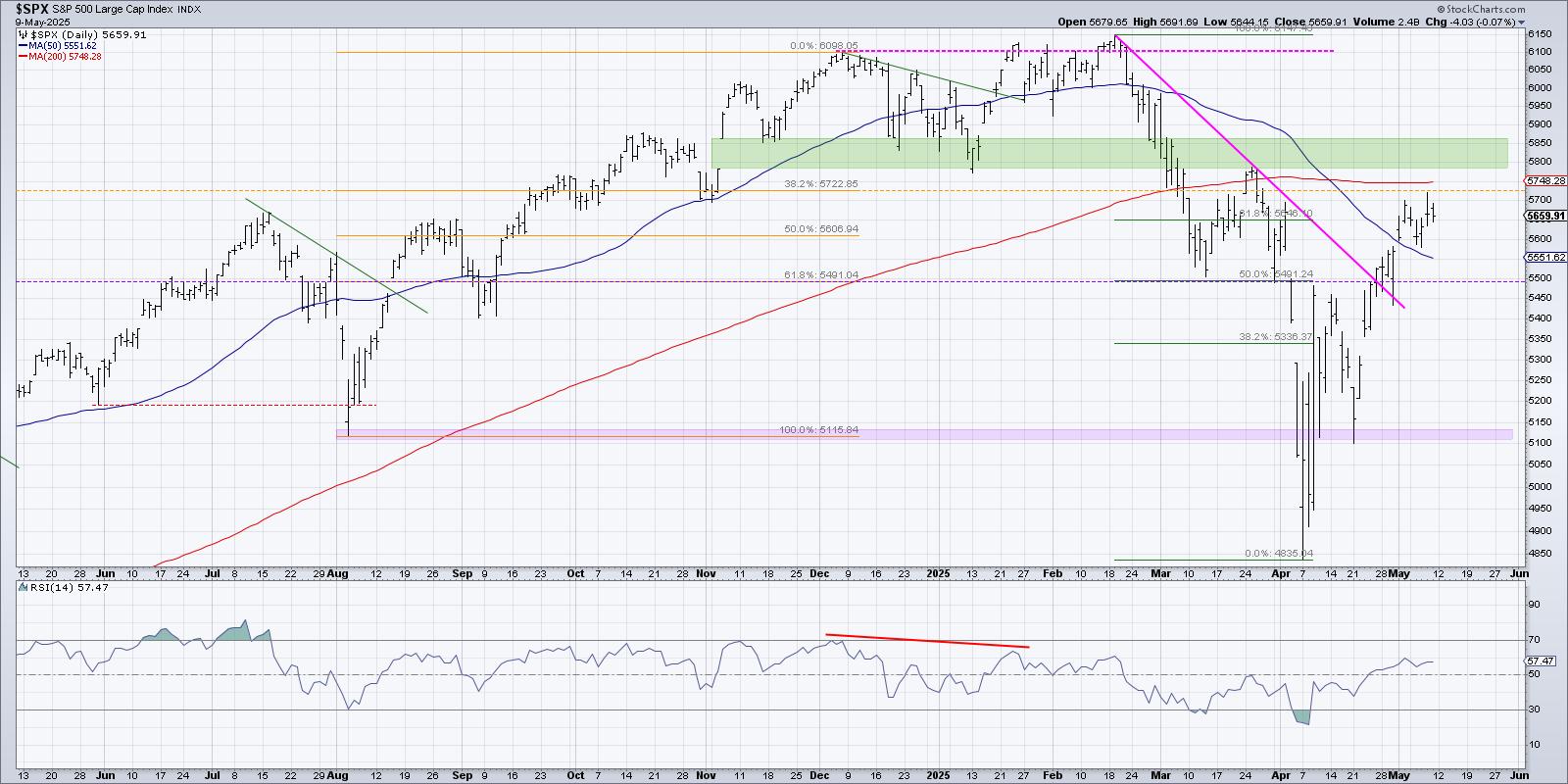

Fibonacci Retracements: The Key to Identifying True Breakouts

by David Keller,

President and Chief Strategist, Sierra Alpha Research

If you've looked at enough charts over time, you start to recognize classic patterns that often appear. From head-and-shoulders tops to cup-and-handle patterns, they almost jump off the page when you bring up the chart. I would definitely include Fibonacci Retracements on that list, because before I ever...

READ MORE

MEMBERS ONLY

How to Use Fibonacci Retracements to Spot Key Levels

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Join Dave as he shares how he uses the power of Fibonacci retracements to anticipate potential turning points. He takes viewers through the process of determining what price levels to use to set up a Fibonacci framework, and, from there, explains what Fibonacci retracements are telling him about the charts...

READ MORE

MEMBERS ONLY

Bearish Divergence Suggests Caution For S&P 500

by David Keller,

President and Chief Strategist, Sierra Alpha Research

With Friday's pullback after a relatively strong week, the S&P 500 chart appears to be flashing a rare but powerful signal that is quite common at major market tops. The signal in question is a bearish momentum divergence, formed by a pattern of higher highs in...

READ MORE

MEMBERS ONLY

Is the S&P 500 Flashing a Bearish Divergence?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Unlock the power of divergence analysis! Join Dave as he breaks down what a bearish momentum divergence is and why it matters. Throughout this video, Dave illustrates how to confirm (or invalidate) the signal on the S&P500, Nasdaq100, equal‑weighted indexes, semiconductors, and even defensive names like AT&...

READ MORE

MEMBERS ONLY

Three Charts Showing Proper Moving Average Alignment

by David Keller,

President and Chief Strategist, Sierra Alpha Research

I'm a huge fan of using platforms like StockCharts to help make my investment process more efficient and more effective. The StockCharts Scan Enginehelps me identify stocks that are demonstrating constructive technical configuration based on the shape and relationship of multiple moving averages.

Today, I'll share...

READ MORE

MEMBERS ONLY

How I Find Up-trending Stocks Every Week (Step-by-Step Scan Tutorial)

by David Keller,

President and Chief Strategist, Sierra Alpha Research

In this video, Dave shares his weekly stock scan strategy used to identify bullish stock trends. He illustrates how to set up this powerful scan, reveals the tips and tricks he uses to identify the most constructive patterns, and explains the four winning chart setups that tend to come up...

READ MORE

MEMBERS ONLY

Breakouts, Momentum & Moving Averages: 10 Must-See Stock Charts Right Now

by David Keller,

President and Chief Strategist, Sierra Alpha Research

by Grayson Roze,

Chief Strategist, StockCharts.com

Discover the top 10 stock charts to watch this month with Grayson Roze and David Keller, CMT. From breakout strategies to moving average setups, the duo walk through technical analysis techniques using relative strength, momentum, and trend-following indicators.

In this video, viewers will also gain insight into key market trends...

READ MORE

MEMBERS ONLY

Leadership Rotation Could Confirm Corrective Phase

by David Keller,

President and Chief Strategist, Sierra Alpha Research

There's no denying that the equity markets have taken on a decisively different look and feel in recent weeks.

We've compared the charts of the S&P 500 and Nasdaq 100, as well as leading growth stocks like Nvidia, to an airplane experiencing a "...

READ MORE

MEMBERS ONLY

What Happens When the S&P 500 Breaks Below Gap Support?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

My main question going into this weekend was, "Will the S&P 500 finish the week above its 200-day moving average?" And while the S&P 500 did indeed finish the week above this long-term trend barometer, our main equity benchmark is now within the gap...

READ MORE

MEMBERS ONLY

Not All Price Gaps Are the Same! Here's How to Trade Them

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Learn how to analyze stock price gaps with Dave! In this video, Dave discusses the different types of price gaps, why all price gaps are not the same, and how you can use the StockCharts platform to identify key levels and signals to follow on charts where price gaps occur....

READ MORE

MEMBERS ONLY

S&P 500 Now in Weakest Seasonal Period... Or Is It?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* "Sell in May" is less about weakness in the spring and more about weakness in the autumn months.

* Since the COVID low, the S&P 500 has usually been quite strong in May-June-July.

* We're watching the SPX 5750 level along with other indicators...

READ MORE

MEMBERS ONLY

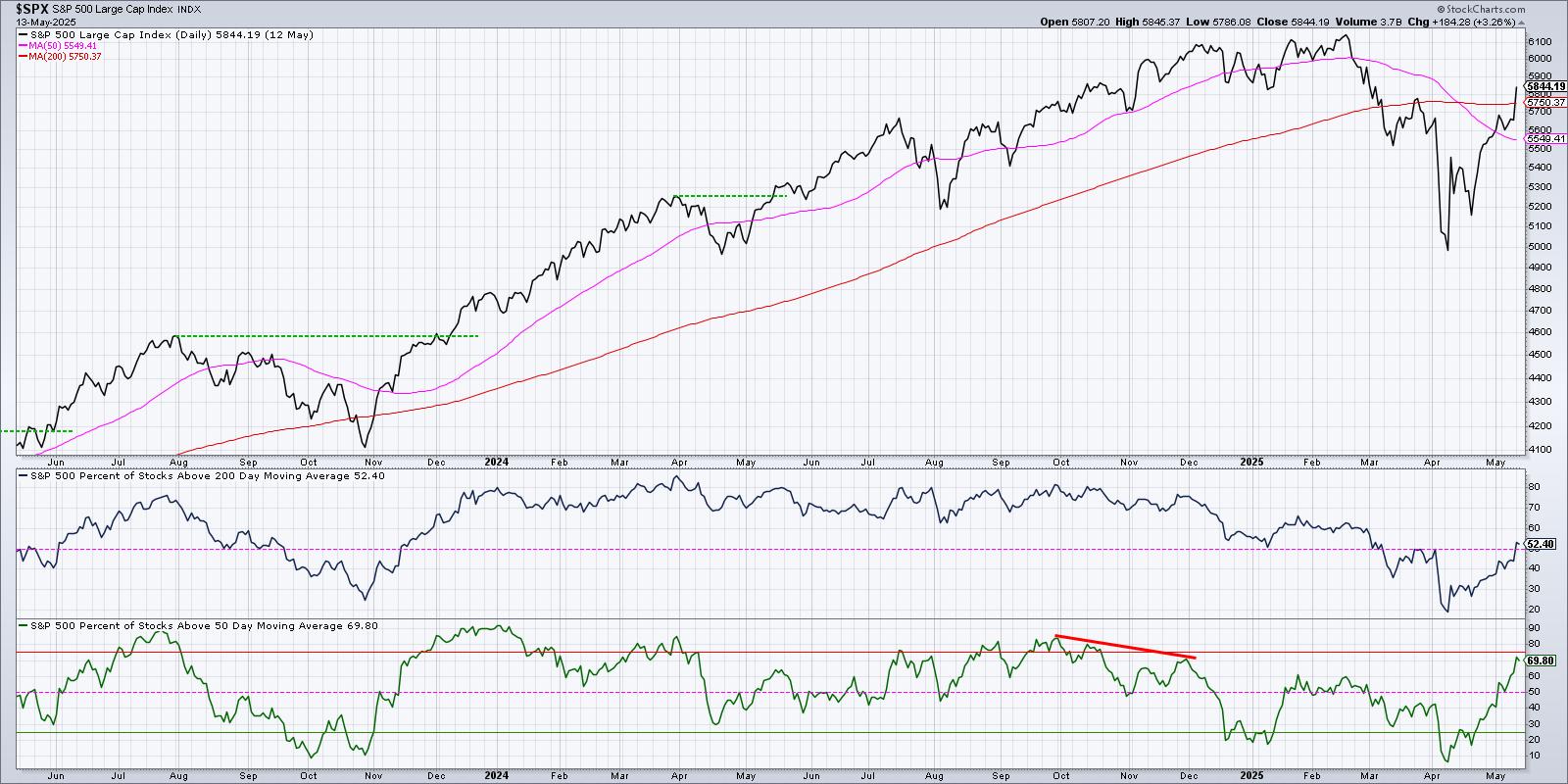

Bullish Breadth Improvement Suggests Further Upside for Stocks

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* For the first time since early March, over 50% of S&P 500 members are above their 200-day moving average.

* When this long-term breadth indicator has gone from below 25% to above 50%, forward 12-month returns have been positive.

* Investors should keep a watchful eye on the...

READ MORE

MEMBERS ONLY

50% of S&P 500 Stocks Just Turned Bullish – What Happens Next?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Bullish signal alert! Over 50% of S&P 500 stocks are now above their 200-day moving average.

In this video, Dave explains this key market breadth indicator and what it means for stock market trends. He shows how moving average breadth has reached a bullish milestone, what this means...

READ MORE

MEMBERS ONLY

Which Will Hit First: SPX 6100 or SPX 5100?

by David Keller,

President and Chief Strategist, Sierra Alpha Research

Last Friday, the S&P 500 finished the week just below 5700. The question going into this week was, "Will the S&P 500 get propelled above the 200-day?" And as I review the evidence after Friday's close, I'm noting that the...

READ MORE

MEMBERS ONLY

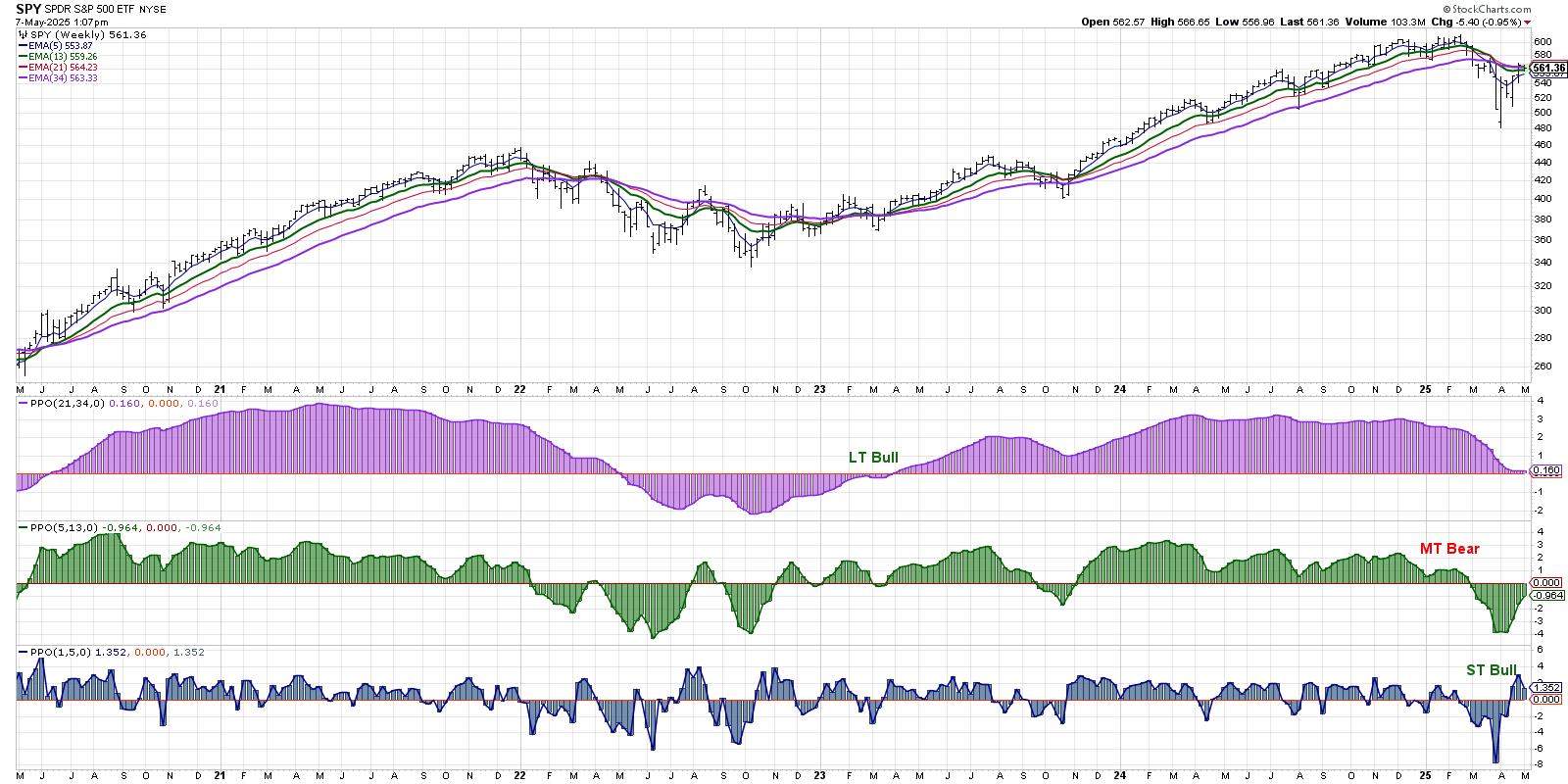

Three Charts to Watch for an "All Clear" Signal

by David Keller,

President and Chief Strategist, Sierra Alpha Research

KEY TAKEAWAYS

* If our medium-term Market Trend Model turns bullish this Friday, that would mean the first bullish reversal since October 2023.

* Less than 50% of S&P 500 members are above their 200-day moving average, and any reading above 50% could confirm bullish conditions.

* Offensive sectors like Consumer...

READ MORE